Emerging Market Links + The Week Ahead (August 19, 2024)

Zerohedge has an interesting (paywalled) piece on AI (“I tried it twice” – 10 less bullish observations on AI 🗃️) that noted how hundreds of millions of people have tried ChatGPT, but most of them haven’t been back. They noted an analyst who has compared the AI bubble to the JPY carry trade and then there was this hilarious observation:

The consultant driven rally….

S&P Global is paying Accenture to train all 35k staff in ‘generative AI’.

Benedict Evans: “I used to joke that if you say ‘Digital Transformation’ three times, an Accenture partner will appear in a puff of smoke and offer you a contract – now the same happens for ‘AI’. Welcome to enterprise IT.”

Finally, there are yet more supply chain and shipping disruptions (Red Sea deadlock raises shipping costs and cripples global maritime industry, China port explosion snarls trans-Pacific container trade, etc.). I am visiting California at the moment and just finished with the almond harvest on my parents property (a reason for fewer than normal posts this month & this one being later than normal…) – note that most California almonds are exported around the world and most almonds in the world come from the state…

According to the latest Blue Diamond Almond Market Report (a good gauge of regional economic sentiment given almonds’ premium food nature & supply chain situation), almond shipments were down in July, but still up for the year (as COVID pandemic backlogs and carryovers have largely been cleared) with India and the Middle East increasingly becoming key markets while China has faced low demand (albeit some almond flows have been rerouted to China via SE Asia and Vietnam in particular)…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Comments on Alibaba’s Second Quarter Earnings. (Investing in China)

I’ve been very critical about Alibaba (NYSE: BABA) BABA 0.00%↑ in the past, as you can see in my previous articles here and here. However, despite the somewhat disappointing numbers this quarter, I believe things are gradually improving at Alibaba. The key reason for this shift is that the new management seems to have finally overcome the leadership mistakes made under former CEO Daniel Zhang.

Under Zhang’s leadership, Lazada lost to Sea, Ele.me lost to Meituan, AliExpress to Temu/Shein, Taobao/Tmall to PDD, and the cloud business didn’t perform well either. All were losing market share or their dominant positions while incurring huge losses, except of Chinese e-commerce. Or worst of all, his new retail idea with Sun Art, Freshsippo, and Intime, which the current management absolutely despises. This is from their first-quarter call, where they blame weak performance on those exact acquisitions.

🇨🇳 Alibaba (9988 HK/BABA): 1Q25, Growth Lower Than Expectation, But Many Expansion Plans Following (Smartkarma) $

Alibaba (NYSE: BABA)’s revenue grew by 4% YoY in 1Q25 due to the stagnancy in e-commerce.

However, many expansion plans follow, including overseas market, physical stores, and fresh food wholesale.

We set an upside of 51% and a price target of HK$115 for March 2025.

🇨🇳 JD.com (JD US): Strong Profitability And Upsized Share Buyback in 2Q24 (Smartkarma) $

Profitability of the business surprised on the upside, as the net profit margin of JD.com (NASDAQ: JD) increased from 3% in 2Q23 to 5% in 2Q24.

Share buyback accelerated in 2Q24, as the company bought USD2.1bn worth of stock in the quarter, up from USD1.2bn in 1Q24.

The stock is trading at 7x 2024 PE, with a yield of >10% through dividend and buyback.

🇨🇳 State-Owned SAIC Motor Reshuffles Management as Sales Tumble (Caixin) $

SAIC Motor Corp (SHA: 600104) reshuffled its leadership, appointing Jia Jianxu as president after a sales decline saw them fall behind BYD in monthly sales for the first time.

In June, SAIC’s sales dropped 25.9% year-on-year to 300,545 units, compared to BYD’s 341,658 cars, which increased by 35%; the sales gap widened further in July.

SAIC is focusing on enhancing its NEV offerings and local JV capabilities, including new ventures with Volkswagen and General Motors to regain market share.

🇨🇳 Growing Ecarx tries, but struggles, to drive away from Geely (Bamboo Works)

The smart car technology company posted solid quarterly revenue growth, but dependence on its controlling shareholder continues to pose a key risk for the company

Ecarx Holdings (NASDAQ: ECX)’s revenue grew 31% in the second quarter, apparently driven by sales to brands owned by its controlling shareholder

The company’s heavy reliance on Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) and its subsidiaries leaves it vulnerable if ties between the two weaken

🇨🇳 EV-Maker Zeekr Irks Customers With All-Too-Frequent Upgrades (Caixin) $

Customers are upset with ZEEKR Intelligent Technology Holding Limited (NYSE: ZK) for frequently upgrading models, feeling it undermines brand trust.

Zeekr’s new 2025 versions of the 001 and 007 feature advanced tech, including Nvidia chips and ultra-fast charging.

Despite announcing ambitious sales targets and plans for global expansion, Zeekr faces challenges in a competitive NEV market, with a recent loss but strong revenue growth.

🇨🇳 Overhauled Niu returns to accelerating growth track (Bamboo Works)

The electric scooter maker’s revenue grew 13.5% in the three months to June, as it forecast the growth rate would zoom to about 50% in the third quarter

Niu Technologies (NASDAQ: NIU) has returned to growth after an overhaul last year, opening a net 300 new stores in the first half of the year

Analysts are becoming more bullish on the electric scooter maker, with all three polled by Yahoo Finance rating the company either a “buy” or “strong buy”

🇨🇳 Huya Pays Out a 25% Dividend – hints at more dividends to come (Investing in China)

(Game live streaming platform) Huya Inc (NYSE: HUYA) Rewards Shareholders with a Massive $1.08 Per Share Dividend

I want to provide a brief update on the current situation with HUYA 0.00%↑. I’ll keep this short. For more background information, you can refer to my previous article on the subject.

This quarter was relatively unspectacular, with the numbers very much in line with what management previously indicated, so no big surprises here. Here’s a brief summary of the key figures.

🇨🇳 Lenovo: Results Beat Expectations And Prospects Are Favorable (Seeking Alpha) $ 🗃️

🇨🇳 China’s Hesai to be removed from US defence department blacklist (FT) $ 🗃️

🇨🇳 Top steelmaker Baowu warns Chinese producers face severe crisis (FT) $ 🗃️

Baoshan Iron & Steel Co Ltd (SHA: 600019)

🇨🇳 Trying to make sense of Lufax (Turtles all the way down!)

Lot’s of confusion for me around (online lender) Lufax Holdings (NYSE: LU). I took my dividend in shares being under the impression the scrip price was $2.15 (1 ADR is 2 shares):

“Option 2: Elect Stock – You may elect to receive the dividend paid in new ADRs of LUFAX HLDG LTD at rate USD 1.073647 per share held on record date.”

But apparently it is actually $2.25? Did IBKR make a mistake, will I get my shares at $2.15 or did I misread the above?

🇨🇳 Country Garden Services Expects 30% Profit Drop as Property Downturn Drags On (Caixin) $

Country Garden Services Holdings (HKG: 6098 / FRA: 75H / OTCMKTS: CTRGF), China’s largest residential property manager, forecasts a net profit drop of over 30% for the first half of the year due to the ongoing real estate downturn.

First-half revenue is expected to slightly increase to between 20.9 billion and 21.2 billion yuan, but net profit is anticipated to fall to 1.36-1.55 billion yuan from 2.35 billion yuan last year.

Despite revenue growth, the company has faced a significant net profit decline, and in 2023, posted a net profit decrease of 85% to 292 million yuan due to the property market crisis.

🇨🇳 Kweichow Moutai starts to diversify investments, venturing into semiconductor chips (The Global Times)

Chinese liquor giant Kweichow Moutai (SHA: 600519) has recently ventured into the chip sector. Industry experts said this move will allow the traditional liquor producer to capitalize on the booming chip industry, while providing much-needed capital for innovation in the increasingly important technology sector.

