Development of professional advisors applying the casino winning strategy “Monte Carlo method” to lot sizing – Trading Systems – June 4, 2024

introduction

The Monte Carlo method is one of the gambling system betting techniques and is a ‘casino strategy’ that is legendary for destroying the land-based casino in Monte Carlo, Monaco.

The Monte Carlo method allows you to increase or decrease the bet amount according to set rules and conditions, allowing you to make up for losses and make a profit when you lose.

click here For detailed explanation.

On the other hand, since the increase in betting amount is gradual, the possibility of default is low.

So, I have been thinking for a long time that applying this to FX lot sizing would allow for advantageous trading, and this time I succeeded in systematizing it.

We have already been running Real Forward for about 8 months and have shown very good results.

In this article, I would like to introduce EA (Expert Advisor) developed by applying the Monte Carlo method.

Advantages and disadvantages of Monte Carlo method

First, I will explain the advantages and disadvantages of applying the Monte Carlo method to FX.

Pros: The profit/loss curve rises beautifully.

Disadvantage: Drawdown becomes deeper

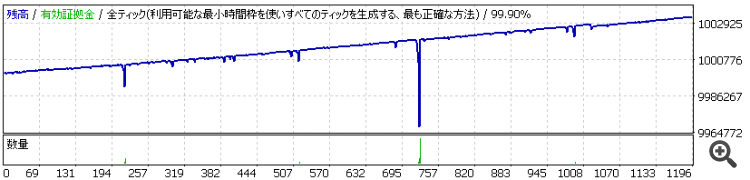

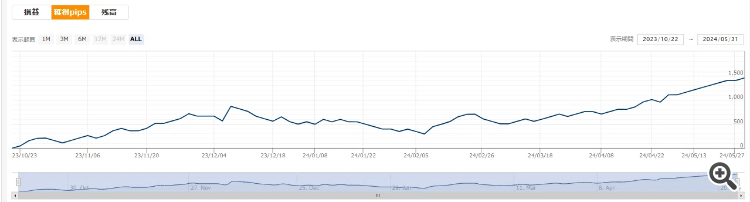

The figure below is an example of a profit/loss curve for a lot sizing system using the Monte Carlo method.

You can understand the advantages and disadvantages above.

As you can see in this graph, if things go well, the profit and loss curve rises almost in a straight line.

However, if you lose money, your lot will swell, so of course money management is important.

It is also important to find ways to prevent losses from being concentrated.

The description of Monte Carlo EA

Now, we will explain “Montecarlo EA,” which applies the Monte Carlo method to Lot Sizing.

Strategy Overview

In addition to using the Monte Carlo method for lot size determination, Monte Carlo EA has the following features:

1. To utilize lot sizing according to the Monte Carlo method, all positions are executed at 50 pips for take profit and stop loss (designed with a risk-reward ratio of 1:1).

2. It consists of a total of 19 charts from 6 EAs with different logic and multiple currency pairs to prevent lots from increasing due to consecutive losses, and implements a unique algorithm for further decentralization.

3. All six logics are advantageous logics that can make profits without lot changes.

As you can see, there are many ways to utilize Monte Carlo methods.

Next, let’s look at performance (backtesting, live trading).

Backtest

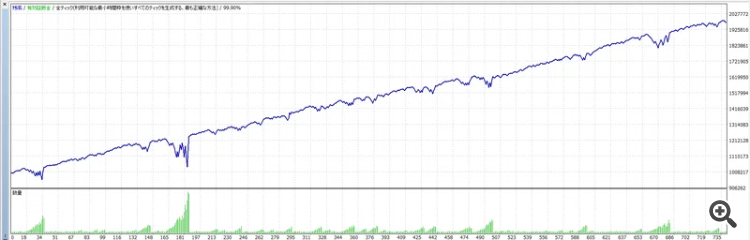

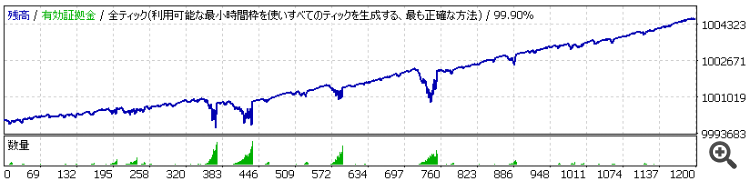

Below is a summary of our backtest of 19 charts using Quant Analyser.

We were able to draw a steadily rising asset curve.

However, this backtest did not reflect the effectiveness of the decentralized algorithm described above.

Therefore, DD tends to be smaller than the backtest.

Now let’s check the performance of real transactions to prove the effectiveness of the decentralized algorithm.

live trading

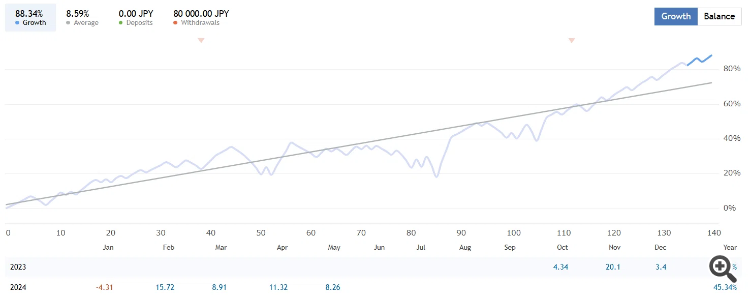

Below is actual trading performance.

Live Trading Links

Eight months have passed since we started operations, and according to the theory, we were able to draw a steadily rising profit and loss curve.

The profit margin is also perfect at 88%.

However, because this EA uses the Monte Carlo method, it is natural that the asset curve rises steadily.

Now let’s look at what performance would be if the Monte Carlo method was not used.

Below is the pip-based asset curve.

Compared to the curve using the Monte Carlo method, the decline is longer, but it still shows a steady upward trend.

This shows that EA does not win based on lot size alone.

conclusion

In this article, we explained EA that applied the Monte Carlo method to Lot Sizing.

If you are interested in “Monte Carlo EA” after reading this, please check the sales page below.

I hope this article and EA will help you live a comfortable trading life.

The EA page is here

(reference)

The Monte Carlo method has slower lot changes and suppressed DD compared to the Martingale method, which is also used as a winning strategy in casinos.

Please refer to the following as a comparison of backtests when Monte Carlo and Martingale methods were performed using the same logic.

In the Monte Carlo method, the maximum lot is suppressed to 37 times the initial lot, but in the Martingale method, it swells to 1024 times, and the maximum DD is also overwhelmingly large in the Martingale method.

Monte Carlo method

Initial Lot: 0.03

Maximum lot: 1.1 (37x)

martingale method

Initial Lot: 0.01

Maximum lot: 10.24 (1024)