Emerging Market Links + The Week Ahead (April 15, 2024)

There is more conflicting China data, information, or propaganda depending on how you look at it. On one hand, USA-based Fitch has revised their outlook on China to negative while the FT has reported that Chinese capital markets activity has fallen to multi-decade lows 🗃️. On the other hand, the 2024 Kearney FDI Confidence Index has China back in the third spot while industrial metal prices have jumped as investors bet on rising China demand 🗃️ (“Zinc, copper and nickel outperform stocks as signs of resurgent demand add to fears about supply constraints…”).

Then there is this which will never be reported in the Western press outside of Asia: The State of Southeast Asia: 2024 Survey Report has found that the majority of ASEAN people favor China over the US 🗃️ with over 75% of survey participants in the majority Muslim countries of Malaysia and Indonesia preferring China whereas its roughly the opposite for the Philippines and Vietnam who still strongly prefer the USA.

Finally, the ETF launches and liquidation section at the end of this post have been updated as more Chinese ETFs have gotten culled along with two frontier market ETFs: The Global X MSCI Nigeria ETF and the VanEck Egypt Index ETF.

$ = behind a paywall

-

🇨🇳 CMBI Research China & Hong Kong Stock Picks (March 2024) Partially $

-

SANY International, BYD Electronic International, ZhongAn Online P & C Insurance Co, New Hope Service Holdings, DPC Dash, WuXi Biologics, BYD Company, AK Medical, Ping An, Weichai Power, Sichuan Kelun-Biotech Biopharmaceutical, Zhihu Inc, SenseTime, China Yongda Automobile Services Holding, BOE Varitronix, Glodon, Jiumaojiu International Holdings, FIT Hon Teng, Shanghai Henlius Biotech, Aac Technologies Holdings, Baozun, Greentown Management Holdings Company, Zhejiang Dingli Machinery, J&T Global Express Ltd, Geely Automobile Holdings, Pinduoduo, Tencent, ZTO Express, China Lilang Ltd, Akeso, WuXi AppTec, Kingdee International Software Group, Xiaomi Corp, Tencent Music Entertainment Group, XPeng, Tongcheng Travel Holdings, JOYY Inc, Shanghai INT Medical Instruments, Xtep, GigaCloud Technology, Shennan Circuits, AIA Group, Tuhu Car, Mobvista, Weibo Corp, Ke Holdings, 361 Degrees International, Horizon Construction Development, Intron Technology, ZTE, Bilibili, Prada SpA, JD.com, Yuexiu Transport Infrastructure, NIO Inc, Cloud Music, Hutchmed, Budweiser APAC & NetEase

-

20+ high conviction stock ideas: Li Auto, Geely Automobile, Weichai Power, Zhejiang Dingli, CR Power, CR Gas, DPC Dash, JNBY, JS Global, Vesync, Kweichow Moutai, BeiGene, PICC P&C, Tencent, Alibaba, Pinduoduo, Amazon.com, Netflix, Kuaishou, GigaCloud, CR Land, FIT Hon Teng, BYDE, Luxshare, Innolight & Kingdee

-

-

🌐 EM Fund Stock Picks & Country Commentaries (April 14, 2024) $

-

New March or Q1 fund updates/letters, metals as an indirect tech-AI play, what to look for in Chinese stocks, Indian sectors that will benefit from growth, EM optimism, April risk monitor, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Can Generative AI be the Next Transformative Force for China’s Internet Giants? (KraneShares)

Spring 2024 China Internet Earnings Report

Many leading China internet companies beat analyst estimates in their Q4 earnings, reflecting increased consumer activity surrounding the 11/11 festival as well as strong demand for travel booking and other services heading into the Lunar (Chinese) New Year holiday.

China Internet companies currently trade at, on average, a -40% discounted earnings multiple compared to their US-based peers. As such, many continue to repurchase shares and KraneShares CSI China Internet ETF (NYSEARCA: KWEB)’s top 10 holdings have an average buyback yield that is nearly 6%.1

Two new companies joined the KWEB portfolio this quarter: YSB Inc (HKG: 9885). and Fenbi Ltd (HKG: 2469). YSB is an online pharmacy and Fenbi provides vocational training and examinations. Check out our Subsector Analysis to learn more about these exciting companies.

🇨🇳 Alibaba will struggle to knock Temu off ecommerce top spot (FT) $ 🗃️

🇨🇳 What’s behind the rise of Chinese e-commerce platform Temu in the US? (Momentum Works)

Temu is among a new generation of Chinese players disrupting the e-commerce landscape in Western markets. After making its US debut in September 2022, it is available in 56 countries as of March, including our neighbours Malaysia and the Philippines. The platform generates US$2 billion in sales each month, a figure that is growing.

Other notable Chinese e-commerce companies now are SHEIN, which is now seeking an initial public offering (IPO) of up to US$90 billion, and TikTok Shop, which major sellers told us clocked more than US$30 million in US sales on Black Friday last November.

TikTok Shop, Temu and SHEIN, however, are different each in its own way, capturing a key piece of the value chain.

🇨🇳 ‘Warcraft’ return to NetEase signals extension of China’s gaming relaxation (Bamboo Works)

A new deal to bring popular ‘World of Warcraft’ games back to China after a one-year absence will have relatively little financial impact on the game’s local host

This week’s renewal of NetEase (NASDAQ: NTES)’s agreement to operate games from Blizzard in China will have relatively little financial impact on either company

The deal signals China’s continued relaxation of regulatory policy and encouragement of global exchanges for the gaming sector

🇨🇳 Is Niu Technologies ready to charge ahead again? (Bamboo Works)

The electric scooter maker reported a sharp upturn in its first quarter sales volume, reversing weak growth throughout last year

Niu Technologies (NASDAQ: NIU) said its unit sales at home and abroad rose more than 30% in the first quarter, following a tough 2023 when its revenue fell 16%

The electric scooter maker’s shares jumped 34% from an all-time low in the week following the announcement

🇨🇳 BYD takes the lead in China NEV exports with 130% growth in first quarter (Caixin) $

China’s electric car maker BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) is stepping up the pace of vehicle exports and overseas production, strengthening its foothold as a global industry leader.

BYD’s export of new energy vehicles (NEVs) — including pure electric, plug-in hybrid and fuel cell vehicles — reached 99,000 vehicles in the first quarter, marking a 130% increase over the same period last year, according to data from the China Association of Automobile Manufacturers (CAAM). Tesla Inc.’s China plant exported 88,000 vehicles during the quarter.

🇨🇳 YTO International ships in new CEO as its revenue fails to deliver (Bamboo Works)

Revenue at the international arm of one of China’s leading parcel delivery companies shrunk by nearly 30% last year on falling international freight prices and waning demand

YTO International Express and Supply Chain Technology Limited (HKG: 6123 / OTCMKTS: YTOEF)’s profit fell 29.2% to HK$96.8 million last year, as its revenue fell at a similar rate to HK$5.29 billion

The international arm of one of China’s leading delivery companies replaced its CEO Sun Jian with newcomer Zhou Jian, former CEO of Shenzhen Fengwang Express or S.F. Holding Co Ltd (SHE: 002352)

🇨🇳 China Pair Trade Idea: Long Air China (753 HK), Short CSA (1055 HK) (SmartKarma) $

Air China (SHA: 601111 / HKG: 0753 / FRA: AD2 / LON: AIRC / OTCMKTS: AIRYY) had 15.4% interest-bearing debt denominated in USD, vs. 21.3% for China Southern Airlines Co. Ltd. (SHA: 600029 / HKG: 1055 / FRA: ZNHH / OTCMKTS: CHKIF), making it less exposed to Rmb depreciation.

