Emerging Market Links + The Week Ahead (February 12, 2024)

Chinese New Year started in Asia on Saturday with Chap Goh Mei set to fall on Saturday February 24th this year – meaning the next two weeks should not be too eventful in much of East and SE Asia:

In Malaysia, its a three day weekend with packed malls and a few weeks of mall entertainment like acrobatic lion dances which are always amazing to watch – this one was from this afternoon:

On a fun financial note, Hong Kong based CLSA has been doing their Feng Shui Index 2024 report for a couple of decades with sector, property, Chinese zodiac sign (mine is predicted to have a mediocre year… 🫣🫣🫣) and celebrity (including Taylor Swift 🙄, Jerome Powell, etc.) predictions:

For what its worth, the Feng Shui Index predicts things will be looking up some time later this year for the Hang Seng Index, but not for all sectors…

$ = behind a paywall

-

🇮🇳 moneycontrol India Stock of the Day (January 2024) Partially $

-

Craftsman Automation, Asian Paints, Persistent Systems, Tata Consumer Products, INOX India Ltd, Aarti Industries, Sky Gold Ltd, GAIL, Transport Corporation of India, SBI Life Insurance, Prince Pipes and Fittings Ltd, Data Patterns (India) Ltd, Varun Beverages, Bosch Ltd, Syngene International, DCB Bank, Dhanuka Agritech, Trent Ltd, Manappuram Finance Ltd & Home First Finance

-

-

🌐 EM Fund Stock Picks & Country Commentaries (February 11, 2024) $

-

“This NVIDIA is killing me (coz I follow the benchmarks…),” funds take notice of India’s high valuations, Nu Holdings report, Tata Motors, Georgia Capital Plc, EZCORP Inc, Gruma, Melco Resorts, etc.

-

(Note: I have also added some additional international focused funds that can have emerging market stocks as their holdings, but may not have monthly factsheets or only do quarterly letters, etc. that then get posted on Seeking Alpha, Reddit, etc.)

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 BYD vs Tesla: The Battle for the EV Market (The Asset)

🇨🇳 Alibaba International records solid growth led by AliExpress (Bamboo Works)

The international e-commerce arm of Alibaba Group (NYSE: BABA) posted 44% revenue growth in its latest quarter, led by major contributions from its AliExpress B2C global marketplace

Alibaba International recorded strong revenue growth in the three months to December, its sixth consecutive quarterly increase since Alibaba partner Jiang Fan took the helm in 2022

The company will further invest in its AliExpress “Choice” program, which has shown strong results in boosting customer acquisition and retention

🇨🇳 China Semi Foundry: Fierce Competition & Sluggish Rebound In Year Of The Dragon (Smartkarma) $

Both Semiconductor Manufacturing International Corporation (SMIC) (SHA: 688981 / HKG: 0981 / FRA: MKN2) & Hua Hong Semiconductor (HKG: 1347 / FRA: 1HH / OTCMKTS: HHUSF) reported Q423 earnings in line with expectations and both guided Q124 flat to slightly down. SMIC expects FY24 mid single digit growth YoY.

The downturn has exposed inherent weakness in China’s Semi Foundry segment relative to peers as exemplified by the significant GM disparity

China’s two leading semi foundries have ~80% domestic dependence. Right now, that’s a headwind

🇨🇳 Yum China expands footprint in lower-tier cities to drive growth amid growing consumer caution (Bamboo Works)

The operator of KFC and Pizza Hut restaurants in China posted 21% revenue growth last year, led by aggressive new store opening and price widening campaigns to capture new customers

YUM China (NYSE: YUMC)’s revenue grew 21% in both the fourth quarter and for all of 2023, as it opened a record of nearly 1,700 new stores last year

The master franchisee for KFC and Pizza Hut restaurants in China had 14,644 stores at the end of last year, and reiterated its plan to raise that to 20,000 by 2026

🇨🇳 EDU/TAL: China Tutoring – Here Comes The Policy Tailwind (Smartkarma) $

Today, after Hong Kong market close, the Ministry of Education issued a new draft regulation on K12 tutoring.

