Emerging Market Links + The Week Ahead (December 25, 2023)

Air Cargo carriers appear to be the winner in the growing conflict in the Red Sea and they are also benefiting from the West’s growing love for eCommerce sites Shein and Temu. In addition, the Yuan has unseated the Yen to rank #4 for global payments while China’s stock market (the world’s worst-performing major market) leave many high-quality and high-yielding stocks trading at bargain valuations.

Finally, and while Argentina has been grabbing recent headlines about Latin America, Chileans have rejected another attempt (this time from the country’s Right) to rewrite their Pinochet era constitution. It remains to be seen whether or not both the Left and the Right will can just move on or focus their attention on tweaking the existing Constitution which has served the country (and investors) well.

$ = behind a paywall / 🗃️ = Archived article

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 U.S. chipmaker Qorvo sells China facilities in supply chain revamp (Caixin) $

American chipmaker Qorvo (NASDAQ: QRVO) has agreed to sell its assembly and test facilities in China to contract manufacturer Luxshare Precision Industry (SHE: 002475), amid a broader supply chain revamp of the U.S. semiconductor industry.

Qorvo has reached a definitive agreement with the Chinese company Luxshare to sell operations and assets of Qorvo’s two facilities in Beijing and Dezhou, Shandong province, said the wireless connectivity chip manufacturer in a Monday statement. The sale includes the property, plant and equipment, as well as the existing workforce to allow operations to continue.

🇨🇳 (Meituan (3690 HK, BUY, TP HK$118) Company Update): Why ByteDance’s Purchase of Eleme Is a Bad Idea? (Smart Karma) $

Local news reported an unnamed expert suggesting ByteDance might be buying Eleme for US$7bn, leading to share of Meituan (SEHK: 3690) to fall;

While we believe (1) buying a food delivery business to complement Douyin’s in-store business makes some sense and…

(2) ByteDance has been aggressive in pushing the boundary of its businesses, an entry into domestic food delivery is a daunting challenge that yields very little benefits for ByteDance;

🇨🇳 Dada Nexus rides closer to JD.com’s orbit with management shakeup (Bamboo Works)

The intra-city delivery company named a new chairman and CFO, both with close ties to JD Logistics

Dada Nexus (NASDAQ: DADA) has appointed two JD Logistics (HKG: 2618 / OTCMKTS: JDLGF) veterans as its new chairman and CFO, hinting at closer integration between the two companies

The intra-city delivery company has become more integrated with JD.com (NASDAQ: JD) since JD boosted its stake in Dada Nexus to 52% last year from a previous 47%

🇨🇳 RoboSense steers tricky course in self-drive tech market (Bamboo Works)

China’s leading LiDAR company, Hesai Group (NASDAQ: HSAI), listed its shares in the United States earlier this year and now one of its key competitors, RoboSense Technology Co. Ltd., is on track to become the first auto sensor specialist to make its debut on the Hong Kong Stock Exchange.

Can a Hong Kong listing help the maker of LiDAR automotive sensors break out of a cycle of rising sales but mounting losses?

The sensor technology firm’s losses have widened over the past three years, reaching 2.09 billion yuan last year

Gross margins are narrowing and last year spiraled to minus 7.4%, hit by price pressure from automakers

🇨🇳 REPT BATTERO Energy IPO Trading – Needs to Correct by 20-30%, at Least (Smart Karma) $

REPT BATTERO Energy (HKG: 0666) raised around US$270m in its Hong Kong IPO.

REPT is a lithium-ion battery manufacturer in China, focusing on R&D, production, and sales of EV/ESS lithium-ion battery products such as battery cells, modules and packs.

We have covered various aspects of the deal in our previous note. In this note, we will talk about the demand and trading dynamics.

