Emerging Market Links + The Week Ahead (December 22, 2025)

Some interesting China stock related news as the Financial Times has noted that Chinese stocks cool on weak economic data 🗃️ while Caixin has reported that the Beijing Exchange’s IPO Frenzy Spurs Arbitrage and Regulatory Tightening plus Hong Kong Warns IPO Sponsors Over Slipping Application Quality. In addition, Caixin has reported how China Bad-Debt Managers’ Bet on Bank Stocks Could Backfire and How ‘Paper Wealth’ Masks Risks for Chinese Insurers…

Finally, I was just in Best Buy and realized that last week when mentioning my long stopover in Taiwan, I had missed noting a piece (E Ink Holdings (TPE: 8069): Moving Beyond ePaper & the Amazon Kindle into Digital Retail Pricing Labels) I had done about Taiwanese stock E Ink Holdings (TPEX: 8069). Best Buy is apparently using e ink technology for its product labels; but their system comes from Sweden based Pricer AB (STO: PRIC-B / FRA: PRRB / OTCMKTS: PCRBF).

$ = behind a paywall

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏🇯🇵 Asian UHNWIs face regime change as BOJ rate hike looms (The Asset) 🗃️

Unwinding of yen carry trades to suck global liquidity back to Japan

For decades, the BOJ has been the silent architect of global liquidity, a reliable source of “free” money that fuelled everything from Manhattan penthouses to Silicon Valley unicorns.

That era officially ends this week, with a near-unanimous forecast among economists ( e.g., 100% in Bloomberg surveys, 90% in Reuters polls ) of a BOJ rate hike on December 19, which will bring the policy rate to 0.75%, the highest level in 30 years.

For Asian UHNWIs, this is not a mere statistical adjustment; it is a systemic “regime change” that demands immediate defensive action.

For Asian UHNWIs, the coming weeks will separate the agile from the exposed. By rotating into Japanese financials and deploying tactical currency hedges, investors can transform this volatility from a threat into a structural opportunity.

🇨🇳 Chinese stocks cool on weak economic data (FT) $ 🗃️

Profit-taking has also brought this year’s steep rally to an end in the last quarter

The MSCI China index has fallen 7.4 per cent since September, its worst three-month performance in an otherwise strong year for the country’s equities, with gains fuelled by optimism over Chinese technological innovation and government support for markets.

🇨🇳 China Targets AI-Generated Misinformation, Illegal Stock Tips in New Cleanup (Caixin) $

China’s cyberspace and securities regulators said on Friday they had shut down and penalized a batch of online accounts for spreading false information and illegally promoting stocks, as part of a continuing crackdown on market rumors.

The Cyberspace Administration of China, working with the China Securities Regulatory Commission, said the action targeted accounts that fabricated policies, distorted public disclosures, used AI to generate false content or lured investors with illegal stock tips.

🇨🇳 Beijing Exchange’s IPO Frenzy Spurs Arbitrage and Regulatory Tightening (Caixin) $

The Beijing Stock Exchange (BSE) has delivered debut gains of several hundred percent this year — levels rare in major equity markets — drawing in arbitrage capital and prompting regulators to tighten IPO allocation rules.

The frenzy took hold after the BSE loosened IPO allocation rules in April, enabling small private funds to exploit nearly risk-free spreads between primary and secondary markets. Many funds rushed into IPO allocations as strategic investors and then sold their shares as soon as lockups expired — a practice technically compliant but widely criticized.

🇨🇳 Chinese GPU-Maker Warns Stock Surge Won’t Last Forever (Caixin) $

Moore Threads Technology Co Ltd (SHA: 688795), a Chinese GPU-maker positioning itself as a domestic alternative to Nvidia, has warned investors of potential risks after its share price skyrocketed more than 700% within a week of its listing.

In an exchange filing issued late Thursday, the company cautioned that its recent stock surge significantly outpaced the broader STAR Market indexes and that investors would face substantial risks in trading its shares.

🇨🇳 Alibaba Group: What’s Behind the Qwen3-Max Momentum- Inside the Model Strategy Shaping Real-World Adoption! (Smartkarma) $

Alibaba (NYSE: BABA)’s recent results demonstrate a mixture of performance across its different business segments, with significant growth in some areas, tempered by challenges in others.

Positively, the company reported a 15% year-over-year increase in total revenue when excluding contributions from Sun Art and Intime, driven by strong performance in key areas such as Cloud Intelligence, which saw a remarkable 34% revenue growth.

This growth was largely fueled by sustained demand for AI and the increasing usage of public cloud services, evidencing Alibaba’s strong positioning in the AI and cloud sectors.

🇨🇳 PDD Fires Government Relations Staff After Fistfight With Regulators (Caixin) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo has dismissed several employees from its government relations department following a physical altercation between company executives and Shanghai market regulators earlier this month, Caixin has learned.

The fight occurred at the Chinese e-commerce giant’s Shanghai headquarters on Dec. 3, when local officials, acting on a referral from the State Administration for Market Regulation (SAMR), were carrying out an investigation, sources with knowledge of the matter told Caixin. The situation escalated into a physical altercation, prompting the regulators to call the police. The authorities subsequently penalized several PDD employees, including imposing administrative detention, for obstructing official duties.

🇨🇳 Weibo (WB) is the dog I can’t sell (nVariant Capital Fund)

(Weibo Corp (NASDAQ: WB))

Business stagnant, management blahh, but god it cheap

But my problem is it owns 26.57% of INMYSHOW, a $10B market cap Shanghai stock, and carries that $2.7B on the books at $300M. Making its net cash value somewhere around $16/share.

🇨🇳 A decade in the making: Kunlunxin chips could bring excitement back to Baidu (Bamboo Works)

The search giant and AI aspirant is considering a possible separate listing for its Kunlunxin chip unit, seeking a slice of a market currently led by Nvidia

Baidu (NASDAQ: BIDU) says it is considering a listing for its Kunlunxin chip unit, which hopes to challenge AI chipmakers like Nvidia

The company is expected to generate revenue of 3.5 billion yuan to as much as 5 billion yuan this year

🇨🇳 Baidu Weighs Spinoff of AI Chip Unit for Independent Listing (Caixin) $

Baidu (NASDAQ: BIDU) is weighing a spinoff and separate initial public offering of its artificial intelligence chip unit, the company confirmed Sunday, following weeks of speculation surrounding one of its most strategically valuable businesses.

In a filing to the Hong Kong Stock Exchange on Dec. 7, Baidu said it is exploring the possibility of spinning off and listing its non-wholly owned subsidiary, Kunlunxin (Beijing) Technology Co. Ltd. The company cautioned that the plan is still under evaluation and would require regulatory approval, with no guarantee of execution.

Shares of Baidu rose 3.5% in Hong Kong trading Monday, closing at HK$125.8 ($16.2).

🇨🇳 NetEase’s New Business Models Look Disruptive—Could This Be the Next Massive Competitive Edge? (Caixin) $

NetEase (NASDAQ: NTES), a key player in the global gaming industry, recently showcased its third-quarter earnings for 2025, highlighting both its strategic advancements and challenges.

Throughout this period, NetEase demonstrated robust growth, with total revenues increasing by 8% year-over-year to RMB 28.4 billion.

This growth was mainly propelled by a 12% rise in revenues from its games and related value-added services, emphasizing the company’s strength in game content production and delivery.

🇨🇳 Kuaishou Finds Formula for Growth in Brazil, International Chief Says (Caixin) $

Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) is striving to build a stronger foothold in the Brazilian market by customizing its strategy to local tastes and infrastructure, a move that largely helped the short-video firm’s international business turn a profit for the first time in the first quarter.

Kwai, the international version of its eponymous Kuaishou app, has been operating in the Latin American country for eight years. Citing third-party data, the company said that the app now has 60 million monthly active users in Brazil, equivalent to nearly one-third of its population, with each user spending an average of more than 75 minutes on the platform every day.

“When I first came to Brazil at the end of 2022, we didn’t even have our own office, and we worked out of a WeWork office space,” Du Zheng, head of international commercialization at Kuaishou, told Caixin at the firm’s office in Vila Olímpia, São Paulo.

🇨🇳 iQIYI Turns Chinese Dramas Into a Global Export Powerhouse—Is This Its Breakout Advantage? (Smartkarma) $

iQIYI (NASDAQ: IQ)’s third-quarter 2025 earnings call presented a snapshot of the company’s performance and strategic direction, marked by a balanced view of advancements and challenges.

As a leading player in China’s online video space, iQIYI’s ability to produce widely appreciated content—such as the highly successful drama “The Thriving Land”—remains a significant asset.

This drama, with its universal appeal, underscores the company’s strength in long-form content that transcends cultural and temporal boundaries.

🇨🇳 Horizon Robotics Opens Core Smart-Driving Technology to Partners (Caixin) $

Horizon Robotics (HKG: 9660), a Chinese designer of self-driving computing chips, will make its core development capabilities available to partners, a move aimed at enabling more of the industry to get involved in the development of assisted driving systems, founder Yu Kai said.

The Beijing-based company will license its foundational models and algorithms to external developers under a program dubbed “HSD Together,” freeing up more time and energy for them to handle system integration, function customization and vehicle development, Yu said.

The program’s first customers will include Japanese auto parts maker Denso Corp. and assisted driving system developers Carizon and neueHCT, which are joint ventures Horizon Robotics established with Volkswagen AG and Continental AG, respectively, according to Yu.

🇨🇳 JD.com’s Industrial Unit Slides in Hong Kong Trading Debut (Caixin) $

Jingdong Industrials Inc., a supply chain management spin-off from Chinese e-commerce heavyweight JD.com (NASDAQ: JD / SGX: HJDD), saw its shares falter on their Thursday trading debut in Hong Kong, reflecting broader investor caution despite strong demand and the city’s recent resurgence as a leading global IPO venue.

