Deckers Outdoor: Attractive Growth Story, But Shares Could Fall Further (DECK)

Roman Tiraspolski

Introduction and investment thesis

Deckers Outdoor (New York Stock Exchange: Deck) is a casual lifestyle and performance-focused footwear, apparel and accessories company that has outperformed the S&P 500 and Nasdaq 100 YTD. The company reported third quarter 2024 results. In February, sales and profits increased by 16% and 44%, respectively, compared to the same period last year, significantly exceeding expectations. In FY24, the company expects revenue to increase to $4.15 billion, up 14.3% year over year, with operating margins expected to improve 200 basis points to 20%.

I’ve been very impressed with Deckers Outdoor’s execution so far. We see strong growth across our UGG and HOKA brands, contributing 96.2% of total revenue, and benefit from strong consumer demand, leading to higher average selling prices (ASPs) and strong operating margins. . The company continues to drive strong product innovation and is gaining tremendous momentum in the direct-to-consumer (DTC) channel as it expands its presence in both the US and the US. Participate in internationally trending marketing collaborations to increase awareness and increase conversion rates.

Although the company may face some short-term challenges with CEO David Powers retiring and Stefano Caroti taking over at a time of heightened macroeconomic and geopolitical uncertainty, I believe Deckers Outdoor has a long-term growth story, given its culture: I believe there is. Build meaningful, resonant consumer moments through innovation. Unfortunately, when it comes to the stock price, I think the upside is limited given its current valuation. As a result, I would sit on the sidelines for now, rating the stock a “Hold” in hopes of a better entry point leading to meaningful upside.

About Deckers Outdoor

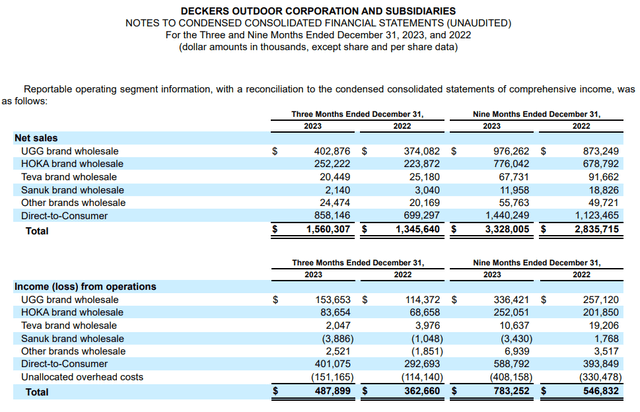

Deckers Outdoor designs, markets and distributes footwear, apparel and accessories designed for casual lifestyles and high-performance activities across five proprietary brands, including UGG, HOKA, Teva, Sanuk and Koolaburra. The company sells its products through wholesale and DTC channels in the U.S. and internationally. The company has six operating segments, including five strategic business units for global operations in the branded wholesale segment and the DTC channel. For the nine months ended FY23, the company generated 56.7% of its revenue from the wholesale channel, with UGG and HOKA wholesale revenue contributing 93% of total wholesale revenue. The remaining 43.3% of revenue was generated from the DTC segment, which also has the highest operating margins.

Pros: Significant growth in sales for UGG and HOKA in the U.S. and globally. Excellent coordination between product innovation and marketing; solid margins

The company reported third quarter FY24 results in February, with revenue up 16% to $1.56 billion, beating expectations by 7.2%. Of the $1.56 billion in revenue, UGG and HOKA brands contributed a combined 96.2% to total revenue, growing 15.2% and 21.9%, respectively.

