Emerging Market Links + The Week Ahead (April 8, 2024)

For those interested in nearshoring or friendshoring, FT just had an interesting podcast (A surprising winner in the US-China chip wars – How Malaysia is making the most of the rivals’ battle for global tech supremacy) while the NY Times had a piece about Costa Rica (Is This the Silicon Valley of Latin America? 🗃️ – Now Costa Rica is positioning itself to become a major hub outside Asia for packaging and testing microchips…). I don’t know much about Costa Rica, but I do know that the FT (as a corporate mainstream media outlet…) completely left out or danced around a number of details concerning the challenges Malaysia faces.

That brings me to Brazil which is lurching more and more towards dictatorship (or at-least heavy handed government censorship) thanks to a leftist Supreme Court judge – it looks like Twitter may soon get blocked there. What the Brazilian Senate or people do remains to be seen.

Investors in Brazil and especially in state-controlled Petrobras (NYSE: PBR / PBR-A) need to remember what happened the last time Lula was in power – Operation Car Wash who’s investigation eventually ensnared politicians, corporate executives and companies all over Latin America (before the investigation was shut down…)

I had once asked someone if there is a good objective research source (especially in English) for Brazilian stocks and the economy in general. I was told there were none – local stock analysts, economists, or journalists need to be careful criticizing a publicly listed company or (“mainstream” non-populist) economic policy.

For all it’s faults, Twitter is still a place where critical stories or accurate details the mainstream media will not touch can be reported. For example: Brazil has experienced massive anti-government protests in recent months and here is how the mainstream English language media reported about them:

And here is just one of many videos of the “thousands” of protesters on Twitter (search: Sao Paulo Protests) and its just the protestors on the main street in downtown Sao Paulo – not the side or parallel streets where there were additional protestors (plus busloads of protestors from other places were apparently stopped by Lula controlled police on Brazilian highways…)…:

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Tencent Music Entertainment Group: Initiation Of Coverage – Core Business Strategy (SmartKarma) $

Tencent Music Entertainment Group (NYSE: TME) posted robust results in its fourth quarter and full year 2023 earnings call.

Increasing subscribers and expedited revenue growth were notable positives, taking the total number of subscribers to the 100 million milestone due to the company’s focus on content leadership, platform value, and offering a high-quality user experience.

Yet, the company also faced some headwinds, particularly in the social entertainment business.

🇨🇳 JST Group shows there’s still growth potential in China’s tough e-commerce market (Bamboo Works)

The country’s largest provider of ERP software as a service for e-commerce has filed a second time to list in Hong Kong, reporting its revenue grew more than 30% last year

JST Group has filed to list in Hong Kong, disclosing it became China’s largest ERP SaaS provider for e-commerce last year with 23.2% market share

The company’s revenue grew 33.3% to 690 million yuan last year, while its gross profit margin improved by 10 percentage points to 62.3%

🇨🇳 Chinese robot maker says protectionism will not stop its march (FT) $ 🗃️

🇨🇳 China’s Zeekr renews plans to raise up to $500 million in U.S. IPO, sources say (Reuters) 🗃️

Zeekr, the premium electric vehicle (EV) brand of Chinese automaker Geely Automobile Holdings (HKG: 0175), has restarted stalled plans to raise up to $500 million in a New York initial public offering (IPO), according to two sources with direct knowledge of the matter.

The company in November put listing plans to raise about $500 million on hold because of a mismatch in valuation expectations between investors and the company, Reuters reported then citing sources.

🇨🇳 Keep Inc. sprints towards profits as investors remain wary (Bamboo Works)

China’s leading fitness app operator returned to revenue growth in the second half of last year, as it adjusted to a post-pandemic return to outdoor-related activities.

Keep Inc.’s (HKG: 3650)’s revenue grew 3.7% in the second half of the year, reversing a 2.7% decline in the first half on falling product sales

The fitness app operator slashed its headcount and costs last year, helping to significantly boost its margins

🇨🇳 ‘Sing! China’ flames out, leaving STAR CM in the dark (Bamboo Works)

The popular talent reality show was temporarily suspended, and its creator’s revenue plunged, after a famous singer criticized it in a video last year

STAR CM Holdings Ltd (HKG: 6698) fell into the red last year with a 1.6 billion yuan loss after a controversy broke out surrounding its main money-spinner, the “Sing! China” reality show

The company is suing Warner Records China (Hong Kong) for critical remarks made by the late singer Coco Lee in a video that ignited the controversy

🇨🇳 Strawbear slips into the red but seeks salvation in AI (Bamboo Works)

The drama production company has lost 90% of its market value since an IPO three years ago, and just posted its first annual loss

Strawbear Entertainment Group (HKG: 2125) made a net loss of 109 million yuan last year and its revenue dropped 14.3%

The maker of dramas for film and TV hopes to cut costs by using AI to generate content

🇨🇳 Midea Group (000333 CH): Strong 4Q23 Result As Expected (SmartKarma) $

Midea (SHE: 000333) posted strong 4Q23 results, with net profit up 18% yoy and sales up 10% yoy.

In terms of 2024 outlook, management targets a 5-10% yoy growth in both the top and bottom line.

The stock is has rerated up to 12x 2024E earnings, compared to an average of 13x over the last 10 years.

