Emerging Market Links + The Week Ahead (April 7, 2025)

The billionaire/corporate/Wall Street controlled media is hyperventilating about Trump’s tariffs; but alt-media is already reporting a different story e.g. Vietnam, Taiwan Capitulate: Offer To Remove All US Tariffs, Boost Investment (ZeroHedge) 🗃️.

Here’s another example: There has not been much talk lately or concern about tariffs in the California almond industry press or among almond farmers (in sharp contrast to what the corporate media talks about when they do talk about the industry).

India now is probably the single most important export market for California almond farmers (along with the growing Middle East region) and they have long had 20%+ tariffs on California almonds. So Trump’s (I guess) 26% blanket tariff on India leaves room for negotiation to everyone’s eventual benefit…

For investors, Motley Fool has this piece about the only publicly listed almond stock:

🇦🇺 This ASX agricultural stock could be a major winner of Trump’s tariffs 🗃️

This company could see a boost in a demand as a result of this trade war.

That company is Select Harvests Ltd (ASX: SHV / FRA: H0I / OTCMKTS: SHVTF), Australia’s largest listed almond producer. It operates 15 farms across Victoria, New South Wales and Australia.

The US imposed a further 35% tariff on Chinese imports last week, bringing the cumulative levy to 54%. China has responded with its own tariffs, including an additional 10% on Californian almonds, raising total tariffs to 35%.

And:

To counter these tariffs, Californian almond growers will need to either absorb the costs or pass them on to consumers through higher prices. Given how competitive almond pricing is, the latter option would likely crush demand, which would benefit Australian almond growers.

This is nonsense and the usual anti-tariff talking points. China is still buying California almonds the same way Europe buys Russian oil and gas – via other countries like Vietnam… IF any US-Vietnam tariffs get renegotiated, I suspect almond exports to Vietnam will see another increase (like during Trump’s last “trade war”).

California almond (along with walnut) prices are also up as the overplanting has stopped, the overhang from Covid supply chain disruptions have finally been cleared, and the overleveraged (and often private equity) players are or have been forced out by the low prices for the past 4+ years.

In addition, last summer’s heat wave along with leveraged farmers not properly maintaining their orchards due to low prices (plus some recent fickle weather) seems to have impacted the Nonpareil bloom as those nuts aren’t setting right (but self-pollinating varieties like what I planted on my parent’s property appear to be doing just fine). This should further support almond prices and maybe drive them higher for the incoming crop – to the benefit of both Californian AND Australian farmers. It will also help to offset any short-term pain higher tariffs might cause while trade negotiations take place (and don’t forget, Trump kicked back alot of tariff money to farmers the last time around…).

In other words, pay closer attention to a specific industry’s press and what people within an industry (who hopefully aren’t just parroting the corporate media) are saying – not just what the corporate media is reporting.

(However and if I was an Australian farmer, I would be leery of planting new orchards or becoming too dependent on exporting to China – as companies or sectors in Korea, Taiwan, and Japan have found out the hard way…)

$ = behind a paywall

-

🌐 Emerging Market Stock Picks (Early April 2025) Partially $

-

Myanmar/Thailand earthquake impacted stocks

-

🇹🇼 Taiwan – Yue Yuen Industrial Holdings & Minth Group

-

🇮🇩 Indonesia – Mitra Adiperkasa Tbk PT, Perusahaan Gas Negara Tbk PT, PT Trimegah Bangun Persada Tbk, Indofood CBP Sukses Makmur Tbk PT, Indofood Sukses Makmur Tbk PT, Bank Jago Tbk PT, Bukit Asam Tbk PT, Alamtri Resources Indonesia Tbk PT, Bank Mandiri (Persero) Tbk PT, Bank Negara Indonesia (Persero) Tbk PT, Bank Rakyat Indonesia (Persero) Tbk PT, Sumber Alfaria Trijaya Tbk PT, AKR Corporindo Tbk PT, First Resources Ltd, Bank Central Asia Tbk PT & GoTo Gojek Tokopedia PT Tbk

-

🇵🇭 Philippines – Emperador

-

🇸🇬 Singapore – ComfortDelGro Corporation Ltd, CapitaLand India Trust, Digital Core REIT, Daiwa House Logistics Trust, Singapore Technologies Engineering Ltd, CapitaLand Integrated Commercial Trust, IFAST Corporation & Mapletree Industrial Trust

-

🇹🇭 Thailand – AEON Thana Sinsap Thailand PCL, Home Product Center PCL, Amata Corporation PCL, Osotspa PCL, Central Pattana PCL & TQM Alpha PCL

-

🇿🇦 South Africa – CA Sales Holdings, Rainbow Chickens, Remgro Ltd, Premier Group, Stadio Holdings, Curro Holdings, MTN Group & Sun International Ltd

-

🇲🇽 Mexico & Central America – Wal-Mart de Mexico SAB de CV, Alfa SAB de CV, Fibra Monterrey SAPI de CV, America Movil SAB de CV & Grupo Aeroportuario

-

-

🌐 EM Fund Stock Picks & Country Commentaries (April 6, 2025) Partially $

-

AI bubble (Nvidia/CoreWeave/DeepSeek), all about Trump’s tariffs (impact on Vietnam, etc), BYD’s EV dreams, rediscovering South African stocks, Asian/EM debt, fund updates/annual reports, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🌏 Asian defense and industrial winners in the Trump Era? (Pyramids and Pagodas)

How shifting US policies could prove to be a boon for certain companies in Japan, South Korea, and Hong Kong

One unintended consequence of Trump’s unpredictable and heavy-handed negotiating tactics is that customers of US defense manufacturers (both in countries with friendly and not-so-friendly US ties) are increasingly looking elsewhere to mitigate the risk of being cut off from US technology. This also comes at a time when geopolitical tensions in Asia are ramping up, with Korean and Japanese defense manufacturers enjoying robust demand domestically and from neighboring countries.

Hanwha Aerospace (KRX: 012450), a South Korean defense and aerospace company with a market cap of USD 19.45 billion, is streamlining operations to focus on defense technologies across land, sea, air, and space.

Notably, we identified two companies from Hong Kong/China: Continental Aerospace Technologies Holding Limited (HKG: 0232 / FRA: CTQ0) (0232.HK; “Continental Aerospace”) and Cirrus Aircraft Ltd (HKG: 2507 / OTCMKTS: CRRSF) (2507.HK; “Cirrus”) with market caps of USD 136 million and USD 1.78 billion respectively.

🇨🇳 Mistress Economics (The Great Wall Street – Investing in China)

Forget GDP—Find Out What Your Gucci and Louis Vuitton Investments Really Depend On

Forget GDP figures. If you really want to understand China’s economic health, look no further than the Mistress Spending Index (MSI)—a much more revealing indicator than official reports.

Boom times – Burberry bags, Cartier bracelets, and luxury condos sell like hot dumplings. Mistresses thrive.

Slowdowns – Discretionary spending contracts, mistresses pivot to “affordable luxury,” and suddenly, Chanel sales dip.

Crises – Mass mistress layoffs. Some even downgrade from luxury apartments to self-sufficiency.

And if you invest in Louis Vuitton, Gucci, Hermès, or Cartier, let’s be honest—you’re not just betting on high-end fashion. You’re secretly betting on the Chinese mistress economy.

🇨🇳 Frenemies No More? How Trump’s Tariffs Might Push China and Japan Into Each Other’s Arms (KonichiValue Japan)

And when two powers face a shared threat, they sometimes, just sometimes, stop glaring at each other and start talking.

That’s my central thesis: Trump’s hammering has made Japan and China desperate enough to rethink their frosty posture toward each other.

The truth of the matter is that Japan and China has much more in common than either country has with the US!

🇨🇳 Fitch downgrades China’s sovereign debt over spending and tariffs (FT) $ 🗃️

🇨🇳 A brief history of quick commerce in China (Momentum Works)

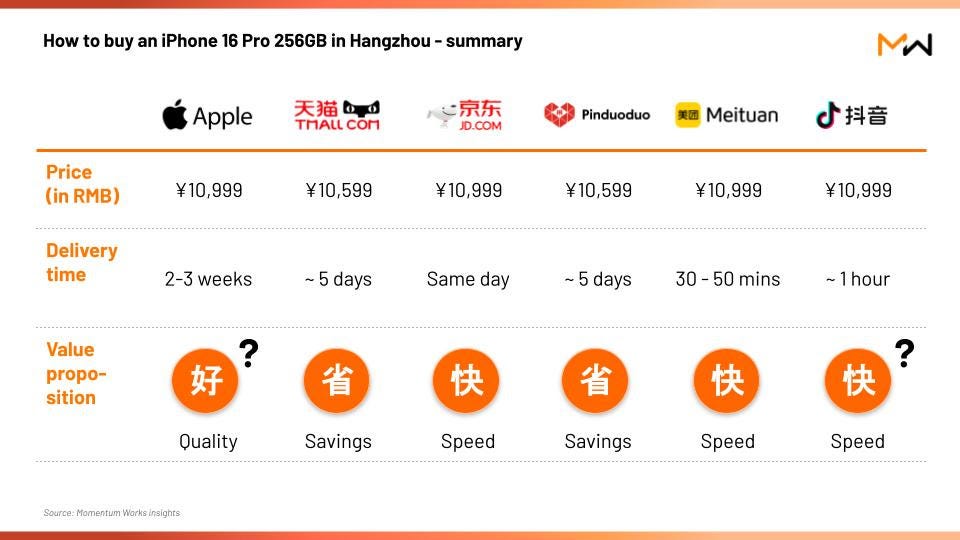

In February this year, JD.com (NASDAQ: JD), a leading ecommerce platform in China, entered the food delivery market. We said then that JD’s real intention might be disrupting Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY)’s aggressive move into quick commerce, which erodes JD’s dominance in the premium customer segment in China.

Few realise that JD was once a pioneer in the space of quick commerce in China. Here is a brief history of quick commerce in China, excerpted from a blog post written by Zouma Caijin, a China-based blogger and stock analyst focused on the digital economy. Please note that the opinions expressed here are of the author, not Momentum Works.

🇨🇳 After 14 years of losses, Zhihu finds an answer to its profitability question (Bamboo Works)

The company, sometimes called the Quora of China, is banking on growth from a new AI tool to improve expert-supplied answers to user questions

Zhihu Inc (NYSE: ZH) reported its first-ever profit in the fourth quarter, though its revenue fell by 25% as its marketing and education services both reported big declines

The knowledge-sharing platform may have found a winner in its new Zhida.ai platform, which uses AI to enhance its core Q&A services

🇨🇳 China’s Didi enters Brazil’s food delivery market (Momentum Works)

We have confirmed with credible sources that the launch is indeed happening. DiDi Global (OTCMKTS: DIDIY)’s food delivery service in Brazil will operate under the brand 99food, taking the name of the Brazilian ride hailing platform Didi acquired in 2018.

