Emerging Market Links + The Week Ahead (August 12, 2024)

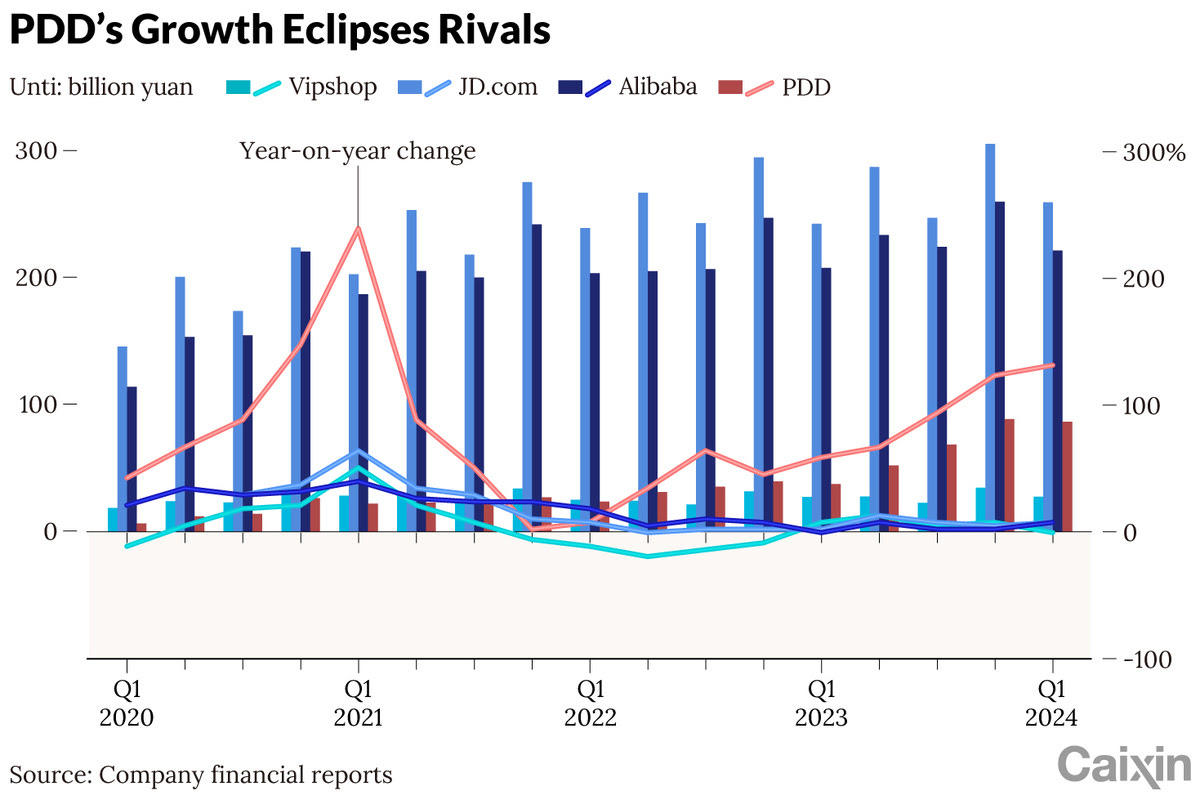

Eyes are increasingly on China as the FT reports that multinationals are sounding the alarm over weak demand there (🗃️) as the world’s second-biggest economy slows, the appetite for foreign brands has weakened, and local competition has intensified (e.g. Caixin has also reported how PDD’s bare-knuckle tactics have upend the Chinese eCommerce landscape).

However and in a recent interview («The World Is not Willing to Absorb the Overproduction Coming Out of China»), Beijing-based economist Michael Pettis said he does not expect a financial crisis. Nevertheless, he says China’s economy is facing major upheavals that will affect the rest of the world…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 In Depth: PDD’s Bare-Knuckle Tactics Upend E-Commerce Landscape (Caixin) $

Temu and Shein face potential U.S. crackdown over import tax loopholes, while Temu’s penalty system for merchants has sparked significant protests in China.

Pinduoduo (PDD Holdings) (NASDAQ: PDD), Temu’s parent company, saw a 131% revenue increase in Q1 2023; its market cap briefly surpassed Alibaba (NYSE: BABA)‘s.

Temu’s controversial practices, including heavy fines and incentivizing low prices, have strained small businesses and driven market-wide low pricing strategies, impacting overall industry dynamics.

🇨🇳 O2O Playing a More Prominent Role in China Street Drinks (Smartkarma) $

On August 7th, Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY)‘s on-demand order volume reached a historical high of 98mn on surging orders from street drinks. Meituan has connected to the backend systems of street drink vendors;

Delivery order is a double-edged sword. It boosts volume at the expense of margin. Further, the ownership of the volume is questionable;

With Pin-hao-fan, Meituan already atomized the small restaurants. Now Meituan is playing the same trick with street drinks. The result will be more dramatic to the benefit of Meituan.

