U.S. Rep. French Hill (R-Arkansas) didn’t mince words on Capitol Hill Thursday, effectively criticizing fellow D.C. lawmakers for accusing cryptocurrencies of financing international terrorism, “whose reactionary claims have proven to be greatly exaggerated.”

This was the second part of the House Financial Services Committee titled ‘Cryptocurrency Crime in Context’, which drew testimony from financial industry experts on anti-money laundering measures and cryptocurrency analysis.

“Through hearings and confidential briefings, the committee heard from the intelligence community, blockchain experts, and law enforcement and gained a much better understanding of the scope and scale of cryptocurrency’s role in terrorist financing,” Hill said. “While reactionary claims have proven to be greatly exaggerated in the case of Hamas and Gaza, it remains important to identify and close potential gaps that criminals and terrorists can exploit.”

To this end, Hill emphasized the need to ensure proper oversight of the cryptocurrency industry, which could actually be facilitated by the technology itself.

“The transparency of public blockchains provides law enforcement with critical data about illegal actors and their networks, allowing them to track them down,” he said.

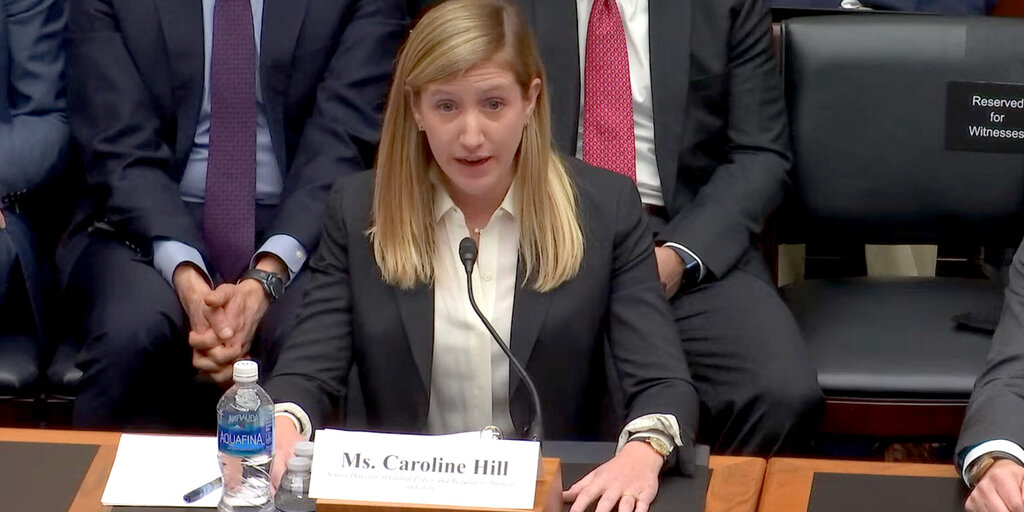

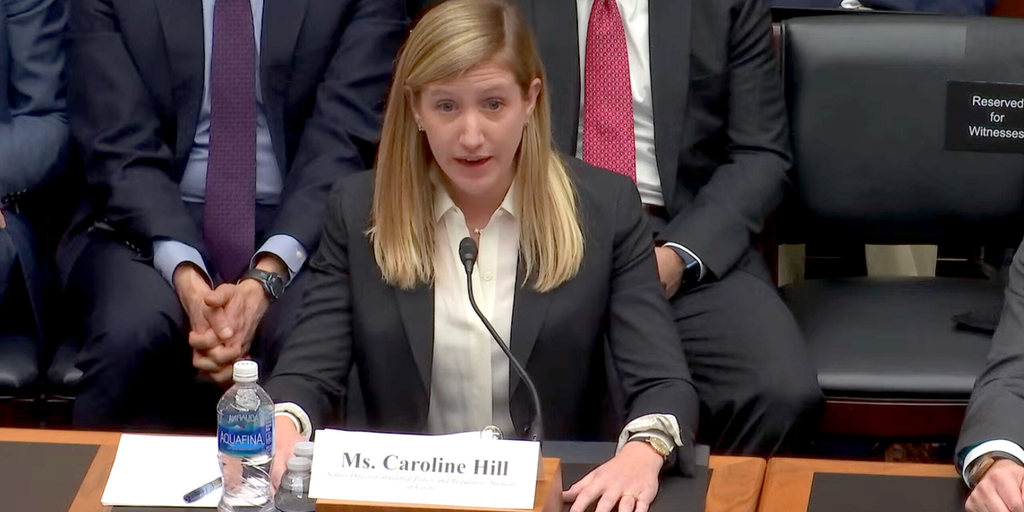

Caroline Hill, senior director of global policy and regulatory strategy at stablecoin platform Circle, told the committee that terrorist organizations were increasingly using stablecoins to solicit donations.

“I don’t know why illegal actors are turning to certain offshore stablecoins, but I think it’s because they have publicly taken the view that they are higher than anti-money laundering and terrorist financing standards,” Hill said. “We will encourage stablecoins pegged to the U.S. dollar to have the same regulatory obligations under OFAC and FinCEN to ensure they are not used by terrorist financing groups.”

Another major challenge facing federal regulators is the concentration of illegal actors and organizations beyond U.S. borders.

“Sanctions evasion, terrorist financing and criminal activity are concentrated on offshore platforms,” said Grant Rabenn, director of financial crime at cryptocurrency exchange Coinbase. He said existing legal tools should be more widely adopted to “crack down on foreign actors.”

He noted that while Coinbase has identified more than 8 million cryptocurrency wallets believed to be involved in the fraud, OFAC has sanctioned a total of about 560 addresses.

“By making inferences based on these OFAC addresses, we can block funds from flowing to malicious actors in real time,” said Rabenn, noting that domestic regulated exchanges are investing heavily in compliance. They are moles trying to circumvent strict anti-money laundering rules and expecting regulators not to care.”

Rabenn also warned against over-regulation of the cryptocurrency industry, echoing Hill’s comments that the transparency of public blockchains provides more visibility into transactions than traditional finance.

“In this way, cryptocurrencies are compliance on steroids,” he said. “This allows for a new level of compliance – a public ledger that provides visibility into what users are doing on and off the platform.”

The beauty of blockchain was also praised by Michael Mosier, former acting director of the Financial Crimes Enforcement Network (FinCEN) and current general counsel at cryptocurrency company Espresso Systems.

“Mr. Rabenn was explaining a case the Department of Justice was prosecuting, and we had enforcement from both OFAC and FinCEN,” Mosier recalled. “The ability to have this transparent ledger and operate in the digital space of structured data has allowed us to build cases exponentially faster.”

Mosier argued that regulators like FinCEN need increased funding from Congress to combat illegal cryptocurrency activity. Ranking Committee member Maxine Waters, D-Calif., directly blamed Republicans for obstructing law enforcement.

“We want to strengthen the jurisdiction of U.S. enforcement agencies so they can expand their reach internationally, but extreme MAGA Republicans are trying to cut funding to these agencies and put our national security at risk,” Waters said. .

Meanwhile, Rep. Ted Byrd, R-N.C., warned against judging emerging technologies by their “worst uses,” arguing that this would lead to “poorly conceived public policy.”