Emerging Market Links + The Week Ahead (August 26, 2024)

A number of emerging market and well-known Chinese stocks in particular have reported a mixed bag of earnings depending on the sector and the company. Other recent news out of China has not been so good for foreign investors (e.g. China Steel Mill Profits Collapse, Goldman Issues: “Bleak Outlook” For Iron Ore, China mutual funds reel from crackdown 🗃️, China’s Stricter Rules, Sluggish Market Lead to Surge in Delisting, China’s Languishing IPO Market Strains Startup-Investor Relations, Top private equity firms put brakes on China dealmaking 🗃️, etc.)

However, Caixin has noted how Chinese food and beverage (F&B) companies have expanded quickly into Southeast Asia (and even into North America and Europe) driven in part by saturation at home. And the Financial Times has noted (Nepo baby leaders are stifling south-east Asia 🗃️) that with over 670 million people and a combined economy that is the fifth largest in the world, Southeast Asia has become a “crucible of geopolitical competition between the US and China.”

However, some things have not changed as those who want to succeed in the region still must understand the region’s political and business family dynasty dynamics (as political families make a resurgence)…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 (XPeng Inc. (XPEV US, SELL, TP US$2) Earnings Review): Delivery Goal for MONA M03 Is Unrealistic (Smartkarma) $

(Chinese Smart EV maker) XPeng (NYSE: XPEV) reported C2Q24 top line, non-GAAP operating loss and GAAP net income in line, 5.4% worse and 7.5% better than our estimate.

We raised our MONA forecast by 13% but still significantly below XPEV’s guidance. We believe management guidance is overly optimistic;

We maintain a SELL rating on the stock and TP unchanged.

🇨🇳 PDD (PDD US): Stock Plunged After Excellent 2Q24 Result – Your Time to Buy (Smartkarma) $

The stock (PDD Holdings (NASDAQ: PDD) or Pinduoduo) plunged today after the announcement of excellent performance for 2Q24.

In 2Q24, revenue grew by 86% YoY and the operating margin improved 10 percentage points YoY.

We believe investors should buy, as it is just a tactic from major stock sellers.

🇨🇳 Temu parent’s share price drops ~30%: our thoughts (Momentum Works)

Yesterday (26 August), Temu’s parent company PDD Holdings (NASDAQ: PDD) or Pinduoduo released its Q2 2024 results. Revenue missed analyst consensus while profit beat expectations.

Stock prices started sliding down in the pre-market. However, it was the remarks by the Co-CEO Chen Lei during the earnings call that truly spooked investors. He “made it clear to investors” that “in the long run, the decline in profitability is inevitable”, and added competition in its global business faces a “rapid shift in external environment”, and “significantly greater uncertainty”. Chen Lei also highlighted that the competition PDD faces is growing stronger, “is here to stay” and “is expected to intensify”.

Therefore, the management has reached a unanimous decision that the next few years are “not appropriate” for dividends and share repurchases.

Some of our thoughts:

🇨🇳 J&T Express turns profitable in China (Momentum Works)

Yesterday (19 Aug), J&T Global Express Ltd (HKG: 1519 / SWB: J92) released its unaudited interim results for the 1st half of 2024. The company registered an adjusted EBIT of US$118.243 million and a net income of US$31 million.

Notably, adjusted EBIT for J&T’s China business has turned positive too.

This is reassuring for its management and investors, with the latter worrying for a few years about whether the company will ever make money in China’s logistics red ocean.

A few facts, and thoughts:

🇨🇳 🇿🇦 Naspers X Prosus Discount Update Post Tencent 2Q FY24 Results, Narrowing Gains Momentum (Smartkarma) $

Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) reported a softer set of results for Q2 relative to Q1. Revenue for the quarter was up 1% QoQ and 8% YoY.

Since our last discount update mid-August, the discounts of both Naspers (JSE: NPN / FRA: NNWN / OTCMKTS: NPSNY) and Prosus (JSE: PRX / AMS: PRX / OTCMKTS: PROSY / OTCMKTS: PROSF / ETR: 1TY) have continued to narrow.

Naspers’ discount is trading well off the lows reached at the end of July (~45%).

🇨🇳 Comments on Tencent’s Second Quarter Earnings. (Investing in China)

How Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY)’s Strategic Shifts Are Paving the Way for Future Growth

Tencent’s management consistently sets clear strategic goals and delivers on them, with predictions from previous quarters continuing to materialize.

Effects of that strategy can be clearly seen:

🇨🇳 Tencent Music Entertainment Group: Innovation In Subscription & User Experience & Other Major Drivers (Smartkarma) $

Tencent Music Entertainment Group (NYSE: TME) demonstrated a strong performance in the second quarter of 2024, anchored by significant growth in its online music services and a robust increase in adjusted net profit.

The company reported a 28% year-over-year growth in online music services and a 26% increase in adjusted net profit, signaling robust operational health and profitability.

The addition of over 10 million music subscribers in the first half of 2024, combined with an increase in average revenue per paying user (ARPPU), underscores the company’s effective market penetration and pricing strategy.

🇨🇳 Alibaba International records strong growth, Lazada milestone (Bamboo Works)

CEO Jiang Fan said Alibaba (NYSE: BABA)’s global e-commerce unit is focused on business and supply chain upgrades, technology innovations and growth in key markets

Alibaba Group’s international e-commerce arm posted 32% revenue growth in its latest quarter, driven by strong performance for its cross-border businesses

The company’s diverse mix of cross-border and local e-commerce offerings presents big potential for more market expansion

🇨🇳 Alibaba Group: A Blend of Growth (Smartkarma) $

Alibaba (NYSE: BABA)‘s June Quarter 2024 financial report showcases a blend of growth, challenges, and strategic advancements.

The group reported steady growth in its core e-commerce businesses, Taobao and Tmall Group, with an increase in Gross Merchandise Volume (GMV) and order volumes.

Particularly, the company’s focus on enhancing user experience and AI-driven strategies appears to be bearing fruit, assuring an upward trajectory in retaining and attracting customers, which is crucial in a competitive e-commerce landscape.

