EM Fund Stock Recommendations and Country Commentary (January 12, 2025)

Updates on new funds for December and Q4 as the new year begins (updated continuously) The post with all the funds is here . The October study piece has now been removed… ) has become available with many new research works.

-

🔬🌐 abrdn This article was published shortly before the California fires: 5 key considerations for insurance investing in an evolving economic environment in 2025 – Insurance companies will need to adapt to the macroeconomic changes expected with the election of a new President Trump by focusing on bond opportunities, diversifying assets, and remaining alert to regulatory changes.

-

🔬🌐 Bailey Gifford Here’s a reality check: The Conundrum of Focus: Challenge or Opportunity?

-

Market focus on large companies such as ‘The Magnificent Seven’, It dominated returns and created difficulties for active managers.

-

Investing heavily in these large-cap stocks may limit potentially more promising investment opportunities elsewhere.

-

Excellent growth opportunities often lie in less studied companies, such as: sweet green (NYSE: S.G.), Door Dash (NASDAQ: dash) and Cloudflare (NYSE: net).

-

-

🔬🇬🇧 Janus Henderson Investor This work is also being mentioned or discussed. Several UK-based stocks: Discover the Super 6 Stocks Outperforming Mag 7 – The UK markets may not be known for being dynamic, but their shareholder friendliness has stood out over the past three years. Here we discuss how this affected Henderson High Income.

-

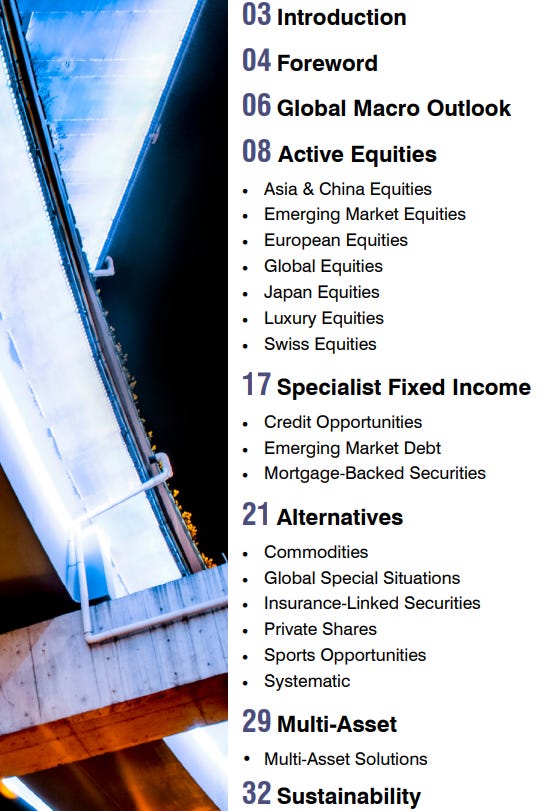

🔬🌐 GAM Investment There is this report: Outlook to 2025: Navigating Volatility

-

i invest I have a fragment like this:

-

🔬🌐 Uncommon truths about 2024: Looking back on the year – The central bank’s easing cycle began in 2024, helping to create a rewarding year for many investors. I wish I could say the same about my list of Aristotle’s 10 Surprises.

-

🔬🌐 FX Pulse: Looking for the highest dollar for Q1 2025. – Our preferred currencies and preferred hedging activities for the next 3 and 12 months

-

🔬🌐 A new year begins and geopolitical unrest continues. – 2024 was also a year in which stock market performance was better than expected, and we expect 2025 to be a positive year with performance expanding compared to last year. Where else could the trends of 2024 extend into 2025? Follow along and find out.

-

-

🔬🌐 Global Risk 2025: A Turning Point? (MetLife Asset Management) – As the dust settles from the U.S. election, the new year brings new challenges. Tariffs are likely to be a dominant topic in early 2025. Our base case is that the incoming Trump administration will impose significant (though not universal) tariffs on most countries.