Dylan LeClair: Bitcoin Bull Market Bearish or Cycle Reverse?

This article was produced in partnership with Unchained, Bitcoin Magazine’s Official US Co-Managing Partner and an essential sponsor of related content published through Bitcoin Magazine. Please visit our website to learn more about the services we offer, our storage products, and the relationship between Unchained and Bitcoin Magazine.

Bitcoin fell below $60,000 last weekend due to the conflict between Iran and Israel, sparking concerns that escalation could lead to Western intervention in the Middle East war. This increases inflationary pressures in the 21st century and disrupts global supply chains and commodity markets. Skeptics were quick to mock Bitcoin’s almost immediate sell-off in response to news of the dispute, but ironically Bitcoin was one of the only global assets available for trading over the weekend, with stock, commodity and bond strategists all turning their eyes to Bitcoin’s charts. I did it. It is an attempt to assess what damage could be done to global markets when trading begins on Sunday night.

Moving away from geopolitics, this brief article will look at on-chain spending behavior and the latest developments in the Bitcoin derivatives market, and analyze whether the decline from the current high of $73,000 is typical of a typical bull market correction or a cyclical one. . peak.

Many preconceptions about the typical Bitcoin cycle have already been shattered, with the cryptocurrency hitting new highs before the upcoming halving at block 840,000. So let’s evaluate and look at where we are now and how these conditions and investor behavior will affect what happens next.

We will look at both on-chain data to analyze the behavior of current Bitcoin holders and new market entrants, as well as the derivatives market to gauge whether there is anything of concern regarding the leverage that currently exists. market.