Recovery of international traffic and routes will help to lower unit costs. Air China’s unit costs for FY23 were Rmb4.0445, whereas CSA’s were only Rmb3.2000.

There is more upside for Air China’s load factor which was down 7.8pp YoY in FY23, compared with -4.7pp for CSA.

🇨🇳 Ping An Trust delays repayment, citing China property market woes (Reuters)

A subsidiary of China’s Ping An (HKG: 2318 / OTCMKTS: PNGAY) failed to repay a roughly $107 million trust product on time, citing the property market crisis and adding that it is suing developer Zhenro Properties Group Ltd (HKG: 6158 / FRA: 1ZZ) with which it invested the sum.

Ping An Trust’s missed payment adds to signs of spreading stress in a financial market dragged down by the property crisis.

Concerns have grown over the past year about the outsized exposure of China’s $3 trillion shadow banking sector, roughly the size of Britain’s economy, to developers and the wider economy as the real estate sector lurched from one crisis to another.

🇨🇳 TAL Education Group: Initiation Of Coverage – What Is Its Real Business Strategy And What Is The Impact Of AI On Its Business? – Major Drivers (SmartKarma) $

TAL Education Group (NYSE: TAL) reported net revenues of USD 373.5 million for its third quarter fiscal year 2024, exhibiting an increase of 60.5% and 63.7% in U.S. dollar and RMB terms.

Despite the impressive revenue growth, profitability remained a concern with non-GAAP loss from operations and non-GAAP net loss attributable to TAL amounting to USD 10.2 million and USD 1.9 million, respectively.

Baptista Research looks to evaluate the different factors that could influence the company’s price in the near future and attempts to carry out an independent valuation of the company using a Discounted Cash Flow (DCF) methodology.

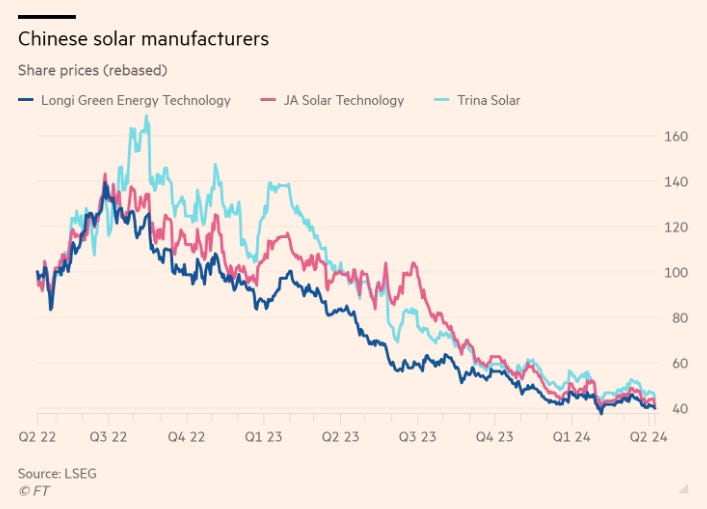

🇨🇳 Chinese solar companies are paying a high price for victory (FT) $ 🗃️

🇨🇳 COSCO Shipping Energy (1138 HK): Surfing the High Tide (SmartKarma) $

Despite YTD strengths in share price, Cosco Shipping Energy Transportation Co. Ltd. (SHA: 600026 / HKG: 1138 / FRA: HIFH / OTCMKTS: CSDXF) is still cheap at 5.7x PER and 0.9x P/B.

VLCC is forecast to stay undersupplied in FY24 and FY25, supporting the rates and CSET’s profitability. YTD, the VLCC rates have recovered by 19.5%.

LNG transportation generated 19% of FY23 earnings. With 40 more vessels on order, compared with a current fleet of 43, there is immense upside from this segment.

🇨🇳 Cosco Shipping Energy 1138.HK – Higher for Longer (SmartKarma) $

The Supply/ Demand imbalance in tankers will persist for longer, supporting earnings

A beneficiary of increased global tensions and higher oil and gas prices

Proposed Stock option scheme incentives management in the right way

🇨🇳 Guoquan Food boosts efficiency. But is that enough for growth-hungry investors? (Bamboo Works)

The hotpot ingredient supplier profited on the home dining craze during the pandemic, but now it’s struggling to adapt as consumers return to more eating out

Guoquan Food Shanghai Co Ltd (HKG: 2517)’s (Website down?) revenue fell 15% year-on-year last year to 6.09 billion yuan, but it managed to post 9.3% profit growth on greater efficiency

The provider of hotpot ingredients for home dining has responded to changes in consumer dining habits, but there’s little space for more efficiency gains this year

🇨🇳 Baicha Baidao IPO: The Bear Case (SmartKarma) $

🇨🇳 CanSino Biologics (688185 CH): Limited Downside Is Seen; Meningococcal Vaccines to Drive Growth (SmartKarma) $

In 2023, CanSino Biologics (HKG: 6185 / SHA: 688185 / FRA: CJH / OTCMKTS: CASBF) generated revenue of RMB561.7 million from the sales of meningococcal conjugate vaccines, up 266% YoY.

This year, consensus is expecting CanSino to report revenue of RMB858 million, up whopping 140% YoY, mainly driven by meningococcal vaccines.

CanSino is expected to add pneumococcal conjugate vaccine (PCV13) vaccine in its revenue stream in 2025. The company’s PCV13i is a potential best-in-class improved PCV13.

🇨🇳 Asian Dividend Gems: Golden Throat Holdings (Asian Dividend Stocks) $

Golden Throat Holdings Group Co Ltd (HKG: 6896) is a gem. It has excellent fundamentals including an eye-catching dividend yield (17.9% in 2023) and a blistering DPS growth (10x from 2020 to 2023).

It also benefits from a compelling long-term theme (relieving sore throats caused by worsening air quality/smog/fine dust problems along with recurrent regular cold/flu symptoms among millions of people in China).

Golden Throat Holdings is one of the leading throat lozenges manufacturers in China. Its net margin averaged 24% from 2019 to 2023.

🇭🇰 ESR: A Diversified Fund Manager and Good Alternative Stock to Own in This Chaotic Time (SmartKarma) $

While most HK/China stocks continue to be traded at depressed valuation, we view ESR as an interesting play among most real estate stocks

The investment highlights of ESR Group Ltd (HKG: 1821 / FRA: 3K6 / OTCMKTS: ESRCF) are: 1) as a leading fund manager with growing AUM and fee income 2) leader in new economy sector, and 3) APAC focused

ESR’s EBIT mainly comes from 3 segments: investment, fund management and new economy development. ESR is now trading at deep discount to NAV

🇭🇰 IH Retail (1373 HK) – 2024 update (Asian Century Stocks) $

Hong Kong’s leading discount retailer down over 50% in less than a year.

I wrote about Hong Kong-based retailer International Housewares Retail (HKG: 1373 / OTCMKTS: IHSWF) back in mid-2023 (International Housewares Retail (1373 HK)). The company operates houseware discount stores in Hong Kong, Macau and Singapore under the “Japan Home” and “JHC” brand names.

Since mid-2023, the stock price has fallen over 50% due to lower sales of pandemic supplies after Hong Kong eased its COVID-19 restrictions.

In this post, I discuss exactly what went wrong since 2023 and what might happen in the future. In the final part of the post, I also project earnings into 2027 and discuss the valuation multiples the stock would end up trading at.

🇭🇰 Giordano CEO voted out after fight with Hong Kong tycoon Cheng (Nikkei Asia) $ 🗃️

New World chief picks new management for struggling Jimmy Lai-founded apparel chain

Shareholders in Hong Kong apparel maker Giordano International (HKG: 0709 / FRA: GIO / OTCMKTS: GRDZF) voted Wednesday to oust its CEO, as a company that once inspired the founder of Uniqlo faces mounting pressure from its top shareholder over long-languishing earnings.

