Columbia Threadneedle Fixed Income Monitor: February 2024

DNY59

Track your fixed income opportunities with these monthly updates.

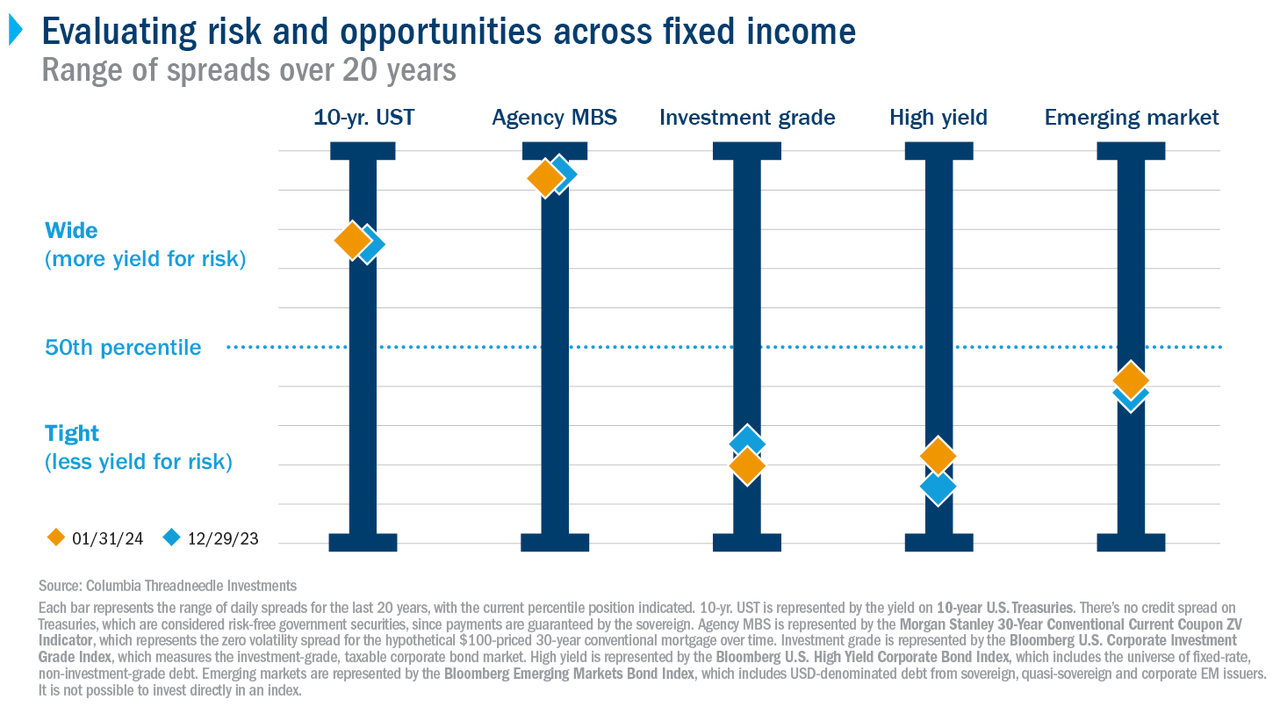

One way to understand where opportunities lie in the broader bond market is to look at credit spreads, which measure the difference in yield between a bond and a risk-free benchmark bond (such as U.S. Treasury bonds). Same period.

When looking at opportunities across bonds, credit spreads indicate how much more an investor receives in return for taking on additional risk.

If the spread is higher than the long-term average, it is called a wide spread. If it is below the long-term average, it is said to be tight.

Spreads are constantly changing, and these changes are driven by investor psychology and risk perception.

Our proprietary Fixed Income Monitor compares current spreads across fixed income asset classes against a 20-year history to help investors identify opportunities across the fixed income sector.

Key Takeaways February 2024

- Positive momentum heading into the new year slowed in January as investors digested firmer-than-expected economic data.

- Volatility has eased compared to previous periods. After an initial sell-off, spreads ended the month essentially unchanged across credit and securitized assets. Rates rose slightly for most of the trading day but ended near their starting levels.

- Spreads remain tight across many sectors, but yields are at multi-year highs. This has reignited demand for high-quality, low-risk income across the fixed income landscape as the Federal Reserve moves toward easing monetary policy.

Learn more about the importance of understanding spreads from Gene Tannuzzo, Global Head of Fixed Income.

transcript

When we talk about spread instruments in the bond market, we mean any bond that is not a risk-free asset. So in the taxable bond market we are talking about any bond that is either not a Treasury bond or is trading at an additional yield compared to a Treasury bond.

In the municipal bond market, we are talking about any bond that is not AAA, general obligation bond. The main role of spread products is to add additional yield to your portfolio.

When looking at spreads over a long period of time, if the spread is higher than its long-term average, it is considered wide or cheap. And if they are more expensive than their long-term average, we can call them rich or tight.

So typically we look for spread products or opportunities in the bond market where credit spreads are wide or cheap relative to the risks inherent in those securities.

expose

Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval from your Home Office.

© 2016-2024 Columbia Management Investment Advisors, LLC. All rights reserved.

Investors should consider Columbia Seligman Premium Technology Growth Fund’s investment objectives, risks, charges, and expenses carefully before investing. To obtain the Fund’s most recent periodic reports and other regulatory filings, please contact your financial advisor or download the reports here. These reports and other filings can also be found in the Securities and Exchange Commission’s EDGAR database. You should read this report and other documents carefully before investing.

With respect to mutual funds, ETFs and Tri-Continental Corporation, investors should carefully consider the fund’s investment objectives, risks, fees and expenses before investing. To find out more about this and other important information about each fund, download our free prospectus. You should read the prospectus carefully before investing.

The views expressed are as of the date given, are subject to change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) subsidiaries or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for their own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into account the circumstances of any individual investor. Investment decisions should always be made based on the investor’s specific financial needs, goals, objectives, time horizon and risk tolerance. The asset classes described may not be suitable for all investors. Past performance is no guarantee of future results, and no predictions should be considered guarantees. Because economic and market conditions change frequently, there can be no assurance that trends described herein will continue or that any forecasts will be accurate.

The Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. The Columbia Fund is managed by Columbia Management Investment Advisers, LLC and the Columbia Acorn Fund is managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. The ETF is distributed by ALPS Distributors, Inc., member FINRA, a non-affiliated entity.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.