🇨🇳 (Kuaishou (1024 HK ,BUY, TP HK$75) TP Change): Temporary Setback from Weak Macro…Reiterate BUY (Smartkarma) $

Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) reported C2Q24 revenue, IFRS operating profit, and IFRS net income in-line, in-line, and 5.7% vs. our estimates; and in-line, 9.0% and 14% vs. the consensus.

The bright spot was strong growth in its advertising and stabilization in the regulation-affected live streaming. Our BUY case of AI empowering mid-sized traffic platforms is intact;

We cut TP to HK$75 to reflect the sustained damage of weak consumption. The stock is trading at only 8.5x PE for 2025.

🇨🇳 Chinasoft stays hitched to Huawei as revenue, profit contract (Bamboo Works)

The IT outsourcing company’s revenue fell 6.2% in the first half of the year, as it continued staff cuts dating back to last year

Chinasoft International Limited (HKG: 0354 / OTCMKTS: CFTLF)’s revenue and profit declined in the first half of 2024 as its customers reined in their spending amid China’s economic slowdown

The IT outsourcing services provider’s all-in strategy with Huawei offers stability but also poses the risk of overreliance

🇨🇳 JD.com Inc.: Enhancing Platform Ecosystem For Third-Party Sellers As A Key Growth Catalyst! – Major Drivers (Smartkarma) $

JD.com (NASDAQ: JD) reported its second quarter and interim 2024 earnings, presenting a mixed performance amid challenging market conditions.

The company achieved record non-GAAP net profit for a single quarter, indicating strong profitability and effective cost management.

However, revenue growth was modest, reflecting the competitive and dynamic nature of the market JD.com operates in.

🇨🇳 ATRenew posts market-defying growth as partnerships with JD.com, Apple advance (Bamboo Works)

The company’s revenue grew 27% in the second quarter, as it deepened its collaboration to promote recycling with JD.com (NASDAQ: JD)

ATRenew (NYSE: RERE) posted strong revenue growth in the second quarter and predicted similar trends in the third, as it banks on rising demand from value-conscious consumers

The recycling specialist is placing greater emphasis on its higher-margin businesses, which it is pursuing partly through growing ties with partners Apple and JD.com

🇨🇳 Xiaomi (1810 HK): 2Q24, Revenue up by 32%, Electric Vehicle Profit to Follow, Buy (Smartkarma) $

Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF)

Excluding the new business electrical vehicle, total revenue increased by 23% YoY in 2Q24.

Smartphone shipments grew faster than Samsung and Apple in 2Q24.

We believe electrical vehicle will bring significant gross profit in following two years.

🇨🇳 Q Tech needs better R&D focus to go eye-to-eye with sharper optic rival (Bamboo Works)

The camera module maker recorded solid growth in the first half of 2024 on a rebounding smartphone market, but still lags Sunny Optical (HKG: 2382 / LON: 0Z4I / FRA: SXC / OTCMKTS: SNPTF / SOTGY) in terms of product development

Q Technology (Group) Company (HKG: 1478)’s first-half revenue rose 40% to 7.68 billion yuan, while its profit jumped 454% to 115 million yuan

The company’s R&D spending accounted for only 3.7% of revenue for the period, well behind as much as 7% spent by rival Sunny Optical in recent years

🇨🇳 China Steel Mill Profits Collapse, Goldman Issues: “Bleak Outlook” For Iron Ore (Zerohedge)

The global commodities market peaked in early 2022 and stumbled ever since. China’s property sector remains in a multi-year slump, resulting in soft demand for base metals like iron ore and copper. Last week, Baoshan Iron & Steel Co Ltd (SHA: 600019) Chairman Hu Wangming warned that the economic conditions in the world’s second-largest economy felt like a “harsh winter.”

As the world’s largest steel producer, Baowu Steel’s chairman warned that the steel industry’s downturn could be “longer, colder, and more difficult to endure than expected,” potentially mirroring the severe downturns of 2008 and 2015. This should serve as a major wake-up call for macro observers that a recovery in China isn’t imminent; in fact, Beijing might not unleash the monetary and fiscal cannons until after the US presidential elections.

Here are the highlights from the note:

🇨🇳 Huya’s fledgling diversification drive shows early promise (Bamboo Works)

The operator of a livestreaming gaming platform said revenue from its new services launched just a year ago accounted for 20% of its total in the second quarter

Huya Inc (NYSE: HUYA)’s revenue declined 16% in the second quarter, but income from its new game-related services more than doubled

The company is trying to diversify its revenue in the face of a softening Chinese economy and low margins

🇨🇳 Beststudy scores profits by thinking outside the box (Bamboo Works)

The provider of education and training services in southern China has boosted its earnings with new courses, pivoting to non-academic tuition after a crackdown on tutoring for school subjects

Before the restrictions, academic education contributed nearly 90% of China Beststudy Education Group (HKG: 3978)’s revenue but the company’s new extra-curricular courses now account for 40% of turnover

The company has also launched study tours to gain a foothold in a market valued at more than a hundred billion yuan

🇨🇳 FAST NEWS: Keep Inc. reports small revenue growth as loss narrows (Bamboo Works)

The Latest: Online fitness platform Keep Inc.’s (HKG: 3650) announced Friday its non-GAAP adjusted loss in the first half of this year narrowed to 160 million yuan ($22.5 million) from 223 million yuan a year earlier.

Looking Up: The company’s revenue grew by 5.4% to 1.04 billion yuan during the period, primarily on improving monetization across its self-branded products, online membership subscriptions, and advertising sales. As that improved, its gross margin also rose from 43% to 46%.

Take Note: The company’s selling and marketing expenses increased by 25.8% to 323 million yuan, mainly due to higher promotional and advertising spending with the launch of more brand promotions and marketing campaigns.