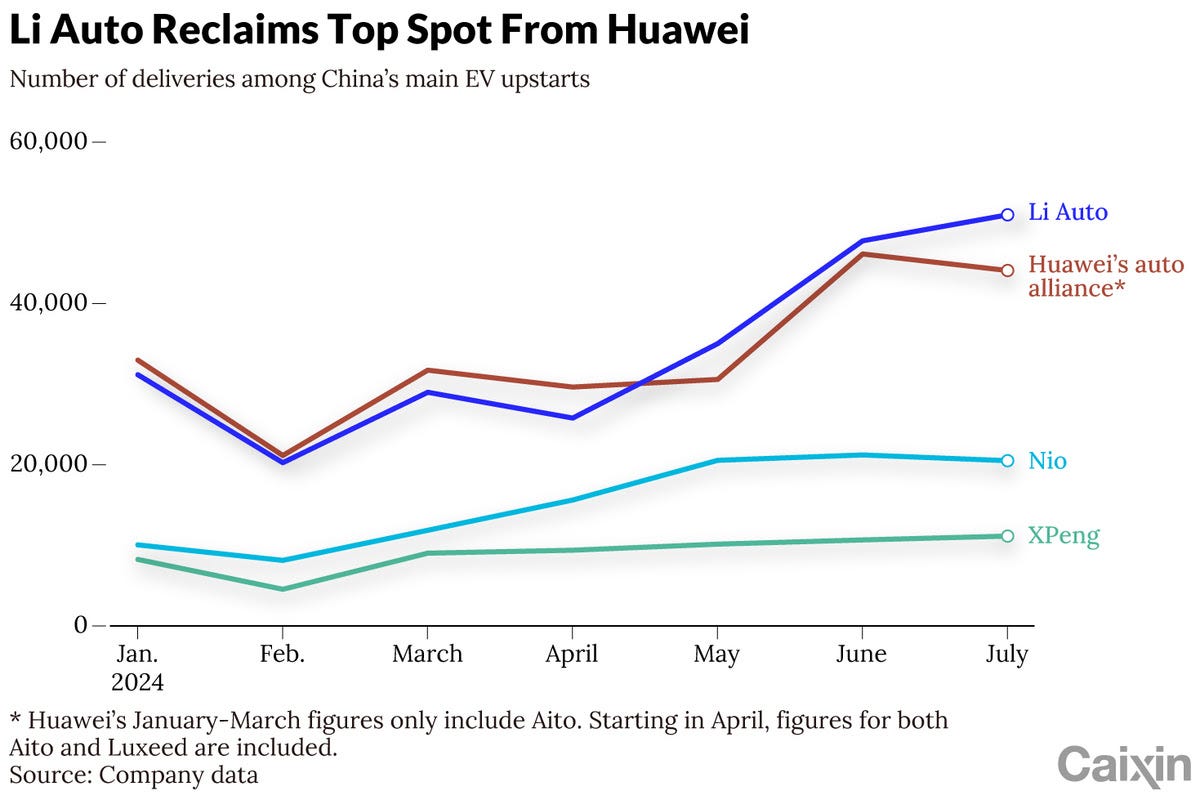

🇨🇳 Charts of the Day: Li Auto Retakes EV Sales Top Spot From Huawei (Caixin) $

Li Auto (NASDAQ: LI) topped EV deliveries among emerging Chinese EV-makers in June and July, with 47,774 and 51,000 units respectively.

Huawei’s EV brands, Aito and Luxeed, had combined deliveries of 46,141 in June and 44,090 in July.

Li Auto’s setbacks included a viral image of its Mega EV and increased competition from Huawei, prompting various corrective measures including price cuts and redesigns.

🇨🇳 XPeng’s Flying Car Unit Secures $150 Million Fresh Funding to Start Mass Production (Caixin) $

XPeng Aeroht (XPeng (NYSE: XPEV)) raised $150 million in a funding round coordinated by the Guangzhou government, with at least three state-owned companies participating.

The funds will be used for research, development, and mass production of flying cars, with pre-sales starting in Q4 2023 and mass production in Q4 2025.

XPeng Aeroht’s post-investment valuation exceeds $1 billion, and it plans to build a manufacturing plant in the Guangzhou Development Zone.

🇨🇳 Daqo New Energy Corp. ($DQ) (“From $100K to $1M” & More.)

The solar industry is like a minefield, with many absolutely terrible companies destroying shareholder value. But if you dig deeper, you might uncover Daqo New Energy (NYSE: DQ)—a company that might initially seem like just another name in the solar sector, but is far from ordinary. This article offers a deep dive into Daqo New Energy’s business and investment potential. Stick around to discover why this extraordinary company presents an exciting opportunity!

Daqo New Energy supplies polysilicon and polysilicon products for solar panels globally. They produce high-purity polysilicon through a chemical vapor deposition process which involves the reaction of purified silicon tetrachloride with hydrogen.

High purity polysilicon is the foundational material for manufacturing photovoltaic (PV) cells, which convert sunlight into electricity. The purity of the polysilicon significantly impacts the efficiency and performance of solar panels. Higher purity polysilicon allows for the creation of more efficient and reliable solar cells, enhancing overall energy conversion.

🇨🇳 Comba Telecom rings up red ink on 5G spending slowdown (Bamboo Works)

The network equipment supplier said it would report a HK$160 million loss in the first half of this year, as it fell into the red for the first time since 2021

Comba Telecom Systems Holdings Ltd (HKG: 2342 / FRA: COA1 / OTCMKTS: COBJF) lost money in the first half of the year as China’s three wireless carriers continued to cut spending on their 5G networks

The telecoms equipment supplier said its financial position “remains sound,” even as it canceled its final dividend last year and reported its cash fell by 20%

🇨🇳 Horizon Robotics IPO: High Valuation Is At Risk As NEV Production Forecasts Have Weakened (Smartkarma) $

Horizon Robotics, a leading provider of ADAS and AD solutions for passenger vehicles, plans to raise up to $500M in Hong Kong IPO.

I expect Horizon Robotics will price its IPO below last round valuation of ~$8.7B as revenue growth will slow below 50% y/y in 2024, down from 71% y/y in 2023.

The company’s key competitors, including Mobileye Global (NASDAQ: MBLY) and Microchip Technology (NASDAQ: MCHP), revised their revenue guidance downwards for the second half of 2024.

🇨🇳 Ubtech Robotics set to keep stumbling into the red (Bamboo Works)

The maker of humanoid and industrial robots faces high production costs and an array of competing machines from big names such as Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF), Tesla, Amazon, and OpenAI

Ubtech Robotics Corp Ltd (HKG: 9880) has predicted fast revenue growth for the first half of the year but is expected to stay mired in losses

Humanoid robots are expensive to manufacture and operate, leaving surgical systems as the most promising part of the robotics industry for now

🇨🇳 New Oriental Education (EDU) (East Asia Stock Insights)

Epic comeback from regulatory woes

When you first saw the title, you might have thought, “Didn’t China’s tutoring sector get decimated in 2021-2022? Why am I reading about a dead industry?”

Indeed, the market panic during that time is still fresh in my memory. I recall a fellow investor telling me that New Oriental Education (NYSE: EDU) was as good as dumplings in a hot pot—finished!

Fast forward to today, and I would never have imagined that EDU shares would be up sevenfold since March 2022. Despite the “double reduction” policy that banned all K-9 academic tutoring and wiped out more than half of EDU’s business, the company has staged an incredible transformation and comeback.

