Danaher: Continuing to Compound (NYSE:DHR) | pursue alpha

miscellaneous photos

introduction

As a long-term oriented investor, I am always looking for long-term oriented companies. There are many ways to measure this, and they are somewhat subjective. But I think there are few companies that do this better and better. More resolutely than Danaher (New York Stock Exchange: DHR).

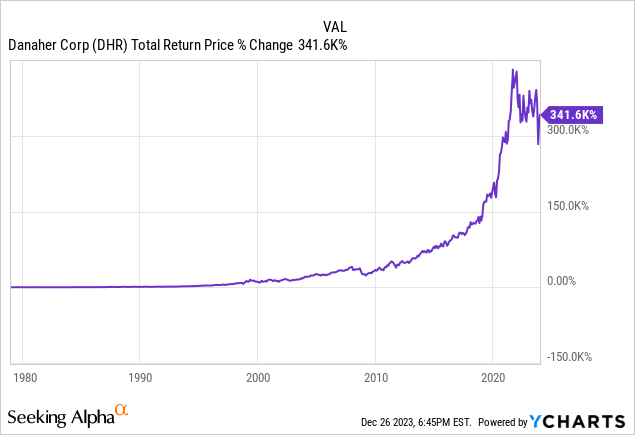

And while stock charts don’t always tell the whole story, in Danaher’s case we believe it’s a strong indicator of the quality of its business and management.

Danaher is a life sciences company, but it wasn’t always that way. A few years ago, it was just a real estate trust. So how did a real estate trust become a rock star in life sciences? Danaher’s story is one of radical change driven by management focused on capital allocation.

It wasn’t Danaher’s transformation. accident.

In today’s article, we will look at Danaher’s financial performance. But more importantly, we have been able to rise to the top of the industry through continuous and active adaptation to market trends.

unique change

Many companies use M&A to fuel growth. Some use it to strengthen their market share, others use it to enter new growth areas, and sometimes they use it to acquire talent.

Some companies use it to achieve a sort of corporate facelift. That is, a “boring” stable business can acquire something “sexy,” generating positive buzz on the street, which can then lead to a higher revaluation relative to improved returns. majority. I would argue that an example of this is AT&T (T)’s acquisition of Warner Bros. (WBD). However, this was later canceled.

M&A is common. What’s unusual is Danaher’s approach to this.

As mentioned in the introduction, Danaher used M&A to fundamentally transform its business. After all, how can a real estate trust be a pioneer in the life sciences field? Let’s discuss how things came together.

From real estate to manufacturing tools

Danaher’s dominance in life sciences did not happen overnight. In fact, it is the product of several successful reinventions. Danaher’s first big change was its transition from a real estate trust to a manufacturing tools provider.

They achieved this transformation through a series of acquisitions in the manufacturing tools space, including Chicago Pneumatic, Qualitrol, and Easco Hand Tools. In just a few years since its founding, it has successfully acquired 12 companies. These early moves established a clear strategy.

M&A is in Danaher’s DNA.

In addition to acquisitions, we routinely sold non-strategic business units. One of these early sales was part of one of our first acquisitions, Chicago Pneumatic, where we sold off parts of the business that were not suited to manufacturing tools.

