DecisionPoint Trading Room: Narrow down the big questions! | decision point

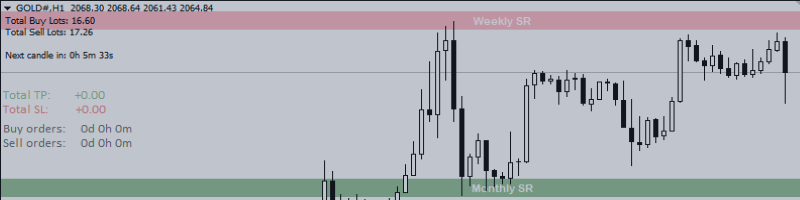

Last week’s market rally was very narrow, mainly due to big gains in communications services stocks like Meta. Many technical indicators are showing negative divergence. The broader market suffered. Erin reviews all sectors internally and then takes symbol requests.

Key Takeaways:

– Communication services and technology sectors are the strongest, while materials, energy, and real estate sectors are the weakest. Industrial goods were selected as an industry to watch this week.

– Treasury yields rebounded last week, but the yield curve is still inverted, which could be a sign of economic weakness.

– Specific stocks discussed included PHR (buy opportunity on pullback), LDS (technically aligned but waiting for better entry) and CRWD (hold tight).

– The presenters have a bearish short-term outlook for the market and expect prices to decline this week. If the market falls, the defensive sector may perform better.

Watch the latest episodes. decision pointtrading room On DP’s YouTube channel here!

Try it for 2 weeks with a trial subscription!

Use coupon code DPTRIAL2 at checkout!

Technical analysis is a windbreaker, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletter, blog or website materials should not be construed as a recommendation or solicitation to buy or sell any security or to take any particular action.

Useful DecisionPoint links:

trend model

Price Momentum Oscillator (PMO)

balance volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear market rules

Erin Swenlin is the co-founder of the DecisionPoint.com website with her father, Carl Swenlin. She started the DecisionPoint daily blog with Carl in 2009 and currently serves as a consulting technical analyst and blog contributor at StockCharts.com. Erin is an active member of the CMT Association. She holds a master’s degree in information resources management from the Air Force Institute of Technology and a bachelor’s degree in mathematics from the University of Southern California. Learn more