Coca-Cola FEMSA: Buy Growth at a Price (NYSE:KOF)

Hector Vivas

Coca-Cola FEMSA (New York Stock Exchange: KOF) is the world’s largest bottler of Coca-Cola beverages by volume. KOF is Rare It has a mix of quality, growth, and attractive valuation.

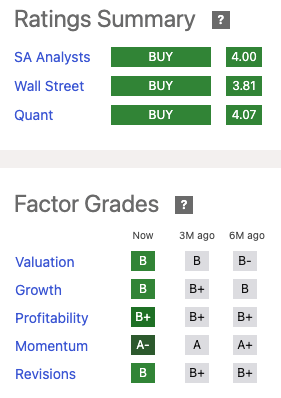

The stock is currently rated a Buy. Seeking Alpha Analyst, Wall Street Analyst and Alpha Quant Assessment. Additionally, KOF enjoys strong volume ratings across all key factors.

Simply put, KOF is a stock that investors should keep an eye on.

pursue alpha

The world’s largest bottler of Coca-Cola beverages

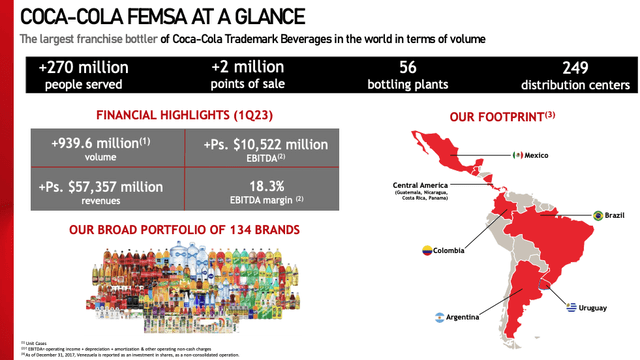

KOF is the world’s largest bottler of Coca-Cola beverages by volume. KOF accounts for approximately 11.5% of the total volume of the global Coca-Cola system.

The company has operations in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina and Uruguay. KOF also operates business in Venezuela through investment in KOF Venezuela.

KOF is unique. A significant portion of the stock is not publicly traded. Mexican beverage and retail company FEMSA own Approximately 47.2% stake in the company. The Coca-Cola Company (am) owns approximately 27.8% of the company, with the remaining approximately 25% of KOF comprising public equity.

KOF has two reporting segments: Mexico and Central America and South America. The Mexico and Central America segment accounts for ~69% of Adjusted EBITDA, while the South America segment accounts for the remaining ~31% of Adjusted EBITDA.

The company’s two largest markets are Mexico and Brazil, which account for approximately 50% and approximately 27% of total revenue, respectively.

KOF Investor Briefing Session KOF Investor Briefing Session

High-quality, recession-resilient business

KOF enjoys a fairly wide moat surrounding its business. exclusive It is important to note that KOF’s respective bottler agreements with Coca-Cola will automatically renew at the end of the 10-year term, but can be terminated by either party. Contract termination.

Additionally, KOF must purchase Coca-Cola concentrate at the price set by Coca-Cola. However, prices are a percentage of the weighted average retail price in local currency.

One could argue that the moat surrounding KOF’s business is not that wide given its dependence on Coca-Cola, but since Coca-Cola is the majority shareholder of KOF, we disagree that it is expressing a commitment to a long-term relationship.

KOF’s main competitors are local Pepsi bottlers and other bottlers of lesser-known brands.

Not only is KOF a fairly high-quality business, but it’s also fairly resilient to economic downturns, given that beverages tend to be consumed regardless of economic conditions.

