Emerging Market Links + The Week Ahead (April 14, 2025)

The Asset has noted that investors are urged to diversify urgently in wake of Trump’s ‘Liberation Day’ 🗃️ with countries facing smaller tariff increases (e.g. Australia, UK, Brazil, Singapore, etc.) and companies in sectors like financials, healthcare, and consumer services being mentioned as places to look for opportunities…

The New York Times though has noted that Trump’s tariffs will pummel Asia, but one country sees opportunity 🗃️ with that one country being the Philippines. When I lived in the Philippines almost two decades ago, a good portion of the country’s manufacturing base was being or had already been hollowed out by China (and then Vietnam) while Intel had closed its foundery there to consolidate in Malaysia.

The problems with the Philippines has always been (often militant) labor unions, lower productivity (compared to China or Vietnam), the lure of working abroad (making it difficult to retain employees), and a complex labor code worthy of a Western or Scandinavian (“democratic socialist”) country. And I doubt much has changed.

Nevertheless, the NY Times quoted someone as saying that “it costs about $820 a month to employ someone in China; in the Philippines that same worker costs $274…” In other words, emerging and frontier markets such as the Philippines (and even long forgotten about countries in Africa and Central America) may suddenly become competitive with East Asian countries thanks to tariffs…

$ = behind a paywall

-

🇮🇳 moneycontrol India Stock of the Day (Q1 2025) Partially $

-

Tariffs + KEC International, Bajaj Auto Ltd, eMudhra Ltd, Prudent Corporate Advisory Services Ltd, Repco Home Finance, Cera Sanitaryware, Tbo Tek Ltd, Dodla Dairy Ltd, Sun Pharmaceutical Industries Ltd, CSB Bank, Indian Energy Exchange, Goldiam International Ltd, Maruti Suzuki, Indian Railway Catering & Tourism Corporation Limited (IRCTC), Crompton Greaves Consumer Electricals, Computer Age Management Services Ltd, HEG Ltd, Bharat Dynamics Ltd, Landmark Cars Ltd, TVS Motor Company Ltd, Nestlé India Ltd, Sky Gold Ltd, V-Guard Industries Ltd, Medi Assist Healthcare Services Limited, Bharat Electronics, Ami Organics, Blue Star Ltd, CE Info Systems Ltd (MapMyIndia), Aptus Value Housing Finance India, ITC Hotels Ltd, Welspun Living Ltd, Kajaria Ceramics, AU Small Finance Bank Ltd, S.P. Apparels Ltd, HDFC Asset Management Company Ltd, Indian Hotels Company, Cyient DLM Ltd, PCBL, Doms Industries Ltd, CEAT Ltd, Cummins India, Cholamandalam Investment and Finance Co Ltd, Amber Enterprises, Tata Consultancy Services, Titan Company, R R Kabel Ltd, Zomato Limited, State Bank of India, Bikaji Foods International Ltd, ITC Ltd, Muthoot Finance Ltd & NCC Limited

-

-

🌐 EM Fund Stock Picks & Country Commentaries (April 13, 2025) Partially $

-

Everyone has a tariff opinion, what’s wrong w/ Chinese corporate profits, passive investing risks, MENA’s new face, SE Asia opportunities, commodities advance, March/Q1 fund updates, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🌏🌎 The Tariff Paradoxes of Latin America and Asia (Asianometry)

I have been thinking about tariffs recently. No reason why, just interested. And while reading, I came across a series of interesting papers by economists Michael Clemens and Jeffrey Williamson. They explore what looks like an economic paradox. Up until World War I, the countries of Latin America were the most protectionist in the world, with some of its highest tariff rates. East Asia on the other hand – for reasons we will discuss later – had tariffs just a fraction as high. Yet during these decades, the Latin American countries grew faster than the Asian ones. Before World War I, one might argue that if you wanted faster economic growth, you needed high tariffs. Then things changed. In this video, high tariffs in Latin America. Low tariffs in Asia. One works the other doesn’t, right? Time, context, and composition matter.

🇨🇳 In Depth: How China’s Quant Funds Became AI Incubators (Caixin) $

DeepSeek sent shockwaves through the global tech industry in January after launching its low-cost, open-source artificial intelligence (AI) large language model (LLM) to compete with market leader OpenAI. Yet for many, just as surprising was the fact that China’s emerging leadership and innovation in the field was financed by a relatively unknown quantitative fund.

The company behind DeepSeek, Hangzhou-based High-Flyer Asset Management (Zhejiang) Co. Ltd., was set up by stock trader and AI enthusiast Liang Wenfeng, and its AI-powered chatbot was born out of the firm’s development and use of AI algorithms for its financial market activities.

🇨🇳 Cargo Ships Are Racing Across Pacific as U.S.-China Tariff Deadline Looms (Caixin) $

In a desperate sprint to beat looming U.S. tariffs, cargo ships and airlines are racing across the Pacific at record speeds. Containers are stacked to the brim, ports are scrambling to meet demand and freight rates are soaring amid a surge in shipping activity.

The American-flagged container ship President Bush, packed with more than 7,000 containers, left Shanghai Port Monday at a brisk speed of 15 knots. During its earlier voyage from Oakland, California, to China, the ship clocked 20 knots — nearly double the usual economic cruising speed — crossing the Pacific in only 17 days.

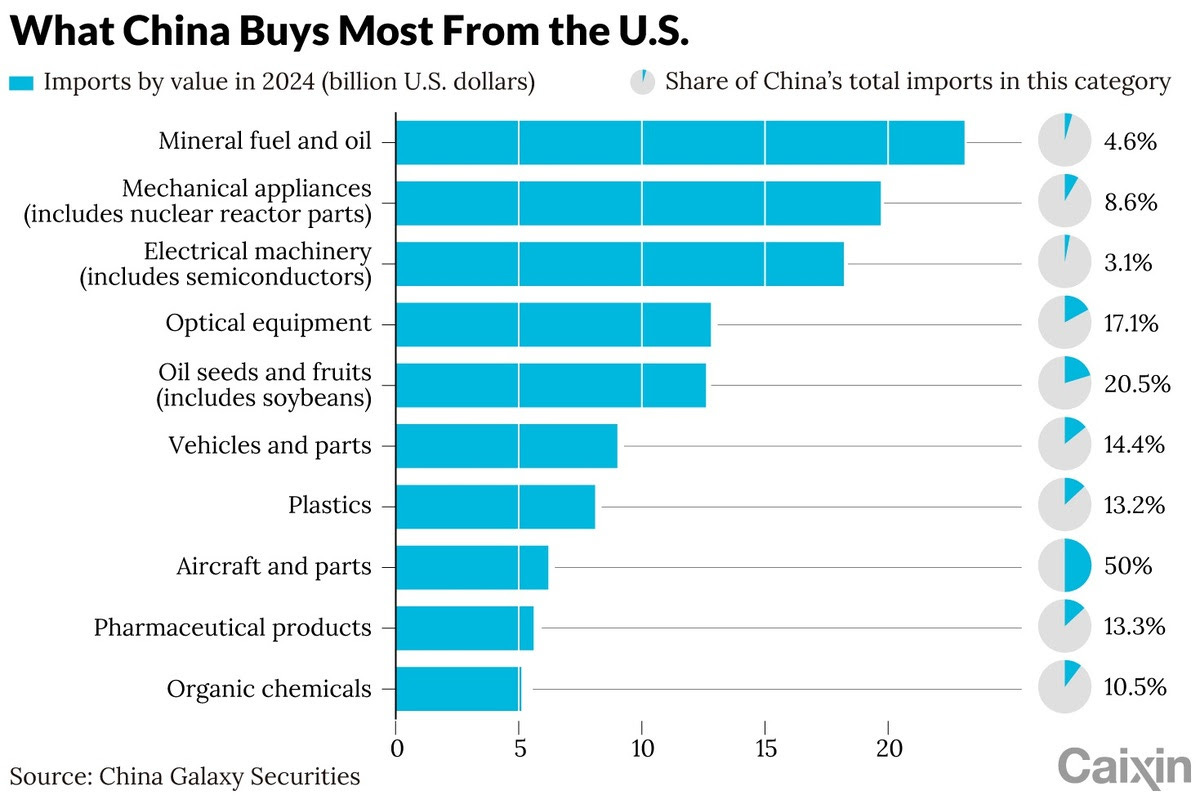

🇨🇳 Chinese firms set to seek alternative sources for key U.S. imports (Caixin) $

As Washington and Beijing continue to go toe-to-toe with tariffs, Chinese companies are expected to seek alternative sources for affected goods, such as soybeans, while accelerating efforts toward technological self-sufficiency, analysts said.

The State Council, China’s cabinet, on Wednesday announced an additional 50% retaliatory tariff on all U.S. imports, bringing the total levy to 84%. U.S. President Donald Trump then raised the overall tariff on Chinese goods to 125%, while announcing a 90-day pause for countries hit by his “reciprocal tariffs.”

🇨🇳 Postcard from Shenzhen (The Great Wall Street – Investing in China)

Brief impressions from my visit last week

The city sparkles with energy. It’s fast, intense, and you feel it the moment you arrive. My local friends, who took me out to restaurants and helped me hunt for apartments, kept repeating Shenzhen speed like a running joke—but it wasn’t a joke. You see it everywhere. The pace of the people, the pace of the city, the pace of everything. It’s China’s Silicon Valley. Delivery robots in hotels, autonomous cars on the streets, drones above you, new tech popping up on every corner. It’s energizing. It’s innovation at full throttle.

🇨🇳 Blood on the streets: My opinions on the current trade war and an extended commentary on the Chinese stock market along with the stocks that I own

Secondly and perhaps more poetically, I am tending to draw more and more parallels between American actions under Trump and the final days of China Evergrande Group, which I’ve written in detail about in my real estate article (check it out if you’re interested)…

Now finally coming to the individual equities that I really appreciate particularly in this current environment. If U.S.-China bilateral trade goes to zero which well— it will— then the only logical long term thesis is that Chinese domestic consumption and advanced manufacturing is bound to do well and prosper.

🇨🇳 PC 1Q25: 5% YoY Growth but Shipments Inflated Ahead of US Tariffs. Dream of a Refresh Cycle Continue (Smartkarma) $

PC units grew by 1% in 2024, accelerating to 5% YoY in 1Q25. Best performers: Apple, Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF). Higher shipments to the US ahead of potential import tariffs but flat end-demand.

~70% of Computers are Made in China, US consumes 25% of total PC. The supply chain is accelerating relocating US-purchased PC out of China, this should be done by end-2025.

There is a risk of over-built and over-stocking in my view if PC Brands are too optimistic on Windows 10 end-of-support and AI PC upgrades.

🇨🇳 (BYD Company (1211 HK, BUY, TP HK$400) TP Change): Better than Expected ASP Is the Positive Surprise (Smartkarma) $

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) reported C1Q25 net profit up 86%-119% YoY, with the midpoint exceeds our estimate/consensus by 12%/20%.

