COPT Defensive Asset: A Solid Buy on Government Rent Checks (NYSE:CDP)

Azan

It’s been a while since COPT Defense Properties(New York Stock Exchange: CDP) received a ‘Buy’ rating in October, highlighting its defensive real estate profile, discounted valuation and long-term growth potential.

While stocks showed an upward trend The stock has fallen since then, largely driven by market speculation about the direction of interest rates, with the stock recently falling from its January high to 1.3% below where I last covered it. Over the past year, CDP has declined 13%, as shown below, despite sound operating fundamentals.

CDP 1-Year Price Return (Alpha Exploration)

In this article, we provide an update and discuss why CDP continues to offer good value and return opportunities for patient investors with a long-term focus. So let’s get started!

Why CDP?

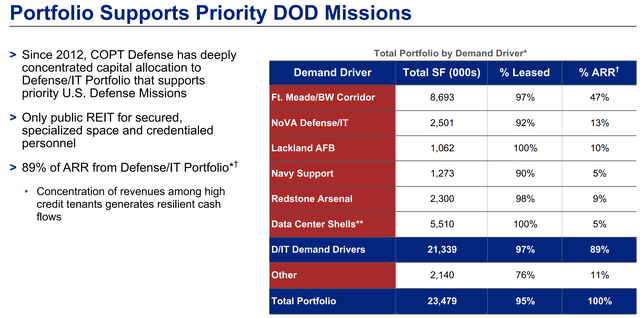

COPT Defense Properties is a member of the S&P MidCap 400 Index. A self-managed REIT focused on owning and leasing real estate related to the mission-critical defense/IT sector. This includes assets associated with the U.S. government and defense contractors, from which CDP derives 89% of its annual recurring rent. COPT’s current portfolio consists of 188 properties totaling 21.3 million square feet, of which nearly half (47%) of annual rents occur in Ft. This is the Meade/Baltimore-Washington corridor as shown in the picture below.

investor presentation

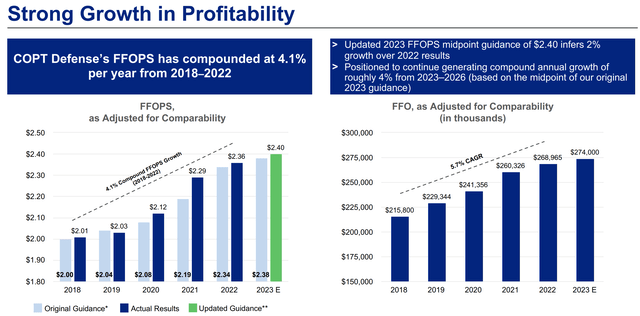

What makes CDP different from its office REIT peers is that remote work doesn’t really factor into the equation. This is because the critical nature of the work performed on the site makes it simply impractical or unsafe to carry out the work remotely. This has led to a steady increase in CDP’s FFO per share since 2018, a year of much upheaval in commercial office real estate. As shown below, CDP’s FFO/share has risen at a significant CAGR of 4.1% since 2018.

investor presentation

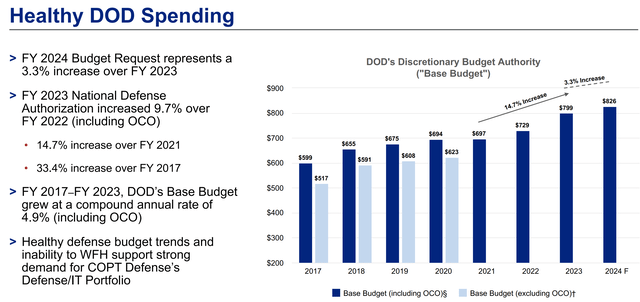

Additionally, the steady nature of government contracts and funding for the Department of Defense makes CDP tenants less vulnerable to economic downturns and corporate downsizing. This is supported by the following chart, which shows that the defense budget has increased every year since 2017, with the FY 2023 budget increasing by 9.7% over FY 22. In particular, this period includes executive leadership in American politics.

investor presentation

Although CDP’s stock price has been largely stagnant since our visit last October, CDP’s operating fundamentals have strengthened further during this period. This is reflected in CDP’s occupancy improving by 230 basis points (bps) from 93.6% in the second quarter to 95.9% in the third quarter, and lease rates improving by 200 bps between the two quarters from 95.0% to 97.0%. This includes a 97% leasehold ratio for the Defense/IT portfolio. This is the highest since the company began disclosing this segment in 2015 and an increase of 70 bps from the previous year.

