DLC evolves to meet institutional needs

Discreet Log Contracts are now an old concept in the field, proposed by Thaddeus Dryja (co-creator of the Lightning Network Protocol) in 2017. DLC is a smart contract structure designed to solve three problems associated with contracting schemes prior to proposals: First, the scalability of smart contracts themselves, which require larger on-chain space to achieve more potential outcomes. Second, there is the problem of bringing data from outside the blockchain “into the blockchain” to conclude contracts. Lastly, there is the privacy of smart contract users.

The basic method is very simple. Two parties create a multi-signature address and select an oracle. It then creates a series of contract execution transactions that interact with the oracle. Let’s say an oracle announces the price of Bitcoin and participants are betting on the price of Bitcoin. What the oracle does is publish a series of promises for messages to be signed to “announce” the price of Bitcoin at a certain price. hour. CETs are structured such that the signature of each CET provided by one participant to another is encrypted using the adapter signature. Each signature to enter into a contract at a specific price can only be deciphered by the information in the signed oracle message proving that price. An oracle simply publishes a promise for a message about all data for which it acts as an oracle, and any participant can use this information non-interactively to create DLC. The last part is a time-locked refund transaction. If Oracle doesn’t broadcast the information needed to pay for the DLC, both parties will simply get their money refunded after a time lock period that extends beyond the life of the contract.

This addresses three key issues with Tadge (Thaddeus) outlined in the original DLC whitepaper: It is scalable and only requires a single transaction to fund a contract and a single transaction to resolve it. Allows a way to “import” external data into the blockchain. And this solves the privacy issue in that Oracle blindly broadcasts the data to the public, giving no insight into who in the contract is using the data as oracle. You can also use a federation of multiple oracles. Here, if the values they prove are close enough to each other, the contract is concluded correctly. One final important thing to note about DLC is that oracles lying to missettle contracts is a very different model than traditional escrow multi-signature. In an escrow model, an oracle may choose to selectively harm a single user by signing an inappropriate agreement. There is the potential to mitigate reputational damage, but the DLC model does not allow oracles to do this. When you sign a message, it is used to settle all DLC associated with that settlement message and time, and since you don’t know who is using it, you can’t selectively target specific parties for malicious actions.

Aside from the inevitable reliance on oracles, the only real downside to this plan is the coordination problem. Depending on the nature of the contract, for example a bet on the price of Bitcoin and a bet on a sports game (Team Potential consequences. This causes two problems: One is that if the transaction set is large enough, there is the possibility of network issues and DoS attacks wasting people’s time by not completing the contract setup. Second, the possibility of a free options problem that requires an on-chain transaction to handle. A free option issue is when a contract has been set up and finalized but the party that has received the full funding signature has not aired it. This allows them to fund on-chain DLC only when they have the advantage, otherwise the only way for the opponent to avoid this situation is to spend the result of their funding twice on-chain.

DLC market

LN Markets recently published an article describing a new DLC specification designed to tailor the DLC mechanism for institutional actors. The existing suite of projects built on DLC are geared more toward retail consumers, leaving room to modify their designs to address the needs of large institutional actors.

Some issues for institutional customers include: Issues with free options not acceptable in that type of environment; The second is the lack of margin calls. This means that if one party does not have enough margin capital to cover the trade at the current price, the position will be closed or that party will add the additional margin required to sustain the position. Lastly, the ability to use capital in a more efficient way than having it locked in one location from the beginning to the end of the contract.

To solve all these problems, LN Markets introduced the concept of DLC Coordinator. Instead of colleagues on a contract coordinating directly with each other to handle the financing and negotiation of a contract, a coordinator can sit in the middle and help facilitate it. This somewhat elegantly solves the free option problem by having the coordinator facilitate contract negotiations. Instead of interacting directly with each other to execute contracts and sign funding transactions, each peer submits signatures for all of this to the coordinator. At no point will any of the participants have access to the signatures needed to fund the contract, eliminating the ability to have a free option. The Coordinator is the only person who can have both signatures, and to solve the problem of colluding with participants or maliciously not submitting funds transactions for other reasons, funds transactions involve payment of a fee for performing the following functions: coordinator. This provides a direct incentive to submit funding transactions after the DLC has been negotiated and signed.

