Emerging Market Links + The Week Ahead (August 5, 2024)

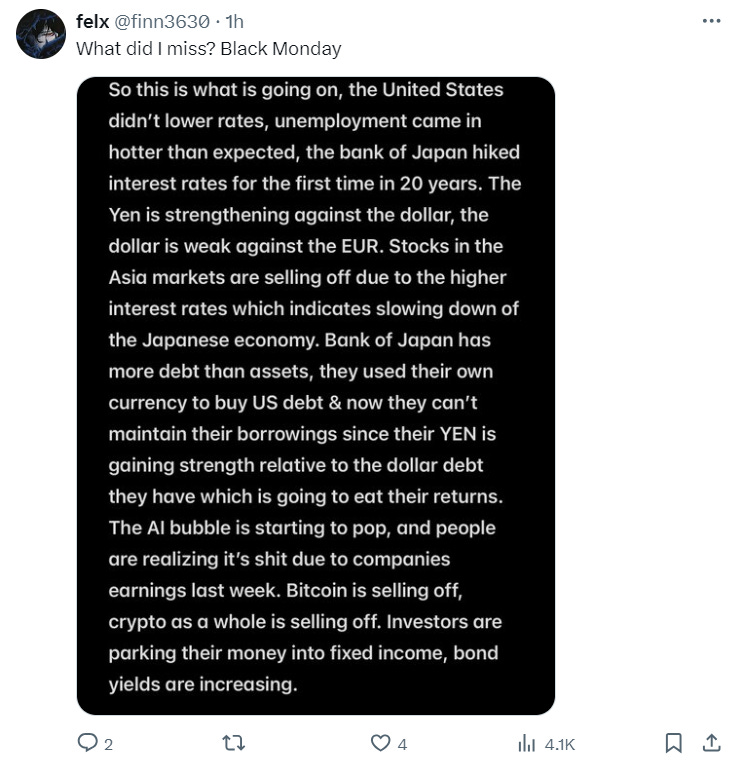

Black Monday was trending this weekend on Twitter (along with WWIII) as I compiled this post – here is a good summary of the mess we are facing:

And finally, a tweet plus meme that sums up the current situation:

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Alibaba | The Obvious Multi-Bagger No One Wants to Touch (Value Investing Blueprint)

Full analysis of Alibaba (NYSE: BABA) as a business and investment opportunity.

Imagine finding a gold bar just sitting on the sidewalk, ignored by everyone passing by. Alibaba could be just that. They generate significant cash, promise future growth, and are undervalued, yet remain largely unnoticed and unloved. I’ll dive into Alibaba’s operations, address the concerns, explain why they’re overstated, and share my 5-year outlook for the company.

🇨🇳 Pinduoduo Emerges Stronger as Rivals like Alibaba and Douyin Struggle with Low Prices (Investing in China)

Pinduoduo Dominates with Low Prices, Forcing Rivals like Alibaba (NYSE: BABA), Douyin (ByteDance Ltd.), Tmall, and Taobao to Rethink Strategies.

In recent months, the landscape of Chinese e-commerce has undergone significant changes, with PDD Holdings (NASDAQ: PDD) or Pinduoduo PDD 0.00%↑ solidifying its position as a dominant force in the market. Pinduoduo, a latecomer to the scene, has captured substantial market share from established giants like Alibaba and JD.com (NASDAQ: JD), while newer players like Douyin and Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) have also entered the field. All these platforms feared Pinduoduo because of its ability to offer the lowest prices, prompting them to adopt similar low-price strategies. However, they are now finding it increasingly challenging to sustain this approach and are shifting back to prioritizing GMV.

🇨🇳 China’s ‘basic self-sufficiency’ in chip-making tools could come this summer, veteran says (SCMP)

🇨🇳 Navigating Restrictions: How China’s Semiconductor Industry and Alibaba Are Innovating Amidst Challenges (Investing in China)

China’s semiconductor industry is reportedly on the verge of achieving basic self-sufficiency, according to the South China Morning Post. This milestone comes amidst ongoing tensions with the United States, which has imposed restrictions on China’s access to advanced semiconductor technology. These developments have spurred China to accelerate its efforts to innovate and become self-reliant in this critical sector.

Yesterday, there was an interesting article in the SCMP (China’s ‘basic self-sufficiency’ in chip-making tools could come this summer, veteran says) about China’s semiconductor industry that got me thinking about the whole situation.

🇨🇳 In Depth: ‘Exorbitant’ Fines Land Temu in Hot Water With Chinese Merchants (Caixin) $ & Hundreds of China merchants join protest against Temu fines (IOL)

Merchants are protesting against Temu‘s high fines for alleged product defects without evidence, with combined fines totaling 142 million yuan.

Temu, owned by Pinduoduo (PDD Holdings) (NASDAQ: PDD), uses an “after-sales deposit” system to cover fines, causing significant financial strain on sellers.

Despite rapid growth and popularity in the U.S. market, Temu faces legal and financial challenges from merchants over its penalty practices and lack of transparency.

🇨🇳 WuXi AppTec (2359.HK/603259.CH) 24H1- Backlog Looks Good but It May Not Bring a Performance Reversal (Smartkarma) $

The message WuXi AppTec Co (HKG: 2359 / SHA: 603259 / OTCMKTS: WUXAY) hopes to convey in 24H1 report is that the Company isn’t losing orders/customers due to BIOSECURE Act and from 2025 it will return to high growth.

TIDES business growth is below expectations. Whether WuXi AppTec’s performance can be reversed is no longer solely depends on fundamentals/industry cycles, but on whether geopolitical risks can be fully resolved.

Regardless of the outcome of 2024 presidential election, securing US supply chain is a already bipartisan consensus. If any Bill does pass in the future, valuation will plummet again.

🇨🇳 JD.com’s founder ‘still running’ ecommerce group from overseas (FT) $ 🗃️

🇨🇳 China’s Kuaishou Looks to Cash In on AI-Powered Video Generation (Caixin) $

Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) has begun charging users for its AI-powered video generator Kling, with subscription fees ranging from 66 to 7,992 yuan.

Kling, launched in June, allows text-to-video generation and has seen major upgrades since; over 1 million people have applied to test it.

Competing Chinese companies are also developing similar AI technologies, spurred by the success of OpenAI’s Sora.