Didi also attempted food delivery in Brazil under the 99food name between December 2019 and September 2022. However, breaking through Brazil’s market proved to be a bigger challenge, with leading incumbent iFood owning more than 80% of the market share.

People familiar with the matter told us that the urgency of Didi’s food delivery launch in Brazil is to stay ahead of Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY), whose international subsidiary Keeta has been expanding aggressively.

Keeta’s incursion into Saudi Arabia last year gave a glimpse of how it chose a market:

Some investors we spoke to are a bit worried about Didi’s increased spending by launching food delivery in Brazil, especially when the global equity market is under turmoil.

🇨🇳 BitFuFu rides crypto wave, flexible business model to lofty profits (Bamboo Works)

The provider of digital asset mining services is growing its portfolio of self-operated mining machines and data centers as high crypto prices fuel strong revenue and earnings gains

BitFuFu Inc (NASDAQ: FUFU / FUFUW)’s revenue grew 63% in 2024, as its annual net profit surged more than fivefold

The provider of digital asset services is benefitting from the latest cryptocurrency boom, and is now looking to boost its own mining operation to improve profitability

🇨🇳 The relentless innovation fuelling China’s ‘brutal’ car wars (FT) $ 🗃️

🇨🇳 Xiaomi Shares Slide After SU7 Sedan With Intelligent Assisted Driving Crashes, Three Dead (ZeroHedge)

Shares of Chinese electric vehicle manufacturer Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) tumbled in Hong Kong trading on Tuesday following a deadly crash involving one of its SU7 sedans, which claimed three lives on Saturday. The accident has intensified scrutiny over the safety of advanced driving systems, as data from the vehicle has been turned over to local authorities for investigation.

“Investors might have concerns over Xiaomi’s competitiveness and growth outlook after reports of the car accident,” Shen Meng, director at Beijing-based investment bank Chanson & Co., said, adding that the completion of the share sale has “also weighed on sentiment.”

🇨🇳 BYD (1211 HK): God’s Eye & Potential HSTECH Index Inclusion (Smartkarma) $

🇨🇳 In Depth: The battle for control over a billion-dollar satellite firm (Caixin) $

What happens when a Chinese company’s founders fall out with their powerful investor?

For the past more than six years, the founding team of Chengdu CORPRO Technology Co Ltd (SHE: 300101) has been pitted against the company’s biggest investor in a struggle for control of the billion-dollar Chinese satellite-equipment maker.

The case drew attention from both technology and legal communities, highlighting the challenge courts face in resolving corporate deadlocks — balancing the need to maintain business continuity while protecting minority shareholders’ rights.

🇨🇳 Blue Orca is Short Hesai Group (Blue Orca Capital)

We are short Hesai Group (NASDAQ: HSAI) (“Hesai” or the “Company”), which in our opinion is a Nasdaq-listed Chinese scam actively lying to investors, the Department of Defense, and a United States federal court. In our view, it dishonestly attempts to escape its designation as a “Chinese military company” by insisting that it has no involvement with the Chinese military. Yet, we found clear smoking-gun photographic and video evidence that Chinese military vehicles are outfitted with Hesai LiDAR systems. Nor do we trust Hesai’s financial disclosures. It claims revenues that, in our opinion, do not appear to be consistent with the purchasing volumes of its largest customer. It claims industry leading margins which defy the laws of financial physics. It claims that its business has finally turned a corner to sustained profitability while failing to disclose to investors that it has lost its largest customer and it is laying off up to 30% of its employees. In short, we think Hesai is full of lies, from its suspect financials to its denials made to the government and in court regarding its LiDAR and the Chinese military. In our opinion, it is completely untrustworthy as a business and uninvestable as a stock.

🇨🇳 Skyworth (751 HK): Another Buyback (Smartkarma) $

On 27 March, (consumer electronic products) Skyworth Group Ltd (HKG: 0751 / FRA: KYW0 / KYW / OTCMKTS: SWDHY / SWDHF) launched a conditional buyback to acquire a maximum of 350.0m shares (15.67% of outstanding) at HK$3.11, a 15.2% premium to undisturbed price.

Unlike the previous buybacks, the controlling shareholder can vote. Therefore, while the buyback offer is unattractive, the shareholder vote will pass.

Based on the irrevocables, a 100% share minority participation rate implies a minimum proration of 37.84%. The actual proration was around twice the minimum proration for the previous two.

🇨🇳 Three Stocks: A turnaround, a profitable net-net with massive buybacks and a new pick. (The Great Wall Street – Investing in China)

Updates on an old pick, a net-net that’s now profitable, and a brand-new idea

Recently I wrote an article about Tongdao Liepin (talent acquisition services Tongdao Liepin Group (HKG: 6100 / FRA: 6WT / OTCMKTS: TGDLF)) as an investment idea. Since then, things have been quietly moving in that direction—just as predicted.

Not just Alibaba (NYSE: BABA)—hiring is picking up across the board. HR departments are stretching again after a long hibernation.

This is where Liepin comes in. The AI boom is no longer confined to tech firms. Everyone wants in—property developers, tutoring firms, cement mixers—name a sector, and you’ll find someone proudly announcing they’re “implementing AI,” preferably DeepSeek. Naturally, they’ll need people to actually do that work. That’s where Liepin sits: right at the source of high-quality talent, handing out engineers like hot dumplings

🇨🇳 Lianhe Sowell launches listing into stock market storm (Bamboo Works)

The machine vision company’s shares tumbled on their second trading day last Friday, as it searches for a formula to jumpstart its stalling growth

Lianhe Sowell International Group Ltd (NASDAQ: LHSW)’s shares rose on their trading debut last Thursday, but tumbled the next day amid a broader market selloff on fears of a global trade war

The machine vision company’s recent rapid revenue growth came to a sudden halt in its latest reporting period

🇨🇳 ZJK Industrial Is A Boring Nuts And Bolts Manufacturer – Evidence Suggests Their Claimed Collaboration With Nvidia Is A Lie (White Diamond Research)

ZJK Industrial Co Ltd (NASDAQ: ZJK) is a Chinese precision fastener company (it makes nuts and bolts), it’s not an AI or liquid cooling system company.

ZJK claims to have a collaboration with Nvidia to manufacture liquid cooling systems, and is an “approved vendor”. Our evidence shows that this is false – there’s no connection whatsoever between the two companies.

Pre-IPO investors, which include related parties, were able to buy 60M shares at 7c apiece. The lock-up expiry is on 3/31/25.

Nvidia doesn’t assemble liquid cooling systems itself, it buys the whole thing from companies like Vertiv Holdings Co (NYSE: VRT) or CoolIt Systems, therefore would have no reason to collaborate with a nuts and bolts company like ZJK.

Google Maps reveals that ZJK’s North American office is a residential house, which suggests they have little to no business in North America.

Nvidia investor relations responded to our inquiry and confirmed that they have no partnership with ZJK.

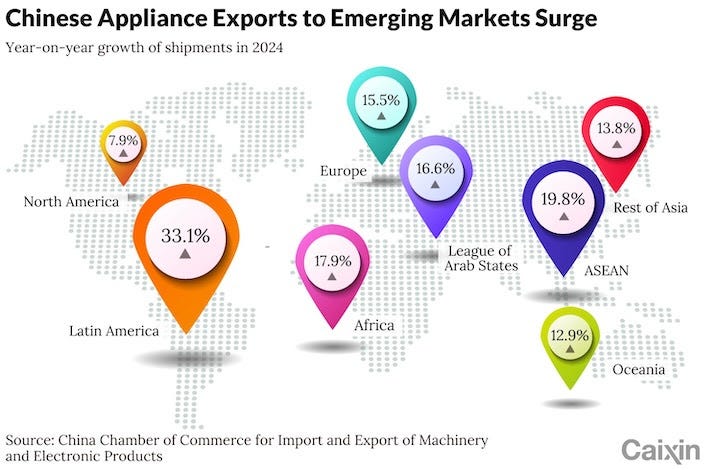

🇨🇳 In Depth: China’s Appliance-Makers Hunt Emerging Market Growth (Caixin) $

From emerging markets to premium segments, China’s home-appliance makers are hunting for new growth overseas, as their home turf has become saturated.

Companies are also ramping up investment in brand recognition and local manufacturing bases abroad, as more shift from their traditional role as third-party producers for foreign brands to carving out markets for their own marques.

🇨🇳 Chinese Banks Are Told to Expand Consumer Lending (Carnegie Endowment)

The result may be significant and bode well for economic growth in the short term, but over the longer term, what will matter is the impact of these positive short-term outcomes on overall confidence.

🇨🇳 Jiayin cashes in on China’s efforts to boost consumer spending (Bamboo Works)

The fintech lender’s revenue from its main business jumped in last year’s fourth quarter as China rolled out a series of measures to stimulate its economy

Jiayin Group Inc (NASDAQ: JFIN)’s revenue from its main loan facilitation services rose 46% in last year’s fourth quarter as it predicted more strong growth for that business this year

The company’s business boomed as Chinese policymakers sought to boost the country’s economy through a new series of private consumption stimulus measures

🇨🇳 Overseas losses put wrinkle in H World’s welcome mat (Bamboo Works)

The hotel operator’s overseas revenue grew last year, but its widening losses sharply dragged down the company’s overall profit

H World Group (NASDAQ: HTHT) reported its profit dropped nearly 27% in 2024, including a 93% plunge in the fourth-quarter

The hotel company’s overseas business recorded an operating loss of more than 400 million yuan last year

🇨🇳 DPC Dash serves up banner 2024 topped with milestones (Bamboo Works)

The operator of Domino’s Pizza restaurants in China said its revenue rose 41% last year, as it announced plans to accelerate its new store openings in 2025

DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF) reported its first-ever annual profit in 2024, as its revenue rose 41% and it passed the 1,000-store milestone

The operator of Domino’s Pizza restaurants in China plans to open 300 new restaurants this year, with a strong focus on ‘new growth markets’ outside Beijing and Shanghai

🇨🇳 Embattled developer R&F sells most of its overseas assets (Caixin) $

Guangzhou R&F Properties Co Ltd (HKG: 2777 / FRA: G5HA / OTCMKTS: GZUHF) has offloaded nearly all of its overseas assets as the embattled Chinese real estate giant grapples with a worsening liquidity crunch.

The company “has almost entirely monetised key overseas assets for restructuring and liability management” over the past fiscal year, Chairman Li Sze Lim said in the developer’s 2024 annual financial report.