The resolution was submitted by the family of Henry Cheng, who chairs New World Development Company (HKG: 0017 / FRA: NWDA / OTCMKTS: NWWDF) and Hong Kong’s largest jewelry store chain operator, Chow Tai Fook Jewellery Group. The family owns about 24% of Giordano through an investment company.

The Chengs put forward Colin Currie, a former Asia-Pacific managing director at Adidas, to replace Lau as CEO, and two of Cheng’s children as non-executive directors. These proposals passed as well.

🇭🇰 Water Oasis (1161 HK) (Oriental Value) $

Following the positive response to our article on Perfect Medical Health Management (HKG: 1830 / OTCMKTS: PFSMF), we are keen to introduce our readers to another noteworthy company in the healthcare and beauty industry, Water Oasis Group Limited (HKG: 1161 / OTCMKTS: WOSSF).

Despite initial appearances suggesting sluggish revenue growth over the past decade, a deeper examination reveals significant improvements in business quality and consistent shareholder returns through substantial dividends.

This under-the-radar company, we believe, presents an attractive risk-reward profile.

🇹🇼 TSMC: Potential for 60% Upside? (Capitalist Letters)

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is one of the most important companies in the world and it’s a great play for investors. Why? No matter who comes up with the best chip, TSMC will be the one who will manufacture it.

Despite its capabilities, the company stays undervalued in the overvalued semiconductor industry and offers around 60-70% upside potential for investors.

🇹🇼 TSMC’s CHIPS Act Money (The Asianometry Newsletter)

I am frankly tired of doing videos about TSMC for now. So this newsletter is all that we are going to get. Here are some raw thoughts about the TSMC CHIPS deal, based on what I have seen. Add disclaimers – things are subject to change. Memorandum of Intent etc.

🇹🇼 Himax Technologies: Even More Attractive Than Before, But Caution Is Warranted (Seeking Alpha) $

Himax Technologies (NASDAQ: HIMX)‘ revenues and financial metrics have trended down in 2023, causing a decline in its stock price.

The company’s balance sheet is still strong, but uncertainties regarding consumer demand remain.

The company’s outlook depends on the recovery of the automotive and consumer electronics markets, as well as the success of its new products and innovations.

🇰🇷 Coupang: Why I’m sitting out (East Asia Stock Insights) $

Competitive and political risks are being underestimated

Coupang (NYSE: CPNG) is Korea’s leading e-commerce retailer. It operates an asset-heavy model and is known for its fast delivery time and customer-obsessed culture. As the clear winner in Korean e-commerce in recent years, it has become a favorite among Wall Street and foreign investors.

Why am I writing this? As someone who lives in Korea and uses Coupang almost daily, I thought I’d share insights from my dual perspective as both a user and an analyst. I remain a happy user of Coupang. But I have a different opinion on the stock.

🇰🇷 Orion Holdings: Updated NAV, Higher Dividend Yield, and Exhuma Catalyst (Douglas Research Insights) $

Our NAV valuation suggests implied market cap of 1 trillion won or NAV per share of 15,983 won which is 11% higher than current price.

Orion Holdings (KRX: 001800) has attractive dividend yields and payouts. The company’s dividend yield increased from 4.1% in 2021 to 4.6% in 2022 and 5.1% in 2023.

The recent phenomenal performance of the movie Exhuma has resulted in a long-awaited revived positive sentiment on Showbox Corp (KOSDAQ: 086980) (which is 57.5% owned by Orion Holdings).

🇰🇷 Samsung Electronics: Block Deal Sale of 5.2 Million Shares by Lee Boo-Jin (Douglas Research Insights) $

After the market close on 8 April, it was reported that Lee Boo-Jin will sell 5,247,140 shares of Samsung Electronics (KRX: 005930 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) in a block deal (up to 443 billion won).

The expected block deal sale price is 83,700 to 84,500 won per share, which represents a discount rate of up to 0.95% compared to the closing price on 8 April.

We are positive on this block deal sale and on Samsung Electronics. We would take the deal.

🇰🇷 Special Changes in KOSDAQ 150: Deletion (NKMAX) + Addition (GI Innovation) (Douglas Research Insights) $

On 8 April, the Korea Exchange announced special changes to KOSDAQ 150. NKMax Co Ltd (KOSDAQ: 182400) will be excluded from KOSDAQ 150 and it will be replaced by GI Innovation Inc (KOSDAQ: 358570).

NKMAX was designated as “administrative issue” and “investment attention issue” on 8 April 2024, which resulted in the Korea Exchange deciding to remove this stock from KOSDAQ 150.

We believe that this inclusion of GI Innovation in KOSDAQ 150 is likely to further positively impact its share price.

🇰🇷 HD Hyundai Marine Solution IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of HD Hyundai Marine Solution (HD Hyundai Group) is target price of 98,254 won per share, representing an 18% upside from the high end of the IPO price range.

The company’s ROE averaged 67% in 2022 and 2023. In comparison, the comps’ ROE averaged 10.6% in the same period. (HD Hyundai Marine Solution > Comps)

Our base case valuation is based on 24.7x P/E (comps’ average) using our estimated net profit of 178.7 billion won for the company in 2024.

🇰🇷 ICTK IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of (Internet of Things (IoT) security) ICTK is target price of 28,694 won, which is 79% higher than the high end of the IPO price range.

Our base case valuation is based on P/S multiple of 20.8x using our estimated sales of 18.1 billion won in 2025.

ICTK’s operating margin improved from -129.9% in 2022 to -38.2% in 2023. We estimate its operating margin to improve further to -12.4% in 2024 and 17.7% in 2025.

🇸🇬 Digital Core REIT Announced Two Acquisitions Recently: Can its Share Price Revisit its 2022 Highs? (The Smart Investor)

The data centre REIT is working through last year’s problems to try to emerge stronger in 2024.

Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF), or DCR, is on a roll.

The data centre REIT recently announced that it plans to up its stake in two data centres within its portfolio.

A resilient set of earnings

Increasing its stakes in two data centres

Conducting a private placement and arranging debt financing

Sponsor’s pipeline and growth opportunities

Get Smart: Positioned for growth

🇸🇬 DFI Retail Group’s Share Price is Close to its 52-Week Low: Can the Retailer Enjoy a Rebound? (The Smart Investor)

Can the pan-Asian retailer see its share price recover this year?

Investors in DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) have a reason to feel despondent.

Shares of the pan-Asian retailer have lost a third of their value in the past year and are down nearly 13% year-to-date after touching their 52-week low of US$1.98.

DFI Retail Group’s financial numbers, however, paint a different picture

Earnings jumped more than five-fold

A mixed performance

Encouraging business developments

Executing its strategic framework

Get Smart: Healthy guidance for 2024

🇸🇬 China visitor comeback aids Resorts World Sentosa: firm (GGRAsia)

The improvement in volume of Chinese visitors to Singapore “is expected to contribute positively” to the “performance” of the Resorts World Sentosa (RWS) casino resort (pictured) in the city-state, said the venue’s promoter.

Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) was responding, via a voluntary filing to the Singapore Exchange on Friday, to questions submitted by its shareholders ahead of the annual general meeting on April 18.

Restated data issued by Singapore Tourism Board show that first-quarter Chinese visitor volume to Singapore as a whole, lagged the overall recovery rate for the city’s tourism market relative to the pre-pandemic trading period of 2019.

🇸🇬 SGX Has Listed 5 New Singapore Depository Receipts: What Can Investors Expect? (The Smart Investor)

🇸🇬 Wilmar International: It’s All About Margins (Seeking Alpha) $

A potential negative surprise for Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY) could come in the form of delayed rate cuts and elevated finance costs.