We believe this driven by better ASP mix of its products, among other factors;

We believe a possible China-EU deal on EV market access can be positive for BYD. We raise the TP to HK$400 and place BYD back to TOB BUY.

🇨🇳 Chenqi keeps racking up losses in congested China ride-hailing race (Bamboo Works)

The shared economy platform bled more red ink last year, as its hyped robotaxi business fails to show any signs of breakthroughs

Chenqi Technology (HKG: 9680) lost 564 million yuan in 2024, extending its long stream of red ink over the last four years

The company has hyped the potential of its robotaxi service, but revenue from that part of its business has so far been miniscule

🇨🇳 Niu Technologies gets charge from China’s consumer trade-in program (Bamboo Works)

The electric scooter maker’s China unit sales rose 66% in the first quarter, while its global sales grew by just 6% on tariff headwinds

Niu Technologies (NASDAQ: NIU) said its China e-scooter unit sales rose 66% in the first quarter, boosted by a government program to stimulate consumer spending

The company’s international unit sales growth slowed to just 6% in the first quarter, as it faced tariff headwinds in the U.S. market

🇨🇳 Microvast zooms with turbocharged margin gains (Bamboo Works)

The EV battery maker reported a huge increase in its gross profit margin last year, a significant achievement that can help it stand out in a crowded field

Microvast Holdings (NASDAQ: MVST)’s gross profit margin jumped to 31.5% in 2024 from 18.7% the prior year, already exceeding the company’s target for this year

The U.S.-based EV battery maker is reducing its reliance on China by boosting its sales to other markets, which is also helping to beef up its margins

🇨🇳 Apollo Future: A smart car dreamer in jeweler’s clothing? (Bamboo Works)

With only two vehicles delivered in 2024, the company’s vision of transforming from a watch and jewelry seller to maker of high-tech electric cars looks dubious

Apollo Future Mobility Group Ltd (HKG: 0860 / FRA: U1R1 / OTCMKTS: ALFMF)’s net loss widened by nearly 80% to HK$1.54 billion in 2024

Jewelry and watch sales accounted for over 85% of its revenue for the year, while it sold only two high-tech electric vehicles that it’s hyping as its future

🇨🇳 Uxin gets new cash injection as its used car superstores gain speed (Bamboo Works)

The company said it closed a deal first announced last September to sell new stock to shared ride operator Dida (HKG: 2559) for $7.5 million

Uxin Ltd (NASDAQ: UXIN) has received $7.5 million in funding from Dida, following a similar $27 million cash infusion from longtime investor NIO Inc (NYSE: NIO) last month

The company reported strong growth for its two used car superstores in the third quarter, and announced plans to add new stores in the cities of Wuhan and Zhengzhou

🇨🇳 STAR Chip Index Rebalance Preview: Potential Changes in June (Smartkarma) $

There could be 1 constituent change for the STAR Chip Index at the June rebalance. There will also be a few capping changes.

Estimated one-way turnover is 2.1% resulting in a round-trip trade of CNY 1.04bn (US$141m). Passives need to trade between 0.65-1.65x ADV in the potential changes.

Jinhong Gas (SHA: 688106) is also a potential delete from the STAR100 Index and that will lead to increased passive selling in the stock.

Joinn Labs undermined by AI as FDA phases out animal drug testing (Bamboo Works)

The outsourced clinical research services provider’s shares tumbled after the U.S. drug regulator announced a new approach to drug testing

Joinn Laboratories China (SHA: 603127 / HKG: 6127)’ shares fell on heavy trading as investors worried about a shift in U.S. policy to gradually phase out animal testing for new drug development

Immediate impact on the company should be relatively limited, since it only derives about 20% of its revenue from the U.S., with most of the rest coming from China

🇨🇳 Investors cheer Akeso’s revenue milestone, even as it returns to the red (Bamboo Works)

The drugmaker’s shares rallied after the release of its strong annual report, up by a cumulative 18% over the next three trading days

Akeso (HKG: 9926 / FRA: 4RY / OTCMKTS: AKESF)’s drug sales rose 25% last year to just above 2 billion yuan, setting a new high for the company

A potential launch for the company’s ivonescimab in the U.S. next year could bring it big new returns in licensing milestone and sales-related payments

🇨🇳 Could consumer stimulus send Li Ning stock vaulting higher? (Bamboo Works)

The sportswear maker’s gross margin rose by 1 percentage point last year as it boosted its dividend payout ratio to 50%

Li Ning (HKG: 2331 / FRA: LNLB / LNL / OTCMKTS: LNNGY / LNNGF)’s net profit declined last year, mainly due to impairment provisions related to falling values for some of its properties

Despite a strong showing for its running shoe business last year, the sportswear maker is valued lower than rival ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF)

🇨🇳 Fengxiang (9977 HK): PAG’s Preconditional Privatisation Offer at HK$2.00 (Smartkarma) $

(Chicken meat products) Shandong Fengxiang (HKG: 9977) has disclosed a preconditional privatisation offer from PAG, the controlling shareholder, at HK$2.00 per H share, a 33.3% premium to the undisturbed price.

The precondition relates to regulatory approvals. The key conditions for the privatisation will be approval by at least 75% independent H Shareholders (<10% of all independent H Shareholders rejection).

The shareholders with blocking stakes which have not provided irrevocables will likely be supportive as the offer is reasonable and there is a potential scrip alternative.

🇨🇳 QuantaSing finds new tune in experiential pop toys (Bamboo Works)

The adult education company is adding products for seniors to adapt to changing times, and is now also testing out the youth market with a new toy investment

QuantaSing Group Ltd (NASDAQ: QSG) bought a controlling stake in fantasy toy maker Letsvan, moving it into the fast-growing sector for experiential toys for all ages

The adult education company’s rising profits and healthy cash flow should help to support the investment

🇨🇳 Nongfu Spring: A Buy On Strong Growth And High Margins (Seeking Alpha) $ 🗃️

-

🇨🇳 Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF) 🇨🇳 – China’s largest packaging water supplier + tea beverages, functional beverages & juice beverages. 🇼 🏷️

Red Bull slayer Eastroc chases Hong Kong IPO to boost global charge (Bamboo Works)

After finding a strong audience for its stock among domestic investors, the functional beverage maker aims to offer its stock to global buyers as well

Eastroc Beverage Group Co Ltd (SHA: 605499) has filed for a Hong Kong IPO to complement its existing Shanghai listing, reporting its profit surged 63% last year to 3.33 billion yuan

The company has been China’s top functional beverage brand by sales for four consecutive years

🇨🇳 Chagee Holdings IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Chagee Holdings is target price of $46.7 per share, representing 67% higher than the high end of the IPO price range ($28 per share).

Our base case valuation is based on a P/E of 21.4x on our estimated net profit of 2.9 billion RMB in 2025.

We used a very conservative valuation multiple, mainly due to the extremely high macro risks related to the ongoing tariff dispute between China and the United States.

🇭🇰 Hong Kong Stock Market Rides Tech Fever to Bumper First Quarter (Caixin) $

Hong Kong’s equity capital market raised $16.7 billion in the first quarter, up more than 13 times year-on-year, fueled by a surge of investor interest in Chinese tech companies, according to data from London Stock Exchange Group (LSEG).

The vast majority of fundraising was via follow-on offerings — post-IPO share sales — which totaled around $14 billion. This was led by two mainland-based giants: automaker BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) and consumer electronics firm Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF), raising a combined amount of about $11 billion.

🇭🇰 Hong Kong IPO fundraising up threefold in Q1 2025 (The Asset) 🗃️

🇭🇰 Budweiser Brewing: Management Changes And Price Hikes Are In The Limelight (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇭🇰 CK Hutchison: Consider Asset Monetization And Business Mix (Seeking Alpha) $ 🗃️

🇭🇰 Goldlion Holdings (533 HK): An Attractive Spread Ahead of the Vote on 9 May (Smartkarma) $

(Manufactures and distributes apparel) Goldlion Holdings Ltd (HKG: 0533 / FRA: GLH / OTCMKTS: GLLHF)’s IFA considers Mr Tsang’s HK$1.5232 per share offer fair and reasonable. The vote is on 9 May.

The key condition is the scheme approved by at least 75% disinterested shareholders (<10% disinterested shareholders rejection). FMR holds a blocking stake but should be supportive.

The offer is reasonable compared to peer multiples and historical trading ranges. At the last close and for the 10 July payment, the gross/annualised spread is 4.3%/19.0%.

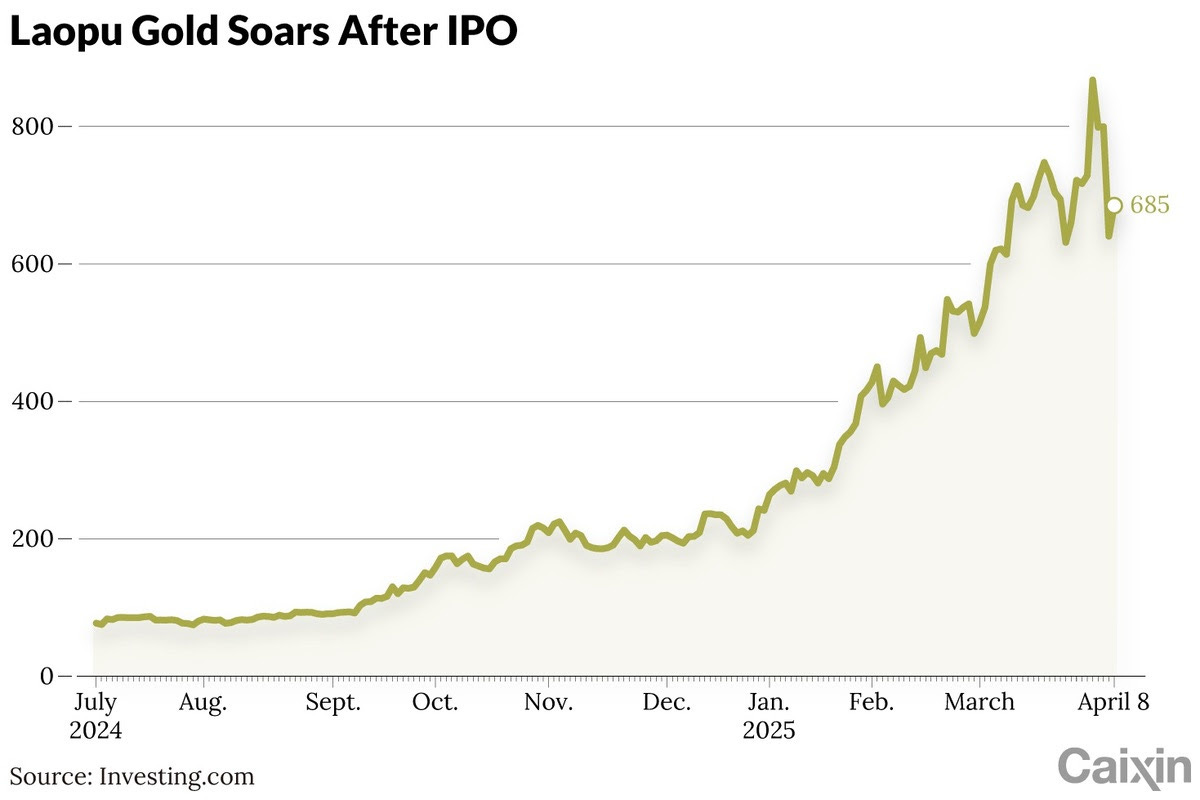

🇭🇰 In Depth: For Laopu Gold, the Jewelry Isn’t the Only Thing That’s Expensive (Caixin) $

Hong Kong-listed Laopu Gold Co Ltd (HKG: 6181)’s skyrocketing stock price pushed up one measure of the upstart jewelry retailer’s value to a level that one private equity investment manager called “madness.”