Another huge efficiency lies in the coordination process that puts DLC together in the first place. Without a coordinator involved, participants would have to communicate with each other, exchange addresses and UTXO information, and then coordinate DLC settings. The Coordinator allows users to register an xpub and some UTXOs with the Coordinator and simply register proposals for contract terms. When someone accepts an existing offer, the Coordinator will have all the information needed to construct a CET, which can then be given to the person accepting the offer to verify and sign, and then transmit the signature to the Coordinator. The original proposer then receives the CET, verifies it as soon as it goes online, signs it, returns it, decides to accept the other party, and sends it back to the coordinator who can combine the signatures and submit the funding transaction.

clearing

Involving a coordinator provides a reliable point of communication for adding final missing pieces (liquidation and additional margin addition processing) for DLC as it applies in a professional environment.

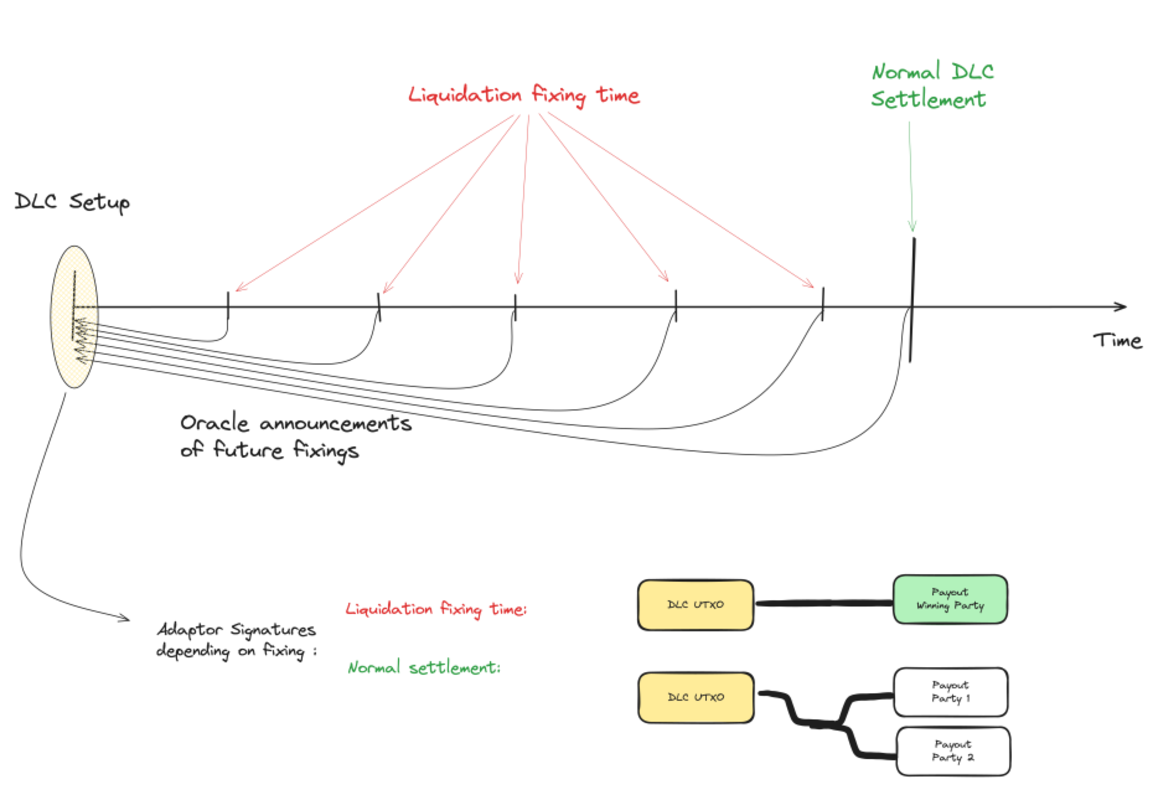

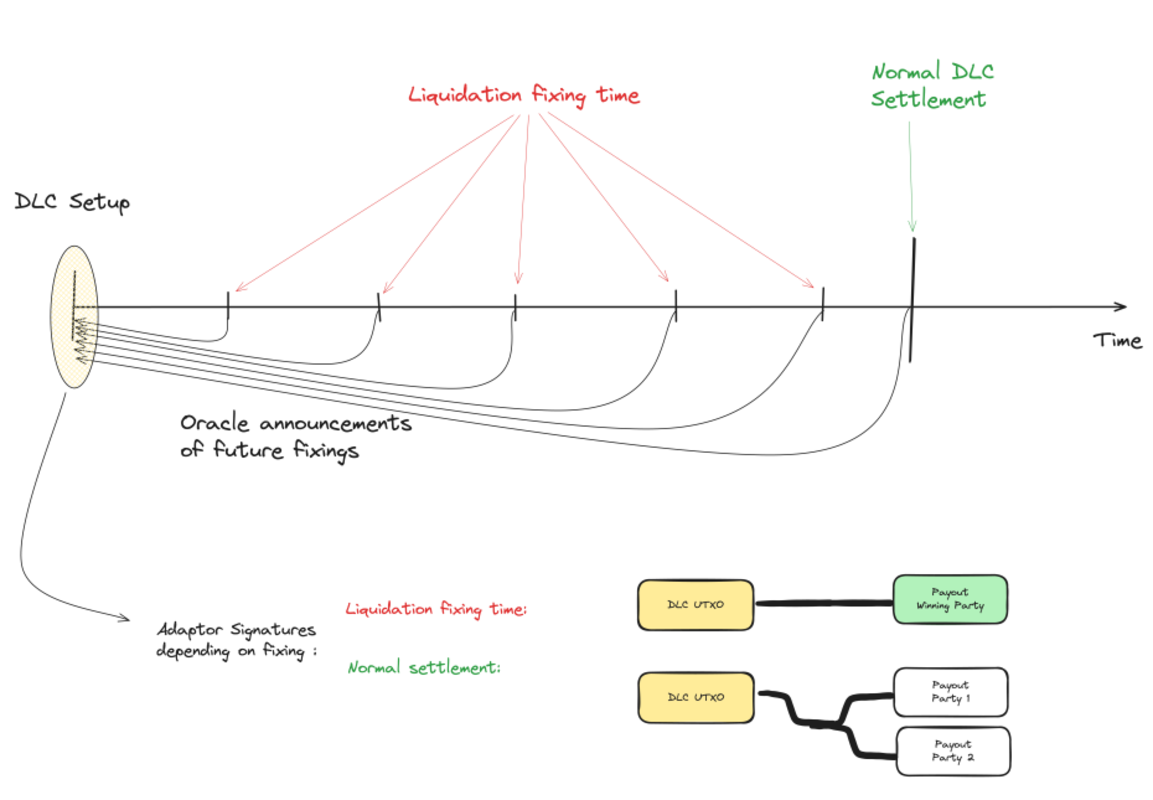

There was a nice infographic in the white paper included in the article LN Markets wrote announcing the proposal, which I think is much more intuitive to understand. In addition to all CETs attached to oracle messages for price announcements that may occur upon contract expiration, there are also special settlement deals for the period prior to actual contract expiration. The interval of these transactions can be determined by the participants based on their frequency. Oracle publishes price messages. Each party has one special CET for each “clearing time”, and if the price goes outside the contract at one of those clearing points (i.e. all funds are owed to one side) they can simply submit this trade. there is. And end your contract earlier.