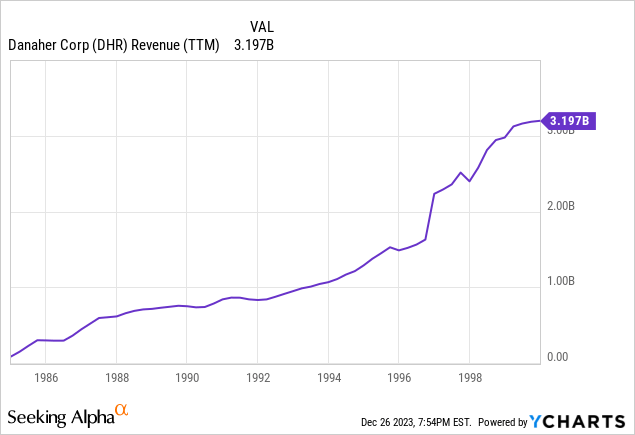

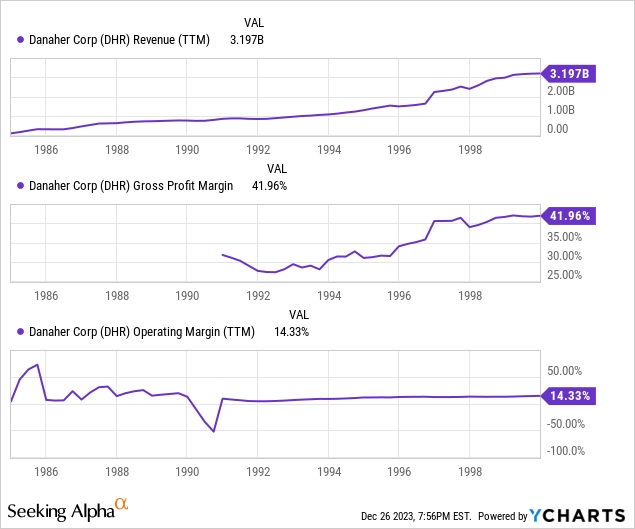

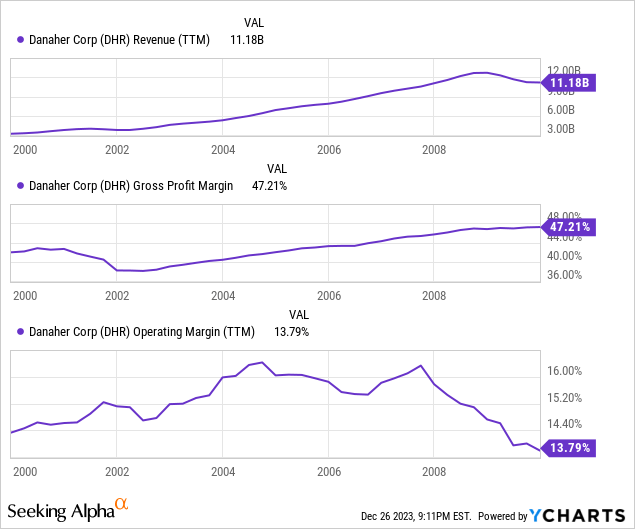

As a result of these changes, Danaher’s profits exploded from less than $500 million in the early 1980s to more than $3.2 billion by the turn of the century. Gross profit margin followed a similar trend, expanding from approximately 30% to over 40% over the same period.

These early years would be defining for the company. By leaping into new business areas with compelling fundamentals, we achieved remarkable financial success and doubled down by acquiring companies in those areas to serve a wider range of customer needs and gain share.

Kaizen

Before we move on to Danaher’s next reinvention, let’s take a look at the mindset that made it possible: Kaizen, Danaher’s guiding philosophy.

Kaizen is a lean manufacturing principle originating in Japan that emphasizes continuous improvement in all aspects of operations. This mindset is deeply ingrained in our company culture, creating an environment where innovation is encouraged and expected.

At Danaher, Kaizen demonstrates our relentless pursuit of efficiency and quality and empowers employees at all levels to identify and implement improvements. That is why I would like to argue that this Kaizen philosophy was the driving force behind Danaher’s radical reinvention.

Danaher in the 2000s

After achieving great success with its expansion into manufacturing tools, Danaher continued to expand through M&A and into new fields such as life sciences and dentistry.

By the 2000s, Danaher had become a truly large corporation, operating many divisions and serving a very diverse group of customers. Things looked good for a while and profits continued to grow along with margins.

Surprisingly, despite the 2008 financial crisis, gross margins were maintained and profits only declined slightly. Unfortunately, at this stage, operating profit margins showed signs of deterioration, declining from 16% in 2008 to 13.8% in 2010.

From 2010 to present

After decades of sustained growth, the business has reached a scale that few companies can achieve. But increasingly, large corporations are no longer in vogue. The failure of companies like GE highlighted the difficulties of running a large company with such a wide range of businesses.

I think the 2010s were when Danaher decided to go all in on life sciences. Acquisitions such as that of Beckman Coulter fit right into this vision, but required more effort because operations were spread across so many industries.

To strengthen its focus and streamline its operations, the company separated two major parts of its business into two new companies: Fortive (FTV) and Envista (NVST). Fortive handled the industrial tools division and Envista handled the company’s dental division.

Both companies continued to have strong product offerings in their respective niches, but abandoning slower-growing segments allowed Danaher to focus on parts of its business with a better runway for future growth.