🇨🇳 Tian Tu plunges into the red on sagging Hong Kong stock market (Bamboo Works)

The venture capital company posted 814 million yuan in investment losses last year, reversing 337 million yuan in gains for 2022

Tian Tu Capital (HKG: 1973) posted an 873 million yuan net loss last year, reversing a 559 million yuan profit in 2022

The venture capital firm is getting hit by weakness in the Hong Kong IPO market, one of its primary venues for disposing of its consumer-related investments

🇨🇳 Investors lap up China Feihe despite declining profits and revenue (Bamboo Works)

The premium infant formula maker is taking a hit from China’s low birth rate, but investors may like its dividends and transition to other dairy products

China Feihe Ltd (HKG: 6186 / OTCMKTS: CHFLF / CFEIY) posted declines in both profits and sales last year, as it is heavily exposed to the country’s falling birth rate

The company, which gets 91% of its revenue from infant milk formula, may remain attractive to investors due to its pledge to pay much of its profits as dividends

🇨🇳 In Depth: Luckin challenger pushes China’s coffee price war toward boiling point (Caixin) $

China’s coffee market is in the midst of a price war, and it’s showing no sign of abating as the country’s leading affordable brand Luckin Coffee (OTCMKTS: LKNCY) faces down challenger Cotti Coffee, the upstart launched by Luckin’s disgraced co-founders Lu Zhengyao and Qian Zhiya.

Forced out of Luckin for their role in perpetrating a $300 million fraud, Lu and Qian returned in late 2022 with a new venture and promptly went to battle with their former brainchild. They adopted the same low-price strategy, at one point undercutting Luckin’s best discount.

🇨🇳 Shangri-la finds new life in tourism industry rebound (Bamboo Works)

The high-end hotel operator ended three years of losses with a return to profits last year, buoyed by a post-pandemic rebound in global travel

Shangri-La Asia (HKG: 0069 / FRA: SHN / OTCMKTS: SHALF) earned a profit of $184 million last year and distributed a dividend of HK$0.15 per share to celebrate its return to the black after three years of losses

The Hong Kong-listed hotel operator expects its next growth driver to come from a pickup in Chinese traveling abroad

🇨🇳 Anta Sports (2020 HK): Sustains Strengths into FY24 (SmartKarma) $

After a solid FY23, ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF)‘s outlook for FY24 looks equally encouraging. Its various brands are expected to grow by 10-30% YoY still.

Listing of Amer Sports (NYSE: AS) will provide Rmb1.6bn non-recurring gain in 1H24. For the full year, there will be a positive swing in its profit contribution.

Anta Sports can be considered as a sportswear brand incubator, and its premium PERs of 18.3x and 15.9x for FY24 and FY25 reflect the ability to brew new brands.

🇨🇳 Chinese IVF specialist expands into Southeast Asia with Indonesian investment (Caixin) $

Jinxin Fertility Group (HKG: 1951 / FRA: 3NX / OTCMKTS: JXFGF), China’s largest private provider of in vitro fertility (IVF) services, is buying a stake in an Indonesian peer, venturing into Southeast Asia as demand in China declines with more couples opting not to have babies.

Hong Kong-listed Jinxin Fertility has signed an equity investment deal to become a “significant shareholder” of PT Morula Indonesia, an IVF specialist affiliated with PT Bundamedik Tbk (IDX: BMHS), a major women- and children-focused health care services group in Indonesia, according to a joint statement Monday. It did not specify how much capital Jinxin will invest.

🇨🇳 Hansoh Pharmaceutical (3692 HK): Performance Improves in 2H23; Innovative Drugs to Continue to Roar (SmartKarma) $

Hansoh Pharmaceutical Group Company (HKG: 3692 / FRA: 3KY / OTCMKTS: HNSPF) reported a whopping 55% YoY net profit growth to RMB3 billion on just 13% YoY revenue growth to RMB6 billion in 2H23.

Revenue from innovative drugs zoomed 52% YoY to RMB4 billion and its proportion to total revenue increased to 73% in 2H23 from 54% in 2H22 and 62% in 1H23.

Although Hansoh is not expected to receive marketing approval for any in-house innovative product in 2024, existing portfolio of innovative drugs will continue to drive the growth of the company.

🇨🇳 Citic Resource Holdings (1205.HK) – A Play on Oil and Coal Demand

CITIC Resources Holdings Limited (HKG: 1205 / FRA: CZR / OTCMKTS: CTJHF / CTJHY)

One of a basket of Hong Kong commodity stocks we like

One off issues in 2023 which should reverse in 2024

Can also be viewed as a tangential play on India’s industrial growth

🇨🇳 Exclusive: Beijing nudged Syngenta to withdraw $9 billion Shanghai IPO on market weakness (Reuters) $ 🗃️

Chinese authorities nudged Swiss agrichemicals and seeds group Syngenta to withdraw its application for a long-delayed $9 billion IPO in Shanghai on concerns about the impact a sizeable new offering would have on a volatile market, four people said.

The Chinese state-owned pesticide giant last Friday withdrew its bid for the initial public offering (IPO) saying the decision was taken “after careful consideration of (the) industry environment and the company’s own development strategy”.

🇲🇴 Timing on Macau Legend Laos casino sale extends to Apr 15 (GGRAsia)

The timing for arrangements regarding planned disposal of a Laos casino resort business by Hong Kong-listed Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) has been extended again, now to April 15.

The disposal, if realised, is expected to help strengthen Macau Legend’s cash flow and its financial resources for Macau operations, the firm has said in previous filings.

Macau Legend owns a tourism complex called Macau Fisherman’s Wharf, where it runs casino hotel Legend Palace, via a so-called services agreement, under the gaming licence of Macau concessionaire SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY). Fisherman’s Wharf is waterfront complex close to Macau’s Outer Harbour Ferry Terminal on the city’s peninsula.

