EM Fund Stock Picks & Country Commentaries (March 23, 2025)

I know that many people don’t like or listen to Alex Jones and his Infowars. But one of their reporters had one of the most interesting discussions I just heard. A method of destroying a business that can be used with private equity funds and adjustable rates (aka Red Lobster, Party City, Joann ‘S, Forever 21, Big Lots and Current HOOTER’S) With the sportsman TIFFANY CIANCI (After the franchise was taken away, she became an anti -PE activist, and her life was almost destroyed when a private equity company acquired and forced a company owning a franchise.

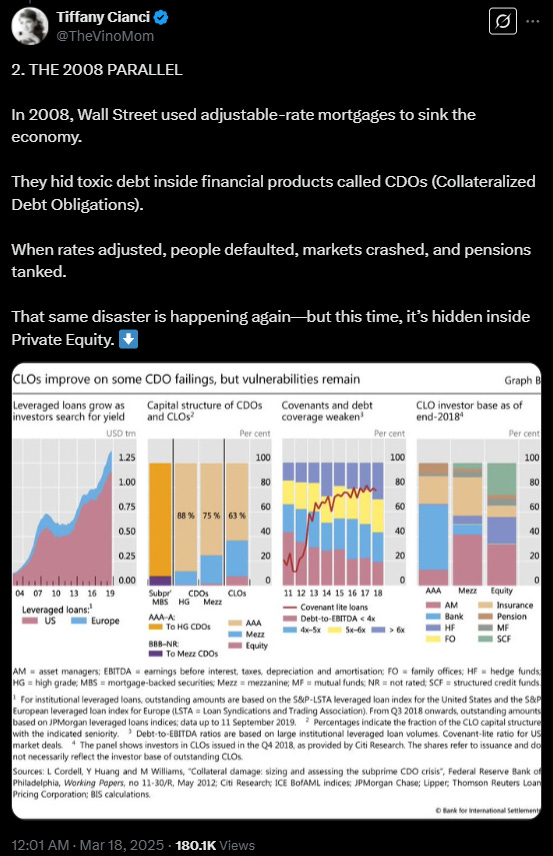

you I don’t want to hear it for an hourHere is a much shorter video with Twitter thread and summary.Back floating interest rate loans ”(eg, adjusted interest rate loans) are used by private equity funds to buy a good company with banks, and re -package and sell loans for pension funds that need to be sent off at some point.:

my March 10 posts I bypassed the EMS and discussed the destruction of private equity funds in the California almond industry (with family and orchard).

As Tiffany discussed in relation to what is happening in other industries, in this case, the almond agricultural organization of bankruptcy It is owed with just $ 155 million. Labo agriculture (Dutch subsidiary Labo Bank Group And one of the world’s largest AG Pixt))) 2022 $ 38 million floating interest rate loan (ED Damcus) pushes them over the edge and have 107 pages of claims to other central valley companies.

And as Tiffany said about the pension fund California University Regent and MAKENA HOLDINGS (More than 50 people and the foundation customers) were one of the investors and would potentially erase the investment, and there may be rumors that Oprah Winfrey and John Madden can never be proven considering the LLC’s web related to protecting the status.

Anyone who wants to invest in private equity or that of all stocks on that issue “Loan or adjustable fee loans For the participation of books or PEs, it is a good idea to listen to or pay attention to Tiffany’s talk about the subject.

As of mid -March, the February Fund Update (continuous update Here is a post that contains all the funds.) It started with a part of the part, and it was provided with some new studies.

-

🎙️🇪🇺🚩 There are several European stocks about this podcast. European growth: unique brand, hidden champion (Baillie Gift) 34:45 minutes

-

European stocks appear to be undervalued compared to the United States and create investment opportunities.

-

Based on the basic characteristics of each stock, including pricing and culture, long -term approaches to European stocks are related.

-

The continent has a company with its own brand.LVMH MOët Hennessy Louis Vuitton (EPA: MC / otcmkts: lvmue / LVMHF))), It dominates the niche market (Spotify Technology sa (NYSE: dot))), ‘Hidden Champion’Camurus by (STO: Camps / at: 7ca / otcmkts: CAMRF))))

-

-

🔬🌐 New era of globalization: Opportunity to change opportunities in the dual -track world (PGIM) – In national elections around the world, one theme was almost universal dominant. Dissatisfied with the world economy that prefers others through us. On the surface, the whirlpool title around the tariff and the crushed supply chain suggests that the high -speed globalization train is completely derailed. The world, however, entered a new era when globalization inherently popped into two separate tracks.

-

🎙 Nilam this State street Podcasts have a report card. The other side of the trade war (30 minutes) – As tension and trade tariffs increase, market discussions often land on how the US import costs affect US consumers, US trade and inflation, and the meaning of the US dollar.

-

🔬🌐 There is a PDF slide neck with this Invesko piece: Focus: AI after deepSeek – We think that the AI competitiveness is changing and more participants have entered the market with the emphasis on efficiency. As the open source model becomes more powerful, the value capture can be moved from the IP of the model. However, using a cheaper model is expected to accelerate adoption, which must maintain the possibility of AI, which has benefited from the demand for computing power and the boom of technology.