EM Fund Stock Recommendations and Country Commentary (October 24, 2023)

We outline the various emerging market fund stock picks, research, and observations we’ll be highlighting this week:

-

Two recent interesting Chinese podcasts with good insights.

-

all middle east education stocks with hospital stocks – Both have wide footprints.

-

much less known Latin American Ecommerce Stocks We have a differentiated business model.

-

Good article or essay on not investing in potentially popular Indian multibagger companies. corporate governance issues.

-

Here are links to more emerging markets funds to let you know when they’ve been updated with the latest fact sheets and/or commentary.

A recent podcast mentioned how to: Many markets in China are fragmented and “ready for consolidation.” But for some reason, Integration and the economies of scale it brings have become a mirage. For many sectors where larger or leading players are struggling to gain traction (e.g. as mentioned) yesterday: Deep Dive: Challenges Faced by China’s Hypermarkets).

In recent events Boqii Holding Ltd (NYSEAMERICAN: B.Q.) who was going to do it Consolidating a Fragmented Pet Sector, but has now been delisted from the NYSE. Not sure if there are any issues with execution or not. Or simply because Chinese consumers prefer to shop at local pet stores where owners know them and their pets’ names.

I think it’s closer to the latter, and I suspect that the people who work at locally owned pet stores (perhaps the owners themselves) know more about individual customers and their needs than anyone else. Large corporations are trying to do the same using “big data,” AI, apps, websites, social media, and analytics..

A few years ago a large supermarket chain in Southeast Asia recruited a number of butchers from the UK and Europe. Certainly many (especially older) expat customers from Europe are still accustomed to going to their neighborhood butcher to buy meat and seek advice from a butcher they know by name along with their buying habits.

Asian butchers are decent and cheap to hire, but they tend not to be experts on imported red meats, lunch meats, or the sausages preferred by Western expats. These expat customers naturally gravitated toward purchasing (or being up-sold to better cuts, receiving preparation advice, etc…) from the Western expat master butchers working in the stores.

This supermarket chain soon began to dominate all competition in meat sales. Remember that all good red meat such as steak, lamb, mutton etc is imported and sold at premium prices with high margins in SE Asia.

However, there has been a change in ownership or management. The new bean shop decided it no longer needed the “expensive” expatriate butchers and got rid of almost all of them. They seemed to do this under the assumption that they would still be able to retain most of the sales they generated.

The result would have been entirely predictable: meat sales would have plummeted and meat waste would have increased. And some of the laid-off expats have undoubtedly been employed by smaller competing chains or have set up their own small butcher shops to serve expat customers, creating new competition in the premium meat sector.

I’ve also been listening to more political podcasts recently where someone mentioned how local butchers in the US have just opened (meaning the big supermarkets haven’t killed the concept). He said he was willing to do it. I would pay a few extra dollars to support them rather than the big supermarket chains. (He might support political causes he disagrees with, but that’s a whole other issue…).

My point is that fragmented markets are “suitable for consolidation” with the use of expensive technologies. ‘Big data’, AI, apps, websites, social media and analytics to understand what faceless customers want. will do It doesn’t automatically make a company successful. The level of competition and ruthlessness in China also makes it a difficult market to succeed in. This is especially true if you operate in a sector that is not currently a priority for you.

Another recent podcast showed that the Chinese data isn’t all that bad. But there Expectation gaps and confidence issues Years of tech crackdowns, lockdowns and real estate sector problems have brought the middle class on board. Crackdown on corruption and purge of Xi Jinping It also hit the administrative sector, causing inertia. Many people sit with their hands folded, waiting for instructions from the top. (Or you don’t want to raise your head and risk getting your head cut off). It remains to be seen whether China will be able to overcome these problems and repeat what began in 1998 with the liquidation of the state-owned sector (securing massive resources…).

However, it was also pointed out that China’s bigger problem is its own problem. destruction of the social contract Over the past year+. i will add it this is This is what has happened in almost every country that has implemented a strict coronavirus lockdown..

This is the current perception in China. What used to only happen to dissidents can now happen to anyone and the party can go crazy. In other words, the social contract is broken, and like a bad marriage, it won’t be easily repaired. If I could fix it…

Lastly, I’ve added more emerging and frontier markets funds to the template in this post to indicate when the last one was. fact sheet and no more detailed commentary Published. many people at the end Various emerging or frontier markets subheading.

This post also includes links to other interesting, in-depth research material or articles by fund managers and more. Again, you should be wary of any public pop-ups asking what type of investor you are and your location.

disclaimer. The information and views contained on this website and in our newsletter are provided for information purposes only and do not constitute investment advice and/or recommendations. Your use of any Content is entirely at your own risk, and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the Content. For investment advice, seek out a fully licensed professional. I may have a position in that investment. This is not a recommendation to buy or sell any of the investments mentioned.

For additional disclaimers and an explanation of the reason for this post, please see: Disclaimer: EM fund stock recommendations and country commentary posts.

memo: Where possible, company links will direct you to the appropriate investor relations or company page. Region and country links are on the next page. ADR or ETF Pages with additional country-specific resources, such as links to local stock markets and media websites. Please report invalid links in the comments section.