🇨🇳 Miniso’s Share Repurchase Program Will Likely Help The Stock Find Stability After Its Recent Selloff (Seeking Alpha) $

See: MINISO Group Holding (NYSE: MNSO): Asia’s Notorious Copycat Retailer

MINISO Group Holding (NYSE: MNSO) has the potential for a rebound if it defends the critical 18.5 neckline area.

Founder Guofu Ye’s transactions are likely to significantly influence the stock price.

Miniso’s strong supply chain, retail partner model, and product differentiation strategy contribute to its growth and outperformance.

🇨🇳 WuXi Bio prescribes share buyback to relieve revenue pain (Bamboo Works)

The pharma services provider has shocked investors with a steep downward revision of its earnings outlook, slashing its full-year revenue growth forecast to just 10% from an initial 30% and predicting a profit drop

After its shares plunged more than 30% in a week, Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF) announced a buyback of 10% of its shares, saying the battered price did not reflect the company’s value or business prospects

The company blamed the weaker revenue outlook on a financing slowdown in the biopharma industry and regulatory delays in launching star drugs

🇨🇳 HBM gets health boost from drug licensing deals (Bamboo Works)

The biopharma company has marked out a path to profitability by licensing its drug expertise and antibody platforms to partners such as Pfizer

Nona Biosciences, a subsidiary of HBM Holdings (HKG: 2142 / FRA: 6XY / OTCMKTS: HBMHF), has struck a licensing-out deal with a Pfizer-owned biotech for an initial sum of $53 million and milestone payments of up to $1.05 billion

HBM Holdings boosted its revenue by 48% in the first half of this year through licensing-out partnerships and by providing R&D services

🇨🇳 Li Ning buys Hong Kong building for overseas expansion, flipping out investors (Bamboo Works)

The sportswear brand is paying $283 million for a North Point area building that will become headquarters for its non-Mainland operations

Shares of Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF) tumbled 14% after it announced its purchase of a Hong Kong building to become its headquarters outside Mainland China

The purchase will lay the groundwork for the sportswear maker’s overseas expansion, which it intends to officially launch in 2024.

🇨🇳 KFC plucks up major milestone with 10,000th China store opening (Bamboo Works)

The chain launched its latest store in the city of Hangzhou 36 years after becoming the first Western fast food operator in China

KFC (YUM China (NYSE: YUMC)) has opened its 10,000th China store in Hangzhou, and plans to accelerate net new openings to about 1,200 annually over the next three years

The chain has bounced back strongly post-pandemic, but faces uncertainties due to growing Chinese consumer caution

🇨🇳 Midea (000333 CH): Positive Read-Through From Gree’s Profit Alert (Smart Karma) $

Gree Electric Appliances (SHE: 000651) announced a profit alert for FY22 yesterday. Net profit is expected to increase 10.2% – 19.6% yoy for the whole year.

The resilient result of Gree should alleviate concerns of the market that Midea is too correlated with China’s new home sales.

The stock is trading at 10x 2024E earnings compared to an average of 13x over the last 10 years, with earnings likely growing at a high-single-digit pace.

🇨🇳 Hywin undermined in the shadows of China’s real estate slump (Bamboo Works)

Some products distributed by the real estate-focused wealth management company may be having trouble paying promised returns

Hywin Holdings Ltd (NASDAQ: HYW) said it was dealing with “redemption issues” over some asset-backed products it distributed, sparking a massive selloff of its shares

The company traditionally relied heavily on real estate-linked wealth management products, but has been trying to move into other businesses like healthcare services

🇹🇼 Asian Dividend Gems: O-Ta Precision Industry (Asian Dividend Stocks) $

O-TA Precision Industry (TSE: 8924) is a company based in Taiwan that mainly makes golf clubs for global golf equipment branded companies including Titleist, PXG, Mizuno, and Honma.

O-Ta Precision’s dividend yield averaged 9.2% annually from 2019 to 2022. Its annual dividend payout averaged 68.5% in the same period.