Laopu’s trailing price-to-earnings (P/E) ratio reached more than 130 times in late March, according to Yahoo Finance’s estimates. By comparison, LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF), which owns the jewelry brands Cartier and Tiffany & Co., has a P/E ratio in the low 20s.

🇭🇰 Hong Kong casino-related stocks lead sell-off in Asian markets on Monday

Hong Kong-listed Melco International (HKG: 0200 / FRA: MX7A / OTCMKTS: MDEVF), parent of Melco Resorts & Entertainment Ltd (NASDAQ: MLCO), fell 16.1 percent on the day; Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) was down 14.3 percent; and Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) declined 13.0 percent.

Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) fell 12.4 percent on Monday, and MGM China Holdings Ltd was down 11.9 percent at the close of trading.

NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) – the firm behind Cambodia’s largest casino, NagaWorld in the capital Phnom Penh – ended 19.9 percent lower in Monday’s trading in Hong Kong.

Philippines-listed Bloomberry Resorts Corp (PSE: BLOOM / OTCMKTS: BLBRF) – which runs Solaire Resort & Casino in the country’s capital Manila, and also Solaire North in nearby Quezon City – saw its shares decline 8.7 percent on Monday.

In Singapore, the locally-listed shares of Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) – which runs Resorts World Sentosa – ended Monday down 7.5 percent. Sister firm Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) – listed on Bursa Malaysia – recorded a 7.4-percent decline on the day.

Casino operators listed in the South Korean bourse were a bit more insulated from Monday’s meltdown, with declines of between 1.3 percent and 3.9 percent.

🇲🇴 Operating expenses to hit Macau’s 1Q industry EBITDA, says Citi (GGRAsia)

Banking institution Citigroup expects first-quarter earnings before interest, taxation, depreciation and amortisation (EBITDA) for Macau’s gaming industry to decline by 6 percent year-on-year, on what it said was “incremental opex (operating expenses) from new supply” in the market.

Macau’s gross gaming revenue (GGR) growth was flattish in the first quarter of 2025, “in both year-on-year and quarter-on-quarter terms”.

🇲🇴 Macau 2025 fundamentals still helped by China GDP growth despite U.S.-China tariff row: CreditSights (GGRAsia)

Any impact on consumer demand for Macau tourism and gambling stemming from the United States-China trade tariff row, might come as a result of “a ripple effect on more cost-conscious travellers/casino-goers,” says CreditSights Inc. in a Thursday memo.

But the financial research firm added: “At this juncture, we think there is limited impact to the Macau gaming sector at the fundamental level as we still expect China’s 2025 GDP (gross domestic product) growth at 4.7 percent,” above market consensus of 4.5 percent.

“Fundamentally, the Macau gaming sector is largely domestic focused as the bulk of visitors into Macau come primarily from mainland China,” noted CreditSights analysts Nicholas Chen and David Bussey in their memo.

🇲🇴 Wynn Resorts’ largest single shareholder Fertitta ups stake amid new low for stock coinciding with global trade war fears (GGRAsia)

U.S. billionaire Tilman Fertitta – the largest individual shareholder of Wynn Resorts Ltd (NASDAQ: WYNN) – made April 4 and April 7 trades enlarging his stake in the casino group. Following those exercises, Mr Fertitta held 13 million shares in the firm, according to the respective disclosure records.

The United States-based Wynn Resorts is the parent of Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF), the latter operator of Wynn Macau, and Wynn Palace, in the Chinese gambling hub Macau.

🇹🇼 Trump. Tariffs. Taiwan. (The Great Wall Street – Investing in China)

Why now may be the worst time for Beijing to act on Taiwan

Lately I’ve been seeing a bunch of headlines — and getting asked by many people — about whether this is the perfect moment for China to take Taiwan. Global chaos, Western distractions, the usual reasons.

Personally, I don’t buy it. Based on my experience living in China, I come to a different conclusion. But this article isn’t a prediction or a geopolitical analysis — it’s just a different take.

🇹🇼 Himax Technologies: A Stock On Sale Despite Many Catalysts (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Earnings Preview, AI Strength Faces Tariff Headwinds (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor Earnings Preview: Despite Risks And Headwinds, Valuation Remains Attractive (Seeking Alpha) $ 🗃️

🇹🇼 United Microelectronics: The Mirage Of A High Dividend Yield (Seeking Alpha) $ 🗃️

🇰🇷 The unbearable lightness of Korean cute (Chris Arnade Walks the World)

🇰🇷 With Consistent Misses And Falling Margins, KT Corp. Is No Bargain (Seeking Alpha) $ 🗃️

🇰🇷 Kangwon Land revamp spurred by regional competition for Korean gamblers, Japan IR on horizon: management (GGRAsia)

The management at Kangwon Land (KRX: 035250), a resort with South Korea’s only casino allowing locals to bet (pictured), has given GGRAsia an update on its “K-HIT 1.0 Project”, an upgrade and revamp of the property.

The initiative started in April last year. The venue’s promoter, Kangwon Land Inc, says it was in response to the effort by neighbouring jurisdictions to attract South Korean players, a trend that had intensified since fewer Chinese players were going to those neighbouring countries.

Kangwon Land’s revamp was also spurred by the looming competition of an integrated resort (IR) with casino at Osaka, in neighbouring Japan, which is scheduled to open in 2030.

🇰🇷 Are you sipping soju, South Korea’s favourite spirit? (FT) $ 🗃️

HiteJinro Co Ltd (KRX: 000080 / 000087) / Hitejinro Holdings Co Ltd (KRX: 000140 / 000145)

🇰🇷 A Pair Trade Between Korean Air and Hanjin Kal (Douglas Research Insights) $

In this insight, we discuss a pair trade between Korean Air (KRX: 003490 / 003495) (go long) and (logistics solutions stock) Hanjin Kal (KRX: 180640) (go short).

In the past three months as well as 12 months, there has been a sharp increase in the gap of Korean Air Lines and Hanjin KAL Corp.

It is uncertain how much longer Hoban Group will maintain its stake in Hanjin Kal. Hoban could reduce its stake in Hanjin Kal but increase its stake in LS Corp.

🇰🇷 Hanwha Aerospace – Lowers Rights Offering Capital Raise Amount To 2.3 Trillion Won (Douglas Research Insights) $

On 8 April, Hanwha Aerospace (KRX: 012450) announced that it plans to lower its rights offering capital raise amount from 3.6 trillion won to 2.3 trillion won (US$1.6 billion).

The remaining 1.3 trillion won will be secured through a third-party allocation paid-in capital increase targeting three companies, including Hanwha Energy, Hanwha Impact Partners, and Hanwha Energy Singapore.

Hanwha Aerospace disclosed today that it expects sales of 30 trillion won (58% higher than consensus) and operating profit of 3 trillion won (20% higher than consensus) in 2025.

🇰🇷 Potential Sale of a Controlling Stake in SK Siltron to Hahn & Co (Douglas Research Insights) $

In this insight, we discuss about SK Inc (KRX: 034730 / 03473K) which is considering on selling the controlling stake of SK Siltron.

If SK is successful in selling 70.6% stake in SK Siltron for about 5 trillion won, it could result in more than 3 trillion won cash inflow for SK Inc.

Our base case valuation of SK Inc is NAV of 13.9 trillion won (NAV per share of 192,217 won), representing a 61% upside from current levels.

🇰🇷 A Pair Trade Between DL Holdings and DL E&C (Douglas Research Insights) $

In this insight, we discuss a pair trade between DL Holdings Co Ltd (KRX: 000210 / 000215) (go long) and DL E&C Co Ltd (KRX: 375500 / 37550K) (go short).

In the past three months, DL Holdings’ share price is down 9.9% versus DL E&C which is up 21%. We believe this gap has become too excessive.

The shares sold short volume/total traded volume ratio is more than double for DL E&C versus DL Holdings from 31 March to 9 April.

🇰🇷 Samsung SDI: Rights Offering Capital Raise Amount Lowered by 14% to 1.7 Trillion Won (Douglas Research Insights) $

Samsung SDI (KRX: 006400 / 006405 / FRA: XSDG) has lowered the rights offering capital raise amount by 14% to 1.7 trillion won, mainly due to the recent carnage in the global equity markets.

The expected rights offering price has been lowered to 146,200 won, which is 14.9% lower than current price.

We remain negative on Samsung SDI’s rights offering capital raise mainly due to shares dilution risk. We also remain concerned that the weak demand for EVs globally could last longer.

🇰🇷 Korea: Short Selling Data Analysis (Which Stocks Are the Gainers and the Losers?) (Douglas Research Insights) $

We provide the short selling data analysis of the Korean stock market including the top 20 stocks in KOSPI with the highest short interest ratios in KOSPI and KOSDAQ, respectively.

There have been noticeable shorting on the Ecopro Group companies and other key names in the rechargeable battery sector including Posco Future M Co Ltd (KRX: 003670), L&F Co Ltd (KRX: 066970), and SK IE Technology Co Ltd (KRX: 361610).

Shorting has generally worked for KOSDAQ names with higher short interest ratios but not for KOSPI names in the past two weeks.

🇰🇭 🇭🇰 NagaCorp flags 18pct year-on-year increase in GGR for 1Q2025 (GGRAsia)

Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) reported a 17.7-percent rise in gross gaming revenue (GGR) for the first three months of 2025, reaching nearly US$171.2 million, according to a non-statutory filing made to the Hong Kong Stock Exchange on Monday.

NagaCorp holds a monopoly licence for casino operations in Cambodia’s capital, Phnom Penh, where it runs the NagaWorld complex (pictured in a file photo).

The aggregate mass-market table buy-in and slots bills-in amounted to just under US$997.3 million in the three months to March 31, a 4.8-percent increase compared to the same period in 2024. GGR for this segment rose by 17.9 percent year-on-year, to US$109.0 million in the reporting period.

The company’s overall VIP segment also saw year-on-year improvements during the first quarter.

NagaCorp was among the Asian casino-related firms that saw sharp declines in share prices on Monday – its valuation ended 19.9-percent lower in Monday’s trading in Hong Kong.

