EM Fund Stock Recommendations and Country Commentary (November 9, 2023)

Let’s take a look at some quick facts in this shorter-than-usual post.

-

There is a good update on Vietnam from the Vietnam Fund.

-

Another Renewable Stock It was recently IPOed and may have caught the attention of ESG funds as the country’s market has risen multiple times while declining.

-

Petrobras The cost of improved corporate governance and other upsides for Brazilian oil stocks is only $7 to $15 per barrel.

-

Not many funds have updated their fact sheets to cover the month of October.

In a recent podcast interview, it was noted that Brazil currently ranks 8th or 9th globally in oil production, but will be one of the top five oil exporters by 2030.

Additionally, Petrobras’ reforms and asset rationalization will result in Brazil’s oil sector becoming more diversified, the former concentrated in large oil fields, while smaller, more nimble new companies pump oil at low costs and exorbitantly high margins from smaller or more numerous sources. I was able to pull it up. Depleted field.

I’m still in Kyoto as of Monday (for some reason the internet was super slow where I’m staying last night). Then it was back to Tokyo for a full day before leaving Wednesday (for another long stay in Taiwan…).

disclaimer. The information and views contained on this website and in our newsletter are provided for information purposes only and do not constitute investment advice and/or recommendations. Your use of any Content is entirely at your own risk, and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the Content. For investment advice, seek out a fully licensed professional. I may have a position in that investment. This is not a recommendation to buy or sell any of the investments mentioned.

For additional disclaimers and an explanation of the reason for this post, please see: Disclaimer: EM fund stock recommendations and country commentary posts.

memo: Where possible, company links will direct you to the appropriate investor relations or company page. Region and country links are on the next page. ADR or ETF Pages with additional country-specific resources, such as links to local stock markets and media websites. Please report invalid links in the comments section.

🗄️ Funding Documents/Updates; ⚠️ Public or limited access available depending on your location, investor status, etc. 🎥 Video; 🎙️Podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 🗃️ Archived articles; 📯 Press Release; 🔬 Research analysis (including articles/blog posts by fund managers, etc.)

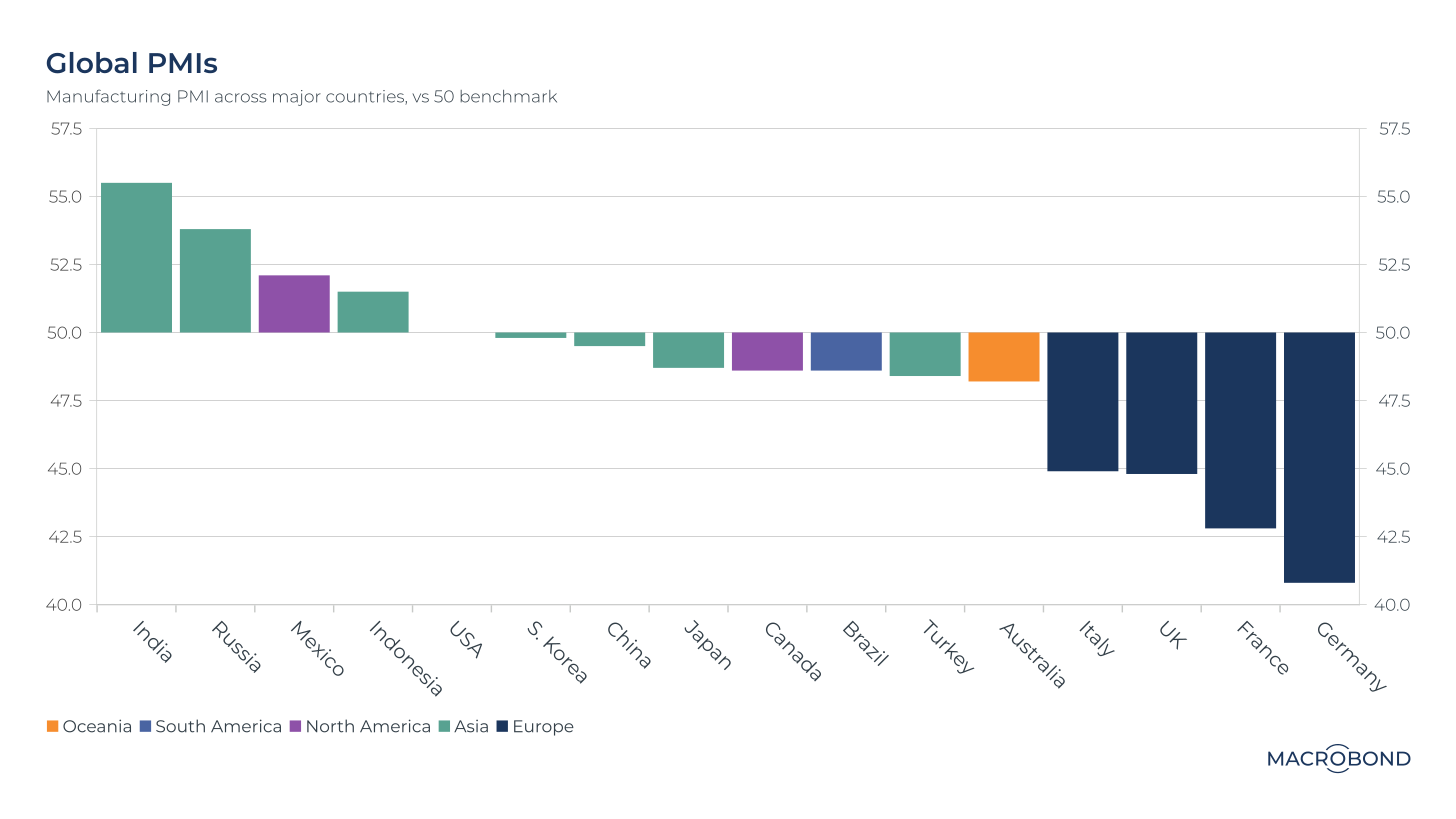

India, Russia, Mexico and Indonesia have positive PMIs.

🔬 Gloom in France and Germany, optimism in Asia on PMI (Macrobond)

In this podcast episode from abrdn, Pruksa Iamthongthong ( Asia Dragon Trust PLC) discussed AI and chips, as well as technology niches that could benefit from trends in these areas:

🎙️ From Smoke Stack to Chip Stack – How EM is driving next-generation infrastructure (abrdn’s Emerging Markets Stocks Podcast) 19:47 mins (November 2023)

In the latest episode of the Emerging Markets Equities podcast, Nick sits down with Pruksa Iamthongthong to assess the AI revolution within emerging markets.

You can view your report card on the abrdn website.

🗄️⚠️ AFC Asia Frontier Fund

The most recent monthly commentary (economics and portfolios) is from the end of 2019. September. Also check: AFC Quarterly Update Webinar Presentation Slides – Wednesday 25thDay October 2023

🗄️⚠️ Asia Dragon Trust PLC (theory: DGN)

The most recent monthly commentary (economics and portfolios) is from the end of 2019. September.