Don’t ignore this unusual event as markets march to new highs | MEM edge

The S&P 500 rose 1.1% last week, pushing the index to an all-time high. While this is exciting news for investors, those who own some of last week’s best performing companies are feeling even better. The average gain for the top 10 stocks in this index was 10.3%. What was even more unusual was that nearly three quarters of these names were from the same industry group.

The industry group I’m referring to is semiconductors, which saw a huge rally after a positive earnings report from Taiwan Semiconductor (TSM), the world’s largest chipmaker, sparked a rebound in these stocks. Before that, a bullish report on Advanced Micro’s (AMD) outlook had the stock expected to rise nearly 20% for the week. Subscribers to my MEM Edge reports will be familiar with this stock. That’s because we highlighted AMD as a strong buy on Sunday and Wednesday.

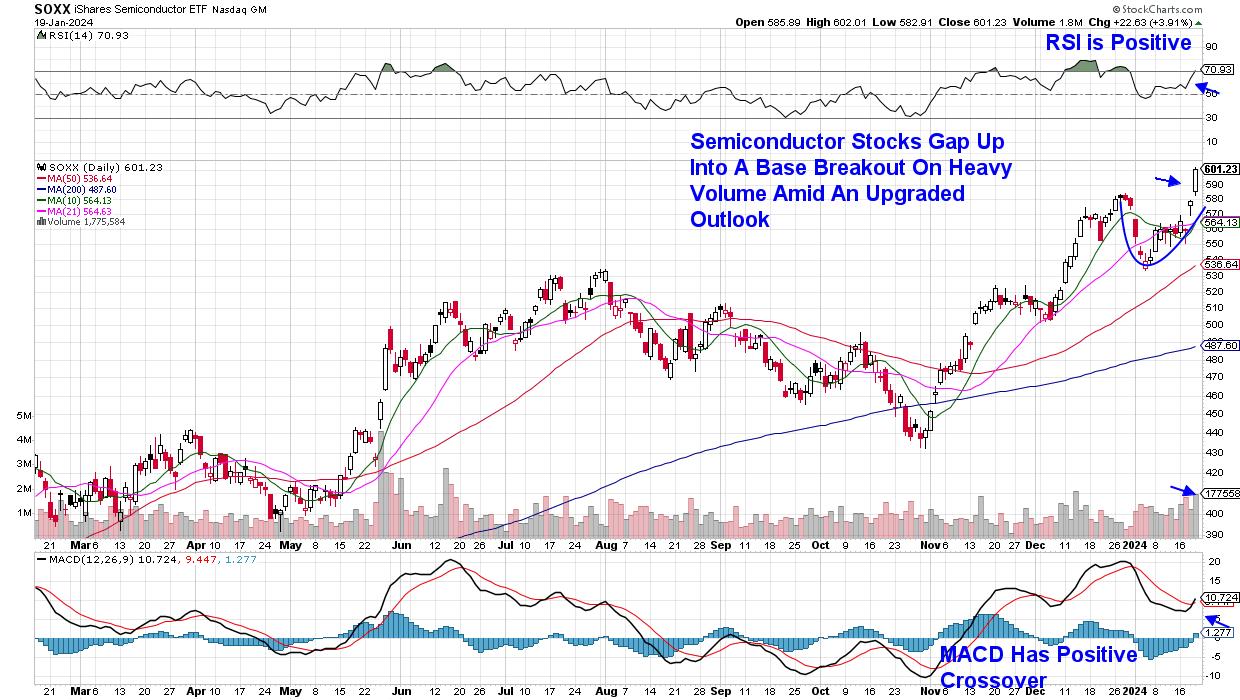

If you’re worried that you may have missed the entry into semiconductor stocks, take a look at the daily chart below and you’ll see that the MACD has just posted a bullish crossover (black line through the red), while RSI is positive. It is not an overbought position. Next week’s results from Texas Instruments (TXN), Lam Research (LRCX), and ASML Holding (ASML) could provide additional fuel for this group, with strong earnings reports or improved growth prospects from these companies becoming key drivers.

iSHARES SEMICONDUCTOR ETF daily chart iShares Semiconductor ETF (SOXX) daily chart

iShares Semiconductor ETF (SOXX) daily chart

Software stocks also performed better last week. This name in the area, which is on the recommended holds list, has posted gains maintaining the confirmed upward trend. They are ready to trade higher from here. To gain immediate access to this list, use the link here to trial the report twice a week for four weeks. In addition to recommending leading stocks that are outperforming the broader market, the report keeps you informed on sector rotations, interest rate outlook, and other big-picture concepts that identify what’s driving the market and, more importantly, what’s driving it . Something to watch out for.

This Sunday’s MEM Edge report will examine additional unusual events occurring in the market. Among them, growth stocks are showing an upward trend despite relatively high interest rates, and while the S&P 500 is currently breaking new highs, the Equal-Weighted S&P 500 is showing sluggish performance. Use the links above to gain insight into these and other counterintuitive activities that shape today’s markets.

warmly,

Mary Ellen McGonagle

MEM Investment Research

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the company to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more