🇵🇭 Genting Malaysia to ask shareholders to ok renewal of share-repurchase scheme (GGRAsia)

The board of global casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) will seek shareholder approval at the next annual general meeting, to renew a share-repurchase scheme. The information was in a Monday filing to Bursa Malaysia, though it didn’t mention a date for the meeting.

If renewed, the cap on repurchases – when taking into account existing treasury shares – would not exceed at any time, 10 percent of the company’s total issued shares.

🇵🇭 Trump’s Tariffs Will Pummel Asia. But One Country Sees Opportunity. (NY Times) 🗃️

🇵🇭 Casinos in Manila see 2024 GGR down 5.3pct y-o-y: Pagcor (GGRAsia)

The Philippine casino sector – including non-casino operations – produced gross gaming revenue (GGR) of PHP372.33 billion (US$6.51 billion) in full-year 2024, up 30.5 percent on the PHP285.27 billion generated in the previous year. That is according to data published this week by the country’s casino regulator, the Philippine Amusement and Gaming Corp (Pagcor).

The full-year 2024 official tally is lower than the PHP410.48-billion preliminary figure cited in late February by Alejandro Tengco, chairman and chief executive of Pagcor.

In 2024, licensed casinos in the nation generated GGR of PHP201.84 billion, down 2.7 percent from the prior year.

🇸🇬 OCBC to deploy £10 billion investment from Asia into UK (The Asset) 🗃️

Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY)

🇸🇬 Why did Grab acquire a taxi license in Singapore? (Momentum Works)

Grab Holdings Limited (NASDAQ: GRAB) is building a taxi company in Singapore. Last week, it was announced that GrabCab, a subsidiary of Grab, had been granted a taxi operator licence in the city state (or, if you want to go technical, the licence is called SSOL – “street-hail service operator licence”).

Instantly, LinkedIn gurus started mocking Grab – saying that after more than a decade of going ‘asset light’, the ride hailing giant has “come full circle” (or “gone back to square one”) by owning an ‘asset heavy’ taxi operator.

These simplistic narratives are often easy to circulate, if they were remotely making any sense. People should not be surprised about Grab’s move into owning taxi operations in Singapore – they attempted to acquire local taxi operator Trans-cab in 2023, a deal that was recently blocked by the country’s antitrust watchdog.

The real question is, why would Grab do it, and so persistently so? A couple of thoughts here:

🇸🇬 United Overseas Bank Is Solid, But Dark Clouds Are Keeping Us On Hold (Seeking Alpha) $ 🗃️

🇸🇬 Are the 3 Singapore Banks Attractive Buys Now? (The Smart Investor)

With the tumble in share prices across the trio of local banks, should investors scoop up their shares now?

The bellwether blue-chip index’s decline was led by the three local banks, namely DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, and Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY).

As of 8 April 2025, DBS had fallen 16.5% over the past three trading days.

OCBC was not far behind with a 13.3% tumble while UOB’s share price skidded 12.9% since 3 April.

With the three banks’ share prices falling from their highs, should investors bite?

Strong results for 2024

Triggering a potential trade war

Anaemic loan growth and more bad loans

A reprieve: interest rates may stay high

Get Smart: The outlook remains murky

🇸🇬 4 Singapore Blue-Chip Stocks Plunging to Their 52-Week Lows: Are They a Steal? (The Smart Investor)

🇸🇬 4 Promising Mid-Cap Singapore Stocks to Grow Your CPF Account for Retirement (The Smart Investor)

🇸🇬 4 Singapore Blue-Chip Stocks That Hiked Their Dividends by Double-Digit Percentages (The Smart Investor)

🇸🇬 SATS’ Share Price Tumbled 27% Year-to-Date: Can the Airline Caterer Enjoy a Rebound? (The Smart Investor)

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) delivered a stellar return last year, but its share price is slumping by double digits this year.

Even before the sell-down, the airline caterer was one of the worst-performing blue-chip stocks.

SATS’ share price has tumbled 27% year-to-date and investors may be curious to know if the group can see a rebound anytime soon.

A sparkling set of earnings

Strong operating metrics

Tariff impact on trade flows

Greater control under the new law

Air passenger demand to moderate

Get Smart: Caution warranted

🇸🇬 CICT’s Share Price Rose 11.3% This Year: Can the Retail and Commercial REIT Raise its DPU Further? (The Smart Investor)

The retail and commercial REIT is one of the best-performing REITs year-to-date.

The REIT sector remains in the doldrums as persistent worries linger over the impact of Trump’s widespread tariffs.

However, there is a bright spark among the REITs as CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), or CICT, posted an admirable 11.3% year-to-date (YTD) share price gain.

What’s driving these gains, and can CICT continue to grow its distributions into the future?

🇹🇭 Minority party in Thai coalition declares against casino policy as opposition to legalisation bill bubbles (GGRAsia)

One of the parties in Thailand’s current coalition government has issued a formal statement saying it “cannot accept the principles” of the government’s casino legalisation move, due to moral and other objections.

The announcement by the Prachachat Party – which draws its support from the predominantly Muslim south of the country – was made on Tuesday.

It came after Prime Minister Paetongtarn Shinawatra shelved plans for a Wednesday reading of the enabling legislation, the Entertainment Complex Act, in the National Assembly. The reading of the bill has now been postponed until at least July, when the new parliamentary session begins, according to reports by Thai media.

🇹🇭 Year 2027 now more likely for Thai casino bids, licensing: commentators (GGRAsia)

A “2027 timeline now seems more realistic” for a bidding process on anticipated Thai casino resort licences, says a partner at the Rajah & Tann (Thailand) Ltd law practice, in response to an enquiry from GGRAsia.

Another commentor told GGRAsia a “good outcome” would be an actual licensing phase by first quarter 2027.

The lawyer also observed: “The government now has a three-month window to regain public confidence in the transparency of the entertainment complex policy. This is indeed a pivotal moment for the administration.”

🇰🇿 Kaspi: A Strong Buy For Value Investors, While Dividend Investors Should Keep It On Close Watch (Seeking Alpha) $ 🗃️

-

🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🇮🇳 Wipro: Strong Financials But Lacks Alpha Amid Sectoral Headwinds (Seeking Alpha) $ 🗃️

🇮🇳 Tariff Shock Creates Overreaction: Indian Metal Stocks Poised for a Tactical Rebound (Smartkarma) $

U.S. tariff surprises triggered a sharp correction in global commodity prices and Indian metal stocks.

Despite limited U.S. exposure, Indian metal producers were hit hard—despite strong domestic demand and top-tier cost positioning.

Valuation reset appears overdone; further dips offer a compelling entry point. Vedanta (NSE: VEDL / BOM: 500295), JSW Steel Ltd (NSE: JSWSTEEL / BOM: 500228), Jindal Steel & Power (NSE: JINDALSTEL / BOM: 532286) and NMDC (NSE: NMDC / BOM: 526371) or National Mineral Development Corporation are best bets in our view.

🇮🇳 Jindal Stainless: Near-Term Headwinds Appear to Be Well Factored (Smartkarma) $

Jindal Stainless Ltd (NSE: JSL / BOM: 532508)

Management has lowered its volume and margin guidance over the last few quarters even as they have gradually lowered their export share to less than 10%.

Despite a 40% drop from its high over the last few months JDSL trades at premium to its historic valuations. Significant investments in Indonesia to raise capacity is positive

A 20-25% increase in volumes (through Indonesia investments) over the next 2-3 years coupled with 20% ROIC and Debt <1X EBITDA implies that premium valuations could sustain.

🇮🇳 #1 Leadership Bytes (07-Apr-25) (Smartkarma) $

Dixon Technologies (NSE: DIXON / BOM: 540699), Metropolis Healthcare Ltd (NSE: METROPOLIS / BOM: 542650), Hitachi Energy India Ltd (NSE: POWERINDIA / BOM: 543187) have shared major updates on expansion plans, acquisitions, order growth, and strategic shifts across sectors.

Each company is taking strategic steps to expand market share, strengthen operations, and tap into emerging growth sectors.

These updates highlight diverse growth strategies, from Dixon’s manufacturing expansion to Apollo’s focus on defense, suggesting a balanced approach across market leaders.

🇮🇳 LG Electronics India IPO: The Bull Case (Smartkarma) $

LG Electronics India (123D IN)/LGEIL, a subsidiary of LG Electronics (KRX: 066570 / 066575 / FRA: LGLG / LON: 39IB), aims to raise up to US$1.5 billion through a secondary offering (15% of outstanding shares).

According to Redseer, as of 30 June 2024, LGEIL was the market leader in India in major home appliances and consumer electronics (excluding mobile phones) in terms of volume.

The bull case rests on a strong market position, solid revenue growth, top-tier operating and FCF margin profile.

🇮🇳 Max Healthcare (MAXHEALTH IN): Multi-Pronged Expansion Strategy Augurs Well for Sustainable Growth (Smartkarma) $

Max Healthcare Institute (NSE: MAXHEALTH / BOM: 543220) completed the acquisition of Jaypee Healthcare in last November, thereby adding 700 beds. Jaypee added INR1,120M revenue with an operating EBITDA of INR230M in Q3FY25.

Max is setting up ~500 bedded hospital at Thane, Maharashtra on an asset-light built-to-suit basis. The proposed construction of hospital premises is expected to be completed by 2028.

Current expansion plan indicates significant capacity ramp-up (20%+) in FY26, and majority of which will come by Q1, thereby generating scope for revenue realization for most part of the year.

🌍 🇮🇱 🇸🇦 🇹🇷 🇦🇪

🇮🇱 Ituran: 6G, AI And Big Data Are Its Growth Engine (Seeking Alpha) $ 🗃️

-

🌐 🇧🇷 Ituran Location And Control Ltd (NASDAQ: ITRN) – Leader in the emerging mobility technology field, providing value-added location-based services, including a full suite of services for the connected-car. 🇼 🏷️

🇯🇴 International General Insurance’s Greatest Catalyst Is Its Ability To Manage Its Combined Ratio (Seeking Alpha) $ 🗃️

🌍 Jumia: Competition Will Be Critical In 2025 (Seeking Alpha) $ 🗃️

-

🌍 Jumia Technologies (NYSE: JMIA) – Operates a pan-African e-commerce marketplace, logistics service & payment service platform. Berlin HQ. 🇼

🇧🇦 🇷🇸 Adriatic Metals: High-Grade Silver Mine, Ready To Go (Seeking Alpha) $ 🗃️

🇵🇱 InPost S.A.: Strong Moat, Clear Growth Runway, Cheap Valuation (Seeking Alpha) $ 🗃️

🇺🇦 Ukraine research excursion – what did I find? (Undervalued Shares)

My recent publications about investing into the reconstruction of Ukraine generated tremendous interest.

However, investment options are limited, and it’s difficult to get an idea of the ‘real’ situation on the ground.

What would have been more obvious than hopping on a train and visit?

