Emerging Market Links + The Week Ahead (February 10, 2025)

Given what has been in the news lately, the All-In Podcast (@chamath, @jason, @davidsacks, and @friedberg) recently had this fascinating episode worth listening to:

They discussed the turnaround at Twitter e.g. when some of them arrived there to fix the mess, they discovered that whiteboard pens had gone dry in the conference rooms from lack of use, food was getting made in the cafeteria for a fully staffed office (and tossed in the garbage as almost everyone was working from home, meaning each meal for those eating was costing the equivalent of $800 a person!), Grade A office space was being rented for $100 sg ft to store office furniture from the old HQ, there were SAAS software licenses hardly being used or NOT even activated being paid for (I think this is a common problem!), etc. In other words, massive waste, fraud, and corruption.

Apparently when you want to fix a troubled company (or find out where the money is flowing), you turn off the credit cards/payment systems and wait for people to start screaming – those screaming the loudest are probably the ones defrauding you the most. That’s basically what Elon-DOGE did and USAID screamed the loudest plus they were violating Trump’s executive orders the most…

Interestingly enough, one podcast participant said they WON’T work with a company getting more than a 1/3rd of their revenue from Medicare/Medicaid payments as they inevitably find massive and continuous fraud – something to remember when encountering stocks getting revenue from any and from the US’s government in particular…

(NOTE: Unlike with the US government, Twitter actually had audited financial statements, a controller, and reconciliation of the books… They also just issued bonds with a minimal discount – a testament to Elon et al’s turnaround there working…)

Finally, and for anyone based in SE Asia: Sophocles Sophocleous, CFA of the FatAlpha Blog will be holding the Asia Value Investor Conference March 27-28, 2025, at the Royal Varuna Yacht Club in Pattaya (Thailand) with what I presume to be the list of speakers or attendees here (including at least one of my paid subscribers who had alerted me to the conference…).

$ = behind a paywall

-

🇨🇳 China & Hong Kong Stock Picks (January 2025) Partially $

-

Americans fascinated by Chinese grocery prices + Zhongji Innolight Co Ltd, China Life Insurance, Shengyi Technology, BYD Electronic International / BYD Company, Foxconn Interconnect Technology, InnoCare Pharma, Tuhu Car, Will Semiconductor Co Ltd, New Oriental Education, Tencent, Yancoal Australia, Wingtech Technology Co Ltd, JD.com, Great Wall Motor, Weichai Power, WuXi Biologics, iQIYI, Dmall Inc, Baidu, Q Technology (Group) Company, BeiGene, Zhejiang Leapmotor Technology Co Ltd, Xtep, Sichuan Kelun-Biotech Biopharmaceutical, ANTA Sports Products, CMGE Technology, YUM China, Innovent Biologics, Horizon Construction Development, Cimc Enric Holdings Ltd & Ubtech Robotics Corp Ltd

-

CMB 20+ high conviction stock ideas: Li Auto, Geely Automobile Holdings, Xpeng Inc, Zoomlion Heavy Industry, China Hongqiao Group, Bosideng International Holdings, Luckin Coffee, ANTA Sports Products, JNBY Design, YUM China, Proya Cosmetics, China Pacific Insurance (Group) Co (CR Beverage), BeiGene, Shanghai United Imaging Healthcare, PICC Property and Casualty Co Ltd, Tencent, NetEase, Alibaba, Greentown Service Group Co, Foxconn Interconnect Technology (FIT Hon Teng), Xiaomi, BYD Electronic International, Zhongji Innolight Co Ltd, NAURA Technology Group & Kingdee International Software

-

-

🌐 EM Fund Stock Picks & Country Commentaries (February 9, 2025) Partially $

-

Understanding the sources of value in EMs, gold is shiny again, opportunities from India’s water crisis, tariff risk framework, DeepSeek & the US$, Richemont, Tbc Bank, Halyk Bank, UAC Nigeria, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 Tesla vs. BYD: Who Will Dominate the Global EV Market in 2025? (The Smart Investor)

The electric vehicle (EV) market is heating up, and two companies are leading the charge: Tesla (NASDAQ: TSLA) and BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF).

Which electric vehicle company will win the market? Let’s find out.

Global EV Market Momentum

Market Leadership Dynamics

Revenue Comparison

2024 Vehicle Sales Comparison

Strengths and Challenges

Get Smart: Navigating the EV Landscape

🇨🇳 Auditor drama casts unflattering light on Lufax at already-difficult time (Bamboo Works)

The online loan facilitator moved to fire PwC after the accountant raised a red flag over some related-party transactions

Lufax Holdings (NYSE: LU)’s board has proposed terminating PwC as its external auditor after the accounting firm raised questions about related-party transactions

The clash comes at a critical time when the loan facilitator is trying to reverse its falling revenue and profits

🇨🇳 Vesync (2148 HK): Antitrust Condition Satisfied, and the Scheme Vote Remains Low-Risk (Smartkarma) $

On 27 December 2024, Vesync (HKG: 2148 / OTCMKTS: VSYNF) disclosed a Cayman scheme privatisation offer from the Yang family at HK$5.60. On 28 January, the antitrust condition was satisfied.

Despite a light offer, the scheme vote is low-risk. No disinterested shareholder holds a blocking stake, there is a scrip option with no cap, and there is no retail opposition.

The scheme document will be despatched by 11 April. At the last close and for an end-of-May payment, the gross and annualised spread is 6.9% and 22.7%, respectively.

🇨🇳 After a failed Fosun buyout, what’s next for drug maker Henlius Biotech? (Bamboo Works)

Hong Kong shareholders have foiled plans by Shanghai Fosun Pharmaceutical (HKG: 2196 / SHA: 600196 / FRA: 08HH / OTCMKTS: SFOSF) to take its biologics subsidiary off the stock market at half the IPO price

Fosun Pharma has pledged to continue to support Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF) over the long term, after abandoning a bid to buy out the firm’s minority shareholders

Unlike its loss-making peers, Henlius Biotech has logged net profits from sales of innovative cancer drugs

🇨🇳 Gasping Huabao’s profits go up in smoke (Bamboo Works)

The vaping device and component maker warned it will report a pre-tax loss of up to 455 million yuan last year after taking up to 1 billion yuan in one-time charges

Huabao International Holdings Ltd. (HKG: 0336 / FRA: CEY2 / CEY / OTCMKTS: HUABF / HUIHY) swung sharply into the red last year, as it took large charges related to its flavors and reconstituted tobacco leaf businesses

The company’s close ties to China’s state tobacco monopoly that were once one of its biggest assets are now becoming a liability

🇨🇳 Shenzhen Metro buys out Hongshuwan project to ease Vanke debt burden (Caixin) $

As China Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / FRA: 18V0 / OTCMKTS: CHVKF) approaches a peak in debt repayments, its state-owned shareholder, Shenzhen Metro Group, has stepped in to acquire the Shenzhen Hongshuwan project. While the deal provides limited liquidity, it helps optimize Vanke’s financial statements and signals increased state-backing for the property developer.

Vanke successfully bid for the Hongshuwan project in 2014, paying 4.53 billion yuan ($625 million) and developing it in partnership with Shenzhen Metro, which owns a 51% stake. The project spans 419,000 square meters, including office, commercial, hotel and serviced apartments, most of which have been sold. Office units remain available.

🇨🇳 The state steps in to shield China Vanke from debt crunch (Bamboo Works)

Default risks have receded at the embattled property developer after a state-backed support effort, but business recovery is still a long way off

The head of the firm’s biggest shareholder, state-owned Shenzhen Metro, will take the China Vanke (SHE: 000002 / HKG: 2202 / FRA: 18V / FRA: 18V0 / OTCMKTS: CHVKF) helm in a boardroom shake-up

The real estate developer warned of a net loss of up to 45 billion yuan for 2024 after making a 12.2 billion yuan profit a year earlier

🇨🇳 Trade tensions threaten to unravel Texhong turnaround story (Bamboo Works)

The yarn maker has been profitable since the second half of 2023, but its recent turnaround could be threatened by new U.S. tariffs against Chinese exports

Texhong International Group (HKG: 2678 / FRA: T1TA) reported a profit of 580 million yuan last year, extending a recent turnaround as it focuses on its core yarn business and cost controls

The company sells its yarns and fabrics mostly to textile makers in China, which could expose it to new U.S. tariffs imposed by Donald Trump this week on Chinese goods

🇨🇳 Yum China (9987 HK): 2025 Outlook. Modest Growth and Margin Upside Amid Sector Headwinds (Smartkarma) $

YUM China (NYSE: YUMC) posted robust year-over-year operating profit growth in 4Q2024 on the back of low single digit sales increase and operating efficiencies.

Despite significant sector headwinds, Yum China has managed to outperform peers and grow ahead of sector in 2024 by swiftly adapting to shifting consumer preferences.

Yum China’s value-for-money QSR model with mid-tier pricing amidst tough sector outlook implies limited margin upside, a likely single-digit sales growth outlook, and a modest dividend yield for 2025.

🇨🇳 TH International: Tim Hortons’ Rocky Road In China (Seeking Alpha) $ 🗃️

🇨🇳 Guming IPO: The Good, The Bad and The Valuation. Is It Time to Sip or Skip? (Smartkarma) $

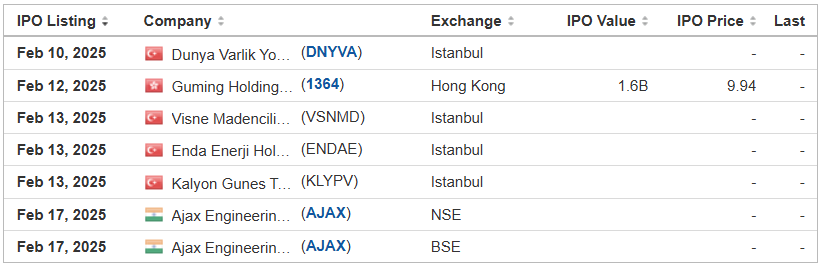

Guming Holdings (HKG: 1364) is offering 158.6 million shares in a price range of HK$8.68 to HK$9.94 in its Hong Kong IPO aiming to raise up to HK$1.58 Bn.

Despite outperforming peers in revenue and profit growth, Guming is grappling with a bleak macro environment, operational slowdowns, and intensified competition.

Guming Holdings (GUM HK) ‘s faltering operating metrics for last reporting period cast doubt on its near-term growth and profitability outlook—leaving investors to ask: Sip or skip?

🇨🇳 Guming Holdings (1364 HK) IPO: Valuation Insights (Smartkarma) $

🇨🇳 Guming Holdings (Good Me) IPO Preview (Douglas Research Insights) $

Guming Holdings (HKG: 1364) is getting ready to complete its IPO on the Hong Kong Exchange in February.

At the high end of the IPO price range, the listing will raise about HK$1.58 billion.

Guming is a ready-to-drink beverage company specializing in freshly made tea beverages.

🇨🇳 Guming Holding IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Guming Holdings (HKG: 1364) is implied target price of HKD 13.70, which is 38% higher than the high end of the IPO valuation range.

Given the solid upside, we have a Positive view of this IPO. Our valuation sensitivity analysis suggests a range of HKD 11.09 to HKD 16.57 per share.

Our base case valuation is based on 2025E P/S multiple of 3x, which is a 30% premium to the two closest comps (Sichuan Baicha Baidao Industrial (HKG: 2555) and Helens International Holdings Co Ltd (HKG: 9869 / FRA: 5ZW)).

🇨🇳 🇭🇰 HK 第33部分; One Day Stocks #2 (Jam_invest) $

Some stocks gradually compound away, year after year. Others return years of performance in a brief period of time… Mexan Ltd (HKG: 0022) just did 82%(!!) in one day. There are lots of others with such potential.

🇲🇴 🇱🇰 Melco-run casino at City of Dreams Sri Lanka to open 3Q 2025, says local development partner John Keells Holdings (GGRAsia)

The Sri Lanka real estate developer is the partner of casino operator Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) for the US$1-billion City of Dreams Sri Lanka scheme (pictured). The partnership had been announced in April, and is based on infrastructure started before the Melco brand’s involvement.

Banking group Morgan Stanley said in a July memo after meetings with John Keells Holdings PLC (CSE: JKH)’ management, that Melco Resorts would get circa 50 percent of casino EBITDA (earnings before interest, taxation, depreciation and amortisation) for the Sri Lanka site.

🇲🇴 🇸🇬 LVS says likely further delays to Marina Bay Sands expansion project, opening only in January 2031 (GGRAsia)

Casino operator Las Vegas Sands (NYSE: LVS) says the expansion project for its existing Marina Bay Sands (MBS) casino complex in Singapore is now expected to be completed only by June 2030, with an anticipated opening date in January 2031. Just last month, the company had affirmed in a revised agreement with the Singapore authorities plans for project completion by July 2029.

In January, Las Vegas Sands announced an agreement between the property’s operator – its subsidiary Marina Bay Sands Pte Ltd – and the Singapore Tourism Board, allowing the firm to increase the overall gaming area allocation for the expansion project, among other amendments. In return, Las Vegas Sands agreed to pay US$1 billion to the Singaporean authorities.

🇰🇷 Update Of GPT-3 Based Services And Cash Flows Make SK Telecom Undervalued (Seeking Alpha) $ 🗃️

-

🇰🇷 SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) – Wireless telecommunication services in Korea. 3 segments: Cellular Services, Fixed-Line Telecommunications Services & Other Businesses. 🇼 🏷️

🇰🇷 Must Asset Mgmt Goes Activist on Young Poong (Douglas Research Insights) $

Must Asset Management, a 3% shareholder of Young Poong Precision Corporation (KOSDAQ: 036560), started to go activist on the company on 5 February.

Based on current market cap, this would represent a P/B of 0.2x using the consolidated controlling interest equity of 3.9 trillion won!

There is some speculation that Must Asset Mgmt may form an alliance with Chairman Choi’s family as it proposed to Young Poong to recommend outside directors.

🇰🇷 Hana Financial: Share Buyback and Cancellation of 400 Billion Won + 50% Total Shareholder Return (Douglas Research Insights) $

On 4 February, Hana Financial Group (KRX: 086790) announced a share buyback and cancellation of 400 billion won worth of treasury shares, representing 2.3% of its market cap.

Hana Financial plans to achieve a total shareholder return ratio of 50% by 2027. Its total shareholder return ratio increased to 37.8% in 2024, up 4.8% YoY.

Hana Financial’s total cash dividend per common share is 3,600 won in 2024 (up 5.9% YoY). Hana Financial’s total shareholder return ratio increased to 37.8% in 2024, up 4.8% YoY.

🇰🇷 Samsung Life Insurance Is Considering on Incorporating Samsung F&M Insurance as a Subsidiary (Douglas Research Insights) $

After the market close on 4 February, several local news outlets reported that Samsung Life Insurance (KRX: 032830) is considering on incorporating Samsung Fire & Marine Insurance (KRX: 000810 / 000815) as a subsidiary.

Share cancellation by Samsung F&M Insurance would lead to an increase in ownership stake of Samsung F&M Insurance by Samsung Life Insurance which would violate the current Insurance Business Act.

It is unlikely for Samsung Life Insurance to sell some of its stake in Samsung F&M Insurance, but Samsung Life Insurance could increase its stake in Samsung F&M Insurance.

🇰🇷 Daemyung Sono Group May Wage a Public Opinion War for T’Way Air (Douglas Research Insights) $

In the past two trading days, share prices of T’Way Air (KRX: 091810) and TWay Holdings Incorporation (KRX: 004870) are down 16.4% and 14.1%, respectively.

According to Hankyung daily, Daemyung Sono Group Chairman Seo may choose to wage a public opinion war, instead of purchasing additional shares.

If Daemyung Sono Group is unable to take over the management control of T’Way Air using this method, then a potential tender offer of T’Way Air is possible later on.

🇰🇷 Korea Small Cap Gem #32: Pulmuone (Douglas Research Insights) $

Pulmuone Corporate (KRX: 017810) has benefited from improved sales and profitability of its US subsidiary, driven by higher demand for Korean foods and plant based/non-meat based foods such as tofu.

The company has nearly 70% market share in the tofu segment in the US. It has gained meaningful economies of scale of its tofu product in the United States.

Pulmuone currently has a market cap of 390 billion won. Using the consensus net profit estimate of 37.6 billion won, this would suggest a P/E of 10.3x.

🇰🇷 A Partial Tender Offer of Englewood Lab by Cosmecca Korea (Douglas Research Insights) $

On 6 February, Cosmecca Korea (KOSDAQ: 241710) launched a partial tender offer on Englewood Lab (KOSDAQ: 950140).

Cosmecca Korea announced that it plans to purchase 11% (2.185 million) of Englewood Lab’s outstanding shares at the tender offer price of 10,000 won.

It appears that this partial tender offer is an attempt by Cosmecca Korea to increase its stake in Englewood Lab even further, capitalizing on the lower share price.

🇰🇷 Acquittal of Lee Jae-Yong and Impact on Samsung C&T (Douglas Research Insights) $

Now that Lee Jae-Yong’s legal problems appear to have finally have been resolved, it could positively impact Samsung C&T Corp (KRX: 028260 / 02826K), Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF), and Samsung Biologics (KRX: 207940).

Given the fact that Samsung Electronics and Samsung Biologics are the two most important drivers of Samsung C&T, this could positively benefit the valuation of Samsung C&T.

Our NAV analysis of Samsung C&T suggests NAV of 38.7 trillion won or NAV per share of 217,747 won which is 84% higher from current levels.

🇰🇷 LG CNS: First Day Trading Strategy Post IPO (Douglas Research Insights) $

In this insight, we discuss the first day trading strategy of (Digital Transformation (DX) Specialist) LG CNS Co Ltd (KRX: 064400) which starts trading on 5 February.

On the first day of trading, we believe LG CNS’s shares could trade at higher levels, overshooting its intrinsic valuations.

We recommend investors to take some profits off the table if the share price shoots higher by 30% to 50%+ from the IPO price on the first day.

🇰🇷 Samsung chair cleared of fraud and stock manipulation (FT) $ 🗃️

🇵🇭 Philippines-based DigiPlus seeks local partner for Brazil after netting online gaming licence there (GGRAsia)

Philippines-listed DigiPlus Interactive (PSE: PLUS) is seeking a “strategic partner with gaming expertise” for its expansion in Brazil, a market where the company was recently granted the rights to operate sports betting and online gaming.

The search for the local partner was confirmed in a Wednesday filing to the Philippine Stock Exchange.

🇸🇬 4 Singapore Data Centre REITs That Should Benefit from the AI Investment Boom (The Smart Investor)

With AI looking to be an enduring trend, here are four Singapore data centre REITs that can give you a front row seat to the action within this space.

🇸🇬 Sheng Siong’s Share Price Barely Budged in the Past Year: What’s Next for the Retailer? (The Smart Investor)

The retailer’s share price has skidded to a halt but could there be potential for better profits and higher dividends going forward?

Let’s delve deeper to see what we can expect from Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) in the coming months.

A commendable set of earnings

Bidding and winning

New stores drive revenue growth

A promising HDB supply pipeline

Get Smart: Good times ahead

🇸🇬 4 Singapore Stocks That Could See Their Share Prices Slither Higher in the Year of the Snake (The Smart Investor)

As we welcome the Year of the Snake, here are four stocks that could do well.

Here are four Singapore stocks that are well-positioned to see their share prices rise in 2025.

Riverstone Holdings (SGX: AP4) is a manufacturer of nitrile and natural rubber clean room gloves used in highly-controlled environments as well as premium nitrile gloves used in the healthcare industry.

iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) is a financial technology company operating a platform for the buying and selling of unit trusts, equities, and bonds.

Nanofilm Technologies (SGX: MZH / OTCMKTS: NNFTF) is a provider of nanotechnology and technology-based solutions across a wide range of industries.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), or MMH, is a supplier of high precision tools and parts used in the wafer fabrication and assembly processes of the semiconductor industry.

🇸🇬 5 Singapore Stocks Touching Their 52-Week Lows: Are They a Bargain? (The Smart Investor)

These five stocks may be breaching their 52-week lows, but could they be a juicy bargain for investors who are looking for cheap stocks to scoop up?

Digital Core REIT (SGX: DCRU / OTCMKTS: DGTCF), or DCR, is a data centre REIT with a portfolio of 10 data centres worth US$1.4 billion as of 30 September 2024.

Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF) is a provider of technology products, services and solutions to a wide range of customers spanning different verticals.

UOL Group Limited (SGX: U14 / FRA: U1O / OTCMKTS: UOLGY / UOLGF) is a property and hospitality group with total assets of around S$22 billion.

Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF), or RMG, is an integrated healthcare provider with operations in 14 cities across five countries in Asia.

Ireit Global (SGX: UD1U) owns a portfolio of 53 properties in Germany (5), Spain (4), and France (44) with a total portfolio value of €855.6 million.

🇹🇭 Haad Thip (HTC TB) (Asian Century Stocks) $

Monopoly Coca-Cola bottler at 10x P/E and 7% dividend yield

Haad Thip PCL (BKK: HTC / OTCMKTS: HAATF) — US$194 million) is a Coca-Cola bottler responsible for Thailand’s 14 southern provinces. It was mentioned by the Twitter account Nate, who suggested I read through Haad Thip’s annual report. And I’m happy I did.

A bottler works with the Coca-Cola Company in the United States to manufacture and distribute its products. It buys concentrate and then mixes it with water, sweetener, carbon dioxide and other additives. Finally, it fills the drink into bottles sold to retail outlets across Southern Thailand.

Haad Thip is run by Patchara “Dollar” Rattakul, the son of the previous CEO. Before becoming CEO, he spent 10 years as Chief Operating Officer, during which Haad Thip modernized its production equipment and became a lean operation. From what I’ve read, I’ve been impressed by Patchara and consider him a safe pair of hands.

🇮🇳 SHEIN: Back in India in Alliance with Reliance, Amid Woes in the West (Smartkarma) $

SHEIN (1895674D HK) returns to India after a five-year hiatus under a license agreement with Reliance Industries Limited (NSE: RELIANCE / BOM: 500325) owned Reliance Retail ltd.

India’s vast, untapped market for fast fashion, driven by a large and growing young population, rising disposable incomes, and increased e-commerce penetration presents an attractive growth opportunity for Shein.

Shein faces growing challenges in the US due to new trade restrictions. Its partnership with Reliance could serve as a strategic move to develop alternative supply chains outside China.

🇮🇳 Aarti Industries Limited: Q3 FY25 Update (Smartkarma) $

Aarti Industries (NSE: AARTIIND / BOM: 524208) reported Q3 FY25 revenue of Rs. 2,305 crores with 14% QoQ growth, robust volume gains, capacity expansions in MMA and nitro-toluene, and ongoing cost optimizations.

Strong Q3 performance and capacity boosts bolster AIL’s long-term growth prospects, mitigating pricing pressures and forex challenges while fueling diversification into renewables and chemical recycling.

AIL’s strategic investments and diverse product mix signal resilient growth and margin improvements, suggesting a promising long-term outlook despite current short-term forex volatility.

🇮🇳 The Beat Ideas: Aarti Drugs Revival (Smartkarma) $

Received US FDA Approval for both Tarapur & Baddi Facility & moving to regulated market.

Increase in revenues & margins with the US FDA approvals & Many products are backward integration or import substitution which is expected to boost demand

US entry to allow product & bottomline expansion and would also focus on increasing market presence from semi-regulated markets along with regulated markets

🇮🇳 Sify Technologies: Unlocking Value with Data Centre IPO (Smartkarma) $

Sify Technologies (NASDAQ: SIFY) is planning a Rs. 3,000 crore IPO for its data centre subsidiary, Sify Infinite Spaces, aiming to unlock significant hidden value and realign its market valuation.

The IPO underscores rapid growth in India’s data centre market, driven by Digital India and 5G, offering a strategic edge with lower capital costs versus global peers.

Investors can capitalize on a notable valuation arbitrage, as Sify’s data centre arm is vastly undervalued compared to the parent’s market cap, promising long-term upside.

🇮🇳 Sify Technologies: Positive Beneficiary of the Potential IPO of Sify Infinit Spaces (Douglas Research Insights)

The potential IPO of Sify Infinite Spaces is likely to have a positive impact on Sify Technologies (NASDAQ: SIFY) .

The overall market size of data centers in India is huge and Sify Infinite Spaces certainly has the experience and capability to become one of the leaders in this segment.

Despite attractive market opportunity, there will be some investors that will question the overall valuation levels of Sify Infinite Spaces to justify seeking nearly 30 billion INR in the IPO.

🇮🇳 Ganesha Ecosphere Limited: Q3 FY25 Quarterly Update (Smartkarma) $

Ganesha Ecosphere (NSE: GANECOS / BOM: 514167)’s Q3 FY25 revenue surged 39.6% YoY to ₹397.8 crores, with production volume up 22.3% YoY, and capacity expansions underway.

Strong revenue growth and capacity expansions enhance GEL’s market position amid rising global demand for sustainable PET recycling.

Investors gain confidence in GEL’s strategic shift towards high-value recycled products and international market expansion, promising long-term sustainability.

🇮🇳 Himadri Speciality Chemical Ltd: Q3 & 9M FY25 Performance Analysis (Smartkarma) $

Himadri Speciality Chemical (NSE: HSCL / BOM: 500184) delivered strong Q3 and 9M FY25 performance, with revenue, EBITDA, and PAT rising significantly, and launched major capacity expansions and new high-value product investments.

Himadri is set to capitalize on growing EV and lithium-ion battery markets, enhancing long-term profitability and sustainability.

Company acquired Birla tyre and also took more than 10% stake in Sicona, an Australian startup specializing in silicon anode technology, which will drive further growth once stabilise.

🇮🇳 Clean Science and Technologies Ltd- Entering New Habitats (Smartkarma) $

Clean Science and Technology Ltd (NSE: CLEAN / BOM: 543318) is one of the leading chemical manufacturers globally of functionally critical specialty chemicals, Pharmaceutical Intermediates, and FMCG Chemicals.

It has embarked on a massive expansion by commissioning a new plant to manufacture HALS and is also spending additional capex to manufacture new products.

With forensics, we pay attention to excessive remuneration being paid to promoters, concentration risk from top customers, and increase in attrition of permanent employees.

🇮🇳 Hexaware Technologies IPO: The Bull Case (Smartkarma) $

Hexaware Technologies (HEXW IN), an Indian mid-sized global IT services company, aims to raise up to US$1.0 billion.

BPEA privatised Hexaware in 2020. In 2021, Carlyle won an auction to acquire a 95.51% stake in Hexaware.

The bull case rests on sold revenue growth, reducing customer concentration, high utilization, low attrition rates, high customer satisfaction scores and top-tier cash generation.

🇮🇳 Hexaware Technologies IPO: The Bear Case (Smartkarma) $

Hexaware Technologies (HEXW IN), an Indian mid-sized global IT services company, aims to raise up to US$1.0 billion.

In Hexaware Technologies IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

The bear case rests on mid-tier revenue growth, bottom-tier margins, low offshore mix, rising unbilled receivables/contract assets and a large post-IPO share overhang.

🇿🇦 Harmony Gold: Striking Gold With Copper (Seeking Alpha) $ 🗃️

🇿🇦 DRDGold’s expects massive 60-70% earnings jump on bumper gold prices (IOL)

DRD Gold (JSE: DRD / NYSE: DRD)’s R1 billion revolving credit facility from Nedbank remained undrawn as at the end of 2024, with the company remaining free of bank debts as it benefited from currently elevated gold prices to post an increase in interim earnings of between 60% and 70% after revenues ramped up by 28%.

The revolving credit facility from Nedbank (JSE: NED / FRA: NCO / OTCMKTS: NDBKY / NDBKF) is earmarked to “support liquidity” for the gold producer as it pursues “significant capital expansion” programmes.

🇿🇦 Bulls&Bears: Retail revival: signs of hope for South African consumers (IOL)

It’s been a long time since we have seen South African retailers talk about a positive outlook for the consumer in their trading updates. With the consumer having battled Covid-19, high interest rates, low wage growth, low gross domestic product growth and high inflation over the past five years or so.

It was encouraging to see Mr Price Group (JSE: MRP / FRA: M5M1 / OTCMKTS: MRPLY) in their 22nd January update for the 13 weeks to December 28, 2024 make the following outlook statement. “The 2025 economic growth outlook for South Africa is anticipated to improve in comparison to 2024. A steadily improving consumer environment, aided by decreasing inflation and lower interest rates, continues to build a solid platform for growth in comparison to recent years.”

🇬🇷 Titan America (TTAM): Spin-Off Successful as US Infrastructure Play Finds a Bid in IPO Aftermarket (Smartkarma) $

Titan Cement (EBR: TITC / FRA: TCJ / OTCMKTS: TTCIF)

After the deal’s order book finished multiple-times oversubscribed, the company priced at the lower-half of the range and opened for a minimal gain.

Buyers stepped in and rebounded the stock past its opening price and as high as $17.27 for a gain of 8% at its top-tick.

Value investors found favor in the secular tailwinds of US infrastructure and the positives this company will be able to extract as a newly-formed company.

🌎 MercadoLibre: Why You Shouldn’t Buy Now (Seeking Alpha) $ 🗃️

🇧🇷 Embraer Inks Largest-Ever Private Jet Order, Shares Soar To 1995 Highs (ZeroHedge)

Brazilian planemaker Embraer SA (BVMF: EMBR3 / NYSE: ERJ) has signed its largest-ever deal with Flexjet, the second-largest operator of commercial private jets, to supply 182 aircraft with an option for 30 additional units. The new fleet will include Praetor 600, Praetor 500, and Phenom 300E models.

“This is the largest order placed by Flexjet in its 30-year history and is also the largest firm order for Embraer’s executive aircraft,” Embraer wrote in a statement. Flexjet operates within the fractional jet ownership segment.

🇧🇷 PagSeguro: A Perfect Buying Opportunity After The Recent Downtrend (Seeking Alpha) $ 🗃️

🇧🇷 Cosan: I Was Wrong (Seeking Alpha) $ 🗃️

🇨🇱 LATAM Airlines: Dominant Position In South America, But Fairly Valued (Seeking Alpha) $ 🗃️

-

🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subsidiaries in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇨🇴 Bancolombia: Undervalued With Potential Catalyst (Seeking Alpha) $ 🗃️

-

🌎🅿️ Bancolombia (NYSE: CIB / BVC: PFBCOLOM) – First Colombian financial institution listed on the NYSE. It provides banking products & services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda & Guatemala. 🇼 🏷️

🇲🇽 More Mexican stocks. Are the new tariff an opportunity? (Bos Invest Substack)

In part 13 of my all-Mexican stocks series I will discuss the third of the 3 Mexican airports and will finish with my second Mexican holding: Promotora y Operadora de Infraestructura.

Times of stress create change. Mexican stocks have been quite attractive for a while. The tariffs will change a lot but many Mexican companies are positioned well to deal with it. I hope to keep my PINFRAL shares for a long time. Not too worried about the new tariffs.

🇲🇽 CEMEX Valuation Is Fair, But Not Tactically Attractive Going Into A Down Cycle (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Financiero Banorte: 9% Dividend Yield For Whoever Can Handle The Geopolitical Risks (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Carso Consolidates Oil Stake, But Remains Expensive (Seeking Alpha) $ 🗃️

🇲🇽 GCC’s Cycle Seems To Be Turning, And Key Markets Show Negative Trends (Rating Downgrade) (Seeking Alpha) $ 🗃️

-

🇲🇽 GCC SAB de CV (BMV: GCC / FRA: AK4 / OTCMKTS: GCWOF) – Gray Portland cement, ready-mix concrete, aggregates, coal & construction-related services. 🏷️

🌐 Nebius: Supercharging Its AI Infrastructure Before Wall Street Wakes Up (Seeking Alpha) $ 🗃️

🌐 Nebius Group: The Hidden Gem Of AI Infrastructure (Seeking Alpha) $ 🗃️ (?)

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 A trade war could crash China Trump’s timing couldn’t be worse for Beijing (Unherd) 🗃️

The reason imports are so weak is twofold: China owns the entire supply chain in a large number of goods, so it has no need to import intermediate or component products; more important, though, is the fact that household incomes, and therefore consumer demand, are in the doldrums. And the government has no desire, or finds it hard politically, to recalibrate this economic imbalance.

For now, then, China’s modern, vibrant tech sector is concealing other vulnerabilities. It sits alongside leading firms and brands in clean energy, electric vehicles, batteries, industrial machinery, semiconductors, robotics, life sciences and biotechnology. But it only accounts for about 13% of GDP. And much of that remaining 87% is treading water, with the country’s still outsized real estate and infrastructure sectors facing difficult years ahead as they come to terms with excess supply, shrinking demand, and severe financial problems among heavily indebted provincial governments.

Almost 20 years ago, Premier Wen Jiabao noted that China’s economy was unbalanced, unstable, uncoordinated and unsustainable. In some important ways, things are much worse now. But its impressive looking tech scene and surging exports are drawing attention away from systemic weaknesses for which they cannot compensate.

🇨🇳 Republican attorneys-general say Wall Street firms underplay China risk (FT) $ 🗃️

Companies including BlackRock and JPMorgan accused of ‘misstatements or material omissions’

In a letter to the three firms and other big asset managers, including State Street, Invesco and Morgan Stanley, 17 attorneys-general said the financial groups were concealing or misrepresenting the investment risks in China.

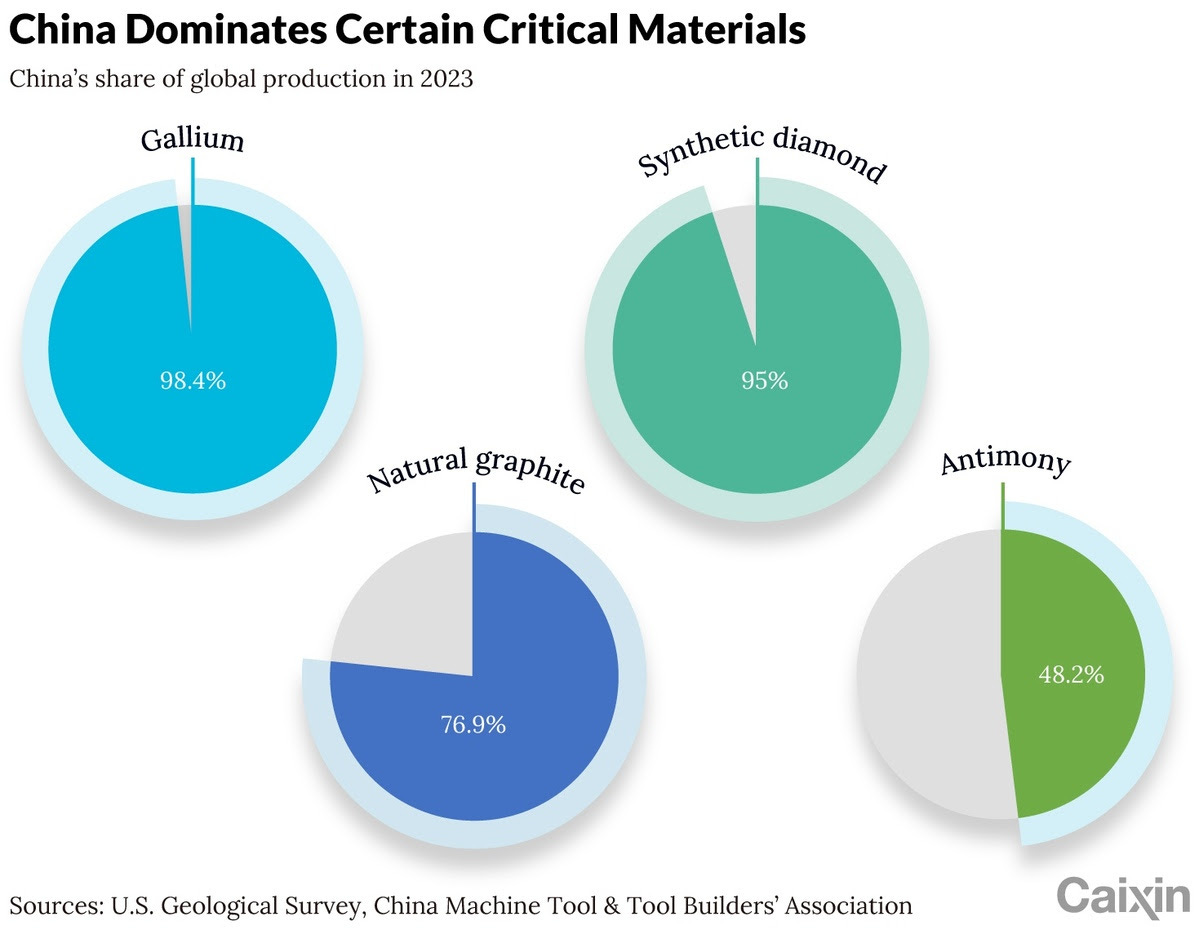

🇨🇳 In Depth: Beijing’s ban on mineral exports to U.S. leaves traders scrambling (Caixin) $

As China’s trade war with the U.S. continues to escalate, Beijing has imposed its strictest restrictions yet on exports of critical materials used in semiconductor and defense manufacturing.

On Dec. 3, the commerce ministry banned shipments of gallium, germanium, antimony and superhard materials to the U.S., and tightened the rules on graphite exports, based on China’s Export Control Law and related regulations. This is the first time that China has explicitly targeted the U.S. by restricting exports of key minerals and prohibiting re-export to the U.S. through third countries.

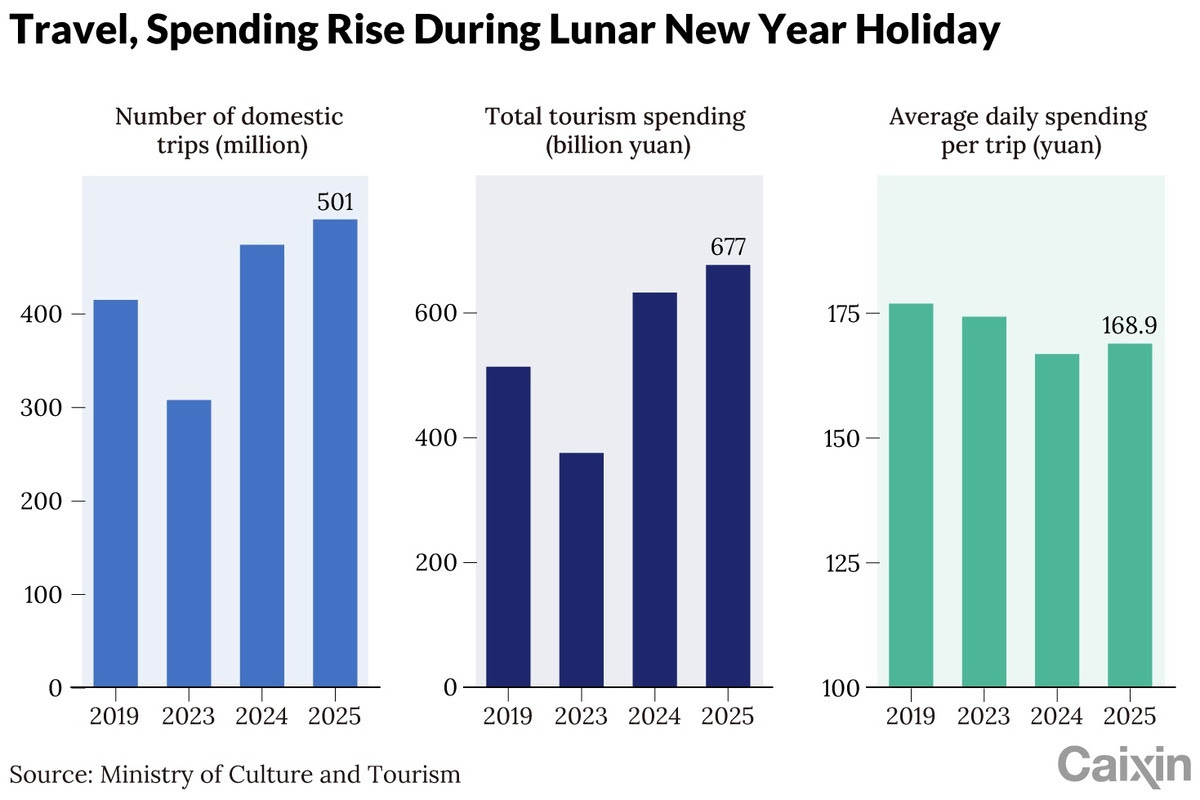

🇨🇳 Analysis: Record Lunar New Year Travel Boosts Consumer Spending (Caixin)

China’s tourism spending and box office sales hit new highs during the Lunar New Year holiday, showing signs of a much-needed rebound in domestic consumption. But whether the growth can maintain momentum or fades with the festive cheer is uncertain.

Overall domestic tourism spending during the eight-day holiday, which ended Tuesday, rose 7% year-on-year to 677 billion yuan ($93 billion), state media reported, citing data from the Ministry of Culture and Tourism. Tourists also made 501 million trips, up 5.9% from last year. Both figures set record highs, the report said.

🇨🇳 Analysis: China’s Rock Bottom Drug Prices Spark Quality Concerns (Caixin)

In a bid to lower the prices the Chinese state and public pay for medicines, Beijing implemented its centralized procurement policy in 2018. Under this system, the drugs are included by China’s state-run health care insurance and negotiated on a national basis.

Ever since, it’s been fiercely debated whether or not the hard bargains driven by the government undermine drugs’ quality.

These worries were reignited by the most recent procurement round, which concluded late last year. That round saw the prices of some drugs slashed by over 70%.

🇨🇳 DeepSeek’s Lessons for Chinese AI (Asianometry)

I apologize for adding yet another DeepSeek video to your video queue. During a trip to Tokyo last year, I was told that DeepSeek was the real deal. A cracked team, and perhaps the only ones of significance in China. Since then, I have annoyed the guys on Transistor Radio – our podcast with Dylan Patel and Doug O’Laughlin – into talking about it. Though there was nothing much to be said. In December 2024, DeepSeek released their V3 base model, which had impressive efficiency. A few people in AI were impressed. Then on January 22nd 2025, DeepSeek released their reasoning model, R1, which works kind of like OpenAI’s o1 and o3 models. It takes extra compute time to “think” up a better answer. R1’s release kicked everything off. The next day, the New York Times published an article on it, but focused mostly on the earlier V3’s training costs.

🇲🇴 ‘Unrealistic’ to expect Macau’s casino GGR to return to pre-Covid levels says Ponte 16 boss (GGRAsia)

Boosting Macau mass-market gambling is undoubtedly the key to maintaining growth momentum for the city’s entire casino market, but it is unlikely to push it to the level of the industry’s pre-pandemic performance. That is according to Hoffman Ma Ho Man, deputy chairman of satellite-casino backer Success Universe Group Ltd.

🇲🇴 Citigroup more than halves Macau 2025 GGR growth forecast amid ‘disappointing’ CNY and U.S. tariffs on China (GGRAsia)

Citigroup has slashed its 2025 growth forecast for Macau casino gross gaming revenue (GGR), citing as factors “disappointing” Chinese New Year (CNY) Golden Week gambling volume, and the implementation by the United States, on February 1, of tariffs on Chinese exports to the U.S.

High-value mainland players in the Macau casino market have traditionally included Chinese factory owners, often with interests in export sectors, according to long-standing commentary by investment analysts.

🌏 South-east Asia calculates its next move as US and China face off (FT) $ 🗃️

🇵🇭 Boosting stock trade: A closer look at CMEPA (BusinessWorld)

The Capital Markets Efficiency Promotion Act (CMEPA), currently known as Senate Bill No. 2865, has been approved on Third Reading by the 19th Congress. The objective of our lawmakers in passing the CMEPA is to introduce reforms that may help boost trading in the Philippine Capital Markets, by providing a simpler, fairer, more efficient, and regionally competitive passive income tax system.

Based on the current version, the following key amendments are expected to boost and stimulate market activity and attract investment:

🇵🇭 A coming surge in trading volumes (Asian Century Stocks) $

How CMEPA will affect Philippine equities. Estimated reading time: 12 minutes

I’m excited about the new Capital Markets Efficiency Promotion Act (CMEPA), which just passed the Senate of the Philippines.

Once it’s been signed into law, it will lower stock transaction taxes from 0.6% to 0.1%. Dividend withholding taxes for foreigners will decrease from 25% to 10%.

I’m convinced the new law will be bullish for trading volumes and perhaps even the overall market. Let’s dig into it.

🇻🇳 ‘Too hard’: Vietnam’s factory workers return to country life (AFP via The Star)

Housing, utility, healthcare and education costs are rising across the country, and workers in Ho Chi Minh City say their salaries can no longer meet their needs.

But when the Covid-19 pandemic forced people out of factories and back to their homes, many found rural areas had developed, offering more opportunities than a decade earlier and a higher quality of life.

Business is beginning to feel the effects.

An August survey by ViecLamTot showed around 30 per cent of manufacturers in the city faced a labour shortage, while 85 per cent said they were having trouble recruiting.

🇿🇦 South Africa plans R940 billion infrastructure spend over the next three years (IOL)

This investment aims to address critical infrastructure needs, create jobs, and stimulate economic activity, with the expectation that GDP will exceed 3%, he said in his State of the Nation address. He stated that R375bn of this amount will be spent by state-owned enterprises (SOEs) to build roads, bridges, dams, waterways, and ports.

🇿🇦 Ramaphosa says South Africa nearing turning point in ending load shedding for good (IOL)

🌎 A framework for how Latin American leaders respond (Latin America Risk Report)

🇧🇷 Quo Vadis, Brazil? Opportunities and Challenges in The New World Order (The Emerging Markets Investor)

Because Brazil did not benefit significantly from globalization, it has little to lose from its unwinding. A more protectionist global environment, coupled with a renewed emphasis on industrial planning policies, could be advantageous for Brazil. Such a world would favor large-population countries with significant domestic markets.

Additionally, the emerging technological paradigm of AI and robotics is on the verge of eliminating the labor cost advantages that drove the outsourcing of manufacturing and IT services to Asia. A well-designed approach to industrial planning, combined with the strategic adoption of new technologies, could potentially revive Brazil’s manufacturing sector and drive a surge in productivity growth.

Unfortunately, the Brazilian opportunity faces considerable headwinds.

🌐 Tariff saga spurs investors to accumulate US dollars (The Asset) 🗃️

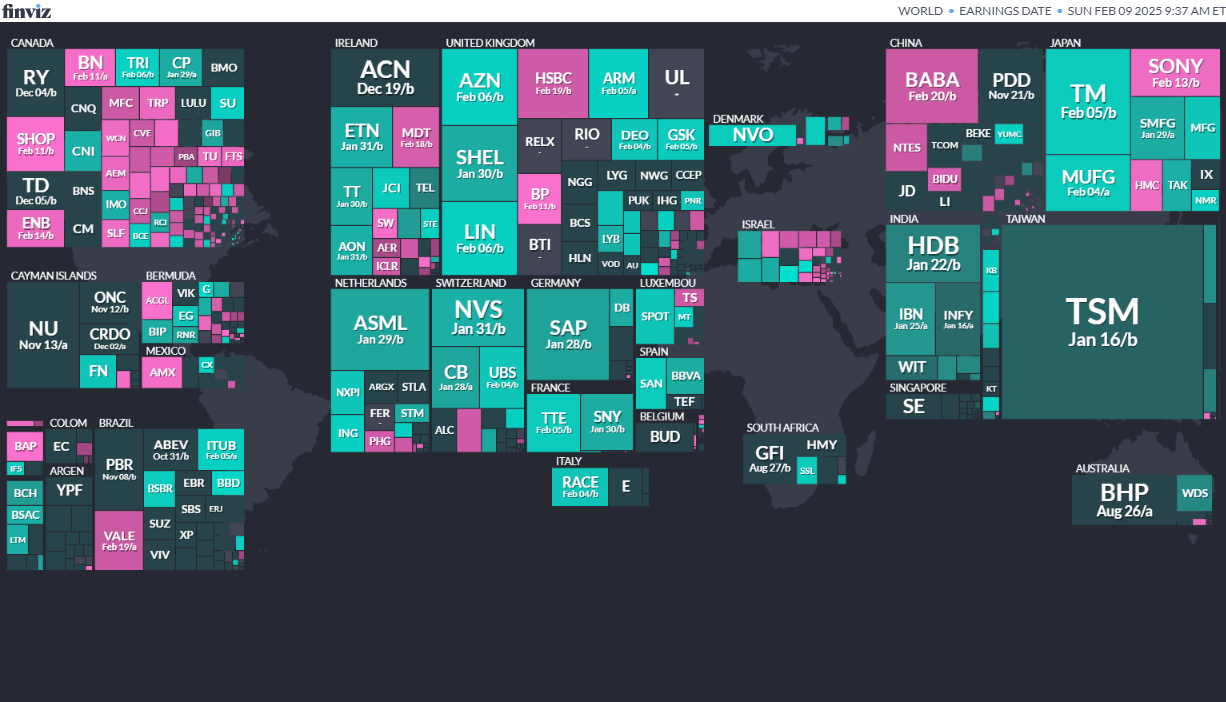

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

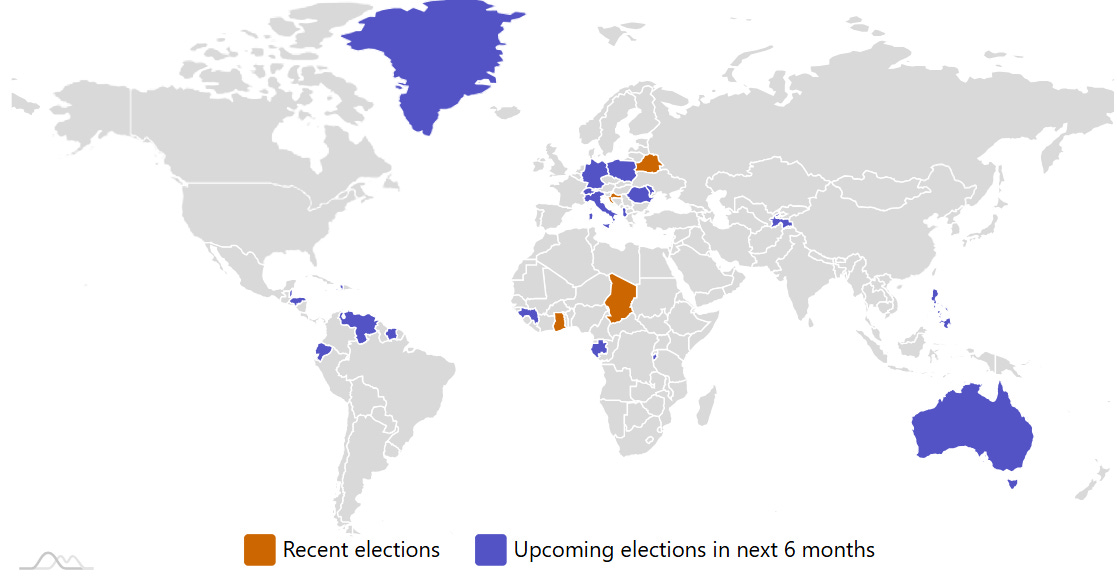

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Huachen AI Parking Management Technology Holding Co., Ltd. HCAI Benjamin Securities/D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-4.00, $6.0 mil, 2/5/2025 Priced

We specialize in smart parking solutions in China. We also provide equipment structural parts. (Incorporated in the Cayman Islands)

We offer several types of automated parking systems: PSH (lifting and horizontal sliding), PJSA (convenient lifting) and PCS Vertical Lifting, designed to maximize space in urban environments. We also provide equipment structural parts, including conveyor belt components, feeder system parts, and railroad accessories, along with product design consultation and maintenance services for parking systems.

Note: Net income and revenue are for the 12 months that ended Dec. 31, 2023.

(Note: Huachen AI Parking Management Technology Holding Co., Ltd. priced its IPO at $4.00 – the low end of its $4.00-to-$6.00 price range – and sold 1.5 million shares – the number in the prospectus – to raise $6.0 million on Tuesday night, Feb. 4, 2025.)

(Note: Huachen AI Parking Management Technology Holding Co., Ltd. whacked its IPO’s size by 70 percent to 1.5 million shares – down from 5.0 million shares initially – and kept the price range at $4.00 to $6.00 – to raise $$7.5 million, according to an F-1/A filing dated Dec. 31, 2024.)

(Note: Huachen AI Parking Management Technology Holding Co., Ltd. filed its F-1 on Aug. 14, 2024, and disclosed its IPO’s terms: 5.0 million shares at a price range of $4.00 to $6.00 to raise $25.0 million. Background: Huachen AI Parking Management Technology Holding submitted confidential IPO documents to the SEC on Dec. 19, 2023.)

Plutus Financial Group PLUT R.F. Lafferty/Revere Securities, 2.1M Shares, $4.00-4.00, $8.4 mil, 2/5/2025 Priced

We are a holding company whose Hong Kong operating subsidiaries, Plutus Securities and Plutus Asset Management, provide financial services. (Incorporated in the Cayman Islands)

Plutus Securities is a licensed Hong Kong securities broker whose services include brokerage services and margin financing services as well as underwriting and placement services.

Plutus Asset Management provides asset management services and investment advisory services.

Note: Net loss and revenue are in U.S. dollars for the 12 months that ended June 30, 2024.

(Note: Plutus Financial Group priced its IPO at $4.00 – the low end of its range – and sold 2.1 million shares – the number in the prospectus – to raise $Plutus Financial Group filed its F-1 on Jan. 31, 2024, and disclosed the terms for its IPO – 2.1 million shares at a price range of $4.00 to $6.00 to raise $10.5 million, if priced at the $5.00 mid-point of its range.)

EPWK Holdings Ltd. EPWK Cathay Securities/Revere Securities, 2.8M Shares, $4.10-4.10, $11.3 mil, 2/6/2025 Priced

We are the parent of a Chinese crowdsourcing platform. (Incorporated in the Cayman Islands)

We are the second-largest online marketplace in China. Our platform, operated through EPWK VIE, is one of only two comprehensive crowdsourcing platforms in China. The other one is operated by Zhubajie.

Our marketplace platform was launched in 2011. We have achieved significant growth ever since our inception. Our platform users consist of buyers who seek talent for their jobs and sellers who offer different talents and skills. We currently have over 25.27 million registered users and offer an expansive catalog to provide diversified services to businesses of all sizes. Our daily inquiries well exceed 10,000 from logo design to business name selection to software development.

Our buyers range from micro-sized and small businesses to medium-sized businesses from various industries.

Our sellers include student artists, professional designers, part-time freelancers and micro, small, and medium-sized businesses with different talents, skills and services to offer.

As of Dec. 31, 2023, we had 8.59 million accumulated registered buyers and 16.68 million accumulated registered sellers, covering all 34 provinces of China. Specifically, in 2023, we enabled approximately US$349 million of GMV across nearly 1 million projects (0.986 million projects). In 2022, we enabled approximately US$333 million of GMV across 0.91 million projects.

Through our website and mobile apps, buyers can post their jobs for free, connect easily with talented people, and get a broad range of services executed quickly and efficiently.

**Note: Net loss and revenue are in U.S. dollars for the fiscal year that ended June 30, 2024.

(Note: EPWK Holdings Ltd. priced its micro-cap IPO of 2.75 million shares at $4.10 – near the bottom of its $4.00-to-$6.00 price range – to raise $11.28 million ($11.275 million), the company announced on Thursday, Feb. 6, 2025.)

(Note: EPWK Holdings Ltd. increased the size of its small IPO to 2.75 million shares – up from 1.47 million shares – and set the price range at $4.00 t0 $6.00 – from a previously blank price range in the prospectus – to raise $13.75 million, according to an F-1/A filing dated Oct. 23, 2024. Background: EPWK Holdings Ltd. replaced the original price range with blank spaces in an F-1/A filing dated Sept. 17, 2024, for its IPO of 1.47 million shares, run by Cathay Securities and Revere Securities. Previously EPWK Holdings Ltd. disclosed the terms for its small IPO in an F-1/A filing dated July 9, 2024: The company is offering 1.47 million Class A ordinary shares (1,466,667 ordinary shares) at a price range of $7.00 to $8.00 to raise $11.0 million. Background: EPWK Holdings Ltd. filed its F-1 on Feb. 9, 2023, without disclosing terms for its IPO.)

FBS Global Ltd. (New Filing December 2024) FBGL Wallach Beth Capital, 2.3M Shares, $4.50-4.50, $10.1 mil, 2/6/2025 Priced

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing on Dec. 5, 2024. Background: This filing followed the company’s withdrawal of its previous IPO plans in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO. FBS Global’s path to going public began in mid-September 2022 when the Singapore company submitted confidential IPO documents to the SEC.))

(Note on corporate structure: The predecessor of our principal operating company was incorporated on March 9, 1996, in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG. (Incorporated in the Cayman Islands) )

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, research, and development, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

**Note: Net loss and revenue are in U.S. dollars (converted from Singapore’s currency) for the 12 months that ended June 30, 2024.

(Note: FBS Global Ltd. priced its micro-cap IPO at $4.50 – the bottom of its range – and sold 2.25 million shares – the number of shares in the prospectus – to raise $10.13 million, according to the company’s statement on Thursday, Feb. 6, 2025. Background: FBS Global Ltd. revived its IPO plans with a new F-1 filing dated Dec. 5, 2024, in which it kept the same terms from its IPO filing on Aug. 13, 2024: The company is offering 2.25 million shares at a price range of $4.50 to $5.00 to raise $10.69 million.)

(Note: FBS Global Ltd. withdrew its IPO filing in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO.)

(Note: FBS Global Ltd. revived its micro-cap IPO and disclosed its revised terms on Aug. 13, 2024, in an F-1/A filing: The company increased the number of shares to 2.25 million – up from 1.88 million shares – and raised the lower end of its price range to $4.50 – up from $4.00 – so the new price range is $4.50 to $5.00 – to raise $10.69 million. The company named WallachBeth Capital as its sole book-runner, replacing Eddid Securities USA.)

(Note: FBS Global Ltd. postponed its IPO in April 2024, when it had been expected to price its micro-cap initial public offering on or around April 13, 202r. Background: FBS Global Ltd. says its assumed IPO price is $4.00 – the low end of its $4.00-to-$5.00 price range – on 1.875 million shares, according to an F-1/A filing dated Feb. 23, 2024. Background: FBS Global Ltd. cut its IPO’s size to 1.875 million shares – down from 2.75 million shares – and set the price range at $4.00 to $5.00 to raise $8.44 million, according to an F-1/A filing dated Dec. 29, 2023. In that Dec. 29, 2023, filing with the SEC, FBS Global Ltd. also disclosed that it has changed its sole book-runner to Eddid Securities USA from Pacific Century Securities.)

(Note: FBS Global Ltd. filed an F-1/A dated July 27, 2023, in which it trimmed the size of its IPO to 2.75 million shares – down from 3.75 million shares – at US$4.00 to raise $11.0 million. The number of shares – 2.75 million – will all be offered by the company – and this is the same as in the previous prospectus (F-1/A) filed on June 26, 2023. The difference: The selling stockholder’s 1.0 million shares are not highlighted in the July 27, 2023, prospectus. However, in the July 27, 2023, filing, there is a note that the selling stockholder still intends to sell up to 1.0 million shares. Background: FBS Global Ltd. filed an F-1/A on June 26, 2023, and updated its financial statements for the year ended Dec. 31, 2022. FBS Global Ltd. filed its F-1 on Jan. 30, 2023, and disclosed terms for its IPO: 3.75 million (3,750,000) shares at US$4.00 to raise $15.0 million. Of the 3.75 million shares in the IPO, the company is offering 2.75 million shares and the selling stockholder is offering 1.0 million shares. FBS Global Ltd. will NOT receive any proceeds from the sale of the selling stockholder’s shares. FBS Global Ltd. filed confidential IPO documents on Sept. 13, 2022.)

Micropolis Holding Co. MCRP Network 1 Financial, 5.0M Shares, $4.00-5.00, $22.5 mil, 2/10/2025 Week of

We are a holding company. Micropolis Digital Development FZ-LLC (“Micropolis Dubai”), our wholly owned subsidiary, is a robotics manufacturer founded in 2014 and based in the United Arab Emirates (“UAE”) with its headquarters located in Dubai Production City, Dubai, UAE. (Incorporated in the Cayman Islands)

We specialize in developing autonomous mobile robots (“AMRs”) that utilize wheeled electric vehicle (“EV”) platforms and are equipped with autonomous driving capabilities.

We have historically conducted our business through Micropolis Dubai.

We operate in the GCC region, with a focus on the UAE and Saudi Arabia. The robotics industry in the UAE and Saudi Arabia is rapidly growing, with governments committing significant resources to technological advancement. Furthermore, Dubai, a hub for technological innovation in the region, presents a unique opportunity for the Company. With a robust portfolio of AMRs and a strong track record of successful partnerships with local governments, the Company is poised to take advantage of the growing demand for innovative robotics solutions in the Middle East.

Our flagship products are customized AMRs that can operate without the need for human intervention. These robots can be used in a wide range of industries, including security, hospitality, real estate, retailing, city cleaning, and logistics. The robots can be equipped with advanced sensors, machine learning algorithms, and computer vision technology that enable them to navigate complex environments, avoid obstacles, and interact with humans.

We specialize in the development and integration of AMRs, operating software, electronic control units and power storage units. Our extensive product offerings are organized into three main categories:

A. AMRs: Our AMRs (autonomous mobile robots) are engineered with precision and tailored to meet diverse requirements. They are composed of two main parts, namely the mobility specific platform and application-specific pods.

B. Operating Software: Our software suite is further segmented into three distinct categories: (1) autonomous driving software, allowing users to manage fleets of AMRs from an operational room with real-time streaming service; (2) fleet mission planner, aiding operators in mission planning, path management, and performance monitoring; and (3) user bespoke software development service, offering customized software solutions for customers, integrating additional robot functionalities with existing systems to ensure cost-effectiveness and seamless deployment

C. Electronic Control Units and Power Storage Units: Our in-house-developed control units and power storage solutions serve as the driving force behind our AMRs, providing energy-efficient and reliable performance. The Micropolis Robotics Controller Unit (“MRCU”) is an innovative and advanced electronics board designed to serve as a centralized control unit for a wide range of robots, including AMRs and EVs; while The Smart Power Distribution Unit (“SPDU”) is designed to address the challenges present in battery-based systems, i.e. efficient energy utilization.

Our business is collaboration-based. In collaboration with our customers and partners, we are actively engaged in the development of cutting-edge technologies that aim to bring enhancements in security, logistics, and surveillance operation management. We have established a strong track record of successful partnerships with local governments and real estate developers. Our work with the Dubai Police is a prime example of this ongoing effort; they are playing an essential role in the creation of “Microspot,” which is an AI-powered security software we are currently developing as of the date of this prospectus. In particular, the Dubai Police have assembled a team to assist us in shaping the Microspot software, providing crucial insights into police operations and supplying dummy data for data science and machine learning. This partnership has not only facilitated us in navigating regulatory complexities but also provided invaluable support in testing and validating our products. Further, we have partnered with Dubai Police to develop self-driving security patrolling vehicles that enhance security surveillance operations, to help reduce crime through security deterrence.

We are also working closely with the Road and Transportation Authority in Dubai, UAE (“RTA”) through Dubai Police Innovation Lab. RTA is aiding us by designating the Jumeirah 1 area in Dubai as a safe testing environment for our autonomous driving system, which is still in development as of the date of this prospectus. RTA is also supplying high-definition maps of the area and data that will be essential in shaping the autonomous driving system.

Furthermore, our ongoing partnership with The Sustainable City in Dubai is proving invaluable, as they provide us with both high-definition city mapping and a living lab within their residential community for testing and validation. This collaboration allows us to work within a real-life environment to iteratively refine our autonomous driving features. Further, we have also worked with The Sustainable City in Dubai to develop autonomous community delivery robots that are able to autonomously deliver goods within their assigned territory, making urban and sub-urban logistics more cost effective and energy preserving.

Note: MIcropolis Holding Co. reported a net loss on minimal revenue for the 12 months that ended June 30, 2024. (These net loss and revenue figures are in U.S. dollars converted from the UAE’s currency.)

(Note: Micropolis Holding Co. cut its IPO’s size to 5.0 million shares – down from 8.2 million shares originally – and kept the price range of $4.00 to $5.00 – to raise $22.5 million, according to its F-1/A filing on Sept. 24, 2024. Background: Micropolis Holding Co. initially planned to offer 8.2 million shares at $4.00 to $5.00, according to its F-1 filing on Dec. 22, 2023.)

Odysight. AIODYS The Benchmark Company, 2.5M Shares, $8.50-8.50, $21.5 mil, 2/10/2025 Week of

(Note: This is a NASDAQ uplisting – a public offering – and NOT an IPO. The stock currently trades on the OTCQB.)

We are a pioneer in the development, production and marketing of an innovative visualization and artificial intelligence, or AI, solution that deploys small cameras to monitor critical safety components in hard-to-reach locations and harsh environments, across various Predictive Maintenance, or PdM, and Condition Based Monitoring, or CBM, use cases. (Incorporated in Nevada)

We aim to be the industry benchmark for real-time, visual-based machine and infrastructure health monitoring through AI and machine learning data analytics.

The Odysight TruVision solution streams visual information to our processing unit, an in-platform, high-performance AI/machine learning computer, allowing maintenance and operations teams, on the ground and during operations, visibility into areas that are inaccessible under normal operating conditions or where conditions are not suitable for continuous real-time monitoring. The rich and informative data, continuously collected and analyzed by our solution on our secured cloud, provides customers with real-time failure / anomaly detection, events and data recordings, interfacing with platform mission systems and providing real-time alerts and streaming video or images, all while training our algorithms for ongoing improved accuracy and prediction capabilities. Our customers benefit from increased safety, a reduction in downtime and lower maintenance costs for their monitored platforms, using the prediction capabilities of our solution to efficiently plan maintenance work on monitored components.

Note: Net loss and revenue are for the 12 months that ended Sept. 30, 2024.

(Note: Odysight.AI increased the size of its public offering – a NASDAQ uplisting deal – to 2.53 million shares (2,529,411 shares) – up from 2.12 million shares (2,117,647 shares) initially – and kept the assumed public offering price at $8.50 – to raise $21.51 million, according to its S-1/A filing dated Jan. 31, 2025. The assumed public offering price of $8.50 is Odysight.AI’s closing stock price on the OTCQB on Jan. 23, 2025. Background: Odysight.AI disclosed the terms of its public offering (NASDAQ uplisting) – 2.12 million shares (2,117,647 shares) at $8.50 each – in an S-1/A filing dated Jan. 24, 2025. )

LZ Technology Holdings LZMH Benjamin Securities/ D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-6.00, $7.5 mil, 2/14/2025 Friday

We are a holding company whose operating subsidiaries provide advertising services in China. (Incorporated in the Cayman Islands)

The Company is an information technology and advertising company. Its operations are organized primarily into three business verticals: (i) Smart Community, (ii) Out-of-Home Advertising, and (iii) Local Life.

Smart Community. The Company provides intelligent community building access and safety management systems through access control monitors and vendor-provided SaaS platforms. The Company’s intelligent community access control system makes resident access to properties simpler. As of June 30, 2024, approximately 72,773 of the Company’s access control screens had been installed in over 4,000 residential communities, serving over 2.7 million households.