🇨🇳 Don’t write off China edtech just yet, says IPO-bound YXT.com (Bamboo Works)

The digital corporate learning company is aiming to raise $36 million in a New York listing, as China’s education sector slowly rebounds from a crackdown two years ago

YXT.com Group Holding Limited has filed for a New York IPO, aiming to sell investors on its position as China’s largest digital corporate learning company

YXT is trying to sell investors on its big growth potential, even as its revenue contracted in this year’s first quarter

🇨🇳 As Chinese cinema spotlight fades, investors see value in Imax China as privatization play (Bamboo Works)

The big-screen cinema operator reported a slight profit decline in the first half of the year as China’s box office stalls after an initially strong post-pandemic performance

IMAX China (HKG: 1970 / FRA: IMK / OTCMKTS: IMXCF) reported its profit fell 9% to $12.65 million in the first half of this year

Some observers expect a potential new privatization bid for the Chinese cinema company by its Canadian parent, after a previous bid failed

🇨🇳 Tongcheng slows spending as budget travel frenzy fades (Bamboo Works)

The online travel agent has scrapped a major planned acquisition as it faces a slowdown from a sluggish economy, stagnating outbound tourism and backlash over its ease of refunds

Tongcheng Travel Holdings (HKG: 0780)announced it scrapped its planned purchase of a fintech company as a post-Covid ‘military-style’ travel boom starts to fade

The online travel agent’s revenue rose 81% in 2023 as it catered to a new generation of frugal travelers, but the growth rate slowed to 50% in the first quarter

🇨🇳 Struggles in China Hurt Uniqlo’s Bottom Line (Caixin) $

Uniqlo (Fast Retailing Co Ltd (TYO: 9983 / FRA: FR70 / FR7 / OTCMKTS: FRCOY / FRCOF))‘s revenue and profit in Greater China fell in local currency terms during March-May, impacted by increased competition and cautious consumer spending.

Fast Retailing cited factors like poor consumer demand, unseasonal weather, and high comparison base for the decline, with Greater China accounting for 22.1% of total revenue.

To counter weak performance, Uniqlo plans to adjust its strategy in China, including changes to store openings and product offerings.

🇨🇳 Struggles in China Hurt Uniqlo’s Bottom Line (Smartkarma) $

Uniqlo Co. Ltd.’s strategy of raising prices in the face of rising costs has taken a toll on the Japanese clothing retailer’s bottom line in China due to growing competition and thriftier consumers.

The fast-fashion chain’s Greater China profit and revenue both fell in local currency terms during the March-May period, dragged down by poor performance on the Chinese mainland and in Hong Kong, according to earnings results released last month by its parent company, Fast Retailing Co Ltd (TYO: 9983 / FRA: FR70 / FR7 / OTCMKTS: FRCOY / FRCOF). The results did not provide specific earnings figures for the period.

Fast Retailing attributed the poor performance to lackluster consumer appetite, unseasonal weather and an insufficient product lineup to satisfy local customer needs.

🇨🇳 Xtep races to cut loose money-losing brands (Bamboo Works)

The sports apparel maker will sell the entity that owns K-Swiss and Palladium just five years after acquiring the brands to take them off its books

Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) will sell KP Global, the owner of K-Swiss and Palladium, to Xtep’s controlling shareholders for $151 million through a series of transactions

The foreign brands have racked up losses since the athletic apparel and shoe seller acquired them for $260 million in 2019

🇨🇳 Yum China serves up profit, margin growth despite challenging consumer landscape (Bamboo Works)

The operator of KFC and Pizza Hut restaurants in China reported revenue and profit growth in the second quarter, even as sales contracted at many of its rivals

YUM China (NYSE: YUMC)’s revenue rose 4% in the second quarter on a constant currency basis, while its core operating profit rose 12%

The company is raising its profits and margins by leveraging AI in its in its customer-facing and back-office operations and taking other efficiency-boosting measures

🇨🇳 Chabaidao cancels dividend, Nayuki swings to red as bubble tea sector boils over (Bamboo Works)

China’s premium tea space has become rife with cutthroat competition, with 3,000 brands and up to 420,000 stores fighting for business at the end of last year

Chabaidao (Sichuan Baicha Baidao Industrial (HKG: 2555)) canceled its previously announced dividend, as management said it needs to keep the money for daily operations

Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF) said it fell into the red in the first half of this year due to a weak recovery in consumer demand

🇨🇳 WuXi AppTec posts lower profits but avoids more share price pain (Bamboo Works)

The pharmaceutical services giant delivered lackluster half-year earnings, with revenues and profits both falling, but investors were relieved that its U.S. business took only a minor hit

U.S. sales dipped slightly, with limited impact for now from a proposed law that could limit Chinese access to the U.S. drugs market, where WuXi AppTec Co (HKG: 2359 / SHA: 603259 / OTCMKTS: WUXAY) makes nearly two thirds of its revenue

China’s drug services companies are cutting prices in a battle for business, eating into profit margins

🇨🇳 CR Sanjiu (000999.CH) To Acquire Tasly Pharma (600535.CH) – SOEs Have High Enthusiasm for TCM Assets (Smartkarma) $

China Resources Sanjiu Medical & Pharmaceutical Co (SHE: 000999) plans to acquire 28% stake in Tasly Pharmaceutical Group Co Ltd (SHA: 600535) for RMB6.21 billion at RMB14.85/share. The acquisition of Tasly is in line with the strategic direction of 14th Five-Year Plan.

China Resources is positioned as a leading enterprise in modern industrial chain of TCM by the SASAC. Due to policy support, TCM assets are more likely to be favored by SOEs.

The deal is positive for Tasly, whose valuation has room to rise further, but the market seems “skeptical” about China Resources Sanjiu’s decision, leading to a lackluster share price reaction.

🇨🇳 Hutchmed China Ltd (13.HK/HCM.US) 24H1 – Fruquintinib’s US Sales Beat; Break-Even Is Within Reach (Smartkarma) $

Fruquintinib US sales continue to be the main performance driver. License-out expectations for surufatinib is low. Highlight for savolitinib is the combination with osimertinib for NSCLC, which would bring high growth.

Future playbook of Hutchmed (NASDAQ: HCM) is “continued sharp reduction of expenses + milestones from Takeda based on fruquintinib overseas sales = rapid narrowng of losses”. 2024 overseas market sales may exceed US$300m.

There is not much problem with HUTCHMED completing its performance guidance for the year 2024. Reasonable market value range for HUTCHMED is US$1.75-3.75 billion. Breakeven is expected in 2025.

🇨🇳 Saint Bella IPO: Growth Story Intact, A First-Mover Advantage in Postpartum Care Market in China (Smartkarma) $

Saint Bella, a premium postpartum care service provider, filed to go public in Hong Kong. UBS and CITIC Securities are leading the offering.

Saint Bella operates ultra-premium postpartum centers in Asia, which are located at luxury hotels and detached villas. The company opened its first postpartum center in Hangzhou in 2017.

With strong multi-brand strategy and asset-light business model, Saint Bella is uniquely positioned in premium segment under Saint Bella, Bella Isla and Baby Bella brands.

🇭🇰 Lion Rock Group (1127 HK) (Asian Century Stocks) $

Top global book printer run by a master capital allocator at 7x P/E with net cash

During my trip to Hong Kong a few months ago, I had the privilege of meeting “CK Lau”, the Chairman and founder of Lion Rock Group Ltd (HKG: 1127) - US$146 million).