At some point closer to liquidation, if one party is at the liquidation point, they can use a coordinator to add margin to the contract and make arrangements for the other party to withdraw funds from the contract and realize a portion of the profits. This involves both parties receiving more funds from the undercollateralized party in the funds multisig and jointly spending them on a new DLC from which the “winning” party can withdraw some of the funds. Otherwise, new DLC will have the same expiration time and corresponding liquidation point.

These dynamics provide functionality that is much more consistent with what institutional investors expect. The ability to manage liquidity more effectively, the ability to expire contracts early if one party lacks collateral based on current market prices, and the ability to add more collateral in response to an upcoming liquidation event.

What’s the big deal?

To some, this may seem like a series of very small and ultimately unrelated tweaks to the original DLC spec, but these small changes take something that didn’t have much potential outside of retail consumer use due to its existing shortcomings and bring it into the league. The idea is that it can potentially meet the needs of a much larger pool of economic players and capital. If the Lightning Network was a huge leap forward in the transactional use of Bitcoin, we believe it has the potential to be a similar leap forward in the use of Bitcoin in capital and financial markets.

Not every use case for Bitcoin will be a use case that everyone else likes or needs, and some may create externalities for other use cases, but that’s also the reality of how Bitcoin works: an open system. . Anyone can build on it. This offer may not be a primary use case for many people reading this, but we shouldn’t ignore the fact that this could grow into a very big offer.