🇨🇳 Shiyue Daotian reaps profits on bumper move to corn (Bamboo Works)

The grain seller’s record corn sales were the highlight of its 2024 results, underscoring the brand’s potential to hop on the healthy food bandwagon

Shiyue Daotian Group (HKG: 9676) recorded a net profit of 204 million yuan in 2024, swinging back to the black after three years of losses

Revenue from the grain seller’s corn products surged 5.3 times last year to 815 million yuan, accounting for 14% of its total

🇨🇳 Dispute over Covid vaccines casts doubt on Clover Bio recovery (Bamboo Works)

The Chinese biopharma firm faces a potentially damaging fight over a $224 million upfront payment it received in an ill-fated deal to supply Covid vaccines

The Gavi international vaccines alliance has demanded a refund from Clover Biopharmaceuticals Ltd (HKG: 2197) after scoring a victory in a similar contract disagreement with Novavax

Vaccine delays and strained finances have sent Clover Bio’s stock tumbling from an IPO price of HK$13.38 to just HK$0.24

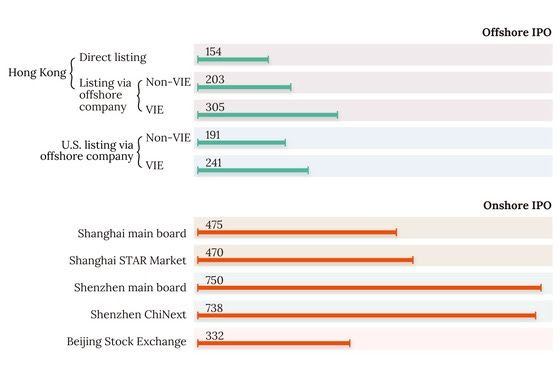

🇨🇳 In Depth: China Gears Up for Overseas IPO Bonanza (Caixin) $

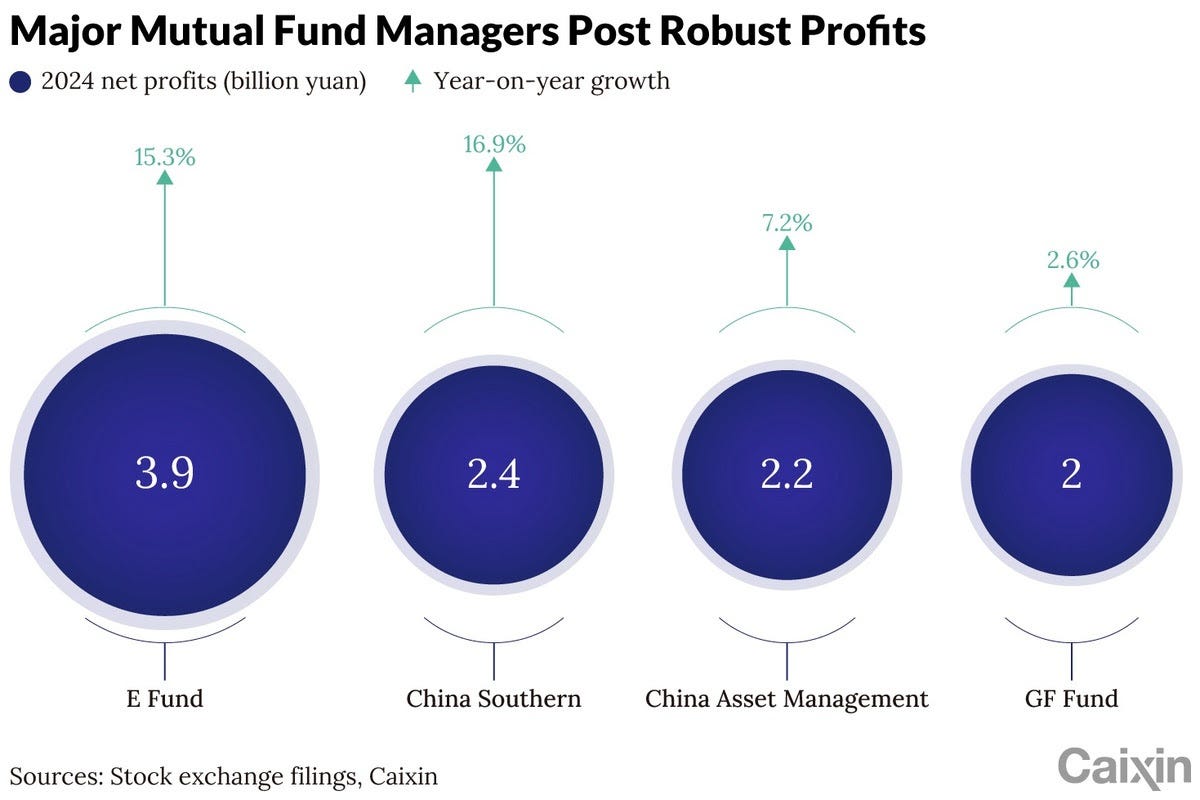

🇨🇳 Diverging Profits Show How Size Matters for China’s Mutual Fund Firms (Caixin) $

Profitability among China’s mutual fund managers has continued to diverge, as larger players better equipped to navigate regulators’ sweeping fee cuts reported strong performance, in stark contrast to smaller rivals.

While industry leaders saw net profit jump as much as 17% in 2024, their small and midsize counterparts reported declines of up to 42%, according to Caixin’s analysis of recent stock exchange filings.

🇨🇳 Chagee Holdings IPO Preview (Douglas Research Insights) $

Chagee Holdings (CHA US) is getting ready to complete its IPO on NASDAQ in the next several weeks. Chagee is one of the largest premium tea chains in China.

The company’s sales and profits have been exploding higher in the past three years. Its sales jumped from 0.5 billion RMB in 2022 to 12.4 billion RMB in 2024.

Chagee could raise more than $500 million in this IPO. However, this is subject to change.

🇨🇳 Chagee Holdings (CHA US) IPO: The Bear Case (Smartkarma) $

Chagee Holdings (CHA US), a leading premium tea drinks brand, is seeking to raise US$400-500 million through a Nasdaq IPO.

In Chagee Holdings (CHA US) IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

The bear case rests on unsustainable growth rates, pressure on KPIs, signs of margin pressure, increasing S&M expenses and weakening forward growth indicators.

🇭🇰 Richard Li’s Pacific Century Distances Itself from CK Hutchison’s Global Port Sale (Caixin) $

Richard Li’s Pacific Century Group has made clear that all its businesses operate independently following inquiries from Chinese mainland partners about CK Hutchison (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF)’s planned sale of its global port assets.

The clarification came amid public and political scrutiny of CK Hutchison’s pending $19 billion deal to sell its 43 port operations across 23 countries — including key terminals at either ends of the Panama Canal — to a consortium led by U.S. asset manager BlackRock. The deal is expected to be finalized by April 2.

🇭🇰 CK Hutchison clarifies no decision made on telecom assets spin-off (Caixin) $

CK Hutchison (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF), controlled by Hong Kong billionaire Li Ka-shing’s family, said on Monday in a stock exchange filing that it has not made any decision on its global telecom business, following media reports about a potential spin-off for a London listing.

“From time to time, the Group receives proposals and explores and evaluates opportunities that may be available, with a view to enhancing long term value to shareholders, including possible transactions relating to the assets and operations of the company’s global telecommunication business,” the board of the conglomerate said.

🇲🇴 Trump’s policy actions increase risk for U.S. casino operators in Macau: Morningstar (GGRAsia)

Equity research provider Morningstar says “geopolitical and U.S. policy actions increase the risk premium” for the stock prices of American casino operators with exposure to Macau’s gaming market.

Morningstar Equity Research said in a stock note on Thursday that it had adjusted its cost of equity assumptions for U.S.-listed casino operators Wynn Resorts Ltd (NASDAQ: WYNN), Las Vegas Sands (NYSE: LVS), and MGM Resorts International (NYSE: MGM) “due to their exposure to Macau” and “increasing geopolitical tensions between the U.S. and China.”

“Our reduced fair value estimates are US$53 per share for Las Vegas Sands (US$56 prior) and US$46 per share for MGM Resorts (US$49 prior),” wrote Dan Wasiolek, senior equity analyst at Morningstar.

“Our fair value estimate on Wynn Resorts’ shares remains at US$111,” he added.

🇲🇴 Melco Resorts & Entertainment: Discounted Way Into Asia-Pacific Gambling Recovery (Seeking Alpha) $ 🗃️

🇲🇴 Melco Resorts & Entertainment: I’m Starting To See A Brighter Tomorrow (Seeking Alpha) $ 🗃️

🇲🇴 🇱🇰 Melco says 20-year gaming licence in Sri Lanka, to pay US$16.8mln fee (GGRAsia)

Hong Kong-listed Melco International (HKG: 0200 / FRA: MX7A / OTCMKTS: MDEVF), the parent of casino firm Melco Resorts & Entertainment Ltd (NASDAQ: MLCO), says its licence to run a gaming venue in Sri Lanka is valid for a “term of 20 years effective from 1 April 2024”.

The casino at City of Dreams Sri Lanka, in that country’s capital Colombo, “is expected to commence operations in the third quarter of 2025,” stated Melco International in a Friday filing. The operations will be run by a unit of Melco Resorts.

The US$1-billion City of Dreams Sri Lanka scheme (pictured) is a partnership with John Keells Holdings PLC (CSE: JKH), a Sri Lanka real estate developer.

🇲🇴 Asia Pioneer back to black in 2024 as revenue grows 71pct (GGRAsia)

Hong Kong-listed Asia Pioneer Entertainment Holdings Ltd (HKG: 8400) posted a net profit of nearly HKD3.8 million (US$483,163) for full-year 2024, compared with a HKD1.9-million loss in the previous year.

The group’s revenue in 2024 increased by 70.9 percent year-on-year to just under HKD50.8 million, according to a Monday filing.

The business, via its Asia Pioneer Entertainment arm, is authorised to distribute electronic gaming equipment in Macau, and also provides such technology to land-based casinos in other parts of the Asia-Pacific region.

🇹🇼 Taiwan Semiconductor: Be Greedy When Others Are Fearful (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Supercycle Is Just Warming Up (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: AI’s Most Critical Supplier Is On Sale (Seeking Alpha) $ 🗃️

🇹🇼 Pharmaessentia Corp (6446 TT): Arbitration Reaction Is Overdone; Time to Re-Focus on Fundamentals (Smartkarma) $

PharmaEssentia Corp (TPE: 6446 / FRA: 8Z1) shares nosedived nearly 30% since February 17 after an unfavorable ruling from the ICC regarding an arbitration with AOP Orphan Pharmaceuticals.

Pharmaessentia ended 2024 on a high note, with 91% YoY revenue growth to NT$9.7B and turned profitable at both operating and net level for the first time.