Lion Rock Group is one of the largest book printers in the world. CK Lau built up the business from scratch by setting up printing operations in China back in 2005. Since then, he’s made a series of acquisitions, all at mid-single-digit P/E multiples or lower.

CK Lau is a brilliant individual. At his previous company, Cinderella Media, he generated annual returns for shareholders of 23% per year over 13 years.

🇭🇰 Swire Properties: Buyback Plan Draws Attention To Stock’s Undervaluation (Rating Upgrade) (Seeking Alpha) $

Swire Properties (HKG: 1972 / OTCMKTS: SWPFF)‘s recent 1H 2024 results didn’t disappoint the market, as its interim recurring underlying profit accounted for half of the sell side’s full-year consensus forecast.

Swire Properties’ undemanding valuations are in the spotlight, after the company initiated a HK$1.5 billion share repurchase program.

My rating for SWPFF is revised to a Buy, considering that the stock is trading at a depressed 0.3 times P/B and offers a potential high-single digit percentage shareholder yield.

🇲🇴 Analysts cut Wynn Macau Ltd year forecasts on China outlook (GGRAsia)

“Rising uncertainty” around China consumption trends has prompted JP Morgan Securities (Asia Pacific) Ltd to cut its estimate for Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) Ltd’s 2024 and 2025 adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA).

Possible pursuit of casino resort projects in downstate New York in the United States, and in Thailand, might limit the ability of the group as a whole, to issue “large-scale dividends”, remarked Seaport’s memo.

🇲🇴 Wynn Macau Ltd says lower mass hold, share hit 2Q results (GGRAsia)

Macau casino business Wynn Resorts Ltd (NASDAQ: WYNN) reported operating revenues of US$885.3 million in the second quarter, down 11.3 percent from the preceding quarter. Such revenue rose by 15.0 percent from US$700.0 million in the prior-year quarter, according to a Tuesday filing from the parent, U.S.-based Wynn Resorts Ltd.

🇲🇴 Wynn ‘meaningful progress’ on debt for UAE says CFO (GGRAsia)

Casino business Wynn Resorts Ltd (NASDAQ: WYNN) says it has made “meaningful progress” on the debt financing for the Wynn Al Marjan Island project (pictured in an artist’s rendering) in which it is an equity partner in Ras Al Khaimah in the United Arab Emirates (UAE). It has also purchased its pro-rata share of the reclamation land on which the scheme sits.

🇹🇼 Silicon Motion: Now Attractively Valued Amid Strong Q2 Results (Rating Upgrade) (Seeking Alpha) $

Silicon Motion Technology Corp (NASDAQ: SIMO) is a global leader in NAND flash and SSD controllers, leveraging its extensive patent portfolio to achieve consistent innovation, secure market dominance, and deliver strong long-term earnings.

Despite a growth rate contraction expected, SIMO’s 2025 growth forecasts still make it a Strong Buy, with a potential 50% price increase in 12 months.

Supply chain risks and regulatory challenges in the semiconductor sector could impact SIMO’s growth, but its strong market position and innovation history offset these concerns.

🇰🇷 SK Telecom: A Blue-Chip Defensive Stock That Could Outperform KOSPI Amid Market Turmoil (Douglas Research Insights) $

Amid recent market turmoil, we believe that SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) could be a solid blue-chip, defensive Korean stock that could outperform the market in the next 6-12 months.

SK Telecom reported better than expected profits in 2Q 2024. The company’s sales were 0.5% higher than the consensus and its operating profit was 3.9% higher than the consensus estimates.

SK Telecom’s shareholder return policy is to return at least 50% of adjusted profit for the year on a consolidated basis.

🇰🇷 Doosan Group Revises Merger Report and Increasing Probability of Merger Getting Cancelled (Douglas Research Insights) $

On 6 August, the Doosan Group (KRX: 000150) announced a revised merger report. Despite some changes in the merger report, there was no change the merger ratios.

Many minority shareholders of Doosan Enerbility (KRX: 034020) and Doosan Bobcat (KRX: 241560) are likely to oppose this merger. The net result is an increasing probability that this merger gets cancelled, in our view.

Doosan Enerbility has set aside about 600 billion won for exercise of appraisal rights and if it exceeds this amount, the merger may be cancelled.

🇰🇷 Initial Thoughts on the K Bank IPO (Douglas Research Insights) $

In this insight, we provide an update on the K Bank IPO, which is more likely in 1H 2025. K Bank is one of the largest Internet-only banks in Korea.

A successful IPO of K Bank could have a positive impact on KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC) which is the indirectly the largest shareholder of K Bank.

K Bank had total operating income of 51.5 billion won (up 328% YoY) in 1Q 2024. Operating margin improved materially from 5.7% in 1Q 2023 to 19.5% in 1Q 2024.

🇰🇷 Delivery Hero losing grip? | Impulso E85 (Momentum Works) 22:23 Minutes

When Delivery Hero (ETR: DHER / FRA: DHER / OTCMKTS: DLVHF) acquired Baemin in 2021, Korea’s leading food delivery platform was financially strong – Eur156 million EBITDA to be specific.

However, recently Baemin is struggling, losing market share to Coupang Eats (Coupang, Inc. (NYSE: CPNG)) and dealing with the resignation of its CEO, Lee Gyuk Hwan.

What does this mean for Baemin’s parent company, Delivery Hero, which relies on Baemin to subsidise its loss-making markets?

Baemin is not the only platform under Delivery Hero facing intense competition. The company’s global portfolio, including operations in the Middle East, Europe, and Southeast Asia, is under significant pressure.

🇰🇷 SK Innovation: Considering on Using Its Treasury Shares to Inject Capital into SK On (Douglas Research Insights) $

SK Innovation (KRX: 096770) is considering on using its treasury shares to inject capital into its EV battery making subsidiary SK On.

The appraisal rights exercise price is 111,943 won per share (15% higher than current price). Many minority shareholders are likely to exercise their appraisal rights in SK Innovation.

We remain Bearish on SK Innovation. We continue to be negative on the SK Innovation and SK E&S merger. Plus, we are concerned about the continued weakness at SK On.

🇰🇷 Korea Zinc: Impressive Capital Return Plans and a Big Price Gap Between Korea Zinc and Young Poong (Douglas Research Insights) $

On 7 August, Korea Zinc (KRX: 010130) announced several impressive capital return plan that should help to increase shareholder value.

The separation of Korea Zinc between the Choi and Jang families has been in progress in the past several years. The exact timing of when this occurs remains uncertain.

Our NAV Analysis of Young Poong is NAV per share of 470,065 won, representing a 52% upside from current levels.

