EIA Mining Survey Has Big Impact on Bitcoin Mining Industry

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. Subscribe now to be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox.

Bitcoin miners have not been operating under normal circumstances for the past few months. Bitcoin’s blockchain has seen particularly intense demand over the past few months, and the image inscriptions that look like BRC-20 and, to a lesser extent, made possible by the Ordinals protocol are largely responsible. Essentially, the protocol allows users to inscribe unique data into the tiniest unit of Bitcoin and create new “tokens” directly on the Bitcoin blockchain. This means that one penny worth of Bitcoin in terms of fiat value can be bought and sold multiple times, and all of these transactions must be processed through the same blockchain, not to mention the high demand seen during initial minting.

This is where Bitcoin miners come into play. The energy utilization calculations performed by specialized mining hardware can not only be used to create new Bitcoins, but can also be used to verify transactions on the blockchain and keep the digital economy flowing smoothly. With network usage higher than ever, there is ample opportunity for miners to profit just from processing these transactions, and the actual production of newly minted Bitcoin may take a backseat. These conditions have resulted in a situation where, as of February 2024, mining difficulty is higher than at any time in Bitcoin history, while the industry is making huge profits. But one of the most reliable patterns in the Bitcoin market has been sheer chaos, with fees soaring and then plummeting. So what happens to miners when these conditions change?

When federal regulators issued a new mandate on January 31, this ecosystem was significantly disrupted. The EIA, a subsidiary of the U.S. Department of Energy (DOE), was scheduled to begin a survey of the electricity usage of all miners operating in the United States. . Verified miners will be required to share data on energy usage and other statistics, and EIA Administrator Joe DeCarolis said the study will “focus specifically on how energy demands for cryptocurrency mining are evolving, and identify high-growth geographic areas.” “And we will quantify the amount of mining,” he claimed. It is a power source used to meet cryptocurrency mining needs.” Although these goals seem simple enough at first glance, several factors gave Bitcoin users pause. one thing, forbes The order came from the White House, which called the action an “emergency data collection request.” This survey was created explicitly for the purpose of investigating the potential for “public harm” from the mining industry, apart from the fact that this “urgent” collection may lead to more routine collections expected from all miners in the near future. Included.

Clearly, language like this has made many in the community extremely anxious and several major miners have already issued statements condemning the plan. The tone of regulators seems overwhelmingly clear that these projects pose a potential threat, whether through increased carbon emissions, taxation of electric infrastructure or public nuisances. Some of the most outrageous claims could easily be proven false, but that doesn’t change the reality that a few hostile government actions can significantly disrupt this ecosystem. Moreover, the mining world is already experiencing major disruption in the form of the Bitcoin halving. This regular protocol, built into Bitcoin’s blockchain, is set to automatically halve mining rewards at block 840,000 sometime in April, and already some pessimists are claiming the disruption will be enough to bring almost the entire industry to a halt. What is the actual worst-case scenario here? What is the most likely?

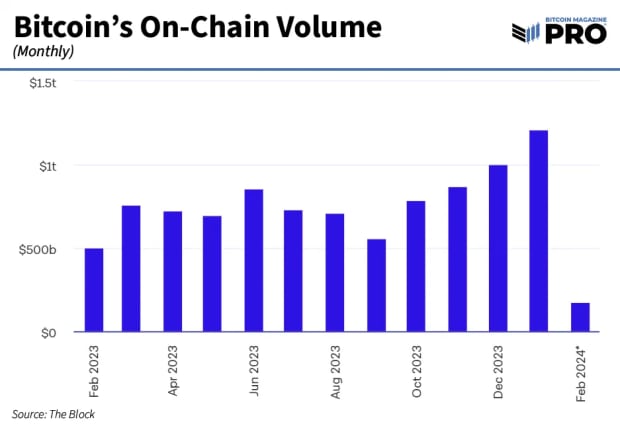

First, it is important to examine some factors unique to Bitcoin that may affect miners regardless of government pressure. Miners are in a strange market situation because transaction fees can generate the same level of revenue as actual mining, but things may stabilize. New data shows Ordinals revenue plummeted 61% in January 2024, showing a likely waning impact on blockspace demand. Therefore, if certain miners rely on these tokens to sustain their profits, that revenue stream does not appear to be particularly reliable. But even if network usage is likely to plummet due to these microtransactions, regular transactions actually look good. Bitcoin’s trading volume is higher than it has been since late 2022, and shows no signs of stopping. If so, there will certainly be a lot of demand for new Bitcoin issuance.

Bitcoin traffic has been increasing for months as the prospect of Bitcoin ETFs becoming legal becomes more and more realistic, and now that this fight is over, trading volume has increased at an even faster rate. Halving can present opportunities and challenges for miners, but no one can argue that it is an unexpected event. Companies have understandably been preparing for this, and about $1 billion of this increased trading volume will come from miners themselves. Bitcoin holdings held by miners are at their lowest since before the 2021 surge, and miners are using the capital raised from these sales to upgrade and prepare equipment.

In other words, it seems likely that market conditions will change due to these factors, regardless of any government action. While the bottom may fall out for some smaller companies operating on tight margins, the overall increase in Bitcoin trading volume means there is always an opportunity to make money. Since it is the most well-capitalized companies that can make the most extensive preparations for halving, it is very likely that some of the more inefficient mining companies will not survive. From a regulatory perspective, this is probably the desired outcome.

The federal government seems primarily interested in perpetuating the idea that the mining industry consumes vast amounts of electricity for dubious profits and is a tax on society as a whole. But only the most efficient operations will be able to survive the halving and its economic fallout. When less efficient people close, survivors are left with a much larger slice of the overall smaller pie. Moreover, open letters from several major companies show that they are ready to speak out against attempts to repress their industry. Given that the survey itself is still in its first week of data collection, it is difficult to say what conclusions will be drawn or what action EIA may take thereafter. The most important thing to consider, then, is that these new trends are occurring with or without the influence of EIA.

The investigation is just beginning, and the half-life is only a few months away. There are many reasons to be concerned about the impact of EIA on the mining industry, but this is not the only factor. From where we sit, it looks like the entire ecosystem could change substantially if regulators are prepared to take some action, even if the measures are harsh. Those left to confront them will stand strong as survivors and innovators in a chaotic marketplace. Bitcoin’s greatest strength is its ability to change quickly, giving new enthusiasts the opportunity to leverage one set of rules and then rise or fall as the rules change. It is this spirit that has catapulted Bitcoin to global status over more than a decade of growth. Compared to that, what opportunity does the opponent have?