Macau Legend had a net loss for 2023 of HKD4.9 million (US$626,193), according to its annual results filed on March 28.

🇲🇴 LVS buybacks, dividends a credit constraint: Moody’s (GGRAsia)

Casino operator Las Vegas Sands (NYSE: LVS), which runs gaming resorts in Macau and one in Singapore, has a ‘Baa3’ long-term rating with ‘stable’ outlook on its senior unsecured obligations, supported by the “high quality, popularity, and favourable reputation” of its properties, says Moody’s Investors Service Inc in a Tuesday update.

In Macau, Las Vegas Sands’ unit, Sands China Ltd, is one of that city’s six casino concessionaires. In Singapore, the parent group runs Marina Bay Sands, one half of that city-state’s casino duopoly.

In October last year, it increased its share repurchase programme to US$2 billion and extended the expiration to November 2025.

🇹🇼 6807 :TW a true one foot hurdle with a good catalyst (One foot hurdle)

6807 FY Group (TPE: 6807) is a couch ODM with IKEA as its largest customer (over 80% of sales in 2022). It was listed in April 2022. It is now trading at an EV/EBIT of 3.71 with a dividend yield of 6.28%, near an all time high. Right off the bat there are plenty of signs people do not like: a manufacturer, a concentrated customer with strong bargaining power, newly listed, trading at all time high. However, it is profitable six years in a row, has a healthy balance sheet, and I believe there is an effective catalyst that is working in favor of the company. FY Group is tradable on interactive brokers and English filings are available.

🇹🇼 As predicted, TCL Electronics (1070.HK) wows with 2023 results and continues push into high-end products (Pyramids and Pagodas)

Sales up in lucrative large TV segment, with supplementary income streams showing healthy growth

Spirits were high as we attended the TCL Electronics Limited (HKG: 1070 / FRA: TC2A / OTCMKTS: TCLHF) (“TCL”) investor conference last Thursday (28 March) at the Shangri-La in Hong Kong, following its after-market earnings release. The results topped our own expectations in some areas, which we outlined in our recent write-up on the Company. We decided to summarize the results, as well as management insights shared at the conference for added context.

🇹🇼 Taiwan Dual-Listings Monitor: TSMC, ASE Spreads Bounce Back to Historically Extreme Highs (SmartKarma) $

🇰🇷 S.Korea 1Q casino rev: Paradise Co sales up y-o-y, GKL down (GGRAsia)

Foreigner-only casino businesses Paradise Co Ltd (KOSDAQ: 034230) and Grand Korea Leisure Co Ltd (KRX: 114090), operating from South Korea, each reported on Tuesday their March and first-quarter performance.

Paradise Co’s first-quarter casino revenue was just under KRW208.83 billion, up 55.4 percent year-on-year. First-quarter table drop amount was just under KRW1.73 trillion, a rise of 36.8 percent on the same period in 2023.

GKL saw its casino revenue for the three months to March 31 fall 12.9 percent year-on-year, to just under KRW93.67 billion. Its first-quarter casino drop was KRW916.04 billion, up 21.5 percent from the same period in 2023.

🇰🇷 Kangwon Land to triple casino space in US$1.85bln revamp (GGRAsia)

South Korea’s Kangwon Land (KRX: 035250), which operates Kangwon Land casino resort complex (pictured), has announced a KRW2.5-trillion (US$1.85-billion) new phase for the property, that will triple the size of its casino space by 2032.

Kangwon Land, the only casino in the country open to locals, is in a rural upland area three hours east of Seoul. Its promoters recently announced plans to expand the venue’s appeal and marketing effort, in order to draw more players from overseas.

In full-year 2023, Kangwon Land Inc’s net income attributable to its owners stood at KRW345.15 billion, up 198.5 percent from 2022, on sales that grew by 9.3 percent year-on-year, to just under KRW1.39 trillion.

🇰🇷 Samsung signals end to chip downturn with forecast 10-fold jump in profit (FT) $ 🗃️

🇰🇷 Korean Holdcos Vs Opcos Gap Trading Opportunities in 2Q 2024 (Douglas Research Insights) $

In this insight, we highlight the recent pricing gap divergences of the major Korean holdcos and opcos which could provide trading opportunities in 2Q 2024.

Of the 38 pair trades, 26 of them involved holdcos outperforming opcos in the past six months, suggesting increased capital allocation to Korean holdcos relative to their opcos.

These pairs could generate trading opportunities in terms of their pricing gaps closing reversal. (CJ Corp vs CJ Cheiljedang & Hanjin KAL Corp vs Korean Air Lines).

🇰🇷 Gap Trades in Korean Prefs Vs Common Share Pairs in 2Q 2024 (Douglas Research Insights) $

In this insight, we discuss numerous gap trades involving Korean preferred and common shares in 2Q 2024.

Although the discount on the preferred shares versus the common shares has been gradually narrowing in the past decade, this discount increased from end of 2021 to 1 April 2024.

On a longer timeframe (3-4 years), we believe this discount could narrow further to the 20-25% range, which provides additional opportunities for the Korean preferred shares to further make gains.

From 3 January to 1 April 2024, the preferred stocks of Amorepacific Corp (KRX: 090430 / 090435) and Hyundai Motor (KRX: 005380 / 005385 / 005387 / FRA: HYU / OTCMKTS: HYMTF) displayed sharply higher share price appreciation relative to their common counterparts.