The company’s shares opened at HK$13 ($1.7), below the offering price of HK$14.1. The stock fell as much as 8.1% in early trading before trimming losses to close flat at HK$14.1. The performance lagged a 0.7% rise in the benchmark Hang Seng Index, giving the company a market capitalization of HK$37.7 billion ($4.8 billion).

Jingdong Industrials raised HK$2.8 billion in net proceeds from the initial public offering, which attracted strong demand from both retail and institutional investors. The retail tranche was oversubscribed by 60.5 times, while institutional investors oversubscribed by 7.9 times.

🇨🇳 China’s Bonkers Bike-share Bubble (Asianometry) 50:41 Minutes

Chinese state media hailed it as one of China’s “Four Great Inventions” of modern times. Today, what most people remember are the graveyards. Or the thousands of bikes left on streets and public areas. In less than a year, 70+ bike-share startups burned billions of dollars to put 20+ million bikes on Chinese streets. It was insane. It was unsustainable. Oh boy. In this video, we dive into the bonkers Chinese bike-share bubble of 2017-2018.

🇨🇳 How Great Wall Motor Is Remaking Itself for Brazil (Caixin) $

When Great Wall Motor (SHA: 601633 / HKG: 2333 / FRA: GRV / OTCMKTS: GWLLF / GWLLY) set its sights on Brazil, the Chinese carmaker quickly learned that success would depend on more than exports. To better crack Latin America’s largest auto market, the company has had to rethink everything from engine technology to after-sales services — and even how Brazilians drive.

“Brazilians love to drive fast, and they prefer small cars,” Zhang Gengshen, president of Great Wall Motor’s Brazilian and Mexican operations, said in an interview with Caixin in early December. “The massive sugarcane industry has led to the wide use of biofuels in Brazil, where many cars run on ethanol. These usage habits are completely different from those in China.”

Zhang’s observations come at a pivotal moment for China’s auto industry. As trade tensions with the U.S. and Europe intensify, Chinese carmakers are pivoting aggressively to countries in the Global South. Brazil, the world’s sixth-largest auto market with annual new car sales of more than 2 million units, has become a primary battleground. According to the Brazilian Electric Vehicle Association, sales of light new-energy vehicles in the country grew 9.5% year-on-year in the first half of 2025 to 86,800 units, accounting for 8% of its total light car sales.

🇨🇳 Why China’s robotaxi industry is stuck in the slow lane (FT) $ 🗃️

Shares in Pony AI Inc (NASDAQ: PONY) and WeRide (NASDAQ: WRD) have fallen since their November debuts

Autonomous driving might be a race, but the world’s biggest automotive markets are speeding in different directions. In the US, self-driving cars are viewed as a software platform opportunity. Meanwhile, in China they are mostly being seen as a hardware-intensive mobility service.

🇨🇳 Seyond survives marathon journey to Hong Kong listing (Bamboo Works)

The maker of autonomous driving sensors has completed a backdoor SPAC listing nearly a year after signing a merger agreement for the deal

Seyond Holdings Ltd (HKG: 2665) has become only the third firm to successfully go public in Hong Kong using the stock exchange’s 4-year-old SPAC listing program

The milestone came nearly a year after the maker of sensors used in autonomous driving signed its deal to merge with a special purpose acquisition company

🇨🇳 Major Chinese Polysilicon-Makers Band Together to Curb Overcapacity (Caixin) $

Several of China’s major polysilicon producers have teamed up on a joint venture that industry insiders said is designed to tackle overcapacity in the solar industry.

Beijing Guanghe Qiancheng Technology Co. Ltd. was officially established on Tuesday with a registered capital of 3 billion yuan ($424 million), with its shareholders including nine polysilicon makers and the China Photovoltaic Industry Association (CPIA).

A subsidiary of Tongwei Co., Ltd (SHA: 600438), the world’s largest manufacturer of polysilicon and solar cells, is Guanghe Qiancheng’s largest shareholder with a 30.35% stake. The new entity is run by a management team made up of several industry veterans such as Guo Xuming, general manager of Asia Silicon (Qinghai) Co. Ltd., and Liu Yiyang, executive secretary general of the CPIA.

🇨🇳 China uses green tech dominance to take early lead in clean fuels race (FT) $ 🗃️

🇨🇳 In Depth: How a Chinese Mining Giant Learned to Win in Brazil (Caixin) $

In the heart of Brazil’s central highlands, the small city of Catalão is an unlikely outpost for a Chinese mining giant. A short drive from the town center, paved roads narrow into country lanes winding through a rural landscape where CMOC Group Limited (SHA: 603993 / HKG: 3993) runs a sprawling mining operation.

For nearly a decade, the firm has been operating the niobium and phosphate mines there after acquiring them from Anglo American Plc (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) in 2016. The venture helped CMOC become the world’s second-largest producer of niobium — a critical input for high-strength steel alloys — and the second-largest maker of phosphate fertilizers in Brazil. In 2024, its Brazilian output hit record highs, with revenues climbing to 6.54 billion yuan (nearly $930 million).

🇨🇳 CMOC Group (603993 CH): Brazil Gold Deal Lifts Diversification; Valuation Tied to Metals Regime (Smartkarma) $

(CMOC Group Limited (SHA: 603993 / HKG: 3993) )

Brazil gold acquisition improves diversification and earnings stability; deal appears cash-funded and value-accretive at current gold prices.

Asset quality improves on a risk-adjusted basis, though Brazilian gold mines are higher-cost and shorter-life than tier-1 peers.

Valuation already reflects elevated copper and gold prices; upside now depends on commodity price persistence, not rerating.

🇨🇳 In Depth: Byzantine Billing System Holds Back Chinese Hospitals’ Embrace of Private Insurance (Caixin) $

In late October, the air in Beijing had already turned crisp, but inside Peking Union Medical College Hospital’s international department, the atmosphere was bustling. According to patients at the hospital, there was a sense that the demographic covered by high-end commercial health insurance has expanded in recent years.

Historically, commercial insurance in China has catered to mid-to-high-end medical needs, a segment that did not naturally jive with the public welfare mandate of the country’s dominant state-run hospitals. However, the economic ground has since shifted. With the aggressive rollout of cost-control policies — such as the reform of basic medical insurance payment methods and centralized bulk drug purchasing — state insurance funds are saving money, but hospitals are feeling the pinch.

🇨🇳 In Depth: China Bad-Debt Managers’ Bet on Bank Stocks Could Backfire (Caixin) $

A new player has emerged in the boardrooms of China’s major banks: the “Big Four” state-owned asset management companies (AMCs) created to clean up the bad debts of four state-owned commercial lenders. The balance sheets of the “Big Four” are now glowing with profits — thanks not to their core task, but to a surge in bank stocks.

On Sept. 30, Shanghai Pudong Development Bank Co Ltd (SHA: 600000) (SPD Bank) disclosed that China Orient Asset Management Co. Ltd. had increased its stake in the bank to 3.44%, becoming its fifth-largest shareholder, and nominated one of its own executives as a director. With this, the “Big Four” AMCs, also known as “bad banks” — including China Citic Financial Asset Management Co. Ltd., China Cinda Asset Management Co. Ltd. and China Great Wall Asset Management Co. Ltd. — have become major shareholders in some of the country’s biggest commercial banks.

🇨🇳 CICC Advances State-Backed Merger to Become China’s No. 4 Broker (Caixin) $

China International Capital Corp Ltd (SHA: 601995 / HKG: 3908 / FRA: CIM) has taken a key step toward becoming the country’s fourth-largest securities firm by assets.

The investment bank on Wednesday disclosed key terms for a merger that would see it absorb two smaller rivals through a share swap.

The deal underscores Beijing’s push to consolidate the securities sector, as policymakers seek to form “aircraft carrier-sized” investment banks capable of competing internationally.

🇨🇳 In Depth: How ‘Paper Wealth’ Masks Risks for Chinese Insurers (Caixin) $

When state-owned Dajia Insurance Group Co. Ltd. spent billions of yuan earlier this year buying into Industrial Bank Co Ltd (SHA: 601166), the deal seemed unremarkable at first glance — a typical move by an insurer seeking a stable investment paying steady dividends.

But beneath the surface, a controversial piece of accounting was taking shape.

By building its stake past 3% and securing a board seat, Dajia unlocked a powerful accounting lever: the ability to classify its holding as a long-term equity investment. That technical change allowed the company to book an estimated one-time gain of about 10 billion yuan ($1.4 billion). The gain, however, is essentially “paper wealth,” conjured through the so-called equity method of accounting and a quirk of China’s markets, where most bank stocks trade well below their book value.

🇨🇳 Shanghai Airport To Form JVs with New Duty-Free Operators (Caixin) $

Shanghai Airport (Group) Co. Ltd. (Shanghai International Airport (SHIA) (SHA: 600009)?)on Wednesday said it and its subsidiaries have signed concession transfer agreements with the China unit of Avolta AG (SWX: AVOL / FRA: D2J / OTCMKTS: DFRYF) and state-owned China Duty Free Group Co. Ltd. (CDFG) (China Tourism Group Duty Free (CTGDF) (HKG: 1880 / SHA: 601888)), and would establish joint ventures with each operator to run the duty-free stores.

Dufry (Shanghai) Commerce Co., the Chinese operations of Switzerland-based global travel retail giant Avolta, and CDFG secured the new round of duty-free concessions at Shanghai’s two airports, replacing the current operator, Sunrise Duty Free Shanghai Co. Ltd., after a dramatic bidding battle.