DTC channels have played a key role in driving sales growth for the UGG brand. This represented 62% of total brand sales compared to 60% in the prior year, driven by strong customer acquisition and retention both in the U.S. and internationally. I believe Decker Outdoor’s success in driving growth for the UGG brand through the DTC channel has allowed the company to gain an advantage through pricing power, leading to higher ASPs and stronger gross margins. On the earnings call, David Powers highlighted how the UGG brand has benefited from a strong alignment between product creation, buzzworthy marketing and effective consumer targeting, leading to reduced SKU counts while driving key marketing collaborations and top-line sales. . – Funnel activities that engage the community and convert them into buyers across key franchises including Tasman, Ultra Mini, Classic Mini, as well as the Weather Hybrid Collection, Goldenstar Clog and Lowmel Sneaker.

At the same time, the company is expanding its UGG brand presence internationally, opening stores in key markets such as Shanghai and Munich. Both markets are performing well with high conversion rates and average transaction value (ATV) per customer. Going forward, we believe the company will continue to focus its efforts to grow internationally in key markets, as it sees international sales continuing to grow at 32.8% of total sales through successful product innovation, localized marketing content and brands. – Strengthening distribution partners.

Meanwhile, the HOKA brand, the second largest revenue contributor, also benefited from DTC. DTC accounted for 40% of total brand revenue, up 5% year-over-year as a result of strong customer acquisition and retention both in the U.S. and internationally. UGG brand. The company continued to open retail stores in China and Europe to secure full-price sales while developing the product, announcing the new Cielo At the same time, the company continues to drive moments that resonate with consumers through its marketing efforts. In the third quarter, HOKA partnered with SATISFY Running to create a community experience that brings together skateboarding, trail running, and steep hill sprinting in San Francisco, where HOKA Clifton LS shoes sold out immediately. I believe we will continue to see impressive growth in the HOKA brand as the company establishes itself in the on-road driving segment by enhancing consumer experience and performance in the U.S. and internationally through innovative product innovations and meaningful customer moments. Conversion rate and ASP over time.

10Q- Decker Outdoor’s sales by business segment

Shifting gears to profitability, the company reported gross margin improved 580 basis points year-over-year to 58.7% as strong consumer demand and strong DTC-led growth across both UGG and HOKA brands resulted in higher ASPs, allowing the company to gain economies of scale. Recorded. At the same time, other factors such as freight savings, pricing action selection, and product mix optimization also helped improve gross margins. Meanwhile, the company generated operating profit of $487.9 million, up 34.5% year-over-year, with a margin of 31%, as it increased SG&A spending by 23% year-over-year to invest in talent and drive marketing efforts. I believe the company should continue to see growth in its DTC channel both in the U.S. and internationally, given its focus on driving strong product innovation, consumer targeting, and alignment between marketing efforts to build awareness and drive conversions. I firmly believe it. Pricing power and profit margins.

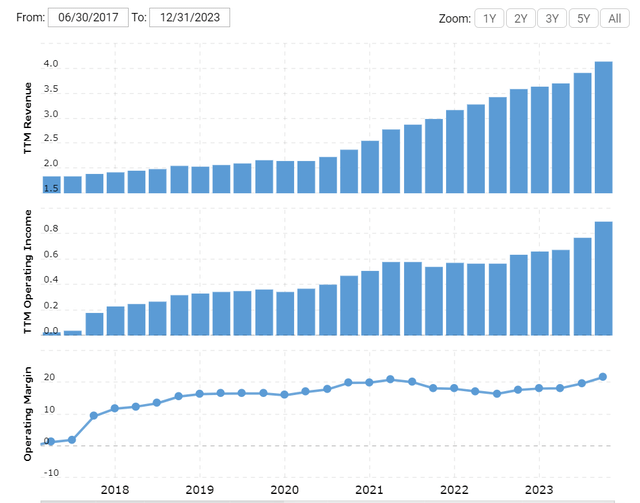

Macrotrends: Improving Decker’s Operating Margins

The Bad: Leadership change amid growing global macroeconomic and geopolitical uncertainty.

Deckers Outdoor has performed fantastically under the leadership of David Powers, with its share price up more than 400% over the past five years, outperforming the index by more than four times. Stefano Caroti will become the next president and CEO as David Powers announces his retirement. Stefano Caroyi has previously served as Chief Commercial Officer and has successfully led the company’s omnichannel strategy and HOKA brand operations, but a change in leadership brings its own uncertainty when the company has typically performed very solidly to date. Accompanying you.

