Cybersecurity ETFs Come to Life as New Trend Stage | chart of art

key

gist

- Stocks go through trending and non-trending phases.

- Non-trend phases often last longer than trend phases.

- CIBR has emerged recently and started a new trend phase.

The Cybersecurity ETF (CIBR) continues its lead, hitting record highs last week. It is important to remember that CIBR began its leadership role much earlier, as it hit new highs in late August. Today’s report will analyze recent breakthroughs and suggest some possibilities for the future.

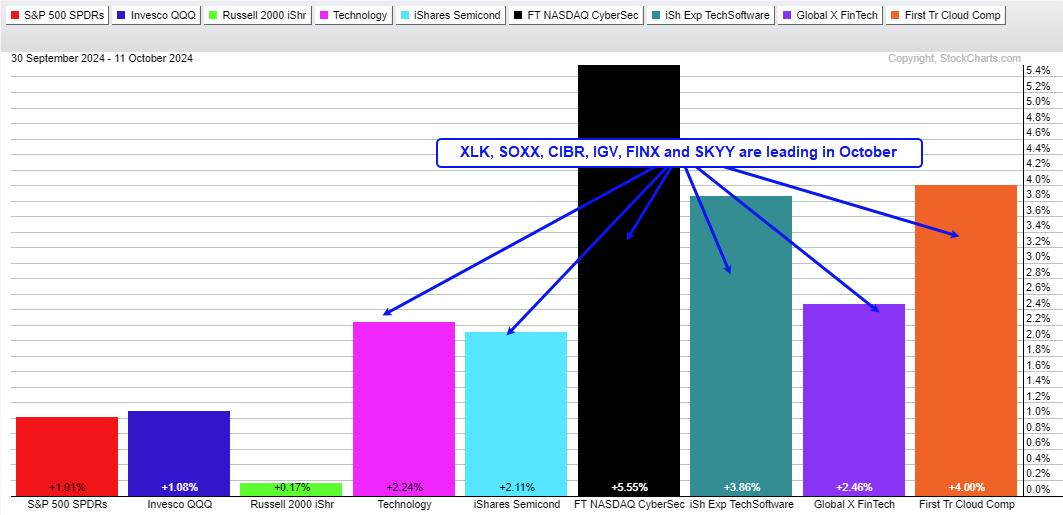

First, note that in October, technology SPDR (XLK) and five technology-related ETFs (Semi, Cybersecurity, Software, Fintech, and Cloud) are leading the pack. They are up over 2% and easily outperform the major index ETFs (SPY, QQQ, IWM). Technology ETFs underperformed in July and August and are now regaining steam.

I introduced CIBR on Art’s Charts on September 14th, showing how to use the percentage above the MA(5, 200) to define trends and reduce whipsaws. In long-term uptrends, stocks and ETFs experience both trending and non-trending periods, with the latter often lasting longer.

The chart below shows the upward trend in CIBR over a period of less than four months from late October 2023 to mid-February 2024. A period of non-trend followed and lasted for more than six months. Most recently, the ETF broke out of this range and entered a new trend period. I expect this trend period to last for several months and push prices higher.

The breakout zone around 59 (red line) turns into the first support zone to watch out for in case a pullback occurs. A pullback occurs when the price falls back into a resistance area after a breakout. Overall, support is seen in the 59-60 area and a pullback to this area would provide a second opportunity to participate in the breakout.

TrendInvestorPro focuses on CIBR, technology-related ETFs, and technology stocks moving from non-trending periods to trending periods. We believe we are looking at a seasonal pattern where the market turns bullish soon after the election. Opportunity awaits! Click here for more information.

special offer!!

Get 2 training reports/videos with each subscription

“Find bullish setup areas with high reward potential and low risk.”. Trends are your friend, and declines within an uptrend present opportunities. We show you how to find attractive setups that combine market conditions, trend identification, oversold conditions, and trading patterns. Trading is about probability and this setup puts the odds in your favor.

“Use of breadth for yield, thrust, market regimes and oversold conditions”. This report covers four ways to use breadth indicators. A yield condition often signals a major low, while a thrust signal signals the beginning of a bullish phase. Market frameworks help distinguish between bull and bear markets, while oversold conditions identify tradable pullbacks within bull markets. We describe the indicators, settings, and signals for each scenario.

Click here to get instant access!

Highlights from recent weekly reports/videos:

October 4th Report: We confirmed strong breakouts in several technology-related ETFs (QQQ, XLK, MAGS). We also recorded continued strong performance in our Software and Cybersecurity (IGV, CIBR) segments. The report also shows a bullish continuation pattern for three major AI stocks and identifies two bullish setups in the healthcare sector.

September 19th report: We started with the breadth model, which has maintained a bullish stance since December 7th. Tightening yield spreads continue to show confidence in credit markets. This report features bullish setups in ETFs related to copper, base metals, copper miners, and palladium (CPER, DBB, COPX, PALL).

Click here to get instant access!

///////////////////////////////////////////////////

Choose a strategy, develop a plan and follow the process

Arthur HillCMT

Chief Technology Strategist at TrendInvestorPro.com

Author, Define Trends and Trade Trends

Want Arthur’s latest market insights?

– follow @ArthurHill on twitter

CMT Arthur Hill is the Chief Technology Strategist at TrendInvestorPro.com. Focusing primarily on U.S. stocks and ETFs, his systematic approach to identifying trends, finding signals within trends, and establishing key price levels has made him a respected market technician. Arthur has written articles for numerous financial publications, including: Barons and Stocks and Commodities Magazine. In addition to his Chartered Market Technician (CMT) qualification, he holds an MBA from Cass Business School, City University of London. Learn more