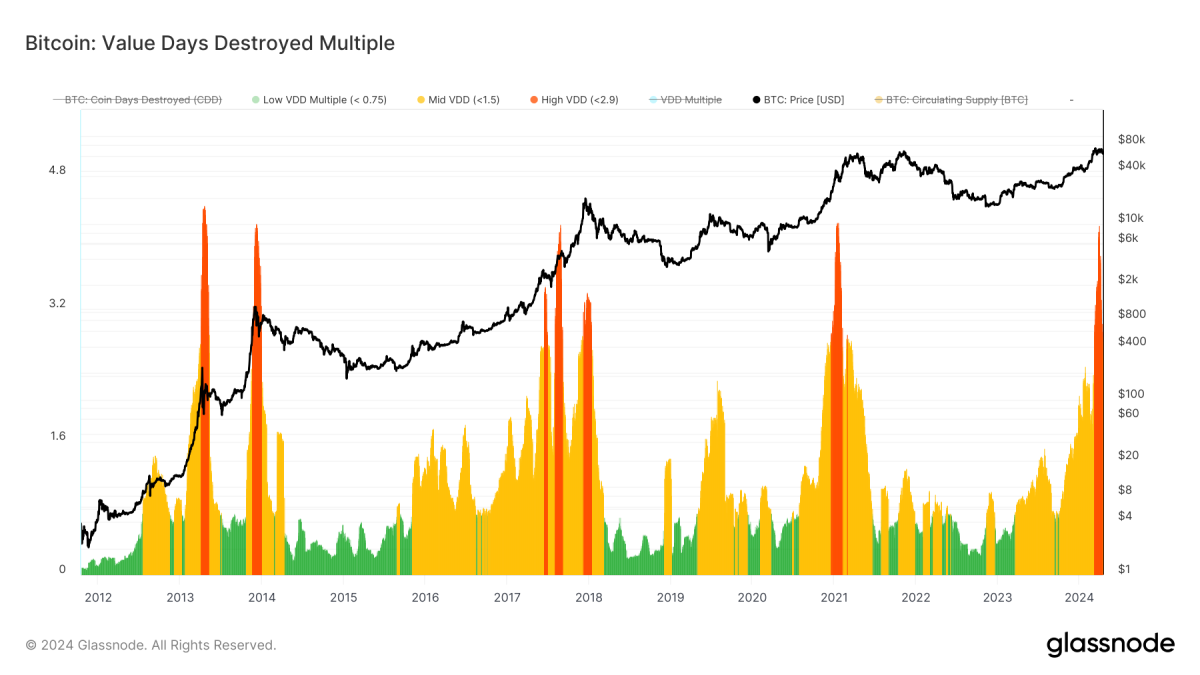

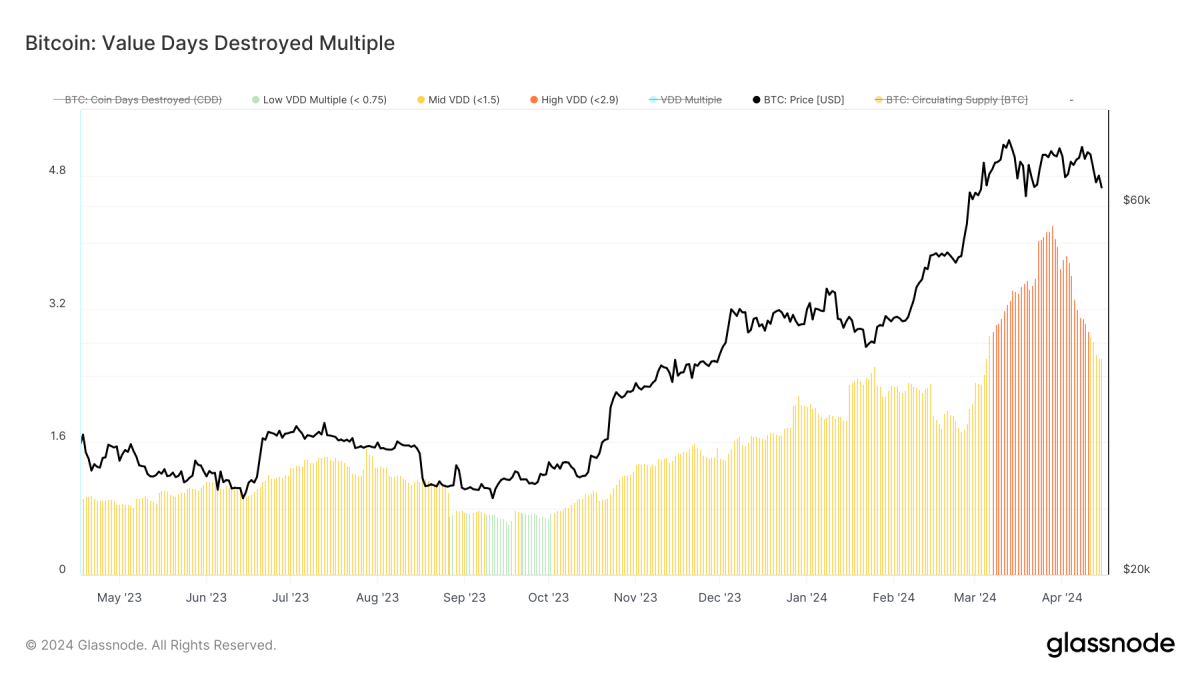

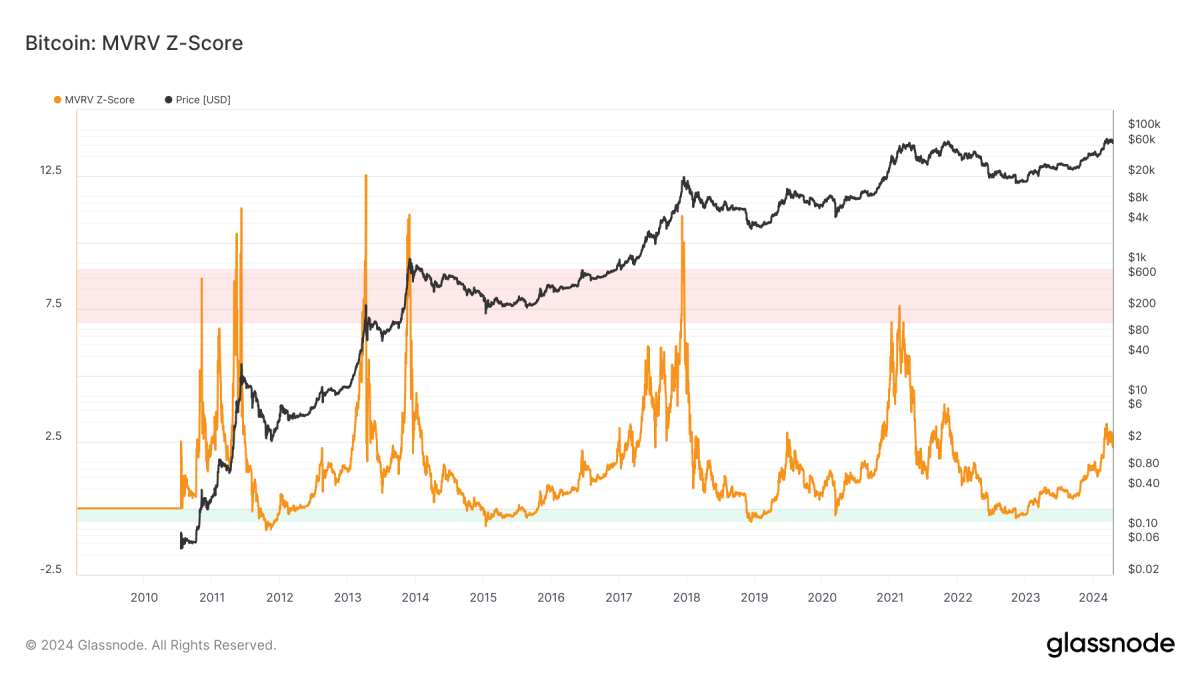

First, let’s look at a metric called Value Days Destroyed Multiple, created and created by Daum. TXMCWe compare short-term spending behavior to annual averages as a means of detecting overheated and undervalued markets. A quick look at this is a sign that the bull market is well underway and may have peaked.

About a third of the spending went to simply transferring coins from Grayscale Bitcoin Trust to new ETF participants such as BlackRock, Fidelity and Bitwise. But raw data is just raw data, and we can see that a significant amount of spending has occurred as we hit new highs.

However, a closer look at the indicators shows that this spending activity is cooling and there is historical precedent for market highs in both the 2017 and 2021 cycles. This is just a data point to keep in mind.