Without a Ukrainian stock exchange as such, several Ukrainian companies are listed on the Warsaw Stock Exchange. Their prices have surged significantly of late, confirming my ultra-contrarian thesis from April 2022. The stock of MHP SA (LON: MHPCq) (ISIN US55302T2042, UK:MHPC), which had been featured at the 2024 Weird Shit Investing conference, subsequently doubled (the Australian reader who presented the case at the conference in New York will this year attend the event in Hong Kong).

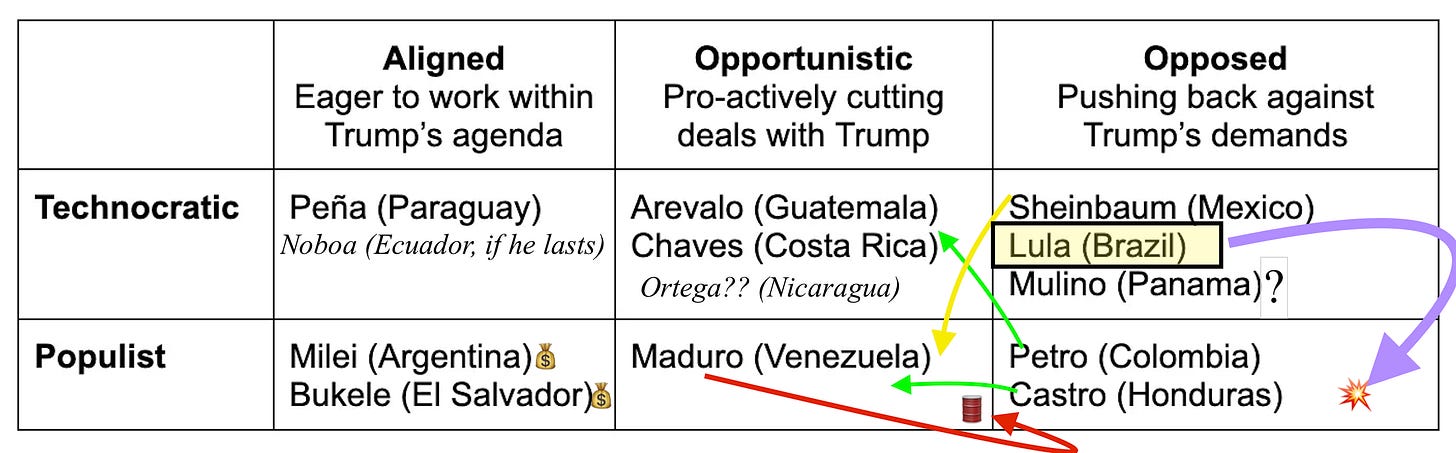

🌎 Revisiting the responses of LatAm leaders (Latin America Risk Report)

I look forward to more readers telling me how wrong my chart is!

It’s less about what the US is doing and more about the various ways Latin American leaders, companies, and populations respond. That’s definitely been a theme across articles I’ve published in recent months, especially the 3×2 matrix of how Latin American leaders are responding to Trump.

As I prepare for tomorrow’s presentation, it’s a good opportunity to mark up the chart and see what I got wrong and what may have changed in the past two months. Also, it was fun to make the chart more chaotic because that’s how we all feel.

🌎 Millicom International: Decent Performance, But Expect The Short Term To Be Painful (Seeking Alpha) $ 🗃️

🌎 Millicom International Cellular Has Reset The Base (Rating Upgrade) (Seeking Alpha) $ 🗃️

-

🌎 Millicom (NASDAQ: TIGO) – Fixed & mobile, telecommunications services, cable & satellite TV, mobile financial services & local content such as music & sports in Latin America. 🇼 🏷️

🌎 MercadoLibre: Macro Challenges Turn Me Bearish (Seeking Alpha) $ 🗃️

🇦🇷 Milei Tries Erasing Argentina’s History to Lure Foreign Investment (Bloomberg) $ 🗃️

Javier Milei is trying to stamp out every vestige of Peronism, Argentina’s dominant strain of populism, in his re-branding of the South American nation as a free-market haven.

The obstacles Milei faces are personified by Cristina Fernandez de Kirchner, who succeeded her husband as president in 2007 and then imposed capital and currency controls during her second term. Those restrictions mean companies can’t send dividends abroad while the peso is carefully managed by the central bank.

🇦🇷 Argentina secures $20bn IMF deal by relaxing currency controls (FT) $ 🗃️

🇦🇷 YPF: The Most Tangible Opportunity For Argentine Equity (Seeking Alpha) $ 🗃️

-

🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇧🇷 Ambev: A Strong Past, A Weak Future (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: Valuation Is Still Attractive (Seeking Alpha) $ 🗃️(?)

🇧🇷 Nu. Serving the Underserved! Equity Research! Part 3/3 (Global Equity Briefing)

AI Private Banker, Emerging Markets Expansion, and an Affordable Valuation!

In Part 1 we explored how Nu Holdings (NYSE: NU) came to be and how this fast-growing Brazilian fintech makes money! (Read Below)

Whilst in Part 2 we looked at Competition and Risks! (Read Below)

Today I will explain how Nu plans to continue growing in Latin America and beyond. Additionally, we will look at how the company will use AI to benefit its customers!

Lastly, I will show my valuation model and explain why I see a potential 300%+ upside for patient Nu investors!

🇲🇽 Evaluating Fibra UNO After Its Recent Outperformance (Seeking Alpha) $ 🗃️

🇲🇽 How Mexico Made a Plutocrat (Asianometry)

Carlos Slim wasn’t the first ever Mexican to be the world’s richest man. That honor should probably go to Antonio de Obregón y Alcocer, the half-Mexican who discovered and ran the greatest silver mine of all time: the Valenciana Mine. That mine, by itself, was responsible for 60% of all the silver produced in the 18th century. So Slim has some ways to go. But I have always been fascinated at Mexico’s wealth inequality. How did a country with 46.8 million people living in poverty also end up hosting one of the world’s richest men? The answer is that they sold him a monopoly. In this video, the birth, development, and eventual sale of Mexico’s telephone industry.

🇵🇦 Copa Holdings: The Market Is Wrong (Seeking Alpha) $ 🗃️

🌐 Nebius: The Neocloud Built For The AI Era (Seeking Alpha) $ 🗃️

🌐 Nebius Group: Too Little, To Late To Compete Successfully (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Glencore: Initiation of Coverage (Smartkarma) $

Glencore (LON: GLEN / JSE: GLN / FRA: 8GC / OTCMKTS: GLNCY / OTCMKTS: GLCNF)‘s 2024 financial results reflect a robust operational year, with the company reporting an adjusted EBITDA of $14.4 billion, indicating strong performance across its industrial and marketing segments.

The industrial segment achieved an adjusted EBITDA of $10.6 billion, primarily driven by a healthy metals business despite challenging conditions in the metallurgical market.

The recent integration of the EVR coal business contributed significantly, adding $1 billion to EBITDA in the latter half of the year.

🌐 Richemont: Luxury Goods Worth Considering At The Right Price (Seeking Alpha) $ 🗃️

-

🌐 Richemont (SWX: CFR / JSE: CFR / FRA: RIT1) – One of the world’s leading luxury goods groups. The Switzerland-based holding company founded by South African businessman Johann Rupert. 🇼 🏷️

🌐 Investors urged to diversify urgently in wake of Trump’s ‘Liberation Day’ (The Asset) 🗃️

Asia to bear brunt of tariffs as fears of US recession, global slump grow

For investors, the hardest-hit regions, including China, South Korea, and Taiwan, are expected to experience further de-risking as investors move towards safe-haven assets such as US treasuries, Japanese yen, and gold.

Investors are advised to switch their asset allocation to economies facing smaller tariff increases, such as Australia, the United Kingdom, Brazil, and Singapore, as well as companies in sectors like financials, healthcare, and consumer services, which may face less pressure on profit margins due to higher import costs.

“At this stage, there are carve-outs for key sectors, including copper, pharmaceuticals, semiconductors, and certain lumber products which help to moderate the immediate impact,” says Sean Sun, managing director and portfolio manager, Thornburg Investment Management. “Semiconductors, in particular, operate within a highly integrated global supply chain, with many critical manufacturing and assembly steps occurring outside the US, which reduces direct exposure.”

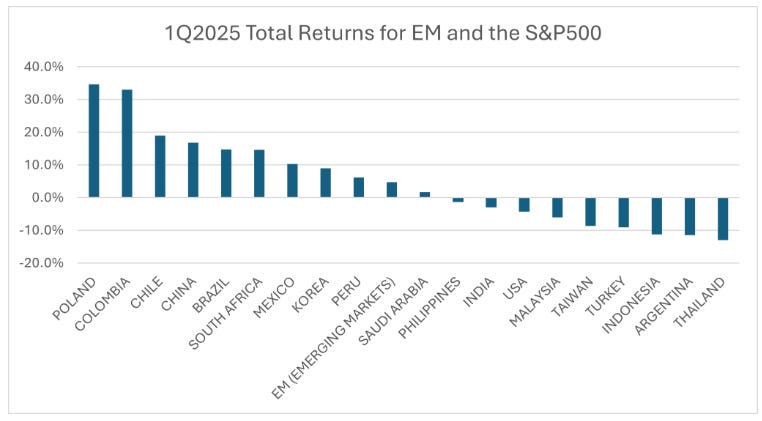

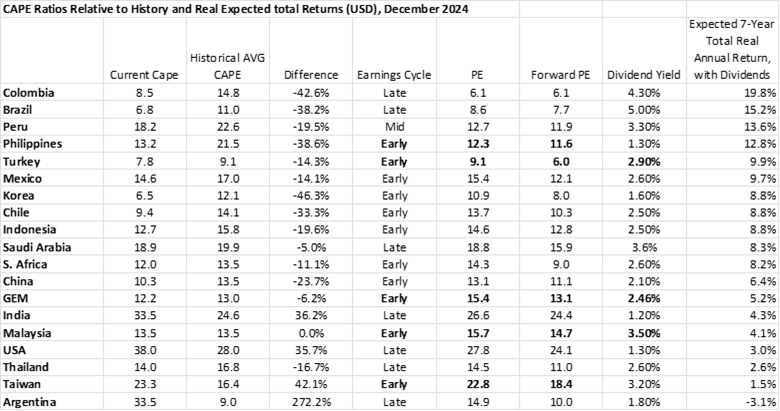

🌐 Expected Returns in Emerging Markets Q1 2025 (The Emerging Markets Investor)