In the same period, the common stocks of CJ Corp (KRX: 001040), Doosan Corp (KRX: 000150), and S-Oil Corp (KRX: 010950) displayed significantly higher share price appreciation relative to their preferred counterparts.

🇰🇷 SK Square: Higher NAV Driven by Its Holding in SK Hynix (Douglas Research Insights) $

SK Square (KRX: 402340) owns a 20.07% stake in SK Hynix (KRX: 000660) which is now worth 27.2 trillion won. SK Square’s market cap is only 39% of SK Square’s stake in SK Hynix.

SK Square has benefited from increased capital allocation to low P/B stocks in Korea due to the Corporate Value Up program. SK Square is trading at P/B of 0.7x.

Amid the tremendous demand for Nvidia (NASDAQ: NVDA)‘s AI related chips, this has also benefited several Korean companies including SK Hynix and SK Square.

🇰🇷 Hyundai Motor Group Becomes the Largest Shareholder of KT Corp (Douglas Research Insights) $

Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) has become the largest shareholder of KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC), as the National Pension Service has recently reduced its stake in KT from 8.53% previously to 7.51%.

Despite this recent change in the largest shareholder status of KT Corp, this requires the approval from the Korean Ministry of Science and ICT.

Although the Hyundai Motor Group (HMG) has become the largest owner in KT Corp, the most likely scenario is for HMG to remain a passive investor in KT.

🇰🇷 Tender Offer of 25% of Hyundai Home Shopping Shares by Hyundai GF Holdings (Douglas Research Insights) $

On 3 April, it was reported that Hyundai G.F. Holdings will be conducting a tender offer of 3 million shares of Hyundai Home Shopping Network Corp (KRX: 057050) (25% of outstanding shares).

The tender offer price is 64,200 won. The main reason for this tender offer is to meet the regulatory requirement of a holding company by 2025.

We are positive on the tender offer of a 25% stake in Hyundai Home Shopping by Hyundai G.F. Holdings.

🇰🇷 Hanwha Group’s Restructuring to Positively Benefit Hanwha Corp but Negatively Impact Hanwha Ocean (Douglas Research Insights) $

We believe the new restructuring plan of the Hanwha Group is likely to have a positive impact on Hanwha Corp (KRX: 000880) but could negatively impact Hanwha Ocean (KRX: 042660).

Our NAV analysis of Hanwha Corp suggests NAV of 3.2 trillion won or NAV per share of 43,168 won, which is 50% higher than current share price.

The biggest component of the valuation is Hanwha Corp’s 34% stake in Hanwha Aerospace (KRX: 012450) which is worth 4.1 trillion won. (187% of Hanwha Corp’s market cap).

🇰🇷 Douzone Bizon: To Become the Fourth Internet Bank in Korea? (Douglas Research Insights) $

On 4 April, Douzone Bizon (KRX: 012510) announced that it plans to become the fourth Internet bank in Korea. Following this news, Douzone Bizon’s share price increased by 21%.

If the company succeeds in receiving the license to operate an Internet bank, this could meaningfully impact the company’s long-term sales and profits.

If Douzone Bizone expands into the Internet banking services, it may need additional backing from strategic/financial partners including Bain Capital which has a 10.2% stake in Douzone Bizon.

🇰🇷 Hanwha Aerospace: Spin Off of Semiconductor Equipment and Video Surveillance Units (Douglas Research Insights) $

On 5 April, Hanwha Aerospace (KRX: 012450) formally announced that it will spin off its semiconductor equipment and video surveillance units which contributed to about 16% of its revenue.

We are Negative on Hanwha Aerospace mainly due to valuations. Its share price has risen so much in the past year that its valuations are no longer attractive.

Hanwha Aerospace is trading at premium valuation to Lockheed Martin on an EV/EBITDA basis. Despite its recent strong growth, Hanwha Aerospace is no Lockheed Martin.

🇰🇷 Hanmi Science: If Talks With Mum and Sister Break Down, Then KKR May Provide a Partial Tender Offer (Douglas Research Insights) $

The 2024 AGM of Hanmi Science (KRX: 008930) is over and the two Lim brothers have control of the company. Nonetheless, the fight for the control of Hanmi Science is not over.

There is an increasingly probable scenario where the KKR private equity firm gets involved, joining hands with the Lim brothers.

If mum and sister do not sell their shares (which seems to be the higher likely scenario), then KKR may issue a tender offer to the remaining minority shareholders.

🇸🇬 Micro-Mechanics (MMH SP) (Asian Century Stocks)

Singapore’s favorite child, now experiencing an industry downturn

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF) – US$147 million) is a manufacturer of precision tools used in the back-end processes of semiconductor chip manufacturing.

The company’s founder, Chris Borch, is an American who was sent to Singapore as an expat working for a semiconductor equipment maker. After two years, he left his job and used his US$600 of savings to build a precision manufacturing company in the back of a hat factory in suburban Singapore.

🇸🇬 Better Buy: Keppel DC REIT Vs Digital Core REIT (The Smart Investor)

We size up both data centre REITs to determine which qualifies as the better investment.

Industrial REITs, however, have held up better than most other REIT sub-sectors as demand for e-commerce remains strong.

In particular, data centre REITs demonstrated resilience as technology companies need vast amounts of storage space with the explosion in digitalisation and electronic device usage.

Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) and Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF) are beneficiaries of this trend.

Both REITs are pure data centre REITs but we compare each REIT on various metrics to determine which is the better buy.