🇨🇳 East Buy faces rebuilding after breakup with star livestreamer (Bamboo Works)

The e-commerce company is trying to diversify its livestreaming and product strategies after a drawn-out dispute with star host Dong Yuhui

East Buy Holding Ltd (HKG: 1797 / OTCMKTS: KLTHF)’s shares fell to a two-year low after the company parted ways with Dong Yuhui, its star livestreaming host who had frequent open conflicts with management

Dong’s departure marks the e-commerce company’s strategic shift away from overreliance on individual livestreaming hosts

🇨🇳 Sunny Optical’s profit surprise overshadowed by competition concerns (Bamboo Works)

An upside profit alert from the lens supplier to Apple failed to excite investors, who may fear a growing challenge from a Taiwanese rival

Sunny Optical (HKG: 2382 / LON: 0Z4I / FRA: SXC / OTCMKTS: SOTGY / SNPTF) said it expects to report a profit of between 1.05 billion yuan and 1.1 billion yuan for the first half of the year, up 1.5 times from 2022

Shares of the lens supplier to Apple took a hit after the forecast, possibly on rumors that Taiwanese rival Largan Precision (TPE: 3008) has signed a long-term supply agreement with the iPhone maker

🇨🇳 Chinese firm featured in ‘American Factory’ film denies being target of U.S. probe (Caixin) $

FuYao Glass Industry Group (SHA: 600660 / HKG: 3606 / FRA: 4FG) is cooperating with a U.S. government investigation into a third-party labor services firm, following a search at its Ohio subsidiary.

The investigation focuses on financial crimes, labor exploitation, and potential human smuggling, causing Fuyao’s shares to drop sharply.

The company gained fame from the Obama-backed documentary “American Factory“ and heavily invests in U.S. operations, contributing significantly to its revenue.

🇨🇳 Solar glut rains on Xinyi Energy’s profit parade (Bamboo Works)

A rapid buildup of solar power in China is eroding the solar farm operator’s profitability

Xinyi Energy Holdings (HKG: 3868) said its net profit in the first half of the year fell by 25% to 35%

The solar farm operator is suffering in a climate of oversupply after a rapid buildup of solar farms in China

🇨🇳 Deep Dive: New Oriental Education (EDU) (Deep Fundamental Research)

New Oriental Education (NYSE: EDU)

20% revenue Cagr and 30%+ earnings Cagr over the next 5 years, trading at 27x PE

High competitive moat in the emerging non-academic tutoring industry; c.20% revenue Cagr and 30%+ earnings Cagr (ex-East Buy) over the next 5 years; successful turnaround from significant industry crackdown in 2021

Current price: US$61.75 (2024.8.1); Target price: US$153

🇨🇳 JF SmartInvest’s new product: Road to riches or desperate move to reignite growth? (Bamboo Works)

The online financial educator is seeking to jumpstart its cooling growth with the launch of a stock-learning device equipped with its own content

JF SmartInvest Holdings (HKG: 9636) has rolled out Enjoy-Stock Pad, a device that gives users easy access to its content and tools

The financial educator took on its current name just a day before the new product rollout, suggesting it may be trying to create a new business identity

🇨🇳 China’s Giant Invests $690 Million in Dry Docks as Tide Turns For Shipbuilding (Caixin) $

China Shipbuilding Industry Co Ltd (SHA: 601989) is investing over 5 billion yuan ($690 million) to acquire shipyard assets to boost its capacity.

The acquisitions include a 4.04 billion-yuan purchase in Shanghai and a 1.04 billion-yuan shipyard acquisition in Wuhan.

Growing global demand has driven investment, with Chinese shipbuilders receiving 54.22 million deadweight tons of orders in H1 2024, up 43.9% from the previous year.

🇨🇳 (Luckin Coffee (LKNCY US, SELL, TP US$16.5) TP Change): Milkteaization Diminishes Differentiation (Smartkarma) $

Luckin (OTCMKTS: LKNCY)’s SSSG declined 20.9%YoY in the peak season, indicating diseconomies of scale for Luckin and a deteriorated competitive environment. We do not expect a quick turnaround in the near term.

We think Luckin has limited capability to further raise its prices in 3Q24, and expect its NPM to be 11.9%/7.1% in 3Q24/4Q24 as the new norm.

We keep SELL rating and lower TP to US$16.5/ADS. The stock trading at 20x/16x PE in 2024/2025, and we expect the NI to increase 15%CAGR in the next 2 years.

🇨🇳 Luckin brews up tumbling margins, falling profits as competition overheats (Bamboo Works)

China’s leading coffee chain said its second-quarter revenue rose 35.5%, even as it opened new stores at a far faster pace to pass the 20,000-store milestone

Luckin (OTCMKTS: LKNCY)’s revenue rose 35.5% in the second quarter as it nearly doubled its store count, but plunging same-store sales caused its margins to drop sharply

The company is facing a double challenge from growing consumer caution as China’s economy slows and competition intensifies from upstart rival Cotti

🇨🇳 Luckin Coffee opens its 20,000th store (Momentum Works)

🇨🇳 Bumpy ride for Fosun Tourism as bargain holidays on the rise (Bamboo Works)

The Chinese owner of the Club Med chain and other travel brands is facing tighter tourism spending and could become a casualty of its parent’s debt problems

Fosun Tourism Group (HKG: 1992 / OTCMKTS: FSNGF) issued an earnings alert projecting revenues in the first half of the year would grow by 8% or more, generating at least 300 million yuan in profit

The company’s share price has fallen nearly 38% so far this year as reports of possible asset sales have shaken investor confidence

🇨🇳 Shanghai Pharmaceuticals (2607.HK/601607.CH) – Profit Will Resume High Growth in 2024 (Smartkarma) $

Due to the low base in 2023, net profit in 2024 would show restorative growth, with net profit attributable to owners of the company reaching RMB5+ billion, up 33% YoY.

Different from Sinopharm/CRP whose assets are scattered in different listed companies, pharmaceutical assets/resources of Shanghai Pharmaceuticals Holding Co (HKG: 2607 / SHA: 601607 / FRA: S1R / OTCMKTS: SHPMY / SHPMF) are integrated within the Company, so the intrinsic value of this model is greater.

SH Pharma is undervalued. Interim dividend will be added in 2024.Future dividend ratio would remain 30+%.SH Pharma as a SOE takes the lead in responding to policies to increase dividends.