Going ahead, geography expansion of Besremi, indication expansion, and pipeline progress will remain the main growth engines. Ongoing global shortage of a competing drug should be positive for Besremi.

🇰🇷 What comes next after South Korean president’s removal? (FT) $ 🗃️

🇰🇷 Hyundai Motor: Automotive Tariff Weighs On Already Uncertain Cash Flow (Seeking Alpha) $ 🗃️

🇰🇷 FSS to Allow Foreigners to Invest in Korean Stocks Through Overseas Local Securities Firms (Douglas Research Insights) $

FSS announced that it will relax the requirements for opening a foreign integrated account to allow foreigners to more easily invest in Korean stocks through overseas local securities firms.

On 11 March, Interactive Brokers announced that it invested 15 billion won in Next Securities. So far, IBKR has not formally announced that it will allow trading of Korean stocks.

We expect IBKR to allow trading of Korean stocks in 2025, mainly due to its investment in Next Securities and FSS’s announcement today on relaxation of opening foreign omnibus accounts.

🇰🇷 Paradise Co aims 10pct plus revenue growth yearly to 2027, drops co-CEO setup (GGRAsia)

Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only casinos, says it plans to increase its revenue “by more than 10 percent” annually through to 2027.

That is part of its “plan to increase corporate value” for investors – also referred to by Paradise Co as its “Value Up” plan, according to a statement issued by the casino group.

The company’s full-year sales in 2024 reached approximately KRW1.07 trillion (US$728.7 million), up 7.8 percent year-on-year. Its operating income for the full year however declined by 6.7 percent year-on-year to KRW136.1 billion.

Paradise Co’s full-year 2024 casino revenue had been KRW818.79 billion, up 10.2 percent from 2023.

Paradise Co is now stating in a filing that it would operate with a single chief executive, rather than under a co-CEO arrangement that had been mentioned in a March 2024 filing to the Korea Exchange.

🇰🇷 Grand Korea Leisure’s March casino sales top US$28mln (GGRAsia)

Casino sales in March at Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, rose sequentially and in year-on-year terms, according to a Thursday update filed to the Korea Exchange.

The firm’s casino sales amounted to approximately KRW41.45 billion (US$28.3 million) last month, up 27.7 percent from February. Judged year-on-year, casino sales rose 2.6 percent.

🇰🇷 Lotte Tour March casino sales up 46.5pct y-o-y, to US$22.1mln (GGRAsia)

Casino net revenue at Jeju Dream Tower resort (pictured in a file photo) on South Korea’s Jeju island, rose 46.5 percent year-on-year in March, to just above KRW32.50 billion (US$22.1 million). Such revenue grew by 43.7 percent sequentially, the venue’s promoter, Lotte Tour Development (KRX: 032350), said in a Tuesday filing to the Korea Exchange.

Nearly KRW30.93 billion of the casino revenue last month was from table games, up 46.3 percent from the prior-year period. The tally increased by 49.3 percent from the preceding month.

Gaming machine revenue in March was just over KRW1.57 billion, a year-on-year gain of 50.4 percent, but down 17.4 percent from February.

🇰🇷 SK Bioscience (302440 KS): New Vaccine Trial and ITD Turnaround To Improve Long-Term Outlook (Smartkarma) $

SK Bioscience Co Ltd (KRX: 302440) has initiated phase 3 trial of Sanofi-partnered pneumococcal conjugate vaccine candidate in Australia. This year, Phase 3 trial will be initiated in U.S., Korea, and EU.

This year, SK Bioscience has initiated global Phase 1/2 trials of mRNA Japanese Encephalitis vaccine candidate in Australia and New Zealand. The company aims to secure interim results by 2026.

ITD Biologika is targeting for a 17% revenue CAGR during 2024–2028. The company aims to achieve EBITDA margin of 25%+ by 2028 and become IPO ready.

🇰🇷 Gap Trade Opportunities in Korean Prefs Vs Common Share Pairs in 2Q 2025 (Douglas Research Insights) $

🇰🇷 A Pair Trade Between LG Chem (Common) And LG Chem (Preferred) (Douglas Research Insights) $

In this insight, we discuss a pair trade between LG Chem (KRX: 051910 / 051915) (common) and LG Chem (051915 KS) (preferred).

The price ratio (LG Chem common/preferred) is now at 2.16x, which is more than 2 STD (standard deviations). Our trading strategy involves revert to the mean.

One of the key reasons why LG Chem (preferred)’s share price has fared much worse YTD than LG Chem (common) is due to much larger selling by the foreign investors.

🇰🇷 KCC Corp: Considering on Issuing an Overseas EB for Its 10% Stake in Samsung C&T (Douglas Research Insights) $

Kcc Corp (KRX: 002380) is considering on issuing an overseas exchangeable bond (EB) for its 10% stake in Samsung C&T Corp (KRX: 028260 / 02826K).

KCC is the second largest shareholder of Samsung C&T with a 10% stake in the company which is worth 2 trillion won (US$1.4 billion).

Our NAV valuation of KCC Corp suggests NAV per share of 332,947 won, which is 27% higher than current price.

🇰🇷 Fat Inheritance Taxes for Hanwha Group Chairman Kim’s Three Sons Post Receiving Hanwha Corp Shares (Douglas Research Insights) $

Hanwha Group Chairman Kim Seung-youn (born in 1952) made a major move to give 11.32% of his shares in Hanwha Corporation (KRX: 000880 / 00088K) to his three sons.

It is estimated that the three sons will need to pay nearly 222 billion won in inheritance taxes associated with receiving additional stakes in Hanwha Corp.

Because the three sons need to pay for the high amounts of inheritance taxes, Hanwha Corp is likely to raise the dividend payout in the next several years.

🇰🇷 Lotte Global Logistics IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Lotte Global Logistics is implied market cap of 560 billion won, which represents target price of 13,454 won per share.

We have a negative view of this IPO as our target price does not provide a meaningful upside to the IPO price range.

Four major factors we are negative on this IPO include lack of sales growth, excessive competition (Coupang, Inc. (NYSE: CPNG) and CJ Logistics (KRX: 000120)), mystery of put option clause, and highly geared balance sheet.

🇸🇬 Grab Holdings Is Quietly Setting Up Again (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited: Resilience In The Face Of Adversity (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Sea Limited – The Full-Stack Advantage (Nikhs)

How controlling the customer experience across gaming, e-commerce, and finance is paying off in Southeast Asia.

What’s particularly noteworthy isn’t just the growth but the integration. Sea Limited (NYSE: SE) has built a self-reinforcing ecosystem where each business strengthens the others in ways that standalone competitors struggle to match

Sea’s approach differs fundamentally from many Western tech companies. Rather than specializing in a single layer of the technology stack, Sea has built vertically integrated businesses that control the entire customer experience. This full-stack approach creates several advantages:

🇸🇬 4 Singapore Mid-Cap Stocks with Attractive Dividend Yields (The Smart Investor)

🇸🇬 4 Data Centre REITs Sporting Dividend Yields of 4.4% or Higher (The Smart Investor)

The data centre space is booming, and here are four data centre REITs that are paying an attractive distribution yield (4%+).

Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) is a data centre REIT with a portfolio of 25 data centres across 10 countries.

Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF), or DCR, is a data centre REIT with a portfolio of 10 data centres.

Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MIT, is an industrial REIT with a portfolio of 56 properties in the US (including 13 data centres), 83 in Singapore, and two in Japan.

CapitaLand India Trust (SGX: CY6U / OTCMKTS: ACNDF), or CLINT, is an Indian property trust with a portfolio of 10 IT business parks, three industrial facilities, one logistics park, and four data centre developments.

🇹🇭 Haad Thip meeting (HTC TB) (Asian Century Stocks)

Steady performance but the higher sugar tax is a near-term headwind. Estimated reading time: 11 minutes

Last week, I had the great pleasure of meeting with Chief Financial Officer Amrit Shrestha and several of his colleagues at Coca-Cola bottler Haad Thip PCL (BKK: HTC / OTCMKTS: HAATF) – US$193 million). The company is the exclusive producer and distributor of Coca-Cola products across Thailand’s 14 Southernmost provinces.

The stock has performed beautifully over time, though sideways since 2021. It trades at a 9.6x P/E ratio and a 6.4% dividend yield.

In this post, I’ll discuss what I learnt from the meeting with Amrit and what the future holds for the Haad Thip.

🇻🇳 A Conversation with Cao Nguyên (Value in Vietnam)

On investing in small companies and the importance of having a margin of safety

A huge percentage of trading on the Vietnamese stock exchanges is done by retail investors.

Many of these people look at the activity as a game, the equivalent perhaps of playing cards, and speculation is rampant.

But there are a few people who take a serious, intelligent, business-like approach to investing.

Cao Nguyên is one such investor.

He’s well-versed in the value investing literature, has a deep knowledge of many specific companies, and (if you speak Vietnamese) is well-worth following on Substack.

The last time we talked was this past January and the conversation was so good that, with his permission, I’ve decided to publish it below.

🇻🇳 These Companies Are Getting Crushed Due To Their Vietnam Exposure (ZeroHedge) $ 🗃️

