Economic situation has reached cruising altitude, but watch out for crashes

JariJ/iStock via Getty Images

The global economy in 2023 defied widespread expectations of a recession and falling interest rates. Instead, the United States, Japan, and, to a lesser extent, Europe have seen much better growth than expected at the turn of the year. The Reserve Bank (Fed) and European Central Bank (ECB) have continued to raise policy rates throughout the year.

Underappreciated economic growth is a powerful driver of global stocks. The performance of the U.S. “Magnificent 7” stocks – Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta (META) and Tesla (TSLA) – has been widely reported. While being discussed, as of December 31, 2023, the German, Spanish and Italian stock exchanges (1) also returned 24.5%, 32.5% and 39% respectively in US dollar terms. .

That’s equal to or more than the S&P 500 index’s 26.4%. Even Japanese stocks (2) Despite the Japanese yen falling to lows in the early 1990s, it has risen at a double-digit rate in U.S. dollar terms.

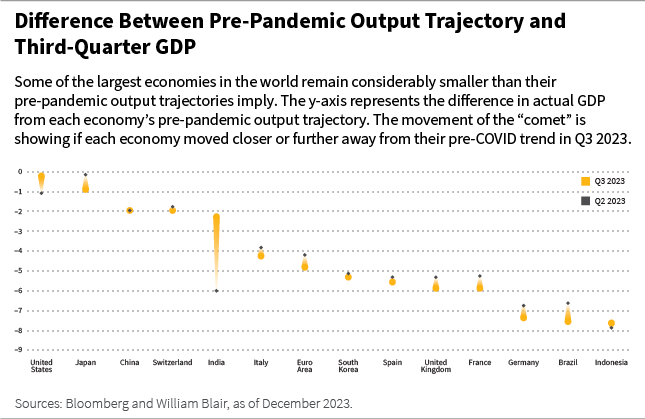

Certainly there is ground in the global economy that needs to be covered. As of the end of 2023, most large economies remain significantly smaller than their pre-COVID-19 growth trajectories, as shown in the chart below.

The United States and Japan are closest, while the United Kingdom, Germany and Indonesia are furthest from their pre-pandemic production trajectories.

The 2023 experience defies the prevailing view of the inevitable trade-off between inflation and unemployment.

Many argue that for inflation to fall into the 2% range, the economy would have to contract and unemployment would have to rise. This view assumes that the rise in inflation over the past two years has been primarily due to excessive growth in demand.

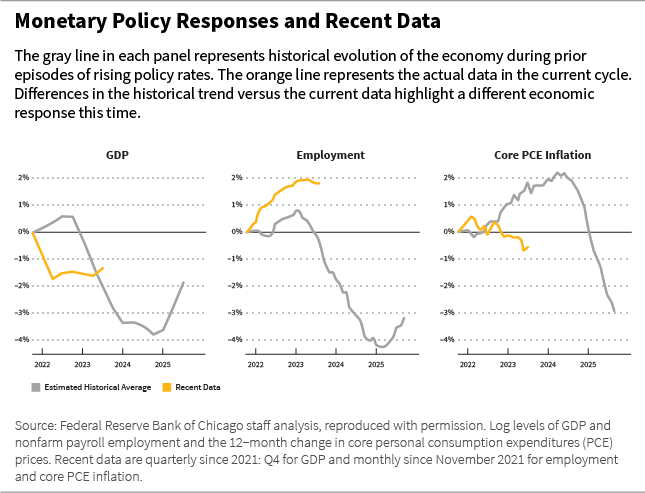

In the chart below, analysis from the Federal Reserve Bank of Chicago shows how differently U.S. economic variables are behaving since the Fed tightened its policies, making a strong case that this inflation is largely due to supply constraints caused by the pandemic.

From this perspective, it is not surprising that both the US and Europe have so far ignored dire predictions of an imminent recession.

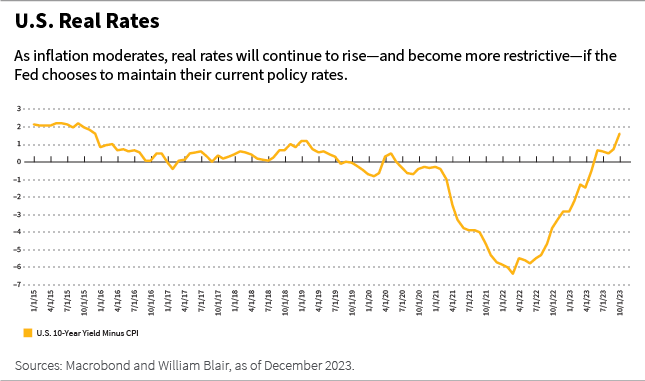

The Federal Reserve’s monetary policy stance is in fact becoming more stringent because a stable policy interest rate means a rise in real interest rates even amid a sharp decline in inflation.

Our outlook for 2024 depends on whether the Fed and ECB can start lowering policy rates early enough to prevent high-accuracy rates from meaningfully dampening economic activity.

As annual price inflation converges back to a 2% rate in early 2024, current monetary policy measured in real interest rates will become more restrictive in nature, as shown in the chart below.