🇸🇬 🇿🇦 Grindrod Shipping: Minority Shareholder Buyout Proposal Might Not Pass (Seeking Alpha) $

Grindrod Shipping (NASDAQ: GRIN) shares rallied by 30% after the company announced plans to buy out minority shareholders for $14.25 in cash per common share.

The offer represents a 12% discount to estimated net asset value and an approximately 45% discount to controlling shareholder Taylor Maritime’s $26 cash tender offer back in 2022.

However, with Taylor Maritime Investments Ltd (LON: TMI / TMIP / FRA: 91E / OTCMKTS: TMILF) not permitted to vote on the proposal, approval won’t be an easy task.

Singapore law requires a 75% majority of shareholders to pass a special resolution on a yet to be scheduled extraordinary general meeting which appears to be a Herculean task.

With approval anything but certain and shares trading just 4% below the proposed buyout price, I would strongly advise investors to consider selling into the open market next week to avoid the risk of shares giving back all of Thursday’s gains in case the special resolution doesn’t pass.

🇸🇬 Flex Ltd.: Undervalued With Solid Fundamentals (Seeking Alpha) $

Flex Ltd. (NASDAQ: FLEX) is up 76.94% over the last year outperforming the S&P 500 with a margin of about 50.59%.

The company is innovative, with a diverse business model which has a high growth potential.

The stock is undervalued with a double-digit upside potential warranting a buy decision.

🇰🇭 🇭🇰 NagaCorp 1Q GGR up 24pct y-o-y, EBITDA tops US$80mln (GGRAsia)

First-quarter casino gross gaming revenue (GGR) at Cambodia operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) rose by 23.7 percent year-on-year, to nearly US$145.4 million, according to a non-statutory filing on its quarterly results made to the Hong Kong Stock Exchange on Wednesday.

The company reported a net profit of US$177.7 million for full-year 2023, up 65.7 percent on the prior year. Such profit was on revenue that rose by 15.7 percent year-on-year, to US$533.2 million.

The management of NagaCorp said in February that it was looking to reduce the scale and budget of its Naga 3 extension project at NagaWorld, in order to minimise capital expenditure, “so that there is surplus cash flow, possibly for the payment of dividends”.

🇮🇳 Infosys: This Pullback Can Set Up For A Move Much Higher (Technical Analysis) (Seeking Alpha) $

Infosys (NYSE: INFY) stock is currently in a pullback phase, but it is expected to make a strong move higher in the future.

The stock has corrected downward in price, making it more reasonable in terms of valuation.

Our analysis suggests that a strong uptrend is likely in place for Infosys stock.

🇮🇳 Infosys: Facing Uncertainty As Gen AI Takes Time To Deliver (Seeking Alpha) $

Infosys (NYSE: INFY) shares have gained over 30% since the release of its Topaz Generative AI tool, but have now dropped to $17.52.

The company is facing demand uncertainty and lower margins, with the AI tailwind not materializing as expected.

Gartner predicts that companies will focus more on traditional IT projects and profitability optimization, delaying investment in Generative AI.

Therefore, this is not the time to invest as there are volatility risks.

Even then, I have a Hold position as this remains a profitable company with a strong balance sheet.

🇮🇳 Wipro: Focus On Peer’s Performance And Long-Term Potential (Seeking Alpha) $

Wipro Ltd (NYSE: WIT)‘s upcoming quarterly results release could potentially be weaker than what the market anticipates, taking into account its peer’s recent quarterly financial performance and management comments.

On the flip side, WIT’s long-term growth outlook is favorable, considering the rise of AI and the projected increase in Engineering, Research & Development or ER&D spending.

Wipro’s shares are rated as a Hold, after assessing the stock’s valuations and evaluating the company’s prospects for the near-term and long-run.

🇬🇷 Greece’s banks cap a remarkable comeback (FT) $ 🗃️

🇬🇷 DB Energy – an intriguing company that supports energy efficiency in the industry (WSE:DBE) (Active Balance)

Note: 10:20 minute podcast

DB Energy SA (WSE: DBE)

Current price: 19,50 pln

Market Cap: ~68 mpln

Share#: 3.476.460

🇵🇱 Text: Commoditization And Disappointing Growth (Seeking Alpha) $

Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF)‘s products are being commoditized, leading to margin contraction.

LiveChat is the company’s biggest product by a sizable margin, but its growth has come to a halt.

ChatBot’s growth is also lackluster compared to the overall chatbot market, indicating that Text’s best days may be behind them.

🇧🇷 Companhia Siderúrgica Nacional: Competition, Low Margins And High Leverage (Seeking Alpha) $

The Brazilian steel industry is suffering from the large supply of Chinese steel in the domestic market. And there should be no action by the Government to protect the national.

Domestic market demand remains weakened, coupled with the strong supply of Chinese steel and difficulty in passing on the price. Result? Low margins.

Additionally, given the capital-intensive nature of the sector, Companhia Siderurgica Nacional SA (NYSE: SID) trades at the highest P/B among its competitors, meaning it has a stretched valuation.

🇧🇷 Petrobras: The Sell-Off Provides Opportunity (Seeking Alpha) $

In recent weeks, Petrobras (NYSE: PBR / PBR-A)‘s momentum has weakened, and at the moment, it’s trading 14% off-high after a wave of analyst downgrades followed dividend frustration.

PBR delivered strong financial performance last year with the second-highest EBITDA ($52.4 billion), operational cash flow ($43.2 billion), and net profit ($24.9 billion) in history.

The market is expecting a further correction in the company’s financials, but this may be already reflected in its forwarding valuation multiples.

Despite risks, I think Petrobras is still undervalued and presents a buying opportunity with double-digit percentage upside potential.