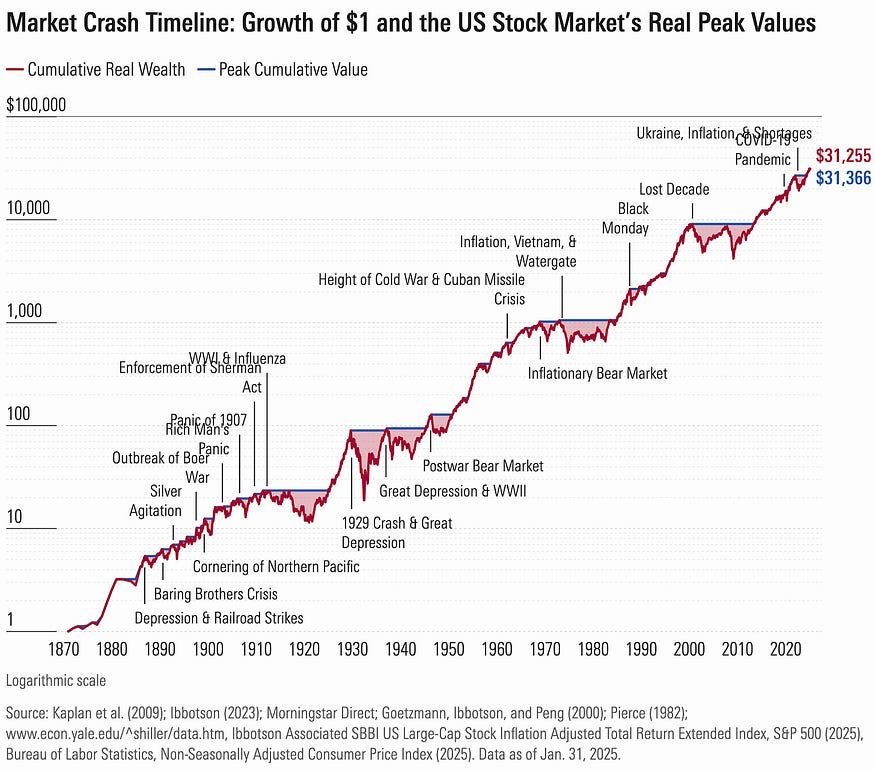

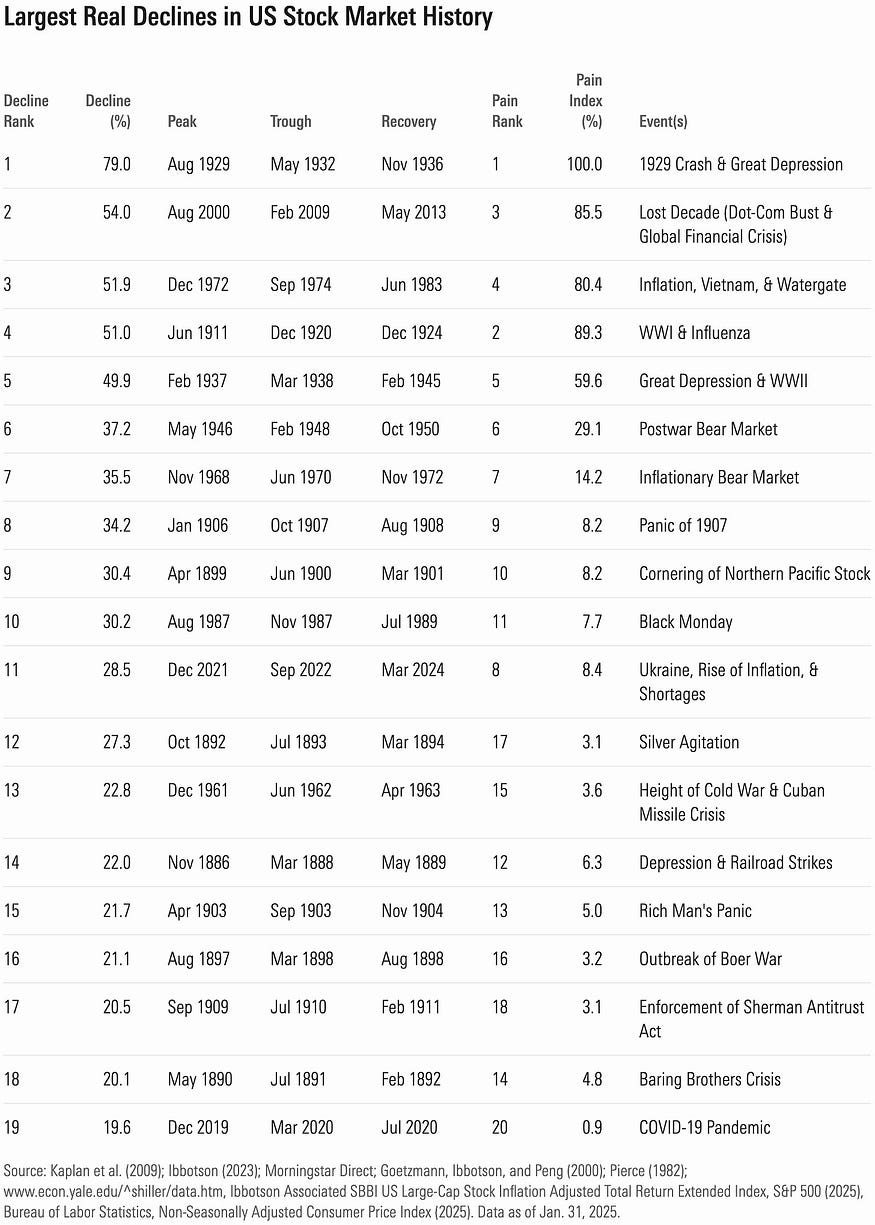

🌐 Lessons from 100+ Years of Stock Market Crashes (The Pareto Investor)

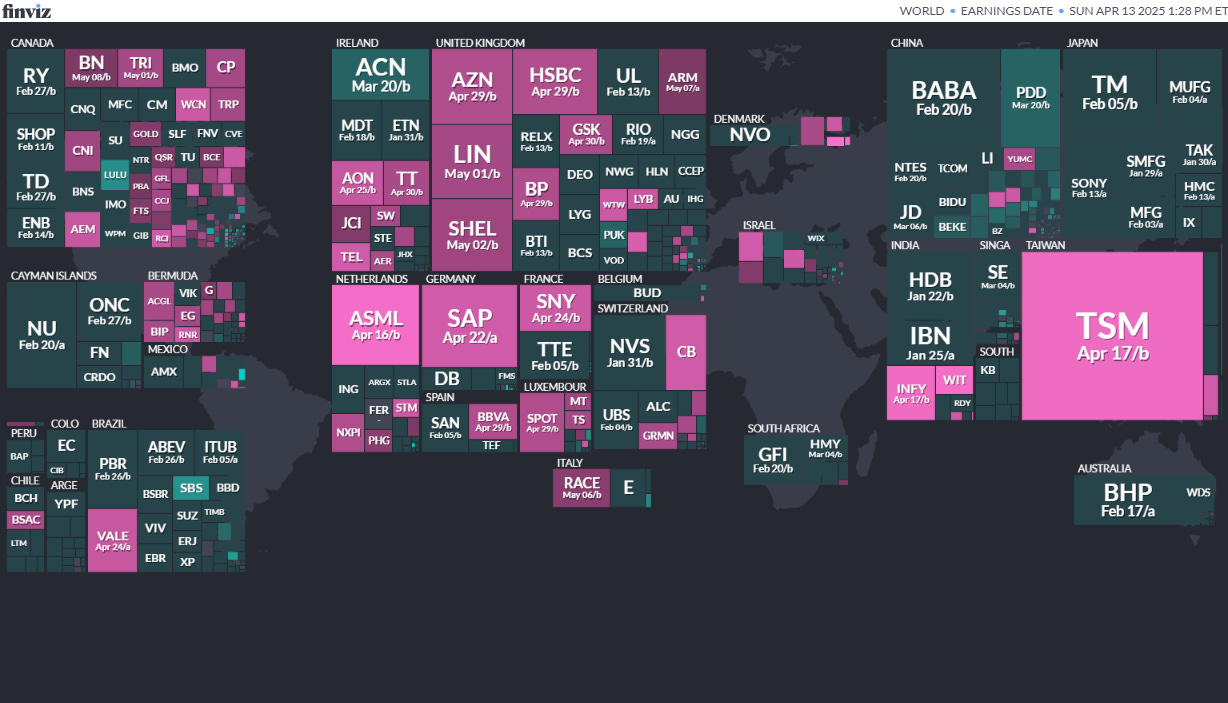

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

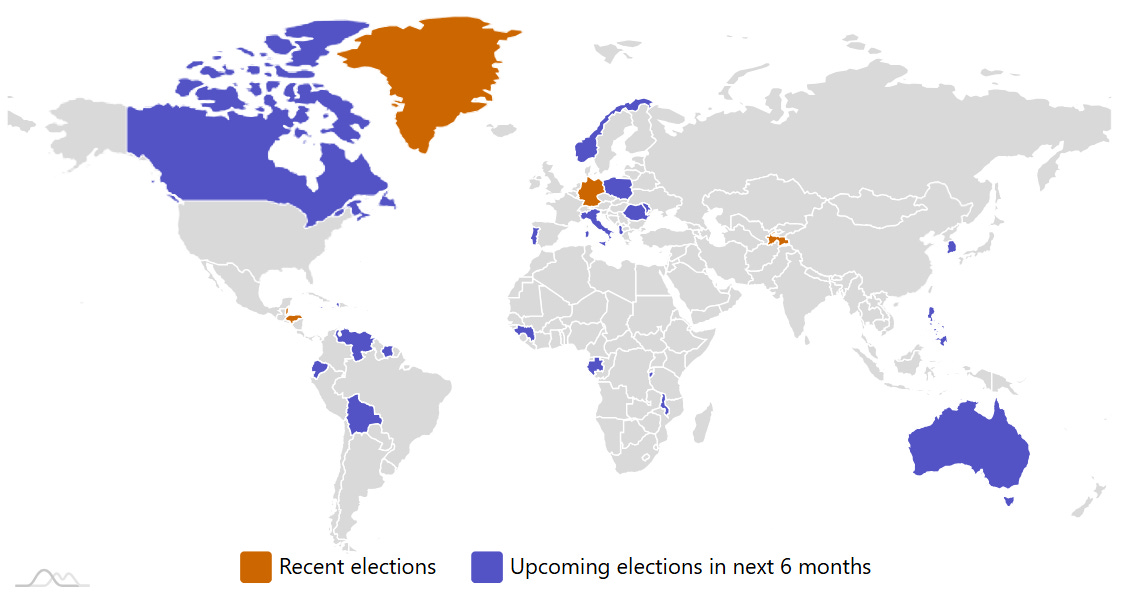

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

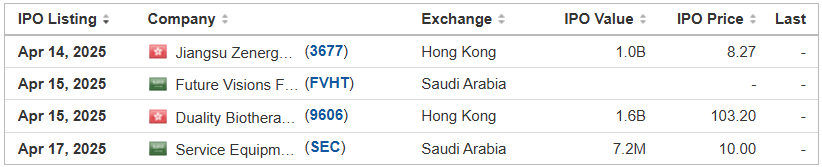

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Everbright Digital Holdings Ltd. EDHL Dominari Securities/Revere Securities, 1.5M Shares, $4.00-5.00, $7.0 mil, 4/14/2025 Week of

(Incorporated in the Cayman Islands)

We are an integrated marketing solutions provider in Hong Kong that is deeply involved in the metaverse and related technologies, and (we) are committed to providing one-stop digital marketing services to support businesses through every stage of their development. Under the all-in-one service, our revenue is generated by providing tailored marketing solutions that address the specific needs of our clients in the context of the ever-developing nature of new forms of media. Operating in the digital marketing solutions industry, our comprehensive range of digital marketing solutions to our clients includes, but is not limited to, metaverse stimulation, virtual reality (VR) and augmented reality (AR) design and creation, creative event planning and management, IP character creation and social media marketing. Unlike firms which provide traditional marketing solutions with boilerplate design and marketing plans, we tailor our marketing solutions based on our clients’ needs, and work together with them to implement our customized design and execute marketing plan for their target customers. We also take a hands-on approach to develop a custom metaverse solution for our clients by directly collaborating with suppliers on the design and implementation.

