Coinbase Q4: Positive Income Recovery, Unlocking New Possibilities (NASDAQ:COIN)

Bijou_n

In its 2023 fourth quarter and full year earnings call, Coinbase Global Inc (Nasdaq:Coin) concluded the preface as follows:

Overall, Coinbase is a fundamentally stronger company today than it was a year ago, and we are in a strong financial position with: Take advantage of the opportunities ahead.

Financially, this is true given the company’s bottom line displays and related line item trends.

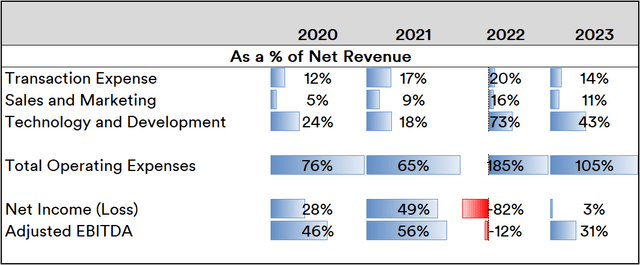

Source: Prepared by Sandeep G. Rao using Coinbase financial statement data

Technology costs remain high but are about $1 billion lower than in 2022. The business has always had high throughput between revenue and net income, except in 2022 when high technology costs were incurred. In 2023, pass-through may resume again as technology costs will be relatively lower than the previous year.

Why are trends in cryptocurrency trading volume and investor sectors High technology cost I needed it.

Deep trend drilldown

In 2021, various cryptocurrency assets competed for investor attention on the company’s platform. An overall sense of unity will be evident in 2022 and 2023.

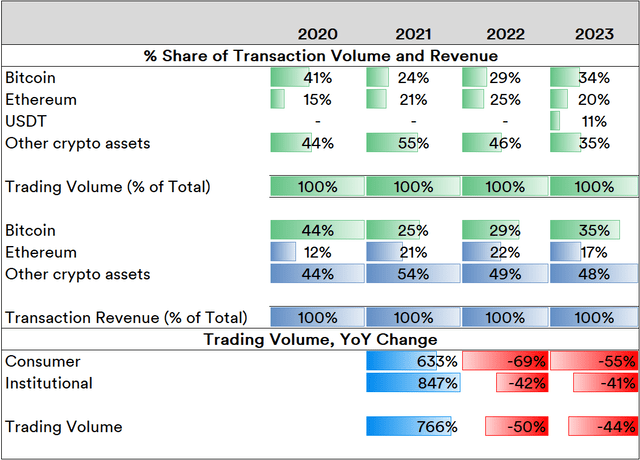

Source: Prepared by Sandeep G. Rao using Coinbase financial statement data

Over the past two years, both While consumer (retail) and institutional trading volumes are declining, two dominant popularity are emerging in the cryptocurrency space: Bitcoin (BTC-USD) and Ethereum (ETH-USD), with the former taking a lead by some margin. While these two cryptocurrencies can be interpreted as the dominant currencies of choice for long-term investors, other cryptocurrencies still remain a strong area of speculation for investors, as evidenced by the fact that they continue to contribute to almost half of the company’s trading revenue.

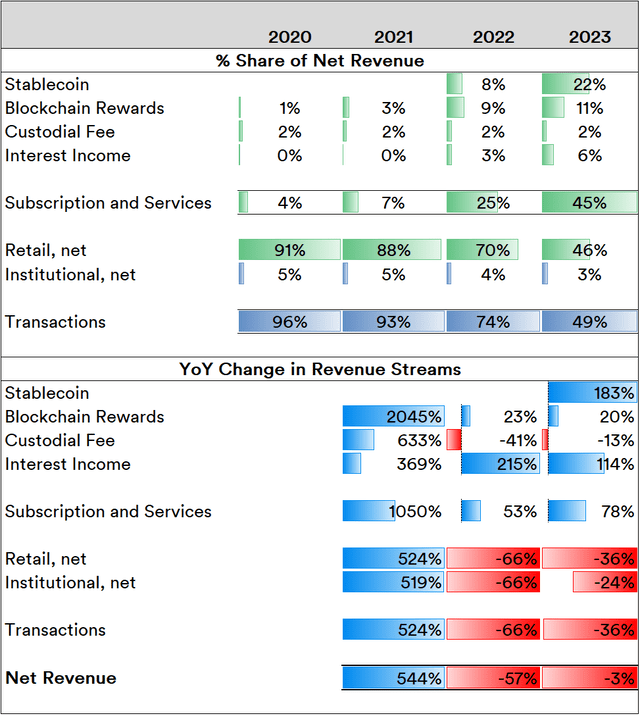

Stablecoins also had a very encouraging debut year on their balance sheets. In a year when subscriptions and services accounted for nearly half of the company’s revenue, stablecoins alone accounted for 22%.