🇨🇳 361 Degrees sprints ahead of rivals in earnings race (Bamboo Works)

The Chinese sportswear brand has outpaced other major players in half-year earnings growth, benefiting from competitive pricing as consumers hunt for bargains and prioritize spending on children

361 Degrees International Limited (HKG: 1361 / FRA: 36L / OTCMKTS: TSIOF) posted a 12% rise in profits and more than doubled its dividend payout for the first half of the year, beating market expectations

Price competition is expected to persist into the second half of the year as major brands step up a battle for market share

🇨🇳 FAST NEWS: Chicmax’s profit skyrockets on growth of Kans brand (Bamboo Works)

The Latest: Skincare products maker Shanghai Chicmax Cosmetic Co Ltd (HKG: 2145) reported Thursday its net profit surged more than three times to 412 million yuan ($58 million) in the first half of this year, mainly due to a big increase in sales for its core cosmetics.

Looking Up: The company’s revenue rose 121% to about 3.5 billion yuan, of which the Kans brand benefited from growth of its e-commerce platform, with revenue for that line soaring 185% to 2.93 billion yuan, accounting for 83.6% of the total.

Take Note: Its selling and distribution expenses jumped 137% to 2.02 billion yuan, accounting for 57.6% of total revenue, as it spent more on brand exposure and promotion, and invested in new and existing channels.

🇨🇳 Sephora cuts jobs in China in further sign of softness in beauty sector (FT) $ 🗃️

🇨🇳 Weilong defies downbeat consumer market with its cheap spicy snacks (Bamboo Works)

China’s leading maker of snacks typically costing less than $1 reported its revenue jumped 26% in the first half of the year, while its profit rose 39%

Weilong Delicious Global Holdings Ltd (HKG: 9985) said its revenue rose 26% in the first half of 2024, as sales of its vegetable products jumped 57% to become its biggest breadwinner

The company looks like a good defensive play in the current environment of consumer caution due to the affordability of its snacks that typically cost less than $1

🇨🇳 China Resources Beverage pumps up water fight with market leader (Bamboo Works)

The maker of C’estbon bottled water has reportedly been approved for a Hong Kong lPO, as its battle for industry dominance with Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF) heats up

China Resources Beverage is preparing a Hong Kong IPO, saying it’s China’s biggest purified drinking water company with 32.7% of the market

Archrival Nongfu Spring has thrown down the gauntlet by re-entering the purified drinking water business in a direct challenge to China Resources Beverage

🇨🇳 In Depth: Pressure Builds on Trailblazing Chinese Bubble Tea Brand Mixue (Caixin) $

Mixue, a Chinese purveyor of cheap, sugary bubble milk teas, has blazed a trail through Southeast Asia, using scale and supply chain mastery to upend local markets by undercutting independent sellers.

With over 36,000 stores in China and the rest of the world, Mixue Bingcheng Co. Ltd. dominates the market by offering milk tea with tapioca, ice cream, and juice at budget-friendly prices of 2 to 10 yuan (14 U.S. cents to $1.40), far less than competitors like HeyTea and Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF) which charge double or triple that. On the Chinese mainland, many of its stores are located in smaller cities and suburban areas, offering sugar hits to price-sensitive consumers.

🇨🇳🌏 In Depth: A New Chinese Food and Beverage Wave Hits Southeast Asia (Caixin) $

Forget kung pao chicken and sweet and sour pork. There’s a new wave of food and beverage chains flowing out of China, and it’s all about Sichuan hot pot, braised chicken rice and pickle fish soup — as well as mainstays like bubble tea.

Chinese food and beverage (F&B) companies have expanded quickly into Southeast Asia, and even into North America and Europe, in the past few years, driven in part by saturation at home. According to Huafu Securities Co. Ltd., nearly 3.19 million new F&B enterprises were registered in China in 2023, a 24.2% increase from the previous year.

🇨🇳 Shanghai Henlius Biotech (2696.HK) – Privatization Has Taken a Positive Step Forward (Smartkarma) $

The Share Alternative is necessary to improve success rate of privatization. Our guess is Henlius Biopharmaceuticals/Lin Lijun would vote for this privatization, but we’re not sure about Qatar Investment’s decision.

Due to its “flaws”, undervaluation of Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF) is difficult to fundamentally change. So, those conservative and cautious investors would choose the Cash Alternative considering the risks behind the Share Alternative.

Even if there’re plans of re-listing, it may be based on a new entity formed after integrating Henlius and other assets within Shanghai Fosun Pharmaceutical (HKG: 2196 / SHA: 600196 / FRA: 08HH / OTCMKTS: SFOSF). So, the value of Rollover Entities/Securities remains uncertain.

🇨🇳 Innovent Biologics (1801 HK) Adds to Its Oncology Portfolio (Smartkarma) $

Dupert, a drug for the special treatment of non-small cell cancer has been approved by the NMPA.

In 2022, China recorded the highest number of new cancer cases, and their exceptional high incidence of smoking is of particular concern.

Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY)’s portfolio of nine oncology drugs is very attractive in the biggest cancer market.

🇨🇳 Legend Biotech: Achieving Regulatory Milestones and Market Approval! – Major Drivers (Smartkarma) $

Legend Biotech (NASDAQ: LEGN), during their second quarter 2024 earnings call, presented a detailed insight into its operations, financial health, and the strides it’s making in the pharmaceutical space, particularly regarding CARVYKTI, their FDA-approved treatment for multiple myeloma.

The company reported an 18.5% quarter-over-quarter revenue growth amounting to $186 million for CARVYKTI, which marks a robust 60% increase year-over-year.

Baptista Research looks to evaluate the different factors that could influence the company’s price in the near future and attempts to carry out an independent valuation of the company using a Discounted Cash Flow (DCF) methodology.

🇨🇳 Sino Biopharmaceutical (1177.HK) 24H1 – The Concerns Behind the Performance Turnaround (Smartkarma) $

After performance headwinds in 2022 and 2023, we have seen a turnaround of Sino Biopharmaceutical Ltd (HKG: 1177 / FRA: SMZ1 / OTCMKTS: SBMFF / SBHMY) in 24H1. The Company is gradually getting rid of the negative influence of VBP.