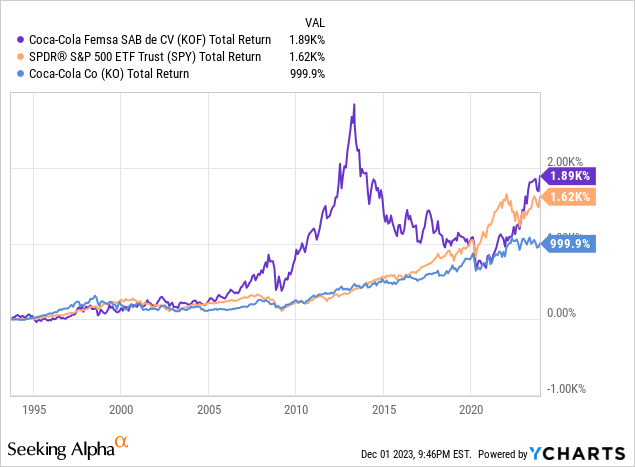

These factors have enabled the company to historically achieve strong shareholder performance. As you can see in the chart below, KOF has delivered a total return of 1,890% since listing, compared to the S&P 500’s total return of 1,620% and Coca-Cola’s 1000%.

growth opportunity

KOF has a number of growth drivers ahead of it over the next few years. One driver is simply economic growth in Latin America. In particular, KOF has high exposure to Mexico and Brazil. Mexico is currently growing its real GDP at 3.2% per year, while Brazil is growing its real GDP at 3.1% per year. By comparison, the United States currently has a real GDP growth rate of 2.1%.

Another key driver of growth is strategic M&A. KOF has a long history of acquiring other Coca-Cola bottlers in Latin America. KOF has the potential to access new markets through these transactions and leverage its scale to increase the efficiency of the acquired bottlers.

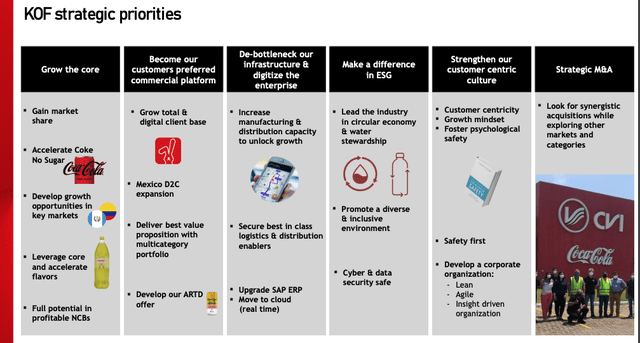

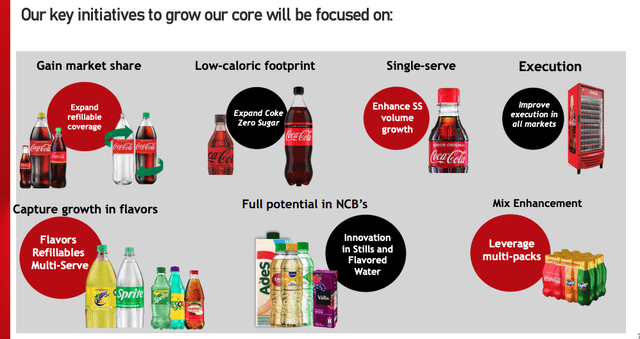

Other growth drivers include increased market share, expansion of its D2C business, new products (including the recent launches of Jack Daniels and Coca-Cola), and corporate digitalization to improve efficiency.

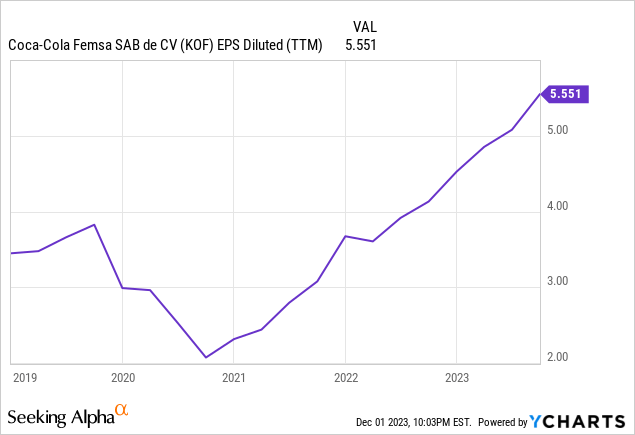

During the third quarter of 2023, KOF recorded a 10.1% increase in revenue compared to the same period last year, while operating profit increased by 15.3% compared to the same period last year. KOF has seen EPS growth at a CAGR of 5% over the past 10 years and at a 32.7% CAGR over the past three years.