Source: Prepared by Sandeep G. Rao using Coinbase financial statement data

Retail investor trading, once a major driver almost All of the company’s revenue now accounts for less than half of its net income. In terms of overall trends, subscriptions and services showed a strong two-year growth trend that easily offset the two-year decline in primarily stablecoin transactions. maximum The growth of electrons. However, despite the greater delivery of revenue to adjusted EBITDA, net revenue Under 3% compared to last year.

The overall downward trend in storage fee growth indicates that the concept of cryptocurrencies as an alternative to the current fiat system is increasingly losing traction. This may be due to the fact that widespread real-world “fungibility”, as ubiquitous as fiat currency, is currently unclear. However, there are very strong prospects for the suitability of cryptocurrencies as investment assets that can be easily converted to fiat currency and vice versa. do This is happening, as evidenced by the huge trading volume trend of Bitcoin ETFs this year. For most of the time since launch, the daily trading volume of these ETFs has exceeded $1 billion. Considering that Coinbase manages 8 of the 11 launched Bitcoin ETFs, it is likely that management fees have risen significantly. However, trading for these ETFs began immediately after SEC approval on January 10th of this year, so these ETFs are not included in this earnings release.

The Way Forward: New Revenue Streams

“Fungibility,” which is currently unclear, is likely a factor in the intense speculation currently swirling around cryptocurrencies. Not like that Bitcoin or Ethereum. These speculations create additional revenue generating channels for the company moving forward. In May 2023, the company launched an ‘international marketplace’ to target international customers. By the third quarter of 2023, it had registered 15 perpetual futures contracts on various cryptocurrencies, with over 100 institutions participating, generating approximately $10 billion in trading volume. In November, Coinbase Financial Markets (CFM) began platforming regulated derivatives for the U.S. market. In general, derivatives markets tend to be much larger than spot markets. Over time, derivatives are likely to become the largest market as eligibility for participation becomes more clearly defined. next Company size and growth drivers.

Regarding the “fungibility” issue, the company’s Base platform came online in August. Built on top of the Ethereum blockchain, the “layer 2” blockchain platform aims to help Coinbase customers stay on-chain and more effectively convert their holdings into fiat and real-world applications. In 2016, Coinbase CEO Brian Armstrong explained that the company’s final step (“Step 4”) in the company’s “secret master plan” was to facilitate everything by enabling the building of apps for the world’s open financial system. I did. Invests in lending and global remittances. The remittance issue alone is a target-rich environment. In a market where foreign workers and businesses remit hundreds of billions of dollars annually, sending $200 to a bank costs 6.2%, compared to an average of 12.1%. % (as of the second quarter of 2023). As of October last year, calculation service L2Fees estimated that $200 transfers to sub-Saharan African countries (which would normally cost more than 7.8%) accounted for just 0.02% of transactions on the Ethereum layer 2 network. Base has significant public utility and monetization potential, being the 4th largest L2 player with a total value locked (“TVL”, which stands for amount locked in Ethereum escrow) of $855 million at the time of this writing. there is.

Expanding international market exposure will help the company’s international and institutional clients address many of the constraints currently occurring within the financial services industry, as well as central bank digital currencies (CBDCs) and interconnected networks of cryptocurrencies, stablecoins and on-chain apps. It is entirely possible to gain significant benefits from . ) currently operates in Japan, India and China, and you can access cheaper money transfer translations through e.g. their Different currencies and each network. Overall, Coinbase is well-positioned to take advantage of not only the current trends in the Bitcoin ETF market, but also its numerous possibilities in the near future on a steady basis.

A new market, increased EBITDA attribution efficiency from revenue, a rise in Bitcoin price, and increased Bitcoin ETF trading volume are enough to warrant a recommendation for the stock. Opening up a new, potentially world-changing disruption in the financial services industry is a convenient bonus.