Darling Ingredients Stock: Turning Waste into Wealth (NYSE:DAR)

Yevhen Smyk/iStock via Getty Images

Darling Ingredients Co., Ltd. (New York Stock Exchange:DAR) is considered to be: largest public enterprise Transforming edible by-products and food waste into sustainable products such as food ingredients, animal feed, biofuel and green energy. This matches well with: of the globe Growing interest in the environment. Recognized as an excellent company in the ESG industry. Morningstar Continuous Analysis. Despite recent stock price fluctuations and concerns about negatively leveraged free cash flow, the company has delivered top and bottom line growth over the past five years, although it has missed EPS and revenue expectations. Q3 2023 Earnings Report.

1 year stock price trend (SeekingAlpha.com)

As global interest in green practices grows, the company appears well-positioned to capitalize on this expanding market, despite being aware of the risks associated with performance sensitivity to commodity price fluctuations. With this in mind, Darling Ingredients The sustainability sector offers promising long-term investment opportunities. So investors might want to be bullish on this stock.

Company Overview

Founded in 1882, Darling Ingredients specializes in recycling food waste and animal by-products into valuable resources such as animal feed and biofuel. The company’s massive scale, with more than 260 facilities and 14,000 employees worldwide, gives it a strong competitive advantage in the rendering industry. We have a diverse portfolio of products and customers serving a variety of industries and markets, including pharmaceuticals, food, pet food, fuel and fertilizer.

Location Overview (Company website)

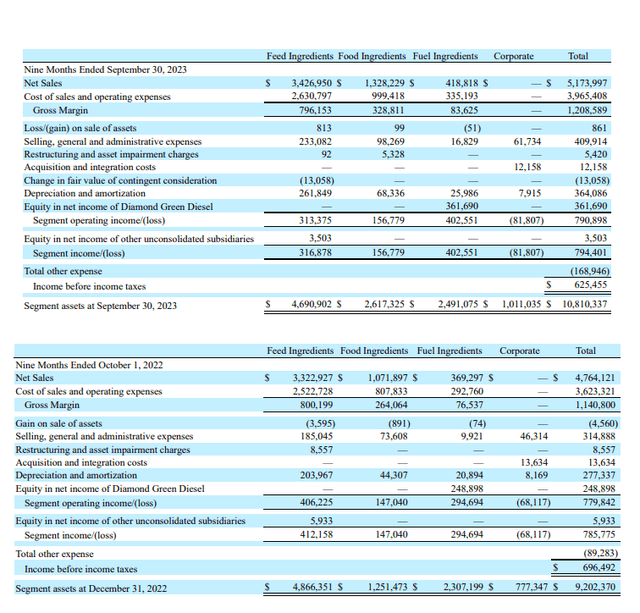

It operates in three industry segments: Feed, Food and Fuel Ingredients. The Company experienced a decline in revenue in the third quarter of 2023 compared to the same period last year, primarily due to lower prices and volumes in the Feed segment, partially offset by higher revenue in the Food and Fuels segment. However, if we look at the last nine months, we see that there has been an increase in all segments due to increased demand and margins for the company’s products.

Financials by sector – 9 months 2022 compared to 2023 (Sec.gov)

We have core growth drivers. diamond green dieselis a joint venture with Valero that produces renewable diesel from low-carbon intensity feedstocks such as animal fat and waste cooking oil. diamond green diesel produce 58% We will produce more biodiesel in 2023. Based on current market conditions, the expected improvement in DGD margins indicates a positive upward trend for the company in 2024. also take over Over the past few years.

Acquisition news update (Company website)

One example is Valley Proteins, a privately owned rendering company that primarily serves the poultry industry in the South, Southeast, and Mid-Atlantic regions of the United States. The acquisition expands Darling’s low-carbon feedstock production capacity and supply and creates synergies and cost savings.

Darling expects total adjusted EBITDA to reach $1.6 billion to $1.7 billion in fiscal 2023. Additionally, the growing focus on sustainable solutions provides a long-term tailwind as the company aligns well with global efforts to reduce greenhouse gas emissions and promote a circular economy. .

finance

Looking back over the past five years, it is clear that the company has shown consistent growth in both revenue and bottom line. Despite this positive trajectory, there is a noticeable increase in debt accumulation, along with a worrying trend in TTM cash flows, indicating a potential risk of cash burn. Even amidst this caution, the company’s revenue and gross profit have shown a consistent upward trend over the same period, with TTM revenue currently sitting at a robust $6.94 billion.

Annual revenue and gross profit (SeekingAlpha.com)

Assessing TTM, net income was $732.4 million, slightly lower than the fiscal 2022 figure. However, when we observe the promising upward trajectory of net income over the past five years, an encouraging pattern emerges.

annual net profit (SeekingAlpha.com)

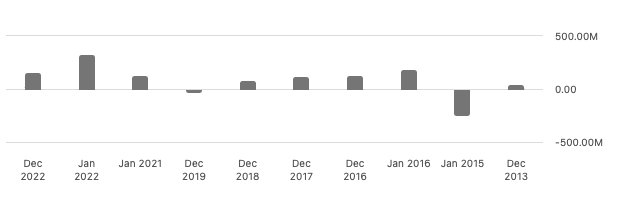

TTM Leved Free Cash Flow was negative $81.5 million, indicating possible cash burn. However, a closer look at annual trends reveals a generally positive trajectory over the past eight years, with the exception of fiscal 2019. This consistent positive trend has allowed the company to allocate resources to rewarding investors, paying down debt, and reinvesting in its business efforts. .