🇧🇷 Ultrapar: The Peak Is Here (Seeking Alpha) $

(Energy and logistics infrastructure conglomerate) Ultrapar Participaçoes (NYSE: UGP) Q4 earnings were strong in all measures, but the stock price has fallen since.

The improvements in Gross Margin and Deleverage seem to have been priced in and are expected to subdue during FY’24.

I don’t expect market-beating returns from Ultrapar as it has almost achieved my previous price target. I recommend investors to exit their positions.

🇧🇷 Braskem: A Rising Odds For ADNOC Deal, Though Declining Risk-Reward (Rating Downgrade) (Seeking Alpha) $

(Plastic producer) Braskem (NYSE: BAK)‘s potential acquisition by ADNOC (Abu Dhabi National Oil Company) is still in the spotlight, with due diligence ongoing. The political environment in Brazil remains supportive of the deal.

BAK’s liquidity is more than enough to cover its obligations in the coming years, mitigating the financial risk.

The uncertainties around tag-along rights are diminishing. In February 2024, Petrobras (NYSE: PBR / PBR-A) exercised its rights when it sold its 18.8% stake in UEG Auracaria.

With the expected takeover price by ADNOC in the range of $14-$15/share and the present stock price of $10.3, the risk-reward is not skewed in our favor. I give BAK a hold rating.

🇧🇷 Blackouts spark fears of grid ‘collapse’ in Brazil’s biggest city (FT) $ 🗃️

Power outages in São Paulo reflect chronic underinvestment in country’s infrastructure

Nunes’s criticisms of Enel Américas SA (SSE: ENELAM) (Enel S.p.A. (BIT: ENEL / FRA: ENL / LON: 0TGA / OTCMKTS: ENLAY)) were echoed by Alexandre Silveira, Brazil’s energy minister, who has asked regulators to start a disciplinary process that could result in company losing its operating concession. Under the terms of the current concession, which is due to run until 2028, Enel is responsible for investing in and maintaining the grid.

🇧🇷 Cosan: A Promising Player In Brazil’s Energy Transition (Seeking Alpha) $

Brazil has enormous potential to be the leading nation in the energy transition with decarbonized products. In this sense, Cosan SA (NYSE: CSAN) stands out as having the most significant energy transition projects.

Despite its promising and diversified business, the company is extremely discounted compared to national and international peers and when compared to its own history.

With the end of the investment cycle approaching, the company should report better results and have a revaluation of multiples by the market.

🇧🇷 WEG: Difficulty In Maintaining Strong Growth, Valuation Appears Stretched (Seeking Alpha) $

(Electric engineering, power and automation technology) WEG SA (BVMF: WEGE3) trades with a large premium of 31% in its valuation compared to its competitors, this is due to the quality of its managers who created a unique business model.

However, in 2023 the company had difficulty maintaining the strong earnings growth embedded in its valuation, this is due to restrictive monetary policies around the world.

With difficult prospects for capital goods businesses around the world over the next few years, the company may undergo multiple repricing by the market.

🇧🇷 BrasilAgro Faces A Challenging H2 2024 And Is Not An Opportunity Yet (Seeking Alpha) $

Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3)‘s stock price remains unchanged since January, and with agricultural commodity markets declining, it is not currently an attractive investment opportunity.

The company experienced seasonal losses and an increase in debt during the planting season, but expects to recoup losses in the second half of the fiscal year.

Indications suggest that the second half of 2024 will not be a great period for BrasilAgro, with decreased corn planting, dry weather conditions, and decreasing agricultural commodity prices.

🇧🇷 Ambev: A Currency That Produces Beer (Seeking Alpha) $

Ambev (NYSE: ABEV)‘s valuation is strongly tied to the strength of the Brazilian Real.

Ambev is a wide-moat company in the markets it operates in, with strong profitability and a solid balance sheet.

Ambev’s valuation is attractive assuming no significant deterioration of the Brazilin real in the near future despite the economical turmoil in Latin America.

🇧🇷 BRF S.A. Has Stabilized Its Business, And Investors Await The Next Act (Seeking Alpha) $

Successful operational improvement initiatives and improving free cash flow have led to strong performance from BRF Brasil Foods SA (NYSE: BRFS / BVMF: BRFS3) shares.

The company has achieved significant improvements in feed conversion, meat yields, plant efficiency, logistical execution and retail in-store positioning.

Competition from JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) in Brazil is a concern, but BRF’s branded share has held up well and the company has continued to build share in key markets outside of Brazil.

I expect the Street to be very focused on management commentary about further margin improvement prospects with the upcoming quarterly report.

Near-term upside looks more “good” than “great,” but there are certainly avenues to greater gains if mid-teen EBITDA margins become a sustainable reality.

🇧🇷 Azul Is Still A Hold Despite The Lower Price And Gol’s Bankruptcy (Seeking Alpha) $

Azul Sa (NYSE: AZUL / BVMF: AZUL4), one of the main Brazilian airlines, has posted strong Q4 and FY23 results, with revenues surpassing FY19 levels and achieving close to a 15% operating margin.

The bankruptcy of competitor Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4) is unlikely to lead to lower competition for Azul and better profitability. Instead, competition is expected to increase, leading to a decrease in Azul’s current high margins.

Azul’s viability is questionable due to its high debt, lease payments, and the need to generate significant EBITDA to break even. The company’s profitability and viability are fundamentally questioned by industry characteristics.