🇨🇳 Luckin Coffee: An Opportunistic Bet On Cheap Coffee (Seeking Alpha) $ 🗃️

🇨🇳 Duty-free giant CTG plays hardball to win shop contracts in Shanghai airports (Bamboo Works)

The company’s spat with one of its own subsidiaries highlights the importance of airport outlets for duty free operators struggling with sluggish business in a slowing economy

China Tourism Group Duty Free (CTGDF) (HKG: 1880 / SHA: 601888) has defeated one of its own subsidiaries in the bidding for licenses to operate shops at Shanghai’s airports

Both revenue and profits are falling for China’s dominant duty-free store operator, as the sector struggles in a slumping economy despite strong government support

🇨🇳 Softcare Limited (2698.HK) – A formidable fortress in Africa finding its footing (Pyramids and Pagodas)

Rare HK-listed frontier market pure play on consumer hygiene

Genuine, investable plays on frontier market consumption are rare. Rarer still are companies that build unassailable local advantages rather than merely exporting to them. Softcare Ltd (HKG: 2698); “Softcare”), the leading diaper and sanitary pad manufacturer operating in the world’s last high population growth region recently listed in Hong Kong and fits the bill. In this piece, we focus largely on its core diaper segment as it’s the bulk of the Company’s business, although other segments hold promise, as we discuss later.

Founded in 2009 as a trading arm of the Sunda Group (“Sunda”), Softcare with a market cap of around USD 2.6 billion, has evolved into a local manufacturing champion in Africa. It has captured a 20% market share by volume, built eight local production plants, and established a robust distribution network on the continent – advantages that are not easily replicated in Africa’s highly relationship-driven FMCG sector.

🇨🇳 2026 High Conviction: Uni President China (220 HK): Modest Valuations, Robust Cash Flows (Smartkarma) $

Uni-President China (HKG: 0220 / FRA: 58U) appeals to value investors with its stable long-term growth, attractive dividends, and diversified consumer staples portfolio, despite severe near-term sector competition.

The intense competition plaguing China’s food delivery platforms and F&B sector have impacted investor sentiment and valuations. Expect stock rebound as the dust settles.

Uni-President’s brand loyalty and innovation capabilities should help sustain revenue and profit growth, enabling the company to weather near-term pricing and margin pressures.

🇨🇳 Lagging in the weight-loss market? Take Fosun’s GLP-1 pill (Bamboo Works)

Playing catch-up in the anti-obesity business, Pfizer has bought global rights to an oral weight-loss drug from Shanghai Fosun Pharmaceutical (HKG: 2196 / SHA: 600196 / FRA: 08HH / OTCMKTS: SFOSF) in another big licensing deal

With the drug still at an early stage of development, Pfizer has negotiated an opt-out clause in case trials do not go to plan

Fosun Pharma’s revenues from innovative drugs jumped 18.09% in the first three quarters, emerging as a growth driver for the company

🇨🇳 Biren Technology IPO: China’s “NVIDIA Moment” and The Rise of a Homegrown AI Chip Champion (Smartkarma) $

Biren Technology, a Shanghai-based fabless chip design company that develops intelligent processors for GPU and DSA computation architectures, filed to go public in Hong Kong.

Biren Technology was founded in 2019 by CEO & Chairman Mr. Wen Zhang, who previously worked at AI software company SenseTime Group Inc.

This is a red-hot upcoming IPO to watch, in my view. Moore Threads Technology Co Ltd (SHA: 688795) and MetaX Integrated Circuits Co Ltd (SHA: 688802) have recently raised $1.1B and ~$600M in their public share offerings in Shanghai.

🇭🇰 Futu: A Robinhood-Style Platform With A Notable Valuation Discount (Seeking Alpha) $ 🗃️

🇭🇰 Futu (FUTU): Is The Triple-Digit Momentum Sustainable? | 2-Minute Analysis (Seeking Alpha) $ 🗃️

🇭🇰 Hong Kong Warns IPO Sponsors Over Slipping Application Quality (Caixin) $

Hong Kong’s financial regulators have issued rare joint warnings to IPO sponsors over declining listing application quality, urging banks to address irregularities that they say could erode the overall standard of companies seeking to go public.

Both the Securities and Futures Commission (SFC) and the Hong Kong Stock Exchange (HKEX) confirmed to Caixin that they had issued letters to sponsors.

🇭🇰 Hong Kong Exchange Launches First Self-Developed Tech Stock Index (Caixin) $

Hong Kong Exchanges and Clearing Ltd. (HKEX) on Tuesday launched the HKEX Tech 100 Index, a new benchmark that tracks the performance of 100 of the largest technology companies listed in the city by market value.

The index marks the bourse’s first independently developed Hong Kong equity benchmark as it seeks to expand its index business.

HKEX also announced an agreement with E Fund Management Co. Ltd. authorizing the firm to launch a Chinese mainland-listed exchange-traded fund (ETF) that will track the new index.

🇲🇴 Macau GGR growth momentum likely to remain for 2026: UBS (GGRAsia)

Investment bank UBS maintains a “constructive” view on Macau’s gaming industry heading into 2026, with “momentum likely to stay resilient” in terms of growth in revenue and earnings.

“The outlook is supported by enhanced tourism offerings, expanded marketing initiatives, and a more diversified customer base, which should continue to drive growth, particularly within premium segments,” stated the institution in a recent memo.

The bank expects Macau’s gross gaming revenue (GGR) and its earnings before interest, taxation, depreciation, and amortisation (EBITDA) to grow 6 percent and 7 percent in 2026, respectively.

🇲🇴 Shopping sees a comeback at Galaxy, Sands malls, as China consumer mood brightens (GGRAsia)

Two Macau casino resort operators saw sequential improvement in the third-quarter net revenues of shopping malls they respectively run at their Cotai properties.

The gains for Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) and Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) coincided with other official economic data indicating stengthening demand for luxury goods in Macau shops generally, and for retailers on the Chinese mainland.

🇲🇴 Macau’s gaming recovery moderating, but still supporting solid 2026 GDP growth: Fitch (GGRAsia)

Fitch Ratings Inc forecasts Macau’s gross domestic product (GDP) to grow 4.0 percent in 2026, supported by “recovery in tourism flows. The forecast is based on the assumption that the city’s casinocgross gaming revenue (GGR) next year “will recover to roughly 88 percent of its 2019 level,” stated the rating agency.

Nonetheless, that will be a slowdown from an estimated 4.6-percent GDP growth this year, and from an 8.8-percent increase in 2024, noted the institution.

The commentary was part of a Tuesday report in which the institution affirmed Macau’s long-term issuer default rating at ‘AA’, with a ‘stable’ outlook.

🇲🇴 Concerts, extra hotel suites and side bets to boost Macau’s 2026 GGR: Citi (GGRAsia)

Citigroup expects Macau industry gross gaming revenue (GGR) to grow by 6 percent year-on-year in financial year 2026, “to MOP263.5 billion, or circa US$33.0 billion; about 90 percent of the 2019 level”.

The banking institution forecasts Macau’s industry earnings before interest, taxation, depreciation, and amortisation (EBITDA) to grow by 10 percent year-on-year in 2026, with EBITDA margins flat at “circa 29 percent,” according to a Thursday memo.

“With an illustrious concert calendar, luxurious new hotel suite supply and new baccarat side bets, we believe Macau will remain the top travel destination for the affluent mainland Chinese visitors who seek a total experience,” wrote analysts George Choi and Timothy Chau.

🇲🇴 Morgan Stanley expects Macau 4Q GGR to grow 8pct sequentially (GGRAsia)

Brokerage Morgan Stanley Asia Ltd says it expects Macau’s gross gaming revenue in the fourth quarter of 2025 to increase by circa 8 percent sequentially, and about 17 percent from the prior-year period.

Such GGR growth would be supported by a 22-percent increase in December, given a “low base in 2024,” wrote analysts Praveen Choudhary and Anson Lee.

🇲🇴 Macau mass-bet minimums softer since October amid contest for business of closed satellites: Citi (GGRAsia)

Macau mass-market baccarat bet minimums showed some month-on-month weakening in the December bet survey by Citigroup, with a possible factor being Macau’s six operators competing for the former business segment of Macau’s now-shuttered satellite casinos.

That is according to a memo by Citi analysts George Choi and Timothy Chau. The last of the city’s satellite venues – Casino Landmark – is due to cease operations on December 30.

🇹🇼 TSMC: The Market Is Still Surprisingly Mispricing Its AI Chipmaking Dominance (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: U.S.-China Negotiations Over Taiwan Likely To Come (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: This Is The GARP Moment You’ve Waited For (Seeking Alpha) $ 🗃️

🇹🇼 United Microelectronics: The Foundation Supporting The Rally Is Not As Solid As It Needs To Be (Seeking Alpha) $ 🗃️

🇹🇼 Perfect Corp.: A Perfect Fit For My AI Small-Cap Pocket (Seeking Alpha) $ 🗃️

-

🌐 Perfect Corp (NYSE: PERF) – SaaS makeup virtual try-on solutions (Beauty AI, Skin AI, Fashion AI & Generative AI SaaS solutions). 🇼

🇰🇷 An Early Look at Potential Additions and Deletions to KOSPI200 in June 2026 (Douglas Research Insights) $

🇰🇷 An Early Look at Potential Additions and Deletions to KOSDAQ150 in June 2026 (Douglas Research Insights) $

🇰🇷 High-Conviction TIGER Semi Top 10 Rebal Trade from MKF500 Rebalance Cues (Smartkarma) $

FnGuide’s December MKF500 rebalance adds Wonik Holdings Co Ltd (KOSDAQ: 030530) to the semis bucket, clearing screens for TIGER Semiconductor TOP 10 ETF, Korea’s largest sector ETF.

October rebalance: Wonik IPS added at 5% weight, pulling ₩100B passive flows and ripping 15%+ as retail chased.

For April rebalance, Wonik Holdings’ high volume lowers theoretical passive impact, but strong retail chasing could trigger Oct 2–style price action—definitely worth monitoring.

🇰🇷 S.Korea’s president questions if private-sector casino licences are ‘appropriate’ (GGRAsia)

South Korea’s leader, President Lee Jae-myung (pictured), has described the issuing of casino licences for private-sector companies as akin to a “significant favour”.