🗄️ Funding Documents/Updates; ⚠️ Public or limited access available depending on your location, investor status, etc. 🎥 Video; 🎙️Podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 🗃️ Archived articles; 📯 Press Release; 🔬 Research analysis (including articles/blog posts by fund managers, etc.)

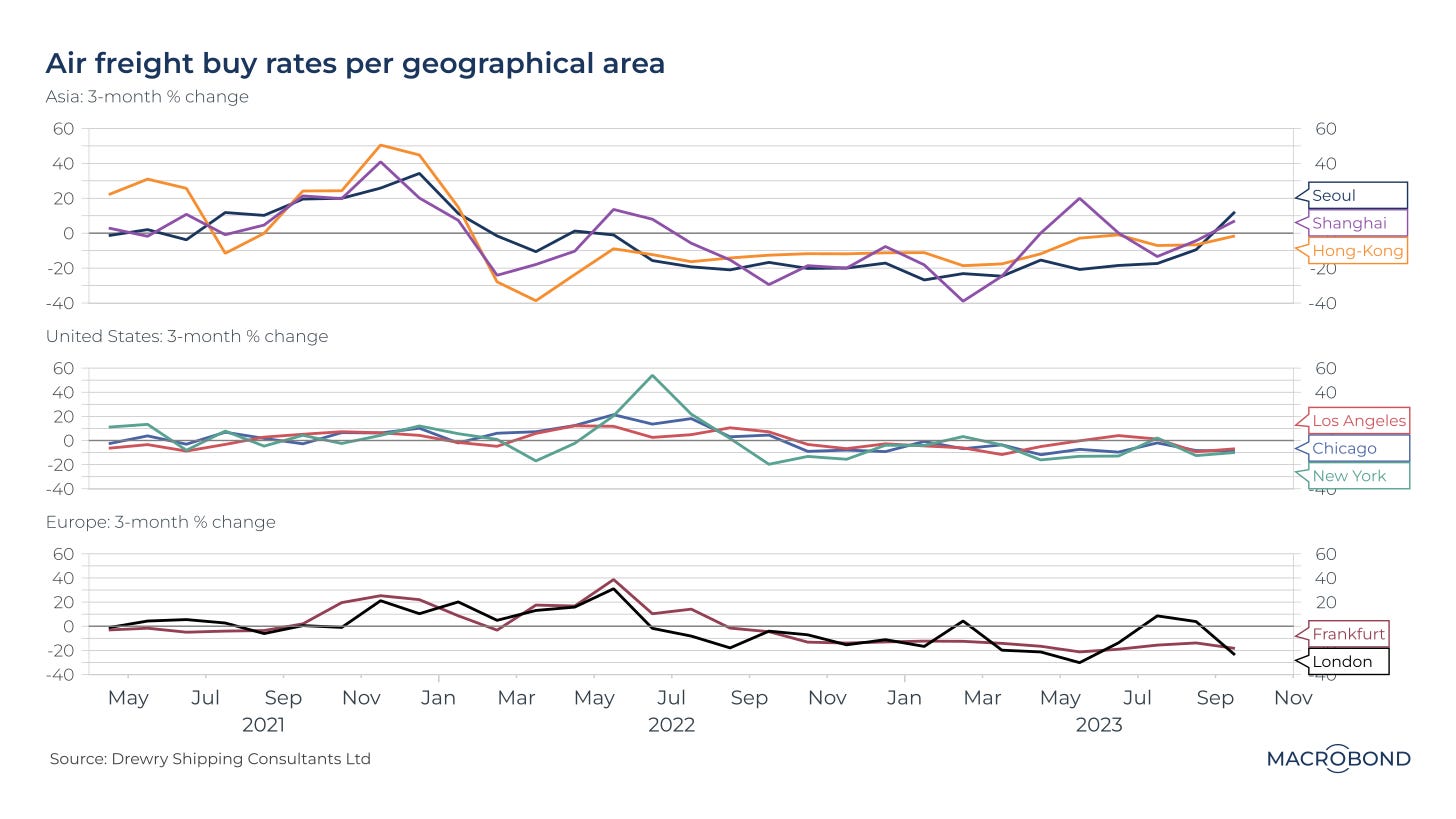

Freight and ocean freight rates are good economic indicators.

🔬 Air fares are attempting to take off in Asia (Macrobond)

However, it is interesting that Seoul and Shanghai have recently been rebounding. This may be consistent with the OECD leading indicators released last week. relative optimism about China.