🇧🇷 Inter & Co: Financial Super App Faces A Growth Test In 2024 (Seeking Alpha) $

Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) is generating strong growth through its Fintech platform as a digital bank in Brazil.

The company has expanded operations into the United States with a plan to double its client base over the next few years.

While benefiting from solid fundamentals, a backdrop of high expectations in a highly competitive market should keep shares volatile.

🇲🇽 MXF: Expect Consolidation For Mexico Stocks As Worries Emerge In 2024 (Seeking Alpha) $

The Mexico Fund, Inc (NYSE: MXF) aims for long-term capital appreciation through equities listed on the Mexico Stock Exchange.

The fund has experienced a large discount to NAV, but this may present an opportunity for investors.

Risks in the short term are emerging though due to currency movements and upcoming elections.

🇲🇽 FEMSA Offers Underrated Quality Growth For Patient Investors (Seeking Alpha) $

Coca-Cola Femsa SAB de CV (NYSE: KOF)‘s shares have come under pressure due to unexpected changes in the C-suite and disappointment about the pace of capital returns to shareholders.

The company has announced a 20% hike in the regular dividend and an extraordinary dividend for the next four quarters, doubling the dividend yield.

FEMSA has underrated growth potential, not only with its core Oxxo brand in Mexico but also with international expansion and newer store concepts like Bara.

🇲🇽 Vista Priced For $65 Oil And No Growth, Still A Buy (Seeking Alpha) $

Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA) is one of Argentina’s largest oil producers and exporters, specializing in the Vaca Muerta basin.

The company showed operational improvement in FY23, with production growth, cost reduction, and improved gas to total production ratio.

Vista has high returns on capital and plans for further growth without the need for debt financing, making it an attractive investment opportunity.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Foreign direct investment into China plummets to 23-year low (Caixin) $

Net foreign direct investment (FDI) into the Chinese mainland plummeted to a 23-year low last year, government data showed Friday.

The $42.7 billion inflow is less than a quarter of that seen in 2022. The latest result was revised up from the $33 billion preliminary number published by the State Administration of Foreign Exchange (SAFE) last month.

🇨🇳 Gloomy China stock market hits brokers’ pay packets (Caixin) $

China’s securities industry experienced another year of pay cuts in 2023 as the country’s depressed capital markets and the government’s campaign against excessive remuneration in the financial sector took their toll.

Disclosures from half of the 44 securities brokerages listed on the Chinese mainland that had published their annual reports by April 1 show a downturn in the industry’s financial performance. Their total revenue in 2023 fell 1.8% to 373.4 billion yuan ($53 billion) while their net profits attributable to their parent companies dropped 7.1% to 108.1 billion yuan, marking the second consecutive year of lower profitability.

🇨🇳 In Depth: Frugality bites for China’s cash-strapped local governments (Caixin) $

Chinese local governments are gearing up for another tough year and coming to terms with the new normal of frugality amid growing pressure on fiscal revenue and efforts to tackle their debt burdens.

In his first government work report to the annual session of the National People’s Congress, the country’s top legislature, in March, Premier Li Qiang told government officials to get used to tightening their belts, echoing a call in December by top leaders when they spoke of the growing pressure on budgets at their annual Central Economic Work Conference.

🇨🇳 China’s rival to Boeing and Airbus looks to Asia first (FT) $ 🗃️

🇨🇳 China’s stockbrokers suffer pay cuts as markets decline (FT) $ 🗃️

🇰🇷 Are we at peak K-pop? Goldman doesn’t think so (FT) $ 🗃️

🇮🇩 Indonesia after Jokowi (Asian Century Stocks) $

How the election of Prabowo Subianto will affect the Indonesian consumer.

Prabowo Subianto will become Indonesia’s president in October 2024. He has pledged to continue President Jokowi’s reforms, including building a new capital in East Kalimantan and pushing for the continued industrialization of the commodity base.

However, given Prabowo’s background as a military commander during the years of former dictator Suharto, it’s not clear what his long-term ambitions are. He has spoken favourably of Suharto, which begs the question of whether we’ll see a return to Suharto-era policies, including greater state ownership and state control.

At the end of the post, I’ll also discuss the likely implications of Prabowo’s presidency on the Indonesian stock market and the currency.

🇲🇾 A surprising winner in the US-China chip wars (FT) 19:59 Minutes + Malaysia: the surprise winner from US-China chip wars (FT) $ 🗃️

How Malaysia is making the most of the rivals’ battle for global tech supremacy

The US and China’s battle for dominance in the semiconductor industry is having some surprising knock-on effects: Companies are looking to insulate their supply chains from rising geopolitical tensions. And many from around the world are setting their sights on Malaysia to set up or expand their chip factories. FT correspondent Mercedes Ruehl explains how the country earned a prized spot in the supply chain, and what it needs to do to keep hold of it.

🌍 How Gulf states are putting their money into mining (FT) $ 🗃️

🌐 Soaring coffee prices will squeeze Asia’s café culture (FT) $ 🗃️

🇨🇷 Is This the Silicon Valley of Latin America? (NYT) $ 🗃️

Now Costa Rica is positioning itself to become a major hub outside Asia for packaging and testing microchips. In the 1990s, Intel built a factory near San José to do just that. That opened the door to more factories and industries and, as a result, an increasingly tech-oriented work force. Today Costa Rica’s biggest category of exports is no longer coffee or bananas but medical devices.