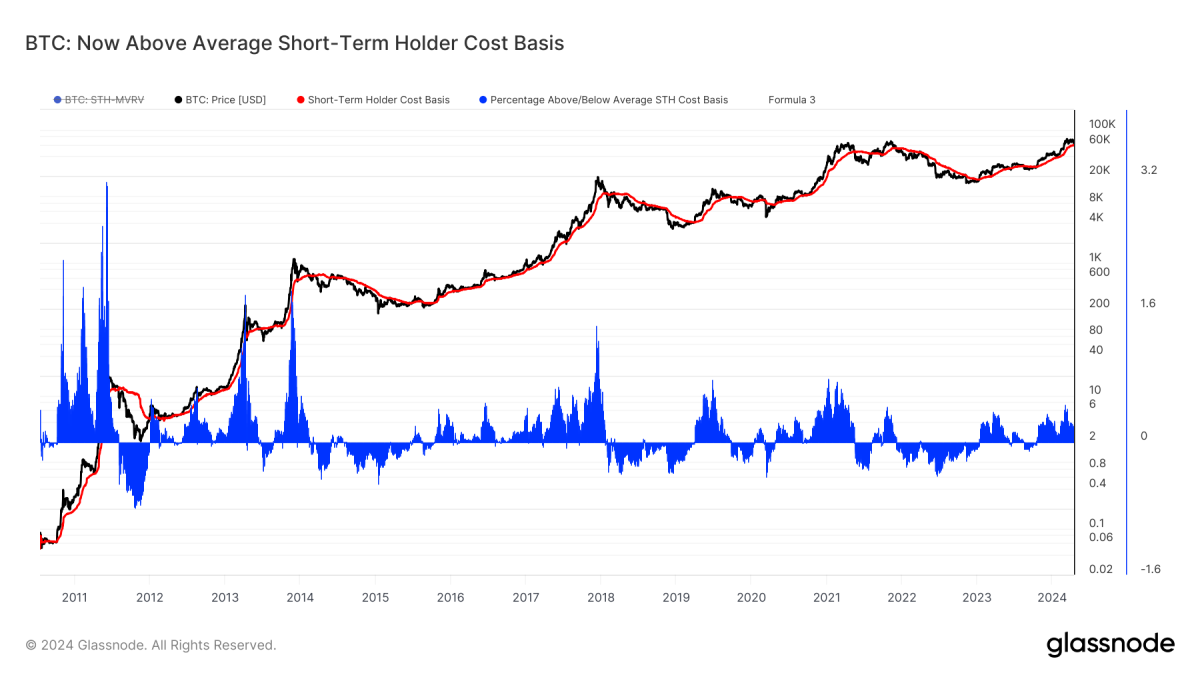

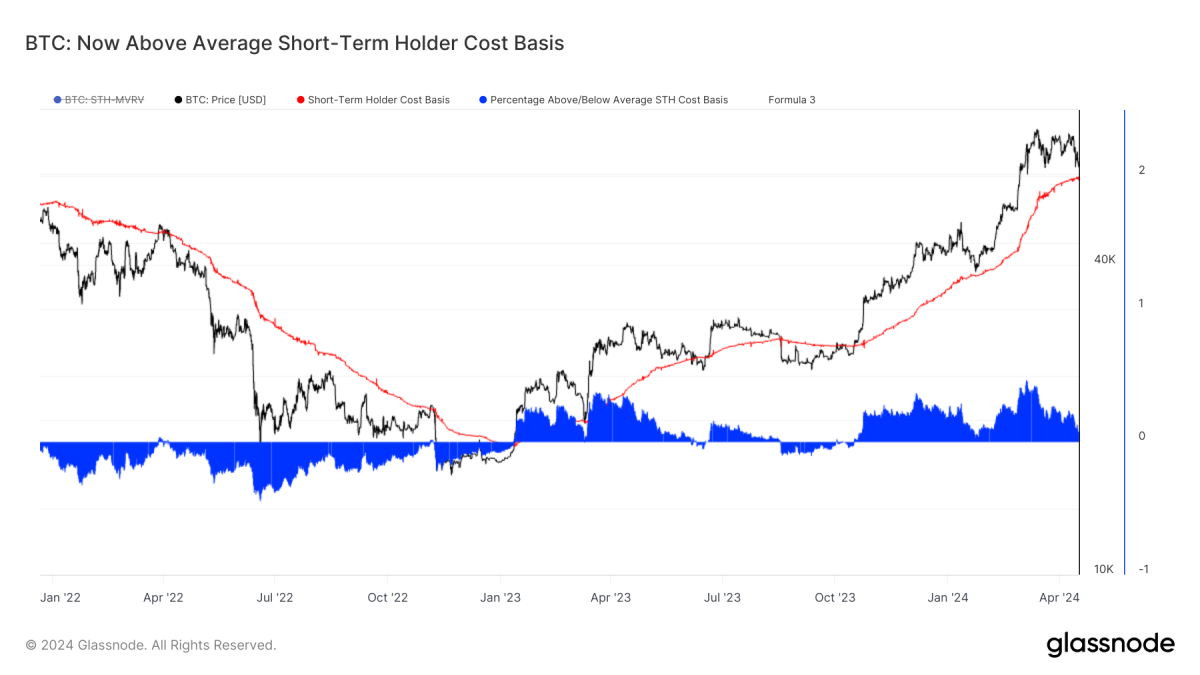

Next, if we look at the interaction between HODLers and new entrants from the perspective of short-term and long-term holders, we see that there is no reexamination of the cost basis of short-term holders during a typical bull market. Typical and quite healthy.

Additionally, the ability of this approximate price level to act as support is a characteristic of a bull market, while the opposite is true in a bear market. The psychological level of the average short-term holding price (based on cost) often plays an ironclad psychological role. and technological resistance. Currently, that level is around $58,500. This means that reaching this level is by no means guaranteed or certain; rather, it is a level that fits perfectly with the norm of activity expected in a bull market.

As attention turned to the derivatives markets, a healthy dose of leverage and speculative bubbles arose throughout the markets. Open perpetual futures on a Bitcoin basis are near their lowest level since 2022, and futures are trading at a slight discount to the spot market after the weekend plunge. There is no law or guarantee that this will immediately result in higher prices, but similar positioning in the past has created the conditions for price increases, with the highest levels of speculative premiums in futures market prices observed last time in a month. After some time, this is a welcome development.