According to corporate information website Tianyancha, two fund companies of Moutai including Moutai Science and Technology Innovation Investment Fund have recently invested in Shanghai SmartLogic. The latter specializes in domestic chip-making technology.

🇨🇳 Rising gold prices take the shine off Chow Sang Sang (Bamboo Works)

The jewelry chain warned its profit fell 40% in the first half of the year, as surging gold prices eroded demand for gold accessories

Chow Sang Sang Holdings International Limited (HKG: 0116 / FRA: CJW1 / OTCMKTS: CHOWF) said its profit fell between 33.5% and 39.5% in the first half of the year compared with a year earlier

Gold accessory consumption declined around 27% year-on-year in the first half of the year across China, according to an industry association

🇨🇳 Fu Shou Yuan (1448.HK) – Negative Growth in 24H1 Seems Inevitable (Smartkarma) $

According to the management, the performance of 24H1 should be better than that of 21H1, but Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF)‘s performance in 2024 full year may still fall short of expectations.

In the future, the development strategy of Fu Shou Yuan would rely more on endogenous growth. Without aggressive M&A, long-term revenue growth rate could fall to single digit.

Special dividends will continue in the future. However, one major risk for Fu Shou Yuan is policy risk. The bottom line is the demand for the funeral industry always exists.

🇨🇳 Helens’ outlook dims as ‘revenge clubbing’ fades (Bamboo Works)

The bar operator posted a double dip in revenue and profit in the first half of the year as its outlook dims with China’s slowing economy

Helens International Holdings Co Ltd (HKG: 9869 / FRA: 5ZW) said it expects to report its net profit fell by up to 57.5% in the first half of this year

The Hong Kong-listed bar operator recently made a second listing in Singapore, hoping to raise its profile as it tries to expand globally

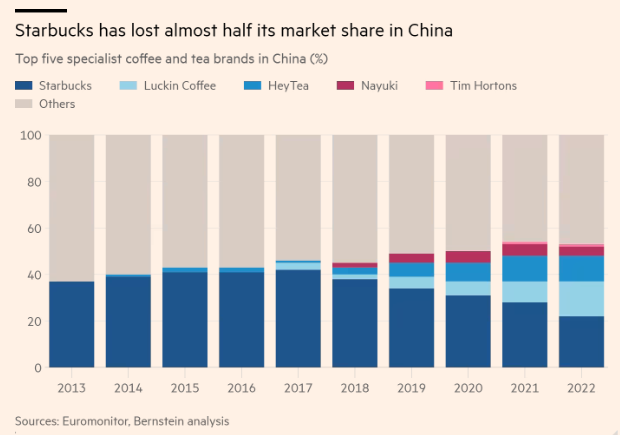

🇨🇳 Starbucks’ $113mn man has a China problem (FT) $ 🗃️

🇨🇳 McDonald’s vs Yum! Brands: Which Fast Food Stock Should You Buy? (Bamboo Works)

We look at two companies that dominate the fast-food industry to determine which is more suitable for your portfolio.

Among all these restaurants, two companies stand out: McDonald’s Corp (NYSE: MCD) and Yum! Brands (NYSE: YUM).

With over 41,000 locations worldwide, the Golden Arches need no introduction.

On the other hand, many may not be familiar with Yum! Brands.

Yum! Brands is the world’s largest restaurant company, operating over 59,000 restaurants.

The company is best known for owning KFC and Pizza Hut, which are popular in Singapore.

Apart from KFC and Pizza Hut, Yum! Brands also owns Taco Bell and The Habit Burger Grill, both of which have a large presence in the US.

🇨🇳 Zylox-Tonbridge Medical Technology (2190.HK) – A Good Alpha-Generating Opportunity for Investors (Smartkarma) $

Zylox-Tonbridge Medical Technolgy Co Ltd (HKG: 2190 / FRA: 818) is a beneficiary of VBP and it has turned losses into profits. 2024 full-year revenue could be up 40-50% YoY. Net profit could be close to RMB100 million.

Whether in terms of the number of products on the market or the efficiency of R&D, Zylox’s performance is superior to peers. Its valuation is expected to be higher than peers.

We’re in a bear market, together with weak liquidity, Zylox’s valuation doesn’t fully reflect its strong fundamentals. So, while this is a good company, investors may need to be patient.

🇨🇳 Hutchmed scores U.S. success with cancer drug, but profits still dip (Bamboo Works)

The drug developer has reported sharply reduced profits, coming off an exceptionally high base last year, but sales of its key cancer medicine are accelerating in the United States

Hutchmed (NASDAQ: HCM)’s U.S. sales jumped nearly 53% in the second quarter from the previous three months, boosted by uptake of the cancer drug Fruzaqla

The company plans to focus on innovative drugs and said it might give up its traditional Chinese medicine business

🇨🇳 BeiGene (6160.HK/BGNE.US) 24Q2 – It Is Time to Open a New Chapter in China’s Pharmaceutical Industry (Smartkarma) $

BeiGene (NASDAQ: BGNE)‘s 24Q2 results far exceeded expectations. Sales of BRUKINSA may exceed that of Calquence for the first time next year. Breakeven in 2024 becomes possible if effective cost control continues.

BeiGene’s 2024 revenue could exceed Hengrui, marking the official transition of China’s innovative pharmaceutical industry from the old generation to the new one. Reasonable market value for BeiGene is US$19-27.5bn.

Current valuation cannot reflect strong fundamentals. As BeiGene has established a convincing profit model, the market turmoil actually provides investors with a good opportunity to buy the stock at low price.

🇨🇳 2024 High Conviction Update: Innovent (1801.HK) 24Q2 – Valuation Upside Will Be Further Opened Up (Smartkarma) $

Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY)’s 24H1 product revenue exceeded RMB3.7 billion. Due to anti-corruption campaign, newly marketed PD-1s are unable to be admitted to the hospitals normally, which indirectly promotes the sales performance of sintilimab.

2024 full-year product revenue is estimated to reach RMB7.7 billion. IBI363 has the potential to be blockbuster variety in global markets, which may put Innovent’s valuation on a new level.

Innovent is undervalued if market value is below RMB38.5 billion. If mazdutide is able to contribute RMB10 billion sales, Innovent’s market value would reach about RMB90-100 billion (based on 5 P/S).

🇨🇳 Jiuyuan Gene seeks IPO cash for bet on weight-loss drugs (Bamboo Works)

The developer of treatments for cancer and bone fractures is branching out into the weight-loss market, but faces strong competition there

At present, Jiuyuan Gene relies heavily on a bone repair product, Guyoudao, for around half its revenue

The company is developing a generic version of the weight-loss drug Semaglutide, which is undergoing clinical trials in China

🇨🇳 WeRide IPO: High-Risk Venture Investment and Unproven Business Model (Smartkarma) $

WeRide, a pure-play autonomous driving company with operations in 7 countries, may raise up to $120M in upcoming IPO in the United States.

WeRide is expected to IPO this week. The company’s amended prospectus puts the price range per ADS at $15.50 to $18.50, implying a market cap of ~$4.6B at the midpoint.

The company has raised ~$1.4B in equity financing to date and was backed by Qiming Venture Partners and the venture capital fund of the Renault Nissan Mitsubishi Alliance, among others.

🇭🇰 HK Stock#3 – Discounted retailer in HK (Taranvir’s Substack)

Does this discounted retailer stand a chance to withstand retail sector pressure?