Annual Leveraged Free Cash Flow (SeekingAlpha.com)

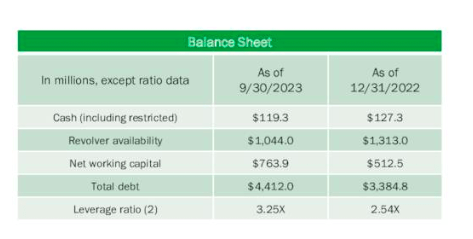

Potential investors should note that debt increases from $3.4 billion to $4.4 billion year-on-year. The bank’s leverage covenant ratio of 3.25x represents a reasonably balanced debt-to-earnings ratio, but the notable increase in debt triggers consideration of financial flexibility and effective debt management. The fact that Darling maintains $1 billion in its revolving credit facility ensures some liquidity, but the significant capital expenditures signal the company’s commitment to strategic growth.

balance sheet (2023 Investor Presentation)

evaluation

Darling Ingredients’ stock price has decreased by 18.53% over the past year. However, this decline contrasts with the company’s historical performance, which peaked at $81.66 in May 2022, indicating previous market optimism. The stock is also trading below the average price target of $71.00, suggesting significant upside potential. The price/earnings ratio (10.70) is also lower than the industry average (16.65), suggesting that it is relatively cheap compared to its peers.

5 year stock trends (SeekingAlpha.com)

Analysts predict an average growth rate of 10% over the next five years, driven by the company’s strong global expansion strategy leveraging successful integrations, particularly Valley and FASA, and its focused initiatives on innovative product development, especially in the specialty food ingredients segment, which we updated. I expect it. From the 2023 third quarter earnings announcement.

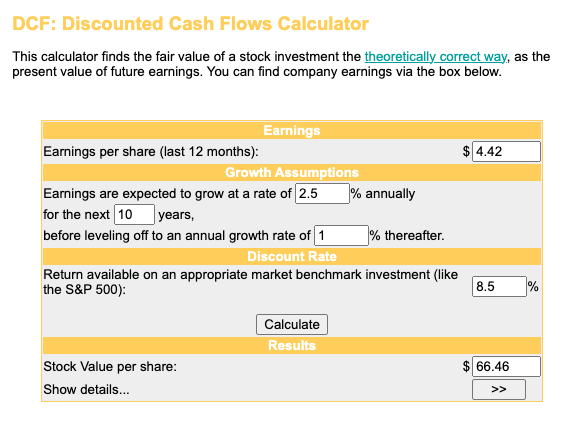

Using DCF (discounted cash flow) analysis Analyst Predictions The implied stock price is estimated at $66.46 due to management’s demonstrated confidence in the upcoming 2023 fourth quarter results and momentum in 2024. DCF analysis is based on the following assumptions:

- Based on the company’s adjusted EBITDA guidance of $1.6 billion to $1.7 billion and expected capital expenditures of $600 million, free cash flow for fiscal 2023 is $1.02 billion.

- Perpetual growth rate of 2.5%, reflecting the long-term growth prospects of the company and industry.

- The discount rate, based on the company’s weighted average cost of capital (WACC), which reflects the company’s required rate of return on equity and debt, is 8.46%.

Discounted Cash Flow Model (Moneychimp.com)

There is a lot of upside potential at the current price. In my view, there is a clear growth strategy and untapped opportunities, such as benefiting from emerging market trends such as surging demand for renewable diesel and sustainable aviation fuel (SAF). Make Darling Ingredients an attractive investment opportunity. However, the market may be missing some of the company’s competitive advantages and growth drivers, such as its innovation capabilities, diverse revenue streams, and strategic partnerships. Additionally, the market may overlook the company’s resilience and adaptability to the challenges and opportunities of the energy transition, as well as its alignment with global sustainability goals. Therefore, I think the Darling ingredient is undervalued and deserves a higher rating.

danger

Investing in Darling Ingredients involves risks related to its financial performance, particularly its sensitivity to fluctuations in commodity prices, particularly feedstocks and energy sources. This volatility impacts Darling’s financial stability by exposing it to potential fluctuations in its margins and overall profitability. The company’s reliance on subsidies to balance the cost gap between renewable diesel and conventional fuels poses another risk. Changes in subsidy structures or reductions in government support could have a direct impact on Darling’s financial health and market competitiveness. Moreover, Darling participates in the feedstock and renewable energy supply chain, which makes it vulnerable to disruptions due to transportation problems, unforeseen events or natural disasters that could potentially impact production and distribution and affect our operations and financial performance. Without substantial investments in innovation and flexibility, Darling may have difficulty remaining competitive in an industry that is constantly evolving due to these changes.

final thoughts

Darling Ingredients is a major player in the sustainability sector. Despite recent share price fluctuations and cash flow concerns, the company has improved its financial position and is well positioned to capitalize on the growing global demand for environmentally friendly practices. As experts in converting waste into resources, our acquisitions make us perfectly aligned with the growing environmental consciousness. Based on a discounted cash flow model, the stock’s intrinsic value is projected to be $66.46, well above its current trading price. As a result, investors may want to take a long-term bullish stance on this stock.