🇨🇳 Will Genscript cash out of Legend Biotech in the face of fat profit temptation? (Bamboo Works)

A potential sale of Legend Biotech (NASDAQ: LEGN) may carry a 30% to 50% premium, which could generate up to 55.8 billion yuan for Genscript Biotech Corporation (HKG: 1548 / FRA: G51 / OTCMKTS: GNNSF) based on its 48% stake in the company

Analysts expect annual sales of Carvykti, Legend Biotech’s core cancer therapy, to peak at $7.3 billion

With about $2 billion in cash reserves, Genscript isn’t under pressure to sell its 48% holding in Legend

🇭🇰 AIA Group: Solid Performance, But You Can Get It In Europe Instead (Seeking Alpha) $

The temperature around Chinese geopolitical concerns is coming down, and the Chinese equity markets also seem to be bottoming out.

AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF) performed strongly in its previous quarter, although investment results shouldn’t see that much incremental benefit. Asset markets are still under pressure in China.

The structural economic issues make financials a little less attractive due to emerging rate pressure, and AIA is more expensive than Chinese and similarly growing European peers.

We’d rather stay in Europe for insurance.

🇲🇴 🇹🇭 Four of six Macau ops could pursue Thai market: CLSA (GGRAsia)

Four out of Macau’s six casino concessionaires “have expressed interest in investing in Thailand” against the backdrop of that country’s mulling of casino legalisation, says a Monday report from brokerage CLSA Ltd.

The institution thinks the annual gross gaming revenue (GGR) value of a Thai casino industry – mostly driven by foreign players – could be US$8.5 billion, up to as much as US$30.8 billion, though CLSA says its “base case is US$15.1 billion”.

“Among Macau gaming concessionaires, we believe Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF), Las Vegas Sands (NYSE: LVS), MGM Resorts International (NYSE: MGM), and Wynn Resorts Ltd (NASDAQ: WYNN) have expressed interest in investing in Thailand,” stated the report, referring to the parent groups of Macau licensees.

“In contrast, Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) and SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) are less likely to show interest given their balance sheet constraints,” added Hong Kong-based CLSA analysts Jeffrey Kiang and Leo Pan; along with their colleague Naphat Chantaraserekul, head of Thailand research.

🇲🇴 🇹🇭 Any Thailand IR bid would be via MGM China: Hornbuckle (GGRAsia)

Gaming developer and operator MGM Resorts International (NYSE: MGM says it would be interested in exploring investment opportunities in Thailand, if that Southeast Asia nation legalises casino gambling. If realised, such investment would be done via Macau-based operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY), said Bill Hornbuckle, chief executive and president of MGM Resorts.

Speaking on MGM Resorts’ second-quarter earnings call on Wednesday, Mr Hornbuckle (pictured in a file photo) said he and Pansy Ho Chiu King, chairperson and an executive director of MGM China, would visit Thailand this month, “looking at that opportunity”.

🇲🇴 🇹🇭 Galaxy Ent keeps options like Thailand in mind: firm (GGRAsia)

Macau casino operator Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF), Las Vegas Sands (NYSE: LVS) has told GGRAsia it is “focused” on its development in that city, but wanted to “keep its options open”, acknowledging that Thailand is “one of the most popular destinations” for travellers.

The comment was from Buddy Lam Chi Seng, the casino group’s director of corporate affairs. It was in response to GGRAsia’s enquiry after a Monday report from brokerage CLSA Ltd suggested Galaxy Entertainment was among four of Macau’s six operator brands likely to be interested in – and have the financial capacity for – investment in casino business in Thailand, if that Southeast Asia nation legalises such activity.

🇹🇼 Brilliant Q2 results and a 12% sell-off – TSMC is still a bargain! (Rijnberk InvestInsights)

After some comments from Trump sent shares down 12% in a week, despite great Q2 results, it is about time we revisit TSMC.

🇰🇷 KT&G: A Strong Candidate for Outperformance Amid Increased Signs of Market Fears (Douglas Research Insights) $

In this insight, we provide an update of KT&G Corp (KRX: 033780) which is a strong candidate for outperformance amid increased signs of market fears.

We continue to believe that there is an increasing probability of cigarette price hikes in Korea in 2H24. Last time that KT&G hiked its cigarette prices was in January 2015.

The company’s shareholder return policy is to provide cash dividends of 1.8 trillion won and share buyback/cancellations worth 1 trillion won from 2024 to 2026.

🇰🇷 Asian Dividend Gems: KT Corp (Asian Dividend Stocks) $

We have a Positive view of (Korea Telecom) KT Corp (NYSE: KT / KRX: 030200 / FRA: KTC) due to three main reasons.

First, KT has started to implement aggressive capital return policy (returning 50% of net income through dividends and share buybacks/cancellations). Two other reasons include Corporate Value Up and higher Smartscore.

KT Corp has been the best performing stock among the three major Korean telcos in the past one year. KT Corp’s shares are up 27.9% in the past one year.

🇰🇷 Potential Big Changes at the Korean Chaebols – The Age Factor of Chairman/Honorary Chairman (Douglas Research Insights) $

One of the important factors of big changes at the Korean chaebols is the age factor of the chairman/honorary chairman of each of these conglomerates.

In this insight, we provide the shareholding ownerships and ages of the top 10 Korean conglomerates where age could become a major factor in impacting big changes that could occur.

Among the 10 conglomerates listed below, Hyundai Motor Group, Celltrion Group, and SK Group have shown greater willingness to improve their shareholder return policies.

🇰🇷 Alpha Generating Opportunities from the Corporate Value Up Disclosures on the KIND System (Douglas Research Insights) $

One of the key takeaways of the Corporate Value Up disclosures on the KIND system is that it could potentially lead to alpha generating investing opportunities.

Since the last week of May, there have been 7 companies that provided specific Corporate Value up programs; (4 major financials) have outperformed KOSPI.

Companies such as KB Financial Group (NYSE: KB) and Shinhan Financial Group (KRX: 055550) that provide more meaningful Corporate Value Up action plans are likely to have greater impact on their share prices.

These four companies that outperformed KOSPI included the major financials including KB Financial (105560 KS), Woori Financial Group (NYSE: WF), Shinhan Financial (055550 KS), and Meritz Financial Group (KRX: 138040).