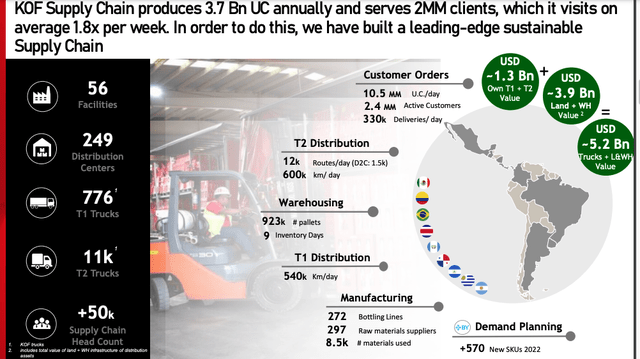

To capitalize on growth opportunities, KOF expects to increase production capacity by 15% and distribution capacity by 30% over the next three years.

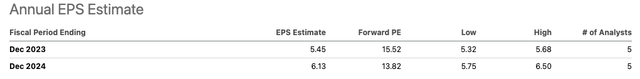

Consensus analysts currently estimate that KOF will grow its EPS by 12% in FY 2024. I believe this level of growth is achievable given the company’s recent acceleration in growth and additional growth drivers in the coming years.

KOF Investor Briefing Session KOF Investor Briefing Session pursue alpha

Very attractive valuation

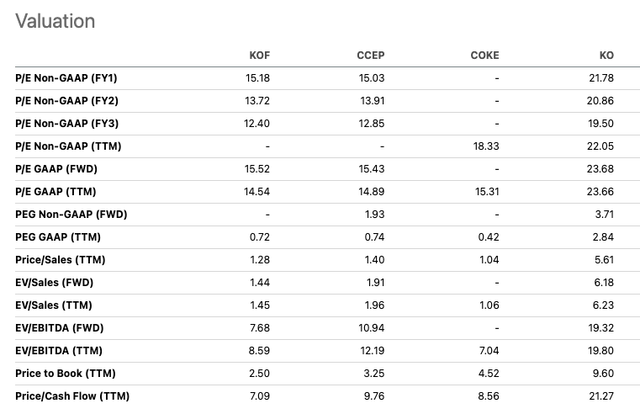

KOF is trading at 13.8x consensus 2024 EPS. By comparison, the S&P 500 trades at about 18.9 times consensus fiscal 2024 earnings. Both KOF and the S&P 500 are expected to see their earnings grow by up to 12% next year. So, relatively speaking, I think KOF is much more attractive.

KOF appears to have an attractive valuation compared to Coca-Cola and Coca-Cola Euro Pacific Partners (CCEP). KO’s forward P/E ratio is 20.9x, which is significantly higher than KOF’s forward P/E of 13.8x. Moreover, KO only expects earnings growth of ~4% next year, representing a much slower growth opportunity investment. CCEP will trade similarly to KOF, but its earnings are expected to grow by about 8%.

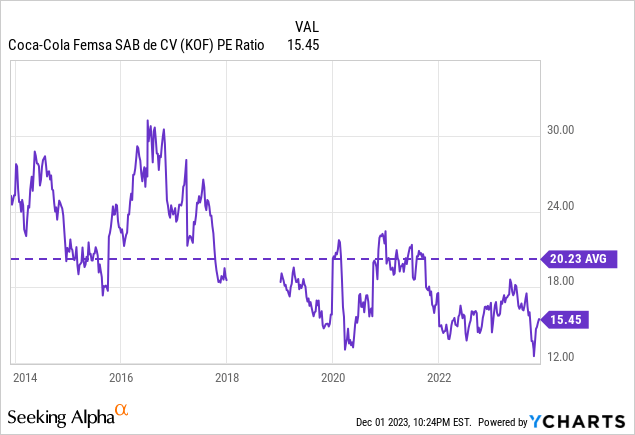

KOF is not only attractively valued relative to its peers, but is also trading at attractive levels relative to its own historical valuation range.

