EM Fund Stock Recommendations and Country Commentary (November 17, 2023)

Let’s take a look at some quick facts in this shorter-than-usual post.

-

Several interesting webinars or podcast interviews, including two focused on popular Eastern European and Latin American stocks.

-

This is an interesting indicator of the Chinese economy.

-

More funds have updated their information for the month of October.

In a recent podcast interview, one fund manager mentioned how they are doing. Reassessment of Chinese investment case For example, taking a blank sheet of paper and looking at the companies they want to follow and taking a fresh look at what’s happened since 2020 (e.g. regulatory crackdown, etc.). they are watching Pockets of growth and profitability Being a fundamental investor versus a “growth bubble at all costs”. However, there are still a few things to check before we get out of our domestic underweight position.

Another interesting observation is: overweight in mexicoAlthough he is worried How themes turn into bubbles. But their research shows that nearshoring is a real and long-term sustainable trend. Mexican stocks are not very expensive and the peso is also supported.

I’m finally back from visiting Kyoto and Tokyo, but I’m planning to fly to the US for the weekend. So next week’s post will be a little slower than usual and may be short like this one. But after that I will have plenty of time to check out my other posts and write a travel report about Japan and Taiwan. No more expiring frequent flyer miles to redeem for inconvenient flights!

disclaimer. The information and views contained on this website and in our newsletter are provided for information purposes only and do not constitute investment advice and/or recommendations. Your use of any Content is entirely at your own risk, and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the Content. For investment advice, seek out a fully licensed professional. I may have a position in that investment. This is not a recommendation to buy or sell any of the investments mentioned.

For additional disclaimers and an explanation of the reason for this post, please see: Disclaimer: EM fund stock recommendations and country commentary posts.

memo: Where possible, company links will direct you to the appropriate investor relations or company page. Region and country links are on the next page. ADR or ETF Pages with additional country-specific resources, such as links to local stock markets and media websites. Please report invalid links in the comments section.

🗄️ Funding Documents/Updates; ⚠️ Public or limited access available depending on your location, investor status, etc. 🎥 Video; 🎙️Podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 🗃️ Archived articles; 📯 Press Release; 🔬 Research analysis (including articles/blog posts by fund managers, etc.)

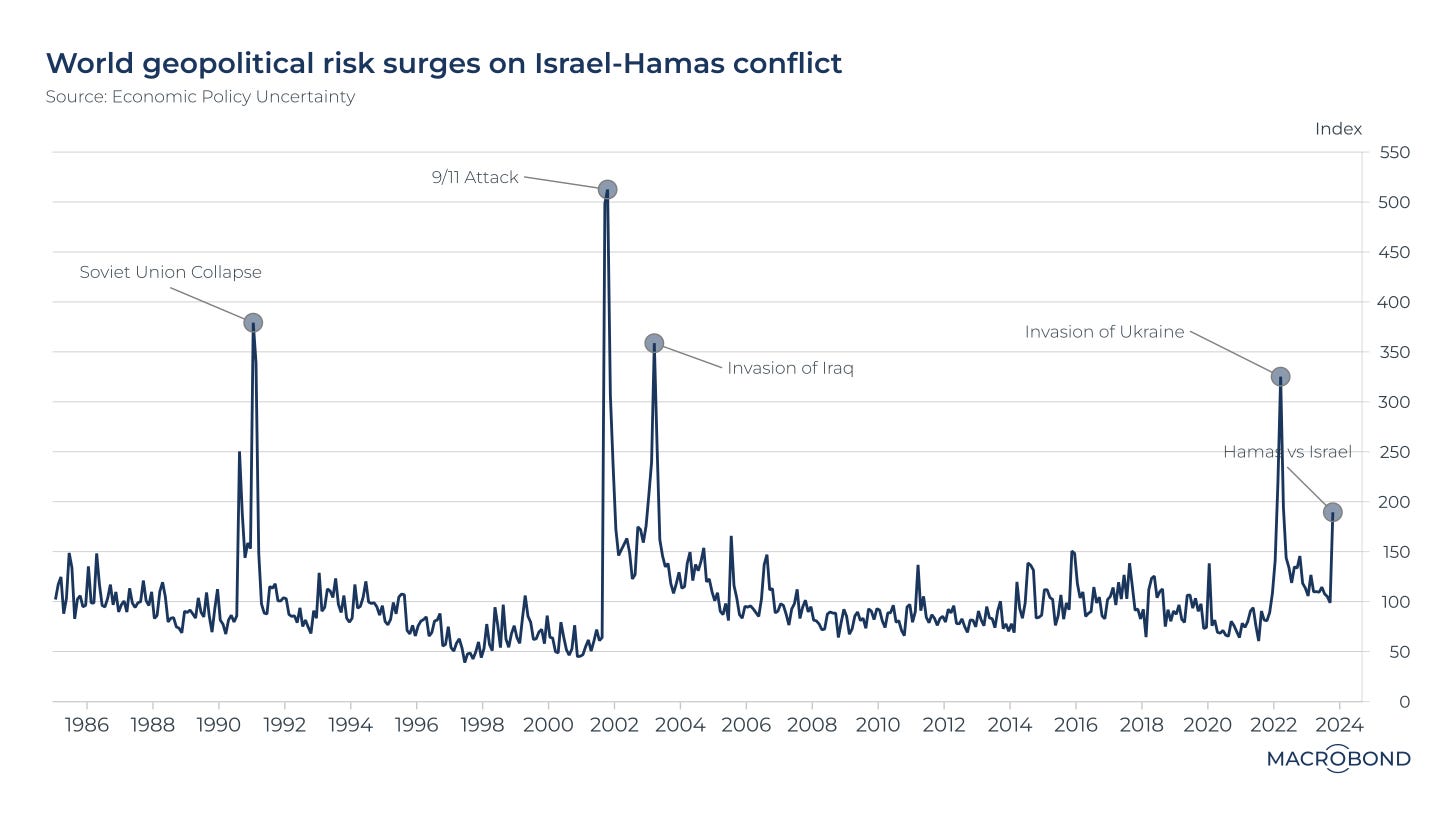

This is an interesting index provided by Macrobond:

🔬 The geopolitical risk index is soaring again. (Macrobond)

The situation in Gaza has raised the risk index sharply, but it is much lower than the impact of the Russian invasion of Ukraine in early 2022.

If you register, you can view last Tuesday’s webinar on-demand.

🎬 Why should you use EM bonds now? (Van Eck) 1:15:00 hours (November)

The Fund’s Investment Process – How to Find Cheap Bonds

When it comes to emerging market debt – the historical performance of emerging market debt compared to other major debt categories suggests that we should allocate much more weight to emerging market debt.

China’s economic reopening and high carry rates are positive for the outlook for emerging market bonds

🗄️⚠️ AFC Asia Frontier Fund

Our latest monthly newsletter (Economics and Portfolio) is October. This noted how many countries are already past the worst of their macroeconomic environment and are better positioned to deal with commodity price shocks.

Again, please also check the following: AFC Quarterly Update Webinar Presentation Slides – Wednesday 25thDay October 2023