🇰🇷 Shinhan Financial: Shareholder Return Ratio of 50% to Boost Corporate Value (Douglas Research Insights) $

Shinhan Financial Group (KRX: 055550) announced that it plans to increase shareholder return ratio to 50%, improve ROE to 10%, and reduce outstanding shares by 50 million+ by 2027.

Shinhan Financial Group’s new, outstanding shareholder return policy has been one of the most impressive since the roll-out of the Corporate Value Up program in Korea a few weeks ago.

The improved corporate governance policy is likely to lead to Shinhan Financial Group outperforming other financial stocks in Korea and KOSPI overall in the next 6-12 months.

🇰🇷 Block Deal Sale Of 2.3% Stake in Woori Financial and Highlights of Its Corporate Value Up Program (Douglas Research Insights) $

On 30 July, it was reported that IMM Private Equity (PE) sold a 2.3% stake (16.78 million shares) of Woori Financial Group (NYSE: WF), which was worth 264 billion won.

Block deal sale price was 15,737 won (0.4% higher than current price). Today’s block deal sale represents a second block deal sale of Woori Financial by IMM PE in 2024.

Under the mid-to-long term Value Up program, Woori Financial Group aims to achieve a sustainable ROE of 10% and total shareholder returns of 50%.

🇰🇷 End of Mandatory Lock-Up Periods for 41 Companies in Korea in August 2024 (Douglas Research Insights) $

We discuss the end of the mandatory lock-up periods for 41 stocks in Korea in August 2024, among which 2 are in KOSPI and 39 are in KOSDAQ.

These 41 stocks on average could be subject to further selling pressures in August and could underperform relative to the market.

The top three market cap stocks including those of which at least 1% of outstanding shares could be sold in August include APR Co Ltd (KRX: 278470), Fadu (KOSDAQ: 440110), and Kuk Il Paper MFG Co Ltd (KOSDAQ: 078130).

🇰🇷 TMON and WeMakePrice File for Court Receivership – Impact on the Korean E-Commerce and PG Sectors (Douglas Research Insights) $

One of the biggest stories in the Korean e-commerce sector this week has been TMON and WeMakePrice filing for court receivership due to liquidity crisis.

Singapore’s Qoo10 is the controlling shareholder of TMON and WeMakePrice. Young-Bae Ku is the largest shareholder of Qoo10 with a 42.77% stake, followed by KKR with a 25.65% stake.

Competitors such as E-Mart (KRX: 139480) and Coupang, Inc. (NYSE: CPNG) are most to benefit. PG companies such as KG Inicis and NHP KCP are negatively impacted.

🇸🇬 Karooooo: A Bet On Emerging Markets And Data (Seeking Alpha) $

Karooooo (NASDAQ: KARO) is a leading provider of an on-the-ground operations cloud, with Cartrack as its most important segment, contributing over 80% of revenue.

The company flies under the radar due to its size and foreign operations, presenting a unique opportunity.

Karooooo generates close to 80% of its revenue in South Africa, with Southeast Asia as its next big market.

The valuation is by no means expensive, considering the company’s quality and growth prospects.

🇸🇬 Is Sea Ltd. An Attractive Stock At This Price? (Multibagger Nuggets)

🇮🇩 Matahari Department Store (LPPF IJ) – Private Label Revamp (Smartkarma) $

Matahari Department Store (IDX: LPPF) reported a slightly weaker 1H2024 due to a slower performance over Lebaran and afterwards but remains confident in its ongoing initiatives to drive future growth.

The company will not open any new stores in the 2H2024 as it focuses on reservations and driving its private labels, including Suko and Nevada, and consignment vendors.

Matahari continues to drive its omnichannel sales and build on its membership penetration to better target sales. Valuations remain attractive on 4.2x FY2025E PER with a 13% dividend yield.

🇻🇳 VinFast Shares Are Little More Than Lottery Tickets; Sell Them Before They Fall To Zero (Seeking Alpha) $

Many electric vehicle startups struggle to succeed in the automotive industry, facing financial risks and challenges in meeting technical and performance standards.

VinFast Auto Ltd. (NASDAQ: VFS), a Vietnamese electric vehicle startup, went public with high hopes but faced a sharp decline in stock value and delivery forecasts, raising concerns about its future.

Despite efforts to crack into the car business with battery-electric vehicles, investing in BEV startups like VinFast may pose financial risks due to weak revenue, large losses, and accounting issues.

Poor reviews of VinFast vehicles suggest the company falls short engineering, design and technical and will fail to attract consumers.

🇮🇳 Govt-funded healthcare can’t work in countries with large populations: Narayana Health founder Dr Shetty (Economic Times)

Health insurance is not very popular in India due to conflict of interests. There is a trust deficit between hospitals, patients and insurance companies. Insurance data says not even 5% of the insured are diabetic? That is impossible because insurance companies rely on people’s declaration.

With its flagship Aditi, Narayana Hrudayalaya (NSE: NH / BOM: 539551) is entering the health insurance business, becoming the first hospital chain to do so. NH founder-chairman Dr Devi Prasad Shetty shares his insights on insurance and healthcare in a chat with ET’s KR Balasubramanyam.

🇮🇳 India must use private defence suppliers more, says Larsen & Toubro (FT) $ 🗃️

Larsen & Toubro (L&T) (NSE: LT / BOM: 500510)

🇮🇳 MakeMyTrip: Dominant OTA Player In India (Seeking Alpha) $

Buy rating for Makemytrip (NASDAQ: MMYT) due to its robust long-term growth runway supported by a strong domestic and international travel industry.

MMYT is the largest player in India’s online travel agency market, with strong revenue growth and margin expansion potential.

The expected target price for MMYT is $111 based on a 9.2x forward revenue multiple.

🇮🇱 Tower Semiconductor: Enhanced Capacity and Technological Advancements in Silicon Photonics and RF-SOI Are Major Growth Drivers! – Financial Forecasts (Smartkarma) $

Tower Semiconductor (NASDAQ: TSEM) posted a solid financial performance for the second quarter of 2024, showcasing revenue of $351 million and a net profit of about $53 million, translating to a net margin of approximately 15%.

Notably, the company achieved sequential quarterly revenue growth as previously targeted and forecasts continued growth with a third-quarter revenue guidance of $370 million, plus or minus 5%.

The commitment to driving innovation and expanding market leadership was evident throughout the period.