Mr Lee also stated: “Significant profits are generated, and it is not appropriate to grant licences for this to the private sector, to specific individuals.”

He added: “It would be good for the Ministry of Culture, Sports and Tourism to keep this in mind when making policy decisions later.

“Why grant it to individuals, to specific companies? That is why people call it a favour. Isn’t it right (better) to grant such things to the public sector?”

🇰🇷 Samsung: Memory Is Booming And Looks Set To Continue (Seeking Alpha) $ 🗃️

🇰🇷 Sale of 1.1 Trillion Won Worth of Hanwha Energy by Kim Dong-Won and Kim Dong-Sun (Douglas Research Insights) $

Kim Dong-Won and Kim Dong-Sun decided to sell nearly 1.1 trillion won (US$750 million) worth of Hanwha Energy.

Through this sale, Hanwha Energy’s value is estimated at approximately 5.5 trillion won.

This large scale stake sale could result in negative sentiment/impact on Hanwha Corporation (KRX: 000880 / 00088K) and Hanwha Systems Co Ltd (KRX: 272210).

🇰🇷 Shinsegae I&C – The Next Tender Offer Target by E-Mart? (Douglas Research Insights) $

In the past two years, E-Mart (KRX: 139480) has announced two tender offers of its affiliates including Shinsegae E&C (September 2024) and Shinsegae Food Inc (KRX: 031440) (December 2025).

We believe the next target of a tender offer by E-Mart could be Shinsegae Information & Communication Co (KRX: 035510) in 2026/2027.

We provide three main reasons why E-Mart may try to conduct a tender offer of Shinsegae I&C in 2026/2027.

🇰🇷 Mirae Asset Group – The Biggest Korean Investor in SpaceX (Douglas Research Insights) $

It has been revealed that three Mirae Asset Group companies including Mirae Asset Securities (KRX: 006800 / 520003 / 00680K), Mirae Asset Venture Investment Co Ltd (KOSDAQ: 100790), and Mirae Asset Capital combined invested US$278 million in SpaceX.

Mirae Asset Group is the biggest Korean investor in SpaceX. Its investment in SpaceX is estimated to be about 2.3% of the total US$12 billion already received by SpaceX.

If SpaceX’s valuation reaches nearly US$1.5 trillion in the upcoming IPO in 2026, Mirae Asset Group companies’ investment returns in SpaceX could be more than 10x their original investments.

🇰🇷 Korea Small Cap Gem #51: Hanssem (Cancellation of 29.5% of Outstanding Shares) (Douglas Research Insights) $

After the market close on 22 December, Hanssem Co Ltd (KRX: 009240) announced that it will cancel all of its 6.933 million treasury shares (29.5% of outstanding shares).

The fact that this share cancellation is a whopping 29.5% of outstanding shares is likely to result in a sharply higher share price for Hanssem in the next several days.

We believe that this massive treasury shares cancellation is likely to have a significantly positive impact on Hanssem’s share price in the next several days/weeks.

🇰🇷 SemiFive IPO Bookbuilding Results Analysis (Douglas Research Insights) $

(Custom Silicon solutions) SemiFive confirmed its IPO price at 24,000 won, which was at the high end of the IPO price range.

A 43.9% of the total IPO shares are under various lock-up periods lasting from 15 days to 6 months. This is also a bullish sign.

Our base case valuation of SemiFive is implied market cap of 1.4 trillion won or target price of 42,349 won per share, which is 76% higher than the IPO price.

🇰🇭 NagaCorp terminates share subscription to fund Naga 3, vows to complete expansion (GGRAsia)

Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) has announced the termination of a subscription agreement that would have seen the company raise funds to fund the Naga 3 expansion project.

Hong Kong-listed NagaCorp has a long-life casino monopoly in the Cambodian capital, Phnom Penh, which it exercises via its NagaWorld complex (pictured).

The subscriber had been previously identified as with ChenLipKeong Fund Ltd, an investment holding company directly and wholly-owned by an entity linked to the Sakai Trust, a family trust established by the casino firm’s founder, the late Chen Lip Keong.

🇲🇾 Moody’s downgrades Genting group, cites increased debt, slower earnings recovery (GGRAsia)

Moody’s Ratings on Monday lowered the rating of Malaysia-listed conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) to ‘Baa3’ from ‘Baa2’, with a ‘stable’ outlook, citing increased debt and slower earnings recovery for the group.

The rating of Genting Overseas Holdings Ltd, which is the holding entity for the parent’s stake in Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY), was also cut by one notch to ‘Baa3’.

Genting Singapore Ltd, operator of Resorts World Sentosa in Singapore, was downgraded to ‘Baa1’ from ‘A3’, also with a ‘stable’ outlook.

The downgrades were announced after Moody’s placed the group on review in October due to what it said were constraints regarding Genting Bhd’s “weaker credit quality”.

🇲🇾 Genting, two other bidders approved for downstate New York full casino licences (GGRAsia)

The New York State Gaming Commission voted on Monday to award full casino licences to three sets of investors, paving the way for New York City’s first Las Vegas-style casino resorts.

Genting New York LLC, a unit of global casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF), is among the companies awarded a casino licence for downstate New York, in the United States.

The Genting group affirmed last month that the Resorts World New York City complex (pictured) in the borough of Queens – currently offering electronic gaming – could become a fully-fledged casino and “begin operations as early as March 2026”.

🇲🇾 Genting Bhd and some gaming units are tagged outlook-negative, on elevated spending, risk appetite: S&P Global (GGRAsia)

S&P Global Ratings revised on Wednesday to ‘negative’ the respective outlook on Malaysia-listed conglomerate Genting Bhd and its gaming subsidiaries Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF), Genting New York LLC, and Resorts World Las Vegas LLC.

The institution said their credit quality could be weakened over the next two to three years, amid committment to high capital expenditure and other “growth priorities”.

“We estimate the (Genting) group’s total capex (capital expenditure) in 2026 will be double the MYR6 billion (US$1.47 billion) in 2025, and much higher than the MYR4.3 billion in 2024,” said the ratings house.

S&P added: “We expect capex to remain above MYR8 billion annually through 2030.”

🇲🇾 Genting says first phase of expanded NYC complex to launch in 2Q of 2026 (GGRAsia)

Casino group Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) says it expects to open the first phase of the expansion of its Resorts World New York City (RWNYC) complex by “the second quarter of 2026”.

The RWNYC property (pictured) in Queens, New York City, is currently an electronic gaming venue. It would be upgraded and expanded as a full-scale casino resort.

The New York State Gaming Commission voted on Monday to award full casino licences to three sets of investors for downstate New York, including to Genting New York LLC, a unit of Genting Malaysia.

Genting New York’s proposal entails a US$5.5-billion expansion up to 2030 of the existing venue, and a US$600-million upfront licence fee, in exchange for a 30-year licence.

🇵🇭 PhilWeb says owner’s 58pct stake to be transferred in two tranches (GGRAsia)

Philippines-listed gaming technology provider PhilWeb Corp (PSE: WEB) says its majority shareholder, Gregorio Araneta Inc, has signed an amended share purchase agreement regarding sale of the latter’s entire stake in PhilWeb. The transaction will now be effected in two tranches.

In October, PhilWeb announced that Gregorio Araneta Inc had agreed to sell its entire stake in PhilWeb for a total consideration of PHP1.80 billion (US$30.5 million currently), equivalent to 829.57 million common shares at PHP2.17 apiece.

The buyers were identified as Philippines-based Nexora Holdings Inc and Velora Holdings Inc. Both firms were described in PhilWeb’s disclosure as domestic holding companies that are not engaged in securities brokering.

🇵🇭 DigiPlus says its online GGR ‘steadily’ improving amid evolving regulation (GGRAsia)

Philippine-listed and licensed online gaming operator DigiPlus Interactive (PSE: PLUS) says it “continues to regain momentum” amid an evolving regulatory and competitive environment for the online gaming sector in the country.

Its momentum, the firm said in a Monday press release, has been “supported by disciplined execution and targeted operational initiatives” across the group’s digital gaming platforms.

In the Philippines, DigiPlus runs BingoPlus, described as the country’s first government-approved online bingo platform. It also operates ArenaPlus, a sportsbook, and GameZone, a platform for casual and arcade gaming.

🇵🇭 A Tender Offer for Asian Terminals by Maharlika Investment Corp (Philippines Sovereign Wealth Fund) (Asian Dividend Stocks) $

Maharlika Investment Corp. (MIC) announced its intentions to launch a tender offer for shares of Asian Terminals Inc (PSE: ATI).

This could accelerate the delisting of Asian Terminals from the Philippine Stock Exchange (PSE).

Tender offer price is 36 PHP. Upon completion, MIC is expected to hold approximately 11.2% of ATI’s outstanding common shares.

🇸🇬 Tech still most attractive bet by far for Singapore investors (The Asset) 🗃️

Sentiment aligns with global punters, AI optimism high, but accountability, transparency concerns remain

Singapore’s investment community is placing a strong bet on the technology sector, with 65% of professionals surveyed seeing it as the most attractive sector over the next three years – well ahead of the power and utilities sector, which came in second at 27%, followed by that of asset and wealth management at 22%, according to a recent survey.

This confidence aligns with global sentiment, where 61% of investment professionals say technology is two to three times as attractive as the next three sectors, finds PwC’s Global Investor Survey 2025, which also reveals that Singapore investors have concerns beyond growth in the tech sector as they want accountability, especially when it concerns artificial intelligence ( AI ).