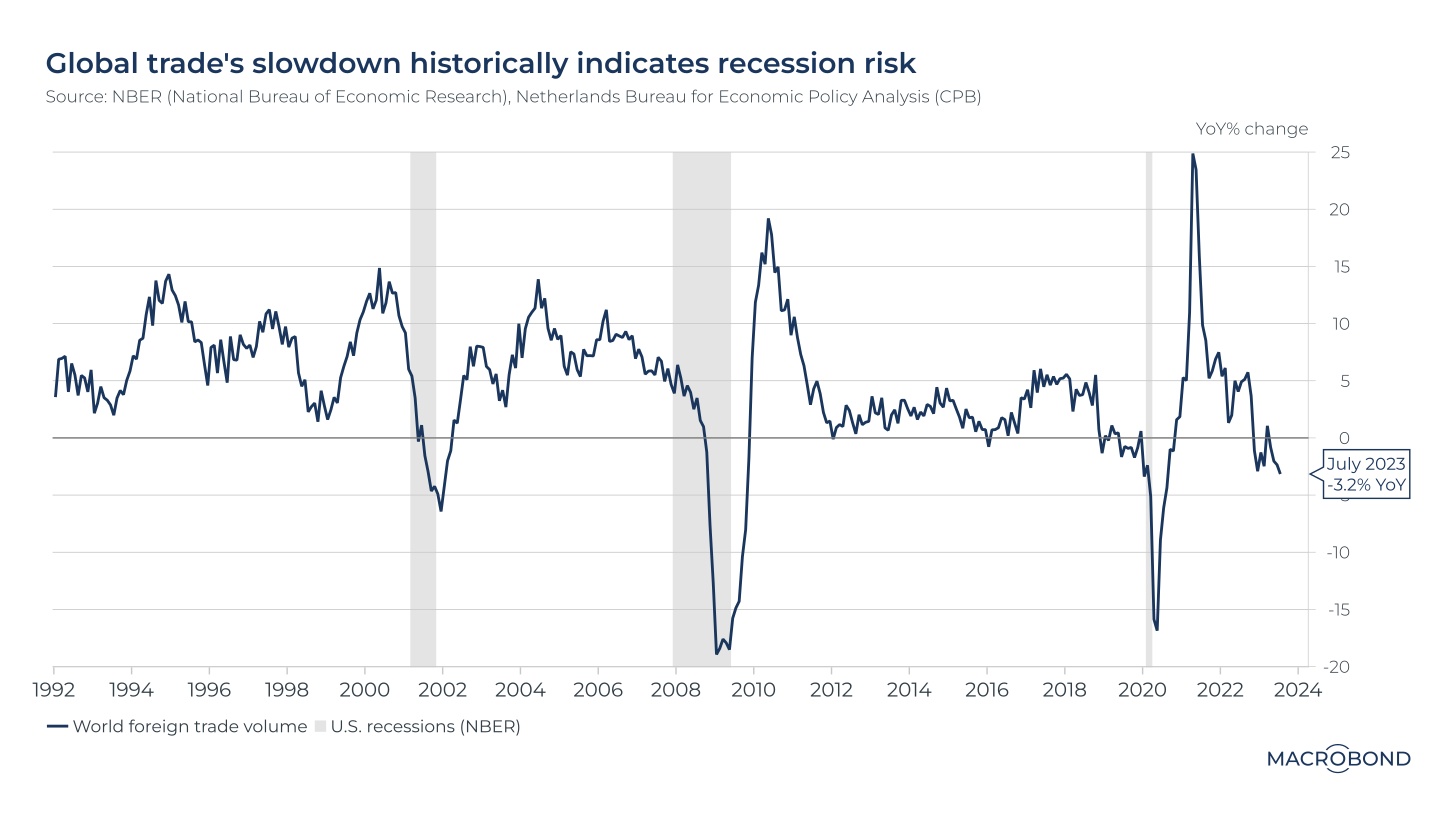

🔬 The World Trade Monitor’s recession signals haven’t started (yet). (Macrobond)

that much Netherlands Bureau for Economic Policy Analysis (known by its Dutch abbreviation) CPB) is scheduled to publish a revised edition. world trade monitor In ~ October 25th.

This piece includes some nice country charts or graphics.

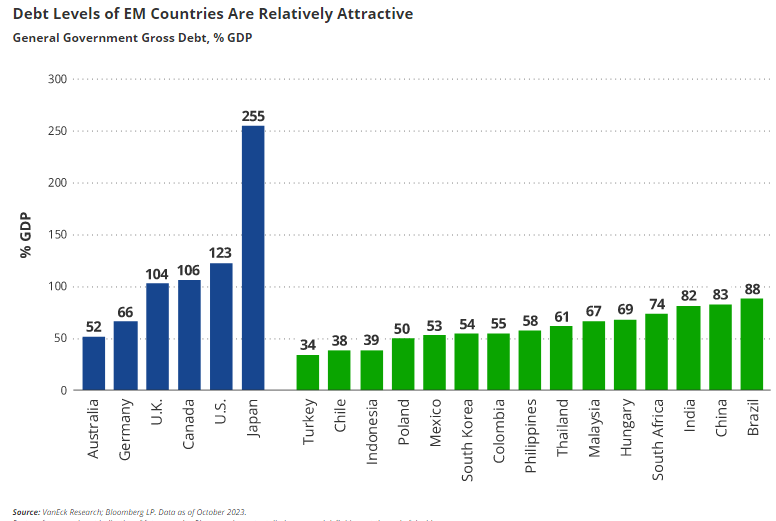

🔬Three reasons to allocate to EM bonds now (van Eck)

Pay attention to our recent hour-long Emerging Markets Bond webinar. Available upon request Once you register: