Emerging Market Links + The Week Ahead (December 29, 2025)

Move over American tech bubble, Caixin has reported that China’s stock trading has set an annual record above 400 trillion Yuan with the current surge being led largely by technology stocks as trading activity has become increasingly concentrated among technology leaders. It has also been reported that China has launched $14 Billion state fund to back strategic tech industries plus the young Beijing Exchange has become China’s new IPO hub (it was launched in 2021 to help fund smaller tech startups).

On the other hand, the FT has reported that China’s industrial profits plunge as weak demand and deflation bite 🗃️ while China’s cash-strapped local governments drive record sales of asset-backed securities 🗃️:

Such is the need for liquidity that one local leader, Li Dianxun, governor of central Hubei province, has coined the slogan: “Turn every possible state-owned resource into an asset, every possible state-owned asset into a security, and leverage all possible state-owned funds…”

… Repackaging these holdings as asset-backed securities is attractive to local authorities, since it can bring forward the income they are expected to generate in the future while retaining state ownership.

$ = behind a paywall

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Shortlist Of High Conviction Ideas Across China, Japan, India – December 2025 (Smartkarma) $

🌏 2025 – Year of misses and close shaves for regional casino industry (GGRAsia)

🇨🇳 Move over, Hong Kong. Young Beijing Exchange becomes China’s new IPO hub (Bamboo Works)

The bourse, launched in 2021 to help fund smaller tech startups, has hosted 38 IPOs this year, up more than 50% from 2024

Just four years after its launch, the Beijing Stock Exchange has quietly boomed this year by helping 38 startups raise about $1 billion

The exchange is currently vetting another 172 IPO candidates, more than quadruple the number for both the rival STAR and ChiNext markets in Shanghai and Shenzhen

🇨🇳 China Stock Trading Sets Annual Record Above 400 Trillion Yuan (Caixin) $

China’s mainland stock market has already set a record for annual trading turnover this year, surpassing 400 trillion yuan ($57 trillion) by Monday, highlighting a sharp rise in market activity.

The market recorded total turnover of nearly 406 trillion yuan, compared with 253 trillion yuan during the 2015 bull market and 257 trillion yuan in 2021.

Unlike the 2015 rally driven by broad-based leverage, the current surge has been led largely by technology stocks. Trading activity has become increasingly concentrated among technology leaders.

🇨🇳 China’s M&A boom opens doors for buyout funds (The Asset) 🗃️

Number of deals up 10% after regulatory measures spur acquisitions for growth

Since the measures were released late last year, the number of disclosed M&A deals in China has increased by about 10% to almost 5,000. Big-ticket targets cluster in next-gen IT, advanced manufacturing, and new materials, while financials are also seeing megadeals. Guangdong leads in case count, followed by Zhejiang, Jiangsu, Beijing, and Shanghai.

🇨🇳 China’s industrial profits plunge as weak demand and deflation bite (FT) $ 🗃️

🇨🇳 China’s cash-strapped local governments drive record sales of asset-backed securities (FT) $ 🗃️

🇨🇳 China Launches $14 Billion State Fund to Back Strategic Tech Industries (Caixin) $

China on Friday officially launched a national venture capital guidance fund, injecting 100 billion yuan ($14 billion) in central government capital and aiming to mobilize 1 trillion yuan to support companies in strategic emerging and future industries, including semiconductors and biotechnology.

The fund is expected to fill funding gaps in capital-intensive hard tech sectors with long development cycles.

🇨🇳 Xiaomi Co-Founder Plans $2 Billion Share Sale to Back New Fund (Caixin) $

Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) co-founder and vice chairman Lin Bin plans to sell up to $2 billion worth of his stake in the Chinese consumer electronics giant to bankroll a new investment fund company.

The divestment plan, announced in a filing on Sunday, marks the largest cash-out by the company’s second-largest shareholder and contrasts sharply with Xiaomi’s ongoing efforts to prop up its sliding share price through aggressive buybacks. Lin intends to cap his sales at $500 million every 12 months starting in December 2026. Despite the planned reduction, Lin stated he remains confident in the group’s prospects and committed to his long-term service at the company.

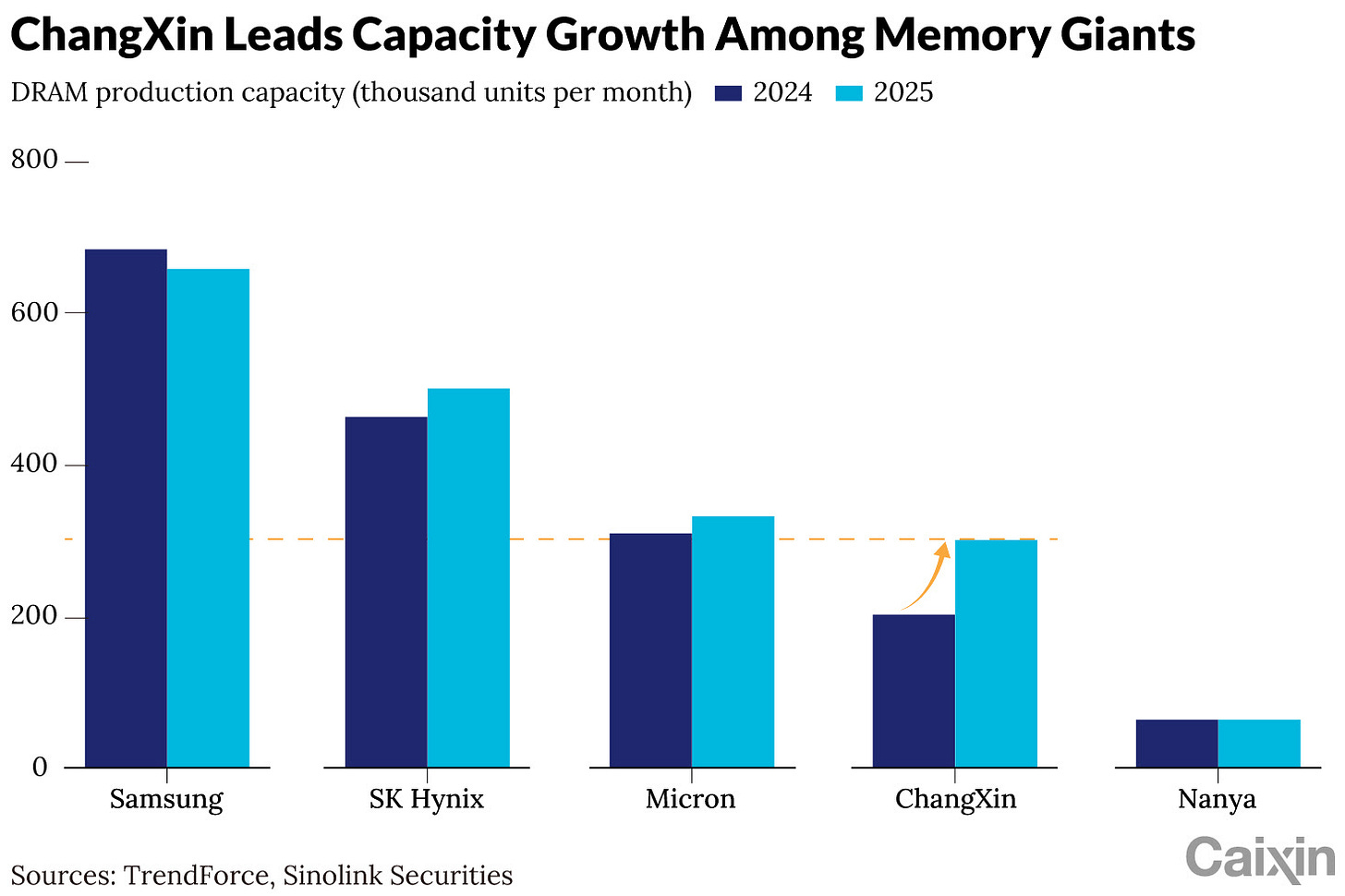

🇨🇳 In Depth: Memory Shortage Creates Space for China’s Lesser-Known Chipmakers (Caixin) $

In late October, Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) founder Lei Jun took to social media to complain about how far memory chip prices had risen, drawing attention to a problem that has heaped cost pressure on manufacturers across China’s consumer-electronics industry.

Lei’s comment coincided with the launch of Xiaomi’s Redmi K90 smartphone, the price of which has risen as much as 400 yuan ($56.81) compared with the prior model with the same configuration. That same month, Chinese smartphone heavyweights Oppo Co. Ltd. and Vivo Mobile Communications Co. Ltd. released new handsets with higher prices. And the market broadly expects smartphone prices to climb further in 2026.

🇨🇳 2026 watchlist: My thoughts and equity picks for the year ahead Part 1 (Dragon Invest)

Will the year of the Horse deliver galloping stock returns

Equities to watch in 2026

(1) ACM Research (NASDAQ: ACMR)

I’ve written extensively about ACMR before, but I’ll summarize it again here for you instead of just linking my previous article (I’ll do that too but I’m a nice guy so I’ll write it here briefly first for those in a hurry).

There is a great opportunity ahead for the Chinese semiconductor in general and ACMR in particular.

(2) RS Technologies (TYO: 3445 / OTCMKTS: RSTCF)

I’ve written about R.S. Technologies earlier too and I’ll briefly summarize my thesis here. The company was only established in 2010 (that’s just 15 years ago, yeah exactly where were you in 2010) has grown into becoming the global leader in wafer reclaim (33% market share) and is rapidly expanding into the prime wafer market particularly in China.

(3) Chongqing Machinery & Electric Co Ltd (HKG: 2722 / FRA: CE3)

Chongqing Machinery is a Chongqing based (one of my favourite cities in China, go there sometime) SOE mostly in the business of producing industrial equipment like transformers, generators, turbine blades, CNC machines among other such boring stuff. A large chunk of the company is composed of barely profitable verticals that is typical of SOEs that aren’t really run to earn surplus profits but rather to boost industrial productivity, produce products essential for national security, and boost employment in their respective cities and provinces.

(4) Foryou Corp (SHE: 002906)

From one industrial to another, let’s jump ship to Foryou Corporation. Foryou is a part of the massively hated Chinese auto ancillary sector notorious for issues like payment delays, massive receivables, tough customers who bake in annual price decreases into supply contracts among other such behavior. Suggesting investing in the Chinese auto ancillary sector is the investing equivalent of suggesting bungee jumping to a paraplegic man. But I have a good thesis to make this outrageous claim, hear me out.

(5) Hengtong Optic-Electric Co Ltd (SHA: 600487)

(6) Futu Holdings Ltd (NASDAQ: FUTU)

Jumping from the productive side to some financial spiritual opium. FUTU stands as perhaps one of the cheapest ways globally to capitalize off of the increasing trend of hyper speculation in the financial markets. FUTU is a brokerage hyper focused on catering to Greater China and South East Asian investors looking to invest globally as well within their domestic markets. They have two different brokerage services: Futubull, focused on mainland and Hong Kong based Chinese speaking investors and Moomoo, focused on SE Asian investors and markets.

(7) Kingboard Holdings Ltd (HKG: 0148 / FRA: KGZ / OTCMKTS: KBDCF / KBDCY) / Kingboard Laminates Holdings Limited (HKG: 1888 / FRA: KLN / OTCMKTS: KGBLF)

Kingboard Holdings Limited is a diversified investment holding company with a significant presence in manufacturing and industrial sectors. It’s listed on the Hong Kong Stock Exchange under the ticker SEHK: 0148, Kingboard’s operations span multiple business segments, with its core activities centered around laminates and printed circuit boards (PCBs), chemicals, and property development. The company has built a reputation as one of the largest global producers of copper-clad laminates (CCL), primarily through its flagship subsidiary, Kingboard Laminates Holdings Limited (1888.HK).

🇨🇳 Kuaishou Halts Livestreams After Moderation Failure Floods Platform With Explicit Content (Caixin) $

Chinese short-video platform Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) said late Monday that it suffered a major content moderation failure after an automated attack disrupted livestreams and briefly flooded the platform with pornographic material, prompting the company to suspend livestream access.

Kuaishou Technology Co. Ltd. said the incident occurred around 10 p.m. on Monday, when it was targeted by what it described as a coordinated attack by “black and gray market” actors. The company said it has reported the case to regulators and alerted police.

🇨🇳 Vanke Avoids Default With Extended Bond Grace Period (Caixin) $

Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) narrowly avoided a default on a domestic bond after creditors agreed to extend a payment grace period on Monday, though they overwhelmingly rejected the developer’s broader proposal to stretch the debt’s maturity by a year.

Bondholders of the medium-term note voted on Dec. 22 to extend the grace period for repayment from five business days to 30 trading days. This pushes the final deadline for the 2 billion yuan ($284 million) bond to Jan. 27, 2026. However, the reprieve is tenuous, as Vanke’s core plan to extend the bond’s maturity to late 2026 failed to pass.

🇨🇳 Beijing Eases Home-Purchase Rules for Nonlocals and Larger Families (Caixin) $

Beijing further relaxed its property market restrictions on Wednesday, lowering the bar for nonlocal residents to buy homes and allowing families with multiple children to purchase an additional property in the city’s core.

The new measures, announced in a notice by the Beijing Municipal Commission of Housing and Urban-Rural Development and three other government bodies, also include adjustments to mortgage policies.

🇨🇳 Jinke Smart Services (9666 HK): Delisting Resolution Passed, but Now for the Hard Part (Smartkarma) $

Boyu’s enhanced offer (HK$8.69) for Jinke Smart Services Group Co Ltd (HKG: 9666) requires satisfaction of the delisting resolution and the delisting acceptance condition (90% minimum acceptance from disinterested shareholders).

On 24 December, the delisting resolution was comfortably passed with 99.37% of disinterested shares voting in favour. The disinterested shareholder participation rate was 67.4%.

However, the key data points from the EGM results suggest that satisfying the delisting acceptance condition is increasingly challenging. The closing date is 26 January.

🇨🇳 Monthly Chinese Tourism Tracker | Sudden Upturn in Domestic and Outbound Demand (December 2025) (Smartkarma) $

Both domestic and outbound air travel activity have improved in recent months

Chinese carriers are now enjoying unusually high load factors on outbound travel

Trip.com (NASDAQ: TCOM) is a laggard vs the airlines, but it doesn’t appear cheap to us

🇨🇳 51Job overpaid for its privatization, Cayman court says, ending dissenters’ challenge (Bamboo Works)

A judge ruled last month that the management-led group’s privatization offer for the leading online job site was roughly double what the shares were worth

A Cayman Islands judge ruled that 51Job’s shares were worth $31.11 at the time of their privatization, about a quarter of the $111.06 that dissident investors were seeking

The ruling spotlights how cases using the Cayman Islands Companies Act are putting a “huge strain” on the territory’s legal system, the judge said

🇨🇳 Zeekr drives off Wall Street, heralding chilly year ahead for U.S. Chinese listings (Bamboo Works)

Trading of the EV maker’s shares was suspended on Dec. 22, after investors approved a plan by parent Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) to privatize the company less than two years after its IPO

ZEEKR Intelligent Technology Holding Limited (NYSE: ZK)’s shares were suspended on the New York Stock Exchange on Monday, moving it closer to its planned delisting and merger with Hong Kong-traded parent Geely

The EV maker’s move was driven by company-specific factors as well as an increasingly hostile environment for Chinese companies on Wall Street

🇨🇳 CaoCao hits rocky post-IPO road amid lingering concerns (Bamboo Works)

The ride-hailing platform’s shares plummeted last week, shaving more than $1 billion from its market value in just days and catching retail investors by surprise

CaoCao Inc (HKG: 2643) shares lost 37% of their value over six trading days this month, as a post-IPO lockup period for the company’s institutional investors gets set to expire

The operator of China’s second largest ride-hailing platform scrambled to contain the damage by saying its operations remain on track

🇨🇳 SenseTime (20 HK): Potential Global Index Inclusion in Feb (Smartkarma) $

With SenseTime Group Limited included in the Non-SDN Chinese Military Industrial Complex Companies List (NS-CMIC List), SenseTime (HKG: 0020 / OTCMKTS: SNTMF) has been kept out of a global index.

With no updates to the NS-CMIC list, SenseTime Group (20 HK) could become eligible for index inclusion at the next rebalance in February.

SenseTime Group is a member of one global index, HSTECH and HSIII indices, and some other indexes. The new inclusion will require passives to buy a large chunk of float.

🇨🇳 Transforming Qian Xun adds polish to new business with crypto cachet (Bamboo Works)

The advertising services company is allowing users to settle payments for its newer business in used gadget trading using stablecoins

Qian Xun Technology Ltd (HKG: 1640) has unveiled PayKet, allowing users to settle payments on its platform with stablecoins, as it shifts away from its previous main business in advertising services

In September, the company also bought a fintech company to develop new products and services based on blockchain technology.

🇨🇳 Soaped up by its U.S. success, COL Group sets sail for Hong Kong (Bamboo Works)

The company says it plans to list in Hong Kong, basking in the limelight of strong demand from American viewers for its over-the-top Chinese-style soap operas

COL Group Co Ltd (SHE: 300364), a Shenzhen-listed producer of online literature and dramas, is preparing to apply for a second listing in Hong Kong

The company’s short dramas, following a formula from popular Chinese online literature, briefly lifted its affiliated ReelShort video platform to fame in the U.S.

🇨🇳 What 1.4 billion consumers? Mannings China exit extends foreign retail exodus (Bamboo Works)

The withdrawal by Hong Kong’s largest health and beauty chain comes as parent DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) trims its money-losing assets, and follows a similar departure this year by peer Sa Sa International

Mannings is closing all of its Mainland Chinese online and offline stores, ending a 21-year foray in the market

A similar move by rival Sa Sa International in June leaves CK Hutchison Holdings (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF)’s AS Watson as the sole major Hong Kong retailer still operating in China’s health and beauty segment

🇨🇳 Biren Technology Hong Kong IPO Preview (Douglas Research Insights) $

Biren Technology is getting ready to complete its IPO in Hong Kong on 2 January 2026. The IPO price range is from HK$17.00 to HK$19.6 per share.

Biren Technology is China-based semiconductor company specializing in general-purpose computing on graphics processing units (GPGPU) and GPGPU-based intelligent computing solutions. Its mission is to deliver foundational computing power for AI.

The company has experienced a significant revenue growth from from RMB 0.5 million in 2022 to RMB 62.0 million in 2023 and RMB 336.8 million in 2024.

🇨🇳 Biren Technology HK IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Biren Technology is implied price per share of HKD38.3, which represents a 95% higher upside versus the high end of the IPO price range.

We have used Moore Threads Technology Co Ltd (SHA: 688795) and MetaX Integrated Circuits Co Ltd (SHA: 688802) as comps. Our P/S multiple of 104x is 40% discount to the comps’ average P/S multiple of 173x in 2025.

We estimate Biren Technology’s sales to increase to RMB0.8 billion in 2025 (up 145% YoY), RMB1.6 billion in 2026 (up 91% YoY), and RMB2.9 billion (up 87% YoY) in 2027.

🇨🇳 Biren Technology IPO (6082.HK): Signals Investor Conviction With Higher Valuation Vs. Prior Funding (Smartkarma) $

Biren Technology, a Shanghai-based developer of GPGPU chips and GPGPU-based intelligent computing solutions, is expected to price the offering next week.

The company’s Global Offering puts the initial price range per share at HK$17.00 to HK$19.60, implying a market cap of ~HK$44.6B or ~$5.7B at midpoint on a fully diluted basis.

After enjoying years of technological and market share dominance in the GPU space in China, NVIDIA faces growing competition from “four little dragons” – MetaX Integrated Circuits Co Ltd (SHA: 688802), Moore Threads Technology Co Ltd (SHA: 688795), Biren and Enflame.

🇨🇳 Pre-IPO Guangdong Rong Tai Pharmaceutical – Low Profitability Is a Pain Point (Smartkarma) $

As a digital circulation platform, Guangdong Rong Tai Pharmaceutical’s business essence is a “middleman”, with limited added value and a naturally lower profit margin than that of R&D-oriented pharmaceutical companies.

Rong Tai’s profitability is disappointing. It’s difficult for the Company to bring decent returns to investors. This actually reflects from the side the flaws of Rong Tai’s business model/channel resources.

Reasonable valuation is RMB1.6bn, lower than post-money valuation after Series B Financing(RMB2.7bn). If market sentiment is pessimistic at the time of IPO, there could be big downward space for valuation.

🇭🇰 🇨🇳 Cash-Hungry China AI Companies Turn to Hong Kong Listings (Caixin) $

Chinese artificial intelligence and semiconductor companies are accelerating plans to list in Hong Kong, seeking fresh capital as heavy research spending, U.S. technology restrictions and intensifying competition strain finances.

GPU maker Shanghai Biren Technology Co. Ltd. on Monday disclosed pricing details for its Hong Kong initial public offering, while large-model developers Zhipu AI and MiniMax and GPU designer Shanghai Iluvatar CoreX Semiconductor Co. Ltd. have all cleared listing hearings at the Hong Kong exchange in recent days.

🇭🇰 MiniMax Hong Kong IPO Preview (Douglas Research Insights) $

MiniMax is getting ready to complete its IPO in Hong Kong in early January 2026. MiniMax is expected to raise at least US$500 million and as much as US$700 million.

Backed by Alibaba (NYSE: BABA), MiniMax is targeting a valuation of more than US$4 billion.

MiniMax develops multimodal AI models including MiniMax M1, Hailuo-02, Speech-02 and Music-01, which can process text, audio, images, video and music.

🇲🇴 Macau’s year-to-date visitor arrivals surpass full-year 2019 record: police (GGRAsia)

Macau is poised to set in 2025 a new record for annual visitor arrivals, as year-to-date numbers had already reached 39.411 million as of 11am on December 27, according to preliminary figures from the city’s Public Security Police.

The year-to-date tally has already surpassed the 39.406 million visitor arrivals recorded in full-year 2019, the reporting period immediately preceding the Covid-19 pandemic and the previous record.

Visitor arrivals from January to November 2025 had already exceeded last year’s full-year figure of 34.9 million, according to official data.

Data disclosed by the police for year-to-date 2025 showed that Macau welcomed a daily average of around 109,000 visitors during the period.

🇲🇴 MGM China downgraded by Morgan Stanley amid doubling of branding-related royalties (GGRAsia)

Banking group Morgan Stanley said in a Monday note it was downgrading the stock of Macau casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) to “equal weight” from “overweight”.

The institution cited factors including “higher royalty payments” to parent MGM Resorts International (NYSE: MGM).

Morgan Stanley stated regarding MGM China earnings before interest, taxation, depreciation and amortisation: “We cut our 2026 and 2027 EBITDA estimates by 7 percent each to incorporate higher royalty payments to parent MGM Resorts.

“The royalty payments are roughly 15 percent of its corporate EBITDA… double what it had been in 2023-2025, and significantly higher than peers.”

🇹🇼 TSMC: Why 2026 Will Be Even Bigger (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Tech Weekly: TSMC a Hidden Capacity Risk for Apple; Memory Pair Long/Short Opportunity (Smartkarma) $

🇹🇼 🇹🇭 Delta Taiwan Vs. Delta Thailand: Valuation Extreme Persists as Growth Leadership Shifts to Parent (Smartkarma) $

🇰🇷 Himax (HIMX US, Long): Management Call Confirms 2026 Mass-Production Readiness; Increasing Forecasts (Smartkarma) $

Management Call — Increased Clarity on Co-Packaged Optics Rollout with Nvidia

Positioning Inside the TSMC CoWoS / CPO Supply Chain — Margin Accretive Mix Effects; Low Capital Intensity.

Himax Technologies (NASDAQ: HIMX) — Increasing Our Long-Term Forecasts, Reiterate Structural Long Rating

🇰🇷 Doosan Corp To Sell 18.05% Stake in Doosan Robotics for 948 Billion Won (Douglas Research Insights) $

On 23 December, Doosan Corp (KRX: 000150 / 000155 / 000157) announced that it plans to sell an 18.05% stake (11.7 million shares) in Doosan Robotics (KRX: 454910) for 948 billion won.

It appears that the main purpose of sale is to secure adequate capital for Doosan Corp to acquire SK Siltron which is up for sale.

SK Siltron’s corporate value is estimated at around 5 trillion won, so the transaction size for the 70.6% stake up for sale is expected to 3-4 trillion won+.

🇰🇷 Korea Small Cap Gem #52: Samchully (To Acquire Sung Gyung Food) (Douglas Research Insights) $

On 26 December, Samchully Co Ltd (KRX: 004690) announced that it plans to acquire a 100% stake in Sung Gyung Food for 119.5 billion won in cash.

We like this deal for Samchully mainly because it represents purchase of one of the top brands in the seaweed (gim, laver) industry in Korea with excellent export potential.

In this case of Samchully purchasing Sung Gyung Food, we are Positive on this deal and we expect this deal to have a long-term positive impact on Samchully’s share price.

🇰🇭 🇹🇭 The role of Preah Vihear in the Thai-Cambodia war (Murray Hunter)

The latest round of fighting between Thailand and Cambodia across the border has gone no way to settle the long dispute over Preah Vihear Temple complex.

The Preah Vihear (or Prasat Preah Vihear) Temple complex has played a pivotal role in the Thai-Cambodia conflict. The ancient Hindu temple is situated on top of 525 metre Pha Mo I Dang cliff on the Dangrek Mountains separating Sisaket Province in Thailand from Preah Vihear Province in Cambodia.

🇲🇾 Top Glove Corporation Bhd. 2026 Q1 – Results – Earnings Call Presentation (Seeking Alpha)

-

🌐 Top Glove Corporation (KLSE: TOPGLOV / SGX: BVA / OTCMKTS: TPGVF) – World’s largest manufacturer of gloves. Manufacturing operations in Malaysia, Thailand, Vietnam and China + marketing offices in these countries, USA, Germany & Brazil. 🇼 🏷️

🇲🇾 Fitch affirms Genting Bhd at investment grade but outlook is ‘negative’ amid costs on Genting Malaysia, downstate NY licence (GGRAsia)

Fitch Ratings Inc has affirmed the long-term issuer default rating of Malaysian casinos and plantations conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY) at “BBB” – i.e., investment-grade – and removed it from “rating watch negative” status.

The institution noted however in a December 22 memo that the outlook for Genting Bhd is “negative”.

It reflected the risk Genting Bhd “may be unable to deleverage to a level consistent with its rating”.

‘BBB’ ratings indicate that expectations of default risk are currently low, according to Fitch’s own definitions. Under that rating, the capacity for payment of financial commitments is considered adequate, but “adverse business or economic conditions are more likely to impair this capacity”.

🇸🇬 Grab’s Robot Delivery Revolution: Will Humans Be Replaced? (Smartkarma) $

Grab Holdings Limited (NASDAQ: GRAB) has announced a bold step in its ongoing transformation into a tech-driven super-app, revealing plans to acquire Chinese startup Infermove in a move that could reshape its delivery logistics.

The Singapore-based firm, already a key player in Southeast Asia’s ride-hailing and food delivery market, is doubling down on artificial intelligence and robotics to sharpen its edge against rivals.

Infermove, a Beijing-based company founded in 2021, specializes in mixed-road autonomous driving systems and a suite of robotic delivery hardware, including single-arm and armless delivery robots.

🇸🇬 Can the Government’s Equity Stimulus Really Boost Dividends for Retail Investors? (The Smart Investor)

The government’s equity stimulus may support markets, but its impact on dividends for retail investors is less clear.

In a bold move to revitalise the Singapore equity landscape, the Singapore government has rolled out the multi-billion-dollar Equity Market Development Programme (EQDP).

The EQDP aims to strengthen the local asset management and research ecosystem, and increase investor interest in Singapore’s equities market.

For dividend-focused investors, the key question is whether this stimulus will translate into bigger payouts.

In this article, we will unpack what the EQDP is all about, and how it impacts listed companies, dividend policies, and long-term investor outcomes.

🇸🇬 The Most Overlooked Dividend Stock on the SGX Right Now (The Smart Investor)

Buried under all that market noise, this high-yield stock may offer steady income and upside.

A Hidden Gem

I’m sure you have heard of Chang Beer, Oishi Green Tea, or 100PLUS.

These familiar brands fall under Southeast Asia’s largest beverage player Thai Beverage PCL (SGX: Y92 / OTCMKTS: TBVPF / TBVPY) or ThaiBev.

ThaiBev’s total revenue slipped 2.1% year-on-year (YoY) for the fiscal year ended 30 September 2025 (FY2025), to THB333.3 billion.

The top-line decline may not impress, but this is a business built for stability.

Risks and What Could Go Wrong

How to Approach This Stock (and Others Like It)

Get Smart: Look Where Others Aren’t Looking

🇸🇬 3 Small-Cap Stocks Ringing in Singapore’s Festive Season (The Smart Investor)

🇸🇬 Opportunity? 3 Small Cap REITs Offering Yields of 7% or More (The Smart Investor)

🇸🇬 Year-in-Review: Top Blue-Chip Losers for 2025 — Opportunity? (The Smart Investor)

Three blue-chip stocks have seen their stock price languish, trailing the broader market. Has the market gotten it wrong?

Thai Beverage PCL (SGX: Y92 / OTCMKTS: TBVPF / TBVPY) or ThaiBev: Total Returns -11.1% YTD

Thai Beverage, or ThaiBev, is one of Southeast Asia’s largest beverage companies, with a portfolio spanning spirits, beer, non-alcoholic beverages, and food.

The group reported a mixed set of earnings for the fiscal year ended 30 September 2025 (FY2025).

Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF): Total Returns -3.4% YTD

Mapletree Industrial Trust, or MIT, is an industrial REIT with a portfolio spanning data centres (58.2%), hi-tech buildings and business space (18.1%), and general industrial buildings (23.6%).

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF): Total Returns -2.8% YTD

SATS is one of the world’s largest air cargo handlers and Asia’s leading airline caterer, headquartered in Singapore.

Following the acquisition of Worldwide Flight Services (WFS) in 2023, the combined network operates over 225 stations in 27 countries.

Get Smart: Follow the cash

🇸🇬 Year in Review: Top 3 Best Performing Blue-Chip S-REITs (The Smart Investor)

🇸🇬 Year in Review: Best Performing Blue Chips Stocks for 2025 (The Smart Investor)

🇹🇭 🇻🇳 Thailand’s Central Retail exits Vietnam electronics market (The Asset) 🗃️

Retail group to book US$187 million impairment following sale of Nguyen Kim to Pico Holdings for US$36 million

Central Retail Corporation PCL (BKK: CRC / CRC-F), Thailand’s largest retail conglomerate, has agreed to divest its entire stake in Vietnamese electronics chain Nguyen Kim, marking a strategic retreat from a sector hampered by fierce competition and changing consumer habits.

The Bangkok-listed company says it has signed a share purchase agreement with Vietnam’s Pico Holdings Joint Stock Company to sell its 100% interest in NKT New Solution and Technology Development Investment JSC – the holding entity for the Nguyen Kim brand.

The transaction gives the business an enterprise value of US$36 million, approximately 1.14 billion Thai baht. However, the exit comes at a steep accounting cost: Central Retail will record a one-time, non-cash impairment charge of 5.9 billion baht ( US$187 million ) in the fourth quarter of 2025.

The divestment signals a sharp pivot for Central Retail in Vietnam, which remains its most important overseas market. The Thai group says the move is part of a broader plan to “optimize its business portfolio” and reallocate capital towards its two highest-growth pillars in Vietnam: food and property.

🇮🇳 Decoding the Cobrapost Allegations on Murugappa Group: Noise Vs. Structural Governance Risk (Smartkarma) $

(Cholamandalam Investment and Finance Co Ltd (NSE: CHOLAFIN / BOM: 511243))

Investigative portal Cobrapost has alleged significant governance lapses in the Murugappa Group, specifically regarding INR 25,000 crore in cash deposits and INR 10,262 crore in RPTs.

On December 23, 2025, CIFCL issued a formal rebuttal to the exchanges, labeling the report “malicious and baseless”.

While the market’s immediate 6-8% rally suggests institutional confidence in the company’s defense.

🇮🇳 Event Driven: Coforge Acquisition ~ The Fall Analysis (Smartkarma) $

Coforge (NSE: COFORGE / BOM: 532541)’s stock fell 9.5% in five sessions as investors reacted to the massive equity dilution triggered by the board’s approval to acquire Encora.

The $2.35 billion all-stock deal aims to create a scaled AI-led engineering powerhouse, significantly expanding Coforge’s presence in LATAM and the US.

While massive share issuance creates a short-term headwind, the acquisition is structurally accretive, targeting$2.5 billion in revenue without diluting consolidated earnings.

🇮🇳 Gujarat Ambuja Exports ~ Leading The Turnaround Play For The Maize Cycle (Smartkarma) $

Gujarat Ambuja Exports Ltd (NSE: GAEL / BOM: 524226) is India’s premier maize processor with a 20% market share, operating twelve strategically located, vertically integrated agro-processing facilities.

Recent maize margins collapsed due to high raw material costs and export headwinds, but strong soya cake export realizations stabilized overall group profitability.

Steady revenue growth is expected as maize spreads normalize and high-margin fermentation-based specialty chemicals structurally enhance the long-term business risk profile.

🇮🇳 One Mobikwik Systems Ltd ~The Next Paytm? (Smartkarma) $

One MobiKwik Systems Ltd (NSE: MOBIKWIK / BOM: 544305) is India’s leading digital wallet platform, serving over 183 million users and 4.7 million merchants through integrated payments, digital credit, and investment solutions.

The company shifted from small-ticket Zip loans to large-ticket Zip EMI products to improve credit book quality and ensure more stable long-term unit economics.

Management expects an EBITDA break-even by Q3 FY26 or Q4FY26, supported by disciplined cost management, 30% loan book expansion, and normalized gross lending margins of 40%.

🇮🇳 Jubilant Ingrevia: Transitioning from Capex Intensity to Earnings Supercycle (Smartkarma) $

(Jubilant Ingrevia Ltd (NSE: JUBLINGREA / BOM: 543271))

Following a INR 2,000 crore capex cycle, the company is operationalizing critical high-margin assets, specifically in the CDMO and Specialty segments.

H2 FY26 (Oct 2025 – Mar 2026) is the launchpad for a structural shift in EBITDA quality, as low-margin Acetyls volume is replaced by high-complexity innovator contracts.

Transitioning from a cyclical chemical play to a structural CDMO story: The upcoming two quarters are critical for “proving the ramp-up.” With the $300M agro-innovator project commissioning in Q4.

🇮🇳 The Beat Ideas on Samvardhana Motherson – AutoElectric Deal: Expanding Global PV Wiring Capabilities (Smartkarma) $

Samvardhana Motherson International (NSE: MOTHERSON / BOM: 517334) has entered negotiations to acquire 100% of AutoElectric for EUR207 million, subject to approvals.

The acquisition strengthens Motherson’sglobal passenger vehicle wiring harness platform, especially in low- and high-voltage systems, and deepens access to premium OEMs.

Strategically sound, capability-driven acquisition that enhances long-term positioning, though near-term financial upside is modest.

🇮🇱 Teva Pharmaceuticals: Why It’s Time To Cash Out (Rating Downgrade) (Seeking Alpha) $ 🗃️

🌍 Endeavour Mining: Strong Execution And Industry-Leading Shareholder Returns (Seeking Alpha) $ 🗃️

🇿🇦 Sibanye Stillwater: You Haven’t Seen Anything Yet (Seeking Alpha) $ 🗃️

-

🌐 Sibanye Stillwater Ltd (JSE: SSW / NYSE: SBSW) – World’s largest primary producers of platinum, palladium & rhodium & is a top-tier gold producer. Projects & investments across 5 continents. 🇼 🏷️

🇿🇦 Valterra Platinum: Possible Backpedalled EU ICE Ban (Seeking Alpha) $ 🗃️

🇨🇿 Palasino’s fourth casino in Czech Republic now open (GGRAsia)

Palasino Mikulov, a fourth casino for Hong Kong-listed Palasino Holdings (HKG: 2536) in the Czech Republic, is now open, according to a press statement from the company.

As well as its three other land-based casinos in the Czech Republic – also with a mix of slots and table games – Palasino Holdings runs hotels in Germany and Austria.

The company was listed in Hong Kong in March last year as a spin-off from Hong Kong-listed property developer Far East Consortium International Ltd (HKG: 0035 / FRA: FET / OTCMKTS: FRTCF).

🇵🇱 CD Projekt: Strong Q3, But Valuation Leaves No Room For Error (Seeking Alpha) $ 🗃️

🌎 Reward countries that toe the line, punish those that don’t: that’s how Trump is exerting control in Latin America (The Guardian)

🌎 MercadoLibre: Even If Growth Is Cooling Down, It’s My Top Pick Right Now (Seeking Alpha) $ 🗃️

🌎 MercadoLibre’s Ecosystem Strengthens, But Rerating Triggers Remain Absent (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Fantastic Company Growth, Beware Of Regional Risks (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Macro And Competition Worries Create Buying Opportunity (Seeking Alpha) $ 🗃️

🌎 Nexa Resources: Portfolio Optimization And Record Output Signal A Buy (Seeking Alpha) $ 🗃️

-

🇧🇷 🇵🇪 Nexa Resources SA (NYSE: NEXA) – Zinc mining & smelting (copper, lead, silver & gold as by-products). 8 opts distributed b/w Brazil & Peru.

🇦🇷 Edenor: Recovery Is Real, But The Market Is Already Pricing It In (Seeking Alpha) $ 🗃️

🇧🇷 AXIA Energia: My Bet For Brazil 2026 (Seeking Alpha) $ 🗃️

-

🇧🇷🅿️ AXIA Energia SA (NYSE: AXIA) – Formerly Centrais Elétricas Brasileiras SA (NYSE: EBR / EBR.B / BVMF: ELET3 / ELET5 / ELET6) or Eletrobras. Electric power holding company. Largest generation & transmission company in Brazil. 🇼

🇧🇷 StoneCo: Credit Portfolio Growth Gives Flashbacks Of 2021 But This Time It’s Different (Seeking Alpha) $ 🗃️

🇧🇷 Patria Investments: Undervalued And Ready For A Shift Toward Emerging Market Alternatives (Seeking Alpha) $ 🗃️

-

🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇨🇱 LATAM Airlines: A Well-Run Airline Isn’t Enough In Brazil (Seeking Alpha) $ 🗃️

-

🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subs. in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇨🇱 Sociedad Quimica Y Minera de Chile: A Buy, But With The Real Upside Pushed Into 2026 (Seeking Alpha) $ 🗃️

🌐 Nebius: A Gift That Will Keep On Giving (Seeking Alpha) $ 🗃️

🌐 Nebius: It’s Beginning To Look A Lot Like Trouble (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 First Quantum: Market Euphoria Could Moderate Despite Robust Copper Price (Seeking Alpha) $ 🗃️

-

🌐 First Quantum Minerals Ltd (TSE: FM / FRA: IZ1 / OTCMKTS: FQVLF) – High-quality, low-cost copper mines. Kansanshi (Africa) & Cobre Panama. Copper & nickel projects in Africa & Australia. Gold, zinc & cobalt. 🇼

🌐 The Uranium Deficit (Public Markets) $

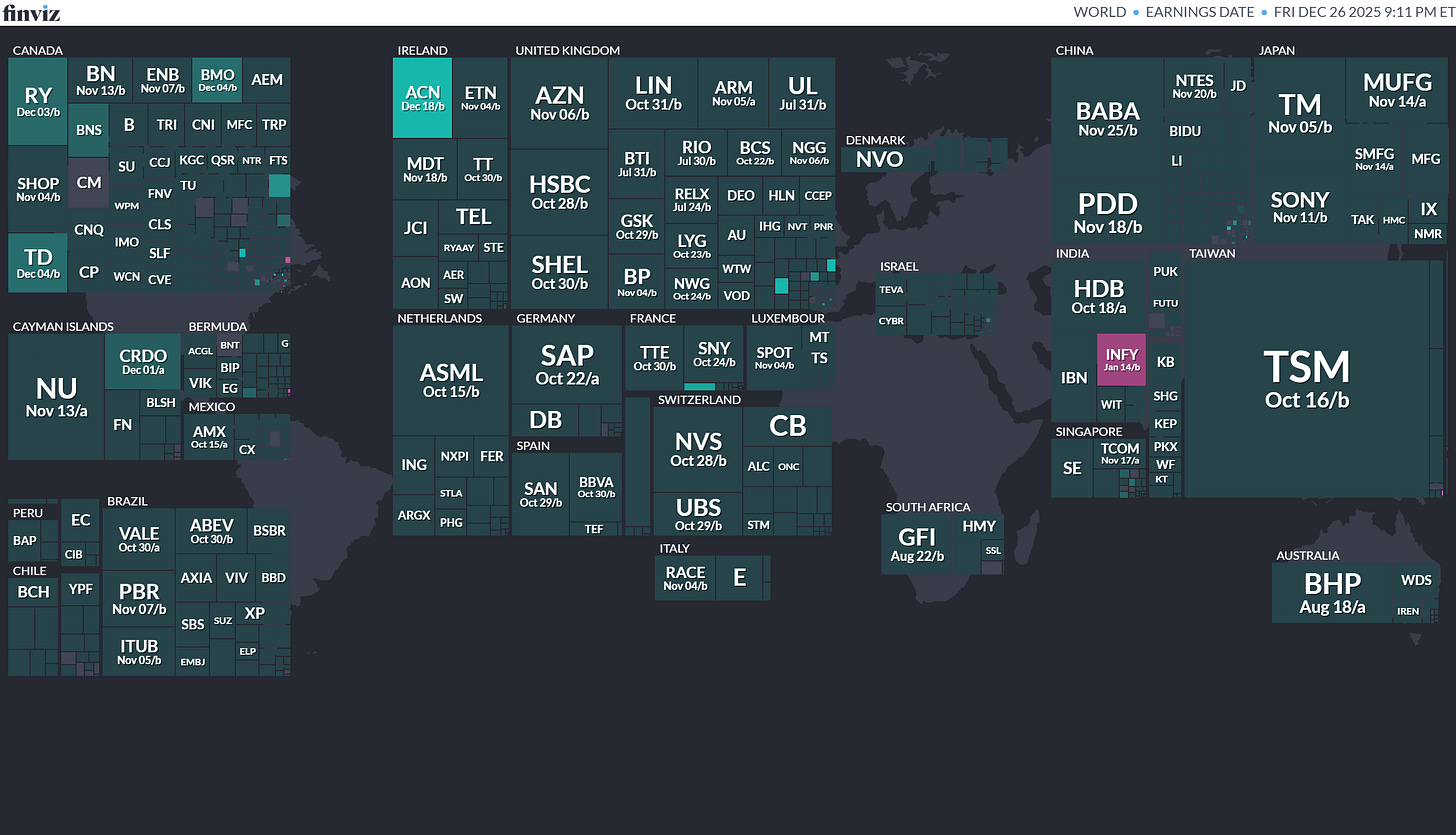

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

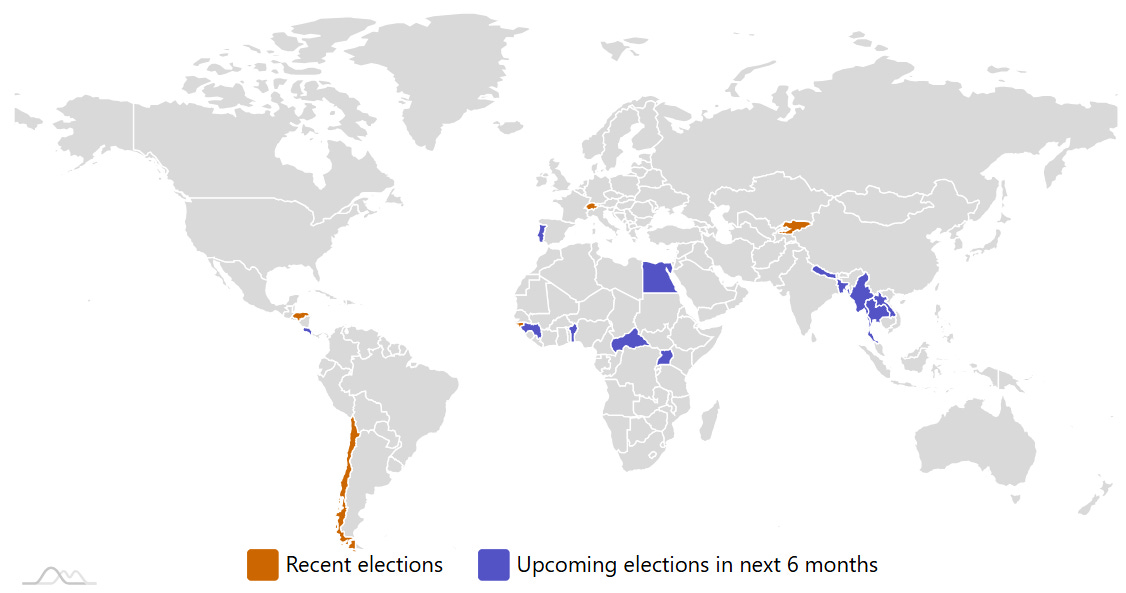

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

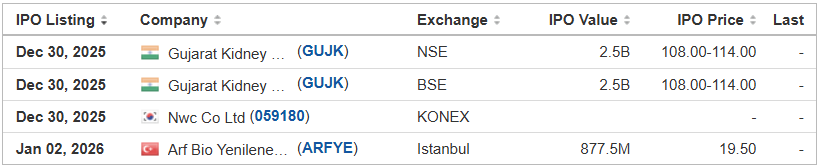

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Hillhouse Frontier Holdings HIFI Cathay Securities, 1.3M Shares, $4.00-6.00, $6.3 mil, 12/29/2025 Week of

(Incorporated in Nevada)

We are a luxury vehicle exporter. Through our subsidiary, Hillhouse Capital Group, we run a vehicle export business that specializes in finding premium vehicles in the U.S. and facilitating their shipment to Hong Kong to our client, who distributes the vehicles to its clients in the People’s Republic of China (PRC).

In 2024, Hillhouse Capital Group did 67 vehicle transactions, including 34 with authorized dealerships and 33 with independent dealers. We worked with 15 purchasing agents.

We specialize in exporting U.S. luxury vehicles having MSRPs of at least $80,000, targeting affluent consumers and dealers seeking premium luxury brands, such as Mercedes-Benz, BMW, Audi and Cadillac. Unlike smaller industry participants—typically family-run businesses that rely on informal sourcing networks—we operate through a structured purchasing model with authorized dealerships (i.e., purchasing from them through their designated purchasing agents) and independent dealers, ensuring a stable and scalable supply chain.

Fenglong Ma has served as our CEO and our chairman of the board since October 2022. He is a seasoned entrepreneur in international trade and automotive sales. He founded our company in October 2022, leading its strategy, operations, and entry into automotive exports. Previously, he co-founded Qingdao High-End Vehicle Trading Co., and served as general sales manager from January 2020 to September 2022. He was responsible for sales, market expansion, and supply chain management of high-end imported vehicles, establishing strong global partnerships and optimizing procurement processes. He received an associate degree in business management from Mudanjiang Forestry Vocational and Technical College. Mr. Ma is a citizen of the PRC and currently resides in the PRC.

Zheng Wen Tong has served as our chief operating officer since November 2024, overseeing vehicle procurement, logistics, and financial transactions. She has extensive experience in automotive trade and supply chain management. Before this, she was an office manager at TW&EW Service from April 2024 to October 2024 and was employed by Wave Capital Management from January 2022 to March 2024, where she oversaw administrative and supply chain operations. From January 2020 to March 2020, she served as an office manager at Luxury Unlimited Group. She received a diploma in accounting from Shanghai Business Trade College in July 1994. Ms. Tong is a citizen of the United States and currently resides in the United States.

Chihyuan Lin has served as our CFO since February 2025, overseeing financial strategy and operations. He is an experienced financial executive with expertise in strategic financial management, accounting, and SEC reporting. Before joining us, he founded Linck Consulting Inc. in September 2024 and has been serving as its CEO, providing accounting and tax consulting services. From September 2023 to September 2024, he worked as a consultant at 8020 Consulting LLC, focusing on SEC reporting and financial advisory services. Prior to that, from October 2022 to September 2023, he was the senior manager of financial reporting and technical accounting at Tattooed Chef, where he managed SEC filings, financial reporting, and statement consolidation. From October 2021 to October 2022, he held the role of senior manager of financial reporting and analysis at HF Foods Group Inc., overseeing financial reporting and compliance matters. Earlier, from February 2018 to October 2021, he served as the assistant director of finance and assistant controller at Ta Chen International Inc., specializing in operational accounting and financial statement consolidation. Mr. Lin earned a Master of Science degree in accounting from the University of Texas at Dallas on August 12, 2011, and a Master of Science degree in Finance from the University of Illinois Urbana-Champaign on May 16, 2010. Mr. Lin is a citizen of the United States and currently resides in the United States.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Hillhouse Frontier Holdings filed its S-1 for its IPO on July 21, 2025, and disclosed the terms: 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million, if priced at the $5.00 mid-point of its range.)

Monkey Tree Investment Ltd. MKTR Craft Capital Management/Revere Securities, 1.6M Shares, $4.00-5.00, $7.0 mil, 12/29/2025 Week of

(Incorporated in the Cayman Islands)

We run English learning centers for children in Hong Kong.

We offer children’s language classes – mostly in English – and some in Mandarin. We serve students ages 3 to 14 through our 20 learning centers in Hong Kong that offer classes in phonics, reading, grammar, writing, conversation and preparation for exams.

We have licensed the “Monkey Tree” brand to other operators that run another 38 centers in Hong Kong.

Note: Net income and revenue are in U.S. dollars for the year that ended March 31, 2025.

(Note: Monkey Tree Investment Ltd. named Craft Capital Management as its lead left underwriter in an F-1/A filing dated Oct. 21, 2025 – to work with Revere Securities. Background: Monkey Tree Investment Ltd. disclosed its IPO terms on Aug. 15, 2025, in an F-1 filing: The company is offering 1.6 million shares at a price range of $4.00 to $5.00 to raise $7.0 million, according to its F-1 filing dated Aug. 15, 2025.)

Seahawk Recycling Holdings, Inc. SEAH Cathay Securities, 2.0M Shares, $4.00-6.00, $10.0 mil, 12/29/2025 Week of

(Incorporated in the British Virgin Islands)

Headquartered in Tokyo, Japan, we are an international recycling company dedicated to advancing sustainable material solutions across East Asia and Southeast Asia. As a committed advocate for environmental sustainability, we have devoted ourselves to promoting the development of a low-carbon and zero-waste global green circular economy by engaging in the trading of recyclable resources such as waste paper and scrap metal.

Our operations are structured around two core business segments: waste paper recycling and scrap metal recycling.

Under our waste paper recycling business, we operate across both the domestic Japanese and international markets by trading two main product categories: waste paper and paper pulp. We source waste papers from collection companies in Japan and supply them to recycled pulp mills or trading companies. In parallel, we purchase paper pulps from recycled pulp mills and supply them to paper manufacturers or trading companies. While our waste paper transactions are primarily domestic, our paper pulp exports serve a broad customer base across East Asia and Southeast Asia.

We also conduct cross-border transactions under our waste paper recycling business by procuring waste paper from suppliers in the U.S. and arranging for direct shipments to pulp mills or paper manufacturers in Malaysia.

Our scrap metal recycling business focuses on the trade of dismantled metal wires and old metal appliances such as motors, engines, air conditioners and refrigerators. For old metal appliances, we acquire these materials from collection companies and supply them to smelters or trading companies, while for dismantled metal wires, we purchase processed and dismantled metal wires such as copper wires, aluminum wires, brass wires and iron wires, from dismantling factories, and then sell them to smelters, or trading firms. While the operations under our scrap metal recycling business are primarily concentrated within Japan due to the heavier nature of these materials, we also export a portion of our dismantled metal wires to our customers in East Asia and Southeast Asia.

For export transactions, we manage the full logistics chain from supplier pickup and port delivery to international shipping, allowing us to ensure timely and cost-effective deliveries.

Note: Net income and revenue are for the fiscal year that ended March 31, 2025.

(Note: Seahaawk Recycling Holdings, Inc. filed its F-1 for its small-cap IPO and disclosed the terms: 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its SEC filing on Sept. 25, 2025.)

Ultratrex UTX Craft Capital Management, 1.3M Shares, $4.00-6.00, $6.3 mil, 12/29/2025 Week of

(Incorporated in the Cayman Islands)

We make marine environmental cleanup and dredging machinery.

We provide environmental solutions that rely on amphibious machinery, aquatic weed harvesters and dredgers.

Environmental cleanup projects, habitat restoration and land reclamation make up most of our projects. We serve customers mostly in Southeast Asia, the Middle East and some parts of Europe.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended on Dec. 31, 2024.

(Note: Ultratrex is offering 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million, according to its F-1/A filings.)

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 1/5/2026 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

DT House Ltd. DTDT American Trust Investment Services, 2.0M Shares, $4.00-5.00, $9.0 mil, 1/5/2026 Week of

(Incorporated in the Cayman Islands)

We are a Cayman Islands exempted company with operations conducted by our subsidiaries in the UAE and Hong Kong. DT House is the holding company of UHAD, UHHK and UFox, all being our wholly-owned subsidiaries. Our headquarters are located in the UAE, and we commenced with the establishment of UHHK in 2020. We provide corporate consultancy services encapsulating environmental, social and governance-related aspects (commonly known as “ESG”) to enterprises and corporations with the purpose of unlocking greater business resiliency and sustainable cost savings along with revenue generating opportunities. As part of our corporate consultancy services around the ESG thematic, we provide travel-related services for leisure travelers into the UAE, which includes primarily the sale of tourism attractions tickets.

Our corporate consultancy services are provided in the UAE and Hong Kong. ESG is an emerging managerial concept for enterprises and corporations. Through technology integration, our corporate consultancy services offer customized hassle-free solutions to clients, from developing the knowledge and acknowledging the importance of ESG criteria, to formulating internal ESG self-assessments and practices, identifying ESG-related risks and opportunities, implementing cost-effective ESG policies and solutions, and eventually to capitalizing on potential ESG-related market opportunities and strategies. Our clients consist of public companies in the United States and Hong Kong, as well as small and medium-sized enterprises and private corporations in the UAE, Hong Kong and southeast Asia. We leverage upon emerging technologies to drive growth, optimize operations, and create new value streams for our clients. We have our own AI driven, cloud-based software program, and will continue to develop such program so that it can interact with various databases, collect relevant data, and use the data collected to perform self-determined tasks to meet predetermined goals (commonly known as “AI Agent”), which enables clients to retrieve, analyze, compare and evaluate ESG performance of themselves, their competitors and other market participants.

In June 2024, we commenced our travel-related services by acquiring UFox. UFox is a company principally engaged in travel-related services in the UAE, with the particular emphasis of eco-friendly and sustainable travel practices. UFox maintains close business relations with various organizations in the MENA Region such as the Union of Overseas Chinese in Saudi Arabia. We believe that our travel-related services could potentially bring about a synergistic effect with our corporate consultancy services if we follow the same set of ESG principles in both segments. Our current plan is to design travel programs based on the sustainable travel concept, such as alternative transport modes with lower carbon footprints and partnering with eco-friendly hotels. Knowledge and experience gained from our design of travel programs would be useful when we develop sustainable travel policies for our corporate consultancy services clients. The cross-over between low carbon footprint travel programs and sustainability business practices would reduce the average development costs of our projects. It also broadens the scope and strengthen the quality of our consultancy in fostering responsible and impactful ESG business strategies and practices for our corporate customers. Through UFox, we started to provide travel-related services for leisure travelers in the UAE. We offer segmented travel-related services to our customers, which includes primarily the sale of tourism attractions tickets. The destinations of the travel-related services offered by us are primarily within the UAE. We offer customizable hassle-free sustainable travel experience to customers. Customers can choose to customize their own tours depending on their demands and requirements and subscribe to services on segmented basis. Currently, we only have limited business activities of travel-related services due to our short operating history of several months in this sector. The major customers of our travel-related services are two online leisure travel platforms, namely, Trip.com Group Limited (Nasdaq: TCOM) and Fliggy international platform (fliggy.com, a member of Alibaba Group (NYSE: BABA) and an online marketplace of tourism products) that connect us with independent travelers for the sales and marketing of our travel products and services. Other customers of ours include travel companies, travel agencies, tour operators, booking agents, as well as other corporations and institutes, which currently contribute an insignificant portion of our revenue from travel-related services. In the future, we hope to expand the clientele of this segment to include retail leisure travelers and clients from our corporate consultancy services, and the scope of this segment to include other types of travel-related services, such as airfreight ticketing, tour guiding, hotel booking and transportation booking, and arrangement of packaged tours.

Note: Net income and revenue are for the year that ended Sept. 30, 2024.

(Note: DT House Ltd. increased its IPO’s size to 2.0 million shares – up from 1.875 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its most recent F-1/A filing. DT House Ltd. has also named American Trust Investment Services as the sole book-runner, replacing Revere Securities. Background: DT House Ltd. filed its F-1 on March 3, 2025, and disclosed the terms for its IPO: The company is offering 1.875 million shares at a price range of $4.00 to $5.00 to raise $8.44 million, if priced at the mid-point of its range.)

HW Electro Co., Ltd. (NASDAQ-New Filing) HWEP American Trust Investment Services/WestPark Capital, 4.2M Shares, $4.00-4.00, $16.6 mil, 1/5/2026 Week of

We are the first company in Japan to obtain a license plate number for imported electric light commercial vehicles. We are the second company and also one of the three companies that sell electric light commercial vehicles in Japan as of the date of this prospectus. (Incorporated in Japan)

The electric light commercial vehicles we sell belong to the category of “light commercial vehicles,” which are commercial carrier vehicles with a gross vehicle weight of no more than 3,500 kilograms.

We commenced selling and delivering two models of electric light commercial vehicles, ELEMO and ELEMO-K, in Japan in April 2022 and July 2022, respectively, and have been working with Cenntro, our cooperating manufacturer, to produce them under our brand, “ELEMO,” in its factory in Hangzhou, China. ELEMO is the first electric vehicle we sell and (it) is the second electric light commercial vehicle that has ever been sold in Japan since the commencement of sales of MINICAB-MiEV in December 2011, which was the first electric light commercial vehicle produced by Mitsubishi Motors Corporation. Since June 2023, we have commenced the sales of a new model called “ELEMO-L,” a van-type electric vehicle that could be used for commercial and recreational camping purposes, which we expect may enable us to increase consumer market penetration.

Under our Exclusive Basic Transaction Agreement dated March 31, 2021 with Cenntro (the “Exclusive Basic Transaction Agreement”), Cenntro manufactures ELEMO, ELEMO-K, ELEMO-L, and other electric vehicles under the specifications designated by us in their manufacturing factories in China and delivers the electric vehicles to the ports in China designated in the individual agreement for a particular order. We arrange for the shipment from these ports to the Port of Yokohama or other designated ports in Japan. Upon arrival, we transport the vehicles to our research laboratory located in Chiba, Japan, for inspection, and then send them to our business partners’ facilities, Anest Iwata’s factory in Fukushima, Japan, and TONOX’s factories in Kanagawa, Japan. The specialists of Anest Iwata, a Tokyo Stock Exchange-listed company that specializes in industrial machinery, supplies, and components, and TONOX, a Japanese commercial vehicle manufacturer, modify the vehicles to comply with the regulations and standards for the Japanese market, install the accessories, and undertake the inspection in accordance with our instructions. After the inspection and modifications, we deliver the electric vehicles to the governmental vehicle inspection office, the National Agency for Automotive and Land Transportation Technology, for individual imported vehicle inspection, and the local land transportation office for registration. Upon completion of the individual imported vehicle inspection and registration, we conduct the final inspection in our research laboratory located in Chiba, Japan, and deliver the electric light commercial vehicles to the customers.

Since the inception of our operation, we have been leveraging the customizability and adjustability of our electric light commercial vehicles to attract corporations in different industries and local governments that have varying needs from their departments in Japan. During the fiscal years ended September 30, 2023 and 2022, we sold and delivered 52 and 16 electric light commercial vehicles to 14 and 11 customers, respectively.

Note: Net loss and revenue figures are in U.S. dollars (converted from Japanese yen) for the fiscal year that ended Sept. 30, 2024.

(Note – New IPO Plans: HW Electro Co., Ltd. filed an F-1 dated May 8, 2025 – the same date that it withdrew its previous IPO plans in a letter to the SEC. In the new IPO document – the F-1 dated May 8, 2025 – HW Electro Co., Ltd. disclosed that it is offering 4.15 million American Depositary Shares (ADS) at an assumed IPO price of $4.00 to raise $16.6 million. American Trust Investment Services and WestPark Capital are the joint book-runners.)

(Background on Previous IPO plans: Registration Withdrawn on May 8, 2025 – A.C. Sunshine and Univest Securities were the joint book-runners. Note: HW Electro Co., Ltd. filed an F-1MEF to increase its IPO’s size at pricing by 200,000 shares, according to a filing dated Jan. 24, 2025. Note: HW Electro Co., Ltd. filed an F-1/A to increase its IPO’s size to 4.0 million ADS – up from 3.75 million ADS – and increase the assumed IPO price to $4.00 – up from $3.00 – to raise $16.0 million – up from $11.25 million initially – according to an F-1/A filing dated Dec. 23, 2024. In that same filing, AC Sunshine Securities was added as the lead left joint book-runner to work with Univest Securities as the other joint book-runner, and the IPO’s proposed venue was changed to the NASDAQ from the NYSE – American Exchange, with the proposed symbol changed to “HWEP” from “HWEC”. Note: HW Electro Co., Ltd. filed its new F-1 (prospectus) on April 26, 2024, disclosing plans for its IPO and its listing of American Depositary Shares (ADS) on the NYSE – American Exchange: 3.75 million ADS at an assumed IPO price of $3.00 per ADS. Each ADS represents one ordinary share. Background: HW Electro Co., Ltd. withdrew its previous IPO plans that called for a listing on the NASDAQ with a different proposed symbol.)

PressLogic PLAI American Trust Investment Services, 1.8M Shares, $4.00-6.00, $9.0 mil, 1/5/2026 Week of

(Incorporated in the Cayman Islands)

We provide digital marketing services to companies in Hong Kong and Taiwan. Our content marketing solutions include a digital marketing solution segment, which offers editorial content, influencer marketing and display advertising, along with advertisements. We run nine proprietary media brands with over 12 million subscribers and followers, including nine websites, five apps, 11 Facebook fanpages, 11 Instagram profiles and eight YouTube channels, as of the date of this prospectus.

Note: Net income and revenue are in U.S. dollars (converted from Hong Kong dollars) for the 12 months that ended June 30, 2025.

(Note: PressLogic filed its F-1/A on Oct. 14, 2025, and disclosed the terms of its small IPO: The company is offering 1.8 million shares at a price range of $4.00 to $6.00 to raise $9.0 million, if priced at the mid-point of its range. Background: PressLogic filed its F-1 to go public in September.)

Riku Dining Group RIKU Eddid Securities USA, 2.3M Shares, $4.00-6.00, $11.3 mil, 1/5/2026 Week of

(Incorporated in the Cayman Islands)

We operate and franchise Japanese-style restaurants in Canada and Hong Kong:

In Canada – Ajisen Ramen is our franchise. We run four restaurants and we franchise nine more restaurants across Ontario.

In Hong Kong – We have seven restaurants under three franchised brands – Yakiniku Kakura, Yakiniku 802 and Ufufu Cafe.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended March 31, 2025.

(Note: Riku Dining Group disclosed the terms for its IPO in an Oct. 8, 2025, filing with the SEC: The company is offering 2.25 million shares at a price range of $4.00 to $6.00 to raise $11.25 million. Background: Riku Dining Group filed its F-1 for its IPO in September 2025 without disclosing the terms. Estimated IPO proceeds are $16 million.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

09/13/2025 – WisdomTree Asia Defense Fund – WDAF

-

08/12/2025 – Neuberger Berman Emerging Markets Debt Hard Currency ETF – NEMD

-

07/15/2025 – OTG Latin America ETF – OTGL

-

06/21/2025 – FT Vest Emerging Markets Buffer ETF June – TJUN

-

06/18/2025 – AB Emerging Markets Opportunities ETF – EMOP

-

06/05/2025 – Harbor Emerging Markets Equity ETF – EPEM

-

06/03/2025 – Russell Investments Emerging Markets Equity Active ETF – ZJUN

-

05/30/2025 – Emerging Markets Equity Active ETF – REMG

-

05/16/2025 – Harbor Emerging Markets Select ETF – EMES

-

04/02/2025 – Goldman Sachs India Equity ETF – GIND

-

03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

-

02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

-

02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

-

02/14/2025 – GMO Beyond China ETF – BCHI

-

02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

-

01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

-

01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (December 29, 2025) was also published on our website under the Newsletter category.