🇮🇱 First International Bank of Israel Ltd (Herald of the Hudson)

First International Bank of Israel (FIBI) (TLV: FIBI / OTCMKTS: FBKIF) is the smallest of the five large banks in Israel. Together they create an oligopoly with oligopolistic economics. FIBI is the highest quality of the five banks as evidenced by its economic castle, moat, and management.

For decades, the banking oligopoly in Israel has been fat and happy. Within the last decade, the entire industry has undergone an efficiency initiative. This is primarily due to government initiatives to make the banking industry in Israel highly competitive. FIBI has the largest moats because of its niche brands and balance sheet. Furthermore, FIBI has the best ROE because of the managements focus on quality instead of size. This is likely to continue because of a long time, long term, controlling shareholders.

🇿🇦 Woolworths forecasts lower earnings as weak consumer spending in Australia and SA bites (IOL)

Woolworths Holdings (JSE: WHL) said headline earnings a share from continuing operations were expected to fall by between -14% and -19% for the year to June 30 due to investments made and the effects of the weak trading environment on its apparel businesses.

“Whilst the group has maintained its stringent focus on preserving gross profit margin and containing costs, we equally continue to invest behind our key strategic initiatives. This, coupled with the impact of a weaker trading environment, has resulted in negative operational leverage in both apparel businesses,” the group said in a trading update yesterday.

🇿🇦 Shoprite grocery chain OK Franchise reports strong sales growth in weak market conditions (IOL)

Shoprite Group (JSE: SHP)’ OK Franchise business division reported strong sales growth of 23.8% in the 52 weeks to June 30 at a time when many grocery retailers are reporting only single digit sales growth.

A Shoprite operational update said this growth had been boosted by the opening of 73 OK Franchise stores in the year, compared with 22 opened in 2023 – the OK Franchise division ended the year with 608 stores.

🇿🇦 SA miners lead global gold production ramp-up amid record prices (IOL)

Production of gold from global bullion mines is projected to soar even higher, boosted by surging output from Africa – including South Africa – against the backdrop of higher prices, although producers are being held back from full profitability potential by rising costs and weakening demand.

South African gold producers – such as Harmony Gold Mining Company Limited (NYSE: HMY), Pan African Resources plc (LON: PAF / JSE: PAN / FRA: RTZ / OTCMKTS: PAFRF / PAFRY), DRD Gold (NYSE: DRD) and AngloGold Ashanti (NYSE: AU) among others – fed into the global gold supply for this year’s second quarter, which recorded a 4% rise to 1 258 tons compared to the same period last year.

🇿🇦 Can Nedbank dodge the consequences of alleged state capture? (IOL)

This is the million dollar question most South Africans will be asking themselves as the bank gears up for a legal fight with the Special Investigating Unit (SIU) and Transnet over the alleged R2.7 billion Gupta spoils in an interest rate swops deal dating back to the state capture-era in 2015/16.

Nedbank (JSE: NED / FRA: NCO / OTCMKTS: NDBKY / OTCMKTS: NDBKF) is front and square of public inspection for its alleged role in state capture as outlined in the Zondo Commission of Inquiry from which it appears it is still reaping billions of rand to date.

🇿🇦 Dismissal of MTN’s application the latest in a series of reputation damaging cases (IOL)

The ruling by the Special Tribunal that dismissed MTN’s application for exception related to the unsolicited supply of 10 000 cellphones during the Covid-19 era is the latest in a series of reputation damaging cases for the South African mobile operator.

MTN Group (JSE: MTN) has previously been embroiled in tax fraud, corruption and other reputation damaging cases at home and abroad over the past few years. In October last year a Lagos tax appeal tribunal ordered MTN to pay $72.5 million (R1.3 billion currently) to the Nigerian Federal Inland Revenue Services for tax defaults.

🇿🇦 Why DRDGOLD $DRD is the blueprint for how Sibanye Stillwater $SBSW will handle its 60 million pounds of uranium reserves. (Value Degen’s Substack)

Ferengi Law of Acquisition 287: Always get somebody else to do the lifting.

DRD Gold (NYSE: DRD) is the 50% owned subsidiary of Sibanye Stillwater Ltd (NYSE: SBSW), and it processes the tailings of various South African gold mines in order to extract their proven reserves of 5.79 million ounces of gold. A tailings dump is the pile of crushed rock left behind after a mine has been operating for decades, and they can be enormous.

If SBSW can’t find a junior miner to swap reserves for equity, they might be able to convince Gold Fields (NYSE: GFI), who already processes uranium in South Africa, to create a joint venture subsidiary with SBSW contributing reserves for equity. Alternatively, SBSW could task DRD to try and develop a uranium competency, and pay SBSW royalties for the uranium, but this path is likely less desirable as SBSW would be less interested in a distant revenue stream than an initial equity swap.

🇵🇱 Stalprodukt SA – Weak Interest in the Tender Offer (Hidden Zlotys)

(Processed steel products) Stalprodukt SA (WSE: STP / FRA: 0WB) published a tender offer on July 1st for 415k shares at 240 PLN/share – totaling a maximum of 100 mpln and 10% of the outstanding shares. This represented a premium of just under 10%. This equated to a valuation of approximately P/TB 0.34, EV/EBITDA 2.9, and EV/S 0.29 – in other words, a very low valuation. The purpose of the buyback was to redeem and reduce the company’s share capital.

🌎 MercadoLibre: Doubling Profits While Accelerating Growth (The Wolf of Harcourt Street)

MercadoLibre (NASDAQ: MELI) Q2 2024 Earnings Analysis

MercadoLibre Marketplace reported an increase in GMV to $12.6 billion, reflecting a 20% YoY growth. Items sold grew by 29% YoY, marking the highest growth rate since Q1 2021. Brazil led with a 37% increase, Mexico saw a 30% growth, and Chile and Colombia hit their highest growth rates since 2021. Argentina also reversed earlier declines.

🌎 Ternium: Patience Should Pay Off, But Near-Term Conditions Are Weak (Seeking Alpha) $

Ternium S.A. (NYSE: TX) reported weaker-than-expected Q2’24 results and weaker EBITDA guidance for Q3’24, as the company is seeing significant steel price pressure and higher cash production costs.

While this is not the best of times for Ternium, the company’s per-tonne profitability still compares favorably to global producers (including Steel Dynamics (NASDAQ: STLD)) and demand should improve later this year.

Ternium offers attractive leverage to significant manufacturing nearshoring growth in Mexico, as well as further import substitution in key markets like autos.