Hong Kong’s retail sector is in doldrums, taking multiple beatings on different fronts. After almost 3 years (2020-2022) of on-and-off restrictions during COVID, Hong Kongers seem to be engaged in “revenge travelling”. On 8th June 2024 (3-day weekend due to the Dragon Boat Festival), over 520k1 Hong Kong residents departed from various border checkpoints, representing c.7% of total population. The savings pool piled up during COVID is being spent on trips across the border in Shenzhen, as well as in countries like Japan (depreciating Yen!) and Taiwan. Moreover, the lure of online shopping (HKTV Mall, Taobao etc.) has continued to hurt physical retailer.

The stock discussed below is International Housewares Retail Company Limited (HKG: 1373 / OTCMKTS: IHSWF). It trades at a mere 5x earnings and a mouth-watering 15% dividend yield (ex-special dividend) on FY232 reported numbers. Current market capitalization is HK$930mn (c.US$120mn), while enterprise value3 is HK$1.1bn. With an EV/EBIT of 5x and P/B of 1x, the stock will probably look enticing to a value investor, so let’s see what this discounted retailer has to offer.

🇭🇰 Cathay upgrades fleet with order for 30 A330-900s (The Asset) 🗃️

New aircraft to enhance customer experience, reduce fuel consumption and carbon emissions

Based on Airbus’ list prices, the deal is worth about US$11 billion. However, the Hong Kong-based airline (Cathay Pacific Airways Limited (HKG: 0293 / OTCMKTS: CPCAY)) has secured “significant price concessions” for the purchase.

🇭🇰 🇰🇭 NagaCorp flags US$95mln impairment on Vladivostok project (GGRAsia)

Hong Kong-listed Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) says its first-half results will be impacted by a “revaluation” of the group’s stalled casino resort project (pictured in a file photo) at Primorye, near Vladivostok in Russia.

NagaCorp is the operator of NagaWorld, a casino resort monopoly in the Cambodian capital Phnom Penh.

The group said it expects to record either a net profit of US$3.1 million or a net loss of US$6.9 million for the six months to June 30 this year, compared to a profit of approximately US$83.0 million in the prior-year period, according to a Monday filing.

🇭🇰 LET shareholders nod plan to sell Tigre de Cristal ops (GGRAsia)

Shareholders of casino investor LET Group Holdings (HKG: 1383) have approved a proposal to dispose of the group’s investment in the Tigre de Cristal casino resort in Russia. The announcement was made in a filing to the Hong Kong Stock Exchange on Thursday.

Oriental Regent is the company through which Summit Ascent Holdings Ltd (HKG: 0102) – a majority-controlled subsidiary of LET Group – runs gaming and hotel operations at the Tigre de Cristal casino resort near Vladivostok in Russia.

In a previous filing, LET Group said it would use part of the proceeds of a potential sale of G1 Entertainment for payment of a special dividend to Summit Ascent shareholders.

The remaining part would be used to finance the construction of the group’s casino resort project in the Philippine capital Manila – being developed by subsidiary Suntrust Resort Holdings Inc – as well as general working capital. The Manila venue is scheduled to commence operations in the first quarter of 2025.

🇲🇴 Galaxy Ent 2Q EBITDA grows, posts US$563mln interim profit (GGRAsia)

Macau casino operator Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) reported a first-half profit of nearly HKD4.39 billion (US$563.0 million), up 51.8 percent from the prior-year period. The firm also announced an interim dividend of HKD0.50 per share, payable on October 25.

The chairman stated that the group’s balance sheet “continued to be healthy and liquid,” with total cash and liquid investments of HKD29.0 billion: a net position of HKD25.2 billion, and debt of HKD3.8 billion.

“Our strong balance sheet allows us to return capital to shareholders through dividends and to fund our longer-term development plans and international ambitions,” he added.

🇰🇷 GKL announces first interim dividend since pandemic (GGRAsia)

Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, posted in the second quarter a 11.0 percent sequential increase in net profit attributable to the shareholders, and a 31.9 percent increase judged year-on-year.

Such income for the three months to June 30 was nearly KRW11.33 billion (US$8.3 million), compared to KRW10.20 billion in the first quarter.

In June, Grand Korea Leisure flagged plans to shake up its business, amid regional competition.

🇰🇷 Coupang Business History (Speedwell Memos)

Building the Leading South Korean Ecommerce Business from the Ashes of Mediocrity

There is a podcast of this memo available if you prefer listening to it. You can find it on our podcast feed here (Apple, Spotify).

We also have a 2 hour Company Podcast just on Coupang, Inc. (NYSE: CPNG)!

🇰🇷 Coupang Inc.: Market Expansion Through WOW Membership Program Is A Critical Growth Lever! (Smartkarma) $

Coupang, Inc. (NYSE: CPNG)‘s recent quarter highlights a strong performance driven by strategic initiatives and operational improvements, alongside a promising outlook tempered by certain challenges that need to be addressed for sustained growth.

The company’s revenue grew by 30% year-over-year in constant currency, showcasing impressive sales momentum.

This growth was partly fueled by the acquisition of Farfetch, which played a key role in the company’s multifaceted growth strategy.

🇰🇷 Macquarie Korea Infrastructure Fund: Rights Offering of About 500 Billion Won (Douglas Research Insights) $

Macquarie Korea Infrastructure Fund (KRX: 088980) announced that it is proceeding with a rights offering capital increase of 500 billion won, which represents about 9.4% of its current market cap.

MKIF plans to use higher liquidity increase in the following main areas: Seoul East Underground Expressway – 215 billion won Acquisition of Hanam Data Center – 423 billion won

In the next 6-12 months, we believe MKIF has a solid chance of outperforming KOSPI (on combined capital gains/dividends basis).

🇰🇷 Tender Offer of BusinessOn Communications by Skylake Equity Partners (Douglas Research Insights) $

On 12 August, Skylake Equity Partners announced a tender offer of 6.58 million shares (28.9% stake) of BusinessOn Communication. The tender offer price is 15,849 won.

BusinessOn Communication Co Ltd (KOSDAQ: 138580) is one of the leading digital tax invoice software providers in Korea. It also provides digital contracts, market intelligence, banner advertising, and supply chain management services.

Skylake plans to purchase all of the shares subscribed in this deal, regardless of the subscription rate. If the public offering target quantity is successful, Skylake plans to delist BusinessOn.

🇰🇷 DB Hitek: Buying a Golf Course Overshadows Corporate Value Up Efforts (Douglas Research Insights) $

DB HiTek Co Ltd (KRX: 000990)‘s investment in a golf course operating company is a poor investment, one that destroys shareholder value.

Most investors would rather have DB Hitek increase shareholder returns through share buybacks/cancellations and dividends as well as invest in its core semiconductor business rather then buy a golf course.

Given DB Inc’s lack of cash, there is a growing possibility that it will use the proceeds from selling its DB World shares to increase its stake in DB Hitek.

🇰🇷 SK Square: Updated NAV Valuation Post Recent Share Price Decline (Douglas Research Insights) $

Our NAV analysis of SK Square (KRX: 402340) suggests NAV of 15.6 trillion won or 115,605 won per share, representing 48% higher than current share price.

SK Square’s market cap is only 39% of SK Square’s stake in SK Hynix (KRX: 000660). SK Square’s share price has declined by 27% since reaching its recent peak on 11 July.

SK Square had excellent results in 2Q 2024, driven by improving results of its affiliates including SK Hynix.

🇰🇷 SM Entertainment: Share Cancellation and the Launch of a New British Band – Dear Alice (Douglas Research Insights) $

In this insight, we discuss the recent share cancellation at SM Entertainment Co Ltd (KOSDAQ: 041510), valuations, and the launch of a new British boy band in August 2024.

Dear Alice boy band will start its promotion with the broadcast of “Made in Korea: The K-Pop Experience” on BBC One and BBC iPlayer on 17 August.