🇸🇬 New Idea: Beng Kuang Marine Ltd. (HALVIO CAPITAL)

Beng Kuang Marine (SGX: BEZ) has undergone a complete business transformation over the past few years brought about from the CEO hired in 2021. What was once an over indebted loss making company that operated in the shipping/oil and gas sector has monetized under-utilized assets, cut costs, paid down debt and entered into business lines that offer predictable recurring contracts. All of this has led to a business that has compounded revenues at 22% over the last 5 years and has allowed BEZ to turn a sustainable profit. Based on todays stock price and the markets uncertainty of a slow down in the business this year, I believe you can purchase BEZ at 3x FCF with a strong net cash balance sheet and an investment property that provides downside protection.

🇸🇬 Haw Par Corporation Limited (smallvalue)

Family ownership, globally recognised brand, and unrecognised value.

Brief Summary: Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF) is a diversified company with exposure to healthcare, leisure, property, and stakes in United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) and UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF). Its flagship brand, Tiger Balm, provides stable cash flows and global recognition. Family-led management retains significant skin in the game, with the Wee family holding over 28% of the company. The company trades at roughly 10× earnings ex-cash, offering upside supported by conservative valuations and substantial family ownership. Despite recent market attention, Haw Par remains an undervalued opportunity within Singapore’s equity market.

🇸🇬 BitFuFu: A Misunderstood Crypto Stock Poised For A Breakout (Seeking Alpha) $ 🗃️

🇸🇬 Sea: Post-Correction Entry Point With Improving Fundamentals (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited: Growth At A Reasonable Price (Seeking Alpha) $ 🗃️

🇸🇬 Sea: Priced For Deterioration That Hasn’t Arrived (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited: Buy This Falling Knife – Compelling Upside Story Ahead (Seeking Alpha) $⛔🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Is Sea Limited Still a Growth Story or Value Trap? (The Smart Investor)

Once a regional tech powerhouse, Sea Limited (NYSE: SE) now sits at a crossroad. Can its core businesses reignite long-term growth, or is the stock becoming a value trap?

Built on three major businesses, namely E-Commerce (Shopee), Digital Financial Services (Monee), and Digital Entertainment (Garena), Sea has emerged as a technology powerhouse.

But its current position shouldn’t be taken for granted.

With intensifying competition, has Sea seen its best years?

🇸🇬 Grab 3Q-25 Earnings Report (Saadiyat Capital)

Superapp raises guidance

Grab Holdings Limited (NASDAQ: GRAB) delivered a strong third quarter of 2025, marked by accelerated growth in its core businesses and continued progress toward sustainable profitability. Group revenue grew 22% year-over-year to $873 million, slightly surpassing expectations, while on demand Gross Merchandise Value (GMV) which encompasses the Mobility and Deliveries segments surged 24% YoY to $5.8 billion. Bottomline wise, Grab remained profitable posting a net profit of $17 million for the quarter (up from $15 million a year ago). Adjusted EBITDA jumped 51% YoY to a record $136 million, marking the 15th consecutive quarter of sequential improvement in this profitability metric. This quarter’s results underscored the company’s successful execution of a strategy that balances growth with cost discipline. Grab’s leadership struck a confident tone on the earnings call, highlighting that the business is building a “more resilient, technology-driven platform for the long term” as its growth engine gains momentum.

Despite the strong headline numbers, market reaction was mixed.

🇸🇬 Year in Review: Best Performing Blue Chips Stocks for 2025 (The Smart Investor)

🇸🇬 Are These 3 Singapore Blue Chips Ready for a Year-End Rally? (The Smart Investor)

🇸🇬 The SGX Has Hit New Highs This Year. Is This the Start of 2026’s Dividend Boom? (The Smart Investor)

Singapore stocks are breaking new highs. Discover why easing rates, stronger blue chips and REITs could make 2026 a key year for dividend investors.

After years of slow, quiet trading, the Straits Times Index (STI) has broken into new all-time highs.

Blue chips such as DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel and Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF) are gathering strength.

Several major REITs, including Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, and CapitaLand Ascendas REIT (SGX: A17U / OTCMKTS: ACDSF), or CLAR, are showing early stabilisation after a rough two years.

A Market Finally Moving With Tailwinds Again

But Not Every Stock Will Win From Here

The Window to Prepare Is Opening Now

Join Us for the Free Webinar: 2026’s Dividend Opportunity

🇸🇬 Beyond Blue Chips: Boost Your Retirement Income With These Stocks (The Smart Investor)

Looking beyond DBS, OCBC, and Singtel? These three stocks deserve a spot on your watchlist.

Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF)

Boustead Singapore Limited, established in 1828, is Singapore’s oldest continuous business organisation.

Today, the Group operates four main divisions: Geospatial (Esri ArcGIS distribution across Asia Pacific), Real Estate Solutions (design-and-build and development management), Energy Engineering (process heater systems for oil and gas), and Healthcare (rehabilitative care solutions).

Credit Bureau Asia Ltd (SGX: TCU)

Credit Bureau Asia, or CBA, provides credit and risk information to banks, financial institutions, government bodies, and public agencies across Southeast Asia.

Every time a bank approves a loan or credit card in Singapore, Cambodia, or Myanmar, CBA’s data is likely involved.

United Hampshire US REIT (SGX: ODBU / OTCMKTS: UNHRF)

Get Smart: Quality over popularity

🇸🇬 3 Hidden Gem Dividend Stocks Rewarding Shareholders Quarterly (The Smart Investor)

🇸🇬 Special Dividends 2025: SGX Companies Paying Extra This Year (The Smart Investor)

Some SGX heavyweights are handing out special dividends in 2025 — here’s why SIA, ST Engineering and Singtel stand out for income-hungry investors.

Let’s see some companies rewarding shareholders with a special dividend: Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF), Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering, and Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel.

How to Evaluate a Special Dividend: Key Considerations

Company Snapshot & What Contributes to a 2025 Special Dividend

What It Means for Income Investors (Now and Going Forward)

How to Position a Portfolio Around Special Dividend Payout

What to Watch Out For — Warning Signals After Big Special Payout

Get Smart: Do Not Think That a Special Dividend is Guaranteed

🇸🇬 Is This the Best Time to Buy Singapore Bank Stocks for Long-Term Income? (The Smart Investor)

Singapore’s banks are posting record profits and strong dividends — but is now the right moment for long-term income investors to buy in?

Singapore’s banks, the trio of DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), and United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), reported their latest results for the third quarter of 2025 (Q3 2025) recently.

Save for UOB, the local banks reported resilient earnings for the quarter.

Only DBS has declared higher dividends for the first nine months of 2025 compared to a year ago.

Both OCBC and UOB still pay dividends, but their amounts were lower year-on-year.

Why Singapore Banks Are Income Powerhouses

The Case for Buying Now

The Case Against Buying Right Now

What Long-Term Income Investors Should Focus On

Are Singapore Banks Still a Buy for Long-Term Income?

Get Smart: Focus on What You Can Control

🇮🇳 Vedanta: NCLT Approval Unlocks Aluminium-Led Break-Up Value (Smartkarma) $

NCLT approval removes the key overhang, enabling Vedanta (NSE: VEDL / BOM: 500295)’s break-up and forcing valuation discovery across aluminium, zinc/silver, power and O&G.

Aluminium becomes the anchor, with falling costs and ~50% EBITDA share; zinc and silver provide resilient cash flows and downside protection.

Intrinsic SOTP ₹1,020–1,050/share implies ~78–83% upside from CMP ₹572; execution-weighted 12-month TP ₹770 offers ~35% upside with downside protected even under stressed aluminium prices.

🇮🇳 The Beat Ideas: Sequent Scientific Merger – CDMO Optionality with Margin Upside (Smartkarma) $

The NCLT has approved the SeQuent Scientific Ltd (NSE: SEQUENT / BOM: 512529)–Viyash merger. The 56:100 swap ratio consolidates two Carlyle-backed entities into an INR 8,000 Cr+ Life Sciences platform.

The injection of Viyash’s 9 USFDA facilities and 28% EBITDA margin profile structurally repairs Sequent’s historical profitability issues, creating a diversified CDMO + Animal Health entity.

With pro-forma EBITDA running at INR 760 Cr (Annualized) and a management upgrade via Dr. Hari Babu (Ex-Mylan COO), the stock is primed for a re-rating if execution holds.

🇮🇳 The Beat Ideas on GE Vernova T&D: Khavda HVDC Win Powers the Next Growth Phase (Smartkarma) $

GE Vernova T&D India Ltd (NSE: GVT&D / BOM: 522275) has secured a landmark HVDC-VSC order for the Khavda-South project, materially improving multi-year revenue visibility.

The win reinforces GVT&D’s positioning in India’s grid transformation, strengthens backlog to record levels, and supports sustained earnings growth through FY28.

With HVDC, grid digitalization, and capex acceleration aligned, GVT&D remains a high-quality transmission compounder with incremental upside optionality.

🇮🇳 Reliance Industries: India’s GDP in a Single Stock? (Smartkarma) $

Reliance Industries Limited (NSE: RELIANCE / BOM: 500325) mirrors India’s economic pulse, integrating energy, retail, and digital sectors to drive consumption, industrial growth, and widespread digital adoption across the nation.

Q2FY26 delivered robust double-digit growth with revenue up ten percent, driven by strong consumer business momentum and a sharp recovery in fuel refining margins.

Future growth is contingent on scaling New Energy gigafactories, monetizing 5G and AI investments, and executing the planned listing of retail and digital consumer businesses.

🇮🇳 TCS Analyst Day Takeaway: The AI Transformation (Smartkarma) $

Tata Consultancy Services (NSE: TCS / BOM: 532540) achieved $1.5 billion in annualised AI revenue with 16.3% QoQ growth, significantly outperforming traditional service segments and signaling a successful transition to AI-led growth.

The company implemented a five-level “Human + AI” service autonomy model, progressing from simple tools to self-learning “Agentic Enterprises” to modernize global service delivery.

TCS launched HyperVault for gigawatt-scale AI data centers and reskilled 580,000+ employees, positioning itself as a full-stack orchestrator in the global AI ecosystem.