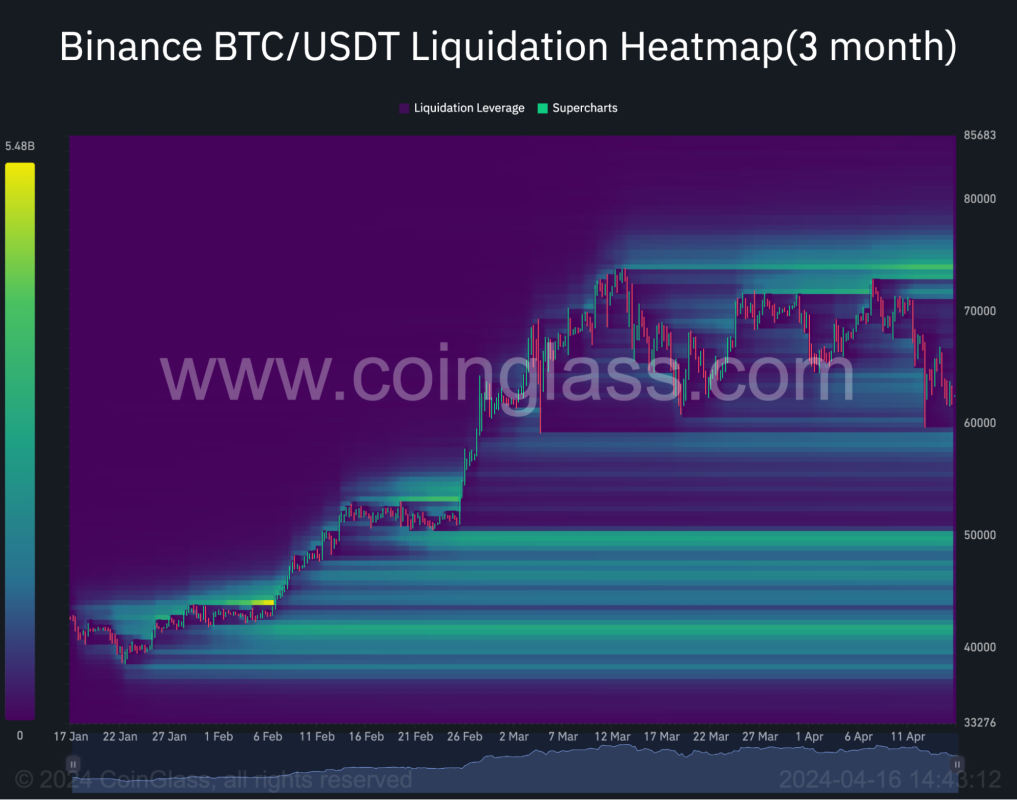

What is interesting when looking at the derivatives landscape is that the buildup of liquidable leverage above $70,000 continues to increase, while emboldened shorts try to drive prices meaningfully below $60,000. There is some leverage that can be removed below the $60,000 level, but the Bears’ actual winnings are below the $50,000 level.

Surely crazier things have happened in Bitcoin than the -33% drop from all-time highs, but spot demand is likely to remain strong at $50,000, suggesting the disappearance of open interest and the onset of a negative futures premium relative to the spot market. Most of the withdrawals have already occurred. It will likely require a significant moment of risk aversion across the macro environment for this to unfold, and given the continued reality of the pace of fiscal deficit spending, the decline is likely to be temporary.

Conclusion: This bull market has legs, and a decline from current highs, along with future currency declines, would be a welcome development for investors with a long enough horizon to understand where this is all headed. Bitcoin’s fundamentals continue to improve, and the pullback is helping remove leverage and weak speculators from a long-term bull market.

BTFD.

This article was created in partnership with Unchained, Bitcoin Magazine’s Official US Collaborative Managing Partner and essential sponsor of related content published through Bitcoin Magazine. Please visit our website to learn more about the services we offer, our storage products, and the relationship between Unchained and Bitcoin Magazine.