While there is still a risk that the cyclical low could be even lower than expected, Ternium looks too cheap across a range of metrics and looks undervalued below the $50’s.

🇦🇷 Grupo Supervielle: Buy The Recent Pullback (Seeking Alpha) $

Argentinian bank stocks rallied post-election of Milei, then pulled back, presenting a buying opportunity.

Grupo Supervielle SA (NYSE: SUPV) offers a wide range of financial services with strong profitability metrics and a well-diversified loan portfolio.

Milei’s shock therapy and austerity cuts aim to strengthen the economy, benefiting banks like Grupo Supervielle.

Shares are a buy with a price target of $10.

🇧🇷 WEG Q2: Excellent Results And Stretched Valuation (Seeking Alpha) $

WEG SA (BVMF: WEGE3)

The company showed strong revenue growth due to M&A. Organic growth was 9%.

The big highlight was the increase in margins, which the market was afraid would worsen due to the incorporation of Regal Rexnord assets.

Although the company has a lot of quality, its valuation is very stretched, making it impossible to recommend buying the shares.

🇧🇷 Petrobras Production Report Q2 2024: Be Careful, As Profits May Fall Sharply (Seeking Alpha) $

Production and sales report is released without major highlights.

Possible investment in Namibia brings risks and bad memories of the past.

Profit may be strongly impacted by non-recurring events.

🇧🇷 Petrobras: 2 Reasons To Buy And 1 Reason To Sell (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) is a cheap oil company with good fundamental indicators, high dividends, and positive operational prospects.

Political uncertainty surrounds Petrobras due to state ownership and influence on fuel prices, impacting government popularity and policies.

Petrobras offers attractive valuation, strong cash generation, high dividends, and good prospects, but state interference poses a significant risk for investors.

🇧🇷 TIM S.A. Q2: Stretched Valuation Does Not Allow Buy Recommendation (Seeking Alpha) $

TIM Brasil (NYSE: TIMB)‘s revenue increased, driven by mobile services, but costs are growing above inflation.

Despite recording the largest profit ever in a 2nd quarter, the reduction in depreciation and capex in the 2nd quarter may not be sustainable.

The valuation of TIM is not cheap, trading at 4.1x EBITDA compared to the historical average of 4x, suggesting little margin of safety.

🇧🇷 Vale Q2: That’s Why Vale’s Profits Soared (Seeking Alpha) $

Vale (NYSE: VALE)

Highest production levels since 2018 and upcoming projects are expected to increase production capacity by 10% by 2025.

The company reported an increase in costs, but this was expected due to the seasonality of the first quarter.

Rumors of a merger with another mining company could change the momentum of the shares.

🇧🇷 Nu Holdings: Premium Valuation Justified Ahead Of Q2 Earnings (Seeking Alpha) $

Nu Holdings (NYSE: NU) is now the largest Brazilian bank by market value, with a market cap of $59 billion and over 100 million customers.

The company’s growth is driven by fast customer expansion, increasing revenue per customer, and efficient operating costs, leading to strong profitability.

Despite risks such as economic downturns and high-interest credit portfolios, Nu Holdings’ shares are attractively valued at 26.6x the next 12 months’ earnings, offering potential for significant shareholder value.

Nu Holdings shows strong growth, robust profitability, and expansion potential in LatAm markets, making it a compelling buy despite macroeconomic risks.

🇨🇱 After Q2 Results, Andina Has Reached Fair Value And It’s Time To Let It Go (Seeking Alpha) $

Embotelladora Andina Sa (NYSE: AKO.A / AKO.B)‘s Q2 2024 results showed strong performance in Brazil and Paraguay, but challenges in Chile and Argentina.

Future growth potential in Brazil, Chile, and Argentina, but exposure to inflation-adjusted debt in Chile remains a concern.

Valuation of Andina is fair but less opportunistic, with multiples of 12.7x EV/NOPAT and 11x P/E, making it a Hold at current prices.

🇨🇴 Bancolombia: Going Digital Is A Positive (Seeking Alpha) $

Bancolombia (NYSE: CIB / BVC: PFBCOLOM) trades at a cheap 5.5x FWD earnings with a 10% dividend yield, making it a strong value play.

The company is heavily investing in digital services, showing strong innovation and potential for growth in the Latin American banking sector.

With improving inflation trends in Colombia, Bancolombia is poised to benefit from potential rate cuts and increased economic activity, making it a buy for investors.

Shares are a buy with price target of $48.

🇲🇽 Consorcio Ara – Analysis and Valuation 2.0 (Dola Capital)

At first glance Consorcio Ara SAB de CV (BMV: ARA / FRA: 4GJ / OTCMKTS: CNRFF) looks incredibly cheap, in this analysis I revisit the company to determine if it is really a great opportunity, or a value trap.

In October 2023 I published a deep dive on Consorcio Ara, where I analyzed and valued the company to determine if it was an attractive investment opportunity. At the time of my writing, the company sold at a share price of MXN$3.4.

Consorcio Ara is a vertically integrated Mexican home builder. The company holds very little net debt and is family owned and operated. German Ahumada, the CEO, and his brother Luis Ahumada, who runs the commercial properties division, own a combined 48.6% of shares outstanding.

The company operates in 3 types of home segments–affordable, middle, and residential.

🇲🇽 Extortion and gang violence are hitting even big corporations and business leaders in Mexico (AP)

Even Mexico’s largest corporations are now being hit by demands from drug cartels, and gangs are increasingly trying to control the sale, distribution and pricing of certain goods.

Well-known, high-ranking business leaders aren’t even safe.

The problem came to a head when the Fomento Economico Mexicano SAB de CV (NYSE: FMX), which operates Oxxo, Mexico’s largest chain of convenience stores, announced late last week that it was closing all of its 191 stores and seven gas stations in another border city, Nuevo Laredo, because of gang problems.

The company said it had long had to deal with cartel demands that its gas stations buy their fuel from certain distributors. But the straw that broke the camel’s back came in recent weeks when gang members abducted two store employees, demanding they act as lookouts or provide information to the gang.

🇲🇽 Gruma’s Execution Is Lessening The Sting Of A Sluggish Top Line (Seeking Alpha) $

Revenue and volume performance has flattened out, but Gruma SAB de CV (BMV: GRUMAB / FRA: 3G3B / OTCMKTS: GMKKY / GPAGF)‘s gross margin has improved significantly due to lower input costs, leading to better-than-expected EBITDA performance.