I have written before on New Oriental Education (NYSE: EDU) and China Beststudy Education Group (HKG: 3978) that there is now a equilibrium reached between all parties on tutoring in China.

The new draft regulation basically puts it into concrete policy, which should alleviate investor concern on the sector.

🇨🇳 Growth-hungry Fanhua finds a potential benefactor in Singaporean investor (Bamboo Works)

The insurance broker has struck a deal to receive up to $1 billion in new investment for itself and recently acquired wealth manager unit Puyi (NASDAQ: PUYI)

Singapore-based White Group has agreed to invest as much as $500 million each in Fanhua (NASDAQ: FANH) and its Puyi wealth management unit

The deal is the latest in a series engineered by Fanhua as it seeks to accelerate its faltering growth

🇨🇳 China Renaissance Edges Closer to Trading Resumption Under New Chairman (Bamboo Works)

Xie Yijing will take over as the troubled investment bank’s head, as missing former chairman and CEO Bao Fan steps down ‘for health reasons and to spend more time with his family’

China Renaissance Holdings (HKG: 1911 / FRA: 6RN / OTCMKTS: CSCHF)’s shares could resume trading as early as March, after it named a new chairman to replace co-founder Bao Fan, who has been missing for a year

The company’s stock could fall 50% or more when trading resumes, reflecting not only concerns about Bao’s departure but also plunging business for Chinese investment banks

🇭🇰 L’Occitane (973 HK): Blackstone Pondering an Offer (Smartkarma) $

Bloomberg reports that L’Occitane International (HKG: 0973 / FRA: COC / OTCMKTS: LCCTF) draws takeover interest from Blackstone (NYSE: BX), which is considering partnering with Chairman and largest shareholder Reinold Geiger.

Blackstone needs an attractive takeover premium due to the presence of significant disinterested shareholders (Mr. Geiger and Acatis KVG).

Shareholders will be wary of the latest rumour due to Mr Geiger’s aborted offer on 4 September 2023. Nevertheless, the valuation is undemanding compared to peer multiples.

🇭🇰 Cathay Pacific – Strong Pax Momentum Suggests 2024 Can Outperform Expectations (Smartkarma) $

🇭🇰 HK 第5部分; 7%+ dividend yield portfolio (Jam_invest’s Newsletter)

On January 12th, 2024, I started writing about absurdly cheap Hong Kong stocks. Today, I reveal my initial HK portfolio, generating a 7%+ dividend yield.

Analogue Holdings Ltd (HKG: 1977) is a reknowned holding of famous HK stock investor David Webb. The stock is current trading at HKD 1. That price is currently more than covered by Analogue’s financial assets value, especially when including market value – as opposed to book value – for the 15.83% interest in Nanjing Canatal Data-Centre Environmental Tech Co., Ltd (SHA: 603912). On normalized earnings, Analogue probably trades around 5-6x P/E and a high-single-digit if not low-double-digit (hsd-ldd) % dividend yield, given the 50% or better dividend payout ratio.

Analogue is an electrical and mechanical (E&M) engineering services company. It makes and installs equipment

🇭🇰 Hong Kong Life Insurer AIA Group: Value Trap After Regulations Erode China Market Economics (Seeking Alpha) $

AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF) is a mix of mature and growing insurance markets, making it suitable for conservative investors.

The company’s growth trajectory has stalled due to COVID-related challenges, including a decrease in the number of insurance agents.

Concerns over Chinese customer preferences, China’s macro weakness, and regulatory changes pose challenges for AIA and its peers.

🇭🇰 TOP Financial: A Meme Trade, Time To Take Some Profit (Rating Downgrade) (Seeking Alpha) $

TOP Financial Group (NASDAQ: TOP), a Hong Kong-based online brokerage firm, has been given a “Sell” rating due to its status as a meme stock.