Even if the performance improves in 2024, there is still great uncertainty about whether the performance target for 2030 (revenue to reach HK$100 billion) can be achieved as scheduled.

The innovative drug pipeline actually lacks competitiveness. Current valuation is not cheap. Deficiencies in corporate governance are one reason why the market is reluctant to offer Sino Biopharm high valuation.

🇭🇰 AGBA Group: $500 Million SEPA With Yorkville Limits Upside Potential Of Triller Merger (Seeking Alpha) $ 🗃️

🇭🇰 Undervalued Cathay Pacific’s Stock Fails To Take Off Due To High Costs And Poor Sentiment (Seeking Alpha) $ 🗃️

🇭🇰 MTR Corporation: Consider Both Earnings And Capital Return Outlook (Upgrade) (Seeking Alpha) $ 🗃️

🇲🇴 Galaxy Entertainment beats the odds with solid results as Macau gaming rebound slows (Bamboo Works)

Macau’s most profitable casino operator posted strong revenue growth in the first half of the year as the city’s post-pandemic tourism rebound continued

Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF)’s profit rose more than 50% in the first half of the year to nearly HK$4.4 billion

The company and its peers are benefiting from a post-pandemic gaming rebound, though the pace of that rebound is slowing

🇲🇴 Melco Resorts spends nearly US$45mln buying own shares (GGRAsia)

United States-listed casino group Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) has bought back just under 8.34 million shares of its own stock on the open market, for an aggregate consideration – before expenses – of about US$44.5 million.

The information was disclosed in a Monday filing by its Hong Kong-listed parent, Melco International (HKG: 0200 / FRA: MX7A / OTCMKTS: MDEVF).

Melco Resorts repurchased a total of 8,335,364 American depositary shares (ADS), each equal to three ordinary Melco Resorts shares. The deal was part of the company’s three-year, US$500-million share buyback programme announced in June 2024.

🇲🇴 Sands China delisting not likely at this stage: Seaport (GGRAsia)

Macau casino operator Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) does not see a “likely scenario at this stage” for buyout of the minority shareholders’ interest in the company and any delisting from the Hong Kong Stock Exchange.

That is according to a Friday note from Seaport Research Partners, citing conversations with the management of Sands China’s parent, Las Vegas Sands Corp, at the 2024 Seaport Annual Summer Conference.

“There is not a likely scenario at this stage of a full buyout of the Sands China minority, and delisting of Sands China Ltd,” wrote analyst Vitaly Umansky in the memo.

🇹🇼 ChipMOS: Geopolitical Issues Likely To Hold Down The Stock For A While (Seeking Alpha) $ 🗃️

🇰🇷 Woori Financial Group: Too Cheap To Ignore (Seeking Alpha) $ 🗃️

🇰🇷 Hyundai Motor India IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Hyundai Motor India is market cap of US$18.6 billion, based on P/E of 24.4x our estimated net profit of 64.1 billion INR in FY25.

There have been some increasing concerns about Hyundai Motor India paying out higher royalty to its parent Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) and dividend to shareholders, which could lower profit.

According to a recent article by livemint, the expected valuation of Hyundai Motor India has fallen to about USD16 billion to USD20 billion

🇰🇷 A Tender Offer to Purchase a 17.5% Stake in Hanwha Galleria (Operator of Five Guys in Korea) by Kim Dong-Sun (Douglas Research Insights) $

It was announced that a tender offer to purchase a 17.54% stake in Hanwha Galleria (KRX: 452260) has been launched by Kim Dong-Sun (Vice President at Hanwha Galleria).

Tender offer price is 1,600 won per share, which is 22.8% higher than the closing price on 22 August. Tender offer amount is 54.4 billion won.

On 23 August, Hanwha Galleria’s share price is likely to rise close to the tender offer price as many investors believe the tender offer is likely to be successful.

🇰🇷 Insulet Launches a Patent Lawsuit Against Eoflow in Europe (Douglas Research Insights) $

Eoflow (KOSDAQ: 294090) announced Insulet (NASDAQ: PODD) had filed an injunction on 3 July against Eoflow and Menarini requesting a ban on the manufacture, sale, distribution, and use of EOPatch in 17 European countries.

Given that Eoflow should have reported this event earlier, this is likely to result in further loss of confidence on Eoflow by many investors in the near term.

If Eoflow is able to complete its rights offering (albeit lower amount than proposed), this could boost its chances to become a formidable competitor to Insulet on a global basis.

🇰🇷 Eoflow: Rights Offering of 82 Billion Won and (Medtronic & Eoflow – Don’t You Forget About Me) (Douglas Research Insights) $

After the market close on 21 August, Eoflow (KOSDAQ: 294090) announced a rights offering capital raise of 9.1 million new shares, representing share dilution of 23%.

Based on the expected rights offering issue price of 9,040 won, the company is expected to raise 82.2 billion won in this capital raise.

Eoflow has monthly cash burn rate of about 3.3 billion won. If the rights offering is successful, it would have adequate capital resources for about a couple of years.

🇰🇷 Archimed Group Seeks Delisting of Jeisys Medical Through Stock Exchange (Douglas Research Insights) $

Jeisys Medical (KOSDAQ: 287410) announced that it has decided to exchange shares with Syracus Subco, its largest shareholder. The stock exchange ratio between Syracus Subco and Jeisys Medical is 1 to 1.3575606.

The exchange date is 23 October. Through this stock exchange, Archimed Group (owner of Syracus Subco) seeks to delist Jeisys Medical (287410 KS).

Jeisys Medical also announced that it plans to cancel 1,075,838 common shares, representing 1.4% of its outstanding shares.

🇰🇷 NPS Will Vote Against the Merger Between SK Innovation and SK E&S (Douglas Research Insights) $

NPS will vote against the merger between SK Innovation (KRX: 096770) and SK E&S, mainly due to significant concerns about destroying shareholder value (especially for SK Innovation shareholders).