We also take a hands-on approach to develop a custom metaverse solution for our clients by directly collaborating with suppliers on the design and implementation. We lead the strategic design and conceptualization of these offerings, determining key objectives, target audience, and the desired level of immersion and integration between the virtual and physical realms. We also identify the essential features to be included in the metaverse solution and provide guidelines to our suppliers, who then handle the technical execution. This involves building the 3D virtual environments, developing the augmented reality components, testing the final products to identify and address any technical issues, and optimizing the performance and stability of the complete solution.

We serve customers ranging from small and medium-sized businesses to sizeable regional conglomerates. Since the commencement of our business operations in 2021 through our subsidiary, HKUML, we have worked with over 20 corporate customers from a diverse array of industries, including real estate developers, concert organizers, and public charitable organizations to serve both their domestic and overseas customers.

Note: Net income and revenue are in U.S. dollars for the 12-month period that ended June 30, 2024.

(Note: Everbright Digital Holdings Ltd. s offering 1.5 million shares at a price range of $4.00 to $5.00 to raise $7.0 million, according to its F-1 filing dated Feb. 25, 2025.)

J-Star Holding Co., Ltd. YMAT Maxim Group, 1.3M Shares, $4.00-5.00, $5.6 mil, 4/14/2025 Week of

As a holding company with no material operations of our own, our operations are conducted through our subsidiaries in the People’s Republic of China (the “PRC”), Taiwan, Hong Kong and Samoa, with our headquarters in Taiwan, and such structure involves unique risks to investors, as the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time. (Incorporated in the Cayman Islands)

Our Predecessor Group was established in 1970 and we have accumulated over 50 years know-how in material composite industry. We develop and commercialize the technology on carbon reinforcement and resin systems. With decades of experience and knowledge in composites and materials, we are able to apply our expertise and technology on designing and manufacturing a great variety of lightweight, high-performance carbon composite products, ranging from key structural parts of electric bicycles and sports bicycles, rackets, automobile parts to healthcare products. According to the industry report commissioned by us and prepared by Frost & Sullivan, we are one of the major global leading players in the carbon fiber bicycle parts industry and carbon fiber racket parts industry.

We primarily generate revenue through three divisions and revenue streams, namely (i) sales of bicycles parts of sports bicycle and electric bicycle; (ii) sales of rackets for use in tennis, badminton, squash and beach tennis; and (iii) sales of other products, which mainly include structural parts of automobile, other sporting goods and healthcare products. Our bicycle parts and rackets are mainly supplied directly or indirectly to branded customers located in Switzerland, France, Italy, the Netherlands, Germany and Japan and they market and distribute their products worldwide. Other customers who rely on our new products, such as automobile parts and healthcare products, are mainly located in Australia, Canada and Japan.

*Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: J-Star Holding Co. Ltd. cut its IPO’s size to 1.25 million shares – down from 2.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $5.63 million in an F-1/A filing dated Aug. 2, 2024; in that same filing, the company said that Maxim Group is the new sole book-runner, replacing EF Hutton. Background: J-Star Holding Co. Ltd. reduced the size of its IPO again – to 2.0 million shares – down from 2.5 million shares – and kept the price range at $4.00 to $5.00 – to raise $9.0 million in an F-1/A filing dated June 13, 2024. In that June 13, 2024, filing, J-Star Holding Co. Ltd. disclosed that EF Hutton is the new sole book-runner, replacing the previous joint book-running team of Maxim Group LLC and Freedom Capital Markets.)

(Background: J-Star Holding Co. Ltd. cut its IPO to 2.5 million shares – down from 4.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $11.25 million, according to an F-1/A filing dated Sept.19, 2023.)

(Note: J-Star Holding Co. Ltd. cut its IPO to 4.0 million shares – down from 5.375 million shares – and set the price range at $4.00 to $5.00 – an upward adjustment from its previous assumed IPO price of $4.00 – to raise $18.0 million, in an F-1/A filing dated Feb. 8, 2023. The downsizing represented a 16.3 percent cut in J-Star’s estimated IPO proceeds, which were $21.5 million under the previous terms. J-Star also disclosed a change in the bankers running its IPO, in the Feb. 8, 2023, F-1/A filing: Maxim Group LLC and Freedom Capital Markets are the joint book-runners, replacing ViewTrade Securities, which previously was the sole book-runner. Background: J-Star upsized its IPO in an F-1/A filing dated Sept. 2, 2022: 5.375 million shares at $4.00 – up from 5.25 million shares at $4.00 in a previous filing on Aug. 19, 2022. Under the new terms, the IPO’s proceeds are estimated at $21.5 million – or $500,000 more than the previous terms. J-Star Holding Co. Ltd. disclosed terms for its IPO in an F-1/A filing dated July 13, 2022: 3.75 million ordinary shares at $4.00 each to raise $15.0 million. J-Star Holding filed an F-1/A dated May 26, 2022, with financial information for the fiscal year ended Dec. 31, 2021. The company filed its F-1 on March 21, 2022, after submitting confidential IPO paperwork on Sept. 30, 2021.)

Kandal M. Venture Ltd. FMFC Dominari Securities/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 4/14/2025 Week of

(Incorporated in the Cayman Islands)

Through FMF, our operating subsidiary, we are a contract manufacturer of affordable luxury leather goods with our manufacturing operations in Cambodia. We primarily manufacture handbags, such as shoulder bag, crossbody bag, tote bag, backpack, top-handle handbag, satchel, and other smaller leather goods, such as wallets. Our customers are well-known global fashion brands that are headquartered in the United States.

With our craftsmanship and extensive knowledge of the leather goods manufacturing process, our product engineers convert our customers’ vision and design into leather goods products. Our products are primarily affordable luxury products that are made of leather and/or other materials.

Our Competitive Strengths

We believe the following competitive strengths differentiate our operating subsidiary from its competitors:

• Having long-term and strong business relationships with renowned global fashion brands but we cannot assure continued good relationships with them, and they are not obligated in any way to continue placing orders with us at the same or increasing levels, or at all;

• Having long-term collaborative relationships with our suppliers but their services are susceptible to fluctuations in pricing, timing, and quality, and we have limited control over their operations and compliance with regulations as we do not have long-term contracts with them;

• Having extensive understanding of leather goods manufacturing process, up-to-date machinery and efficient management resulting in competitive pricing while maintaining quality and high efficiency; and

• Having experienced management team with extensive knowledge of the leather goods manufacturing industry where we operate but we cannot assure the retention of key executives and personnel necessary to maintain or expand our business, and the loss of any member of our management team could negatively impact our business plan and expansion.

Our Strategies

We aim to accomplish our business objective, further strengthen our market position and continue to be a competitive manufacturer of leather goods by pursing the following key strategies:

• Broadening our customer base by expanding our geographical market reach to other key markets, including the European markets but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results;

• Enhancing our production capacity but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results; and

• Establishing a new design and development center for enhancing our product development capabilities but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results.

Corporate History and Structure

KMV is a holding company registered and incorporated in the Cayman Islands, and is not a Cambodian operating company. As a holding company with no material operations, we conduct our core business operations in Cambodia through our operating subsidiary, FMF.

On April 5, 2017, FMF is the Group’s key operating subsidiary and was established under the laws of Cambodia to engage in the business of leather goods manufacturing. FMF’s skilled craftsmanship and high-quality manufacturing capabilities are the cornerstones of the Group’s operations and reputation, allowing us to attract business from leading global brands. Customers issue letters of authorization directly to FMF which grant FMF the right to produce and export leather goods using their trademarks, and they frequently visit the production site of FMF located in Cambodia to inspect orders and conduct quality checks. PFL was incorporated under the laws of Hong Kong on November 3, 2016 as a trading company for the Group’s material procurement and customer invoicing.

Note: Net income and revenue are in U.S. dollars (converted from Cambodia’s currency) for the 12 months that ended March 31, 2024.

(Note: Kandal M. Venture Ltd. trimmed its small-cap IPO’s size to 2.0 million shares – down from 2.8 million shares originally – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its F-1/A filing dated Feb. 18, 2025.)

(Note: Dominari Securities and Revere Securities are the new joint book-runners, replacing the original book-running team of Cathay Securities and WestPark Capital.)

OFA Group OFAL R.F. Lafferty & Co., 1.5M Shares, $4.50-4.50, $6.8 mil, 4/14/2025 Week of

(Incorporated in the Cayman Islands)

Through our wholly owned operating subsidiary, Office for Fine Architecture Limited, we provide comprehensive architectural services, including design and fit out services for commercial and residential buildings. The design service includes both the consultation with our staff and the actual design work and the Company provides a specific conceptualized design with layout plans, detailed design drawings, advice relating to, among other things, budgetary consideration, optimal use of space, the materials, fittings, furniture, appliances and other items to be used with an aim to produce a preliminary design plan and quotation for clients’ considerations. Fit out works include installing protective materials to cover floors or walls, installing or constructing partition walls, windows and window frames and decorative fittings, furniture or fixtures, installing plumbing systems as well as installing switches, power outlets, telephone wiring, computer outlet covers and other electrical and wiring works.

Our mission is to leverage our expertise in architectural design to maximize the potential of every property, ensuring that its unique attributes are highlighted and enhanced through thoughtful innovations. We are focused on innovation, efficiency, and scalability in our business model and service offerings. While we currently operate on a traditional project-based model, we utilize various technological tools to enhance our design process, including Houzz, a commercially available software platform that includes automated visualization capabilities. Through Houzz’s platform, we convert two-dimensional building plans into three-dimensional models and efficiently generate various design alternatives by applying different materials and equipment options. This functionality helps expedite our design process and facilitates client decision-making by providing rapid visualization of different design options. Based on our market research, we believe the use of such visualization tools is not yet widespread among architectural firms in Hong Kong, which we believe provides us with certain operational efficiencies compared to traditional design methods.

We currently utilize Houzz’s standard commercially available features as a regular platform user, which includes basic listing and networking capabilities. As part of our growth strategy, we continuously monitor developments in architectural design and visualization technologies, and may explore potential collaborations or partnerships with various technology providers to enhance our service offerings in Asian markets. However, we have not initiated any discussions regarding such partnerships, and there can be no assurance that any such agreements will be reached in the future.