Investors are warned to be cautious as the stock is prone to speculative activity and may not be suitable for long-term investment.

The company’s financial numbers and business expansion strategy are unconvincing, leading to doubts about its growth potential.

🇲🇴 Wynn’s Macau 4Q GGR outpaces despite competition: JPM + A Macau dividend depends on capital outlook: Wynn CEO + Wynn Macau Ltd 4Q EBITDAR up, revenue tops US$910mln (GGRAsia)

Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF) Ltd outperformed the rest of the Macau casino market in the fourth quarter in terms of sequential growth in gross gaming revenue, according to a Thursday note from JP Morgan Securities (Asia Pacific) Ltd.

It followed the results issued on Wednesday by the United States-based parent Wynn Resorts Ltd (NASDAQ: WYNN) for the three months to December 31.

The quarterly numbers were “very respectable considering the ramp in new supplies by the peers” of the company, said the brokerage.

🇹🇼 3022:TW Industrial PC Manufacturer with 36% Margin and 4.4% dividend yield trading for <5.5 EV/EBIT (One foot hurdle)

IEI Integration (TPE: 3022) is a manufacturer in industrial PCs and related products (embedded systems, motherboards, controllers, network equipment…etc). Industrial PCs is a growing industry with robust scale and strong companies. Founded in 1997, IEI Integration has been profitable in 26 consecutive years. Paying dividend 21 years straight. Trading is available on Interactive Brokers and English filings are available.

IEI Integration is solid, profitable company that occupies a niche. Solid shareholder returns. Daily volume should make it actionable for many investors. It appears that IEI at this price is safe and inexpensive. If the goal is to merely beat the cost of capital in Taiwan(2~3%) it can probably deliver.

🇹🇼 Himax Technologies: Leading Player In Automotive Display, Notable Inventory Improvement, Initiate With ‘Buy’ (Seeking Alpha) $

Himax Technologies (NASDAQ: HIMX) is the leader in the automotive display market, holding approximately 40% of the global market share.

Their automotive display business is expected to experience high growth due to increasing sales of electric and hydrogen fuel cell vehicles and the rising trend of software applications in vehicles.

Himax’s recent financial results showed a decline in revenue and profits, but their automotive business continues to show strong growth momentum.

🇹🇼 United Microelectronics: Not Enough Incentive To Warrant Added Risk (Seeking Alpha) $

The stock has dropped after the latest report from United Microelectronics Corp (NYSE: UMC / TPE: 2303), which came in mixed, especially as it relates to the outlook for FY2024.

UMC was less optimistic about the outlook than others, which is noteworthy in light of all the fab capacity being added everywhere.

The charts seem to have a few things to say, which could provide clues as to how shareholders should position themselves at this time.

Holding on to UMC is still worth pursuing, especially with a generous dividend in store, but to be a buyer is likely not a wise move.

🇰🇷 Kangwon Land 4Q profit US$59mln, rev down 13pct q-o-q (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land, a South Korean resort with the only casino in the country allowed to accept local players, saw fourth-quarter net income attributable to owners of the company increase 5.2 percent quarter-on-quarter. (See our tear sheet: Kangwon Land (KRX: 035250): Shares Are Still Down Despite a Mass Gaming Revenue Recovery)

The volume of visits to the Kangwon Land casino in the quarter to December 31 was 569,957, a 11.3-percent decrease from the preceding quarter. The great majority of the visits were by South Koreans.

For full-year 2023, Kangwon Land Inc’s net income attributable to its owners stood at KRW345.15 billion, up 198.5 percent from 2022, on sales that grew by 9.3 percent year-on-year, to just under KRW1.39 trillion.