🇮🇳 The Beat Ideas: Raymond’s Engineering Rebirth- The Aerospace & Defence Leap? (Smartkarma) $

The latest results reveal strong double-digit growth in the newly separated Engineering business, confirming the strategic shift toward high-precision manufacturing in Aerospace & Defence and Auto Components.

Successful completion and initial performance validation of the demerger process transforms Raymond Ltd (NSE: RAYMOND / BOM: 500330) into two pure-play, specialized manufacturing entities poised to capitalize on global “China + 1” and Indian aerospace tailwinds.

The structural re-rating thesis remains firmly intact, driven by accelerating margins in the Aerospace vertical and long-term contract visibility.

🇮🇳 The Beat Ideas: SBI Cards – Is the Worst Now Behind Us? (Smartkarma) $

(SBI Cards and Payment Services Ltd (NSE: SBICARD / BOM: 543066))

Q2FY26 witnessed sequential NIM stability at 11.2%, but the adverse product mix shift toward transactors, coupled with higher operating costs, led to a lower pre-provision operating profit and PAT.

The company is actively sacrificing immediate yield for better asset quality and volume growth through RuPay/UPI integration, addressing key regulatory and positioning itself to capture theTier II-III consumption base.

If the stabilization of funding costs and the anticipated moderation of credit costs materialise, the premium valuation may be justified by renewed focus on higher-yielding revolving assets.

🇮🇳 The Beat Ideas on GMR Airports: Soaring to New Heights with Record Traffic and Strong Growth (Smartkarma) $

(GMR Airports Infrastructure (NSE: GMRINFRA / BOM: 532754))

November 2025 traffic hit a record ~11.1 million passengers, up ~7.4% YoY (ex-Cebu). Delhi led with 7.3 million passengers and its highest-ever monthly passenger and aircraft movement volumes.

Traffic has normalized post infrastructure disruptions. Broad-based growth across Delhi and Hyderabad, alongside ~2.7% YoY YTD international growth, improves visibility on aero and non-aero revenue expansion into FY26–27.

Focus shifts from recovery to sustainable compounding, led by Delhi and Hyderabad, where domestic scale and rising international connectivity act as structural growth multipliers.

🇮🇳 Milky Mist IPO: A Bet on New Age & Value Added Dairy Products (Smartkarma) $

Milky Mist plans an IPO with a INR 17,850 million fresh issue to reduce debt, expand manufacturing capacity, strengthen cold-chain infrastructure, and support growth in value-added dairy and RTE/RTC segments.

Leadership in branded paneer, strong revenue momentum, and rising demand for value-added dairy products position the company to improve margins, strengthen its balance sheet, and scale operations efficiently.

Supported by favorable industry trends, a strong brand, and disciplined capital deployment, Milky Mist is well positioned for sustained growth in India’s premium dairy and convenience food market.

🇮🇳 AceVector Ltd Pre-IPO Tearsheet (Smartkarma) $

AceVector Ltd (3673145Z IN) (AVL) is looking to raise about US$100m in its upcoming India IPO. The deal will be run by IIFL and CLSA.

AVL is a digital commerce ecosystem comprising (i) Snapdeal, a value-focused lifestyle e-commerce marketplace, (ii) Unicommerce, an e-commerce enablement SaaS platform, and (iii) Stellaro Brands-an omnichannel consumer brands retailing business.

Together, these businesses cover the entire e-commerce value chain across B2C and B2B segments catering to multiple stakeholders vertically- through both online and offline modes and horizontally.

🇰🇿 Kaspi Investment Thesis Statement (Schwar Capital Research)

(KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS))

New Addition to the SCRai

Here is a business growing revenues at 20%+ annually, generating net income margins north of 25%, and trading at just 6x forward earnings. The market appears to be mispricing what is, in my view, one of the highest-quality Super App ecosystems outside of China.

My investment thesis rests on three key pillars:

Self-reinforcing ecosystem moat creates powerful flywheel effects across Payments, Marketplace, and Fintech.

Multiple growth vectors including international expansion, advertising monetisation, and e-Grocery provide runway for years of compounding.

Market misprices temporary headwinds as structural risks – 6x forward earnings drastically undervalues this business in my opinion.

🇰🇿 Kaspi (KSPI): 9 updates for the end of 2025 (Stock Doctor)

🇮🇱 Teva’s ($TEVA) “Pivot to Growth”: Moving from fiction to nonfiction (Kontra Investments)

A unique margin story make Teva Pharmaceutical Industries Ltd (NYSE: TEVA) a hidden biopharma gem.

For years, the investment narrative around Teva Pharmaceuticals was dominated by a single, heavy concept: debt. The world’s leading generics manufacturer seemed shackled by its balance sheet and a business model fighting against deflationary pricing pressure. For many on Wall Street, Teva was a “show me” story that had stopped showing up.

But if you haven’t looked at Teva since CEO Richard Francis initiated the “Pivot to Growth” strategy, you are looking at a ghost. The company that exists today is fundamentally different in structure, strategy, and financial health. And as we will see further down, Wall Street is coming around to that realization.

🇦🇪 Analysts bullish on Wynn Resorts’ UAE project after site check (GGRAsia)

A number of brokerages raised their stock-price target for global casino operator Wynn Resorts Ltd (NASDAQ: WYNN) following a visit to the under-construction Wynn Al Marjan Island casino resort (pictured in a rendering) in the United Arab Emirates (UAE).

The casino group, parent of Macau casino concessionaire Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF), held on December 4 an analyst and investor tour to the UAE, to discuss the market there, and to see the Wynn Al Marjan Island project.

Wynn Resorts is a 40-percent equity investor in the project. The other partners are Marjan LLC and RAK Hospitality Holding LLC.

🇦🇪 Wynn Al Marjan could be ‘largest payer of fees’ to Wynn Resorts: CBRE

The under-construction Wynn Al Marjan Island casino resort (pictured in a rendering), in the United Arab Emirates (UAE), could become a “meaningful source of cash” for global casino operator Wynn Resorts Ltd (NASDAQ: WYNN), suggested CBRE Equity Research in a Tuesday memo.

U.S.-based Wynn Resorts, parent of Macau casino concessionaire Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF), is building the Wynn Al Marjan Island property on an artificial island in Ras Al Khaimah, part of the UAE federation. The site is 50 minutes by road from Dubai International Airport.

Wynn Resorts is a 40-percent equity investor in Wynn Al Marjan Island. The other partners are Marjan LLC and RAK Hospitality Holding LLC. The casino firm will also receive management and licence fees.

🇿🇦 Prosus: Turning Tencent Dividends Into Global Growth Engines (Seeking Alpha) $ 🗃️

🇵🇱 Allegro.eu S.A. (ALEGF) Q3 2025 Sales/ Trading Statement Call – Slideshow (Seeking Alpha)

🇵🇱 InPost S.A. (The Compounder Score) (The Cash Flow Compounder)

Does the company disrupting worldwide delivery deserve a place in your portfolio?

InPost SA (AMS: INPST / LON: 0A6K / FRA: 669) is a Polish logistics company that has revolutionized the “last-mile” delivery for e-commerce, by building the largest network of Automated Parcel Machines (APMs). The company’s core business involves contracting with e-commerce merchants to use this network as a more cost-effective alternative to traditional delivery. These terminals are strategically placed in high-footfall areas, allowing consumers to pick up, send, or return packages using a mobile app.

This model is economically superior because a single courier stop at an APM can successfully deliver dozens of parcels in minutes, drastically reducing delivery costs and virtually eliminating failed deliveries. In Poland, nearly one in two e-commerce parcels now goes through an InPost locker, showcasing deep consumer adoption.

Let’s analyze the company by using The Compounder Score:

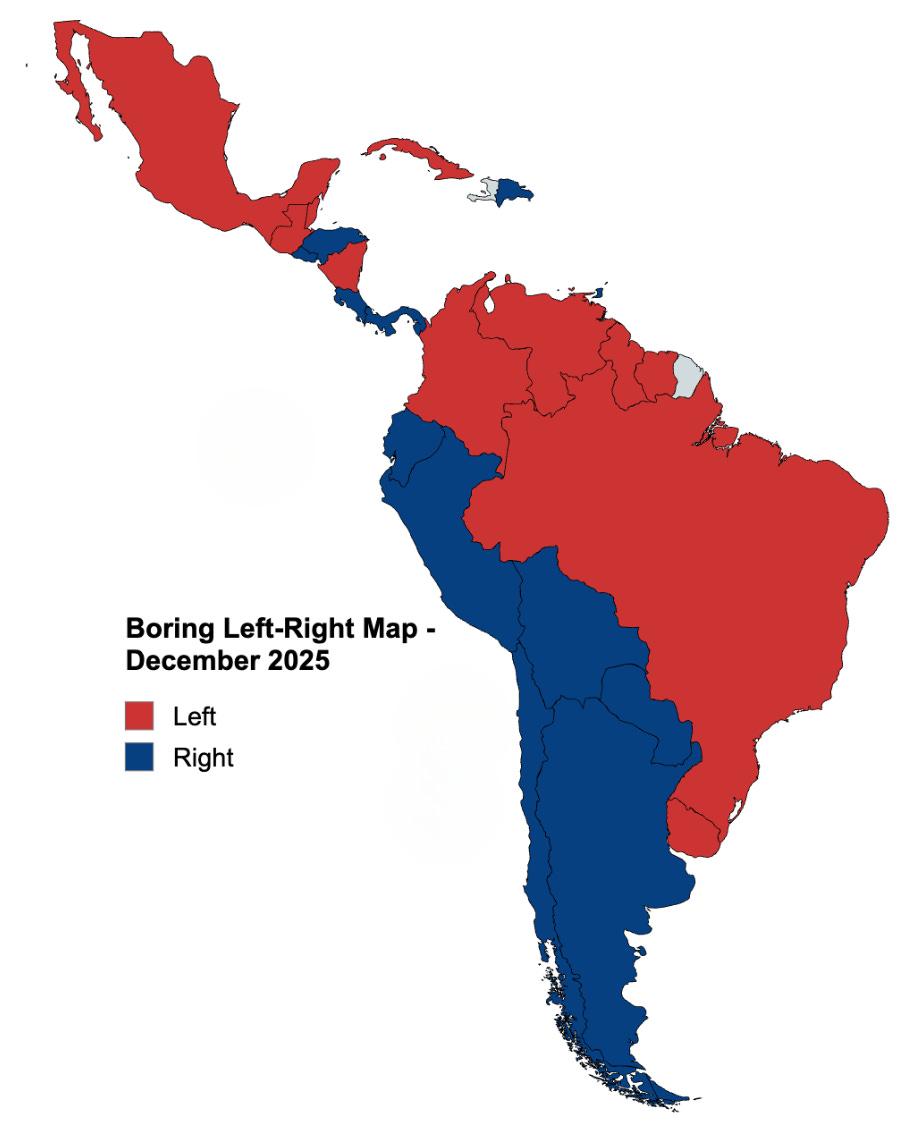

🌎 Mapping the region’s ideological landscape – December 2025 (Latin America Risk Report)