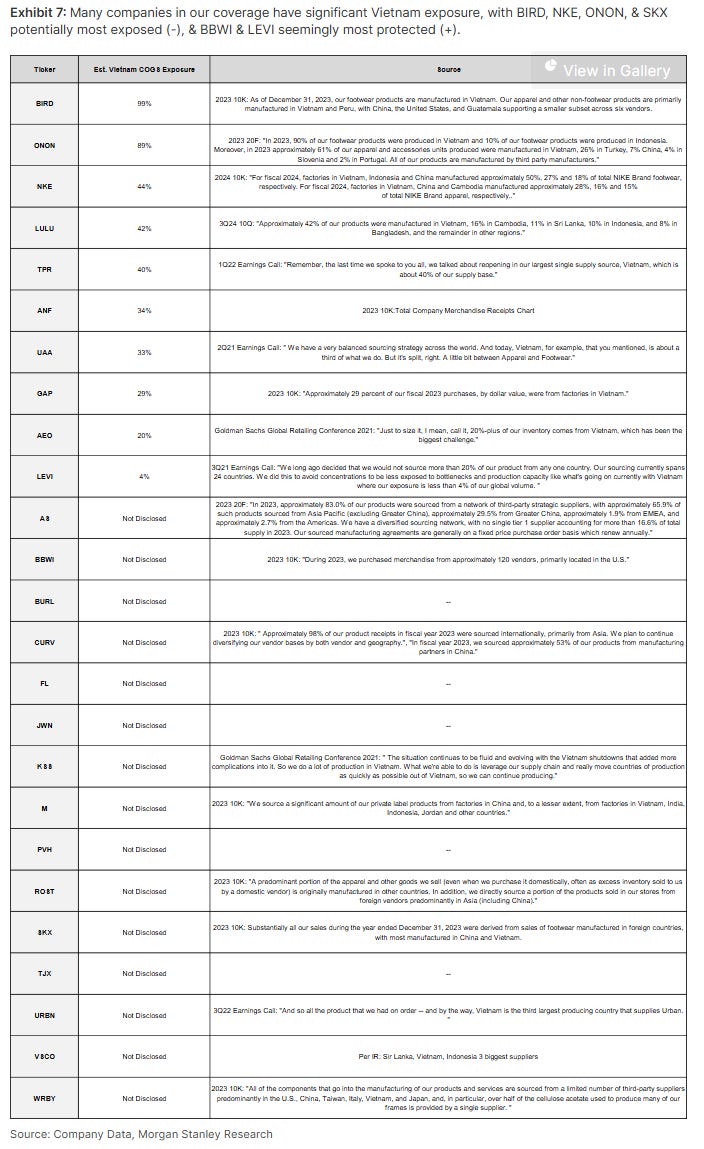

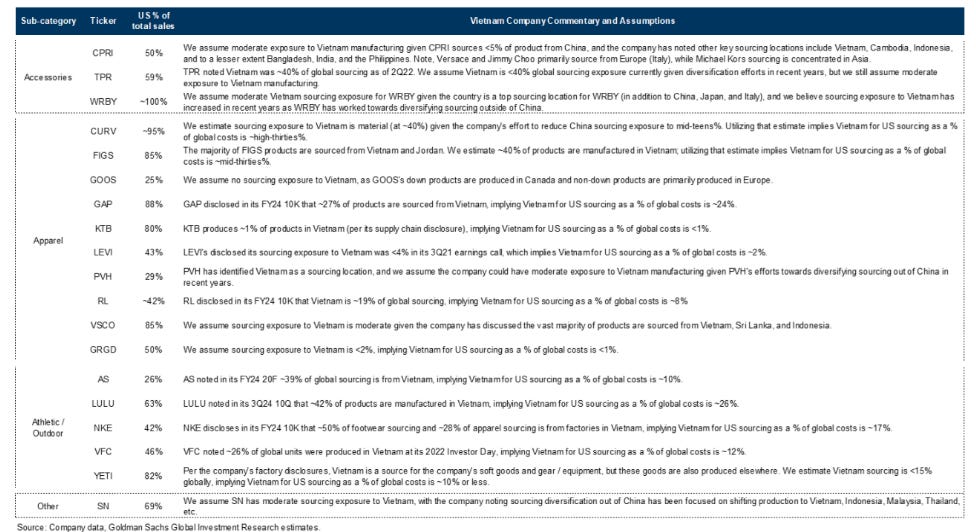

Morgan Stanley writes that Vietnam sourcing exposure in its coverage is significant – particularly for footwear names – with BIRD, NKE, ONON, & SKX potentially most exposed (-), and BBWI & LEVI seemingly most protected (+). In 2024, 19% of US apparel imports & 34% of US footwear imports were sourced from Vietnam – up +3 pts & +7 pts, respectively, from ’19 levels (with Vietnam the largest beneficiary from diversification out of China in this time period).

Goldman Sachs’ consumer specialist Scott Feiler was out with a similar report this morning, writing that Vietnam is “where the incremental surprise really came (46% initial tariff) and where many consumer companies have shifted their exposure (from China to Vietnam).” A few of the GIR estimates on Vietnam sourcing below:

🇮🇳 Starbucks slows India expansion as consumers tighten belts (FT) $ 🗃️

🇮🇳 Infosys: Well-Positioned To Support The Next Wave Of Digital Transformation (Seeking Alpha) $ 🗃️

Infosys: Tough Ride Ahead Amid Recession, Layoffs And Forex Risk (Seeking Alpha) $ 🗃️

🇮🇳 Navkar Corporation: How JSW’s Acquisition of Navkar Creates a Logistics Powerhouse. (Smartkarma) $

JSW group aims to become a complete port and logistics solution provider to end customers, by combining JSWIL’s port infrastructure with Navkar Corporation Ltd (NSE: NAVKARCORP / BOM: 539332)’s inland logistics capabilities (CFS, ICD, PFT,CTO license).

Access to Navkar’s 100 acres undeveloped land in strategic areas offers JSW Infrastructure (NSE: JSWINFRA / BOM: 543994) opportunities for further development and expansion of logistics infrastructure.

JSW targets INR 9,000 crore Capex in logistics by FY30, expecting INR 8,000 crore revenue, INR 2,000 crore EBITDA, and 17-18% ROCE.

🇮🇳 Hindalco (HNDL IN): Investor Day Reaffirms Strategic Growth Plans (Smartkarma) $

Hindalco Industries (NSE: HINDALCO / BOM: 500440) provided details of its ongoing expansion plans of about US$9.1b (US$1.7b spent).

We note near-term headwinds from a) likely weakness in aluminium prices driven by cheaper alumina b) scrap market tightness c) sharp contraction in copper Tc/Rc’s

Valuations: Hindalco trades at about 6.8x EV/EBITDA FY26e which is inline with historic multiples. A lower multiple is warranted to factor impending headwinds.

🇮🇳 Hindware Home Innovation Ltd: Will Restructuring Change the Company’s Fortunes? (Smartkarma) $

Hindware Home Innovation Ltd (NSE: HINDWAREAP / BOM: 542905) plans to demerge its consumer appliances division into a separate listed entity.

Demerger removes loss-making drag, improving profitability and segment-specific valuation clarity.

Unlocks hidden value; better execution with new CEO with clear growth trajectory may lead further value creation for shareholders.

🇮🇳 Event Driven: ITC Acquiring Aditya Birla Group’s Paper Business (Smartkarma) $

ITC Ltd (NSE: ITC / BOM: 500875) recently announced the strategic acquisition of Century Pulp and Paper (CPP) from AB Real Estate (ABREL) for INR 3,500 crore on a slump sale basis.

This Business Transfer Agreement (BTA) occurs amid an industry downturn marked by surging input costs, subdued demand, and competition from low-priced imports.

This acquisition significantly expands ITC’s paper segment capacity by 60%, targeting a 30-40% EBITDA per tonne improvement.

🇰🇿 Kaspi.kz Delivers Scale, But I Need More Than That To Buy (Seeking Alpha) $ 🗃️

-

🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🇮🇱 Playtika Enabling Growth With a Bold Platform Integration Masterplan (Smartkarma) $

Playtika Holding Corp (NASDAQ: PLTK)‘s fourth-quarter 2024 results provide a mixed picture for investors, reflecting both strategic advances and ongoing challenges.

On the positive side, Playtika’s management emphasized their continued focus on growth and portfolio diversification, highlighted by the significant acquisition of SuperPlay, a leading independent studio.

This acquisition is intended to bolster the company’s portfolio with strong game franchises and drive future growth.

🇮🇱 ICL Struggles Amid Falling Phosphate Prices—Can Specialty Expansion Spark a Comeback? (Smartkarma) $

Israel Chemicals Ltd (ICL) (Icl Group Ltd (NYSE: ICL)) reported its financial results for the fourth quarter and full year of 2024, revealing the complexities of a demanding market environment.

The company demonstrated resilience by delivering certain financial achievements despite multifaceted challenges in 2024, including geopolitical tensions in Israel and fluctuating commodity prices.

For 2024, ICL’s revenues stood at $6.841 billion, with an adjusted EBITDA of $1.469 billion, reflecting a margin of 21%.

🇮🇱 Can Tata Motors Withstand the 25% U.S. Auto Tariffs Or It Will Collapse Further? (Smartkarma) $

The US imposed a 25% tariff on auto imports, affecting Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA)’ JLR unit, where the US accounts for 22% of sales.

This could shave off 200–300 bps from JLR’s EBITDA margin or weaken US volumes if costs are passed on to consumers.

Tata Motors’ FY25 EBIT margin guidance of ≥8.5% looks ambitious; a realistic range may shift to 6.5–7.5% without swift demand or cost-side offsets.

🇮🇱 JSW Steel: Low Cost Capacity Expansion Underpin Premium Valuations (Smartkarma) $

JSW Steel Ltd (NSE: JSWSTEEL / BOM: 500228) has grown its domestic steelmaking capacity at CAGR of 14% over the last 2 decades (2x industry) and at 25% lower costs

Gradual capacity ramp-up at recently completed expansion at Vijayanagar (5m) and actively pursuing 10-15mt of new capacity additions over the next 3-5 years

Valuations: JSW Steel trades at premium to its 5yr average EV/EBITDA likely due to a) impending imposition of a 12% safeguard duty b) superior capital allocation etc.

🇷🇺 US-Russia tunnel – a non-consensus investment idea? (Undervalued Shares)

If you believe the gossip emanating from Mar-a-Lago, Elon Musk is considering a Hyperloop train to connect the US with Russia.

What seems like an insane pipedream has actually been talked about since the 1860s, when a close collaborator of George Washington first proposed the idea.

Is there even a vague chance of such an ambitious undertaking ever happening?

Now that Russia-related exposure is gaining attention again, it could be worth taking a look at Globaltrans Investment Plc (AIX: GLTR) (ISIN US37949E2046, AIX:GLTR), a leading freight rail transportation group with operations across the CIS countries. It was listed as GDR on Western exchanges, but had to relist on the Astana International Exchange (AIX) in Kazakhstan as a result of sanctions against Russia. The company had been buying back stock at USD 4.30 but the share price recently fell to USD 3.50 – contrary to many other securities that offer Russia-exposure rallying. It appears Globaltrans has a market cap of just USD 350m.

🌎 MercadoLibre: The Giant Redefining Consumption In Latin America (Seeking Alpha) $ 🗃️

🌎 dLocal: Diving deep on long-term economics (Investing with Andrew)

In this post, I dive deep into the long-term economics of Dlocal (NASDAQ: DLO). In my first deep dive, I presented the high level investment case; this is more detailed with focus on unit economics.

The stock market can be an exceedingly volatile place over the short-term; right now, the market is concerned about the long-term economics in dLocal due to declines in net take rate. I believe that the market’s concern about long-term unit economics driven by short-term take rate declines is simply not correct.

The potential for self-reinforcing growth, very high returns on capital, and very low expectations are what continues to drive my optimism in the long-term investment thesis behind dLocal.

