Costco: If You Have Less Than Four Years Left, It’s Time to Stock Up (NASDAQ:COST)

freely

A few months ago, we wrote an article about Costco.NASDAQ:Cost). In that article, we talked about how the combination of the company’s continued growth, ongoing share buybacks, strong momentum, and reasonable valuation are promising factors. long term Outperformance of equity shareholders.

Fast forward to today and that has certainly been the case. The stock is up up to 30% since the Buy rating was issued, nearly doubling the performance of the S&P 500 in that time.

But after moving so quickly in just a few months, the company’s stock may have packed the next few years of ‘natural’ appreciation in value in a very short period of time.

So when combined with a lackluster second-quarter earnings report, we’re concerned that the stock could face a choppy run.

Everything we said about the initial paper is The name remains today. The company is very well run and has several cost and scale advantages that will drive results for decades to come.

However, if you are not a long-term investor in the name, or if your holding period is only a few years, it may be time to take some profits from the stock.

Today we’ll take a look at the company’s recent earnings report and results valuation picture to determine what could happen next for COST. Sounds good?

Let’s dive in.

Recent Earnings

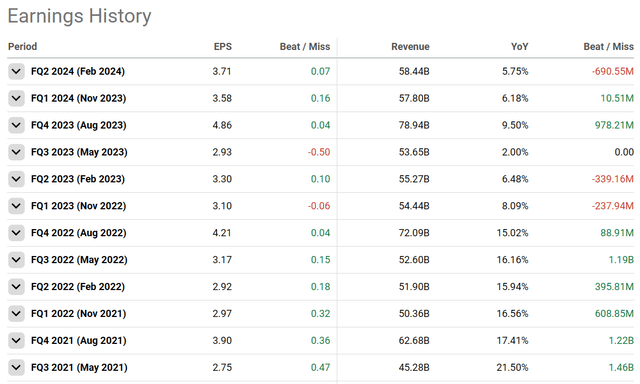

First, let’s look at the second-quarter earnings report, which saw the stock drop 7.5% on Friday.

From a top-down perspective, everything appears ‘fine’. The company reported comparable sales estimates for the holiday quarter, beat earnings estimates and beat earnings expectations by $0.16 per share.

Additionally, net profit margins were around 3%, the highest the company has seen in several years. Considering the difficulties many retailers have experienced over the past eight quarters as inflation has run rampant, COST management has navigated the ship well with a nearly stable NM% and is now expanding margins as things pick up again. This is good news.

But if profits were so good, why were the stocks sold?

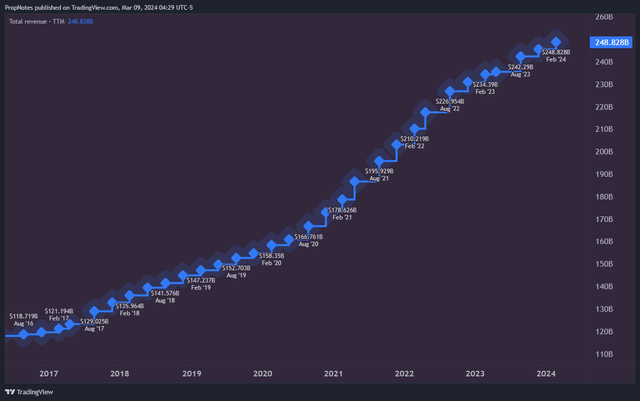

In other words, it appears that the stock price was sold off due to a slowdown in top-line sales. Sure, the components were good (ahead of expectations), but when you zoom out, revenue growth is flat.

pursue alpha

For companies that were doing well a few years ago with high double-digit (even 20%+!) growth rates, growth rates are now firmly in the mid-single-digit range. As we just discussed, this hasn’t impacted margins, but it does indicate that the company is likely to face some challenges going forward in accelerating these numbers again.

There are some levers management needs to pull, such as raising membership fees or pursuing international expansion, but for the time being, COST’s revenue picture appears to be closer to the top of the S curve.

TradingView

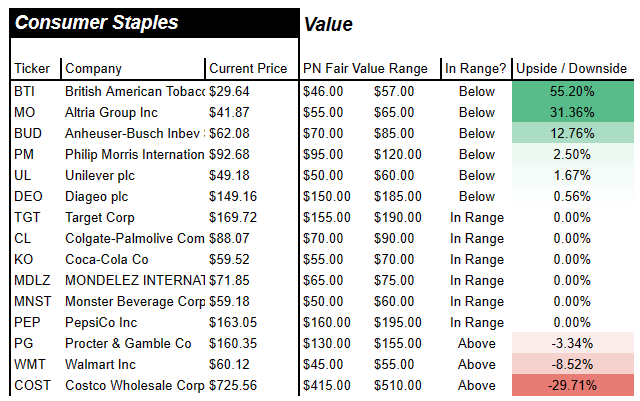

value

This wouldn’t matter as much if valuing stocks weren’t so tricky.

