DBJP ETF: The Yen Can’t Go Lower (NYSEARCA:DBJP)

Gapera

Xtrackers MSCI Japan Hedge Stock ETF (NYSEARCA:DBJP) is a yen-hedged value-weighted ETF that tracks the most representative indices in the Japanese market. There are countless reasons to be optimistic about Japanese stocks. The most overweight market. However, there are many questions about the yen and speculation about a BoJ pivot that will affect how the market plays. An important thing is, The data has just been released About shunto Japanese union wage pressure, which turned out to be a fairly high figure, enough to lead to a more pronounced increase in real wages. Here’s our final coverage: USD, we thought the Fed had expressed its economic concerns. How have we recently wall of maturity There may be something important happening. This could change the dynamics by influencing the increased delivery of Fed policy. Now we want to talk about what’s happening in Japan.

We remain unfazed by the Suunto wage negotiation data. Because our idea that this money will be saved is the same as before and the rationale for the pivot will not materialize as the market expects. That’s what happened last time and maybe it’s just a hunch, but I don’t think there is so much money selling the yen in the carry trade that the yen can’t go any lower even without the BoJ’s willingness to stabilize yen buying. The yen decided to test its limits. DBJP still exposes investors to the upside in the Japanese market, but we see no reason not to buy yen with an unhedged ETF to capitalize on this upside. However, at some point, the appreciation of the yen could become a problem for the performance of the Japanese market.

DBJP Analysis

The expense ratio is 0.45%. This rate is higher than buying the Japanese index because the yen is hedged and costs are incurred. This is another reason to look for reasons not to hedge.

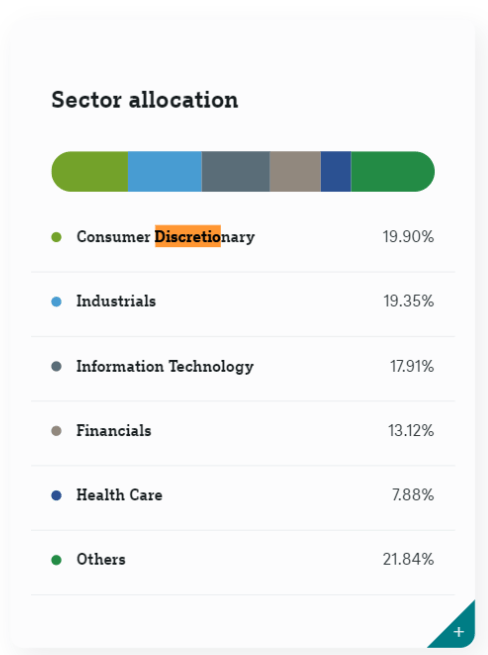

DBJP’s weighting is actually applied as a value weighting based on market capitalization. We have high discretionary consumer exposure due to the large number of equipment manufacturers in Japan, including large Japanese automakers and auto parts manufacturers. This creates significant IT exposure and financial exposure as well.

Division DBJP (etf.dws.com)

A weaker yen helps a lot with consumer discretionary exposure, especially since the markets outside the US and Japan, especially automotive, are very large. Additionally, because they are vertically integrated in Japan, they pay for many of the services and goods needed to build their cars in yen. The same argument applies to industrial goods in general.

The financial sector is not benefiting at all from the current yen situation. While financial exposures in other developed markets have seen significant NI growth thanks to higher interest rates, this is not the case in Japan. Moreover, insurance reserve portfolios are not benefiting from returns on fixed income and low-risk products due to low prevailing interest rates.

Other exposures include quite a few yen-denominated businesses, which probably won’t suffer from a rise in the yen in terms of share price. This means that foreign investors can benefit by holding yen-denominated issues.

On balance, a much stronger yen is not very good for the Japanese market as it has fundamental implications for the average Japanese listed company. Consolation of FX profits. We argue that there is still a lot of potential for the broader market, as Japan’s PE index remains very low at around 14 times, lower than other developed markets, and with many excellent corporate governance reforms in place. It’s explained in detail here.

In yen

So what could actually happen to the yen? Many headlines and commentators think now is the time for interest rates to rise. But do the data allow for it?

First, there is very important news that Rengo, Japan’s largest trade union federation, announced that it is demanding a 5.85% wage increase. This is significantly more than last year’s demand of 4.49%. Even if their demands are not fully met, this will result in large inflation due to the wage increases Japan wants.

As a side note, Japan actually wants inflation. Not supply-side inflation, which is always bad, but mild inflation that is based on other economies but does not exist in Japan’s depressed economy. Wage inflation is especially welcome. This is because the BoJ expects wage increases to translate into spending in a virtuous cycle. Last year, none of that happened. Wages rose, but consumption fell severely, and even the increase in export surplus due to the weakening yen was not enough to prevent a technological recession. In other words, the marginal propensity to save was higher. We talked about this in our last DBJP coverage. If that happens again, it would be one less reason for the BoJ to shift to a less easing stance.

There is some evidence in the real inflation data we have seen recently that points to a less accommodative stance. Inflation continues to fall, which is not really what the BoJ wants, but it is happening more slowly than expected and inflation expectations are lower. Expected slow disinflation is bullish for the yen. Because this is some evidence that things are solidifying. Mr. Ueda also made a statement that he believes the data suggests that is happening.

Firming up inflation is good because it gives the BoJ some room on the interest rate floor. The combination of low interest rates and the potential for consumers to hoard cash creates a liquidity trap situation. This puts it in a vulnerable position and is bad for the yen. The low level of the yen, although good, is putting pressure on consumers. For export-oriented listed markets.

Another reason why the yen could rise is of course what could happen with the USD, but the associated yen selling is a very crowded transaction. Now a few years have passed and those bets are growing. Leveraged trading will likely be dampened significantly due to ongoing factors that could support the yen.

conclusion

We still have an overweight view on Japanese stocks, and in particular some Japanese stocks. However, we acknowledge that a rise in the value of the yen will not be a positive thing for Japan’s listed giants. There may be a longer correction period than the market expects, but the yen is already on a downward trend so there is no need to worry about a decline at this point. If the yen rises, DBJP will face a double whammy of markets that are unlikely to like developments in Japanese stocks and a decline in the value of its yen hedges. For investors who want to stay in the Japanese market for the long term, I think it makes sense to stop hedging the yen and make some adjustments by switching to unhedged ETFs from here on out. We would also consider going further and exiting Japanese large-cap stocks that have already performed very well. Although often very compressed and still defensible in terms of valuations that offer a margin of safety, there is a more selective approach to Japanese stocks that do not suffer from a falling yen, are cheaper and perhaps have the scope for governance benefits. Reform becomes more meaningful.