🇰🇷 SK Innovation: Announces Share Cancellation of Nearly 4.92 Million Shares (Smartkarma) $

On 5 February, SK Innovation (KRX: 096770) announced a large-scale shares cancellation of 4.92 million shares, representing 4.9% of outstanding shares.

This is the first ever large scale shares cancellation for SK Innovation since it was first established in 2011.

All in all, despite the company’s disappointing results in 2023, the large scale share cancellation should help to support SK Innovation’s share price in the coming weeks.

🇵🇭 PLDT Inc. Struggling To Get Traction (Seeking Alpha) $

Inflation in the Philippines has improved significantly, which is positive for PLDT (NYSE: PHI)‘s profitability.

The company is struggling with declining volumes and stagnant average revenue per user (ARPU), impacting its core business.

My updated DCF, taking into account the ongoing struggles in the core business and possible scenarios for new business growth, sets a price target of $17—a 27% downside from current.

The dividend is also at a high risk of being cut.

🇸🇬 Keppel Ltd Chalks Up a Record-High Profit of S$4.1 Billion and Increases Dividends to S$0.34: 5 Highlights from the Asset Manager’s 2023 Earnings (The Smart Investor)

The blue-chip asset manager is going from strength to strength as it pushes on with its asset-light strategy.

Here are five salient highlights from Keppel Corp (SGX: BN4 / FRA: KEP1 / OTCMKTS: KPELY / KPELF)’s latest earnings report.

A blowout set of earnings

All three segments were profitable

Growing its base of recurring income

Building its infrastructure platform to grow FUM

Surpassed its monetisation target

🇸🇬 DBS Reports Record 2023 Profit, Ups Quarterly Dividend to S$0.54 and Proposes a Bonus Issue: 5 Highlights from the Bank’s Latest Earnings (The Smart Investor)

Singapore’s largest bank (DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF)) is returning more capital to shareholders through a dividend increase and bonus issue.

Here are five highlights from the bank’s latest earnings report.

A record net profit

A slight decline in NIM with flat loan book

Healthy growth in fee income

Corporate social responsibility and accountability for digital disruptions

An increase in dividends along with a bonus issue

🇸🇬 CICT Reports a 1.7% Increase in DPU for 2023: 5 Highlights from the Retail and Commercial REIT’s Latest Earnings (The Smart Investor)

The diversified REIT (CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF)) announced a robust set of earnings and has more asset enhancement initiatives planned for its portfolio.

Here are five highlights from the diversified REIT’s latest earnings that investors should pay attention to.

A solid financial report accompanied by a higher portfolio valuation

Resilient operating metrics with a diversified tenant base

An improvement in debt metrics

Healthy leasing activity and retention rates

More AEIs planned

🇹🇭 Asian Dividend Gems: Regional Container Line (RCL) (Asian Dividend Stocks) $

Regional Container Line (BKK: RCL / RCL-F) is the largest container shipping company in Thailand. It has attractive valuations, strong balance sheet, and has a major tailwind of higher global shipping freight rates.

RCL’s dividend yield averaged 9.6% from 2019 to 2022. The biggest factor driving higher shipping freight rates in 2024 has been the Suez crisis resulting from Houthi drone attacks.

🇮🇳 MakeMyTrip: Sales Growth Remains Impressive, But Watching Customer Inducement Costs (Seeking Alpha) $

Makemytrip (NASDAQ: MMYT) has the potential for further growth going forward.

Q3 2024 earnings showed impressive revenue growth and a rise in overall revenue on a year-on-year basis.

Gross bookings are up, and liquidity remains strong, but the rising P/E ratio indicates that price is outpacing earnings growth.

I will be monitoring customer inducement growth across the Hotels and Packages segment more closely heading into the next quarter.

🇦🇪 Yalla Group: High Uncertainty Despite Strong Balance Sheet (Seeking Alpha) $

Yalla Group (NYSE: YALA) aspired to be the “Clubhouse of MENA”. It operates the voice-based group chat platform Yalla and the gaming app Yalla Ludo.