On the flip side, WLMIF’s profit margins might be boosted by a recovery in China’s economy and an improvement in Chinese consumer sentiment.

I leave my Hold rating for Wilmar International unchanged, in view of the mixed margin outlook.

🇰🇭 🇭🇰 NagaCorp 2024 revenue might grow 17pct y-o-y: Moody’s (GGRAsia)

The 2024 revenue for Hong Kong-listed Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) is likely to grow by 16.5 percent year-on-year, says Moody’s Investors Service Inc.

The ratings agency thinks such GGR will be US$621 million, versus US$533 million in 2023.

But the casino firm’s margin on earnings before interest, taxation, depreciation and amortisation (EBITDA) is forecast to contract by 2 percentage points, to 35 percent, added Moody’s in a Tuesday note. It cites Moody’s Financial Metrics and its own estimates.

🇮🇳 Case Study – Make My Trip ($MMYT) (Bullish Growth Stocks)

I had several conversations in my trade group about our position in (Indian online travel company) Makemytrip (NASDAQ: MMYT) this past week. Among the discussion topics were:

Most sold into strength. No one bought more. I did nothing and held.

🇹🇷 Hepsiburada: Profits In Sight (Seeking Alpha) $

D-MARKET Electronic Services & Trading or Hepsiburada (NASDAQ: HEPS)‘s shares have declined significantly but show potential for recovery and profitability.

Hepsiburada is Turkey’s leading e-commerce platform with a wide range of products and a large customer base.

I believe the company’s growth prospects and competitive strengths outweigh Turkey’s inflation crisis.

Shares are a buy with price target of $2.50.

🇹🇷 Turkcell: Continue To Execute On Re-Pricing Strategy (Seeking Alpha) $

Turkcell (NYSE: TKC) is a leading telecommunications provider in Turkey.

Turkcell’s stock has performed well, returning nearly 25% since I raised it to a buy rating in November, as it has been able to navigate the hyperinflationary environment.

Looking forward, as long as the company continues to reprice its services at a faster pace than inflation, margins and earnings should continue to expand, driving shares higher.

🇿🇦 Sibanye-Stillwater reveals plans to retrench 4 000 employees & Sibanye’s proposed downsizing toughens unions’ stance ahead of wage talks (IOL)

Sibanye Stillwater Ltd (NYSE: SBSW) has revealed plans to retrench as many as 4 000 employees from its South African gold mining operations as it restructures its operations, defers capital and address losses from non-profitable shafts.

Sibanye is also re-aligning its regional services, shared services and direct services structures to align with the requirements of a reduced operational footprint.

🇿🇦 Sibanye Stillwater: Bet On Growing PGM Deficit (Rating Upgrade) (Seeking Alpha) $

The PGM market is showing signs of improvement. Major automakers announced their intentions to keep ICE production for the foreseeable future.

Sibanye Stillwater Ltd (NYSE: SBSW) 2023 results are promising, considering the PGM bear market. The company took successful cost-cut measures, resulting in $375 million savings.

SBSW maintains its balance sheet with ample liquidity and a prudent capital structure. The company holds $1,397 billion in cash and owes $1,363 in long-term debt.

With higher gold and PGM production figures in FY24 and stronger spot prices, SBSW’s profitability will recover.

PGM miners are cheap, but SBSW is dirt cheap. I give SBSW a Buy rating.

🇿🇦 Gold Fields: Shares Surge Amid Record-High Gold Prices, Still A Value (Seeking Alpha) $

Gold mining companies have participated in the rally, with the VanEck Vectors Gold Miners ETF outperforming the spot gold ETF.

Gold Fields (NYSE: GFI) is a gold producer with reserves in multiple countries. Its earnings and valuation forecasts suggest it is undervalued despite a recent guidance cut.

GFI’s technical situation is mixed, with the stock at key resistance levels, but strong momentum could lead to a breakout.

I point out key price levels to watch in the months ahead.

🇿🇦 Impala Platinum: Excellent Business At An Attractive Price At The Right Time; Rating Upgrade (Seeking Alpha) $

For 2H23, Impala Platinum Holdings (JSE: IMP / LON: 0S2J / FRA: IPHB / OTCMKTS: IMPUY / IMPUF) reached 1.75 Moz refined production and increased its output by 18% to 1.9 6E Moz compared to 1H23.

On December 31, 2023, Impala reported $502 million in cash, $61.8 million in long-term debt, and $193 million in total debt.

Impala trades at 0.93 TTM EV/Sales and 5.33 TTM EV/EBITDA, cheaper than Anglo American Platinum though more expensive than Sibanye.

I am firm believer, that PGMs will surge in the next several months. I am long a few PGM plays and Impala is among them. I upgrade Impala’s rating to Buy.

🇿🇦 Tiger Brands’ new R300m peanut butter plant to reduce costs (IOL)

FOOD producer Tiger Brands (JSE: TBS / FRA: UG5 / UG5A / OTCMKTS: TBLMY / TBLMF) vowed to meet consumers halfway by bringing down the price of Black Cat peanut butter as it officially launched its new R300 million manufacturing plant on Friday.

Consumer research shows that the nearly 100-year-old brand is found in seven out of 10 South African households or in 10 million out of the 15 million households that purchase peanut butter.

The new production plant employs a total of 62 full-time employees, and produces between 10 000 tons and 20 000 tons of ground nuts from local and international markets every year.

🇿🇦 WeBuyCars lists with fanfare on JSE main board (IOL)

SOUTH Africa’s largest used-vehicles seller, WeBuyCars (JSE: WBC), listed on the Johannesburg Stock Exchange (JSE) main board yesterday with a higher-than-anticipated opening price of R20 a share.

WeBuyCars was the second among 10 expected listings for 2024.

As part of its unbundling process from Transaction Capital (JSE: TCP), WeBuyCars listed separately, echoing a growing trend in the JSE’s equity capital markets.

JSE’s head of capital markets Valdene Reddy said the separate listing revealed the effectiveness of unbundling operations in enhancing business growth and increasing capital.

🇿🇦 As WeBuyCars lists, is buying new listings profitable? (MoneyWeb)

🇵🇱 Dekpol SA – Preliminary figures for units & premises 1Q24 (Hidden Zlotys)

(General contracting and property developer) Dekpol SA (WSE: DEK / LON: 0R68) today presented preliminary figures for premises and units sold during the first quarter of the year. The company sold 115 units (up from 93) and 104 premises (down from 108). They currently have 625 premises listed for sale.

🇵🇱 Monnari Trade SA – Preliminary sales figures for 1Q24, insider transactions & continuous buybacks (Hidden Zlotys)

(Clothing products and accessories for women stock) Monnari Trade (WSE: MON / LON: 0LW1) today released preliminary sales figures for 1Q24 of 72.1 mpln (66.5 mpln), a q/q growth of 8.8%. What is somewhat interesting is that this growth (which is just above the 10-year CAGR) has occurred despite that the number of showrooms (q/q) have been decreasing by 8.6% to 213 (from 233). This, of course, suggests a margin improvement during Q1.

🇵🇱 Dino Polska – An Open Book Success in Food Retail (Sleep Well Investments) $

Part Alimentation Couche-Tard (TSE: ATD / FRA: CJA1 / OTCMKTS: ANCTF) part Walmart (NYSE: WMT) with clear expansion like Floor & Decor Holdings Inc (NYSE: FND)

If Walmart and Alimentation Couche-Tard had a baby, it would be Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY). One can recognize Dino’s frugality and expansion strategy in the suburbs in Walmart’s early days and the focus on the smaller convenience store model in Alimentation Couche-Tard (owner of Circle K). In the first 20 years on the stock market, $1 invested in Walmart would have returned $250 or 31% compounded annual growth rate (CAGR), and Alimentation Couch-Tard would have returned $155 or 28% CAGR. Dino is in the 7th year and has already returned $70 or 38% CAGR.

