Cryptocurrency Fee Updates

Jack Bogle, founder of Vanguard Investments, was an investment mogul, but he was not your typical Wolf of Wall Street.

Born in 1929, the Great Depression instilled in Bogle a deep respect for saving. He was skeptical about the high fees charged by investment managers and banks. They have quietly been eating away at their customers and the revenue they should be generating for them.

He founded Vanguard, which became an industry giant by prioritizing investor returns over company profits. Vanguard also democratized investing for the public by launching the first low-cost index fund for retail investors. (These are the same funds used in the Blockchain Believer Portfolio.)

He founded Vanguard, which became an industry giant by prioritizing investor returns over company profits. Vanguard also democratized investing for the public by launching the first low-cost index fund for retail investors. (These are the same funds used in the Blockchain Believer Portfolio.)

Throughout his long career, Bogle has challenged the industry’s focus on beating the market and pursuing long-term, low-cost investments. The guy was obsessed with fees.

Bogle passed away in 2019 at the age of 89 (read more about his amazing life here). And today we can actually use him for cryptocurrencies where the fees are prohibitively high.

Cryptocurrency Fees, Explained

Cryptocurrencies were founded on the idea of being able to send money around the world instantly and without fees, but the opposite is true. Using cryptocurrency is generally It’s much more expensive Better than TradFi for general users

- exchange fee: When buying or selling cryptocurrency on an exchange platform, you will pay a flat fee or a fee as a percentage of the transaction. You may also pay “hidden” fees in the form of maker-taker fees and spread fees. You may also pay a fee to get money in or out of your account!

- network fee: Most blockchains require you to pay a “gas fee” to process a transaction. This fee is paid to the miners or validators who run the network. These fees can be prohibitively expensive during peak times, especially for small transactions.

- wallet fee: Some wallets, such as managed wallets, may charge fees for sending and receiving cryptocurrency.

- role: If you sell cryptocurrency for a profit, you must pay capital gains tax on the difference between the purchase price and the sale price. Tax rules may vary depending on where you live and how long you’ve held your cryptocurrency, but you’ll pay taxes on any profits you make (up to 34% in the US).

It helps to visualize this. Let’s say you bought Bitcoin last month and made $1,000 in profit, and you want to cash it out. Here’s how much you’ll pay in taxes and fees:

The situation gets even worse if you only make a $100 profit.

More than a quarter of revenue is wasted. Imagine all the short-term investors who are doing these kinds of trades all the time.

There is a better way.

Fee vs. free

The only transactions that are free are transferring cash from one person to another.

Still, you may have paid a fee to withdraw money from an ATM (the average fee is about $4 to $5, according to Bankrate). You may also have been paying a monthly fee to your bank (an average of $15 for an interest-bearing checking account).

Everything else incurs a fee. Credit card. stripe. Paypal. Wire transfer. You pay the fee or the seller pays the fee. For most transactions, this is around 3%, or sometimes a flat fee (about $25 for a wire transfer, according to NerdWallet).

The most difficult people are those who have no money. Banks are waiving fees for larger customers, but the minimum amount to avoid fees has soared to more than $8,600 on average. And people who sometimes withdraw more money than they have in their accounts end up paying as much as $27 each time they overdraft.

It’s easy to see this system as just another way for the rich to get richer and the poor to get poorer. The system is free if you have the money. Otherwise the system is fee. Free vs. fee.

Blockchain will solve all of this, right?

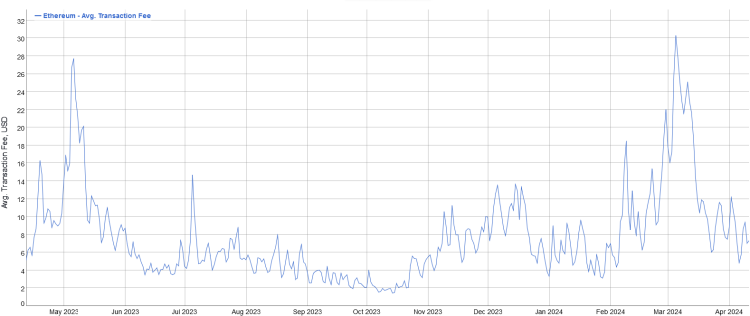

Ethereum average fees

The average fee for a transaction on Ethereum, the layer 1 blockchain where all operations take place, is around $6.50. And on any given day it can soar to $30!

What’s worse is, Ethereum fees are not proportional to the amount transferred.. When you use a bank ATM, you typically pay the same service fee regardless of the amount you withdraw. In Ethereum, fees are charged based on the complexity of the transaction, which is much more difficult to predict.

Even worse: When the Ethereum network becomes more congested, fees become more expensive. – This is the time when most people want to buy and sell, fueled by FOMO.

Cryptocurrency’s exorbitant fees are Huge, gaping defects For people trying to build long-term wealth. Banks are legally prohibited from charging a 30% fee. (Unless you’re poor, of course. Then they can overdraft.)

Of course, there are alternative blockchains (e.g. Solana) that have lower fees than Ethereum. And there are layer 2 platforms (such as Arbitrum) that can make Ethereum transactions cheaper.

But since Ethereum is where the action (DeFi, NFTs, and all the other cool stuff) is, it’s where the problem lies.

Fees are the biggest, unspoken secret of cryptocurrency. Developers, Miners, Vitalik: You must do better.

We have a long way to go in our effort to beat the banks.

Taxes: The biggest fee

Fees are another reason we focus on long-term investing. Every time you exchange one token for another, every time you put money in or out of a cryptocurrency, you pay these huge fees.

But there’s another reason to hold on to it for the long term. Every time you make a transaction This is a taxable event.

This means that when you make money, you pay taxes on your profits. In the US, taxes are 15-20% for most people. Think of this as a government fee.

However, the cost of holding and growing a cryptocurrency is zero. naught. grow. Once you buy cryptocurrency, you can store it completely free.

summary: Do not move your cryptocurrency investment once you have purchased it.. It’s tempting Because it’s so easy: Just click the “Swap” button in your MetaMask wallet. Avoid this temptation.

As the market goes crazy and everyone buys and sells, we keep calm and HODL.

Investor Implications

Jack Bogle has consistently argued on behalf of investors that their profits can be stolen over a lifetime by fee-grubbing financial institutions.

Not only do we follow Bogle’s philosophy, we use his money.

To repeat the strategy: We set up a steady withdrawal from our bank account each month and invest it in the Vanguard All-Stock Fund, the Vanguard All-Bond Fund, and some cryptocurrencies (10% or less). Your entire portfolio.) Learn more about our investment approach here.

Even though today’s blockchain fees are unreasonable, that doesn’t mean you should stay away from cryptocurrencies altogether because the potential profits are too great. Still, here’s what it means: We avoid moving money Until the developers finally fix this issue.

If you can make smart blockchain investments, and leave them alone, we can build wealth faster. If there is no transaction, there are no transaction fees. This means you can grow freely and freely.

It’s free, no fee.