🇦🇷 Loma Negra: A Cement Giant Waiting For Recovery (Seeking Alpha) $ 🗃️

🇦🇷 Lithium Americas: Powering A Robotic Future (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: My Top Bet For Positive Returns In A Market-Wide Correction (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇧🇷 NU: Banking’s Silent Disruptor (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Where Value Investors and Growth Hunters Align (Seeking Alpha) $ 🗃️

🇧🇷 NU Deep Dive Part 1 (Make Money, Make Time)

Business, LatAm, Competitive Advantage, Risks

This deep dive is on Nu Holdings (NYSE: NU), a company that I’ve owned for about a year and one that I added to recently when the stock came back down to the $10-12 range. All of this post will be free, and the majority of Part 2 (opportunities, financials, and valuation) will be for paid subscribers.

🇧🇷 XP’s (Nasdaq: XP) Entire Profits Are Dependent on What Insiders Call a “Madoff-Like Ponzi Scheme” (Grizzly Reports)

XP Inc (NASDAQ: XP) is a Brazilian Nasdaq-listed fintech company. Our research uncovers that the company is running a massive Ponzi scheme facilitated through certain derivatives sales to retail clients, which are funneled through special funds and misrepresented as proprietary trading profits.

At the center of the scheme is a XP fund called GLADIUS FIM CP IE (“Gladius”) that returned over 2,419% over the last five years with unbelievably low volatility.

The returns from Gladius and its affiliated fund COLISEU FIM CP IE (“Coliseu”) are higher than XP’s earnings. Without Gladius and Coliseu, XP would be unprofitable.

The secret to Gladius’ profitability is a product called COE which stands for Certificado de Operações Estruturadas. COEs are predatory investment products that XP pushes aggressively on its Brazilian retail clients.

We consulted with XP formers and people from Brazil who have knowledge of Gladius’ inner workings. They confirmed to us that Gladius is unduly paying out new premiums it receives from the sale of COE products to XP as profits

🇧🇷 Should You Buy BB Seguridade For Its 9% Yield? (Seeking Alpha) $ 🗃️

🇧🇷 BB Seguridade: A Combination Of Bullish Factors Makes The Stock Interesting (Seeking Alpha) $ 🗃️

🇧🇷 Sigma Lithium Surpasses Production Targets With ESG Approach (Seeking Alpha) $ 🗃️

🇧🇷 Suzano: A Winner In The Tariff Tussle (Seeking Alpha) $ 🗃️

🇧🇷 Cyrela: High Interest Rates Could Benefit This Construction Company (Seeking Alpha) $ 🗃️

🇨🇱 Banco Santander-Chile: Solid Latin American Bank Deserves A Closer Look (Seeking Alpha) $ 🗃️

🇲🇽 China’s Tariff-Dodging Move to Mexico Looks Doomed (WSJ) $ 🗃️

🇲🇽 ‘Liberation Day’—For Mexico (The American Conservative)

The Mexican president smells economic opportunity.

While Mexico does still face a 25 percent on steel and automotive exports to the U.S., the country is not subject to any tariffs whatsoever on exports compliant with the USMCA. With immediate access to the massive import American market—the largest in the world—a relatively inexpensive labor force, and uniquely favorable terms of trade, Sheinbaum sees Mexico as well placed to be the largest beneficiary of the new American tariff regime.

The world is still grappling with the new economic order being hashed out at Washington—a return to protectionist measures not seen in the U.S. since the 19th century. Economists are unhappy, American stock markets are dropping, and foreign economic ministers are trying to scrape together deals that might grant them more favorable trade terms with the U.S. But south of the border, things are looking bright for Mexico.

🇵🇪 Compañía de Minas Buenaventura: Strong Gains Remain On The Cards (Seeking Alpha) $ 🗃️

🌐 Glencore Stock: Coal Isn’t A Dirty Word Anymore (Seeking Alpha) $ 🗃️

🌐 Glencore: Positive Near-Term Catalysts Ahead (Seeking Alpha) $ 🗃️

🌐 Nebius: I’m Betting Against Jim Cramer (Seeking Alpha) $ 🗃️

🌐 Nebius: Right Company, Wrong Time For AI Plays – Initiating With Sell (Seeking Alpha) $ 🗃️

🌐 Nebius Group Trades At A Steep Discount (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

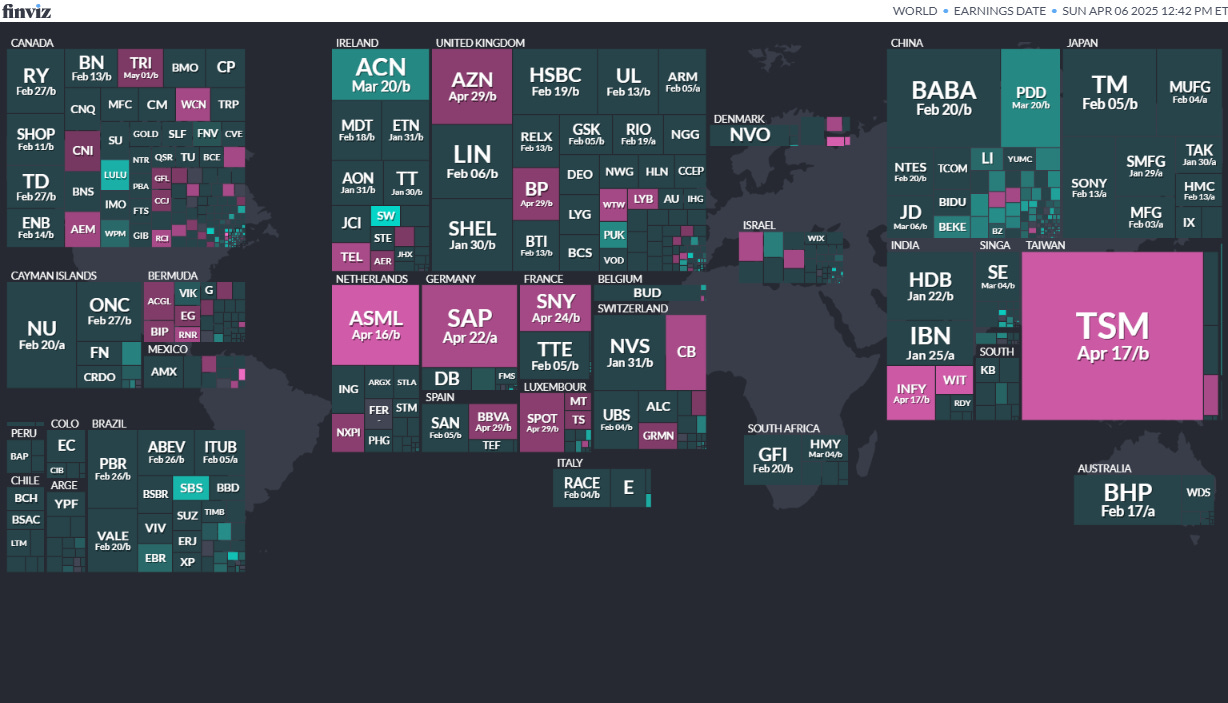

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

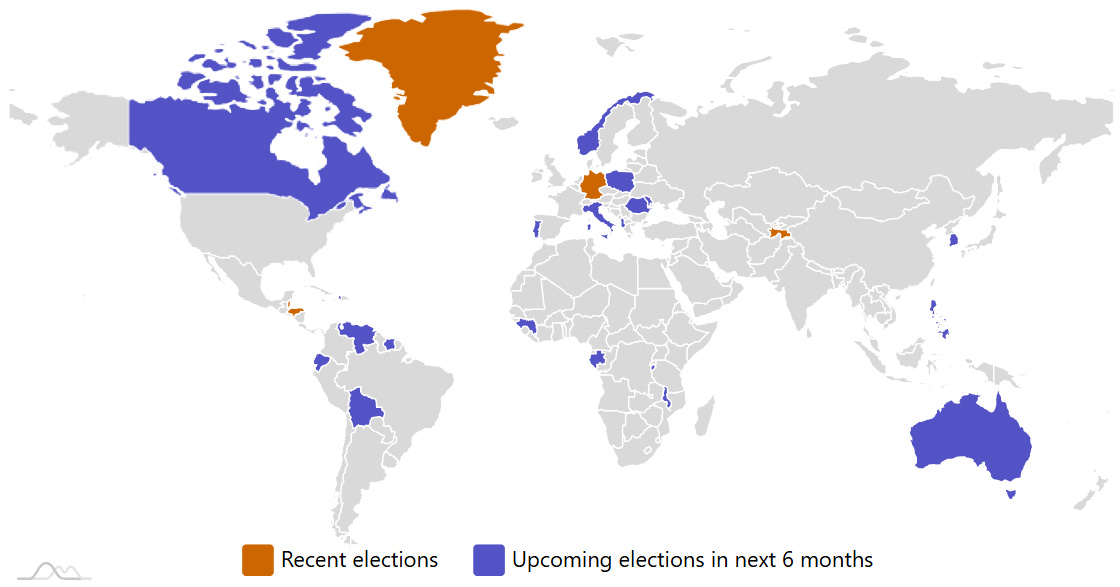

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

The Great Restaurant Development Holdings Limited HPOT Dominari Securities/Revere Securities, 1.4M Shares, $4.00-6.00, $7.0 mil, 4/7/2025 Week of

(Incorporated in the Cayman Islands)

We operate a multi-award-winning Chinese restaurant chain. We specialize in various types of Specialty Chicken Hotpot under the brand name “The Great Restaurant (一品雞煲火鍋)” in Hong Kong. As of the date of this prospectus, we operate seven restaurants in our chain, out of which three are located in the New Territories, three in the Kowloon Peninsula and one on Hong Kong Island. We have over 12 years of experience in the restaurant services industry in Hong Kong and utilize one food factory to support our operations.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: The Great Restaurant Development Holdings Limited cut its IPO’s size to 1.4 million shares – down from 2.0 million shares in the original SEC filing – and kept the price range at $4.00 to $6.00 – to raise $7.0 million, according to its F-1/A filing dated March 3, 2025. Background: Dominari Securities is the “lead left” book-runner, joining the original sole book-runner, Revere Securities, on the cover of the prospectus.)

Ruanyun Edai Technology Inc. RYET AC Sunshine Securities, 3.8M Shares, $4.00-5.00, $16.9 mil, 4/8/2025 Tuesday

We are not a Chinese operating company but a Cayman Islands holding company with no operations. (Incorporated in the Cayman Islands)

**Note: The ordinary shares offered in this (initial public) offering are shares of our offshore holding company, Ruanyun Edai Technology Inc., instead of shares of the VIE or its subsidiaries in China. (From the prospectus – See link to the prospectus in the chart below.)

We are a data driven artificial intelligence, or A.I., technology company focused on kindergarten through year twelve, or K-12 education in China. We bring technology to schools, and we are committed to reforming the traditional Chinese education and learning model by facilitating schools, teachers and students with new teaching, learning, and assessment methods in the A.I. era.

