EM Fund Stock Recommendations and Country Commentary (November 28, 2023)

Some excerpts from this post include:

-

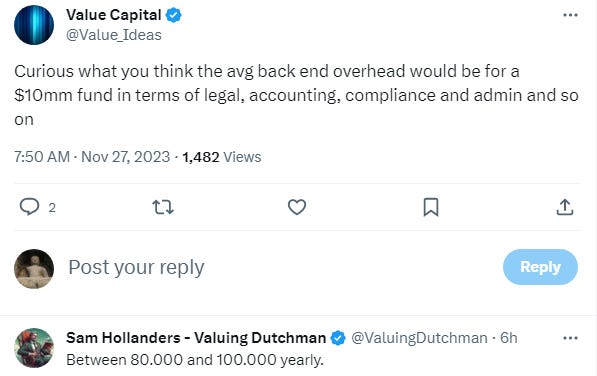

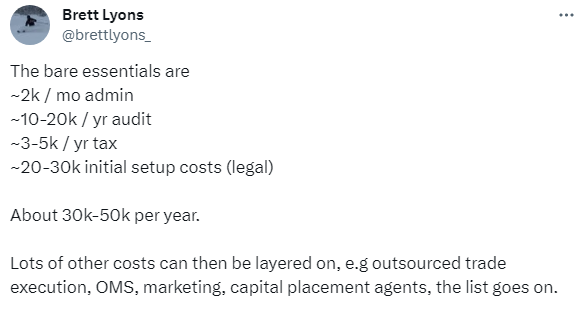

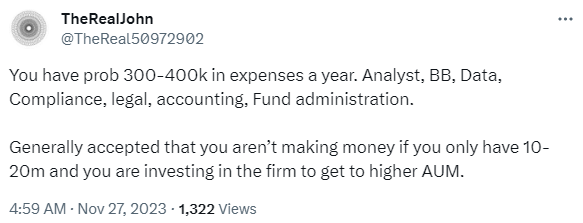

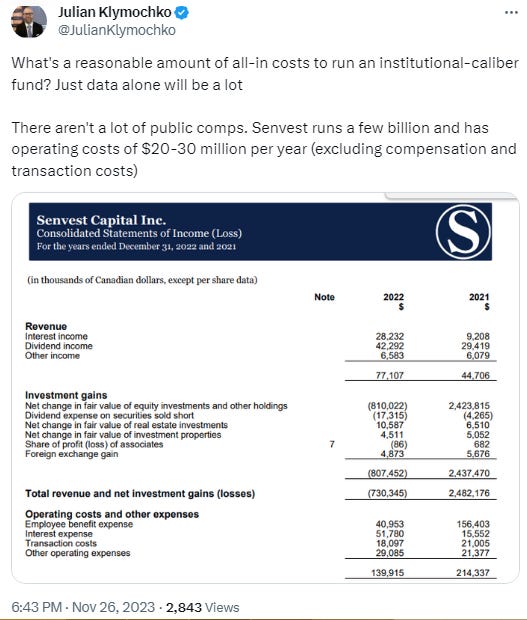

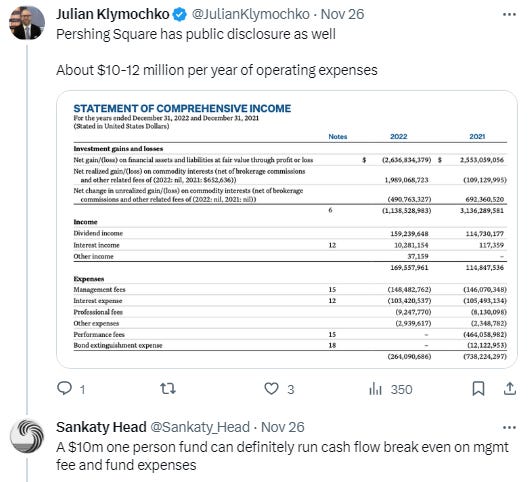

Some tweets about the costs of running a small fund, including fund management costs. It would be interesting to hear what our readers think about the numbers given.

-

recent china stocks They are the target of “research,” also called short-selling groups.

-

Some Less Known South African Small Caps This has rewarded investors who want to invest in something beyond a large-cap family name.

-

Probably the most recent one Charlie Munger’s last interview He talked about China (among other topics…).

-

Most funds have already updated and published their October fact sheets and/or end-of-third-quarter commentary.

In a recent podcast interview, one fund manager said: Three things are happening in our lives that have happened many times in the past. (But not in our lifetimes so far):

-

The amount of debt creation and revenue generation is enormous. The last time this happened was in the 1930s.

