Cryptocurrency prices in the spotlight, small-cap stocks currently on the rise | chart watcher

key

gist

- Bitcoin closes above 42,000, 20-month high

- Small-cap stocks also closed higher and are currently trending upward.

- Take a look at how seasonal patterns play out in December, as this could be an indicator of what to expect in 2024.

The stock market appears to be on the decline after a strong rebound last week. Considering November’s surprising performance, this is a healthy sign. Editor Jeff Hirsch Stock Trader’s Almanac, said so Price movements were flat in early December..

This week you will receive the November Nonfarm Payroll and JOLT reports. The labor market remains strong, and we will see this when data is reported. The market expects 175,000 new jobs to be created, which is a huge number. The unemployment rate is expected to remain at 3.9%. Will a sell-off occur if the data is much stronger than expected?

We need to see signs of inflation cooling before the Federal Reserve cuts interest rates. The Fed says it wants inflation at 2%, but we’re far from that level. But the stock market has priced in four interest rate cuts in 2024, which is the main reason for November’s stellar rally.

bitcoin rally

Bitcoin benefited from this story. The cryptocurrency hit a 52-week high, closing above 42,000 (see daily chart of Bitcoin and US Dollar below).

Chart 1: Daily chart of Bitcoin against the US Dollar. $BTCUSD broke its July high in late October. Since then it has been going higher and higher.Chart source: StockCharts.com. For educational purposes.

In late October, $BTCUSD broke above the July high, which was considered a critical resistance level. After surpassing this level, the cryptocurrency soared. What’s next for Bitcoin? Looking at the weekly chart below, the next level to break above will be the March 2022 high.

Chart 2: Bitcoin weekly chart. When the MACD line crosses the signal line close to the zero line, this is often a very bullish signal. Look what happened in October 2020. Chart source: StockCharts.com. For educational purposes.The MACD line crossed above the signal line, which occurred near the zero line, which is considered a bullish signal. Take a look at what happened when a similar situation occurred in October 2020.

On the daily chart, the MACD crossover of the signal line indicates the potential for further upside, but not as high as on the weekly chart. Since $BTCUSD is a volatile asset, you will want to look at the daily charts to make entry decisions, and perhaps even shorter time frames to make exit decisions.

Gold prices have also seen some interesting price action. The shiny metal hit an all-time high of $2,152 an ounce, but has since fallen sharply. This was interesting considering there was no sharp reversal in interest rate trends. But realistically, it makes sense. Why not profit when gold reaches record highs and earn interest on your cash? So it may be a short-term move. Gold is worth watching as investors use it to diversify and hedge their portfolio holdings.

SPDR Gold Shares ETF (GLD) is popular among individual investors. It tracks the price of gold relatively well (see chart below).

Chart 3: Gold hits new highs but sells off. After gold prices hit record highs, investors rushed to sell off their gold assets.Chart source: StockCharts.com. For educational purposes.

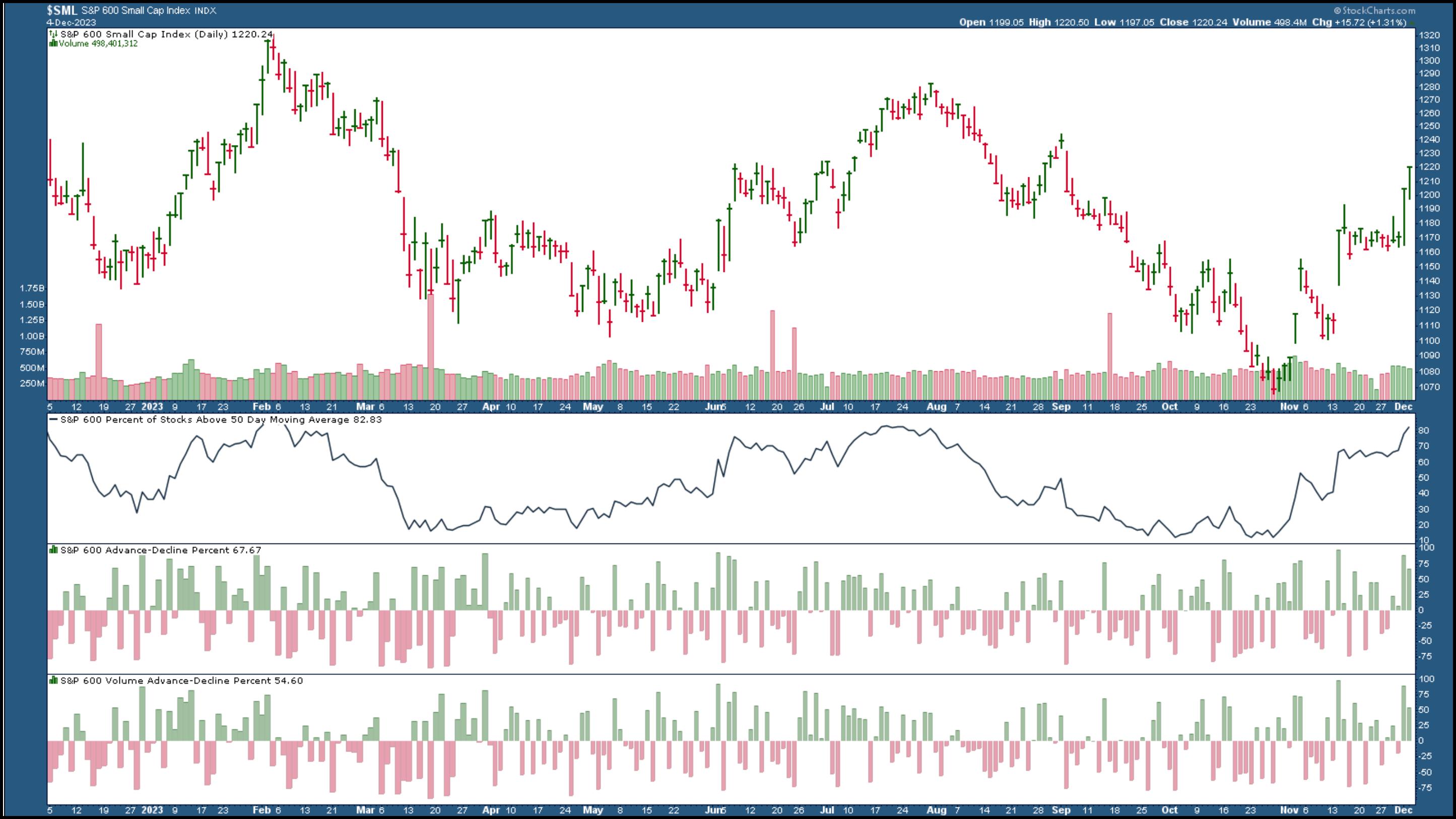

Don’t forget the small caps

One asset class that closed higher today was small-cap stocks. This is a group that is showing strength after being trampled. Market insiders continue to support the upward trend, which is encouraging. Especially after Hirsch reiterated that small-cap stocks tend to perform well starting in mid-December. Are they starting a rally first, or can we expect a big rally in the middle of the month? It’s something to see.

Chart 4: Small-cap stocks are showing strength. After being trampled, small-cap stocks are starting to bounce back and are trending upward.Chart source: StockCharts.com. For educational purposes.

conclusion

Early December will be an interesting time in the stock market. Keep an eye on the seasonal patterns typical of the market this time of year, especially before the election. How December and early January play out will tell us how the markets will perform in 2024.

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as Technical Analysis Editor for Stocks & Commodities magazine for over 15 years. Learn more