Note: Lengthy tweet retweeted by Elon Musk:

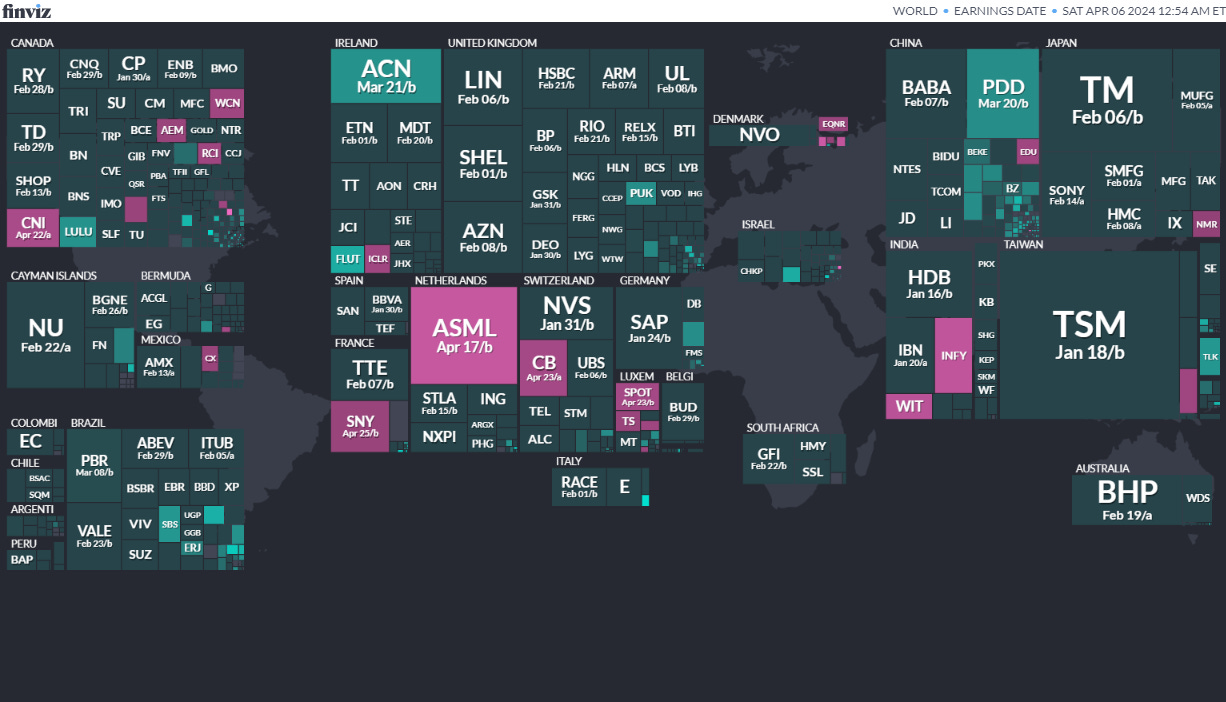

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

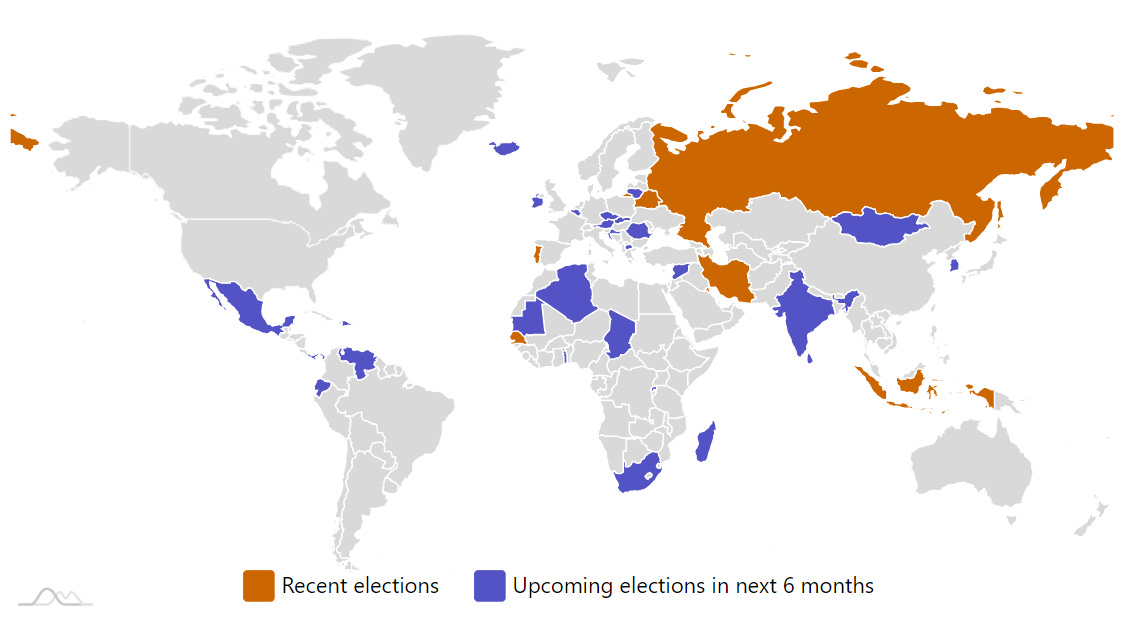

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

KuwaitKuwaiti National AssemblyApr 4, 2024 (d) Confirmed Jun 6, 2023 -

South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

-

Croatia Croatian Assembly Apr 17, 2024 (d) Confirmed Jul 5, 2020

-

India Indian People’s Assembly Apr 19, 2024 (d) Date not confirmed Apr 11, 2019

-

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

-

Panama Panamanian National Assembly May 5, 2024