Sustinvest also recommended that institutional investors vote against this merger, citing that the merger ratio between SK Innovation and SK E&S is disadvantageous to SK Innovation’s general shareholders.

If NPS exercises its appraisal rights, this could put a knife in the wheel of the M&A merger between SK Innovation and SK E&S.

🇰🇷 SM Entertainment: Disposal of Non Core Assets – SM C&C and KeyEast (Douglas Research Insights) $

On 21 August, SM Entertainment Co Ltd (KOSDAQ: 041510) announced that it will sell its non-core assets including its controlling stakes in SM Culture & Contents Co Ltd (KOSDAQ: 048550) and KeyEast (KOSDAQ: 054780).

The combined sales amount could be about 110 billion won or more, representing 7% or more of SM Entertainment’s market cap.

Sale of SM C&C and KeyEast is likely to have a positive impact on SM Entertainment by selling its non-core assets and improving its balance sheet for higher shareholder returns.

🇰🇷 STCube: Rights Offering Capital Raise of 89 Billion Won (Douglas Research Insights) $

(Biotech) STCube announced it plans to increase capital by 89 billion won (13 billion won through a third party rights offering and 75.7 billion won through shareholder preferred capital increase).

We have a positive view of STCube’s capital raise and there could be some alpha generating returns in our view.

The fact that the company’s share price surged nearly 5x from the last rights offering in May 2022 (to October 2022) is likely to positively impact capital raise this time.

🇰🇷 CMES AI Robotics IPO Preview (Douglas Research Insights) $

CMES AI Robotics is getting ready to complete its IPO on KOSDAQ in October. The expected IPO price is 20,000 won to 24,000 won.

CMES provides intelligent robot solutions that combine artificial intelligence (AI) and three-dimensional (3D) vision technology. CMES’s core technologies include 3D vision sensors and image processing algorithms.

Robotics related IPOs have generated enormous interest in Korea. Although CMES is a small cap name, this robotics related IPO is also likely to garner high interest as well.

🇰🇷 Lumir IPO Preview (Douglas Research Insights) $

Lumir is getting ready to complete its IPO on KOSDAQ in September. The IPO which is expected to raise between 49.5 billion won to 61.5 billion won.

Lumir specializes in the development of observation satellite technology including image data processing devices and onboard computers for a number of government satellite series.

Lumir had sales of 12.1 billion won (up 90.5% YoY) in 2023. Its sales surged by 477% YoY to reach 8.2 billion won in 1H24.

🇰🇷 Lumir IPO Valuation Analysis (Douglas Research Insights) $

Base case valuation of Lumir is target price of 18,542 won per share. Given the low upside relative to IPO price range, we have a Negative view of this IPO.

Our net profit estimates in 2025 and 2026 are 38% and 63.3% lower than the company’s estimates, respectively.

Lumir provides key technologies for satellite systems, including small synthetic aperture radar (SAR) satellite systems and payloads.

🇰🇷 I-Scream Media IPO Book Building Results Analysis (Douglas Research Insights) $

(Digital education contents and platform) I-Scream Media reported its IPO book building results. The IPO price has been determined at 32,000 won, which is at the low end of the IPO price range.

A total of 561 institutional investors participated in the IPO survey. The final demand ratio was 31.3 to 1.

Our valuation analysis suggests an implied price per share of 41,450 won, which represent a 29.5% upside from the IPO price.

🇲🇾 British American Tobacco Malaysia: Mixed Financial Prospects (Rating Upgrade) (Seeking Alpha) $

British American Tobacco (Malaysia) Berhad’s revenue outlook has improved because of a decrease in illegal cigarettes’ market share and faster-than-expected economic growth for the Malaysian economy.

BAT Malaysia’s profitability is expected to weaken in the future due to its efforts to grow its vapor product Vuse.

BAT Malaysia’s mixed outlook regarding its top line and profit margins warrants a Hold rating.

🇸🇬 Singapore Post: Analysis of its Strategic Transformation and Governance 2024 & Singapore Post: Strategic Transformation and Governance 2024 (Core Highlights) (Corporate Monitor)

Singapore Post Limited (SGX: S08 / FRA: SGR / OTCMKTS: SPSTY / SPSTF) is a venerable institution with more than 160 years of history. However, its performance and shareholder returns leave much to be desired. This report analyses the Strategic Review which it had announced in 2024 and evaluates the prospects ahead for SingPost.

🇸🇬 BW LPG: Fleet Acquisition And Favorable Market Signals Further Growth (Seeking Alpha) $ 🗃️

🇸🇬 Grab 2Q24 Earnings: Robust Sequential Growth, But Conservative Guidance (Seeking Alpha) $ 🗃️

Grab Holdings Limited (NASDAQ: GRAB)‘s 2Q24 earnings showed solid growth in Deliveries GMV, Ads business, and a strong financial service segment, but dragged down by foreign exchange.

Increased incentives are aimed at driving adoption of affordable options, leading to potential long-term margin expansions.

Conservative guidance, however, suggests possible heightened competition. Alternatively, Grab might be offering more incentives to drive Saver adoption.

We estimate Grab’s fair value range at $3.4 to $3.9 per share, which implies a 2.3-2.9x forward EV/Sales. Catalysts are Fintech and Ads, margin expansions, and FX headwinds winding down.

Investment risks include a foreign exchange headwind and possible heightened competition that might lead Grab to increase incentives.

🇸🇬 Grab Holdings (GRAB US) – Product-Led Sequential Growth Ahead (Smartkarma) $

Grab Holdings Limited (NASDAQ: GRAB) booked record GMV, revenue, FCF, MTUs, and EBITDA in 2Q2024 and flagged an optimistic outlook for 2H2024, with positive adjusted FCF expected to remain positive for FY2024.

The company continues to focus on its product-led and technology-driven initiatives to drive growth and profitability through mass-market and high-value products such as Grab Unlimited, advance bookings, and group bookings.