🇰🇷 Block Deal Sale of About 98 Billion Won Worth of Acushnet Holdings by Fila Holdings (Douglas Research Insights) $

Fila Holdings Corp (KRX: 081660) announced that its subsidiary Magnus Holdings plans to sell a 1.8% stake in Acushnet Holdings Corporation (NYSE: GOLF) in a block deal sale worth about 98 billion won.

Our NAV valuation of Fila Holdings suggests an implied value per share of 49,192 won, representing 18.2% upside from current levels. Fila Holdings’ 51.9% stake in Acushnet Holdings.

The block deal sale of Acushnet Holdings by Magnus Holdings is likely to have a positive impact on Fila Holdings as it could result in higher capital returns to shareholders.

🇰🇷 Korea Small Cap Gem #30: Kiswire (Douglas Research Insights) $

Kiswire Co Ltd (KRX: 002240) is the number one player for steel wire and rope products in Korea. More than 85% of its sales are generated overseas.

The company has a consistent record of generating positive net profit. It is trading at low valuations (P/B of 0.3x and EV/EBITDA of 4.5x).

Its average net profit from 2021 to 2023 are much higher than previous three years from 2018 to 2020, which is a testament of increasing demand for its products globally.

🇰🇷 Paradise Co 2Q profit dips as marketing costs bite (GGRAsia)

Paradise (KOSDAQ: 034230), an operator of foreigner-only casinos in South Korea, reported net income attributable to shareholders of nearly KRW14.55 billion (US$10.7 million) for the second quarter of 2024, according to a filing published on Friday.

Such income was down 50.5 percent from the prior-year period, and declined by 43.9 percent from the preceding quarter.

In July, outside the reporting period, Paradise Co said it would open in September a new space specially for high-roller gamblers at its Paradise Casino Walkerhill casino, in Seoul.

🇰🇭 🇭🇰 NagaCorp ops likely not to return to pre-Covid levels: S&P (GGRAsia)

S&P Global Ratings has affirmed the ‘B’ long-term issuer credit rating of Hong Kong-listed Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF). The rating agency changed NagaCorp’s outlook to ‘stable’, from ‘negative’, according to a Tuesday report.

The institution said however that NagaCorp’s gaming operations “are unlikely to recover to pre-Covid levels”.

“This is due to the elimination of Chinese junket operators. In 2019, Chinese junkets accounted for about 70 percent of gross gaming revenue,” it added. “The removal of Chinese junket operators and the pandemic has weighed on the business.”

🇮🇩 Astra International (ASII IJ) – Strength in Diversity (Smartkarma) $

Astra International (IDX: ASII / FRA: ASJA / OTCMKTS: PTAIF) saw a slight decline in its core earnings in 1H2024, which was an admirable performance given the weakness in the auto market and commodities divisions.

Offsetting the weakness in autos, Astra saw strong performances from its financing businesses for 4W, 2W, heavy equipment, and consumer finance, which booked +8% YoY growth in 1H2024.

Astra remains a key proxy for the overall Indonesian economy, with the diversity of its earnings exposure underpinning its resilience. Valuations are attractive, supported by a 9% FY2024E dividend yield.

🇵🇭 Belle 1H share of COD Manila gaming revenue down 24pct (GGRAsia)

Philippine-listed Belle Corp (PSE: BEL) reported revenues of just under PHP2.73 billion (US$47.6 million) for the first half of 2024, down 5.8 percent from a year ago.

Belle is an investor in City of Dreams (COD) Manila (pictured), a casino resort in the Philippine capital. The complex – run by a unit of Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) – was developed in cooperation with Premium Leisure Corp, a subsidiary of Belle.

The Belle group earns a share – via its units – of the gaming revenue generated at City of Dreams Manila.

🇸🇬 Sembcorp Industries: Positive On Earnings Beat And Higher ROE Target (Rating Upgrade) (Rating Upgrade) (Seeking Alpha) $

I upgraded Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF)‘ from a Hold to a Buy after the company’s interim earnings exceeded expectations and after it raised its long-term ROE target.

SCRPF’s actual 1H net profit was equivalent to 59% of the consensus full-year earnings projection, and its 2H outlook is favorable as its Singapore cogeneration plant maintenance has been completed.

The company has lifted its 2028 ROE goal from 12% to 13%, with its integrated urban solutions business focusing on Southeast Asian markets with stronger growth potential.

🇸🇬 DBS, UOB or OCBC: Which Singapore Bank Should You Pick for Your Investment Portfolio? (The Smart Investor)

We compare the three banks after they released their latest earnings to see which makes the best pick for your portfolio.

This earnings season has seen DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, and Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) releasing strong sets of earnings as high interest rates buoy their net interest income.

Investors may be wondering which of these blue-chip banks stand the best chance of doing well should interest rates fall.

Let’s go through several attributes to compare the trio and arrive at a conclusion as to which makes the most compelling choice for your portfolio.

🇸🇬 4 Singapore Stocks Hitting Their 52-Week Lows: Is a Rebound in Sight? (The Smart Investor)

We sieve out four stocks that are touching their year-lows to find out if they can enjoy an imminent rebound.

Here are four Singapore stocks that recently plumbed their year-lows. Could a rebound be imminent?

Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF), or RMG, is an integrated healthcare player that provides a comprehensive range of healthcare services ranging from tertiary care to health insurance.

AEM Holdings (SGX: AWX) provides comprehensive semiconductor and electronic test solutions and has manufacturing plants in Singapore, Malaysia, Indonesia, Vietnam, China, Finland, South Korea, and the US.

Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF), or SIA, is Singapore’s flagship airline.

Hutchison Port Holdings Trust (SGX: NS8U / FRA: H09 / OTCMKTS: HCTPF / HUPHY), or HPH Trust, operates deep-water container terminals in the Pearl River Delta of South China.

🇸🇬 4 Singapore Stocks That Stand to Benefit Should Interest Rates Decline (The Smart Investor)

🇮🇳 The Beat Ideas: JITF Infralogistics Limited, A Hidden Smallcap Infra Company of Jindals (Smartkarma) $

JITF Infralogistics Ltd (NSE: JITFINFRA / BOM: 540311) sells its railway wagon business to Texmaco Rail & Engineering (NSE: TEXRAIL / BOM: 533326) for Rs 465 crore.

The sale marks a strategic shift towards focusing on water and urban infrastructure segments, leveraging growing market demands and government initiatives.

JITF’s strategic sale and focus on infrastructure position it for substantial growth, driven by its robust order book and government support.