YALA’s share price has been trading sideways since its peak in February 2021. Balance sheet and profitability are strong, but overall growth prospects are unclear.

Heightened competition, past red flags, and elevated risk profile due to the gaming business making YALA too risky despite my 15% upside projection, in my view.

🇿🇦 Ex-Invesco fund manager acquires stake in diversified South African industrial group (Capital Markets Africa)

A former Invesco portfolio manager has acquired a beneficial interest in Argent Industrial (JSE: ART / OTCMKTS: AILTF), a JSE-listed South African steel manufacturer and trader. According to a SENS update from the Johannesburg Stock Exchange, Jason Holzer now owns 5.09% of Argent Industrial’s total issued ordinary share capital.

Argent Industrial, the holding company, sells and trades manufactured steel and steel-related products such as metal gates, railings, and shutters. It owns over 20 vertically-integrated subsidiaries in South Africa, the UK, and the US while it sends exports to over 35 countries globally. The Argent group of companies also includes a number of jet refuelling and fuel storage businesses.

🌍 Listed African banks: Results this week (Capital Markets Africa)

Note: I think this piece was only emailed.

🇧🇷 BB Seguridade: Q4 Earnings, Slowdown Ahead, Still An Attractive Income Stock (Seeking Alpha) $

BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) (holds equity investments in insurance, pension plans, premium bonds and dental care plan companies, as well as in the brokerage business) showed robust profit growth in Q4 2023 despite modest guidance, reflecting potential interest rate declines in Brazil.

Key performance drivers include Brazil’s interest rate environment, economic growth, and inflation, supporting strong profitability and dividend payouts.

Despite the projected slowdown, BB Seguridade remains attractive, maintaining its status as a robust income stock with generous dividends, expected to range from 80% to 90% payout.

Valuation analysis suggests BB Seguridade’s stock may be undervalued, presenting significant upside potential for investors.

🇧🇷 StoneCo: I Was Wrong About This High-Growth Brazilian Fintech Leader (Rating Upgrade) (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) stock has significantly outperformed the S&P 500 since my November update, prompting a reassessment of its bullish momentum.

The inflation dynamics in Brazil have provided more clarity for investors, benefiting battered growth plays like STNE.

StoneCo’s B2B fintech business model and growth prospects make it an attractive investment despite competitive risks and potential interest rate cuts.

I gleaned that bullish sentiments on STNE have remained solid, suggesting investors are holding on to their positions confidently.

Despite the possibility of a welcomed pullback, I explain why I was wrong about my caution in STNE.

🇧🇷 Banco Bradesco: Q4 Earnings, Ugly With Prolonged Recovery Ahead (Seeking Alpha) $

Banco Bradesco (NYSE: BBD) reported poor Q4 results, with a significant decline in net income and a contraction in client margin.

The bank acknowledged the need for structural changes and presented a strategic plan to restore profitability.

Despite the discouraging results, there is optimism that the worst is behind Bradesco, but caution is advised during the strategic restructuring process.

Bradesco’s current trading below 1x its P/B ratio reflects market pessimism, exacerbated by shares trading below $3.

🇧🇷 Itaú Unibanco’s Q4 Earnings: Consistent Quarter And Constructive Guidance (Seeking Alpha) $

Itaú Unibanco (NYSE: ITUB)‘s Q4 earnings showcased consistent net profit growth, robust ROE, and controlled delinquencies, although loan portfolio growth remained a challenge.

The bank announced an extraordinary dividend, raising the payout to 60%, with indications of maintaining this ratio until 2024.

Guidance for 2024 includes anticipated improvements in credit costs and profitability, supporting expectations of higher dividends and continued growth.

Itaú Unibanco maintains a premium valuation compared to peers, justified by its leading position in efficiency, loan portfolio size, low delinquency rates, and strong capital resilience.