We are cautiously positive on Dear Alice band. Unlike most aspiring boy bands, Dear Alice has a HUGE advantage of launching the band on the BBC through a TV show.

🇰🇷 Shift Up: 2Q 2024 Results Analysis (Douglas Research Insights) $

On 14 August, Shift Up Corp (KRX: 462870) reported its 2Q 2024 results, which was the first earnings report post its IPO.

Shift Up reported sales of 65.2 billion won (up 65.4% YoY and 19.5% below consensus) and OP of 45.1 billion won (up 49% YoY and 21.4% below consensus) in 2Q24.

The company is preparing for a PC release of Stellar Blade in the near future to continue its strong popularity and it expects better results on PC than on console.

🇰🇷 HD Hyundai: Updated NAV Analysis (Douglas Research Insights) $

🇰🇷 Warren Buffett Invests in Ulta Beauty – Positive Impact on CJ Corp? (Douglas Research Insights) $

In this insight, we discuss how Warren Buffett’s recent investment in Ulta Beauty (NASDAQ: ULTA) is likely to have a positive impact on CJ Corp (KRX: 001040)‘s valuation.

CJ Olive Young (largest shareholder is CJ Corp) is the dominant health & beauty cosmetics chain in Korea. CJ Olive Young has a similar business model to Ulta Beauty.

Our NAV analysis suggests an implied market cap of 4.7 trillion won or implied price of 160,977 won per share for CJ Corp, representing a 38% upside from current levels.

🇰🇷 Hankook Tire & Technology: M&A of Hanon System Falling Apart? (Douglas Research Insights) $

There are increasing signs that Hankook Tire & Technology Co Ltd (KRX: 161390)‘s M&A of Hanon Systems (KRX: 018880) could be falling apart.

The deadline for signing the main M&A contract to purchase a 25% stake in Hanon Systems has been postponed indefinitely.

New contingent liabilities at Hanon Systems have been uncovered during the 10 week due diligence process of Hanon Systems by Hankook T&T.

🇰🇷 Merger Between Celltrion Inc and Celltrion Pharm Is Cancelled (Douglas Research Insights) $

Celltrion (KRX: 068270) announced that its proposed merger with Celltrion Pharm (KOSDAQ: 068760) has been cancelled due to disapproval of this deal among an overwhelming percentage of Celltrion Inc shareholders.

This cancellation of a merger between Celltrion Inc and Celltrion Pharm is likely to continue to have a positive impact on Celltrion Inc and negative impact on Celltrion Pharm.

The major reason is because Celltrion Pharm trades at high valuation multiples while Celltrion Inc trades at lower valuation multiples. Celltrion Pharm’s P/B valuation is more than 3x Celltrion Inc’s.

🇰🇷 Peptron: Rights Offering of 120 Billion Won (Douglas Research Insights) $

On 16 August, (platform technologies for peptide-based medicines) Peptron (KOSDAQ: 087010) announced that it decided to increase capital through a rights offering worth about 120 billion won, involving 2.64 million shares (12.8% of outstanding shares).

The expected rights offering price is 45,450 won, which is 22% lower than current price.

We are negative on Peptron’s rights offering mainly due to much lower expected rights offering price, concerns about additional rights offering next 2-3 years, and continued lack of profitability

🇮🇩 Astra International (ASII IJ) - 2024 update (Asian Century Stocks)

Indonesia’s leader auto maker at 6.1x P/E. Estimated reading time: 21 minutes

In less than a year, Indonesia has transformed from one of the hottest stock markets in Asia into a relative pariah.

One company that’s suffered recently is the Indonesian automotive conglomerate Astra International (IDX: ASII / FRA: ASJA / OTCMKTS: PTAIF). It has a 56% market share and is widely regarded as one of the best-managed companies in Indonesia. From this perspective, it’s surprising that the stock trades at just 6.1x P/E.

I’ve written about Astra’s parent, Jardine Cycle & Carriage (SGX: C07 / FRA: CYC), in the past. But this time, I want to revisit the story from the perspective of Astra to understand why the company has become out of favor. And to explore what might change over the next few years.

🇵🇭 Bloomberry 2Q income, EBITDA dip on higher costs, weak VIP (GGRAsia)

Philippines-listed Bloomberry Resorts Corp (PSE: BLOOM / OTCMKTS: BLBRF) reported consolidated net income of just under PHP1.34 billion (US$23.7 million) for the three months to June 30, down 49.1 percent sequentially on the first quarter’s PHP2.63 billion, and down 61.1 percent year-on-year.

The information was in a Wednesday filing to the Philippine Stock Exchange. The company runs Solaire Resort & Casino (pictured) in the Philippine capital Manila, and in May – within the second quarter – opened Solaire Resort North, another gaming complex in Quezon City, northeast of Manila.

🇸🇬 Grab Holdings: The Good, The Bad, And The Ignored (Seeking Alpha) $

Grab Holdings Limited (NASDAQ: GRAB) reported mixed Q2 results that lead to a 7%+ sell-off.

Growth was the main issue in the report — however, this was mainly distorted by FX headwinds.

The underlying business fundamentals remain solid with the company producing record numbers.

Furthermore, management expects brighter days ahead as growth is expected to accelerate beyond 2024.

That said, Grab stock remains a generational buy.

🇸🇬 Grab: Profitability In Sight (Seeking Alpha) $

Not much has changed for Grab Holdings Limited (NASDAQ: GRAB) on its path to profitability.

Both its core businesses continue to gain top and bottom-line momentum.

Don’t forget the massive net cash that is slowly but surely being deployed.

Having been harshly penalized recently, Grab stock is worth a look into earnings.

🇸🇬 Shopee shines in Q2, where have its rivals gone? (Momentum Works)

Yesterday, Shopee’s parent Sea Limited (NYSE: SE) released its Q2 2024 results. The capital markets responded very positively, sending the share price up nearly 12%.

No doubt a solid set of results – digital financial services showed steady and robust growth; ecommerce performed well in GMV, take rate and profitability; and digital entertainment also stabilised.

A lot of analysts have published their detailed analyses, so we will not go into that. Instead, as usual, some of our thoughts:

🇸🇬 Sea Limited’s Share Price Surged 68% Year-to-Date: Can its Momentum Continue? (The Smart Investor)

The e-commerce firm is seeing a mix of positive and negative news but reported a stellar set of earnings for 2023.

Sea Limited (NYSE: SE) has been on a roller-coaster ride since the pandemic broke out in 2020.

The e-commerce firm saw its share price leap from US$45 to more than US$350 in November 2021, only to crash to US$52 by the end of 2022 as the boost from the pandemic wore off.

However, things may be looking up for Sea Limited.

Can the gaming and e-commerce firm revisit the highs it hit back in 2021?

🇸🇬 Sea Limited: $100 Inbound (Seeking Alpha) $ 🗃️

🇸🇬 Lazada turns profitable for the first time (Momentum Works)

This morning (13 Aug), Lazada (Alibaba (NYSE: BABA)) held a town hall where CEO James Dong revealed that the company had achieved positive EBITDA in July 2024 – the first since the company’s founding in 2012.

“This EBITDA-positive status proves the effectiveness of Lazada’s business strategy, and Lazada will continue to increase active investment in the Southeast Asian market under a sustainable operating model.” Dong said in the town hall.

Now, in addition to Shopee, one more player has demonstrated that profit for an ecommerce platform in Southeast Asia is possible. TikTok Shop since this year has als been pushing for efficiency, ROI and eventually profitability in the region.

🇸🇬 4 Key Takeaways from iFAST’s Latest Earnings (The Smart Investor)

For the second quarter of 2024 (2Q 2024), iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) released a blockbuster set of earnings.