Like most packaged food companies, Gruma has limited pricing leverage today, but new premium products continue to be well-received and the company’s “better for you” category is growing by double-digits.

Competition from private label hasn’t hit Gruma as hard as other food companies, particularly in its premium offerings.

Further relief from input costs is a potential positive driver to watch; management believes corn prices could ease further and will be looking to hedge in 2H’24.

Gruma is a solid defensive option in packaged food; while the shares don’t appear strikingly undervalued, they have supported a higher EBITDA multiple in the past.

🇵🇦 Copa Holdings: The Free Cash Flow Backs Up The Yield (Seeking Alpha) $

The Global airline industry is struggling despite high travel trends and strong consumer spending.

I see shares of Copa Holdings (NYSE: CPA) as undervalued with high free cash flow, strong earnings, and attractive dividend yield.

But the chart shows a bearish trend, with key support at $78 and resistance near $100.

I also take a look at what the options market says ahead of earnings later this month.

🌐 Market to keep close eye on Glencore with demerger potentially on the cards (IOL)

Markets will be keeping a close eye on commodities firm Glencore (LON: GLEN / JSE: GLN / FRA: 8GC / OTCMKTS: GLNCY / OTCMKTS: GLCNF) after it said yesterday that it would let investors know next week whether or not it planned to demerge its coal and carbon steel materials business.

It is unclear at this point what a demerger would mean for its South African operations. A demerger is when the company splits off certain assets to form a separate company.

🌐 Globant: A Second Stage AI Player (Seeking Alpha) $

Globant (NYSE: GLOB) has maintained a solid revenue growth rate (16%) as customers transition to AI implementation.

The company could be a second-stage AI facilitator and surprise the market with higher growth.

The consensus forecast of over 18% EPS (cash) growth in 2025 has not been priced in with valuation at 1x PEG.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China’s urban pets forecast to outnumber toddlers this year (FT) $ 🗃️

🇨🇳 Weekend Long Read: How Investors Should Respond to China’s Third Plenum (Caixin) $

The Third Plenary Session of the 20th Central Committee of the CPC adopted a decision to deepen reform and promote Chinese-style modernization.

The decision outlines comprehensive economic system reforms, focusing on private enterprise support, technological innovation, legal frameworks, and macroeconomic governance.

Six potential investment areas include public service reforms, bonds, technological innovation, security reforms, healthcare and elderly care, and state-owned enterprise reforms.

🇨🇳 China Tweaks Regulations to Ease the Way for Qualified Foreign Investors (Caixin) $

China is revising its Qualified Foreign Institutional Investor (QFII) and yuan-denominated RQFII rules to streamline foreign investment.

The new rules, effective August 26, simplify procedures, expand currency options, and unify risk management models.

These changes aim to attract long-term foreign capital, reflecting China’s commitment to expanding market openness amid economic slowdowns.

🇨🇳 🇯🇵 Japan, Not China, is Dominating Southeast Asia (KonichiValue)

In a time when everyone’s watching China’s big moves in Southeast Asia, there’s a surprising twist: Japan is the one making waves. Despite what many think, it’s Japan, not China, that’s taking the lead in shaping Southeast Asia’s future. This game-changing turn of events is shaking up what we thought we knew about who’s really calling the shots in the region.

Japan’s investment in the region’s infrastructure is nothing short of epic, completely overshadowing China’s efforts. It’s not just about the money – it’s about Japan making strategic, lasting moves. And in the consumer world, while Chinese brands are catching up, Japanese brands like Toyota, Uniqlo or Muji are still king.

🇰🇷 Absolute Principles of Stock Investment (주식투자절대원칙) – A Book Review (Douglas Research Insights)

This insight is a book review of 주식투자절대원칙 (Absolute Principles of Stock Investment), which was written by a famous Korean retail investor called Park Young-Ok.

Park tries to capture his 30+ years of investing wisdom. I thought this book was excellent, especially because Park included a lot of local flavor of his mindset in investing.

This insight provides 11 major highlights of the book ‘Absolute Principles of Stock Investment.’

🇿🇦 SA’s corporate landscape evolves: New amendments reshape remuneration and ethics oversight (IOL)

In a bold move to enhance corporate governance and address growing concerns about income inequality, the South African government has recently amended the Companies Act.

These changes, focusing on remuneration policies and social and ethics committees, are set to significantly impact public, state-owned and certain private companies.

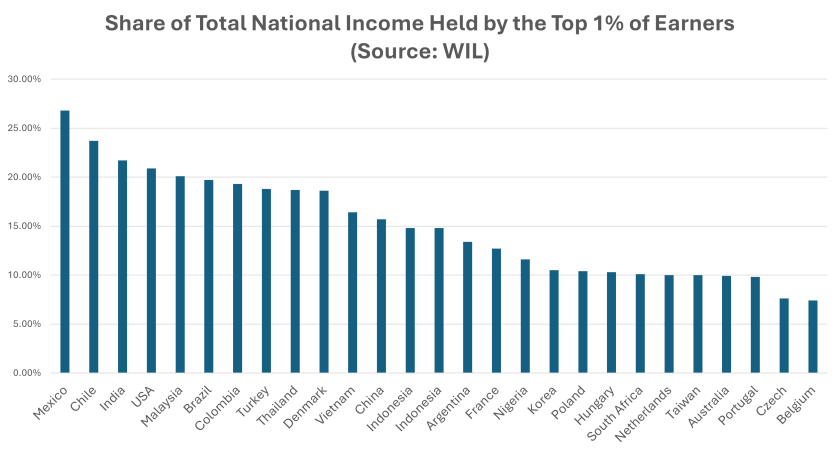

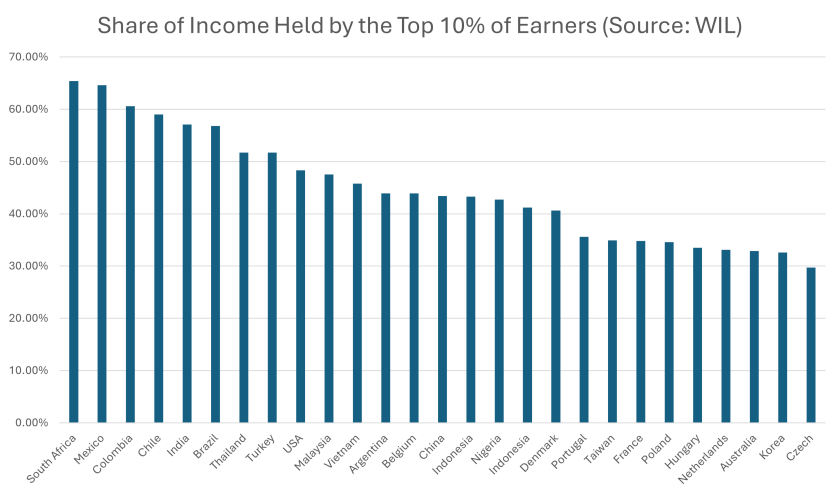

🌐 Income Inequality in Emerging Markets, Market Size and Consumption (The Emerging Markets Investor)