-

The amount of internal conflict between the left and the right, along with the populists. Again, the period 1930-1945.

-

Great powers clash with emerging powers that challenge established powers. Again, the period 1930-1945.

He also explained where he would like to invest geographically.

-

Where you earn more than you spend For example, those with good savings and financial health will do better during this period.

-

A place where there is little risk of major internal conflict For example between left and right, etc.

-

Minimize the places where external warfare can occur. He pointed out that throughout history, neutral companies have performed better economically than those that won wars. For example, Britain bankrupted herself, while the United States was late to every war and hoarded all its gold.

This is connected to what I wrote in January. EMerging Market Country Choice in a Multipolar World: 12 Things to Consider

disclaimer. The information and views contained on this website and in our newsletter are provided for information purposes only and do not constitute investment advice and/or recommendations. Your use of any Content is entirely at your own risk, and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the Content. For investment advice, seek out a fully licensed professional. I may have a position in that investment. This is not a recommendation to buy or sell any of the investments mentioned.

For additional disclaimers and an explanation of the reason for this post, please see: Disclaimer: EM fund stock recommendations and country commentary posts.

memo: Where possible, company links will direct you to the appropriate investor relations or company page. Region and country links are on the next page. ADR or ETF Pages with additional country-specific resources, such as links to local stock markets and media websites. Please report invalid links in the comments section.

🗄️ Funding Documents/Updates; ⚠️ Public or limited access available depending on your location, investor status, etc. 🎥 Video; 🎙️Podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 🗃️ Archived articles; 📯 Press Release; 🔬 Research analysis (including articles/blog posts by fund managers, etc.)

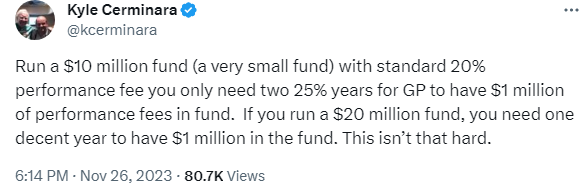

Although not directly related to emerging markets, this tweet and some responses to it (screenshots are linked to the tweet) Fund management costs This may be of interest and worth considering if you are investing in smaller funds.

To access this report, you will need to fill out a short form. They said, “China remains highly relevant to investors, but complex opportunitywe are It is broadly divided into three categories:… ”:

🔬 Emerging Markets Debt: Fresh Thinking on an Evolving Asset Class (McKay Shields) November 2023

This white paper covers the following in detail: Evolving Emerging Market Debt DynamicsWe focus on three key areas:

first, We explore the implications of an increasingly multipolar world and how new centers of economic and geopolitical power are reshaping the investment landscape.

next, We evaluate China, a huge economic power that stands at a crossroads. Is it a maze fraught with risk, or is structural rebalancing setting the stage for continued growth?

finally, We’ll explore ‘leapfrogging’ – the phenomenon where emerging markets leverage cutting-edge technologies to bridge development gaps and offer investors a unique opportunity to support growth and potentially generate returns in those regions.

Through these insights, our goal is to provide investors with new perspectives and actionable insights on how to navigate this evolving asset class.

The bullet points in the following section provide a good summary of this.

🔬 Emerging Markets: Why Bother? (Baillie Gifford) November 2023

Emerging markets have underperformed developed markets since mid-2010, leading many investors to question the value of the asset class. Why might the next decade be better?

Many emerging market countries demonstrate good macroeconomic health, have strong companies at low valuations, and are experiencing rapid development.

We believe the prospects for improving returns here are better than they have been for some time.

🔬 Emerging markets prepare for growth in 2024 (KraneShares) November 2023

Emerging Markets As 2024 approaches, conditions for a recovery in growth in emerging markets continue to emerge. In China, an economic recovery is underway, but the market awaits additional consumer policy support.

The US Federal Reserve’s decision to keep its interest rate target unchanged in November bodes well for emerging markets. A reversal in the strength of the US dollar could lead to positive results.

meantime, Reducing the oversupply of low-cost semiconductors could benefit key technology export markets such as Taiwan and South Korea.

India’s valuationEM ex-China has led performance in recent years, We may have gone too far and we may see a correction as we head into 2024.

that much KraneShares Dynamic Emerging Markets ETF (Ticker: KEM) The fund has outperformed the MSCI Emerging Markets Index since launch, largely due to the cash buffer the fund has maintained over the period.

This chart and analysis of corporate stress risks in various countries is very interesting.