Such a strong performance drove iFAST’s share prices up by over 6% intraday on 26 July.

iFAST Corporation is a Singapore-based financial firm providing a wide array of services such as investing, wealth management services, and banking, among others.

Now, let us dive deeper into what contributed to iFAST’s impressive growth and explore the future of the company.

🇸🇬 ESR-LOGOS REIT Announced a S$772 Million Acquisition: 5 Things Investors Need to Know (The Smart Investor)

ESR-Logos REIT (SGX: J91U / OTCMKTS: CGIUF)

The industrial REIT is growing its asset base with a large, yield-accretive acquisition.

The industrial REIT recently announced a major acquisition of two properties in a transaction worth S$772 million.

The REIT will purchase a 100% interest in a modern logistics facility in Nagoya, Japan, and a 51% stake in a manufacturing facility cum logistics warehouse at 20 Tuas South Avenue 14 in Singapore.

Here are five highlights from this purchase that income investors should take note of.

🇸🇬 GEN Singapore 2Q EBITDA down 46pct q-o-q, flags dividend (GGRAsia)

Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY), the operator of the Resorts World Sentosa casino resort (pictured), reported a net profit of SGD356.9 million (US$271.4 million) for the first six months of 2024, up 29.0 percent from a year earlier.

Revenue for the period rose by 25.5 percent year-on-year, to SGD1.36 billion, said the casino operator in a Wednesday filing.

The company said it would “continue to refresh and rejuvenate existing offerings” at Resorts World Sentosa.

JP Morgan Securities said in a Wednesday memo: “Genting Singapore’s second quarter was bad, no two ways about it.

But they also observed: “On a positive note, Genting Singapore hiked interim dividend per share to SGD0.02 – versus SGD0.015 a year ago – which, assuming the same for final, implies a handsome 5 percent per annum yield.”

🇮🇳 Dr. Reddy’s Laboratories: Economic Factors Square Off To Reiterate Buy (Seeking Alpha) $ 🗃️

🇮🇳 Aarti Industries Q1 FY2025 Update (Smartkarma) $

🇦🇪 Yalla takes its gaming act on the road as search continues for new growth engines (Bamboo Works)

The Middle Eastern social media and gaming company has been building up its fan base through a series of major real-world events since the end of last year

Yalla Group’s (NYSE: YALA) has been building its reputation as a Middle Eastern gaming powerhouse through a recent series of high-profile events

The company is trying to prepare the ground for its next growth phase as it looks to enter mid- and hardcore games through self-development and partnerships

🇿🇦 Renergen’s share price rockets as helium value train finally goes into production (IOL)

Renergen (JSE: REN / ASX: RLT / FRA: 9960 / OTCMKTS: RGNNF / RGNTF), owner of South Africa’s first onshore helium and liquid natural gas (LNG) production facility in Virginia in the Free State, saw its share price shoot up more than 28% yesterday morning after it announced its liquid helium production line was fully operational.

“We can now declare South Africa one of a select few countries worldwide to produce liquid helium for the global market,” CEO Stefano Marani said in a statement.

🇿🇦 Sasol predicts earnings slump after massive R45bn write-downs in its US chemicals operations (IOL)

Sasol (NYSE: SSL), the fuel and chemicals-from-coal group has warned of sharp losses in its year to end June due in no small measure to a R45.5 billion impairment at its Chemicals America business.

Sasol said in a trading statement yesterday that headline earnings per share were expected to be between 59% and 77% lower at between R12.28 and R21.95 per share due to challenging market conditions, notably pressure from low chemicals prices and tight margins.

🇿🇦 Gold Fields buys out Canada’s Osisko’s 50% interest in Windfall for $1.57bn (IOL)

Gold Fields (NYSE: GFI) is buying out Canadian-listed Osisko Mining Inc (TSE: OSK)’s 50% interest in the Windfall project that the two companies jointly control for $1.57 billion (R28.6bn).

The JSE and New York dually-listed gold miner said on Thursday that it expects headline earnings per share for the interim period to June, 2024 to be lower by at least 25% compared to the previous contrasting period on the back of lower gold production. However, the company expects to bump up its output in the second half-year period.

Now, Gold Fields has set its sights on acquiring the remaining 50% it does not already own in the Windfall project through the acquisition of all of the issued and outstanding common shares in Osisko.

🇭🇺 Cash isn’t dead – and this stock stands to benefit (Undervalued Shares)

The stock of Hungary’s leading money printing company is up 135% since October 2023, when Undervalued-Shares.com paid it a visit.

There is another such publicly listed company that now warrants a closer look.

Investors may be able to bag a relatively easy 40-60% over the coming 12 months, by latching onto a determined British activist investor.

There is no certainty at this stage that offers for the two divisions will be made (or accepted), but it certainly does look like De La Rue plc (LON: DLAR / FRA: DL1C / OTCMKTS: DELRF) has effectively put itself up for sale.

Intriguingly, the company offers the same two-tier product range that produced such stunning returns recently for shareholders of Hungary’s ANY Security Printing Company (ISIN HU0000093257, HU:ANY) (Any Security Printing Co PLC (BSE: ANYB / XBER: X07)); also found in some stock databases under its native Hungarian name, Állami Nyomda Nyrt.

🇵🇹 🇵🇱 🇨🇴 Jeronimo Martins: The Recent Drop Justifies Investment Into Undervaluation (Seeking Alpha) $ 🗃️