We like the company’s strong niche in the golf club OEM/ODM business with excellent list of customers with its its historically high dividend payout ratio and dividend yields…

🇰🇷 Taihan Electric Wire: Rights Offering of 50% of Outstanding Shares (Smart Karma) $

Last week, Taihan Electric Wire (KRX: 001440) announced a rights offering of 50% of its outstanding shares. The company is expected to raise 526 billion won.

Taihan Electric Wire is expected to use the rights offering proceeds to mostly expand its submarine cable production.

With the share price falling 21% since the announcement of the rights offering last week, Taihan Electric Wire looks more attractive.

🇰🇷 LG Display: Announces a Rights Offering Capital Raise of 1.36 Trillion Won (Smart Karma) $

LG Display (NYSE: LPL) announced today that it will conduct a rights offering capital raise worth 1.36 trillion won.

The rights offering capital raise involves 142 million shares, which represent 39.7% of its existing outstanding shares.

We believe this rights offering will have a negative impact on LG Display’s share price as it will significantly dilute existing shareholders.

🌏 There’s Something About Air Cargo (Smart Karma) $

FT article (West’s love for Shein and Temu drives ecommerce boom for air freighters) uncovers other contributors to surging air freight rates—Chinese online brands Temu and Shein are flooding Western nations with fast fashion and inexpensive e-commerce goods

The biggest beneficiaries are Chinese carriers with significant air cargo exposure, and Cathay Pacific (Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF)). This presents a potential catalyst for an earnings beat and a boost to the share price.

Carriers from Taiwan and South Korea will benefit from supply tightness to the U.S.. Logistics providers are unlikely to benefit much due to tight margins and volatile high freight rates

🇵🇭 Jollibee Foods: Positive Short-Term And Long-Term Prospects (Rating Upgrade) (Seeking Alpha)

Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY) is the leader in the Philippines’ quick service restaurant market with a 50% market share, and its Philippines business delivered a good +16.5% System-Wide Sales growth in Q3.

The company aims to have its international businesses contribute half of its sales in a couple of years’ time, and this seems achievable with its emphasis on franchising.

I raise my rating for Jollibee Foods to a Buy in view of its favorable outlook for the short term and long run.

🇸🇬 Raffles Medical Group’s Share Price is Near its 52-Week Low: Is the Healthcare Player a Bargain? (The Smart Investor)

The integrated healthcare player is going through a tough period but could see better earnings in the years to come.

Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF), or RMG, however, is reeling from the effects of a sharp drop in vaccinations and pandemic-related tests.

The integrated healthcare player saw its share price plunge to its 52-week low of S$1.01 recently before rebounding slightly.

With medical tourism recovering and its China hospitals edging closer to breakeven, it is a matter of time before the integrated healthcare player sees its profit heading higher.

🇸🇬 4 Singapore Stocks That Conducted Acquisitions to Grow Their Business (The Smart Investor)

These four companies recently announced acquisitions to expand their business.

Grand Venture Technology (SGX: JLB), or GVT, manufactures complex precision machining, sheet metal components, and mechatronics modules.

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF), or STE, is a technology, defence, and engineering group serving the aerospace, smart city, defence, and public security sectors.

Centurion Corporation Limited (SGX: OU8 / HKG: 6090) develops and manages purpose-built accommodation assets (PBSA) in Singapore and Malaysia as well as student accommodation assets in Australia, the UK, and the US.

Tiong Woon Corporation Ltd (SGX: BQM) is a one-stop integrated heavy lift specialist supporting the oil and gas, petrochemical, infrastructure, and construction sectors.

🇸🇬 5 Singapore Stocks That Could Benefit from a Semiconductor Recovery in 2024 (The Smart Investor)

With a recovery expected for the semiconductor sector next year, here are five stocks that could benefit.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), or MMH, designs and manufactures high-precision tools and parts used in the wafer fabrication and assembly processes in the semiconductor industry.

Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF) is a provider of technology products, services, and solutions.

Frencken Group Ltd (SGX: E28) provides original design, original equipment and diversified integrated manufacturing services to the analytical and life sciences, automotive, healthcare, industrial and semiconductor industries.

UMS Holdings (SGX: 558 / KLSE: UMS / OTCMKTS: UMSSF) provides equipment manufacturing and engineering services to original equipment manufacturers of semiconductors and related products.

AEM Holdings (SGX: AWX) offers comprehensive semiconductor and electronics test solutions and has a global presence spanning Asia, Europe, and the US.

🇮🇳 India’s assault on unsecured loans hits Paytm and other fintech companies (FT) $

Country’s central bank raises capital requirements in move to curb rising delinquencies

Since then, the shares of Paytm (One 97 Communications Ltd. (NSE: PAYTM / BOM: 543396)), one of India’s biggest fintech groups with a market capitalisation of Rs384bn ($4.6bn), have fallen more than 30 per cent, with Warren Buffett’s Berkshire Hathaway selling its 2.5 per cent stake in the company shortly after the RBI’s order.

🇸🇦 Saudi-backed fund hit as UAE oil storage Spac runs into trouble (FT) $

🇹🇷 🇷🇺 Turkish brewer to acquire AB InBev stake in Russian joint venture (FT) $

See: Anadolu Efes (IST: AEFES / FRA: EF41 / OTCMKTS: AEBZY): Bridging the East-West Divide With Beer & Soft Drinks

🇵🇱 Fantastic Fundamentals Text SA: The Fundamentals (Compounding Quality)

Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF) might have one of the healthiest Fundamentals I’ve ever seen.

The company has more cash than debt

A ROIC of more than 200% (!)

Translating 50% of its revenue in pure cash

🇵🇱 Asseco Poland: Large Buyback Makes Sense Considering Valuation (Seeking Alpha) $

Asseco Poland SA (WSE: ACP / LON: 0LQG / OTCMKTS: ASOZF) continues to generate strong organic growth and is undervalued, leading to a well-received buyback programme by us.

The company’s earnings showed growth on a constant currency basis, with both their directly managed businesses as well as Formula Systems demonstrating growth.

The dividend is quite high and growing. We put it on the watchlist.

🇦🇷 Dog catches Argentine car (FT) $

🇧🇷 SLC Agricola: A Solid Investment In Brazil’s Agribusiness For The Long Term (Seeking Alpha) $

SLC Agricola SA (BVMF: SLCE3) is a major player in Brazilian agribusiness, focusing primarily on soybeans, corn, and cotton, with strategic use of self-owned and leased lands.

The company utilizes joint ventures, leases lands, and operates SLC LandCo for real estate, showcasing adaptability and operational scalability.

Despite challenges in 2023, SLC Agrícola exhibits robust financials, boasting strong revenue growth, efficient cost management, and a solid financial position with low debt.

The outlook for Brazilian agribusiness in 2024 remains favorable, although concerns persist regarding logistics and climatic conditions.

With a diversified portfolio, competitive advantages, and a discounted valuation, SLC Agrícola presents an attractive long-term investment, despite short-term challenges and uncertainties.

🇧🇷 Neoenergia: Uncovering Hidden Value In Brazil’s Utility Sector (Seeking Alpha) $

Neoenergia (BVMF: NEOE3 / BME: XNEO / OTCMKTS: NRGIY), a Brazilian electricity company with a $5.12 billion market cap, boasts 88% renewable capacity, distinguishing itself in the energy sector.

Despite positive attributes, Neoenergia faces challenges, including high investments, regulatory complexities, and economic risks affecting profitability.

With a history of high indebtedness, Neoenergia’s financial outlook is influenced by Brazil’s interest rates, yet its strategic investments signal a positive trajectory.

Trading at a discounted valuation, Neoenergia presents an underfollowed and potentially undervalued gem in the Brazilian utility sector.

🇲🇽 Gruma Executing Well, But Sentiment And Margin Leverage Could Be More Challenging Soon (Seeking Alpha) $

Gruma SAB de CV (BMV: GRUMAB / FRA: 3G3B / OTCMKTS: GMKKY / GPAGF) has seen strong margin performance in 2023, helped by very strong pricing, stable costs, and innovative new retail products in the U.S. market.

2024 will likely be a more challenging year for the shares due to volatility in grain prices, labor costs, and more pressure on consumer prices, limiting margin leverage.

Ongoing expansion of the value-added portfolio can help support long-term revenue growth around 5% and higher dividend payouts over time.

Gruma may still have a place in defensive portfolios given the longer-term potential, but more opportunistic investors may want to wait for a better entry price.

🇵🇦 Copa Holdings’ Fundamentals Continue To Fly Higher (Seeking Alpha) $

Strong Buy: Copa Holdings (NYSE: CPA) (a leading Latin American provider of airline passenger and cargo service) is a compelling buy, supported by a thorough analysis of financial metrics and strategic expansion plans.

Substantial Upside: Two DCF models project a significant upside, with a fair value of $222.1, a 113.6% increase from the current stock price of $104.

Positive Projections: The first DCF forecasts a promising future, reaching $404.3 by 2028, translating into an outstanding annual return of 57.7%, with a conservative fair price projection of $140.9.

Comprehensive Analysis: Thorough scrutiny of Copa’s financial health positions it favorably for medium-term investment.

🇰🇾 Consolidated Water: Because Water May Be More Valuable Than Oil (Seeking Alpha) $

Water scarcity is a global issue, with projections indicating that 40% of the world’s population could be affected by 2035.

Consolidated Water Company Ltd (NASDAQ: CWCO), a Cayman Islands-based company, is tackling water scarcity through advanced water supply, treatment, and distribution systems.

CWCO has experienced significant growth, securing major contracts and achieving record revenue and income in 2023, with strong growth prospects for the future.

$ = behind a paywall

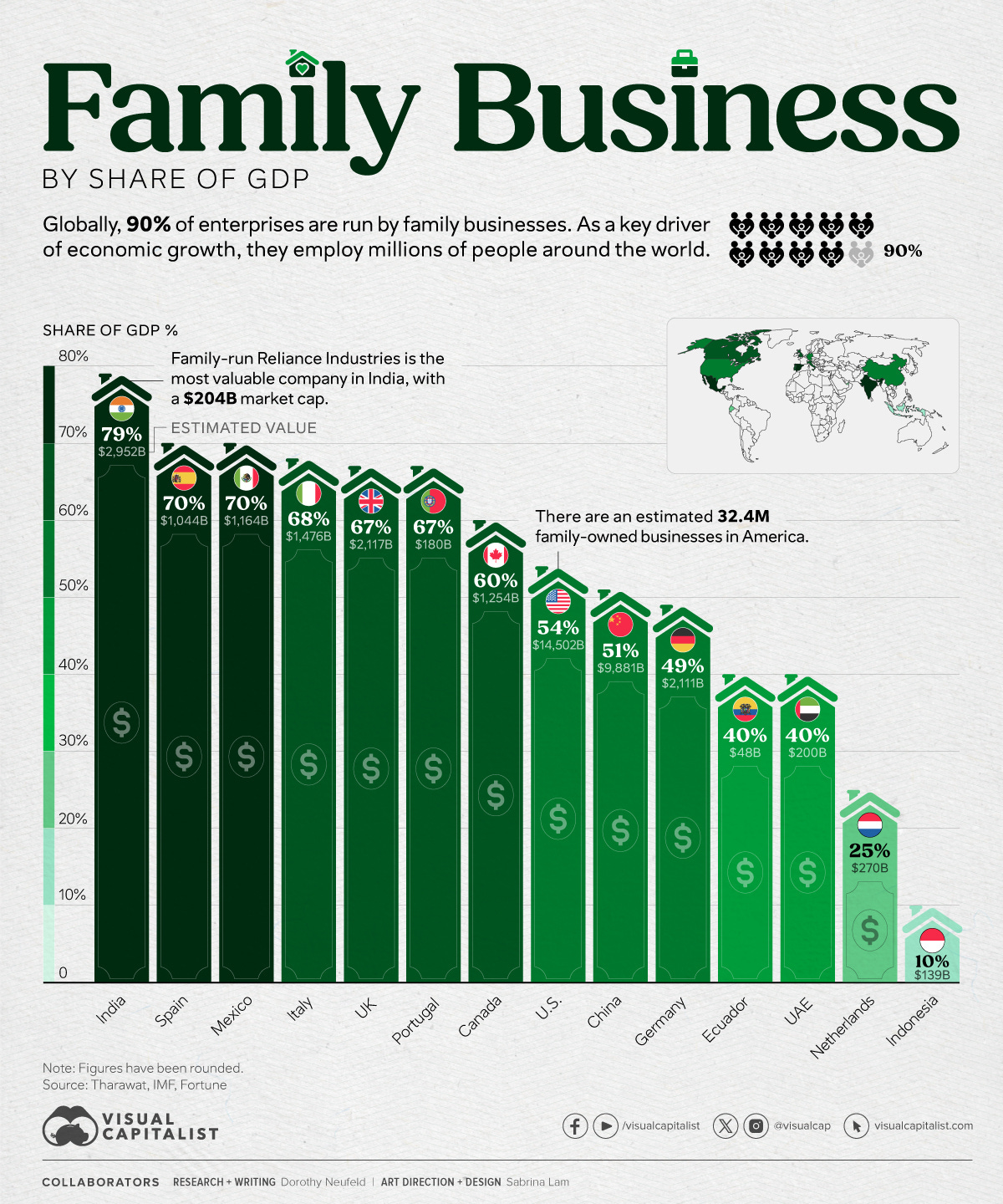

🌐 The Influence of Family-Owned Businesses, by Share of GDP (Visual Capitalist)

🇨🇳 When All Else Fails, Show Me The (Dividend) Money – Play on Chinese High Dividend Yielding Stocks (Smart Karma) $

The CSI 300 Index and MSCI China Index are down 14% YTD, the third consecutive year of decline, and is the world’s worst-performing major market

Many high-quality stocks trade at bargain valuations, but investors ignore earnings and focus on news flow and policy clarity

High yielding stocks could be the best defensive shelter while waiting for sentiments to improve and for fundamentals to take center stage in investment decisions again

