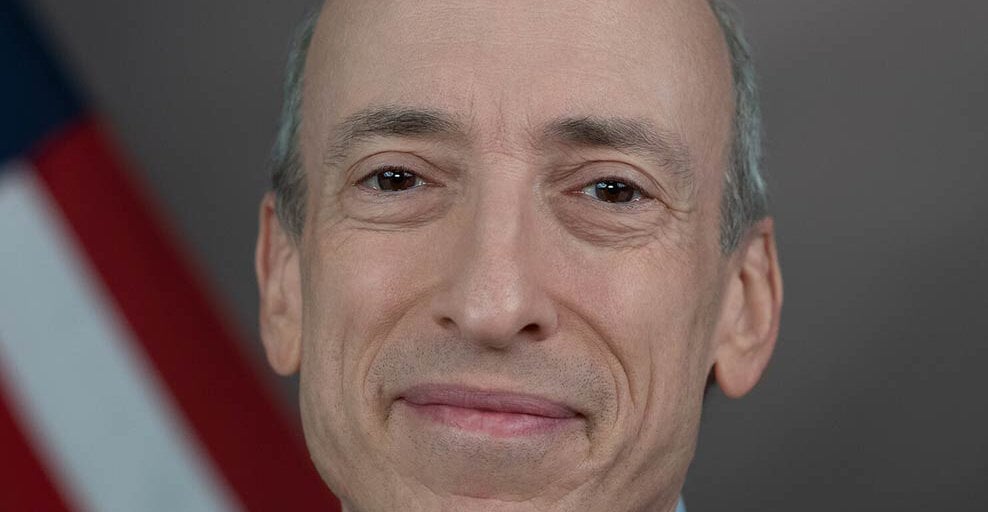

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler once again issued a warning about artificial intelligence and how its rapid development could affect financial markets.

“No greenwash, no AI wash. I don’t know how else to say it,” Gensler said at the “Balancing Innovation and Regulation” AI event. Messenger Wednesday in Washington, D.C. “When we raise funds from the public, offer and sell securities, we provide full, fair and truthful disclosure in accordance with securities laws and allow investors to decide.”

Greenwashing refers to making exaggerated or false claims about environmental, social, and governance practices (also known as ESG) to make a project more attractive. The SEC has previously warned that greenwashing can distract investors from the real risks, rewards and pricing of assets.

Gensler said the hype around AI is turning the technology into a similarly disruptive force.

“We are concerned about market manipulation and fraud on this macro issue,” he continued. “I think there needs to be a lot of discussion, not just here but among financial regulators around the world.”

It highlighted that while generative AI can mimic human speech patterns and writing styles with incredible complexity, there are humans behind the machines who must answer for financial crimes committed by chatbots.

“A fraud is a fraud and if there are humans using a model that deceives the public; Depending on the facts, that human is likely to listen to us,” Gensler said. “Humans are still involved in artificial intelligence as we know it.”

He acknowledged, somewhat jokingly, that human intervention may not always be the case.

“I don’t know when the Sarah Connor era will come,” he said, referencing the iconic character played by Linda Hamilton in the Terminator film franchise. “But there are humans putting the AI models in place and setting the so-called hyperparameters, so there are still humans responsible for that AI.”

Gensler focused on the possible risks of using AI in finance, noting the potential for developers to include personal biases and conflicts of interest in training data. Gensler also highlighted the dangers of relying on uniform or centralized data sets, warning that this could lead to market instability due to a lack of diversity in decision-making.

“A lot of the market is relying on one dataset, which is mortgage data,” Gensler said. “The wound effect can push us off a cliff we didn’t intend to.”

Even as the number of AI developers and significant investments in the field continue to grow, Gensler said we will eventually see less fragmented data as the number of AI models shrinks to three dominant players.

“This usually happens early in the technology,” Gensler said. “So we’re likely going to have three of the dominant foundations or models that everyone else is relying on because of network economics: the AI supply chain.”

“If you haven’t thought about it, if you’re a fintech startup, a community bank, a small asset manager, you can’t build a big model, you have to rely on other people’s models,” he added. .

Last September, Gensler added his name to a growing list of government officials concerned about the negative impacts of generative AI, with a particular focus on AI-generated deepfakes. Testifying before the Senate Banking Committee, Gensler warned that AI deepfakes pose a risk to financial markets, highlighting the SEC Chairman’s example of an AI deepfake that attempted to manipulate the U.S. stock market.

“I think we have good laws, but these new technologies will challenge those laws,” Gensler said. “If you’re using AI and you’re doing deepfakes in the marketplace, that’s a real risk to the marketplace.”

Editor: Ryan Ozawa.sd