pursue alpha

Attractive dividend with growth potential

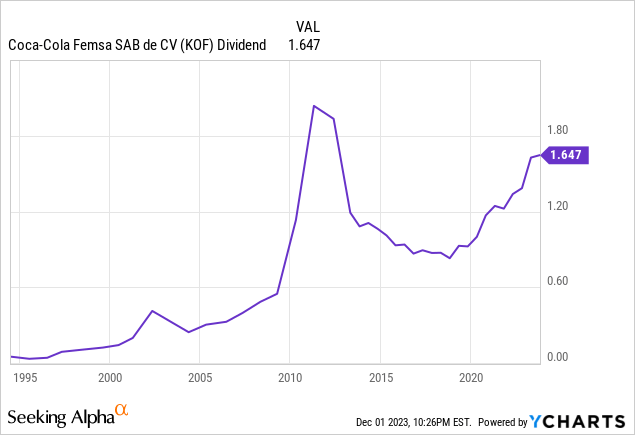

Currently, KOF pays a semi-annual dividend of $1.65 per share. Based on current market prices, the stock yields ~3.8%.

The company’s dividend has historically been volatile, but has increased over time.

The current dividend of ~$3.3 represents a payout ratio of 54% of projected earnings for fiscal 2024. Although the company is focused on using cash to fund growth opportunities, KOF believes it has the potential to significantly increase its dividend in the coming years as earnings grow.

Risks to Consider

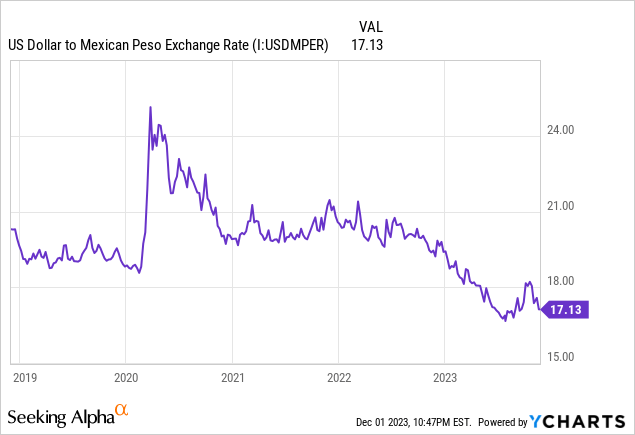

One of the key risks that US investors need to be aware of is FX risk. KOF is an ADR, meaning investors are exposed to movements in Mexico’s locally traded stocks and movements in the USDMXN exchange rate.

From an FX perspective, holding all else equal, KOF shareholders stand to benefit from the appreciation of the Mexican peso against the US dollar.

The U.S. dollar has been strengthening against the Mexican peso recently, but we are not sure if this trend will continue given that low inflation is likely to force the Federal Reserve to change its monetary policy.

Another key risk to consider is that recently launched weight loss drugs such as Ozempic, Wegovy and Mounjaro may reduce demand for sugary sodas in the long term. Morgan Stanley recently reported that 65% of obesity medication patients reduced their soda intake.

These products are currently less widely available in Latin America than in the United States, but that may change in the long term. Investors in KOF should closely monitor trends related to soda consumption in the United States to gain early insight into whether drugs may be impacting consumption.

conclusion

KOF represents a rare mix of high-quality businesses with strong growth prospects trading at a reasonable valuation.

The company enjoys a fairly wide moat due to the exclusive rights to bottle Coca-Cola products in the markets in which it operates. Additionally, Coca-Cola is a majority shareholder of KOF, suggesting that Coca-Cola is committed to maintaining it for the long term. We have partnered with KOF.

KOF has a variety of growth drivers, including strong GDP growth in its core markets, strategic M&A opportunities to grow into additional markets, new products, and a shift to D2C distribution channels.

KOF expects revenue growth of about 12% next year. Even with this level of revenue growth, the company trades at just 13.8 times forward earnings. By comparison, Coca-Cola trades at 20.8 times forward earnings and is expected to grow its earnings by just 4%. Therefore, I see KOF as an attractive value creation opportunity.

Start KOF at Buy level. However, we would consider a downgrade of the company if the valuation picture changes or if soda sales decline significantly in the U.S. due to the use of obesity drugs. This is because it is considered a leading indicator of potential demand changes in Latin America.