A basic characteristic of emerging markets is a high level of income inequality. Most countries have small elites that dominate politics and business and control a large share of financial income and assets. Income concentration creates a chasm between the elites and the general population, significantly reducing the market potential for business, and thereby reducing investment, employment, and consumption.

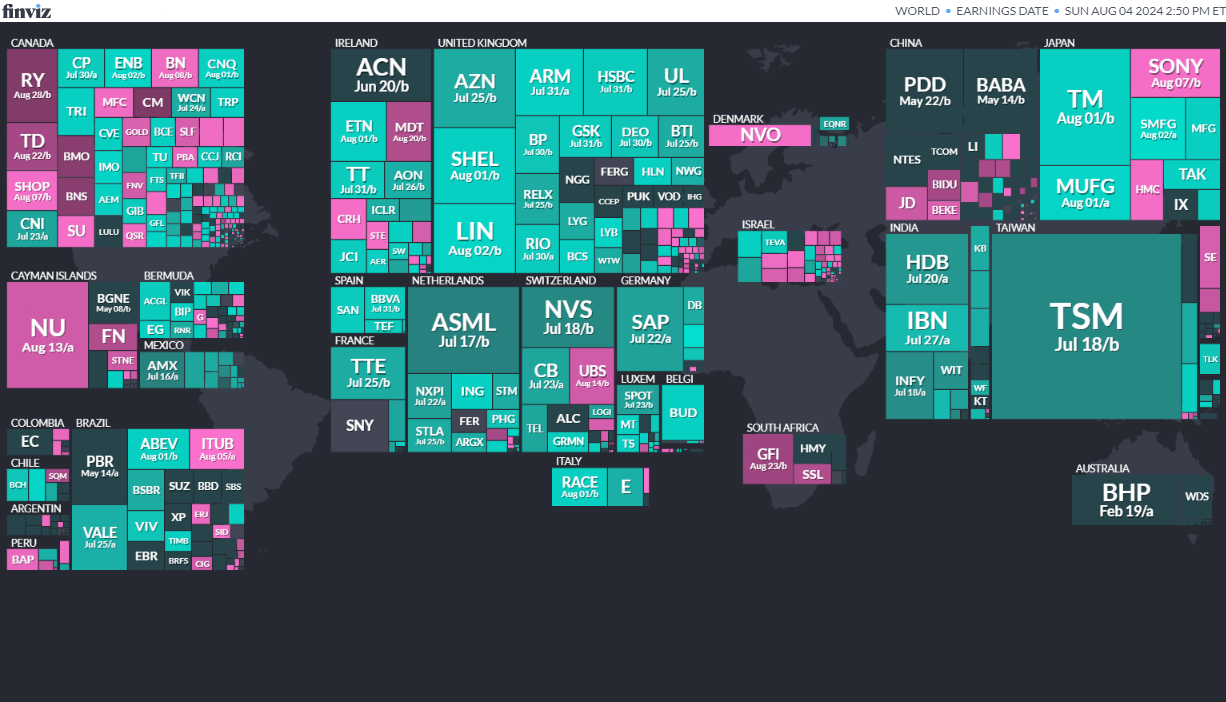

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

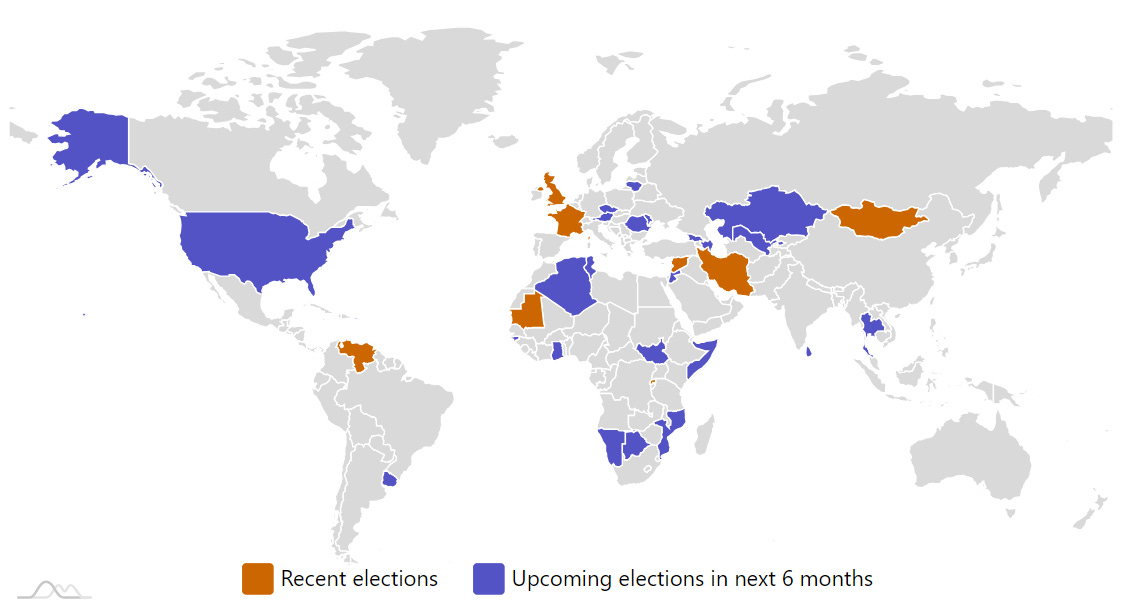

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

VenezuelaVenezuela PresidencyJul 28, 2024 (d) Confirmed May 20, 2018 -

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 21, 2024