🇧🇷 Natura: Strategic Confusion And Subpar Execution (Smartkarma) $

The beauty industry is experiencing significant growth and has strong demand resiliency and pricing power.

Natura & Co Holding (NYSE: NTCO) has repositioned itself in the masstige/low prestige segment, but lost strategic drive.

Natura’s strategic direction and integration of Avon have been challenging, making it a less favorable investment option.

🇧🇷 GOL – Ramifications of GOL’s Chapter 11 Filing (Smartkarma) $

Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4) recently filed for CH11 bankruptcy protection as it was due to run out of readily available cash in mid-February. We assess the ramifications.

We highlight that GOL may need to reduce aircraft ownership/financing costs by a third to achieve PBT margins of 5%+; difficult in a strong aircraft leasing market.

We see the risk GOL loses scale. However, long-term, an increasingly competitive GOL is good for its parent Abra Group, and sister company Avianca.

🇧🇷 Gerdau: Infrastructure Spending Could Fuel Growth In Face Of Cheap Chinese Steel (Seeking Alpha) $

Metalurgica Gerdau SA Preference Shares (BVMF: GOAU4 / GOAU3) faces short-term challenges due to cheap Chinese steel exports but should benefit from significant infrastructure spending in the US and Brazil.

GGB has significant exposure to the US market, which accounts for more than half its gross profits and should offset the impacts of Chinese steel exported to Brazil.

Gerdau has a strong balance sheet and is well-capitalized to ride out these challenges and then benefit from the increased government spending in its key markets.

🇨🇱 Compania Cervecerias Unidas: Strong Company Suffering From External Headwinds (Seeking Alpha) $

Compañía Cervecerías Unidas Sa (NYSE: CCU) is a Chilean beverage company with a strong market position in Chile and other South American countries.

CCU’s financial performance has been impacted by external factors, but it is working towards reaching pre-COVID profitability levels.

The stock could potentially trade 25% higher if external headwinds normalize.

🇨🇱 Embotelladora Andina: A Value Proposition (Seeking Alpha) $

Embotelladora Andina Sa (NYSE: AKO.A / AKO.B) distributes Coca-Cola trademark beverages in South American countries. It is a market leader with a dominant position in the countries it operates in.

The company has a high dividend yield of 6.68% and is rated favorably by credit agencies.

AKO.A pays a safe and sustainable dividend every year.

It is considered cheap and offers a potential 75% upside from the current price of $11.64.

There are headwinds, but the company has weathered the worst in the past 20 years, remained profitable, and continued to pay dividends regardless.

🇨🇴 🇨🇦 Parex Resources – All weather oil stock with a great track record and a strong yield (Calvin’s thoughts) $

A recent sell off represents a rare opportunity to own Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) at very high capital yields

It’s not often you get the chance to buy a world class compounder with a superbly clean balance sheet at under 4x earnings and a 14% 2024 capital yield at $75/bbl, with an estimated 17% annual average capital yield over the next 3 years. Due to a recent sell off, that’s exactly what we’ve got in Parex Resources, a Canada listed, Colombian operated E&P that as of today has a $1.7B USD market cap.

🇲🇽 Aeromexico – International Strength Accelerating Progress but Delta JCA Termination a Speed Bump (Smartkarma) $

We raise our forecasts to reflect the strength of International revenue at Grupo Aeroméxico (BMV: AEROMEX.MX) – we expect it to beat 2023 EBITDAR targets by 26%

Aeromexico has been outperforming domestic competitors Volaris (NYSE: VLRS), Viva Aerobus due to international unit revenue gains – their forced capacity cuts due to GTF issues should help Aeromexico manage 2024 margins

Fitting with the global theme of consolidation difficulties, the US has ruled the Delta/Aeromexico JV must terminate – this could be a double digit % risk to PBT

🇵🇦 Copa Holdings – A Slow-Growth Year in 2024 – Impressive Gain on Pre-Pandemic Economics Sustainable? (Smartkarma) $

Copa Holdings (NYSE: CPA)’s 2023 EBITDAR of $1,117m was achieved while growing unit revenues, while capacity expanded 13% with a 17% unit fuel cost tailwind. Not an easy feat.