🇮🇳 Adani power transmission arm raises $1bn in equity placement (FT) $ 🗃️

First share sale for wider Indian conglomerate since fraud allegations in 2023

Demand for Adani Energy Solutions (NSE: ADANIENSOL / BOM: 539254)’ Rs83.7bn qualified institutional placement was six times above the base deal size, the company said on Monday.

🇮🇳 GHCL Textile Q1 FY25 Update (Smartkarma) $

GHCL Textiles Ltd (NSE: GHCLTEXTIL / BOM: 543918)

Rs. 1,000 crores allocated for growth, with Rs. 350 crores deployed. 25,000 spindles added by May 2025.

Shift towards value-added products, including knitting, weaving, and dyed fabrics, with plans to double revenue in 3-5 years.

Despite expansion and potential opportunities, capacity constraints and global demand shifts temper expectations in the short term.

🇮🇳 The Beat Ideas: Aarti Industries Ltd.- Capex, Growth, Value Addition! (Smartkarma) $

(Specialty chemicals and pharmaceuticals) Aarti Industries (NSE: AARTIIND / BOM: 524208) is planning a huge capex of 2500 Cr, which will increase their PPE by more than 50% from current CWIP and new capex.

Company is targeting 1450 to 1700Cr EBITDA in next year which is almost 1.5x to 2x of the existing EBITDA.

Introducing new products in the value chain, which has high-value added and high margins.

🇮🇳 India’s e-scooter maker Ola Electric surges on market debut (FT) $ 🗃️

Ola Electric Mobility Ltd (NSE: OLAELEC / BOM: 544225)

🇮🇳 Retro Indian motorcycle maker Royal Enfield plans electric foray (FT) $ 🗃️

Falling costs help global motorbike brands push into two-wheel EV market

Iconic motorcycle brand Royal Enfield (Eicher Motors (NSE: EICHERMOT / BOM: 505200)) is in the “advanced” stages of developing its first electric bike for a launch next year, as global manufacturers scale up investments to try to crack the burgeoning market for high-performance electric bikes.

🇦🇪 Yalla Group: The Proverbial Hit Or Miss (Seeking Alpha) $

Yalla Group (NYSE: YALA), a Dubai-based social media and gaming company, has posted impressive growth but a drastic 90% drop in stock price.

Allegations of fraud have emerged since Yalla’s IPO, casting doubt on the company’s integrity and potential investment opportunity.

Investors face a dilemma: believe in Yalla’s impressive financials or fear the risk of permanent capital destruction due to possible fraud.

🇹🇷 Turkcell Q2 Earnings Preview: Business Is Overvalued (Rating Downgrade) (Seeking Alpha) $

Turkcell (NYSE: TKC)‘s earnings are expected to be up sequentially and year-over-year, pacing the company in line with, or ahead of guidance.

Macro factors continue to be a headwind for the business and following a run-up in price, I believe the business is overvalued.

At a price target of $7.00 I lower my rating to sell.

🌍 Jumia Technologies Q2 Earnings: Still Overvalued Despite The Plunge (Seeking Alpha) $

(Africa logistics service and payment service) Jumia Technologies (NYSE: JMIA) stock rallied 82% in the last 12 months but plunged 50% intraday after a weak Q2 earnings release.

Q2 revenue missed estimates, negative EBITDA, and operating cash flow, with deteriorating liquidity position and negative GMV dynamics.

Despite a 50% drop, JMIA stock remains overvalued, with the macro environment looking unfavorable as key economies where Jumia operates are struggling.

🌍 A Primal Panic In Jumia Technologies Did Not Change The Investment Thesis (Seeking Alpha) $

Jumia Technologies (NYSE: JMIA) suffered a 53.8% post-earnings loss despite positive financial results and guidance reaffirmation. A large secondary share offering was the likely cause of the collapse.

CEO Francis Dufay plans to use the secondary offering funds for customer acquisition, accelerating supply, and market expansion beyond capital cities.

Jumia’s business uptrends remain intact with positive growth metrics, especially in countries like Ghana and Ivory Coast, despite on-going macroeconomic challenges.

I maintain strong buy rating given the positive business model remains healthy and intact for the long-term.

🇿🇦 Boxer IPO up next for Pick n Pay after closing R4bn in oversubscribed rights offer (IOL)

Pick ‘n Pay (JSE: PIK / FRA: PIK) expects to separately list the Boxer budget chain before the end of this year after it successfully raised R4 billion under an oversubscribed rights offer that closed last week, while the debt-laden retailer has also established new operational structures.

🇿🇦 Telkom reports strong first quarter driven by investments in its next generation offerings (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1) said it produced strong results for the three months to June 30 in weak economic conditions, with group revenue within guidance and up by 3.9% to R10.91 billion.

First quarter revenue growth was driven by growth in demand for next generation (NGN) offerings. Key contributors to NGN growth include Mobile service revenue growth of 9.5%; fixed-data NGN revenue growth of 7.1%; and information technology revenue growth of 10.3%, the group said in a quarterly update yesterday.

🇿🇦 Tongaat Hulett shareholder meeting raises questions on business rescue process & Tongaat Hulett and Vision’s planned debt-for-equity swop quashed by no-vote from shareholders (IOL)

The Mozambique-based RGS Consortium says it has a new offer for (Feedstocks of sugarcane and maize + property stock) Tongaat Hulett (JSE: TON), but Vision Investments (VI), which were appointed by the business rescue partners, say a yes vote by shareholders at tomorrow’s (Thursday) meeting will bring the beleaguered sugar group a step closer to a “substantially better future”.

But this view is not shared by all, with for instance, agricultural economist Dr Kobus Laubscher saying yesterday that contrary to claims that shareholders will be left with nothing if they vote against Vision’s debt-for-equity swap at the meeting, “the reality is far more complex”. Laubscher claims VI had so far failed to come up with the required funds for the deal.

🌎 MercadoLibre Q2 Earnings: Shipping Success To The Bank (Seeking Alpha) $

I acknowledge that MercadoLibre (NASDAQ: MELI) delivered exceptionally strong Q2 2024 earnings, with impressive revenue growth and the best profit margin in many years.

I appreciate the company’s powerful balance sheet, which provides ample flexibility for a significant acquisition.

Yet, I am cautious about the stock’s valuation, as it is priced at approximately 50x this year’s free cash flow, limiting the upside potential.

🌎 Arcos Dorados Trades At Value Price Despite Growth, The Stock Is A Buy (Seeking Alpha) $

Arcos Dorados (NYSE: ARCO) is a McDonald’s franchisee in most Latin American countries. Since the pandemic, the company has grown by 20% to 30% while reinvesting margins in price competitiveness.

The company’s incentives are different from McDonald’s, but the latter exercises a lot of control via shareholding and franchise agreements. This leads to Arcos overinvesting in growth.