🇵🇱 Poland’s economy through the lens of banks in one email. (Polish Stocks) $

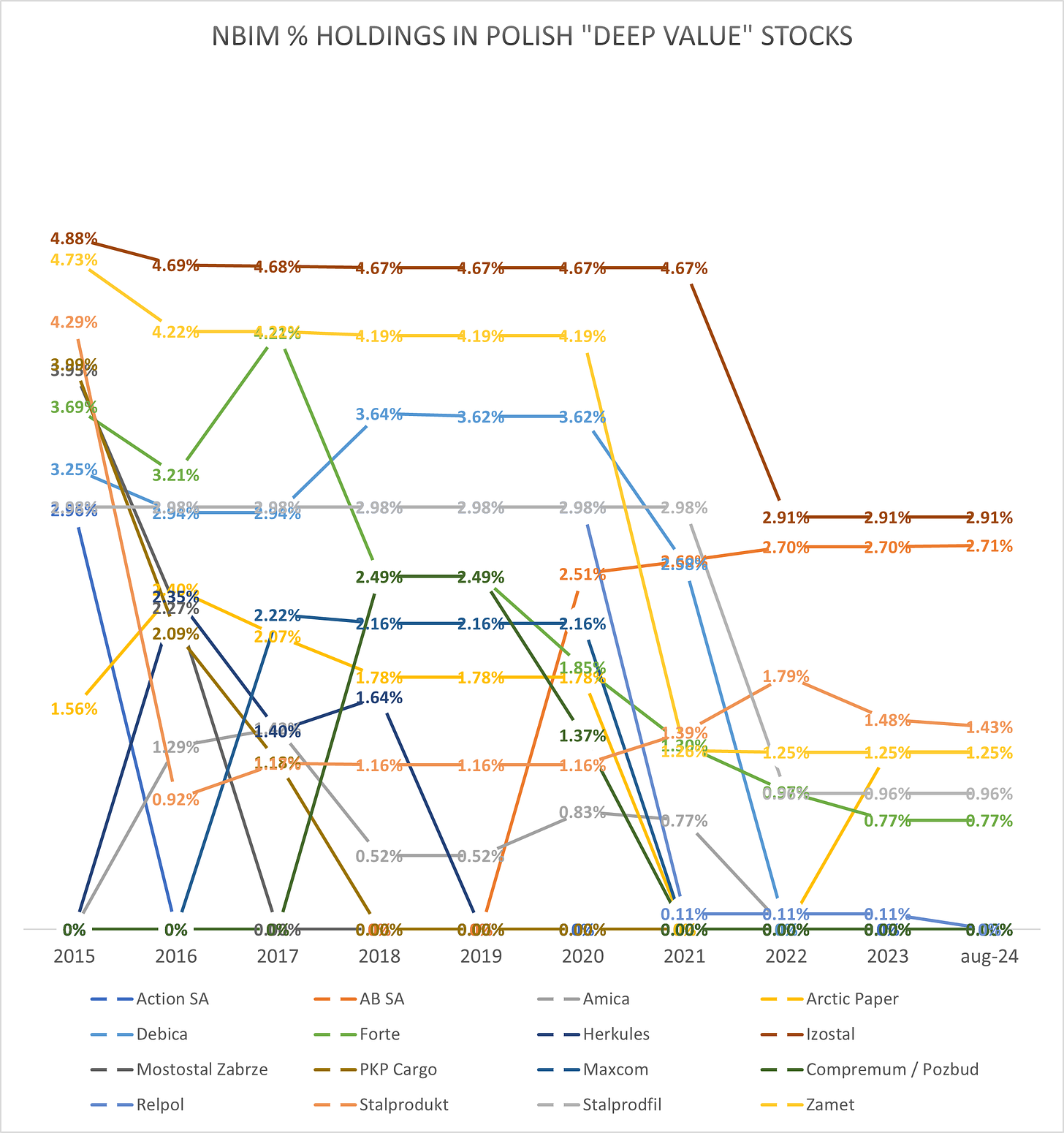

🇵🇱 Norges Bank Investment Management’s investments on the Warsaw Stock Exchange since 2015 (Hidden Zlotys)

Norges Bank Investment Management (NBIM) is a division of Norway’s central bank, Norges Bank, responsible for managing the Government Pension Fund Global, also known as the Oil Fund. The fund, one of the world’s largest sovereign wealth funds, manages Norway’s revenues from the oil and gas industry with the goal of securing long-term financial returns for future generations. NBIM invests globally in equities, fixed income, and real estate. The fund manages $1.4 trillion USD.

🌎 Mercado Libre Q2 Earnings Review (From 0 to 1 in the Stock Market)

In this article, I’ll go over the company’s financials and management’s commentary (they don’t provide guidance). At the end, I’ll share my thoughts on the quarter and what I’m doing portfolio-wise.

During the past quarter, sales exceeded 5 billion dollars, growing 41% on a yearly basis. It is to be observed that an update was made as to how the logistics business is reported. This change contributed 14pps to growth in revenues.

🌎 Mercado Libre. More than Amazon! Deep Dive Part 1/3. (Global Equity Briefing)

Is Mercado Libre (NASDAQ: MELI) really, “the Amazon of Latin America” or maybe it is even more than that?

Let’s dive in!

🌎Mercado Libre. The Flow of Money! Deep Dive Part 2/3. (Global Equity Briefing)

🌎🇰🇾 Why I Sold Patria Investments Following The Q2 Earnings (Seeking Alpha) $

Patria Investments Limited (NASDAQ: PAX)‘ management changed the established capital allocation policy without prior notice. This new policy doesn’t focus much on dividends.

Due to a rapid reallocation of capital and a lack of transparency regarding future plans, I believe an investment in PAX stock doesn’t make sense for dividend investors.

As the satisfaction with the results of an investment in PAX can differ wildly, depending on the investment goal, I rate it a hold.

🌎🇰🇾 Patria: A Heavily Discounted Growth Stock With A Dividend (Seeking Alpha) $

Patria is a global alternative asset manager with $40.3 billion in assets under management and a focus on Latin America. AUM growth in the last 12 months was over 40%.

Despite a drop in net income and dividend reduction for 2024, Patria remains a top growth idea with a positive analyst outlook.

The company’s growth drivers include AUM growth, margin growth, reinvestment growth, and market price potential, making it a compelling long-term investment.

🇧🇷 🇰🇾 StoneCo Stock: Buy The Dip After Q2 Earnings (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) stock has shown significant underperformance over the past quarters despite overall market strength.

As I see it, StoneCo’s Q2 results show impressive MSMB client growth, improved cost management, and potential for further buybacks to enhance shareholder value.

I see that a recovery trend may have already started in July 2022. The nearest resistance target is now ~28% above the current price.

Despite risks and market uncertainty, StoneCo remains a strong “Buy” with growth potential and attractive valuation compared to peers in the fintech market.

🇧🇷 NU: Giving Credit Where its Due (The Wolf of Harcourt Street)

Nu Holdings (NYSE: NU) Q2 2024 Earnings Analysis

Nu added 5.2 million new customers in Q2, bringing the total to 104.5 million, a 20.8 million increase year-over-year. Currently, 56% of Brazil’s adult population are Nu customers, with growth in Mexico and Colombia accelerating from Q1.

Deposits grew 64% year-over-year to $25.2 billion, with effective cost management keeping deposit costs at 87% of blended interbank rates. Purchase volume increased by 19% year-over-year to $31.3 billion, and 29% on a foreign exchange-neutral basis.

Nu achieved a record revenue of $2.85 billion, a 52% year-over-year increase, or 65% on a foreign exchange-neutral basis, driven by growth in active customers and higher average revenue per active customer. Gross profit reached a quarterly record of $1.36 billion, an 88% year-over-year increase on a foreign exchange-neutral basis, with the gross margin improving to 47.7%, up from 41.8% in Q2 2023.

Operating profit surged by 124% to $725 million, with the operating margin reaching a record 25%, up from 17% year-over-year. The monthly average cost to serve each active customer remains stable at $0.90, highlighting Nu’s ability to scale profitably.

🇧🇷 Nu Holdings: Largest Non-Asian Digital Bank, Continues To Deliver (Seeking Alpha) $

Nu Holdings (NYSE: NU) reported strong Q2 earnings with accelerated growth momentum in KPIs, beating earnings and revenue expectations.

The company is outperforming competitors in Mexico and Colombia, expanding its customer base and market share in these countries despite strong neobank competition with more aggressive offerings.

Despite political risks, Nu’s strong fundamentals and upcoming tailwinds from a banking license in Mexico, and tax reform in Colombia, justify a strong buy rating on the stock.

🇧🇷 Assaí – LATAM Stocks Investment Analysis #25 (LATAM Stocks) & Assai / Sendas Distribuidora (Ticker: ASAI) – Single Stock Deep Dive

Sendas Distribuidora S.A. or Assaí (NYSE: ASAI) the 2nd largest retailer in Brazil and Brazil’s 24th largest company.

This is a guest contribution by Patrick Flood of LATAM Stocks on Assai (NYSE: ASAI).

Assai (NYSE: ASAI) is the 2nd largest retailer in Brazil and the 24th largest company overall.

Operates a Cash & Carry wholesale business model (“Costco of Brazil”). Cash & Carry format continues to grow in Brazil with room for further growth.

Casino Group, the company’s former controlling shareholder, fully divested their 40% position in 2023, causing uncertainty and a large drop in the stock price.

History of aggressive expansion financed by debt. 292 stores total, 28 opened in the last 12 months. Highly leveraged, largest risks for equity investors stem from their large debt burden.

Stock currently trades around it’s all time low price, potentially a bottom. This sets up a clearly defined trade parameter with potential attractive risk/return on the long side. Several Variant Perception Indicators support this view.

🇨🇱 LATAM Airlines: Back From The Grave (Seeking Alpha) $

LATAM Airlines Group SA (NYSE: LTM) was relisted on the NYSE with the correct share count and price transparency vs the OTC listing.