In 2024, we expect only 5% EBITDAR growth on 10% capacity growth as unit revenues decline (following the emergence of this theme in 2H23) and EBITDAR-level unit costs grow.

We model Copa’s EBITDAR/ASM premium to 2019 down to a still-impressive 35% in 2024 but new route selection and efficiency will need to be strong to sustain these economics.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China to export deflation to the world as economy stumbles (FT) $ 🗃️

🇨🇳 China’s consumers tighten belts even as prices fall (FT) $ 🗃️

🇨🇳 The risks of US-China decoupling (FT) $ 🗃️

🇨🇳 China’s software service providers bet on AI amid funding chill (Caixin) $

The Chinese software service industry is heading into a capital winter as the buzz of the late 2010s and flood of investment have yet to generate any headline-grabbing success stories. But as downtrodden investors pull back from much of the sector, one niche is still attracting capital: software as a service (SaaS) combined with artificial intelligence (AI).

Embedding software tools with AI technology is allowing some firms to offer better standardized products and cut back on development costs, potentially serving as a last resort for startups trying to secure backing from the sector’s core venture capital (VC) funds.

🇨🇳 China’s software service providers cut costs, prices as investors pull back (Caixin) $

China’s cloud software vendors are feeling the brunt of the sharpest drop in venture capital (VC) investment in the sector in a decade, with many rushing to cut prices or costs to tide them over.

The country’s current 13 software as a service (SaaS) unicorns — startups valued at more than $1 billion — raised just 495 million yuan ($69 million) from investors last year, the lowest amount since 2014, according to ITjuzi, a domestic provider of data on tech companies and investments, based on announced deals. The amount pales in comparison to the peak of 9.3 billion yuan they raised in 2021, when the Covid pandemic boosted demand for digital services.

🇨🇳 Are Chinese stocks a value trade or a value trap? (FT) $ 🗃️

🇨🇳 Chinese stock brokerages reports strong 2023 profits despite market slump (Caixin) $

Despite China’s stock market rout, most of the listed stock brokerages reported increased earnings last year, boosted by investment gains and growth in investment banking business.

Among the 21 listed brokerages that have posted results or estimates for 2023, 17 companies said their profits increased from the previous year.

🇨🇳 China’s star fund manager under investigation, sources say (Caixin) $ & Star Chinese fund manager Wang Yawei no longer involved in daily management of Qianhe Capital (SCMP)

Wang Yawei, one of China’s most prominent fund managers and founder of Qianhe Capital Management Co. Ltd., is facing investigation for violations including insider trading, sources with knowledge told Caixin.

Wang has stepped back from Qianhe’s daily operations due to personal reasons, the private fund manager said in a Saturday statement. Without elaboration, Qianhe said its management team will ensure normal operations of the firm, and it has ample liquidity. The company has almost completed a redemption of funds, it said.

🇭🇰 Hong Kong’s death has been exaggerated (Asian Century Stocks)

Table of contents

1. The opportunity set

2. Timeline of the current bear market

3. Hong Kong remains the centre of Asia

4. Hong Kong’s economy is recovering

5. Potential risks for Hong Kong

6. Hong Kong domestic small caps remain cheap

7. Ten highlighted stocks

8. Conclusion🇨🇳🌏 Profit-flush China pharma firms cast eyes south (The Asset)

In 2023, a total of 35 biomedical companies terminated their initial public offerings on China’s stock exchanges, reflecting various challenges within the domestic market, among them, intensive competition, poor business performance, uncertain prospects, high customer concentration and soaring costs.