Although this leads to low returns on capital, Arcos is still growing profitably at 20% levels, but trades at a 9% earnings yield.

Growth is significantly tied to Latin American economic activity, posing the largest risk for the company, but this is more than compensated by the yields embedded in the stock price.

🇰🇾 🇧🇷 My Favorite Dividend Stock: Patria Investments (Seeking Alpha) $

Patria Investments Limited (NASDAQ: PAX) is replicating Blackstone’s business model, but it’s far cheaper.

It has recently also become the largest REIT asset manager in Brazil.

High yield, high growth, and significant upside. What’s not to like?

🇦🇷 Transportadora de Gas del Sur: Tremendous Q2, But Offers A Mediocre Yield At Best (Seeking Alpha) $

Transportadora de Gas del Sur Sa (NYSE: TGS) experienced an impressive 700% tariff adjustment in the transportation segment, resulting in $55 million in operating profit in 2Q24.

Liquids and midstream segments showed steady performance, with plans for midstream expansion and stable operating income in the liquids segment.

Despite optimistic assumptions, the company’s valuation does not offer an attractive return, with a Hold rating maintained due to high risk in the Argentinian regulated sector.

🇦🇷 The hunt for Argentina’s ‘alter egos’ in $16bn US court fight (FT) $ 🗃️

Oil company Ypf Sa (NYSE: YPF), the country’s central bank and flag carrier are among the assets targeted by plaintiffs

🇧🇷 Bradesco Q2: Results Impressed The Market, But The Stock Is Only Fairly Valued (Seeking Alpha) $

Banco Bradesco (NYSE: BBD)‘s Q2 2024 results showed moderate earnings growth despite lower delinquencies and loan book growth, disappointing in key areas like NPLs and expenses.

The market reacted positively to the results, but analysts see slower reform and recovery compared to peers, facing challenges in competing with neo-banks.

The company’s growth is below the economy, with strong SME segment but weak credit card services, high expenses, and slow efficiency improvements, leading to a air valuation but not an opportunity.

🇧🇷 Vinci Partners Posted A Challenging Bottom-Line Quarter, But Is Still A Buy (Seeking Alpha) $

(Alternative investments platform) Vinci Partners Investments Ltd (NASDAQ: VINP) had challenging 2Q24 results due to factors like BRL devaluation, earnouts recognition, and consulting fees for the Compass acquisition.

The private markets segment is the most profitable for Vinci, with strong growth in AUM and fees, while the public equities segment continues to struggle.

Despite non-recurring expenses impacting net income, Vinci still trades at an attractive valuation of 10x net earnings potential, with potential for further appreciation.

🇧🇷 Azul: Pricing Power Provides Inflection Point (Seeking Alpha) $

Azul Sa (NYSE: AZUL / BVMF: AZUL4)‘s stock is pricing a distressed balance sheet with the risk of dilutive capital increase or a Chapter 11 event.

However, a combination of solid demand, productivity, and pricing power can provide Azul with free cash flow and debt relief.

The stock is a high-risk and high-reward or speculative situation, if it can deliver on free cash flow, the stock has multiples to gain.

I assume a 10% capacity and 4% airfare increase to reach a 30% EBITDA margin and US$177m in FCF in 2025.

🇨🇴 GeoPark Limited: Excellent Acquisitions Should Drive Growth (Seeking Alpha) $

GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) stock remains a buy with high margins, strong growth potential, and a nice dividend, presenting a potential income play for investors.

Savvy acquisitions made by GeoPark, such as acquiring assets in Argentina, are poised to increase shareholder value and diversify operations.

Oil prices are still attractive, with forecasts predicting a rise in the second half of 2024, leading to strong cash flows for GeoPark and potential growth opportunities.

Shares are still a buy with a price target of $15.

🇲🇽 Airports, fly over country cement & Carlos Slim premium All Mexican stocks P7 (Bos Invest Substack)

The interesting case for investing in Mexican airports. A great way to invest in the US cement sector, micro lending & a valuation of Grupo Carso.

In part 7 of the all Mexican stock series I will cover:

🌐 Glencore retains coal, carbon steel assets despite pressure from environmentalists (IOL)

Global commodities trader, Glencore (LON: GLEN / JSE: GLN / FRA: 8GC / OTCMKTS: GLNCY / OTCMKTS: GLCNF) has retained its money-spinning coal business as well as the carbon steel-making operations despite growing pressure from environmentalists to demerge the two units.

Coal has been a major income earner for Glencore, with energy and steel-making coal accounting for $2.7 billion (R49.6bn) of the company’s total earnings before interest, tax, depreciation and amortisation (Ebitda) of $6.3bn for the half-year period to June, 2024.

Bruce Williamson, a resource analyst at Integral Asset Management, told Business Report “coal is the biggest contributor” to Glencore’s earnings.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 «The World Is not Willing to Absorb the Overproduction Coming Out of China» (the market nzz)

Beijing-based economist Michael Pettis expects global trade conflicts to escalate. China is reaching the limits of its growth model, but Beijing is avoiding painful adjustments.

🇨🇳 Multinationals sound alarm over weak demand in China (FT) $ 🗃️

🇨🇳 Cover Story: China Moves to Raise Retirement Age to Bolster Workforce, Ease Pension Pressure (Caixin) $

China plans to gradually raise the retirement age to counter the impacts of a rapidly aging population, affecting over 500 million workers.

The reform blueprint introduced principles of “voluntary participation with appropriate flexibility” and highlights the urgency due to demographic shifts and shrinking working-age population.

Solutions involve delayed retirement, supportive fertility policies, and comprehensive family support measures to tackle low birth rates and aging issues.

🇨🇳 Weekend Long Read: Why Temporary Workers Are a Growing Presence in China’s Factories (Caixin) $

China’s manufacturing sector, despite a decline in workforce and rise in industrial robots, remains essential, with around 27% of non-agricultural jobs in 2020.

The gig economy within manufacturing is growing, particularly for temporary work during peak periods, with estimates suggesting 25-33% of manufacturing jobs are gig-based.

Changes in technology and job trends highlight challenges in social security and labor market dynamics, particularly for well-educated young workers in temporary roles.

🇭🇰 Hong Kong thrives as global financial hub (The Asset) 🗃️

🇰🇷 Potential Additions and Deletions to KOSPI 200 in December 2024 Amid Market Downturn (Douglas Research Insights) $

We discuss the potential additions and deletions to KOSPI 200 in December 2024 amid big declines in share prices of many stocks in KOSPI in the past week.

The eight potential additions are up on average 8.5% from end of 2023. The eight potential deletion candidates are down on average 39.1% YTD.