🇵🇱 #26 Dino Polska – A critical view (Kroker Equity Research)

All that glitters is not gold

Lately, I’ve noticed an increasing number of positive analyses on Substack and Twitter regarding Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY), highlighting its growth strategy, financial health, and future outlook. Such unanimous optimism often makes me cautious about potentially “hyped” stocks, prompting a deeper investigation into the underlying facts.

🇵🇹 🇨🇴 Jeronimo Martins: Steeped In History And Reliant On Emerging Markets (Seeking Alpha) $

Jeronimo Martins SGPS SA (ELI: JMT / FRA: JEM / OTCMKTS: JRONY / JRONF) is a multinational food distribution and retail group operating in Portugal, Poland, and Colombia.

The company has a strong focus on regional scale, creating cost advantages in purchasing, distribution, and marketing.

Poland represents the majority of Jeronimo Martins’ business, while Colombia is a rapidly growing market for the company.

🌎 In Latin America’s Slim-Versus-Thor Brawl, Investors Are the Ones Getting Burnt (Bloomberg) $ 🗃️

Note: Mentions a number of telcos.

WOM Chile’s bankruptcy highlights risks in telecom bonds

Companies struggle with competition, costly technology

For most of the past decade, some of the world’s wealthiest investors poured billions of dollars into Latin American telecom companies, betting they would win by luring in customers with cheaper rates.

Now, cut-throat competition and the cost of keeping up with changing technology have left businesses in the region saddled with debt burdens they can’t pay back.

🌎 MercadoLibre: 2024 Financial Model and Valuation Update (The Wolf of Harcourt Street)

What is the fair value of MercadoLibre (NASDAQ: MELI)?

Twelve months ago, I released my initial investment thesis for MercadoLibre (MELI), providing a comprehensive analysis of the business, including a 5-year projected P&L and discounted cash flow valuation. At that time, my analysis indicated that the company was trading 39% below its fair value, and since the report’s publication, the stock has returned 25%. The full report is linked below.

In this update, I present a revised financial model and a fair value assessment. The starting point for this analysis will be the 2023 financial results. I have already shared a detailed Q4 2023 earnings analysis, which can be accessed via the link below.

🇦🇷 MercadoLibre: New Avenues With Ads And Hope With Argentina (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) is a dominant player in the e-commerce market in LatAm. Additionally, it has competitive advantages that are difficult to replicate, such as its logistics.

Among its highly representative peers, the company has the highest margins, the highest ROE, and excellent prospects for new businesses, such as advertising revenue.

Finally, MercadoLibre trades at the lowest PEG in the last two years, which could be a good investment opportunity.

🇦🇷 IRSA Will Face A Challenging H1 2024 And Continues To Be A Hold (Seeking Alpha) $

IRSA (NYSE: IRS)‘s 2Q24 results were impacted by the devaluation of the Argentinian peso, with varying effects on different segments.

The company recorded gains from selling office floors and bartering a terrain, but the overall outlook for fiscal 2H24 (calendar 1H24) is potentially disappointing.

The recession in Argentina is negatively affecting IRS’s main profitability engines, malls and hotels, leading to lower profits.

🇦🇷 Grupo Financiero Galicia: HSBC Argentina Acquisition Adds New Fuel To The Bull Case (Seeking Alpha) $

The stars are aligning for Argentine banks.

Grupo Financiero Galicia Sa (NASDAQ: GGAL) stands out as a key beneficiary.

The buyout of HSBC Argentina adds legs to Galicia’s post-election rally.

🇧🇷 Petrobras: Repeating Past Mistakes, I Don’t Recommend Buying Shares (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) is the largest company in Latin America and is still reaping good results due to its old divestment strategy and focus on core business. However, the strategy changed completely.

The new management’s plans for increased investments and the abandonment of the international price parity policy raise skepticism about the company’s long-term results.

Despite attractive valuation and strong fundamentals, the uncertain actions of the new management and potential political interference pose risks to the investment thesis.

🇧🇷 Odontoprev – LATAM Stocks Investment Analysis #24 (Latam Stocks)

This edition will cover the largest dental insurance company in Brazil, Odontoprev (BVMF: ODPV3). They have over 8.6 million beneficiaries and a network of over 27,000 dentists.

The current valuation seems fair. It’s not overpriced, but it also doesn’t look cheap.

I’m very excited about this write up because for the first time I will be interviewing the CFO of the company, Jose Pacheco, on the LATAM Stocks Podcast!

The episode will be out next week, so be sure to subscribe to the podcast so you don’t miss it!

🇧🇷 PagSeguro: Business Tailwind And Attractive Valuation (Seeking Alpha) $

PagSeguro Digital (NYSE: PAGS) has a disruptive business model focused on SMEs, which has led to systematic growth since 2009.

In the macroeconomic scenario, Brazil has a tailwind as it is cutting interest rates. The interest rate cut cycle causes a reduction in financial expenses, due to lower funding cost.

The company is trading at a discount compared to its peers, which seems like a great opportunity given the company’s track record.

🇧🇷 Zenvia: The Brazilian Underdog (Seeking Alpha) $

Brazilian software company Zenvia (NASDAQ: ZENV) focuses on customer relations management and is comparable to Twilio and Salesforce.

Zenvia recently went public but has seen a cratered stock price due to earn-out funding gap issues.

Zenvia has recently refinanced debt and renegotiated earn-out liabilities on much better terms, resolving funding gap issues, and returning to high profitable growth.

Price target of $4–$4.5 in 12–16 months. Rating company a Buy.

🇨🇱 Enel Chile: A Sound Investment In A Dicey Country (Seeking Alpha) $

Enel Chile (NYSE: ENIC) is a leading South American utility with a portfolio of 8.5GW of installed capacity, including 6.5GW from renewable sources.

The company has achieved remarkable financial results, with current EV/EBITDA of 6.51x and P/E of 5.68x.

It offers a dividend yield of over 10%, and is currently undervalued by 70% according to my DCF analysis.

Dependence on the Chilean economy, however, is a risk that cannot be ignored.

🇨🇴 GeoPark Limited: High Margins, Solid Growth (Seeking Alpha) $

Oil stocks are undervalued despite higher oil prices, creating investment opportunities for those interested in the sector.

GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) is a solid choice due to its high profit margins, growth potential, and cheap valuation.

The company has a strong track record of unlocking value and expects to continue delivering strong earnings as long as oil prices remain high.

Shares are a buy with price target of $15.

🇲🇽 Banamex Update and Mexican Banks’ January Data – First Look at Early 1Q 2024 Trends (SmartKarma)

We explore Citibank’s upcoming division of CitiBanamex and the forthcoming legacy Banamex IPO; given the market’s premium PBV ratios, this should support the Banamex IPO valuation

Sector trends to January show continued loan growth, but headwinds are building; rising funding costs are eroding credit spreads and credit costs are worsening, even though NPL coverage is healthy

Banco del Bajío, S.A. Institución de Banca Múltiple (BMV: BBAJIOO / FRA: 5NT / OTCMKTS: BBAJF) generates an ROE of 28%+, whilst highly capitalized and on more modest multiples than Grupo Financiero Banorte SAB de CV (BMV: GFNORTEO / FRA: 4FN / OTCMKTS: GBOOY / GBOOF); we stay cautious on Banorte, due to the growing risks to returns and valuation

🇲🇽 Economic And Political Uncertainties Make Grupo Aeroportuario del Pacifico A Harder Call Today (Seeking Alpha) $

Mexican airport operators, including Grupo Aeroportuario del Pacifico (GAP (NYSE: PAC / BMV: GAPB)), have experienced a strong recovery in the tourism sector post-pandemic.

