CMBI Research China and Hong Kong Stock Recommendations (May 2024)

CMB International Capital Corporation It is a wholly owned subsidiary of . China Merchants Bank (Hong Kong: 3968 /shaman: 600036 /OTCMKTS: chicky /OTCMKTS: CIHHF) – one of China’s largest banking groups and the largest privately owned bank. They consistently release free research pieces and post them on their website. china and Hong Kong Stock Recommendations (our first chapter To see the full list tag for us EM Stock Pick Tear Sheet)

Stocks covered this month In May This post includes:

JOYY Inc, Baozun, NAURA Technology Group, CSPC Pharmaceutical, Atour Lifestyle Holdings, Weibo Corp, Topsports, Ke Holdings, Bilibili, NetEase, Xiaomi Corp, PDD Holdings, Kuaishou Technology, Tongcheng Travel Holdings, XPeng, Trip.com, Li Auto, Mobvista, Sany Heavy Equipment International Holdings, iQIYI, Baidu, JD.com, ZTO Express, Tencent, Alibaba, Huya Inc, Tencent Music Entertainment Group, Xtep, GigaCloud Technology, FIT Hon Teng, BeiGene, PICC Property and Casualty Co Ltd, EVA Precision Industrial Holdings, China Pacific Insurance (Group), United Energy Group, Yum China, Shanghai Henlius Biotech, Joinn Laboratories China, WuXi AppTec, China Life Insurance, Amazon.com, BYD Electronic International Co Ltd and Zoomlion Heavy Industry

They also put out monthly lists (and post them on their website). 20+ High Conviction Stock Ideas – i.e. Chinese stock recommendations (our In May, June, July, August, September, October, November, december, January – February, March & april A post summarizing this) However, this list doesn’t change much from month to month. The stocks included in the CMBI July list (including additions and deletions) and included in this post along with updated statistics and charts are:

Li Auto, Zoomlion Heavy Industry, Weichai Power, Zhejiang Dingli Machinery, .com, Netflix, Kuaishou Technology, GigaCloud Technlogy, CR Land, FIT Hon Teng, Xiaomi, BYD Electronic International, Zhongji Innolight, NAURA Technology Group and Kingdee International Software Group.

There has been positive news from China over the past day.

📰 Hong Kong stocks surged as investors focused on China’s market reforms and economic stimulus. (SCMP) 🗃️

📰 China promises NASDAQ-style Star Market reform, quality improvement listing: CSRC (Nike Thing) 🗃️

CSRC Chairman Wu Qing said eight measures have been introduced to reform the Star Market under the Shanghai Stock Exchange.

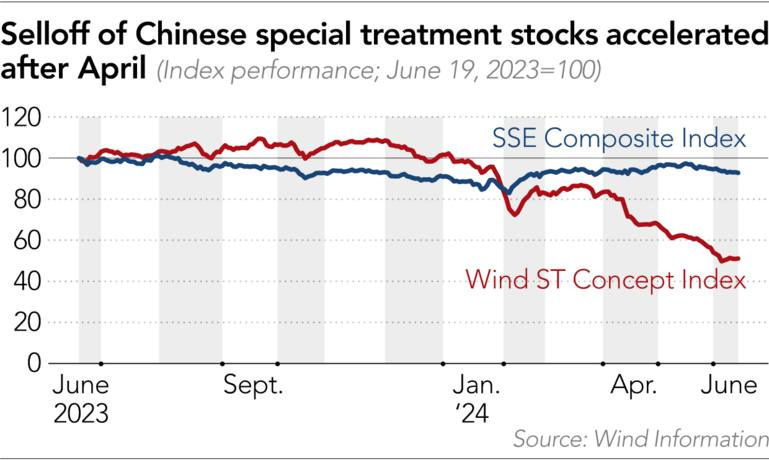

📰 Risky Chinese stocks fall as the market prepares for ‘survival of the fittest’ (Nike Thing) 🗃️

Regulators gathered in Shanghai amid balancing act on standard hikes.

ST or ‘Preferential’ stocks are attracting attention In recent weeks, the government has said it will strengthen supervision of listed companies. Exchanges in Shanghai and Shenzhen add ST labels to companies’ stock codes to warn investors about certain financial risks., consecutive net losses or exchange rate violations, etc. If there is a risk of delisting, an additional asterisk will appear in front of it.

📰 Chinese technology stocks have regained favor with skeptics who had questioned their investment viability. (SCMP) 🗃️

Back to the CMBI study: When you click on the CMBI website, you will see the following message: No pop-ups They ask me what type of investor I am or where I am located. However, at the end of each research report there is a disclaimer that readers should be aware of:

This post is no You must quote directly from the research paper itself (beyond giving a title to the linked research paper – keeping the disclosures above in mind).

To make your life easier, this post includes:

-

A title containing the stock name.

-

IR page link and Yahoo! This is a brief explanation of stock prices. Jae Won.

-

Link to Wikipedia page (for what it’s worth…)

-

This is the title of the report linked to the files page on the CMBI website regarding stock selection.

-

It is the price/book (most recent quarter) ratio plus the forward or trailing P/E plus the dividend yield tied back to Yahoo! This is a financial statistics page.

-

The latest long-term technical charts financial resources linked back to Yahoo!

And as always, this post Provided for informational purposes only (And to make your life easier…). This does not constitute investment advice and/or recommendations…

Joy Co., Ltd. (NASDAQ: YY) A leading global technology company with a mission to enrich lives through technology. Joy currently operate Multiple social productsinclude Vigo Live For live streaming, good night For short videos do Products for multiplayer social networking, instant messaging products, and more. The company has created a very engaging and active user community for users all over the world. JOYY’s ADSs have been listed on Nasdaq since November 2012.

On November 18, 2020, Muddy Waters Research published a report (MW is Short Joyy Inc. (YY US).) JOYY Inc (JOYY refutes Muddy Waters report | JoyY Co., Ltd.).

Baojun (NASDAQ: bjun) He is a leader and pioneer in this field. Brand e-commerce service industry and facilitator of digital commerce In China. We provide services to more than 400 brands in various industries and fields around the world, including East Asia, Southeast Asia, Europe, and North America.

It is owned by Baozun Inc. Three main business linesThese include BAOZUN E-COMMERCE (BEC), BAOZUN BRAND MANAGEMENT (BBM) and BAOZUN INTERNATIONAL (BZI).

Nowra Technology Group (she: 002371) I’m Chinese Manufacturer of integrated circuits and semiconductor equipment (mainly etching equipment). The company was founded through strategic restructuring. Beijing Seven Star Electronics and Beijing North Microelectronics. It mainly produces semiconductor equipment, vacuum equipment, new energy lithium battery equipment, and precision parts business, and provides solutions in semiconductors, new energy resources, new materials and other related fields.

see: NAURA Technology Group (SHE: 002371): Potential beneficiary of US-China chip dispute