Southeast Asia – with approximately 680 million people, equivalent to half of China’s population, and a 7% ageing population – presents a substantial market opportunity. The current development of the Southeast Asian pharmaceutical market is often likened to that of China’s in the early 2000s, suggesting a market size of at least US$200 billion.

In addition to construction, the wider Southeast Asian population tends to favour affordable generic drugs over expensive innovative medications, posing another significant challenge for pharmaceutical firms aiming to make inroads in the region.

🇹🇼 Taiwan set to allow active ETFs into booming retail market (FT) $ 🗃️

🌏 Asian investors return to fixed income funds (The Asset) 🗃️

Equity allocations see modest gains, passive funds back in fashion, while ESG strategies suffer setback

🌐 Global fintech investment drops to six-year low (The Asset) 🗃️

Asia-Pacific hit hard, while payments, proptech, ESG defy trend in challenging year

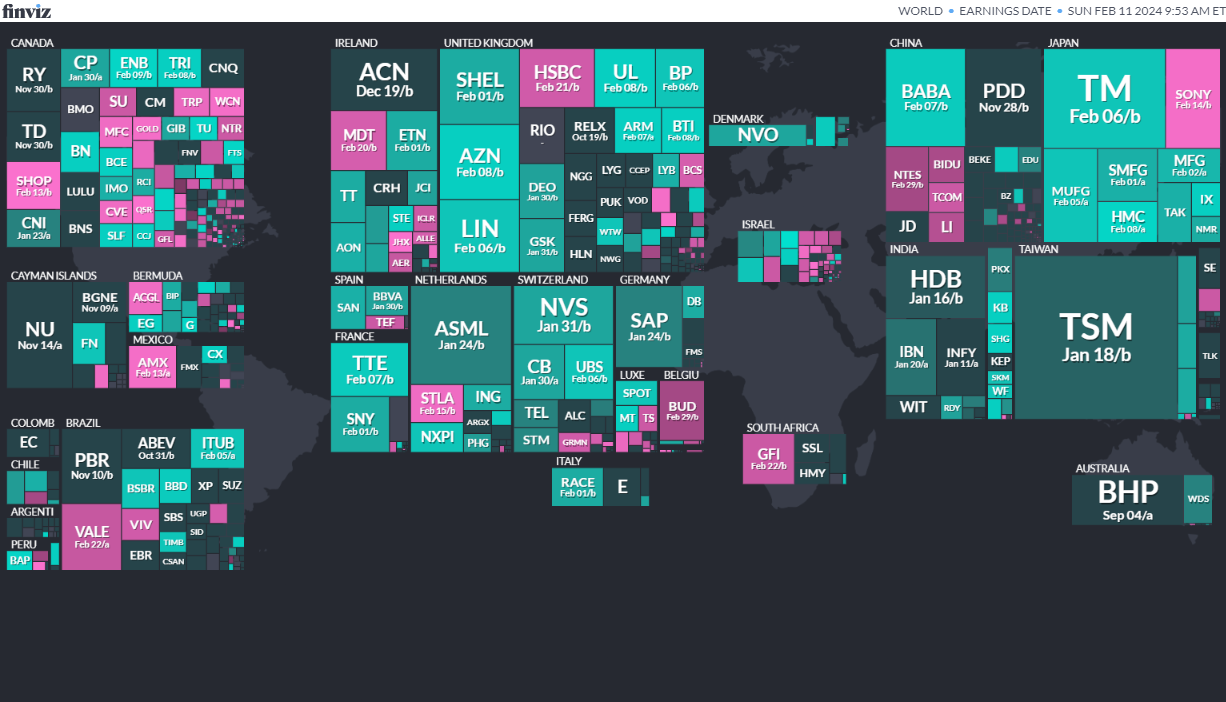

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

PakistanPakistani National AssemblyFeb 8, 2024 (d) Confirmed Jul 25, 2018 -

Indonesia Indonesian Regional Representative Council Feb 14, 2024