Concerns over competition from TikTok look overblown, with Grab already active on social media. Management expects positive sequential growth for the next 2Qs and a stronger growth outlook in FY2025,

🇸🇬 Retail Stock Picks: Finding Your Next Investment Idea (The Smart Investor)

🇸🇬 Singtel’s Underlying Net Profit Continues to Rise: Can the Telco’s Share Price Reclaim its 52-Week High? (The Smart Investor)

The telco is executing its strategic initiatives as it reports a healthy increase in underlying net profit for the first quarter.

Singapore’s largest telco (Singtel (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF)) saw its share price hit its 52-week high of S$3.11 recently but has since retreated to S$2.93.

Investors may be curious to know if the telco can reclaim its 52-week high, so let’s dig deeper into its earnings report to find out.

🇸🇬 SATS Soars Following Strong First Quarter Results (The Smart Investor)

SATS share price soars 10% after posting a strong first quarter earnings result

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF), a leading global air cargo and food services provider, announced yesterday, 20 August 2024, a strong financial performance for the first quarter of fiscal year 2025 (1Q FY2025). The company reported a net profit of S$65 million, a significant improvement from the loss of S$29.9 million recorded in the same period last year.

🇸🇬 AEM Struggles While Nanofilm Improves in 1H 2024 (The Smart Investor)

These two growth stocks released their latest earnings report last week.

Last week, both AEM Holdings (SGX: AWX) and Nanofilm Technologies (SGX: MZH / OTCMKTS: NNFTF) released their financial results for the first half of 2024.

While AEM Holdings saw a year on year decrease in revenue, Nanofilm saw an increase in the first half.

🇸🇬 Genting Singapore’s Share Price is Approaching its 52-Week Low: Is the Stock a Screaming Buy? (The Smart Investor)

Shares of Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) have been on the decline. We will take a closer look at the business to determine if its shares are worth buying.

Genting Singapore cited a slowdown in the last quarter, attributed to the strong Singaporean dollar, which curtailed tourists’ spending power.

This issue was further compounded by the high cost of airfare and weak Chinese tourist numbers.

Following a disappointing earnings report, subsequent events further impacted Genting Singapore’s share price.

Looking ahead, Genting Singapore has guided its investors on several fresh and exciting launches planned.

🇸🇬 Wilmar Boosts Profit, CICT Excels, UOL Group Faces Profit Headwinds (The Smart Investor)

CapitaLand Integrated Commercial Trust (CICT) reported a surge in net property income, while Wilmar International delivered a resilient performance. However, UOL Group Limited faced headwinds due to fair value losses, impacting its overall profit.

Three Singapore Exchange-listed heavyweights, CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF), and Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY), released their financial results for the first half of 2024 on the same day.

The companies showcased a mixed bag of performances, with CICT and Wilmar delivering positive results while UOL faced headwinds.

🇸🇬 CICT’s Share Price is Hitting its 52-Week High: Can the Retail and Commercial REIT Continue its Run? (The Smart Investor)

CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF) stands out as the rare breed of REITs that is seeing its share price break a new year-high

Can CICT continue its impressive run and will investors witness a new high for its unit price?

Continued growth in DPU

Robust operating metrics signal strong demand

AEIs to improve assets

Support from a strong sponsor

Get Smart: Good days ahead

🇮🇳 Narrative and Numbers | Household Durables | FY24 (Smartkarma) $

🇮🇳 Zydus Lifesciences (ZYDUSLIF IN): Q1FY25 PAT Jumps 31%; Increasing Focus on US To Augur Well (Smartkarma) $

Zydus Lifesciences (NSE: ZYDUSLIFE / BOM: 532321) reported stellar performance in Q1FY25, with all key parameters improved sequentially and YoY. The company achieved highest ever operating profit and margin during the quarter.

Sustained growth momentum across all the businesses along with enhanced profitability drove Q1FY25 performance. Execution success of differentiated pipeline in the U.S. and outperformance of India business were particularly noteworthy.

Despite delivering 21% YoY revenue growth in Q1FY25, Zydus reiterated FY25 revenue growth guidance of high teens. The company expects EBITDA margin of 28.5–29.0% for FY25.

🇮🇳 HDFC Bank: Focus On Fundamentals Over The Upcoming $2bn Catalyst (Seeking Alpha) $ 🗃️

🇮🇳 ICICI Bank: Weathering The Cycles With India’s ‘All Weather’ Banking Group (Seeking Alpha) $ 🗃️

🇮🇱 Arbe Robotics: Promising Tech, But Speculative Bet Until OEM Contract Materializes (Seeking Alpha) $ 🗃️

🇿🇦 Capitec gears for strategic market disruption in lucrative business banking segment (IOL)

Capitec Bank (JSE: CPI / OTCMKTS: CKHGY / CKHGF), with a market cap of R336 billion, has plans to further disrupt the business banking landscape with new low-cost packing of its point of sale card machine sales.

The bank is targeting growth of its business banking division, predominantly via the small, medium enterprise sector (SME).

Capitec, which already offers card machines and has 22 million clients, 11.2 million whom are digital, is upping the ante by launching a through-the-line campaign from September 1 by launching three card machine packages with no hidden costs.

🇿🇦 Capitec and SA Inc. ride the wave of GNU investor optimism (IOL)

South Africa has seen a surge of investor confidence and Capitec Bank (JSE: CPI / OTCMKTS: CKHGY / CKHGF) chief executive Gerrie Fourie says things are improving for the better.

Talking at a media briefing last week, Fourie said: “What has happened in South Africa in the last six months has been overall very positive. The coalition government has been very impactful. We’ve seen changes taking place.

🇿🇦 Absa CEO Arrie Rautenbach steps down as the group’s valuation continues to lag that of its peers (IOL)

Absa (JSE: ABG / OTCMKTS: AGRPY) CEO Arrie Rautenbech is stepping down after only two-and-a-half years as the lender reports a 5% slide in first half headline earnings to R10.2 billion, despite profit growth in the South African operations and prospects of a better second half overall.