The real interest rate is nothing more than the nominal interest rate minus inflation. So, if the Fed decides to maintain its current settings, lower inflation will automatically lead to higher real interest rates.

Therefore, we expect the Fed to begin cutting nominal policy rates as early as the first half of 2024, even as domestic economic growth remains resilient.

The disinflation process in the United States and Europe is already quite advanced. In early 2023, consumer prices rose 6% compared to the same period last year.

By the end of the year, the Consumer Price Index (CPI) had risen 3.2% compared to the previous year.

Nonetheless, the Fed’s preferred measure of domestic inflation (PCE excluding volatile food and energy) is still growing at 3.8% as of September 2023, nearly double the Fed’s stated target of 2%. .

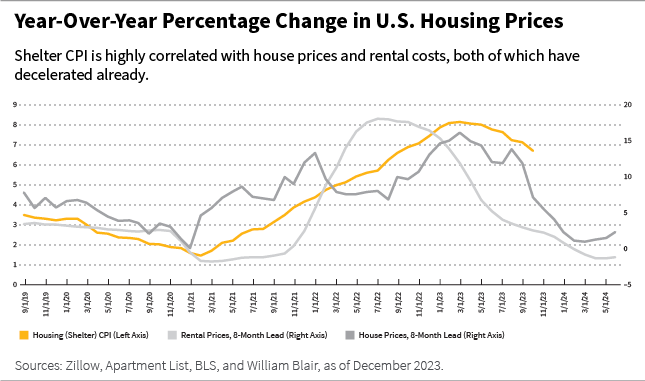

If you take a closer look at the components of price increases, you’ll see that the main culprit remains housing. It is the largest single component of the CPI basket, accounting for approximately one-third of the index.

The housing component of the CPI is an inaccurate mix of house prices and rents.

More up-to-date price information is now readily available through online platforms for buying and renting homes, and these price trends suggest that housing’s contribution to the CPI is likely to decline significantly in the first half of 2024, as shown in the chart below. .

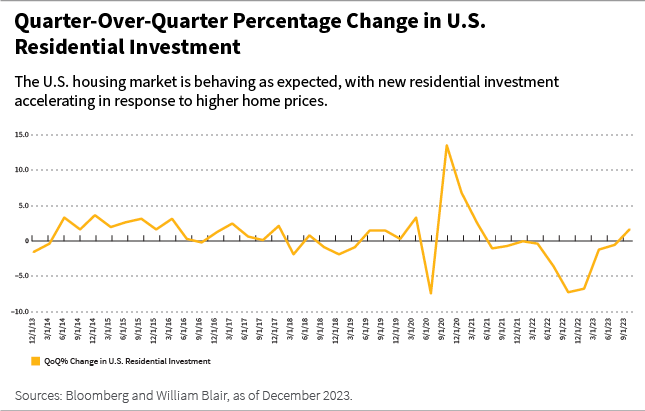

Recent increases in housing prices have led to more buildings being built. As you can see in the chart below, residential investment has returned to growth after two consecutive years of decline.

Over time, this is likely to support more housing market activity and moderate future price increases.

Crucially, the labor market has healed since COVID-19, with supply constraints largely removed. Wage growth continued to moderate. Hourly earnings are now growing at 4%, down from nearly 6% a year ago.

Job numbers continued to decline for most of the second half of 2023, with the economy adding 150,000 net new jobs per month.

In other words, the serious shortage of worker supply was resolved without the unemployment rate improving significantly due to the resumption of the inflow of returning workers and immigrants.

Lower inflation is likely to remain a strong tailwind for consumer spending and, by extension, overall economic growth, as moderate wage increases that exceed the decline in inflation increase real incomes.

This dynamic is also seen in Europe, where the disinflation process began later and continues to progress.

Economic growth is likely to remain more moderate in Europe than in the United States, particularly due to severe geopolitical tensions at the border and significantly higher energy prices compared to pre-pandemic levels.

With prices of goods and services already converging to pre-pandemic trends, it is not unreasonable to assume that U.S. inflation will normalize to its long-term 2% rate in the first half of 2024.

As the inflation elimination process progresses, current monetary policy will become more restrictive in nature, suggesting that some easing of the federal funds rate will be necessary even if economic activity remains resilient.

The ECB is likely to face low inflation and disappointing growth in Europe in the coming months. Relying on today’s, or more accurately, last month’s, indicators of price movements runs the risk of monetary policy remaining too restrictive and punitive toward future economic activity.

We expect the Fed to lower its policy rate to the 3.5% range on an 18-month basis and begin this process in the first half of 2024.

Therefore, if the Fed timely adjusts its “neutral” monetary policy stance to a meaningful reduction in inflation, and the ECB follows suit in Europe, the world’s major demand centers can sustain moderate but sustainable economic growth. In 2024.

In other words, 2024 could be the first year of ‘normal’ economic expansion post-COVID-19.

(1) Stock exchanges are represented by the DAX index (Germany), IBEX 35 index (Spain) and FTSE MIB index (Italy).

(2) Japanese stocks are expressed in the Tokyo Price Index (TOPIX).

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.