We believe the road to college should come with directions. Our mission is to help each K-12 student understand their specialty and find their way to higher education and future success. We believe we have one of the most comprehensive online learning ecosystems covering all K-12 subject fields and grade levels, one of the largest academic exercise question banks that is designed and built for interactive learning, and one of the most advanced A.I. algorithms that power such questions, all of which are accessible online and on demand.

As of Nov. 30, 2022, our online academic exercise question bank has accumulated more than 10 billion test data generated by approximately 14.26 million students from more than 27,000 schools and we have issued over 298 million evaluation reports. With the continuous collection and analyzing of students’ online learning data, our A.I. algorithms are constantly expanding and upgrading, reaching an evaluation accuracy rate of 97% (based on our own calculations), allowing us to provide students with tailored and effective learning strategies. We believe that, in time, our online learning platform will be proven revolutionary in affecting the advancement of China’s K-12 education system.

As of Nov. 30, 2022, approximately 14.26 million students use Jiangxi Ruanyun to collect their daily homework exercise data, prepare for a test or attend the Academic Proficiency Assessment, which is an official assessment across all subjects taught in schools, conducted by the Education Testing Authority in China. This allows us to understand each student better and enables us to help them reach the next level of educational success with an effective strategy, every step of the way.

We value our proprietary technologies and strong research and development capabilities, which we believe differentiate us from other companies in our industry. As of the date of this prospectus, we have an intellectual property portfolio consisting of 11 patents (9 of which have been registered and 2 are pending) and 23 trademarks filed with the PRC State Intellectual Property Administration, 50 copyrights registered with the PRC State Copyright Bureau, and 8 domain names.

Over the last decade, our A.I. learning platform has expanded from learning to assessment in school to A.I application, services and hardware. We believe we are a trend-setter in reforming the traditional education model in China using the technological progress brought about by the advent of A.I. technology. We believe we are the only educational A.I. company in China that serves both everyday learning and Academic Proficiency Test in school. We provide computerized testing for China’s Academic Proficiency Test, or ATP, which is equivalent to the SAT in China. Our everyday learning to official assessment model allows us to expand into a range of personalized “online” services and “offline” products for students in high demand.

We currently sell our products and services through two primary product lines, namely our SmartExam® solution and SmartHomework® solution. Our SmartHomework® solution delivers personalized learning solutions for students to study more effectively. Teachers can adjust instructions for students based on their specific needs. In addition, our SmartExam® solution helps deliver China’s Academic Proficiency Test, which is required in China for obtaining a high-school diploma, in computer-based format. We also provide self-learning solutions and smart-devices, such as smart printer / smart headset for everyday study and test preparation.

*Note – Re corporate structure: We conduct substantially all of our operations in the People’s Republic of China, or the PRC or China, through Jiangxi Ruanyun, the variable interest entity (VIE) and its subsidiaries. We do not have any equity ownership of the VIE. Instead, we have the power to direct the activities and receive the economic benefits and absorb losses of the VIE’s business operations through certain Contractual Arrangements (as defined in the prospectus) and the VIE is consolidated for accounting purposes. This structure involves unique risks to investors. This VIE structure is used to provide contractual exposure through the Contractual Arrangement to foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies.

*Note: Under the Contractual Arrangements, cash is transferred among the Company, Rollingthunder Technology (Jiangxi) Co., Ltd, or our WFOE, Soft Cloud and the VIE. (See the prospectus – link in the chart below – for details on cash transfers, financial statements and other disclosures pertinent to the IPO).

**Note: Net loss and revenue figures are in U.S. dollars for the fiscal year that ended March 31, 2024.

(Note: Ruanyun Edai Technology Inc. filed a new F-1 on Aug. 30, 2024, and disclosed terms for its IPO: The company is offering 3.75 million shares at a price range of $4.00 to $5.00 to raise $16.88 million. The new filing declared that AC Sunshine Securities is the new sole book-runner; under the previous plans, Univest Securities and AC Sunshine Securities were slated to be joint book-runners.)

(Note: The SEC declared that Ruanyun Edai Technology’s IPO filing was abandoned in February 2024 because the company had not updated the filing in a long time. Background: Ruanyun Edai Technology Inc. filed its F-1 on Dec. 29, 2022. The Cayman Islands-incorporated holding company submitted confidential IPO paperwork to the SEC on Aug. 31, 2021.)

OMS Energy Technologies, Inc. OMSE Roth Capital Partners, 5.6M Shares, $8.00-10.00, $50.0 mil, 4/10/2025 Thursday

(Incorporated in the Cayman Islands)

We are a growth-oriented manufacturer of surface wellhead systems, or SWS, and oil country tubular goods, or OCTG products used in the oil and gas industry. These products are primarily used for both onshore and offshore oil exploration and production, or E&P activities in the Asia Pacific and the Middle Eastern and North Africa (MENA) Regions.

Our customers often operate in geographic locations where the operating environment requires wellheads, casing and tubing materials capable of meeting exact standards for temperature, pressure, corrosion, torque resistance and abrasion. Our products have been designed, manufactured and certified with the American Petroleum Standards (API) and International Organization of Standardization (ISO). Through our comprehensive and technologically advanced portfolio of SWS and OCTG, we are able to serve as a single-source supplier for our customers and respond to their demand for products. Our operations benefit from our broad, strategically positioned geographic footprint, which supports our ability to supply our (i) Specialty Connectors and Pipes and (ii) Surface wellhead and Christmas tree, allowing us to serve our customers operating in the Asia Pacific and MENA Regions.

We have finishing facilities in close proximity to some of our top end-users’ E&P operations, for example, we have facilities in Saudi Arabia where our largest client, Saudi ARAMCO Oil is located, which allows us to provide our customers with customized technical solutions and to synchronize our production and logistics with evolving demands.

We primarily conduct our business through our subsidiaries (i) OMS (Singapore), (ii) OMS (Saudi Arabia), (iii) OMS (Indonesia), (iv) OMS (Thailand), (v) OMS (Malaysia Holding), (vi) OMS (Malaysia OpCo) and (vii) OMS (Brunei), operating in Singapore, Saudi Arabia, Indonesia, Thailand, Malaysia and Brunei, respectively. Furthermore, through our localization efforts in collaboration with the various governments, we operate manufacturing facilities and warehouses across these six jurisdictions that we operate in. For further information, please refer to the section entitled “Business — Real Property” in the prospectus.

Note: Net income and revenue are for the 12 months that ended March 31, 2024.

(Note: OMS Energy Technologies, Inc. is offering 5.56 million ordinary shares (5,555,556 ordinary shares) at a price range of $8.00 to $10.00 to raise $50.0 million, according to its S-1/A filings.)

Kandal M. Venture Ltd. FMFC Dominari Securities/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 4/11/2025 Week of

(Incorporated in the Cayman Islands)

Through FMF, our operating subsidiary, we are a contract manufacturer of affordable luxury leather goods with our manufacturing operations in Cambodia. We primarily manufacture handbags, such as shoulder bag, crossbody bag, tote bag, backpack, top-handle handbag, satchel, and other smaller leather goods, such as wallets. Our customers are well-known global fashion brands that are headquartered in the United States.

With our craftsmanship and extensive knowledge of the leather goods manufacturing process, our product engineers convert our customers’ vision and design into leather goods products. Our products are primarily affordable luxury products that are made of leather and/or other materials.

Our Competitive Strengths

We believe the following competitive strengths differentiate our operating subsidiary from its competitors:

• Having long-term and strong business relationships with renowned global fashion brands but we cannot assure continued good relationships with them, and they are not obligated in any way to continue placing orders with us at the same or increasing levels, or at all;

• Having long-term collaborative relationships with our suppliers but their services are susceptible to fluctuations in pricing, timing, and quality, and we have limited control over their operations and compliance with regulations as we do not have long-term contracts with them;

• Having extensive understanding of leather goods manufacturing process, up-to-date machinery and efficient management resulting in competitive pricing while maintaining quality and high efficiency; and

• Having experienced management team with extensive knowledge of the leather goods manufacturing industry where we operate but we cannot assure the retention of key executives and personnel necessary to maintain or expand our business, and the loss of any member of our management team could negatively impact our business plan and expansion.

Our Strategies

We aim to accomplish our business objective, further strengthen our market position and continue to be a competitive manufacturer of leather goods by pursing the following key strategies:

• Broadening our customer base by expanding our geographical market reach to other key markets, including the European markets but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results;

• Enhancing our production capacity but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results; and

• Establishing a new design and development center for enhancing our product development capabilities but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results.

Corporate History and Structure

KMV is a holding company registered and incorporated in the Cayman Islands, and is not a Cambodian operating company. As a holding company with no material operations, we conduct our core business operations in Cambodia through our operating subsidiary, FMF.

On April 5, 2017, FMF is the Group’s key operating subsidiary and was established under the laws of Cambodia to engage in the business of leather goods manufacturing. FMF’s skilled craftsmanship and high-quality manufacturing capabilities are the cornerstones of the Group’s operations and reputation, allowing us to attract business from leading global brands. Customers issue letters of authorization directly to FMF which grant FMF the right to produce and export leather goods using their trademarks, and they frequently visit the production site of FMF located in Cambodia to inspect orders and conduct quality checks. PFL was incorporated under the laws of Hong Kong on November 3, 2016 as a trading company for the Group’s material procurement and customer invoicing.

Note: Net income and revenue are in U.S. dollars (converted from Cambodia’s currency) for the 12 months that ended March 31, 2024.

(Note: Kandal M. Venture Ltd. trimmed its small-cap IPO’s size to 2.0 million shares – down from 2.8 million shares originally – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its F-1/A filing dated Feb. 18, 2025.)

(Note: Dominari Securities and Revere Securities are the new joint book-runners, replacing the original book-running team of Cathay Securities and WestPark Capital.)

MasterBeef Group MB Dominari Securities/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 4/11/2025 Week of

MasterBeef Group is the holding company that runs 12 Taiwanese hotpot and barbecue restaurants in Hong Kong. (Incorporated in the Cayman Islands)

Our mission is to serve quality and value-for-money Taiwanese cuisine to our customers.

We are a full-service restaurant group in Hong Kong, specializing in Taiwanese hotpot and Taiwanese barbecue. As of the date of this prospectus, through our Hong Kong Operating Subsidiaries, we operate 12 restaurant outlets under our Master Beef and Anping Grill brands. Our Group’s revenue is primarily generated from the Hong Kong Operating Subsidiaries’ operation of our Master Beef and Anping Grill restaurant outlets in Hong Kong. According to the Frost & Sullivan Report, in 2023, our Master Beef brand ranked first among the specialty hotpot restaurant chain brands and Taiwanese hotpot restaurant chain brands in Hong Kong in terms of revenue, and our Group comprising our Master Beef and Anping Grill brands ranked first in the overall Taiwanese cuisine market in Hong Kong with a market share of approximately 9.7% in terms of revenue.