GAP’s recent traffic reports show a slowdown in activity, and multiple headwinds, including weaker business activity and airline capacity constraints, could further impact traffic in 2024.

The Mexican government pushed through a surprise hike on concession taxes for airport operators in October of 2023, hurting their profitability further amidst significant labor cost inflation.

GAP offers good leverage to future business travel growth in Mexico (tied to expanded manufacturing activity in the country), but a so-so valuation and concerns about 2024 expectations leave me cautious now.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Fitch Revises Outlook on China to Negative; Affirms at ‘A+’ (FitchRatings)

Fitch Ratings has revised the Outlook on China’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to Negative from Stable, and affirmed the IDR at ‘A+’.

A full list of rating actions is at the end of this rating action commentary.

🇨🇳 The United States takes the top ranking for the 12th consecutive year (Kearney Global Business Policy Council)

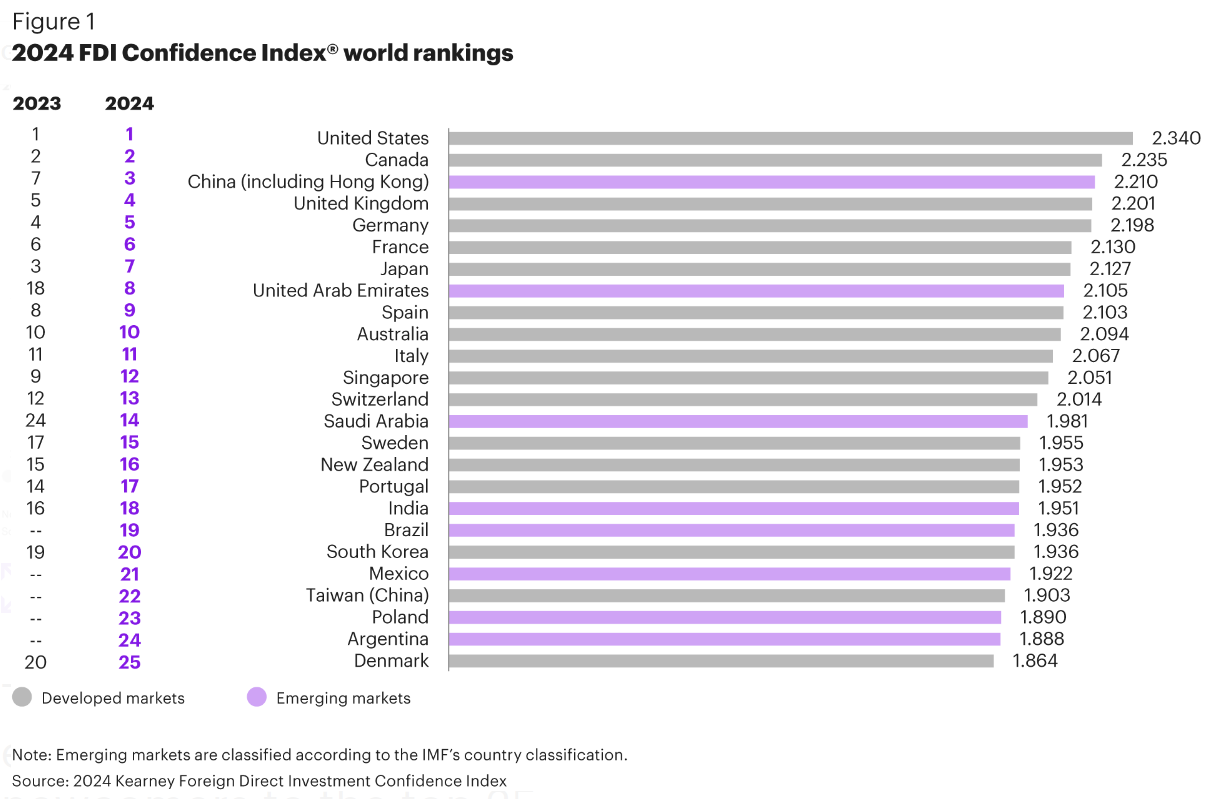

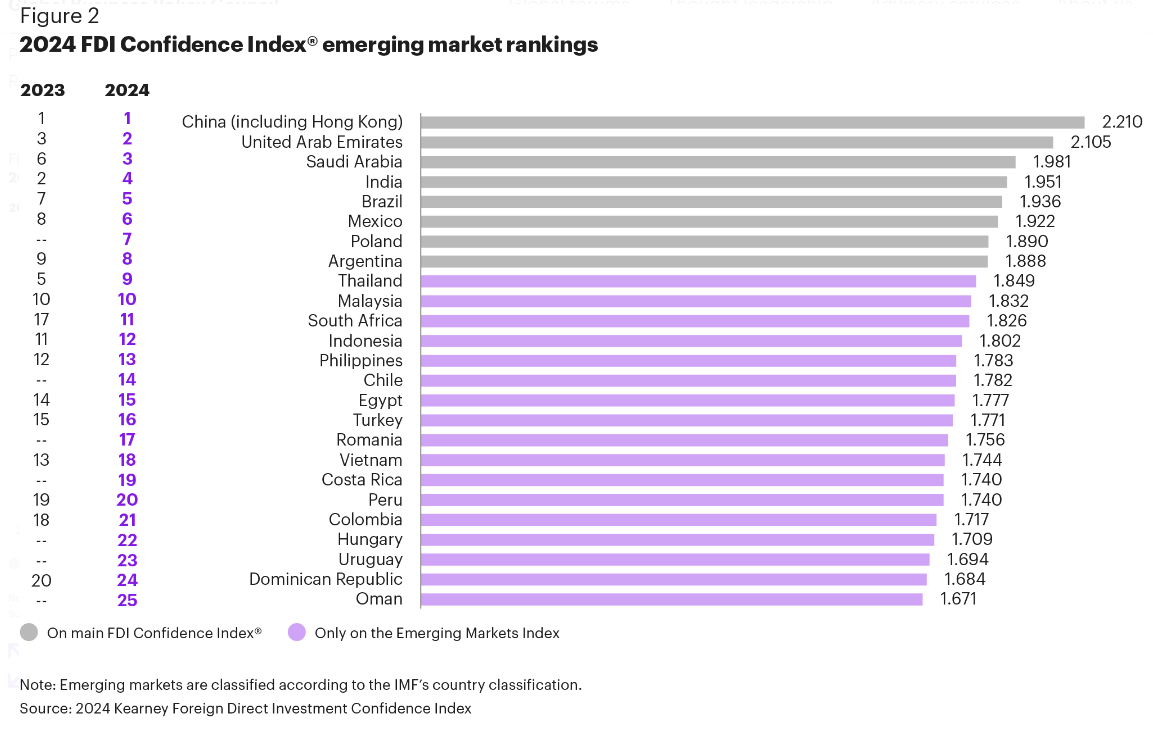

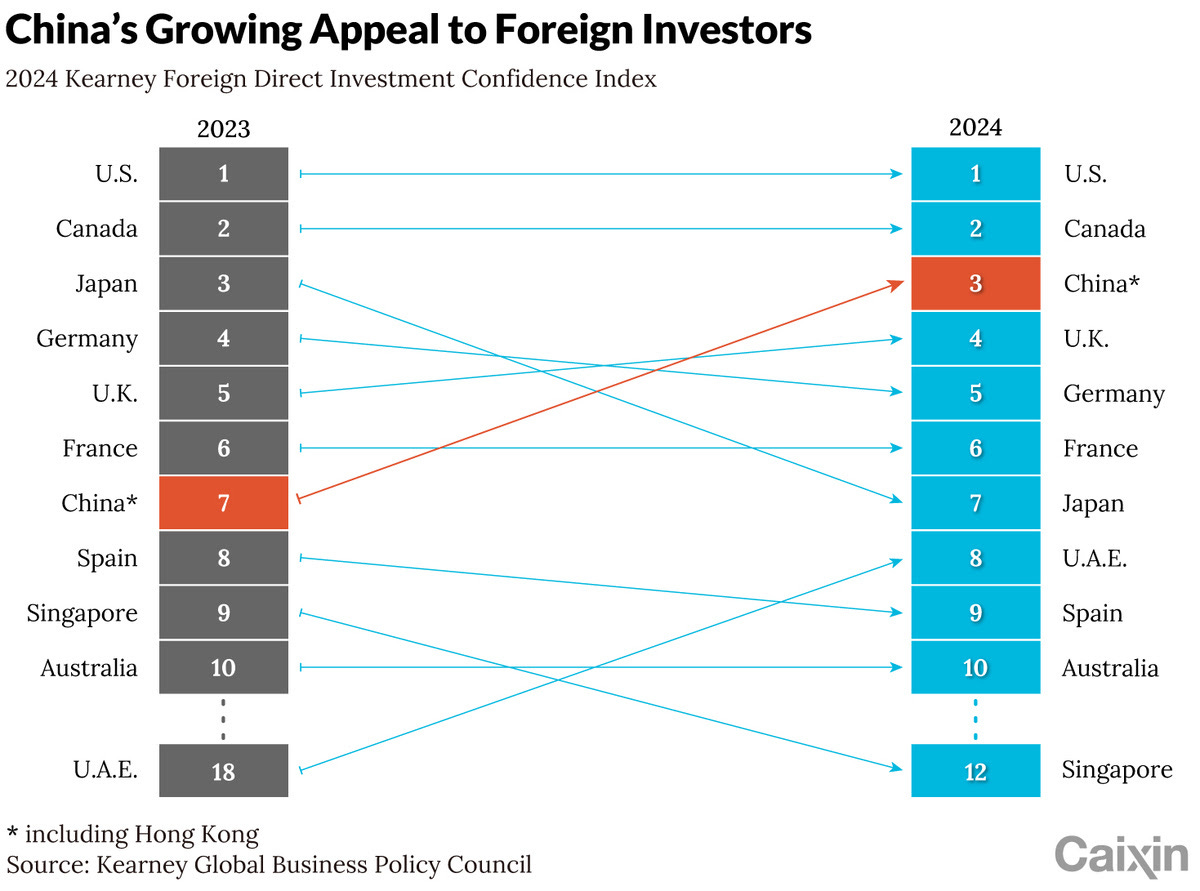

The strength of the US economy—the fastest growing in the G7—and rebounding consumer sentiment likely supported this score. Canada also makes a strong showing, maintaining its second-place rank and forming part of the top five markets for the 12th consecutive year. China jumps from 7th position to 3rd, which could be explained in part by its loosening of capital controls for foreign investors in Shanghai and Beijing in September 2023. And Japan drops from 3rd to 7th, likely reflecting the continuing economic woes of the market, which entered a recession in Q4 2023. Overall, this year’s survey revealed investors’ preference for developed markets, which accounted for 17 of the 25 markets on the Index. However, emerging markets continue to build their presence on the list, with the United Arab Emirates and Saudi Arabia in particular experiencing meteoric rises from 18th to 8th and 24th to 14th, respectively.

China, the United Arab Emirates, Saudi Arabia, India, Brazil, Mexico, Poland, and Argentina make up the top eight positions, and they are the only emerging markets included in the world rankings. Regionally, the Americas has the most markets on the list with nine, followed by Asia Pacific at seven, the Middle East and Africa at five, and Europe at four. Southeast Asia continues to show its strength, with Thailand, Malaysia, Indonesia, and the Philippines all among the top 15. Seven of the 25 markets on the Index—Poland, Chile, Romania, Peru, Hungary, Uruguay, and Oman—joined the list for the first time.

🇨🇳 Charts of the Day: China Rises in Ranking of Favored Foreign Investment Destinations (Caixin) $

China returned to the top three of the world’s most favored destinations for future foreign direct investment (FDI), a new report said, in the wake of the country’s annual FDI sinking to a low not seen in decades.