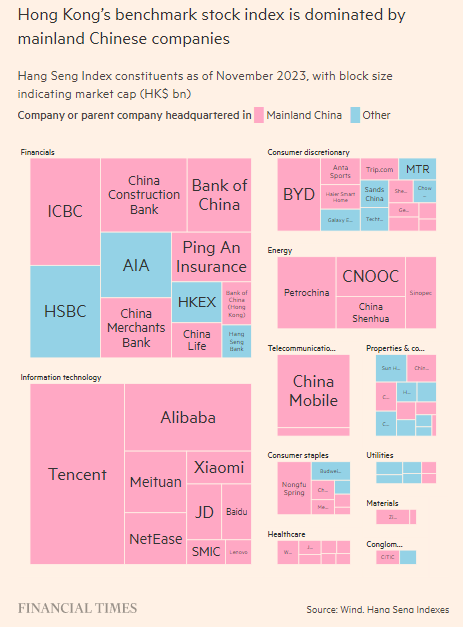

🇨🇳 🇭🇰 How China’s slowdown is deepening Hong Kong’s ‘existential crisis’ (FT) $

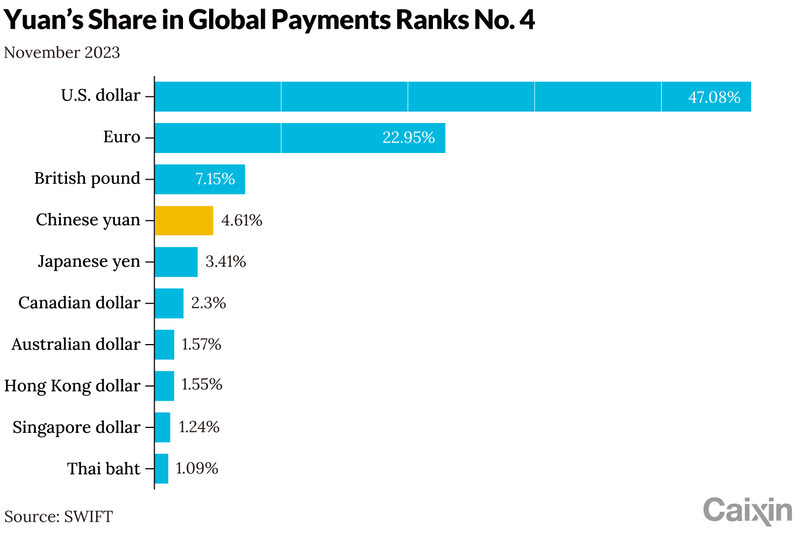

🇨🇳 Chart of the Day: China’s yuan overtakes yen to rank fourth for global payments (Caixin) $

The yuan overtook the Japanese yen to become the fourth-most used currency by value in global payments for the first time in almost two years, according to a monthly tracker of the Chinese currency released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

The share of the yuan as a global payment currency climbed to 4.61% in November from 3.6% the previous month, according to data compiled by SWIFT and released on Thursday. The redback surpassed the Japanese yen, whose share came in at 3.41% in November, down from 3.91% the month before.

🇪🇬 The Red Sea Spaces – Summary (Calvin’s thoughts)

🇨🇳 Chinese shipping giant COSCO halts Red Sea transit amid attacks (Caixin)

China COSCO Shipping Corp. Ltd. (Cosco Shipping International (HKG: 0517 / FRA: CSB / SGX: F83) / COSCO Shipping. COSCO SHIPPING Holdings (HKG: 1919 / SHA: 601919) will suspend shipments through the Red Sea amid escalating attacks against commercial vessels in the area, joining its global peers and further raising some analysts’ concerns over disruption to global trade if the situation persists.

The Chinese shipping giant, which is the world’s fourth largest container shipping company by capacity, will be sending out notices to customers informing them of the service halt in the Red Sea area, a person at China COSCO Shipping told Caixin Monday.

🇨🇱 Chileans reject second attempt to rewrite constitution (FT) $

🇨🇱 REACTION: Chile Rejects Second Constitutional Rewrite (Americas Quarterly)

The nation is the world’s first to turn down two consecutive constitutional proposals. The 1980 charter remains in place.

AQ asked analysts to share their reaction to the result

🇦🇷 Global Conflicts Stir Sleeping Energy Giant in South America (WSJ) $

See: Vista Energy (NYSE: VIST): Has the Largest Shale Oil and Gas Play Under Development Outside North America

🇦🇷 Argentina’s Ruined Railways Will Force Milei to Confront Poverty (Bloomberg)

Those living off state subsidies in ghost towns abandoned by the once-robust train service fear the pain of the new president’s spending cuts will be acute

Since 1950, Argentina has spent more time in recession than any other nation except the Democratic Republic of Congo. This year is no different, with the economy lurching into its sixth downturn in a decade.