The average market cap of the seven potential additions is 1.9 trillion won. The average market cap of the seven potential deletion candidates is 0.6 trillion won.

🇸🇬 Singapore seeks to revitalize equities market (The Asset) 🗃️

🇧🇩 The Post-Coup Political Violence In Bangladesh Bodes Ill For Its Future Direction (Andrew Korybko’s Newsletter)

Apart from retributive political violence and the targeting of minority Hindus, the rioters also attacked symbols and sites associated with the Father of the Nation who led Bangladesh to independence, which sends a chilling message about what they have in mind for the future of their country.

🇳🇬 Nigeria’s struggle to break the ‘oil curse’ | FT Film (FT)

Nigeria’s oil sector has been plagued by profiteering, theft and under-investment. Can the new $20bn Dangote refinery and ending expensive fuel subsidies help to transform the industry – and the wider economy?

🌐 The anti-EV commodities (Asian Century Stocks)

🌐 Developing nations to call for $5 trillion in annual damages for climate debt (IOL)

Civil Society in the Alternative Reform Agenda of the Just Energy Transition yesterday called on South Africa to join the G77 Group of countries in calling for the for the COP 29 Summit in September to push demands for a $5 trillion (R92trl) as an annual downpayment for climate debt owed by the global North to the global South.

The Group of 77 are a total of 134 countries with members including Afghanistan, Algeria, Argentina, Benin, Bolivia, Brazil, Chile, Colombia, the Democratic Republic of Congo, the Dominican Republic, Jamaica, Jordan, Kenya, Peru, Trinidad and Tobago, and China.

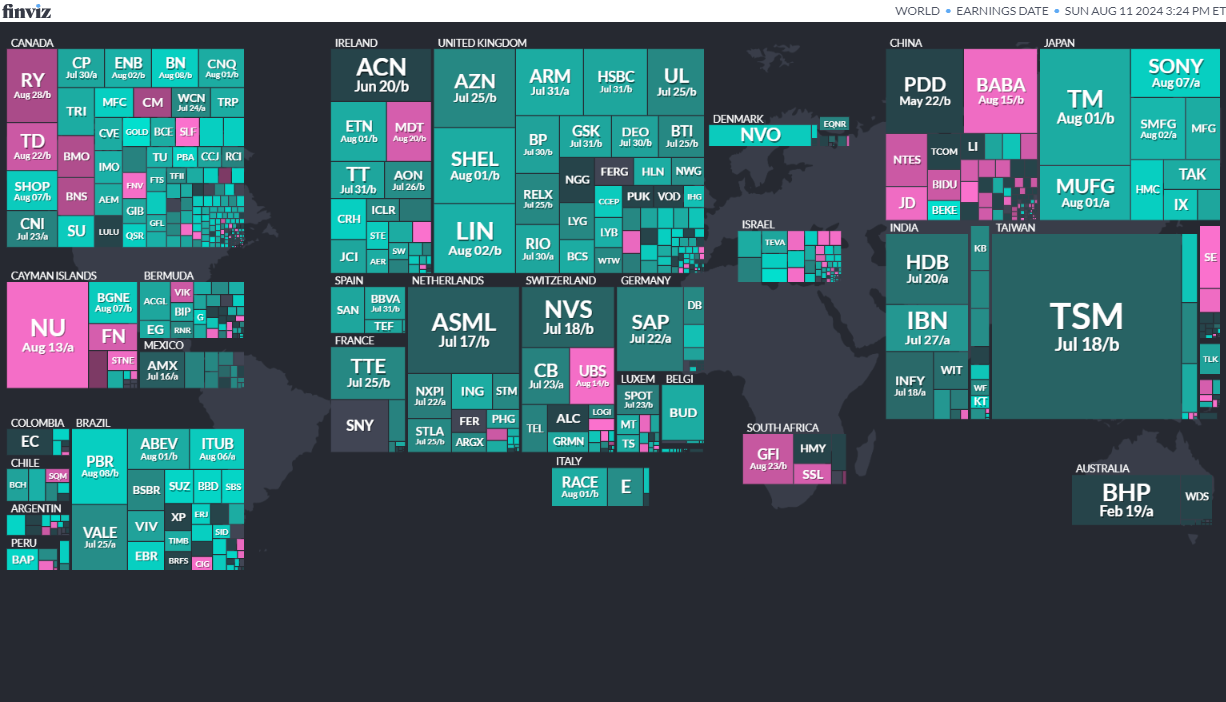

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

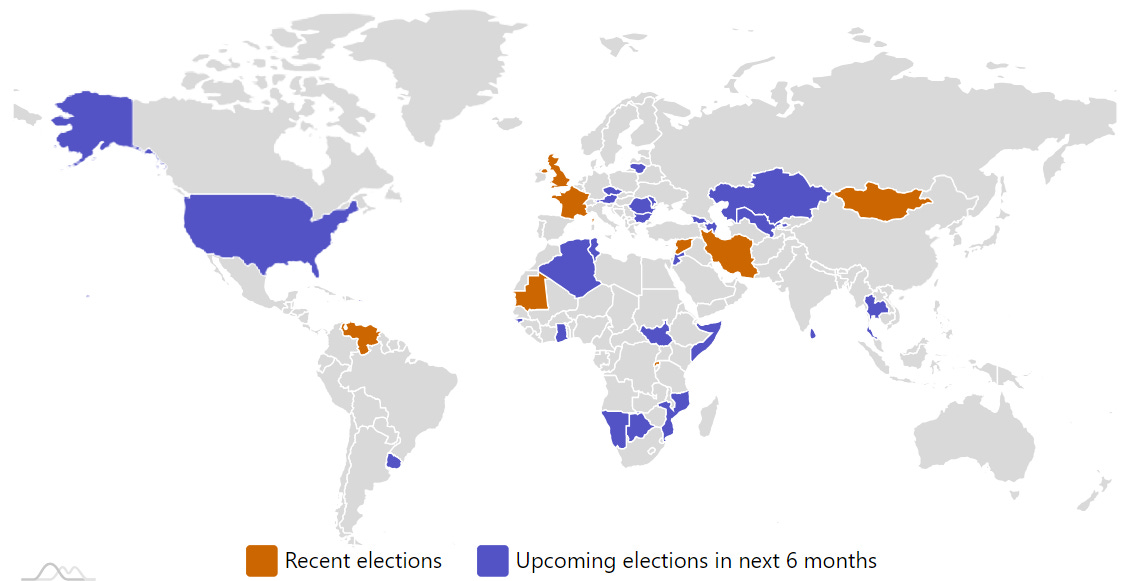

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 21, 2024