China jumped to third from seventh place last year on the 2024 Kearney FDI Confidence Index, just below the United States and Canada, according to a report released Wednesday by management consulting firm Kearney’s Global Business Policy Council.

🇨🇳 China’s capital markets activity falls to multi-decade lows (FT) $ 🗃️

🇨🇳 Industrial metal prices jump as investors bet on rising China demand (FT) $ 🗃️

🇭🇰 🇨🇳 Stagnant rents draw mainland retailers to Hong Kong (Caixin) $

More Chinese mainland food and beverage and lifestyle brands are setting up shop in Hong Kong, as the city’s retail rents are expected to maintain low single-digit growth in the near term, according to a new report.

Many popular Chinese F&B chains including tea and coffee brands Hey Tea, Nayuki and Manner Coffee, as well as barbecue restaurant Xia Laotaitai, noodle chain Hefu-Noodle and spicy sauerkraut fish specialist Tai Er are expanding their outlets in the financial hub, according to a report published Wednesday by commercial real estate services firm Cushman & Wakefield.

🇭🇰 Hong Kong’s IPO market is looking up as pipeline grows, while mainland bourses to struggle amid regulatory curbs: Deloitte (SCMP) 🗃️ & Q1 2024 Review and Outlook for Chinese Mainland & HK IPO markets (Deloitte)

Hong Kong’s stock exchange could host 80 new listings in 2024 with estimated proceeds of HK$100 billion (US$12.8 billion), Deloitte China forecasts

Some 155 listings in Shanghai, Shenzhen and Beijing are projected to generate as much as 166 billion yuan (US$22.9 billion) of proceeds in 2024: forecast

🇭🇰 Hong Kong’s IPO market hits a 15-year low, but Deloitte sees silver lining ahead (Caixin) $

Hong Kong’s stock exchange has experienced its quietest first quarter since 2009, with only 12 new listings raising a mere HK$4.7 billion ($600 million), marking a significant downturn in the city’s IPO activity.

This slump has pushed the Hong Kong Stock Exchange down to 10th place globally in IPO proceeds for the early months of 2024, a notable decline from its sixth place ranking throughout the previous year, according to accounting and consulting firm Deloitte.

Despite the subdued start, Deloitte maintains an optimistic outlook for Hong Kong, projecting a rebound with about 80 new listings expected to generate HK$100 billion during the year.

🇲🇴 CLSA cuts 2024 Macau EBITDA forecast, cites op competition (GGRAsia)

Brokerage CLSA Ltd has reduced its 2024 estimate for Macau-market casino operator earnings before interest, taxation, depreciation and amortisation (EBITDA) by 1.2 percent, to HKD68.63 billion (US$8.76 billion), from HKD69.45 billion.

This was due to the ongoing “competitive landscape” among the city’s six concessionaires, and was “1.8 percent… below consensus,” said the institution.

🇲🇴 Macau diversification may bring sovereign upgrade: Fitch (GGRAsia) & Fitch Affirms Macao at ‘AA’; Outlook Stable (FitchRatings)

Fitch Ratings Inc says that Macau’s “sustained economic diversification away from the gaming industry” could lead to “positive rating action or upgrade” to its sovereign rating. The commentary was part of a Friday report in which the institution affirmed Macau’s long-term issuer default rating at “AA”, with a “stable” outlook.