In a surprise announcement with the interim results yesterday, South Africa’s fourth largest lender said Rautenbach had agreed to take early retirement. This appeared to be favourably received by the market, as the share price had advanced by 4.99% to R165.27 by late yesterday afternoon, which is a sharp increase for one of South Africa’s big banks.

🇿🇦 Adcock Ingram’s share price advances after double-digit earnings growth boosts shareholder returns (IOL)

Adcock Ingram Holdings Limited (JSE: AIP)’ shareholders will benefit from 10% growth in dividends and the repurchase of 6 million shares for the year to June 30, after stronger sales of the group’s winter pharmaceuticals helped generate double-digit earnings growth and strong cash generation.

🇿🇦 Gold Fields’ Half-Year Earnings: Not As Bad As Some Might Have Feared (Seeking Alpha) $ 🗃️

🇿🇦 Sibanye Stillwater: Recovery Hope Dies Last (Seeking Alpha) $ 🗃️ & Sibanye: Refinancing Likely Strengthens Deep Value Argument (Seeking Alpha) $ 🗃️

🇭🇺 Why Did Wizz Air Stock Tumble After Earnings (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Riding A Supersonic Growth Wave (Seeking Alpha) $ 🗃️

🌎 The Bottom Fishing Club: Unloved Growth At DLocal Provides Huge Opportunity (Seeking Alpha) $ 🗃️

🌎 Corporacion America Airports: Unique Assets With Potential – And Risk (Seeking Alpha) $ 🗃️

🇦🇷 🇱🇺 Adecoagro’s Q2 2024 Still Challenged By Falling Prices, The Stock Is Not An Opportunity (Seeking Alpha) $ 🗃️

🇦🇷 Central Puerto: Powering Argentina Sustainably (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Too Many CEO Transitions (Technical Analysis) (Seeking Alpha) $ 🗃️

🇧🇷 Itaú Is A Safe Bet For Reliable Dividends In Brazil (Seeking Alpha) $ 🗃️

🇧🇷 Weak Ethanol And Sugar Prices And Core Operating Structure Impacted Cosan (Seeking Alpha) $ 🗃️

🇧🇷 Embraer Stock Surges 84%: Updated Buy Rating And New Price Target (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings Expands AI Capabilities To Revolutionize Banking Services (Seeking Alpha) $ 🗃️

🇧🇷 Sigma Lithium: Things Are Slowly Improving (Seeking Alpha) $ 🗃️

🇧🇷 After Strong Q2, PagSeguro Stock Still Looks Cheap (Seeking Alpha) $ 🗃️

🇧🇷 Improved Execution Is Letting BRF SA Fully Benefit From A Strong Poultry Cycle (Seeking Alpha) $ 🗃️

🇰🇾 Consolidated Water: Q2 2024 Earnings Make A Splash, But Miss The Mark (Seeking Alpha) $ 🗃️

🇨🇱 Sociedad Química y Minera de Chile: Falling Knife Still Worth Catching (Seeking Alpha) $ 🗃️

🇲🇽 Walmart Mexico accelerates digital overhaul of retail giant under new boss (FT) $ 🗃️

Country’s largest supermarket chain facing increased ecommerce competition

The new boss of Wal-Mart de Mexico SAB de CV (BMV: WALMEX) is planning an ambitious ecommerce push to try to double its sales in less than a decade as competitors nip at the heels of one of the biggest retail businesses in Latin America.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China mutual funds reel from crackdown (FT) $ 🗃️

🇨🇳 China’s Stricter Rules, Sluggish Market Lead to Surge in Delisting (Caixin) $

China’s tightened delisting rules have led to a rapid increase in the number of companies booted from stock exchanges while leaving many others on the brink, as investors have dumped lower-priced stocks amid a sluggish market.

In the first seven months of this year, more than 40 companies traded on the Shanghai or Shenzhen stock exchanges were either delisted or slated for delisting, nearly as many as in all of 2023, according to Caixin calculations based on available records from the bourses.

🇨🇳 China’s Languishing IPO Market Strains Startup-Investor Relations (Caixin) $

Tensions are growing between China’s startups and investors as the latter find it increasingly difficult to exit their investments through a sluggish IPO market, instead resorting to pre-listing agreements with refund clauses, which in many cases lead to litigation.

Private equity (PE) and venture capital (VC) funds will have trouble exiting around 130,000 investments in China, involving about 14,000 companies, Shanghai-based law firm Lifeng Partners estimated in a recent report.

🇨🇳 Top private equity firms put brakes on China dealmaking (FT) $ 🗃️

🇨🇳 PwC braced for 6-month ban in China over Evergrande audit (FT) $ 🗃️

🇨🇳 In Depth: Domestic Carriers Add Global Routes as Foreign Rivals Quit China Amid Sluggish Demand, Russia Ban (Caixin) $

Since China dropped the Covid-era restrictions that slowed international flights to a trickle, the experience of domestic and foreign airlines has diverged sharply.

Many foreign carriers are scaling back their operations in China and in some cases completely withdrawing from the domestic market, largely because the need to avoid Russian airspace has sent their costs spiraling and made them uncompetitive against Chinese rivals who can still fly over the country’s northern neighbor.

🇰🇷 FSS Provides Guidelines for Internal Controls and Stock Balance Management System for Short Selling (Douglas Research Insights) $

On 20 August, the FSS provided guidelines for the internal control and stock balance management system for institutional investors that plan to engage in short selling in Korea.

The time frame to complete the internal control and stock balance management system is to complete them by end of this year.

🇸🇬 Complete guide to Singapore REITs (Asian Century Stocks)

🌏 Nepo baby leaders are stifling south-east Asia (FT) $ 🗃️

🇵🇭 Philippines to slash tax to attract investors (The Asset) 🗃️

Ralph Recto, the recently appointed secretary of finance, wants to boost investors’ interest in the country’s capital market

The Philippines is set to reduce the tax on stock transactions by more than 83% from 0.6% to 0.1%, aligning it with the rest of the capital markets in the region.