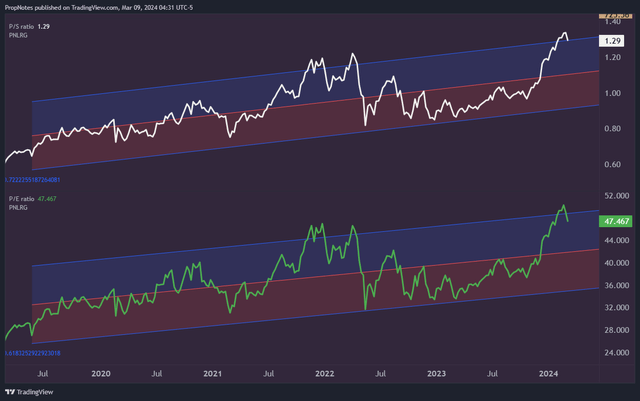

When the stock was first announced last November, the company was trading at a 0.98x sales multiple and a terminal valuation of 39x.

TradingView

But now, with two more quarters of information to process, it’s clear that much of the appreciation the stock has enjoyed over the past four months has been primarily due to multiple expansion.

As you can see above, the highest and lowest stock valuations have extended by more than one standard deviation from a five-year linear regression.

This doesn’t mean the multiple can’t continue to expand, but when combined with the earnings picture, it suggests the stock’s risk is definitely bearish.

In the future, COST will look very expensive.

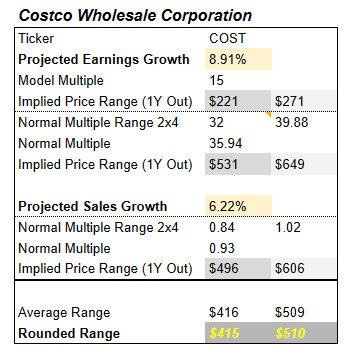

When we bake in historical multiples for that growth, growth, and model multiples, we get a fair value range for COST stock between $415 and $510 per share.

Prop Note

To us, ‘fair value’ is simply the price at which investors can expect to fully participate in the business going forward.

In November we liked the stock at $550. This was slightly higher than our ‘fair value’ estimate. This wasn’t a problem. This is especially true if someone wants to invest in a quality business for the long term.

But now it’s $725 per share. Even after that Down 7%, this stock is still the most valuable Consumer Staples (XLP) stock of all the stocks we cover.

Prop Note

This is concerning because it means that while the company may continue to produce consistent results going forward, the stock could still see a downside, or at least suffer long-term, if multiples start to lower towards mean reversion, as expected. Chop’s.

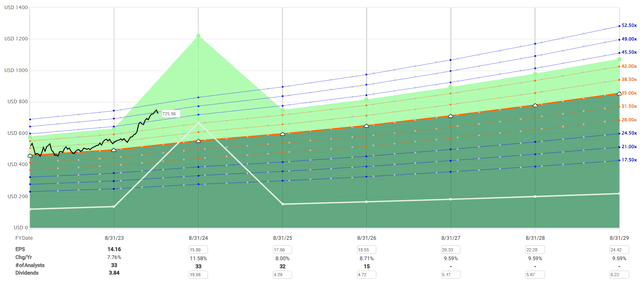

If we look at where the stock is currently trading and extend COST’s five-year historical AOE multiple, the stock is ‘ahead’ of its business results by about four years.

FAST graph

This suggests that if your holding period is shorter than 4-5 years, now could be a very good time to profit from the name. We expect to be able to purchase them again at lower prices at least between now and 2028.

danger

There are several risks with this paper. For example, it’s possible that the market is correct and COST’s long-term multiple should be significantly higher than growth modeling suggests, as well as higher than the already generous valuation at which the stock has been trading recently.

This may be due to underestimating future growth from international expansion or underestimating the margin improvements that could be achieved through better management execution and planning.

but it appears more likely Greed and passion have swept investors with this name and now is a good time to consider raising stakes in short and medium term positions.

summary

Overall, our long-term case for Costco still holds true. This company is a gem and certainly looks like a great business for the long term.

That said, cashing out or trimming now seems to be the best course of action for short- or medium-term investors who are taking large profits from a position, or for those who may need the capital for other things in the next few years. Leveraging rich pricing seems like the best risk/reward approach.

Therefore, we are downgrading COST to ‘Pending’. We look forward to upgrading our stock again when the situation improves, but we do not currently have any in stock.

good luck!