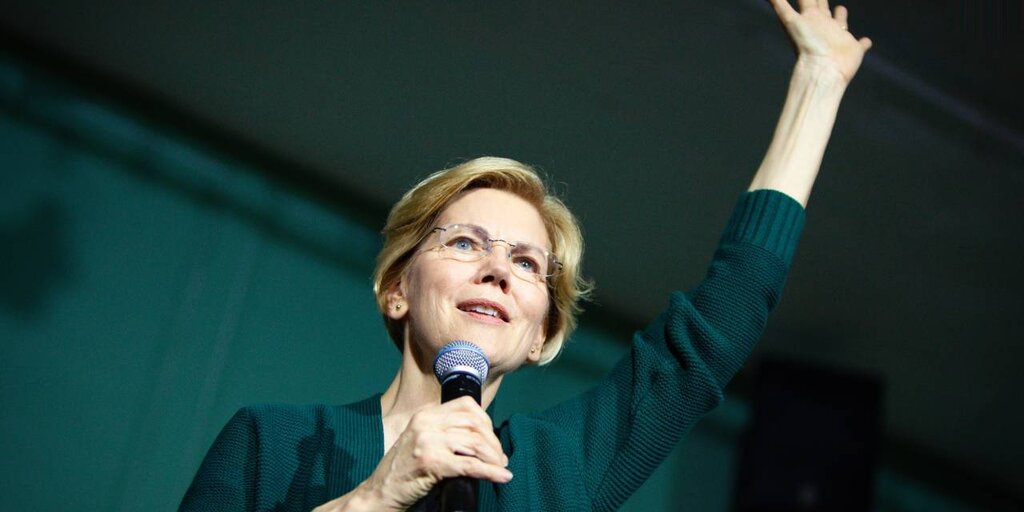

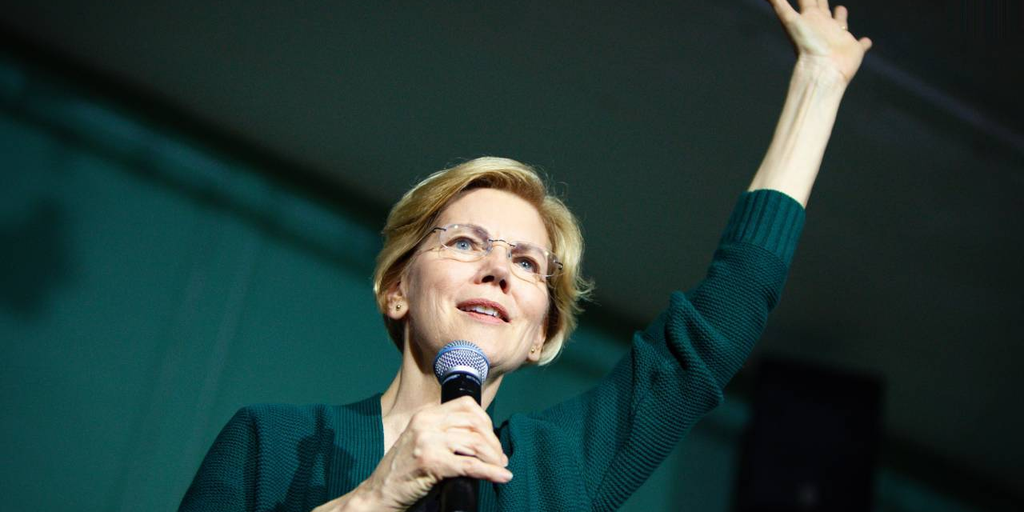

U.S. Senator Elizabeth Warren (D-MA) criticized the Securities and Exchange Commission’s (SEC) multi-spot approval. Bitcoin ETF.

in post on twitterWarren said regulators were “wrong on law and policy” regarding their decision to approve spot Bitcoin ETFs from asset managers including BlackRock, Grayscale and Ark Invest.

“If the SEC allows cryptocurrencies to penetrate deeper into our financial system, it is more urgent than ever for cryptocurrencies to follow basic anti-money laundering rules,” she added.

“I have often said that the Commission acts within the confines of the law and how the courts interpret the law,” SEC Chairman Gary Gensler said in a statement after the ETF’s approval. “Things have changed since the court order was enforced.” He said. Regulatory bodies reviewing the application of grayscale.

At the time, the court ruled that the SEC had already approved a Bitcoin futures ETF, consistent with the SEC’s denial of Grayscale’s application to convert its Grayscale Bitcoin Trust (GBTC) product into a spot Bitcoin ETF. It was ruled that the explanation was insufficient. “Unlike the regulatory treatment for similar products,” it is illegal.

Elizabeth Warren vs Cryptocurrency

Warren has repeatedly criticized cryptocurrencies and the cryptocurrency industry, linking them to money laundering and terrorist financing and claiming that groups like Hamas and Islamic Jihad have raised “more than $130 million in cryptocurrencies.” . Blockchain analytics firm Elliptic disputed this figure. wall street journal The article Warren cited said data provided by the company had been “misinterpreted.”

The senator has called for an update to the Bank Secrecy Act to address the “threat” of cryptocurrencies and is a sponsor of the Digital Asset Anti-Money Laundering Act, a bill that aims to expand know-your-customer (KYC) requirements to: Various blockchain infrastructure providers and participants.

Among other provisions, the bill requires platforms and networks to identify self-custodial cryptocurrency wallet holders and track transactions.

The bill has been criticized by cryptocurrency advocacy groups such as Coin Center as “an opportunistic and unconstitutional attack on cryptocurrency self-storage, developers and node operators.” In December 2023, Warren took direct aim at cryptocurrency industry lobbyists, claiming they were “undermining” the Biden administration’s efforts to curb terrorist financing through cryptocurrencies.

Stay up to date with cryptocurrency news and receive daily updates in your inbox.