I also believe that the leadership transition is occurring at a time of very heightened macroeconomic uncertainty and geopolitical tensions. As the inflation rate continues to exceed the Federal Reserve’s target interest rate of 2.2%, the possibility of an interest rate cut is increasing. This means that financial conditions will remain tight for longer as companies begin to lay off workers to protect margins, which often translates into a future economic slowdown. At the same time, tight monetary policies in the United States often lead to tight monetary conditions internationally, so central banks need to monitor the movements of their currencies. As a result, we believe that a prolonged global macroeconomic downturn will lead to a slowdown in consumer spending, which could harm Deckers Outdoor’s sales and bottom line. This is because ASPs are likely to be lower as large discounts have to be implemented to manage inventory. , return on marketing costs, reduced profit margins, etc.

We would also like to point out that Deckers Outdoor has a purchasing office in Hong Kong, field supervision offices in China and Vietnam, and outsources the production of its products to independent manufacturers, mainly located in Asia. While this gives us the advantage of keeping our assets light as a business, we must not ignore the potential supply chain risks if geopolitical tensions escalate and international trade relationships deteriorate, impacting Decker Outdoors.

Bundled together, Deckers Outdoor is a “hold.”

Going forward, Deckers Outdoor expects revenue to reach $4.15 billion in FY24, up 14.3% year-over-year, with gross profit margin and operating profit margin expected to increase by at least 450 basis points and 200 basis points to 54.5%, up 20% year-over-year. It is expected. The company continues to drive customer acquisition and retention in the U.S. and internationally through powerful product innovation and a buzzworthy marketing engine, enabling it to maintain pricing power and deliver operational leverage.

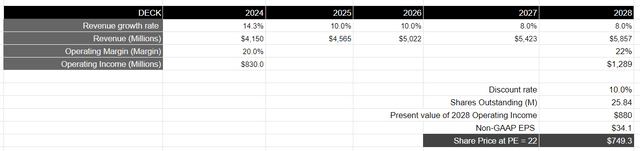

Assuming the company continues to grow in the low teens range for the next three years through FY26, and then growth slows to the high single digits through FY28, it should be able to generate $5.8 billion in revenue. During this period, the company should gradually improve operating margins to at least 22% by FY28 as it continues to optimize its product mix and leverage its pricing power. That brings operating profit to $1.28 billion. At a 10% discount, the current value is $880 million.

Using the S&P 500 as a proxy, if the company’s earnings grow an average of 8% over 10 years and its price-to-earnings ratio is 15-18, I think Deckers Outdoor should trade at least 1.25x. Considering its earnings growth rate over this period, it is a multiple of the S&P 500. This translates to a price target of $749, which represents a downside of about 8%. In particular, we expect a significant decline of at least 10% as the S&P 500’s price-to-earnings ratio rises relative to its five- and 10-year averages, keeping inflation above the Fed’s target and the 10-year U.S. Treasury note rising to 4.5%. As a result, I will remain on the sidelines for now, rating the stock a ‘Hold’ for now, waiting for a better entry point that can capture significant upside.

Author’s evaluation model

conclusion

Deckers Outdoor is seeing strong growth in its UGG and HOKA brands as it is able to drive higher ASPs based on strong consumer demand for its product franchises and its success through DTC channels in the U.S. and internationally, which will enable the company to achieve solid growth. You can keep it. operating margin. Although there is uncertainty about leadership change amid growing macroeconomic and geopolitical uncertainty, Deckers Outdoor believes it can continue to drive growth based on its culture of innovation and creating moments that resonate with consumers. However, I think the stock is perfectly priced right now and the upside is limited. Therefore, I will remain on the sidelines for the time being and rate the stock as ‘Hold’.