Our Group’s history began in 2019 when our founders, namely Ms. Oi Wai Chau, Ms. Oi Yee Chau, Ms. Tsz Kiu So, Mr. Ka Chun Lam and Mr. Shing Yan Lee, identified the untapped potential of the mid-range Taiwanese hot pot market in the highly competitive dining scene of Hong Kong. They decided to capitalize on this opportunity by establishing a semi-self-service hotpot brand called “Master Beef Taiwanese Hotpot All You Can Eat” which focused on providing high-quality hotpot experiences with reasonable prices. The brand’s first restaurant was unveiled at King Wah Centre in Mong Kok in Kowloon, Hong Kong and quickly gained popularity which we believe was due to us providing authentic Taiwanese hotpot experience and excellent value for the money.

We subsequently expanded during the COVID-19 pandemic period and established multiple brands, namely Anping Grill, Chubby Bento, Chubby Noodles and Bao Pot, diversifying its operations into Taiwanese grill, Taiwanese bento, Taiwanese noodles and Taiwanese stone pot. To streamline the corporate structure and recalibrate business strategies and resources, on May 14, 2024, the Group disposed of its operations in Chubby Bento, Chubby Noodles and Bao Pot to Galaxy Shine Company Limited and Thrivors Holdings Limited, our principal shareholders. Immediately prior to the disposal, we were operating three Chubby Bento outlets, two Chubby Noodles outlets and one Bao Pot outlet in Hong Kong. For the pro forma impact on our historical financial data, see “Unaudited Pro Forma Condensed Consolidated Financial Information”.

Note: Net income and revenue are in U.S. dollars (converted from Hong Kong dollars) for the 12 months that ended June 30, 2024.

(Note: Dominari Securities is the new lead joint book-runner, according to an F-1/A filing dated Jan. 22, 2025, and it will work with Revere Securities, initially named as the sole book-runner in MasterBeef’s previous SEC filings.)

(Note: MasterBeef Group disclosed the terms for its IPO in an F-1/A filing dated Nov. 27, 2024: The company is offering 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million, if the IPO is priced at the $4.50 mid-point of its range. Background: MasterBeef Group filed its F-1 on Nov. 12, 2024, without disclosing the terms, and indicated that it intends to raise up to about $8 million.)

J-Star Holding Co., Ltd. YMAT Maxim Group, 1.3M Shares, $4.00-5.00, $5.6 mil, 4/14/2025 Week of

As a holding company with no material operations of our own, our operations are conducted through our subsidiaries in the People’s Republic of China (the “PRC”), Taiwan, Hong Kong and Samoa, with our headquarters in Taiwan, and such structure involves unique risks to investors, as the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time. (Incorporated in the Cayman Islands)

Our Predecessor Group was established in 1970 and we have accumulated over 50 years know-how in material composite industry. We develop and commercialize the technology on carbon reinforcement and resin systems. With decades of experience and knowledge in composites and materials, we are able to apply our expertise and technology on designing and manufacturing a great variety of lightweight, high-performance carbon composite products, ranging from key structural parts of electric bicycles and sports bicycles, rackets, automobile parts to healthcare products. According to the industry report commissioned by us and prepared by Frost & Sullivan, we are one of the major global leading players in the carbon fiber bicycle parts industry and carbon fiber racket parts industry.

We primarily generate revenue through three divisions and revenue streams, namely (i) sales of bicycles parts of sports bicycle and electric bicycle; (ii) sales of rackets for use in tennis, badminton, squash and beach tennis; and (iii) sales of other products, which mainly include structural parts of automobile, other sporting goods and healthcare products. Our bicycle parts and rackets are mainly supplied directly or indirectly to branded customers located in Switzerland, France, Italy, the Netherlands, Germany and Japan and they market and distribute their products worldwide. Other customers who rely on our new products, such as automobile parts and healthcare products, are mainly located in Australia, Canada and Japan.

*Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: J-Star Holding Co. Ltd. cut its IPO’s size to 1.25 million shares – down from 2.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $5.63 million in an F-1/A filing dated Aug. 2, 2024; in that same filing, the company said that Maxim Group is the new sole book-runner, replacing EF Hutton. Background: J-Star Holding Co. Ltd. reduced the size of its IPO again – to 2.0 million shares – down from 2.5 million shares – and kept the price range at $4.00 to $5.00 – to raise $9.0 million in an F-1/A filing dated June 13, 2024. In that June 13, 2024, filing, J-Star Holding Co. Ltd. disclosed that EF Hutton is the new sole book-runner, replacing the previous joint book-running team of Maxim Group LLC and Freedom Capital Markets.)

(Background: J-Star Holding Co. Ltd. cut its IPO to 2.5 million shares – down from 4.0 million shares – and kept the price range at $4.00 to $5.00 – to raise $11.25 million, according to an F-1/A filing dated Sept.19, 2023.)

(Note: J-Star Holding Co. Ltd. cut its IPO to 4.0 million shares – down from 5.375 million shares – and set the price range at $4.00 to $5.00 – an upward adjustment from its previous assumed IPO price of $4.00 – to raise $18.0 million, in an F-1/A filing dated Feb. 8, 2023. The downsizing represented a 16.3 percent cut in J-Star’s estimated IPO proceeds, which were $21.5 million under the previous terms. J-Star also disclosed a change in the bankers running its IPO, in the Feb. 8, 2023, F-1/A filing: Maxim Group LLC and Freedom Capital Markets are the joint book-runners, replacing ViewTrade Securities, which previously was the sole book-runner. Background: J-Star upsized its IPO in an F-1/A filing dated Sept. 2, 2022: 5.375 million shares at $4.00 – up from 5.25 million shares at $4.00 in a previous filing on Aug. 19, 2022. Under the new terms, the IPO’s proceeds are estimated at $21.5 million – or $500,000 more than the previous terms. J-Star Holding Co. Ltd. disclosed terms for its IPO in an F-1/A filing dated July 13, 2022: 3.75 million ordinary shares at $4.00 each to raise $15.0 million. J-Star Holding filed an F-1/A dated May 26, 2022, with financial information for the fiscal year ended Dec. 31, 2021. The company filed its F-1 on March 21, 2022, after submitting confidential IPO paperwork on Sept. 30, 2021.)

Phoenix Asia Holdings Ltd. PHOE D. Boral Capital (ex-EF Hutton), 1.6M Shares, $4.00-6.00, $8.0 mil, 4/15/2025 Tuesday

(Incorporated in the Cayman Islands)

We operate as a holding company. We operate our business primarily through our indirectly wholly-owned Operating Subsidiary, Winfield Engineering (Hong Kong) Limited. We mainly engage in substructure works, such as site formation, ground investigation and foundation works, in Hong Kong. To a lesser extent, we also provide other construction services such as structural steelworks. We mostly undertake substructure work in the role of subcontractor for the six months ended September 30, 2024, and the fiscal years ended March 31, 2024, and March 31, 2023.

Winfield Engineering (Hong Kong) Limited was founded in 1990. Over our 30 years of operating history, we have focused on substructure works, serving as a subcontractor and building up significant expertise and a strong track record. Substructure refers to the foundation support system constructed beneath ground level. We take great pride in our capability to effectively address substructure works challenges during the completion of our works. In 2023, we were awarded with a public project for a major trunk road, which involves marine grouting works and the project is expected to be completed in late-2025. This project further demonstrates our versatility and commitment to delivering high-quality substructure solutions.

Through our Operating Subsidiary, we are mainly engaged in public sector and private sector projects in Hong Kong. In 2023, we were awarded with an infrastructure project for the redevelopment of a riding school with an initial contract sum of over HKD24.4 million (USD3.1 million), which is expected to be completed in mid-2025.

As of the date of this prospectus, Winfield Engineering (Hong Kong) Limited is (i) a Registered Specialist Contractor under the sub-registers of foundation works, site formation works and ground investigation field works categories maintained by the Buildings Department of Hong Kong; and (ii) a Registered Subcontractor under foundation and piling (sheet piles, bored piles, driven piles, diaphragm walls, micro piles and hand-dug caisson) and general civil works (earthwork and ground investigation) of the Registered Specialist Trade Contractors Scheme of the Construction Industry Council of Hong Kong.

We, through our Operating Subsidiary, have achieved significant growth in our business. For the fiscal years ended March 31, 2024 and 2023, our total revenue derived from substructure and other construction services was approximately USD5.8 million and USD2.2 million, respectively. The number of customers with revenue contribution to us was 18 for the fiscal year ended March 31, 2023 and 11 for the fiscal year ended March 31, 2024.

According to the Census and Statistic Department, between 2014 and 2023, the construction industry in Hong Kong maintained growth with a compounded annual growth rate of 1.53%. Driven by (i) sustained supply of residential units and urban renewal program; (ii) the Government’s funding support in innovative constructive methods and new technologies; (iii) the Government’s continuous effort in enhancing rail connectivity, which requires extensive substructure works; and (iii) rapid advancement in technology to optimize productivity and reduce costs such as the building information management and industrialized building system, it is expected that the Hong Kong civil engineering industry will continue to grow.

Note: Net income and revenue are for the fiscal year that ended March 31, 2024.

Jyong Biotech Ltd. (Revived IPO) MENS Joseph Stone Capital LLC, 2.7M Shares, $7.50-8.50, $21.7 mil, 4/16/2025 Week of

*Note: The stock in this IPO is being issued by the holding company. (Incorporated in the Cayman Islands)

We are a science-driven biotechnology company based in Taiwan and are committed to developing and commercializing innovative and differentiated new drugs (plant-derived) mainly specializing in the treatment of urinary system diseases, with an initial focus on the markets of the U.S., the EU and Asia (primarily Taiwan and mainland China).

Since our inception in 2002, we have been dedicated to the research and development of new drugs with high safety and efficacy. Through 20 years of efforts, we have built integrated capabilities that encompass all key functionalities of drug development, including early-stage drug discovery and development, clinical trials, regulatory affairs, manufacturing and commercialization. Leveraging our strong research and development capabilities and proprietary platform, we have been developing a series of drug candidates, including one core drug candidate at NDA stage, one clinical-stage key drug candidate and other preclinical-stage drug candidates. Among our drug candidates, we have filed the new drug application, or NDA, for MCS-2 in the U.S. One of our clinical-stage key drug candidates, PCP, is in the Phase II trials stage in Taiwan. Another preclinical-stage key drug candidate, IC, is under preclinical studies.