Out-of-Home Advertising. The Company offers clients one-stop multi-channel advertising solutions. Capitalizing on the Company’s network of monitors that span approximately 120 cities in China such as Shanghai, Beijing, Guangzhou, Shenzhen, Nanjing, Xiamen, Hefei, Dalian, Ningbo, Chengdu, Hangzhou, Wuhan, Chongqing, Changsha, the Company’s Out-of-Home Advertising services help merchants display advertisements in a variety of formats across its intelligent access control and safety management system. Advertisements are placed on the monitors and within the SaaS software. Residents are exposed to these advertisements each time they enter and exit community buildings or open the SaaS software. This level of visibility serves as a highly effective means of advertising, assisting merchants in effectively promoting their brands and accelerating their product sales. Moreover, the Company partners with other outdoor advertising providers to maximize coverage by placing the advertisements on the partners’ numerous displays in public transportation, hotels and other settings as well as deploying posters at events. This broad approach provides clients with a truly comprehensive out-of-home advertising solution.

Local Life. The Company connects local businesses with consumers via online promotions and transactions. With its strong technological capabilities, the Company helps local restaurants, hotels, tourist companies, retail stores, cinemas and other merchants offer deals and coupons to consumers on social media platforms such as WeChat, Douyin (the Chinese version of TikTok) and Xiaohongshu. The Local Life vertical bridges the businesses’ need for product sales and promotions and the consumers’ need for dining, shopping, entertainment, tourist attractions and other local services. In addition, deals from local businesses can also be displayed on the access control screens. In this way, clients of the Company’s Local Life services can also reach the Smart Community residents, leveraging the Company’s access control screens’ extensive coverage and high exposure potential. Since early 2023, we have embarked on executing the strategy of deepening engagement with merchants and manufacturers within our Local Life space through facilitating retail sales of diversified goods and services, including beverages, groceries and travel packages.

The Company reports financial results in one segment. Currently, a substantial portion of the Company’s revenues are generated from advertising and promotional activities, namely by the Out-of-Home Advertising and Local Life verticals. Revenues from Smart Community, which mainly consist of product sales of access control devices and service fees, contribute only a small portion to the Company’s total revenues. Thus, the Smart Community revenues are grouped with other miscellaneous revenue sources, such as advertising design and production and social media account operations, under the catch-all category titled “Other Revenues” in the description of the Company’s revenues.

For the years ended December 31, 2022 and 2023, the Company had a total of 247 and 255 customers, respectively, who entered into contracts with the Company to purchase the Company’s products and services. For the six months ended June 30, 2024 and 2023, the Company had a total of 168 and 102 customers, respectively, who entered into contracts with the Company to purchase the Company’s products and services. The Company, however, has derived a large portion of its revenues from a few customers. For the years ended December 31, 2022 and 2023, the Company’s top three customers collectively accounted for approximately 84.4% and 24.2% of its total revenue, respectively. For the six months ended June 30, 2024, the Company’s top three customers collectively accounted for approximately 33.2% of its total revenue.

Note: Net loss and revenue are in U.S. dollars (converted from China’s currency) for the 12 months that ended June 30, 2024.

(Note: LZ Technology Holdings cut the size of its IPO to 1.5 million shares – down from 10.0 million shares previously – and kept the price range at $4.00 to $6.00 – to raise $7.5 million, according to an F-1/A filing dated Oct. 30, 2024.)

Epsium Enterprise Ltd. EPSM Benjamin Securities/ D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-5.00, $5.6 mil, 2/25/2025 Tuesday

(Incorporated in the British Virgin Islands)

We are a holding company incorporated under the laws of British Virgin Islands. As a holding company with no material operation of its own, we conduct substantially all our operations through an indirect Macau subsidiary, Companhia de Comercio Luz Limitada in Macau, or Luz. Luz is an 80%-owned subsidiary of Epsium Enterprise Limited in Hong Kong, or Epsium HK. Mr. Son I Tam, our CEO, CFO, Chairman, principal shareholder, and the founder of Epsium and Luz directly holds (i) 89.996% ownership interest in Epsium, (ii) 19% interest in Epsium HK, and (iii) 20% ownership interest in Luz.

Luz is an import trading and wholesaler of primarily alcoholic beverages in Macau. Through Luz, we import and sell a broad range of premium beverages, primarily alcoholic beverages and, in 2022, a small quantity of tea and fruit juice. The alcoholic beverages we sell include Chinese liquor, French cognac, Scottish whiskey, fine wine, Champagne, and other miscellaneous beverage alcohol. Sales of Chinese liquor is by far our most significant operations, and we are a top wholesaler of high-end Chinese liquor in Macau. We operate only in Macau.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Epsium Enterprise Ltd. increased its IPO’s size to 1.25 million shares – up from 1.0 million shares – and cut the price range to $4.00 to $5.00 – down from $5.00 to $7.00 – to raise $5.63 million, according to an F-1/A filing dated Feb. 3, 2025.)

(Note: Epsium Enterprise Ltd. made a change in its joint book-running team, according to an F-1/A filing dated Jan. 8, 2025: D. Boral Capital (formerly known as EF Hutton) was named as a joint book-runner, replacing Prime Number Capital, to work with Benjamin Securities. Background: This is a micro-cap IPO – just 1.0 million shares at a price range of $5.00 to $7.00 to raise $6.0 million.)

Ruanyun Edai Technology Inc. RYET AC Sunshine Securities, 3.8M Shares, $4.00-5.00, $16.9 mil, 2/26/2025 Wednesday

We are not a Chinese operating company but a Cayman Islands holding company with no operations. (Incorporated in the Cayman Islands)

**Note: The ordinary shares offered in this (initial public) offering are shares of our offshore holding company, Ruanyun Edai Technology Inc., instead of shares of the VIE or its subsidiaries in China. (From the prospectus – See link to the prospectus in the chart below.)

We are a data driven artificial intelligence, or A.I., technology company focused on kindergarten through year twelve, or K-12 education in China. We bring technology to schools, and we are committed to reforming the traditional Chinese education and learning model by facilitating schools, teachers and students with new teaching, learning, and assessment methods in the A.I. era.

We believe the road to college should come with directions. Our mission is to help each K-12 student understand their specialty and find their way to higher education and future success. We believe we have one of the most comprehensive online learning ecosystems covering all K-12 subject fields and grade levels, one of the largest academic exercise question banks that is designed and built for interactive learning, and one of the most advanced A.I. algorithms that power such questions, all of which are accessible online and on demand.

As of Nov. 30, 2022, our online academic exercise question bank has accumulated more than 10 billion test data generated by approximately 14.26 million students from more than 27,000 schools and we have issued over 298 million evaluation reports. With the continuous collection and analyzing of students’ online learning data, our A.I. algorithms are constantly expanding and upgrading, reaching an evaluation accuracy rate of 97% (based on our own calculations), allowing us to provide students with tailored and effective learning strategies. We believe that, in time, our online learning platform will be proven revolutionary in affecting the advancement of China’s K-12 education system.

As of Nov. 30, 2022, approximately 14.26 million students use Jiangxi Ruanyun to collect their daily homework exercise data, prepare for a test or attend the Academic Proficiency Assessment, which is an official assessment across all subjects taught in schools, conducted by the Education Testing Authority in China. This allows us to understand each student better and enables us to help them reach the next level of educational success with an effective strategy, every step of the way.

We value our proprietary technologies and strong research and development capabilities, which we believe differentiate us from other companies in our industry. As of the date of this prospectus, we have an intellectual property portfolio consisting of 11 patents (9 of which have been registered and 2 are pending) and 23 trademarks filed with the PRC State Intellectual Property Administration, 50 copyrights registered with the PRC State Copyright Bureau, and 8 domain names.

Over the last decade, our A.I. learning platform has expanded from learning to assessment in school to A.I application, services and hardware. We believe we are a trend-setter in reforming the traditional education model in China using the technological progress brought about by the advent of A.I. technology. We believe we are the only educational A.I. company in China that serves both everyday learning and Academic Proficiency Test in school. We provide computerized testing for China’s Academic Proficiency Test, or ATP, which is equivalent to the SAT in China. Our everyday learning to official assessment model allows us to expand into a range of personalized “online” services and “offline” products for students in high demand.

We currently sell our products and services through two primary product lines, namely our SmartExam® solution and SmartHomework® solution. Our SmartHomework® solution delivers personalized learning solutions for students to study more effectively. Teachers can adjust instructions for students based on their specific needs. In addition, our SmartExam® solution helps deliver China’s Academic Proficiency Test, which is required in China for obtaining a high-school diploma, in computer-based format. We also provide self-learning solutions and smart-devices, such as smart printer / smart headset for everyday study and test preparation.

*Note – Re corporate structure: We conduct substantially all of our operations in the People’s Republic of China, or the PRC or China, through Jiangxi Ruanyun, the variable interest entity (VIE) and its subsidiaries. We do not have any equity ownership of the VIE. Instead, we have the power to direct the activities and receive the economic benefits and absorb losses of the VIE’s business operations through certain Contractual Arrangements (as defined in the prospectus) and the VIE is consolidated for accounting purposes. This structure involves unique risks to investors. This VIE structure is used to provide contractual exposure through the Contractual Arrangement to foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies.

*Note: Under the Contractual Arrangements, cash is transferred among the Company, Rollingthunder Technology (Jiangxi) Co., Ltd, or our WFOE, Soft Cloud and the VIE. (See the prospectus – link in the chart below – for details on cash transfers, financial statements and other disclosures pertinent to the IPO).

**Note: Net loss and revenue figures are in U.S. dollars for the fiscal year that ended March 31, 2024.

(Note: Ruanyun Edai Technology Inc. filed a new F-1 on Aug. 30, 2024, and disclosed terms for its IPO: The company is offering 3.75 million shares at a price range of $4.00 to $5.00 to raise $16.88 million. The new filing declared that AC Sunshine Securities is the new sole book-runner; under the previous plans, Univest Securities and AC Sunshine Securities were slated to be joint book-runners.)

(Note: The SEC declared that Ruanyun Edai Technology’s IPO filing was abandoned in February 2024 because the company had not updated the filing in a long time. Background: Ruanyun Edai Technology Inc. filed its F-1 on Dec. 29, 2022. The Cayman Islands-incorporated holding company submitted confidential IPO paperwork to the SEC on Aug. 31, 2021.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

-