Additionally, CDP continues to see same-property cash NOI growth of 4.5% during the third quarter (down from 5.8% growth in the second quarter), driven by strong rental volume and high tenant retention. This is reflected in a tenant retention rate of 83% for the first nine months of 2023 (82% in the third quarter), putting CDP on track to achieve its annual target of 80-85%.

Looking ahead to Q4 results, CDP has a path for external growth, with 1 million active developments underway. This could be a substantial growth driver for CDP as it represents 4.7% of CDP’s current portfolio base. This includes six projects located in Maryland, Northern Virginia, and Alabama that are already 90% leased, indicating positive demand drivers are firmly in place. Three of these projects entered service in the fourth quarter, and all three are 100% leased. In addition, CDP has an additional development potential of 1.2 million square feet, offering good prospects in the short to medium term.

Risks to CDP include the potential for higher-than-expected inflation, which could exceed the average annual rent increase of 2.7% due to recently renewed leases. Other risks stem from the fact that CDP’s tenant health relies heavily on government funding for defense spending. However, this risk may be reduced in the near term, as the fiscal year 2024 budget request represents a 3.3% increase over the 2023 level. This seems reasonable considering the global conflict in the Middle East and Ukraine.

Meanwhile, CDP has a strong balance sheet with no variable debt exposure, $200 million in cash, and 85% available capacity on its revolving credit lines. Additionally, its net debt to EBITDA ratio of 6.0x is reasonable, a level that the rating agency considers safe for a REIT, thus supporting its BBB- investment grade credit rating. As you can see below, CDP does not have significant debt maturities until 2026, making it less sensitive to the current high interest rate environment.

Importantly for income investors, CDP’s yield is currently 4.7% and its dividend is well covered with a payout ratio of 47%. It is noteworthy that CDP demonstrated its ability to increase dividends by increasing 3.6% last year after freezing dividends since 2012 while shrinking its balance sheet.

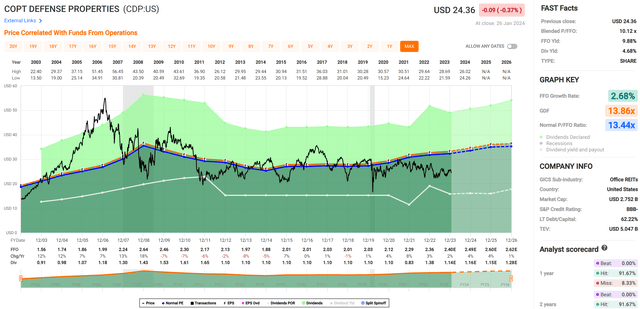

Finally, CDP’s current price is $24.36 and its forward P/FFO is only 10.2, which is lower than its normal P/FFO of 13.4. At current valuations, the market is pricing in a lot of uncertainty, which we do not believe is reasonable for CDP’s certainty about sustainable government-related tenants. Analysts expect FFO/equity growth of 4% per year over the next two years, which we think is a reasonable estimate considering the 2.7% annual rental escalator and development pipeline that needs to add value. This allows CDP to generate market-beating returns with a 4.7% return, 4% annualized FFO/equity growth, and a conservative 2% annual mean-value reversion.

FAST graph

Compared to its office REIT peers, CDP has a ‘moderate’ valuation. For this exercise, we will use EV/EBITDA because Enterprise Value includes the value of both equity and debt. This allows for a normalized and fair comparison compared to using P/FFO, which only measures equity value.

As shown below, CDP provides EV/EBITDA, which is cheaper than Boston Properties (BXP) but more expensive than Kilroy Realty (KRC), Highwoods Properties (HIW), and City Office REIT (CIO). While I see value in CDP’s cheaper Office REIT peers, I believe CDP is still a solid choice for those seeking a relatively safe real estate profile with better near-term dividend growth potential.

CDP vs Peers EV/EBITDA (Alpha Exploration)

Investor Implications

CDP has a strong portfolio of government leased office assets with stable cash flow, a reasonably leveraged balance sheet, and solid dividend growth potential. Our focus on the defense sector provides stability to our tenant base while enabling our development pipeline to drive future growth. CDPs are also partially undervalued, offering attractive current yields and market-beating return potential. Therefore, CDPs may be a worthy addition to a diversified income portfolio due to their quality characteristics. For the above reasons, my argument for CDP remains the same as last time, and my investment opinion remains ‘buy’.