media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png" width="1036" height="1158" data-attrs=""src":"https://substack-post-media.s3.amazonaws.com/public/images/d6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png","srcNoWatermark":null,"fullscreen":null,"imageSize":null,"height":1158,"width":1036,"resizeWidth":null,"bytes":null,"alt":null,"title":null,"type":null,"href":null,"belowTheFold":true,"topImage":false,"internalRedirect":null,"isProcessing":false,"align":null,"offset":false" alt="" srcset="https://substackcdn.com/image/fetch/$s_!YR53!,w_424,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 424w, https://substackcdn.com/image/fetch/$s_!YR53!,w_848,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 848w, https://substackcdn.com/image/fetch/$s_!YR53!,w_1272,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 1272w, https://substackcdn.com/image/fetch/$s_!YR53!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 1456w" sizes="auto, 100vw" loading="lazy" class="sizing-normal"/>

media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png" width="1036" height="1158" data-attrs=""src":"https://substack-post-media.s3.amazonaws.com/public/images/d6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png","srcNoWatermark":null,"fullscreen":null,"imageSize":null,"height":1158,"width":1036,"resizeWidth":null,"bytes":null,"alt":null,"title":null,"type":null,"href":null,"belowTheFold":true,"topImage":false,"internalRedirect":null,"isProcessing":false,"align":null,"offset":false" alt="" srcset="https://substackcdn.com/image/fetch/$s_!YR53!,w_424,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 424w, https://substackcdn.com/image/fetch/$s_!YR53!,w_848,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 848w, https://substackcdn.com/image/fetch/$s_!YR53!,w_1272,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 1272w, https://substackcdn.com/image/fetch/$s_!YR53!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd6461246-3065-4cf5-ac4c-e27aac647d90_1036x1158.png 1456w" sizes="auto, 100vw" loading="lazy" class="sizing-normal"/>🌎 Conservative Kast’s victory in Chile suggests a hard-right, pro-Trump surge across Latin America (AP)

🌎 MercadoLibre: Strong Fintech Upside In 2026 (Seeking Alpha) $ 🗃️

🌎 Deep Dive Brief: Deconstructing Mercado Libre’s Optionality – Part III (Expanse Stocks)

Sizing a Multi-Decade Opportunity in Latin America’s Digital Transformation

At a $100+ billion market cap, MercadoLibre (NASDAQ: MELI) has become one of the most valuable companies in Latin America. The question is whether the addressable market opportunity can support a bigger market cap over the next decade and if so, how much bigger? After digging into the numbers, I think the answer might surprise you.

Let’s go deeper into this third and final part of the Meli’s trilogy, the seventeenth edition of the Expanse Stocks’ Deep Dive Brief series:

🌎 MercadoLibre’s Optical Illusion: The Zero-CAC Flywheel & The Friday Gap (CapexAndChill)

Why Wall Street is misreading the 9.8% margin compression, and how empty trucks on Fridays are fueling a Zero-CAC credit flywheel.

The market is getting MercadoLibre (NASDAQ: MELI)’s MELI -1.26%↓ Q3 wrong. Everyone is fixating on the operating margin dropping to 9.8% and freaking out. It’s a classic knee-jerk reaction from Wall Street observers who are conditioned to favor short-term profits over long-term dominance.

If you actually dig into the filings, the shareholder letter, and CFO Martin de los Santos’s comments, you’ll see that this margin compression isn’t because MELI is getting sloppy. It’s not operational inefficiency. It is the deliberate price tag of building the biggest competitive moat in the history of emerging markets.

The real story this quarter isn’t just the 39% revenue growth to $7.4 billion (though that is huge). The real story is the engineering behind it. MELI is playing a game of internal arbitrage. They are using their commerce dominance to get credit card users for free. They are using empty space in trucks to ship cheap items for free. They are using fintech to fix a broken cash economy.

🇦🇷 Milei’s ‘chainsaw’ minister pushes major reforms for 2026 (FT) $ 🗃️

🇦🇷 IRSA: Monetizing Ramblas (Seeking Alpha) $ 🗃️

🇦🇷 Argentina raises $1bn in dollar debt sale as Milei plots return to global markets (FT) $ 🗃️

Domestic-law sale paves way for serial defaulter to tap international investors next year

Argentina is on Wednesday selling domestic dollar debt for the first time since its 2020 restructuring, marking a milestone for Javier Milei’s government as it plots a return to global bond markets next year.

🇦🇷 Argentina to loosen currency exchange rate band in January (FT) $ 🗃️

Changes aim to build reserves and quell investor concern about President Javier Milei’s economic policy

The monetary authority said in a statement on Monday that starting January 1 it would expand the upper and lower limit of the peso’s exchange rate band each month according to the previous month’s inflation rate, rather than by 1 per cent a month as under the current system.

🇧🇷 Can Brazil’s grid keep up with its clean energy boom? (FT) $ 🗃️

🇧🇷 Petrobras: Cheap, Profitable, And Increasingly Political (Seeking Alpha) $ 🗃️

🇧🇷 COPEL: A Huge Potential, Discounted In The Price (Seeking Alpha) $ 🗃️

🇧🇷 Atlas Lithium At A 2026 Inflection Point (Seeking Alpha) $ 🗃️

-

🇧🇷 Atlas Lithium Corporation (NASDAQ: ATLX) – Exploration projects for lithium & other battery minerals in Brazil + nickel, rare earths, titanium, graphite, gold, diamond & industrial sand.

🇨🇱 Banco De Chile: New Government And Better Economic Outlook Make Me Bullish (Seeking Alpha) $ 🗃️

🇲🇽 Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (VLRS) Grupo Viva Aerobus, S.A. de C.V. – M&A Call – Slideshow (Seeking Alpha)

🇲🇽 Volaris: Stock Has Recovered, But Macro Headwinds Remain (Downgrade) (Seeking Alpha) $ 🗃️

🇲🇽 Wal-Mart De Mexico: More Than Holding Its Own, But Margins Remain A Concern (Seeking Alpha) $ 🗃️

🌐 The Future Fund #1: Research Article & Investment Thesis On Nebius (The Clarity Briefing)

Long Format to Explain the Business, the Opportunity and its Position in the Data Center / AI Race

The inevitability, once explained: A spinoff from Russian tech giant Yandex has emerged as Europe’s most formidable AI infrastructure player, capturing multi-billion dollar contracts with Microsoft and Meta while executing a capital-intensive expansion that could reshape the global compute landscape. Nebius Group NV (NASDAQ: NBIS) isn’t simply renting NVIDIA’s GPUs, Nebius is architecting the physical and economic substrate upon which the next decade’s intelligence will run.

Let me break down for you the whole picture.

🌐 A Modern Railroad in Disguise (slo capital)

At first glance, Nebius Group NV (NASDAQ: NBIS) appears to be a tangle of geopolitical “hair”, a Dutch holding company born from the divestiture of Yandex, the so called “Russian Google.” Many investors stop reading there. Their reluctance is our advantage. By refusing to dig through the debris of the spin off, they are missing one of the most compelling “Special Situations” I have encountered in years.

Nebius is no longer a search engine. It has shed its skin to become a pure-play infrastructure business, a “neo-cloud” building the physical railroads of the artificial intelligence era.

Here is why we are buying.

