EM Fund Stock Picks & Country Commentaries (June 29, 2025)

The recent FT works of the fund manager Aberdeen’s Trainwreck branding, which Abrdn attracted my attention, are as follows.

📰 ‘Don’t try to be teenagers’: Lessons of Abrdn’s miserable brand (FT) June 2025 🗃️

Many attempts to create fresh and agile images have failed, but playing in heritage can be positive.

and:

Creating a brand that is “modern, agile and digital” was part of the theoretical basis specified at the time. There is a lack of Internet address for more obvious choices as Aberdeen.

However, the mockery of the brand is in the end to Jason Windsor Turn over the decision His predecessor Stephen Bird is an attempt to eliminate “distracting”. Aberdin refused to comment.

So what can other companies learn in episodes? Michael Ruby, president of the Consulting Park & Battery, says Aberdin says “It is a well -established organization that tried to look like an innovative fintech.” effort failed It is because it is “immediately screaming, and they try to play in fashion and are not true.”

I don’t know about you, but I think that at least for money issues, it looks like it’s around for many generations or has a very personal name or brand (for example, family names such as Swiss personal banks such as Goldman Sachs or Pictet mean continuity and safety.

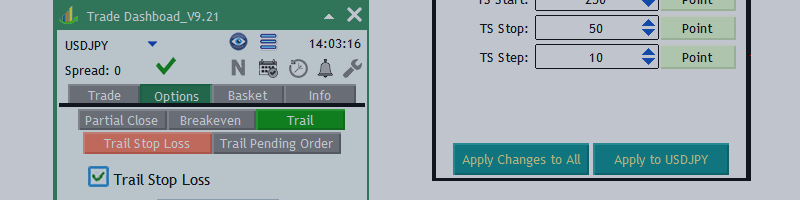

Their failure also reminded me of this Twitter thread for several months on a company that destroys the logo of the digital age or rather looks the same.

Another interesting work comes out Aberdin itself:

🔬 SABA puts an investment trust in the public’s eyes (Aberdin Investment) June 2025

Jonathan Davis, an editor of the annual Investment Trusts Handbook and a host of the award -winning Money Makers Podcast, explores the bold and controversial items. SABA capital management (Closed fund (“cefs”))) To the UK Investment Trust.

Saba Capital Management, a US hedge fund founded by Chess Prodigy Boaz Weinstein, first appeared as a prominent activist in the UK Investment Trust in 2023. Since then, the company aims to make almost 20 investment trusts, which are trying to make more efforts to make a significant stake and to improve shareholder value with a wide range of discounts with net asset value (NAV).

📰 Hedge Fund Saba reaches another investment trust goal and a contract. (Reuters) May 2025

SABA’s $ 5.5 billion activist campaign for the UK’s investment funds has been voted for reorganization or liquidation this year.

Some investor behaviors and hedge funds and private equity funds can be a good thing for all investors and overall economies.

But mine Posts on March 23, 2025 Private equity funds in the United States dealt with interviews with activists who are increasingly destructive and malicious about the US private equity funds in various areas of the US economy. Posts on March 10, 2024 Bypassed by the EMS, we discussed the destruction of private equity funds in the California Almond industry.

The post also mentioned that it focused on the continuous wind of Korea’s preferences. Wise Korea Opportunity Fund (LSE: Wkof)) It seems that it has nothing to do with the behavioralism of this particular hedge fund.

However, given the number of emerging and frontier market investment funds listed in London so that retail investors can easily access such a market, I hope they will not aim for this specific US hedge fund. If they want to return quickly.

As of the end of June, you can support more funds (continuous updates Here is a post that contains all the funds.) It started with more parts of European stocks or other investments and came with new research.

-

🔬🌐 BAILLIE GIFOD Management: The most interesting 7 growth recommendation (Baillie Gift) – Core point

-

The management team strives to identify outstanding growth opportunities in the global market with a sustainable competitive advantage.

-

From Amazon’s sleeve domination to TSMC’s semiconductor leadership and strategic acquisition of DSV, portfolios show a variety of potential growth sources.

-

In addition to stocks, portfolios include bonds that are carefully selected to corporate issuers who complement our growth strategy in Australian government debt.

-

-

🔬🌍 European Renaissance (Baillie Gift) Core point

-

Europe is emerging as an attractive investment destination due to the improvement of economic prospects and significant financial stimulus plans.

-

Our multi -asset portfolio uses European opportunities by investing in utility and warehouses.

-

The increase in European political stability and fiscal expansion creates a rare window for investors who are seeking diversification and growth potential beyond the US market.

-

-

🔬🌍 NATO sets the price in peace. (Northern Trust) – NATO’s new expenditure vows alleviates security issues but adds fiscal pressure.

-

🔬🌍 European plate -intersection (UBS asset management)