East West Bancorp: Dividend Is Growing Very Fast (NASDAQ:EWBC)

JHVEPhoto/iStock Editorial via Getty Images

East West Bancorp (NASDAQ:EWBC) is a bank with capital of nearly $10 billion and was founded in Pasadena, California in 1998.

Compared to its peers, the bank appears to have an advantage, especially in terms of profitability and dividend growth. I decided to dedicate an article to it. EWBC collapsed at the beginning of the year due to the banking crisis, but has recently shown signs of recovery.

Resilience and Perspective

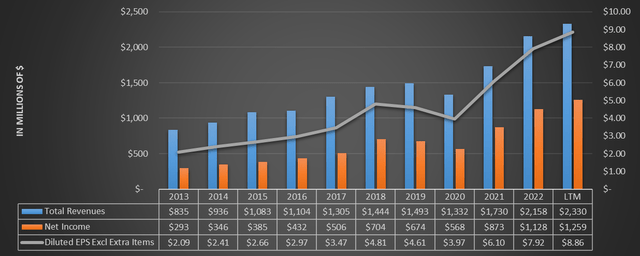

Before discussing EWBC’s prospects, I’d like to first review what the bank has accomplished over the past decade. There have actually been significant improvements worth mentioning.

Chart based on Seeking Alpha data

With the exception of 2020, which was a difficult year for everyone, EWBC has always achieved revenue growth and net profit growth. But there’s more.

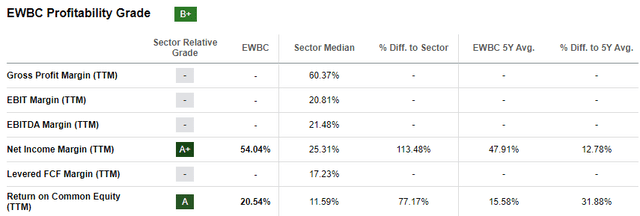

pursue alpha

Net income has grown faster than total revenue, which has led to a significant improvement in net profit margins. It is currently at 54.04% and the sector median is 25.31%. Moreover, ROE is also high at 20.54% compared to the industry average of 11.59%. Finding such a profitable bank is not easy, especially in today’s complex macroeconomic environment. But how did EWBC achieve such results? The answer lies in proper management of your loan portfolio.

East West Bancorp, Inc. (EWBC) Announces Third Quarter 2023 Earnings

First of all, fixed-rate loans account for only 22% of the loan portfolio. So the moment the Fed started raising the federal funds rate, the yield on the loan portfolio increased as a result.

- HELOC and C&I showed change rates of 100% and 88%, respectively. For HELOCs, the ratios are often close to double digits.

- CRE and single-family homes showed change rates of 60% and 43%, respectively.

Overall, compared to the previous year, the average loan yield has increased from 4.75% to the current 6.51%.

East West Bancorp, Inc. (EWBC) Announces Third Quarter 2023 Earnings

The increase in average loan yields offset the inevitable increase in deposit costs. The latter experienced an increase of 192 basis points compared to the previous year.

Many other banks have rates well above 2.43%, so overall it’s not such a bad result. What makes this less bitter is the fact that demand deposit accounts still account for 29% of total deposits.

A second advantage of a loan portfolio is that it is relatively low risk.

East West Bancorp, Inc. (EWBC) Announces Third Quarter 2023 Earnings

CRE loans are the loans most discussed by analysts. This is because they are generally less resilient during economic downturns and are therefore more likely to have impaired loans. In the case of EWBC, CRE loans account for 40% of the total loan portfolio, but the LTV is very low at 51%. Of those, a whopping 44% have an LTV of less than 50%. Moreover, although the CRE portfolio size is $20.4 billion, the average loan size is only $3 million.

So even if the CRE value declines significantly, a low LTV gives the bank enough margin of safety to deal with the problem.

East West Bancorp, Inc. (EWBC) Announces Third Quarter 2023 Earnings

Similar reasoning applies to the $14.6 billion residential mortgage portfolio, about 29% of all loans. The LTV here is also low at 51%, with the average loan size being $436,000. Moreover, home mortgages tend to be less volatile than CREs, which is why such a low LTV represents a much greater margin of safety in the event of a housing market crash.

Overall, constructing a loan portfolio biased towards floating rates and low LTV has proven to be an appropriate strategy to operate in the current macroeconomic environment.

East West Bancorp, Inc. (EWBC) Announces Third Quarter 2023 Earnings

In the third quarter of 2023, we recorded record net interest income of $571 million. The net interest margin fell slightly, but at 3.48%, it is still higher than the 3.26% of peers.

Now let’s look at growth.