🌐 Nebius: This Is A Once-In-A-Generation Opportunity To Purchase An Excellent Company At A Bargain Price (Seeking Alpha) $ 🗃️

🌐 Nebius: H1 2026 Melt-Up, H2 2026 Consolidation, 2027 Unwind (Rating Downgrade) (Seeking Alpha) $ 🗃️

🌐 Nebius: The Only Hyperscaler Worth Buying Right Now (Seeking Alpha) $ 🗃️

🌐 Nebius Epitomizes What’s Wrong With Extremely High-Risk Hyper-Growth Investing (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

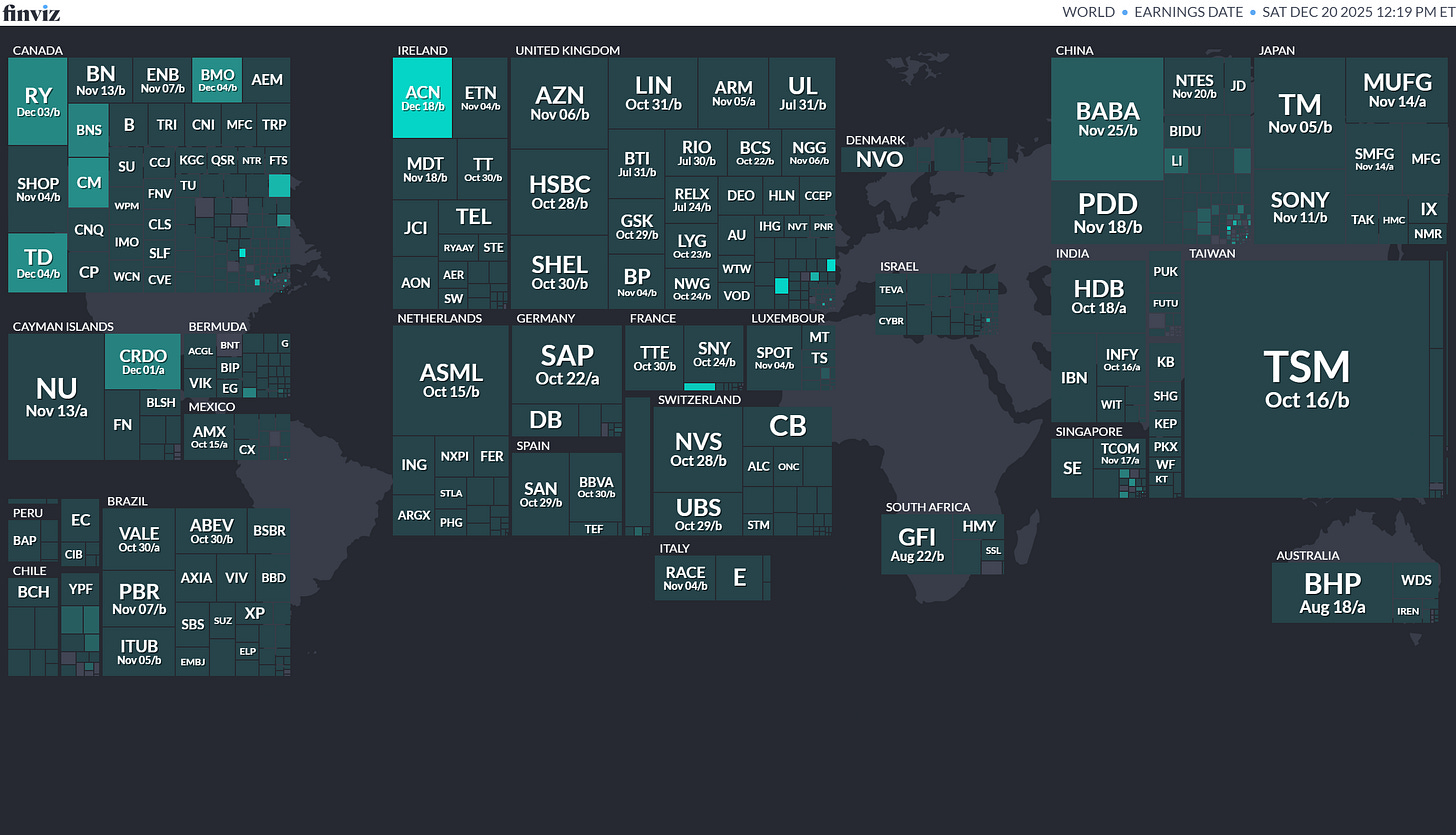

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

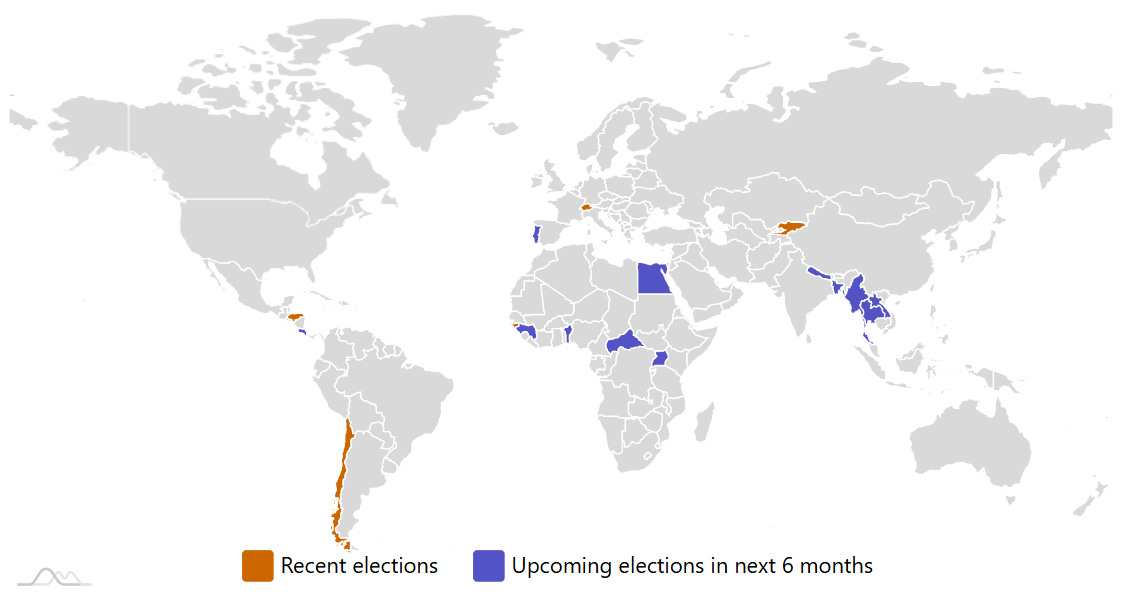

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

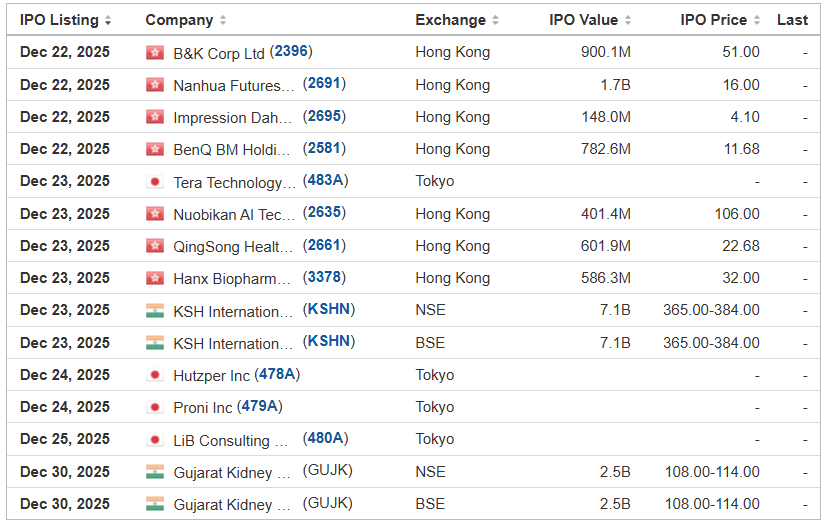

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

DT House Ltd. DTDT American Trust Investment Services, 2.0M Shares, $4.00-5.00, $9.0 mil, 12/22/2025 Week of

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.

In June 2024, we commenced our travel-related services by acquiring UFox. UFox is a company principally engaged in travel-related services in the UAE, with the particular emphasis of eco-friendly and sustainable travel practices. UFox maintains close business relations with various organizations in the MENA Region such as the Union of Overseas Chinese in Saudi Arabia. We believe that our travel-related services could potentially bring about a synergistic effect with our corporate consultancy services if we follow the same set of ESG principles in both segments. Our current plan is to design travel programs based on the sustainable travel concept, such as alternative transport modes with lower carbon footprints and partnering with eco-friendly hotels. Knowledge and experience gained from our design of travel programs would be useful when we develop sustainable travel policies for our corporate consultancy services clients. The cross-over between low carbon footprint travel programs and sustainability business practices would reduce the average development costs of our projects. It also broadens the scope and strengthen the quality of our consultancy in fostering responsible and impactful ESG business strategies and practices for our corporate customers. Through UFox, we started to provide travel-related services for leisure travelers in the UAE. We offer segmented travel-related services to our customers, which includes primarily the sale of tourism attractions tickets. The destinations of the travel-related services offered by us are primarily within the UAE. We offer customizable hassle-free sustainable travel experience to customers. Customers can choose to customize their own tours depending on their demands and requirements and subscribe to services on segmented basis. Currently, we only have limited business activities of travel-related services due to our short operating history of several months in this sector. The major customers of our travel-related services are two online leisure travel platforms, namely, Trip.com Group Limited (Nasdaq: TCOM) and Fliggy international platform (fliggy.com, a member of Alibaba Group (NYSE: BABA) and an online marketplace of tourism products) that connect us with independent travelers for the sales and marketing of our travel products and services. Other customers of ours include travel companies, travel agencies, tour operators, booking agents, as well as other corporations and institutes, which currently contribute an insignificant portion of our revenue from travel-related services. In the future, we hope to expand the clientele of this segment to include retail leisure travelers and clients from our corporate consultancy services, and the scope of this segment to include other types of travel-related services, such as airfreight ticketing, tour guiding, hotel booking and transportation booking, and arrangement of packaged tours.

Note: Net income and revenue are for the year that ended Sept. 30, 2024.

(Note: DT House Ltd. increased its IPO’s size to 2.0 million shares – up from 1.875 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its most recent F-1/A filing. DT House Ltd. has also named American Trust Investment Services as the sole book-runner, replacing Revere Securities. Background: DT House Ltd. filed its F-1 on March 3, 2025, and disclosed the terms for its IPO: The company is offering 1.875 million shares at a price range of $4.00 to $5.00 to raise $8.44 million, if priced at the mid-point of its range.)

ELC Group Holdings Ltd. ELCG D. Boral Capital (ex-EF Hutton), 1.9M Shares, $4.00-6.00, $9.4 mil, 12/22/2025 Week of

(Incorporated in the Cayman Islands)