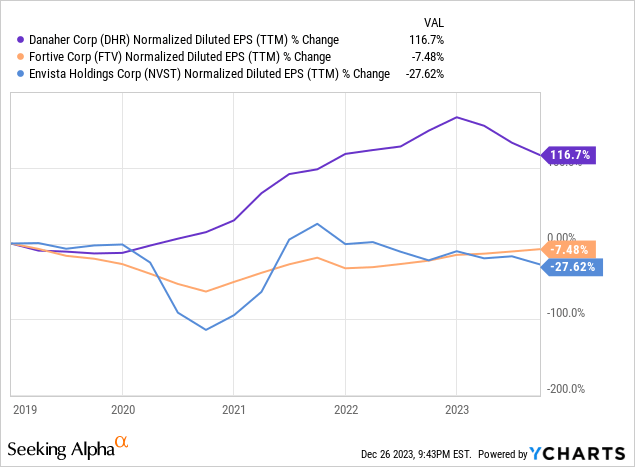

As you can see, over the past five years, Danaher has doubled its EPS, while Fortive and Envista have both decreased.

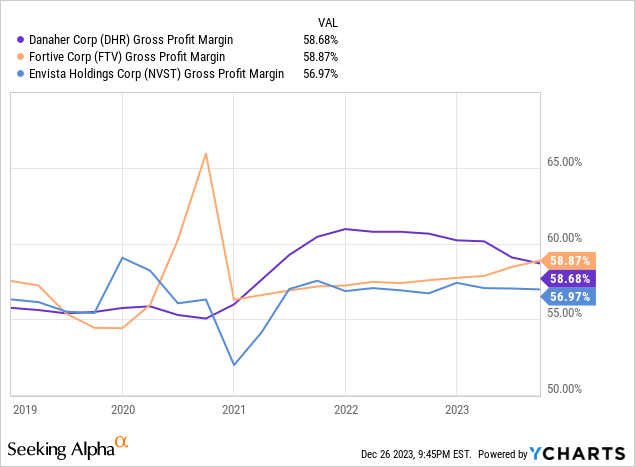

However, as you can see in the chart above, this decline in EPS is not due to lower profitability in the underlying products. In fact, gross margins for all three companies have been relatively stable, if not growing slightly. Danaher’s move allowed it to focus all of its efforts on the best parts of its business, and shareholders were easily rewarded for that focus.

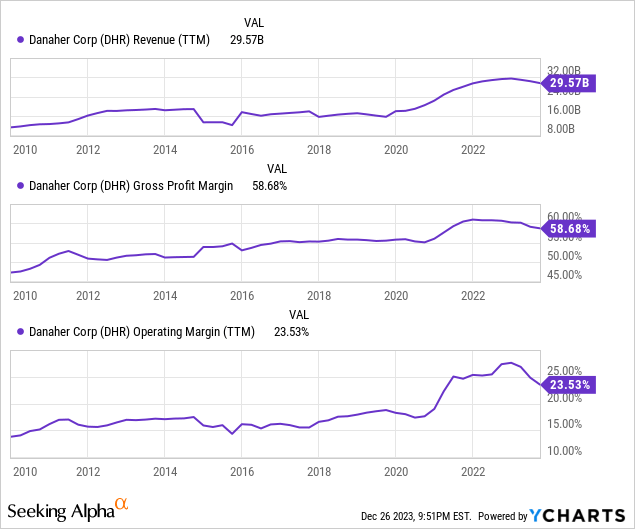

The results of increased focus could not be clearer. Gross margins improved slightly, but operating margins soared and overall revenue also rose.

Some of this growth can be attributed to increased life sciences spending during the COVID-19 pandemic, but some rigidity has clearly been demonstrated as revenues are still well above where they were at the start of 2020. For a more efficient business

Beralto

After spinning off its industrial and dental tools businesses, Danaher went further by spinning off its water quality business into Veralto (VLTO). We won’t spend much time discussing Veralto’s merits in this article, but for Danaher’s investors, this is further evidence that their commitment to aggressive reinvention remains.

I believe investors can be confident that if life sciences slows and confidence wanes, management will quickly identify a new industry to attack and then quickly dominate.

Few companies can pivot as quickly as Danaher. In my opinion, that is their biggest advantage.

Can the growth story continue?

While Danaher has had an impressive performance, one has to wonder how long this story can continue. How much more can you optimize your business after such a large transaction over such a long period of time and a landmark sale? And can stocks continue to rise if key trading slows or ends?