East West Bancorp, Inc. (EWBC) Announces Third Quarter 2023 Earnings

Last year, the loan portfolio increased 7% to $50.9 billion. The fastest-growing category was single-family homes, up 4% compared to the previous quarter and 18% compared to last year. Obviously, high interest rates aren’t much of a deterrent to buying a new home for your family to live in.

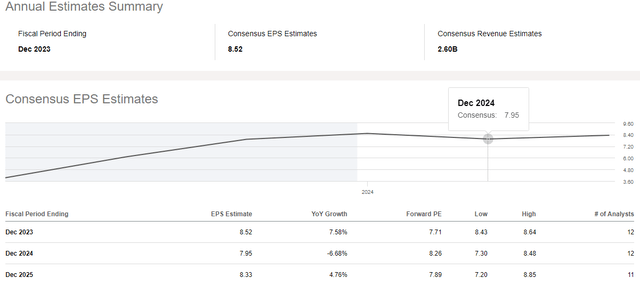

pursue alpha

According to Street Estimates, EPS is expected to decline in 2024 and then recover in 2025. Perhaps the market is ignoring a scenario in which demand for loans will fall but bank funding costs will not, which could make the recession even worse. This becomes NIM and consequently EPS. Interest rates should normalize by 2025, which will bring down the cost of deposits significantly.

Dividends and Fair Value

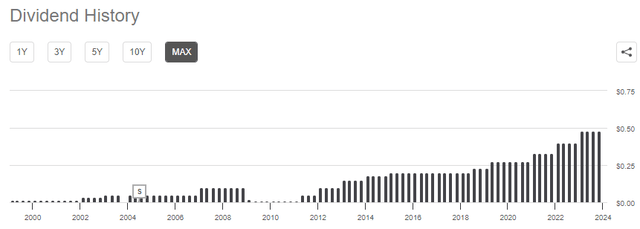

EWBC’s dividend history appears to be somewhat problematic, especially through 2012. At that time, dividends were not always issued and rarely increased.

pursue alpha

As the Great Recession hit, EWBC went through a major crisis, with dividend issuance being the least of its problems. Anyway, it got out a few years later and has been a good dividend company ever since. Clearly the macroeconomic environment favored this, but that doesn’t take away from the fact that dividend growth was much more important than the sector median.

pursue alpha

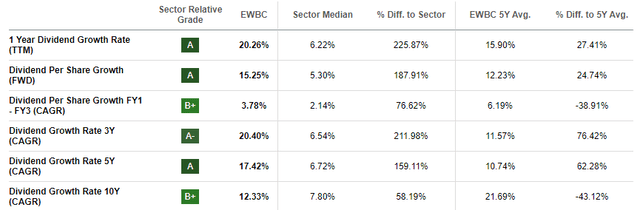

The most surprising thing is the rate of dividend growth over the past 3-5 years.

The current dividend yield is not very high at 2.92%, but it was over 4% just a few months ago. In any case, the payout ratio is just 21.67%, compared to the sector median of 35.95%, which makes EWBC’s dividend broadly sustainable. A potentially low payout ratio could be an important driver of future dividend growth. Even a 10% increase would still be largely sustainable.

Management probably tends to keep it low because they reward shareholders through share buybacks as well as dividends. There were no share buybacks last quarter, but management announced that they would restart share buybacks starting in the fourth quarter. EWBC still has $254 million available for redemption.

conclusion

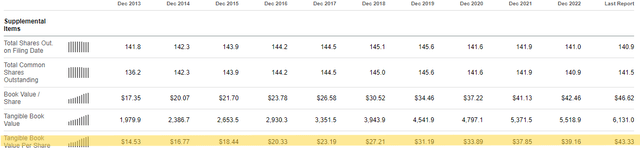

EWBC is a solid bank in many ways. In fact, EPS tends to increase over time, as does tangible book value per share.

pursue alpha

This is not a foregone conclusion, and in fact many banks have seen their equity decline dramatically due to large unrealized losses on AFS securities. For EWBC, these losses amounted to $875.4 million, but nevertheless increased tangible book value per share.

The loan portfolio offset bank funding difficulties and although NIM is falling, NII was by no means high in the third quarter. Street Estimates expect EPS to decline in 2024, but this is not certain.

Dividend issuances and share buybacks are expected to increase in the coming quarters. Capital ratios remain well above minimum standards.

East West Bancorp, Inc. (EWBC) Announces Third Quarter 2023 Earnings

There has been steady improvement since last year and today EWBC is well capitalized.

After taking all these considerations into account, my rating is a Buy. Partly because it doesn’t seem too expensive at current prices. The current tangible book value per share is $43.44. Multiplying this figure by 2.03 times the 10-year average price/tangible book value per share gives us a fair value of $88.18 per share. So we are talking about a potential upside of 34.25%.