We have developed extensive industry relationships through our operating subsidiary’s 10-year membership in the Hong Kong Institute of Architects (“HKIA”) and maintain an active network of approximately 100 clients and numerous industry relationships throughout Hong Kong. As we continue to grow, we plan to leverage these relationships and our local market expertise to explore potential technological partnerships and enhanced service offerings for the Asian market. However, our ability to implement such enhancements would depend on reaching formal agreements with technology providers, and there can be no assurance that such agreements will be reached or that enhanced services will be developed.

Our current service enhancement initiatives focus on utilizing existing visualization tools to improve design efficiency, exploring potential development of specialized software tools for building code compliance, and continuing to evaluate and implement commercially available technology solutions that could benefit our clients. We believe these initiatives can help us deliver more efficient services to our clients, though the implementation and success of these initiatives involve various risks and uncertainties as described in “Risk Factors – Risks Related to Our Business and Industry – Our utilization of artificial intelligence and machine learning technologies may materially impact our business operations and financial result.”

In addition, we have entered into a definitive co-development agreement with Alan To AI Consultancy Co. Limited (“Alan To AI”), a Hong Kong-based firm specializing in IT solutions, for the development of an automated building code compliance review system. This project aims to develop an AI-enabled tool that can analyze architectural drawings and provide feedback based on local building codes and regulations. The development scope encompasses the creation of specialized review systems, integration of regulatory databases, and development of user interface components. The project includes system testing and validation phases, as well as plans for ongoing optimization and enhancement of the technology.

Note: Net loss and revenue are for the 12 months that ended Sept. 30, 2024.

(Note: OFA Group is offering 1.5 million shares at an assumed IPO price of $4.50 to raise $6.75 million, according to its F-1 and F-1/A filings.)

The Great Restaurant Development Holdings Limited HPOT Dominari Securities/Revere Securities, 1.4M Shares, $4.00-6.00, $7.0 mil, 4/14/2025 Week of

(Incorporated in the Cayman Islands)

We operate a multi-award-winning Chinese restaurant chain. We specialize in various types of Specialty Chicken Hotpot under the brand name “The Great Restaurant (一品雞煲火鍋)” in Hong Kong. As of the date of this prospectus, we operate seven restaurants in our chain, out of which three are located in the New Territories, three in the Kowloon Peninsula and one on Hong Kong Island. We have over 12 years of experience in the restaurant services industry in Hong Kong and utilize one food factory to support our operations.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: The Great Restaurant Development Holdings Limited cut its IPO’s size to 1.4 million shares – down from 2.0 million shares in the original SEC filing – and kept the price range at $4.00 to $6.00 – to raise $7.0 million, according to its F-1/A filing dated March 3, 2025. Background: Dominari Securities is the “lead left” book-runner, joining the original sole book-runner, Revere Securities, on the cover of the prospectus.)

Haoxin Holdings Ltd HXHX Craft Capital Management/WestPark Capital, 1.8M Shares, $4.00-6.00, $8.8 mil, 4/15/2025 Tuesday

We are a provider of temperature-controlled truckload service and urban delivery services in China with over 19 years of experience in the transportation industry. (Incorporated in the Cayman Islands)

We started our urban delivery service business in 2003 and started expanding our business into temperature-controlled truckload service in 2016. We currently conduct all of our operations through our subsidiaries, Ningbo Haoxin, Zhejiang Haoxin, Longanda and Haiyue, and have experienced a steady growth in our business in recent years. The goods we take charge of transporting focus on factory logistics, which include electronic devices, chemicals, fruit, food and commercial goods. After continuous development, we have been recognized and accredited by the China Federation of Logistics and Purchasing as a 3A-Grade transportation service provider.

As of June 30, 2022, we operated a truckload fleet with 70 tractors, 155 trailers and 61 vans, 20 tractors and 4 vans of which are under capital lease.

We mainly provide transportation services with our large and medium-sized temperature-controlled logistics transportation vehicles, and charge our customers based on mileage. In addition to temperature-controlled truckload services, we also provide urban delivery services with our medium-sized vans to customers who have short-distance, intra-city delivery needs. The sales revenue generated from temperature-controlled truckload service accounts for about 80.3% and the urban delivery service accounts for approximate 19.7% out of our total sales revenue in June 30, 2022. The sales revenue generated from temperature-controlled truckload service accounts for about 75.5% and the urban delivery service accounts for approximate 24.5% out of our total sales revenue in 2021. We optimize the loading of the vehicles on the forward and return journeys to reduce costs.

We adopt high standards for our own services and provide customers with high-quality, safe and standardized services. We also use a digitized management system in which temperature control can be accessed throughout the whole transportation process through advanced vehicle GPS positioning and real-time temperature monitoring system. We also pay special attention to safe operation and conduct regular safety training and emergency drills to enhance our drivers’ safety awareness. Additionally, we have installed safety systems and warning systems on each vehicle to reduce likelihood of accident.

We plan on consolidating the products that we transport and build cold temperature warehouses to reduce costs. We also plan to obtain relevant qualifications for pharmaceuticals and incorporate medicine transportation into our daily business. We will aim to strengthen informatization construction to integrate the existing vehicle dispatching system and temperature control to build a system to improve efficiency.

Our mission is to become the most reliable and sustainable transportation company that specialize in temperature-controlled truckload services in China by offering punctual, cost-effective, capable and intelligent transportation services, while maintaining a sizeable fleet of transportation vehicles of our own as well as reliable subcontracting arrangements.

**Note: Net income and revenue figures are in U.S. dollars for the 12 months that ended June 30, 2024.

(Note: Haoxin Holdings Ltd. cut its IPO to 1.75 million shares – down from 2.0 million shares – and kept the price range at $4.00 to $6.00 – to raise $8.75 million, according to its F-1/A filing dated March 5, 2025. Background: Haoxin Holdings Ltd. filed an F-1/A dated Sept. 20, 2024, and cut its IPO to 2.0 million shares – down from 3.0 million shares initially – and kept the price range at $4.00 to $6.00 – to raise $10.0 million. In that F-1/A filing, Haoxin Holdings named Craft Capital Management as its lead left joint book-runner to work with WestPark Capital. Background: Haoxin Holdings Ltd. filed its prospectus and disclosed terms for its IPO in an F-1/A filing dated Feb. 10, 2023: 3.0 million shares at a price range of $4.00 to $6.00 to raise $15.0 million. The original sole book-runner was Univest Securities. Haoxin Holdings filed confidential IPO documents with the SEC on Sept. 9, 2022.)

Phoenix Asia Holdings Ltd. PHOE D. Boral Capital (ex-EF Hutton), 1.6M Shares, $4.00-6.00, $8.0 mil, 4/15/2025 Tuesday

(Incorporated in the Cayman Islands)

We operate as a holding company. We operate our business primarily through our indirectly wholly-owned Operating Subsidiary, Winfield Engineering (Hong Kong) Limited. We mainly engage in substructure works, such as site formation, ground investigation and foundation works, in Hong Kong. To a lesser extent, we also provide other construction services such as structural steelworks. We mostly undertake substructure work in the role of subcontractor for the six months ended September 30, 2024, and the fiscal years ended March 31, 2024, and March 31, 2023.

Winfield Engineering (Hong Kong) Limited was founded in 1990. Over our 30 years of operating history, we have focused on substructure works, serving as a subcontractor and building up significant expertise and a strong track record. Substructure refers to the foundation support system constructed beneath ground level. We take great pride in our capability to effectively address substructure works challenges during the completion of our works. In 2023, we were awarded with a public project for a major trunk road, which involves marine grouting works and the project is expected to be completed in late-2025. This project further demonstrates our versatility and commitment to delivering high-quality substructure solutions.

Through our Operating Subsidiary, we are mainly engaged in public sector and private sector projects in Hong Kong. In 2023, we were awarded with an infrastructure project for the redevelopment of a riding school with an initial contract sum of over HKD24.4 million (USD3.1 million), which is expected to be completed in mid-2025.

As of the date of this prospectus, Winfield Engineering (Hong Kong) Limited is (i) a Registered Specialist Contractor under the sub-registers of foundation works, site formation works and ground investigation field works categories maintained by the Buildings Department of Hong Kong; and (ii) a Registered Subcontractor under foundation and piling (sheet piles, bored piles, driven piles, diaphragm walls, micro piles and hand-dug caisson) and general civil works (earthwork and ground investigation) of the Registered Specialist Trade Contractors Scheme of the Construction Industry Council of Hong Kong.

We, through our Operating Subsidiary, have achieved significant growth in our business. For the fiscal years ended March 31, 2024 and 2023, our total revenue derived from substructure and other construction services was approximately USD5.8 million and USD2.2 million, respectively. The number of customers with revenue contribution to us was 18 for the fiscal year ended March 31, 2023 and 11 for the fiscal year ended March 31, 2024.

According to the Census and Statistic Department, between 2014 and 2023, the construction industry in Hong Kong maintained growth with a compounded annual growth rate of 1.53%. Driven by (i) sustained supply of residential units and urban renewal program; (ii) the Government’s funding support in innovative constructive methods and new technologies; (iii) the Government’s continuous effort in enhancing rail connectivity, which requires extensive substructure works; and (iii) rapid advancement in technology to optimize productivity and reduce costs such as the building information management and industrialized building system, it is expected that the Hong Kong civil engineering industry will continue to grow.

Note: Net income and revenue are for the fiscal year that ended March 31, 2024.

Jyong Biotech Ltd. (Revived IPO) MENS Joseph Stone Capital LLC, 2.7M Shares, $7.50-8.50, $21.7 mil, 4/16/2025 Week of

*Note: The stock in this IPO is being issued by the holding company. (Incorporated in the Cayman Islands)

We are a biotechnology company based in Taiwan and are committed to developing and commercializing innovative and differentiated new drugs (plant-derived) mainly specializing in the treatment of urinary system diseases, with an initial focus on the markets of the U.S., the EU and Asia (primarily Taiwan and mainland China).

Since our inception in 2002, we have been dedicated to the research and development of new drugs with high safety and efficacy. Through 20 years of efforts, we have built integrated capabilities that encompass all key functionalities of drug development, including early-stage drug discovery and development, clinical trials, regulatory affairs, manufacturing and commercialization. Leveraging our strong research and development capabilities and proprietary platform, we have been developing a series of drug candidates, including one core drug candidate at NDA stage, one clinical-stage key drug candidate and other preclinical-stage drug candidates. Among our drug candidates, we have filed the new drug application, or NDA, for MCS-2 in the U.S. One of our clinical-stage key drug candidates, PCP, is in the Phase II trials stage in Taiwan. Another preclinical-stage key drug candidate, IC, is under preclinical studies.

Our pipeline features three innovative and differentiated new drug candidates, and we are developing them for (i) the treatment of benign prostate hyperplasia/lower urinary tract symptoms, or BPH/LUTS, (ii) prostate cancer prevention, and (iii) the treatment of interstitial cystitis, respectively.