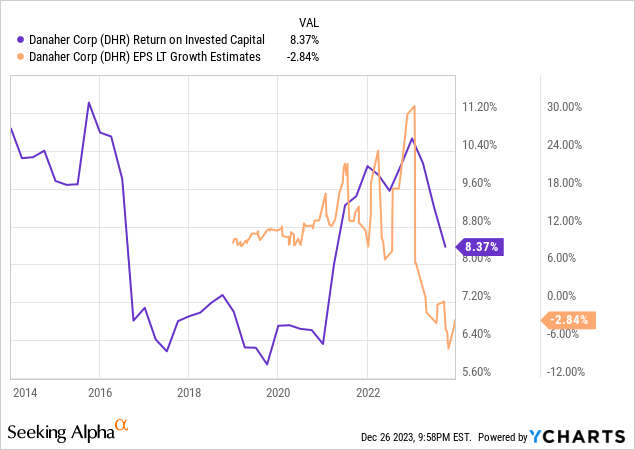

And that’s a good question because business is actually showing signs of slowing down. Long-term EPS growth estimates have been lowered as well as return on invested capital. Additionally, the FTC is likely to hinder future growth as potential deals face increased scrutiny and the likelihood of outright opposition increases.

If the company loses access to the kind of innovative deals it has been able to execute in the past, it will lose a critical growth engine and become increasingly reliant on organic growth to generate revenue. Fortunately, the life sciences field is expected to continue to grow at a rapid pace (CAGR of 15.12% by 2028, according to some researchers).

A rising tide tends to lift all boats.

So, for now it looks like the company can keep going, but investors would be wise to monitor the pace of trading going forward.

evaluation

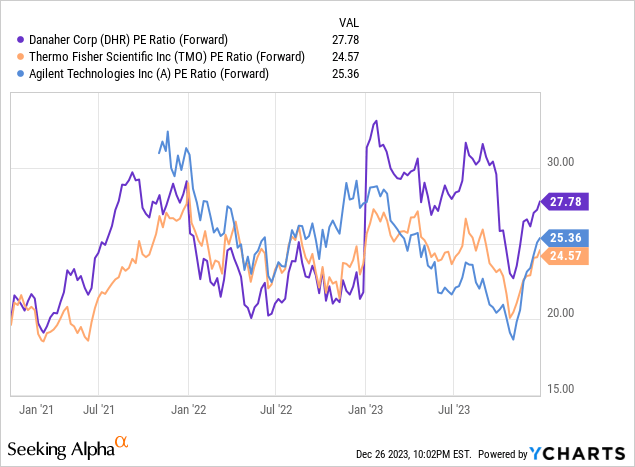

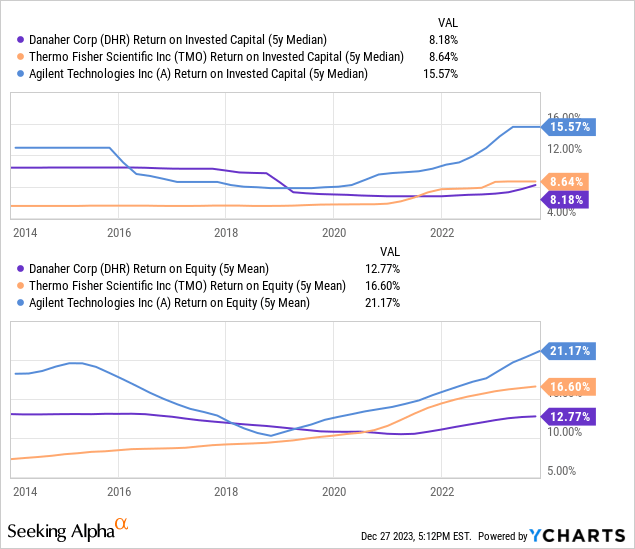

Looking at Danaher’s valuation against peers Thermo Fisher Scientific (TMO) and Agilent Technologies (A), we see that Danaher is trading at the highest forward multiple of 27.7X, with both Thermo Fisher and Agilent trading somewhat lower at around 25X.

Perhaps at odds with this premium valuation over the past decade, Danaher has been deploying capital at lower rates of return compared to its peers. Perhaps what boosts Danaher’s premium is the potential for more innovative M&A since it is the clear leader in its field. Ultimately, whether a small premium is believed to be justified will be subjective to the individual investor. In my case yes.

conclusion

In conclusion, Danaher’s journey from real estate trust to life sciences industry leader demonstrates the power of strategic change and continuous improvement. She has established herself as a resilient and innovative leader capable of navigating the complexities of a rapidly evolving market through her adoption of Kaizen and a focused M&A strategy. The company’s ability to continually reinvent itself while maintaining strong financial performance is a testament to strong management and vision.

The future may not be as rosy as the past, but its commitment to steady growth and strategic evolution makes it an attractive proposition for long-term oriented investors.

I rate Danaher a “Buy.”