🇹🇼 Taiwanese groups consider overseas headquarters to hedge against Chinese attack (FT) $ 🗃️

🌏 The State of Southeast Asia: 2024 Survey Report (ISEAS) & Majority of ASEAN people favor China over U.S., survey finds (Nikkei Asia) $ 🗃️

🌏 Five top learnings from MW Live Commerce Immersion to China (Momentum Works)

The rapid development of live commerce in Southeast Asia has disrupted the ecommerce status quo in the region. So it is not surprising that many in the ecosystem, including enablers, MCNs, brands and investors , have been asking us:

“How do we get involved in live commerce?” ” how shall we do it effectively and profitably?” “What exactly is the formula for success in these areas?” “Shall we pivot our strategy?” “How soon will AI, especially digital humans, disrupt the sector?”

Digital humans are already widely adopted in live commerce

To win in a crowded market, you need the right strategy and positioning

“Top hosts are created by luck. A successful MCN depends on data & SOPs”

Every Chinese player is expanding to Southeast Asia, and looking for partners

“Come to Hangzhou for your next immersion”

🇿🇦 South Africa’s bickering opposition fractures ahead of national vote (FT) $ 🗃️

🇿🇦 SA financial markets face perfect storm as volatile geographic tensions brew (IOL)

The Resource 10 Index jumped by more than 8% since the previous Friday. Financials and Industrial shares – which are more of a representation of domestic economic prospects facing the higher oil price, weaker rand, election uncertainty and another sharp increase in electricity prices at the beginning of June – are losing much ground. Industrials lost 2% last week, while the Financial 15 index traded down by 3.2% since the previous Friday.

This coming week, the economic calendar for domestic indicators awaits the release by Statistics South Africa of the country’s inflation data for March on Wednesday. It is expected the main inflation rate will come down from an annualised 5.6% in February to 5.4% in March. Also on Wednesday, Stats SA will announce the country’s retail sales numbers for February. It is expected that sales at retail shops decreased in real terms by -1.8%, better than the -2.1% in January.

🌐 Era of bribes is over, say commodities trading chiefs (FT) $ 🗃️

🌐 Closed-end funds at a discount (Asian Century Stocks) $

Closed-end funds are actively managed investment vehicles that rarely receive new money from investors. Instead, they trade like stocks and often at discounts to their net asset values.

While the risk of trading at a discount to net asset value may seem to suggest that closed-end funds are inferior, I also think that the lack of redemption pressure allows fund managers to invest for the long term, even in illiquid securities, if they choose to.

I have compiled a list of 49 closed-end funds focusing on equities in the Asia-Pacific region, most of which are listed in the United Kingdom or the United States.

Towards the end, I highlight five closed-end funds worth paying attention to.

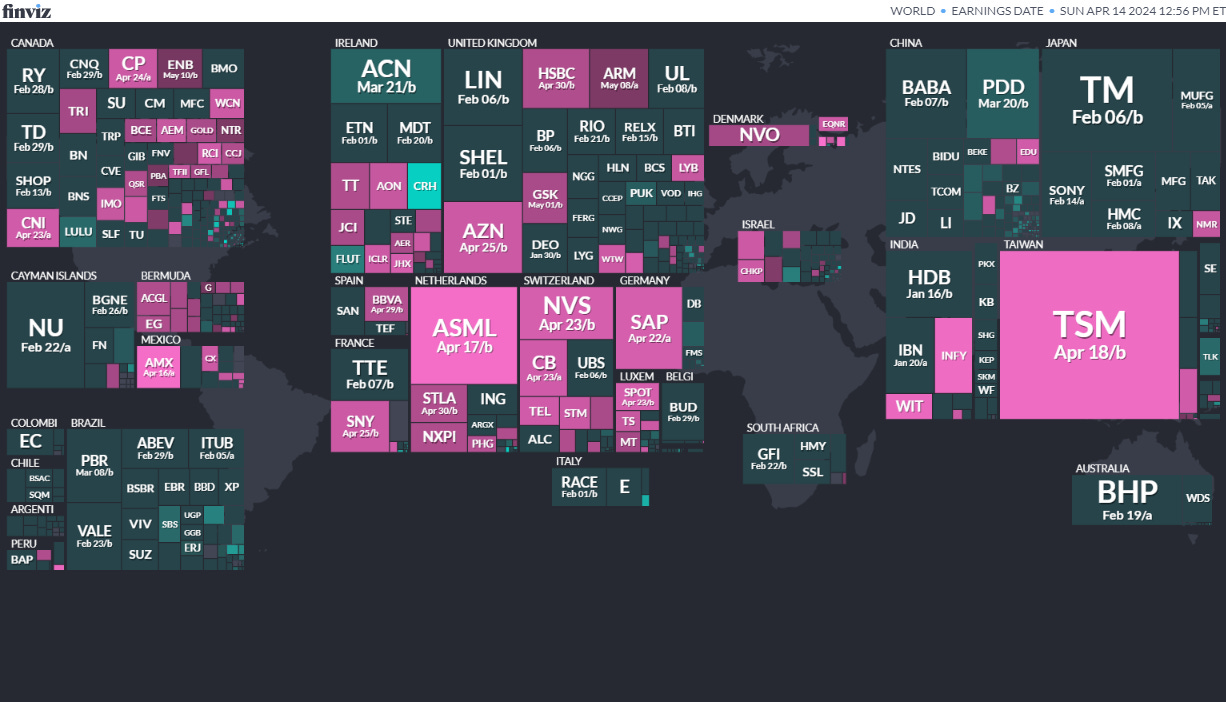

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

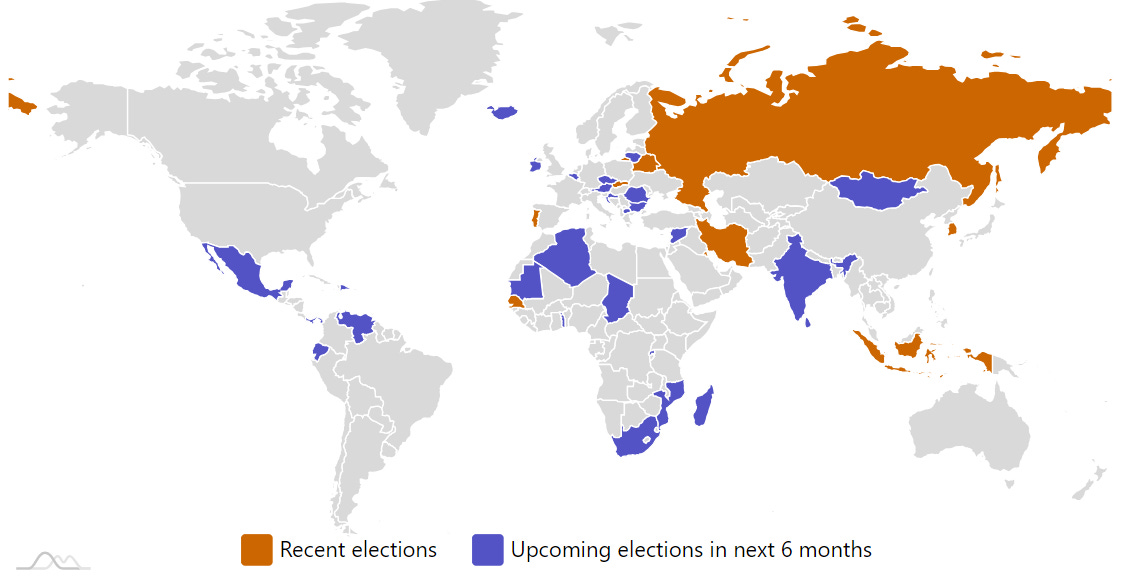

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

South KoreaSouth Korean National AssemblyApr 10, 2024 (d) Confirmed Apr 15, 2020 -

Croatia Croatian Assembly Apr 17, 2024 (d) Confirmed Jul 5, 2020

-

India Indian People’s Assembly Apr 19, 2024 (d) Date not confirmed Apr 11, 2019

-

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

-

Panama Panamanian National Assembly May 5, 2024