LTM emerged from Chapter 11 with a de-risked balance sheet, far more efficient operation, and is executing above target that should drive EBITDA growth of 17%.

At a target multiple of 5x EV/EBITDA, LTM shares have 64% upside potential with solid growth and cash flow prospects.

🌐 Plunging iron ore price wipes $100bn off leading miners’ market value (FT) $ 🗃️

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 In Depth: Chinese Shippers’ Diverging Fortunes (Caixin) $

China’s shipping industry faces high international freight rates (up 210% YoY) contrasted with low domestic demand reducing rates by ~50%.

Domestic firms are shifting resources internationally to mitigate local demand drops, despite higher international tax costs.

Challenges include heavy reliance on trucking, limiting logistics efficiency, while intermodal (rail-water) transport remains underdeveloped due to infrastructure and competition issues.

🇨🇳 China port explosion snarls trans-Pacific container trade (FreightWaves)

Hazmat incident closes busy Ningbo hub

The closure of Ningbo Beilun’s Phase III Terminal is expected to have cascading effects on the main trans-Pacific trade lanes out of Asia, and the supply chain at large, in the midst of the peak shipping season.

Ningbo is the world’s third-busiest container port, with volume of 33.35 million twenty-foot equivalent units in 2023.

The shutdown couldn’t come at a worse time as record peak volumes for North American imports are forecast for August, after an “early peak” in June as shippers rushed to get holiday merchandise ahead of expected supply chain disruptions in the fall.

🇨🇳 In Depth: China Amps Up Scrutiny of Freewheeling Securities Firms (Caixin) $

The China Securities Regulatory Commission (CSRC) has intensified its scrutiny on securities firms, emphasizing cautious conduct in capital-intensive activities and strengthening internal compliance.

Since Wu Qing became CSRC chairman in February, over 100 penalties have been issued to more than 30 securities firms, signaling a stricter regulatory environment.

Securities firms may need to transform their business strategies, possibly through mergers and acquisitions, due to increasing regulatory scrutiny on capital-raising practices and risk management.

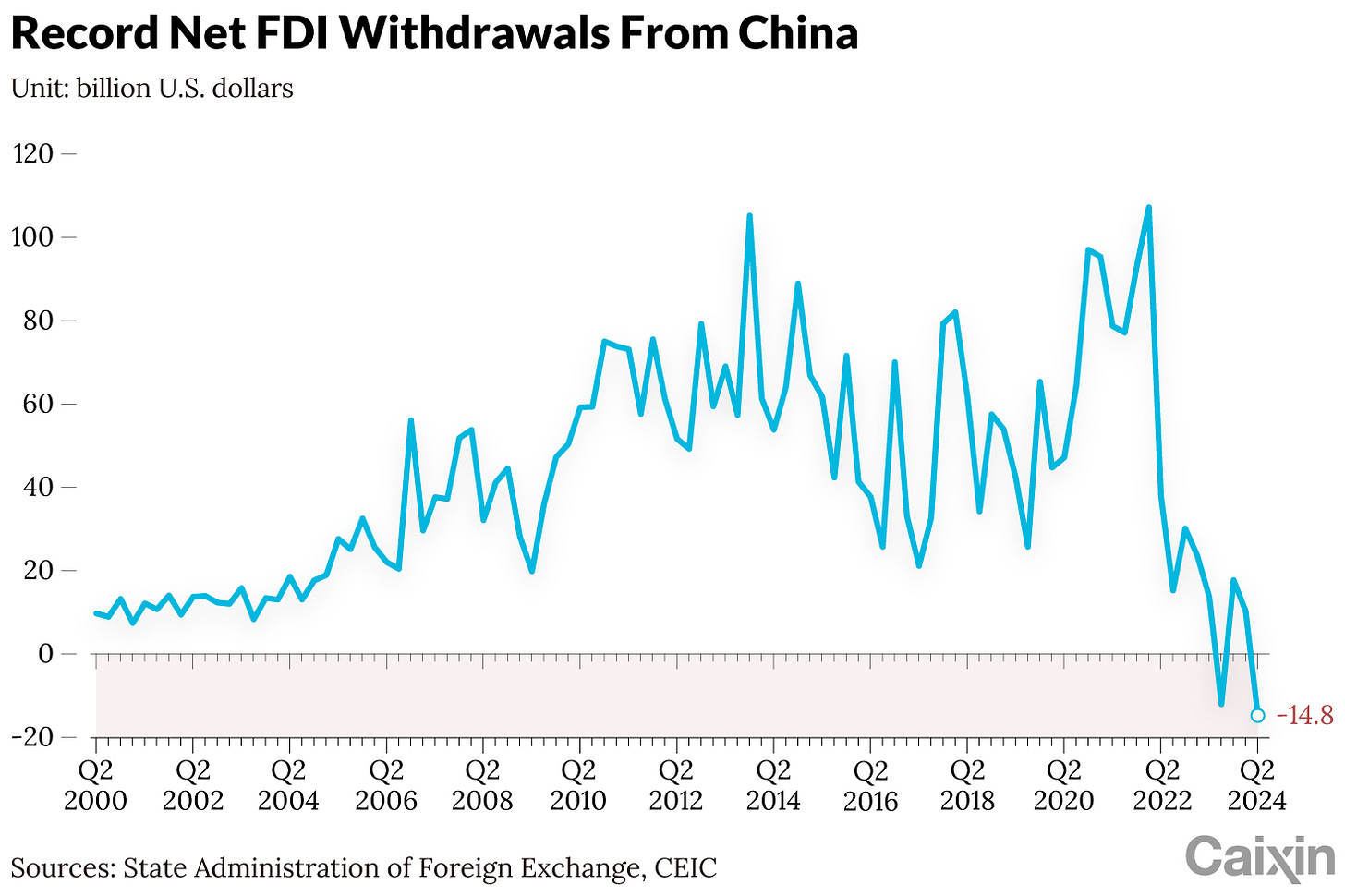

🇨🇳 Net Foreign Direct Investment Withdrawals From China Hit Record High (Caixin) $

China saw a record high $14.8 billion in net foreign direct investment (FDI) withdrawals in the second quarter, according to preliminary data released Friday by the State Administration of Foreign Exchange (SAFE).

This marks the second net FDI outflow in available SAFE data dating back to 1998.

🇹🇼 Taiwan’s stock market continues to forge ahead (The Asset) 🗃️

🌏 Asia-Pacific H1 fintech investment drops 22% (The Asset) 🗃️

🇹🇭 Thai PM pushing casino policy dismissed from office (GGRAsia)

The Thai-government leader – and one of the most vocal officials in support of Thailand’s push to legalise casino resort business – was on Wednesday dismissed from office by the country’s Constitutional Court.

Before news of Mr Srettha’s dismissal broke on Wednesday afternoon, the Bangkok Post news outlet had reported that one of the parties in Thailand’s current coalition government had added its voice to the opposition Democrat Party, with concerns about the social and economic value of legalising casino resort business in the kingdom.

🇮🇳 Five undervalued qualities of the Indian economy (FT) $ 🗃️

🇿🇦 Red Sea deadlock raises shipping costs and cripples global maritime industry (IOL)

Container prices and freight rates are influenced by a litany of costs and sensitive market conditions.

The South African Association of Ship Owners and Agents (Saasoa) has warned that rising shipping costs and longer journey times around the Cape of Good Hope would exacerbate rate hikes.

“In addition, global travel is also being hampered by low water levels in the Panama canal meaning that the waterway cannot be fully utilised but is recovering giving some light at the end of the tunnel.”