🇹🇭 Establishment ‘lawfare’ is holding back Thailand’s economy (FT) $ 🗃️

The return of the Shinawatra dynasty is, sadly, no triumph for democracy

But while his daughter’s accession means that Thaksin — who was deposed by a military coup in 2006 and lived in exile until last year — has his hand on the tiller once again, the real lesson of this sorry saga is the ungovernability of Thailand under its current constitutional settlement, which is preventing urgently needed action to boost the economy.

🇮🇳 India’s stock market is hot, don’t get burned (The Asset) 🗃️

Corporate leaders and analysts ring alarm bells as share prices enter overvalued territory

As early as February, Kotak Mahindra Bank (NSE: KOTAKBANK / BOM: 500247)’s brokerage arm, Kotak Institutional Equities, warned that the market was overvalued by 20%. The feared correction didn’t transpire, however, and the country held a successful general election, which further lifted the buying mood.

🇦🇷 Javier Milei suffers defeat on pension spending in Argentina’s senate (FT) $ 🗃️

🌐 The myth of deglobalisation hides the real shifts (FT) $ 🗃️

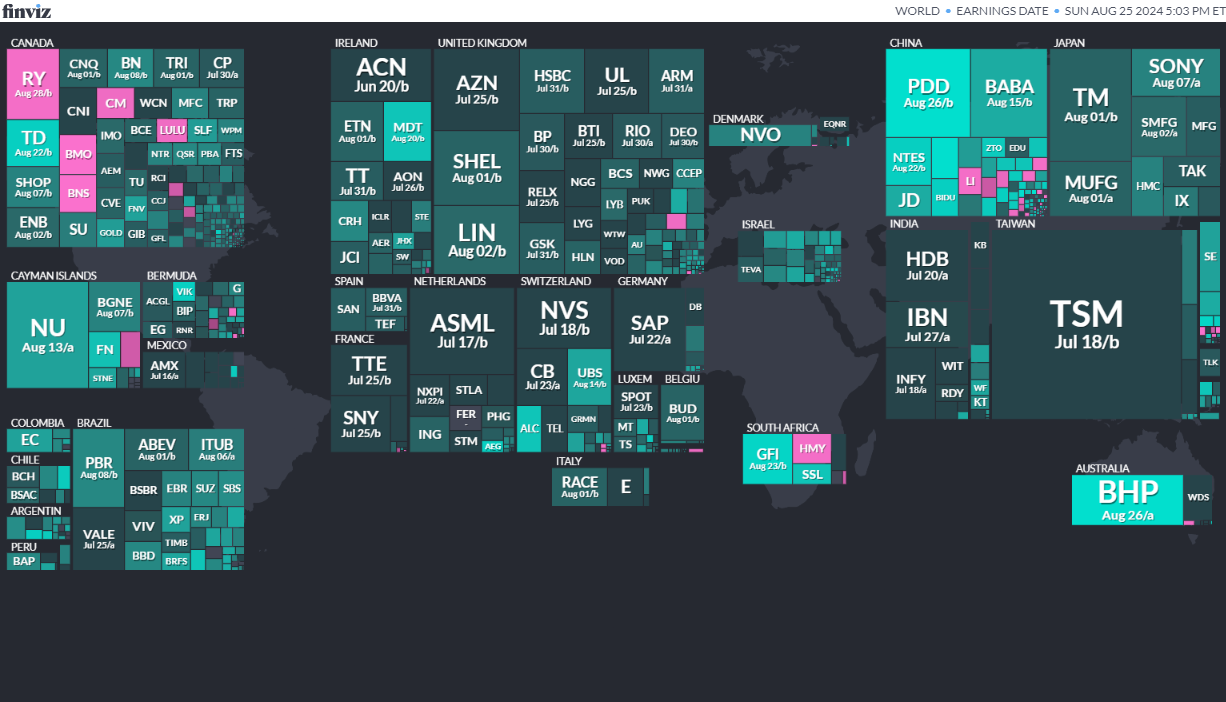

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

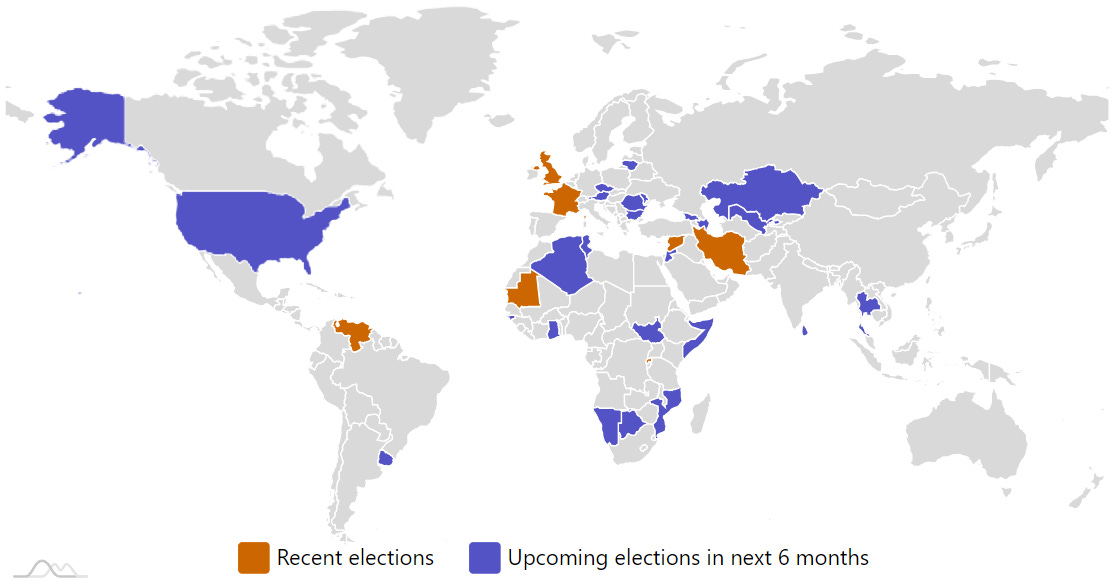

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 21, 2024