Coinbase-powered Base leads Ethereum layer 2 fees amid surge in trading activity.

Base, powered by Coinbase, has the highest transaction fees among the Ethereum layer 2 networks, as it is currently gaining traction among cryptocurrency traders.

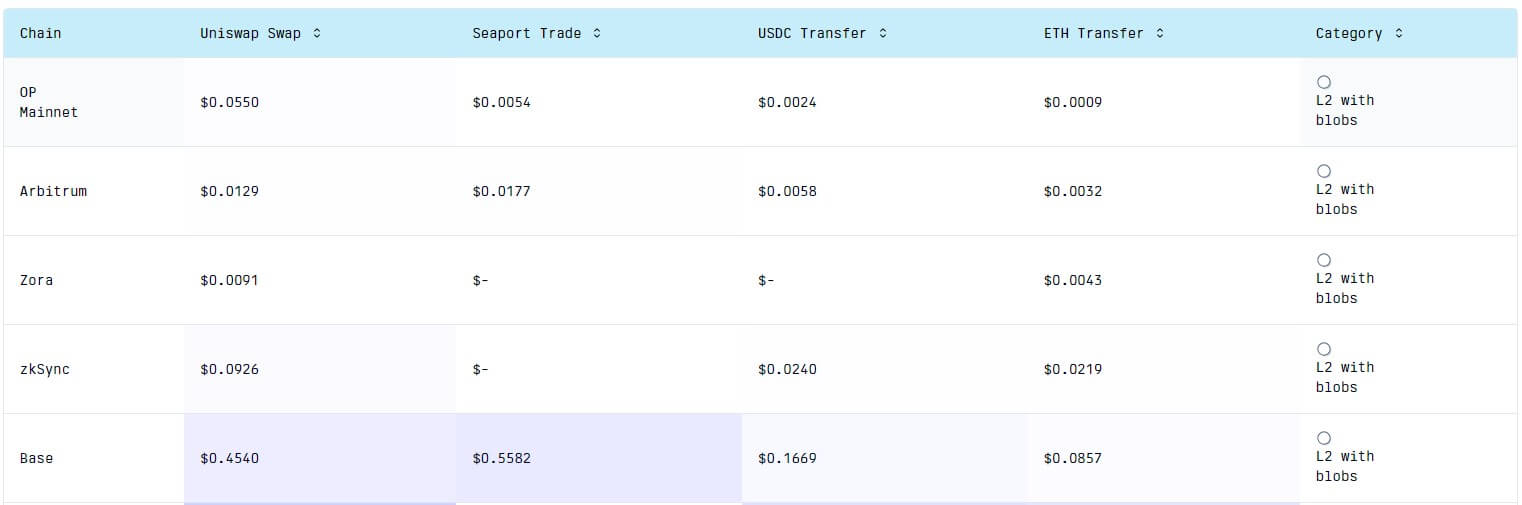

According to Gasfees data, Base is the most expensive layer 2 protocol among scaling solutions that implement the Blob functionality of the Dencun upgrade. This feature allows for a more efficient and cost-effective way to publish rollup data, significantly reducing transaction fees and improving throughput on Layer 2 networks.

In fact, Base’s average transaction fees can reach $0.0857 up to $0.5582 for the average NFT transaction on Seaport, compared to Optimism’s average transaction fees, which range between $0.0009 and $0.0550.

Meanwhile, the blockchain network confirmed that this high fee situation was caused by “excessive network traffic.” However, it was claimed that the issue had been fixed at the time of reporting.

Why Basic Trading Fees Are Soaring

Cryptocurrency analyst Kofi Attributed We are seeing an increase in bot trading activity willing to pay “preferred fees”.

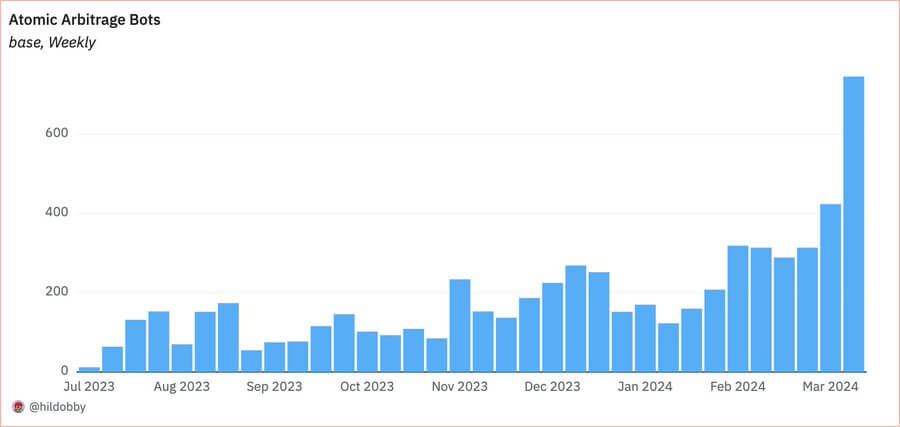

Michael Silberling, another on-chain data analyst, said: offer More comprehensive insights into the fee increase phenomenon. He highlighted memecoins on the Base network and automated actors focused on arbitrage opportunities as the main reason for the surge in fees.

Silberling noted that the increased demand maintains high network fees on Base because these traders are generally less sensitive to fees than regular users.

In particular, the Dune analytics dashboard curated by analyst Hildobby shows that the number of atomic arbitrage bots on Base has been on the rise recently.

Native DEX volume surges

Daily trading volume on the Ethereum Layer 2 network’s decentralized exchange (DEX) hit a new high of $374 million last day due to increased bot trading activity.

This milestone reflects Base’s growing popularity among cryptocurrency traders following the successful completion of the Dencun upgrade. According to data from DeFiLlama, transactions on the platform have increased 71% over the past week, reaching approximately $1.5 billion.

Additionally, the total value of assets locked in the network reached a new high of $775 million.

The post Coinbase-Based Base Leads Ethereum Layer 2 Fees Amid Surge in Trading Activity appeared first on CryptoSlate.