“On the home front, our South African ports are in a dismal state as age-old handling equipment breakdowns continue unabated delaying vessels at the anchorage for 10 to 12 days at a time, then in port a further two to three days because of equipment breakdowns, weather and wind resulting in work stoppages that ultimately follows the vessel at all ports of call coastwise,” he said.

🇿🇦 Retail sales surge to 2-year high, boosting Q2 GDP growth outlook (IOL)

SHOPPING activity has given a significant boost to the second quarter’s economic growth in South Africa as retail trade sales surged to a near 2-year high in June, mainly driven by textiles and clothing.

Data from Statistics SA (Stats SA) yesterday showed that retail sales increased by 4.1% year-on-year in June following an upwardly revised 1.1% rise in May.

🇿🇦 JSE surges to record high bolstered by rand’s strength, record high gold price (IOL)

South African currency and stock markets ended Friday on a high note as the rand surged to its highest in a year while stocks reached a record high as investors flocked to gold, pushing the price of the yellow metal to record highs.

The rand strengthened to R17.87 against the US dollar on Friday afternoon, its highest in 12 months, bolstered by receding concerns over a potential recession in the US and prospects of global interest-rate cuts in the coming months.

🌐 “I tried it twice” – 10 less bullish observations on AI (Zerohedge) $ 🗃️

Hundreds of millions of people have tried ChatGPT, but most of them haven’t been back. If you ask what ‘used’ actually means, it turns out that most people played with it once or twice, or go back only every couple of weeks.

BCA’s great strategy team on the JPY carry trade and the AI bubble:

The analysis of price complexity strongly suggests that the ‘yen carry trade’ and the AI bubble are one and the same trade, premised on three conditions…:

S&P Global is paying Accenture to train all 35k staff in ‘generative AI’.

Benedict Evans: “I used to joke that if you say ‘Digital Transformation’ three times, an Accenture partner will appear in a puff of smoke and offer you a contract – now the same happens for ‘AI’. Welcome to enterprise IT.”

🌐 Country Risk: My 2024 Update (Musings on Markets)

Determinants and Implications

After the 2008 market crisis, I resolved that I would be far more organized in my assessments and updating of equity risk premiums, in the United States and abroad, as I looked at the damage that can be inflicted on intrinsic value by significant shifts in risk premiums, i.e., my definition of a crisis. That precipitated my practice of estimating implied equity risk premiums for the S&P 500, at the start of every month, and following up of using those estimated premiums when valuing companies during that month. The 2008 crisis also gave rise to two risk premium papers that I have updated each year: the first looks at equity risk premiums, what they measure, how they vary across time and how best to estimate them, with the last update in March 2024. The second focuses on country risk and how it varies across geographies, with the focus again on determinants, measures and estimation, which I update mid-year each year. This post reflects my most recent update from July 2024 of country risk, and while you can read the entire paper here, I thought I would give you a mildly abridged version in this post.

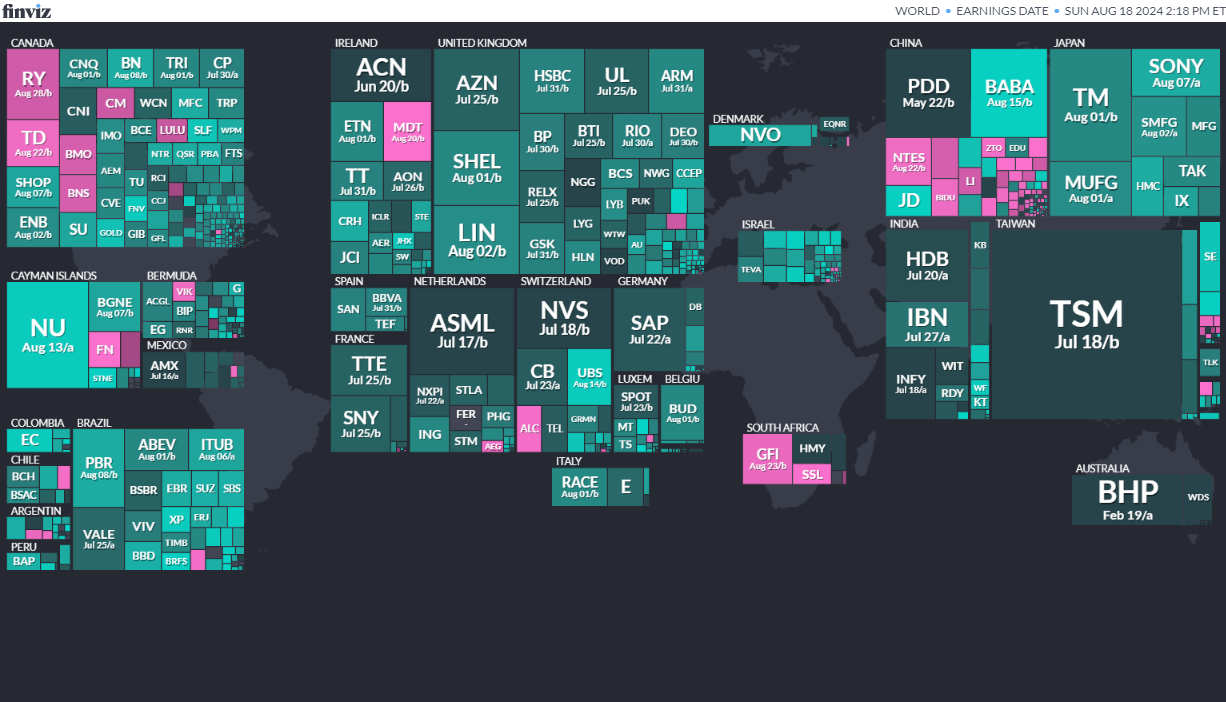

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

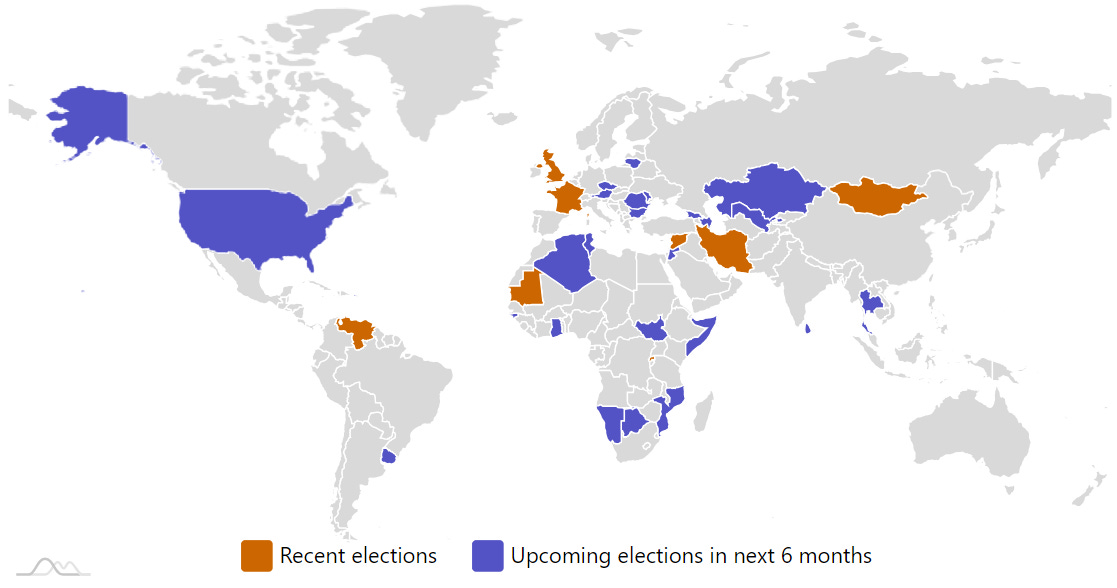

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 21, 2024