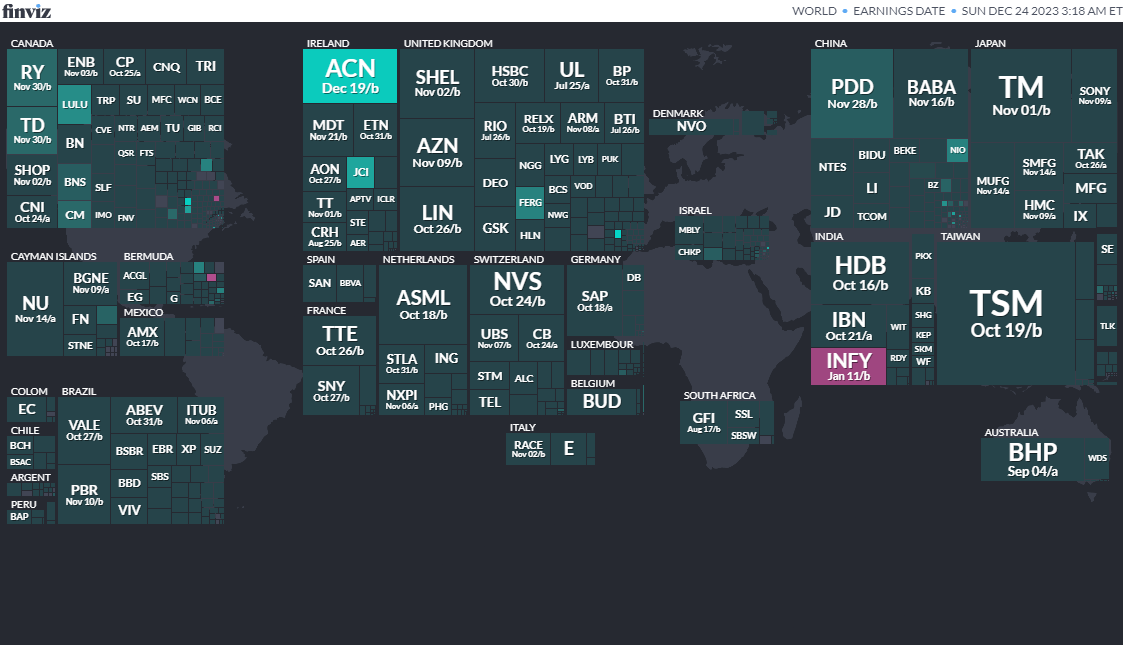

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

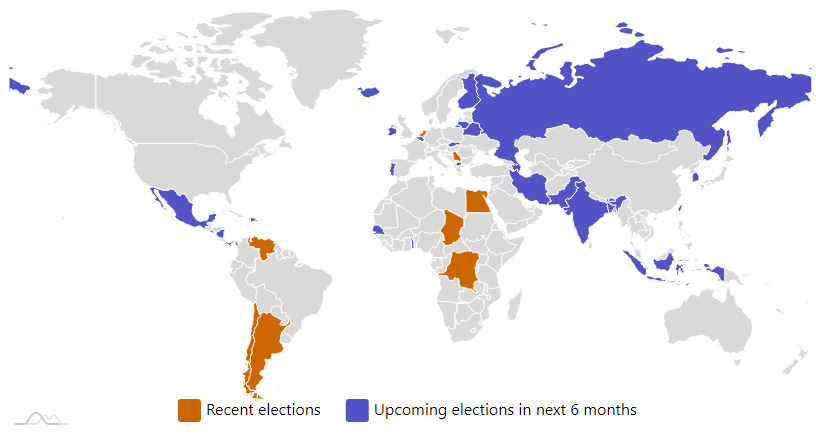

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Bangladesh Bangladeshi National Parliament Jan 7, 2024 (d) Confirmed Dec 30, 2018

-

Taiwan Taiwanese Legislative Yuan Jan 13, 2024 (d) Confirmed Jan 11, 2020

-

Taiwan Taiwanese Presidency Jan 13, 2024 (d) Confirmed Jan 11, 2020

-

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

-

Indonesia Indonesian Regional Representative Council Feb 14, 2024