Emerging Market Links + The Week Ahead (February 19, 2024)

The Chinese New Year holidays are mostly done while its a long weekend in the USA for Presidents’ Day (Washington’s Birthday). It remains to be seen whether the year of the Dragon will see government intervention and/or stabilization for the Chinese and Hong Kong stock markets.

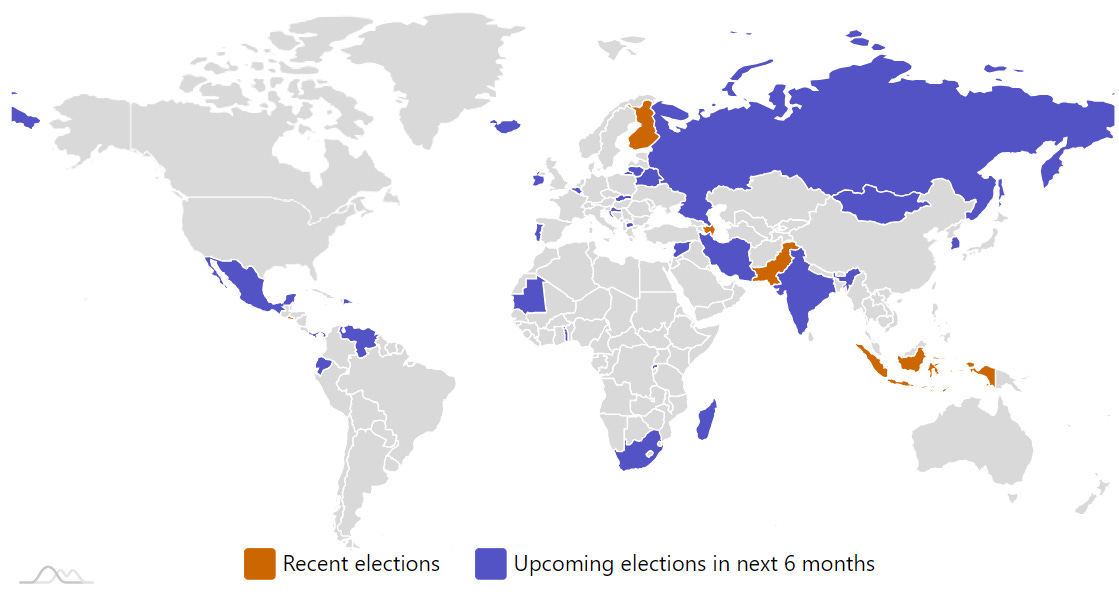

Last week, Indonesia held elections. To avoid a runoff against his two rivals, Defense Minister Prabowo Subianto needs more than 50% of all votes cast and at least 20% in each of the country’s provinces. It looks like he will achieve that once all the votes are counted, but Western governments via Western corporate media are already telegraphing they don’t like the results:

As briefly noted later in this post, the Edelman Trust Barometer 2023 found that 73% of Indonesians say they expect to be better off in five years (among the highest readings for any country). In contrast, only 36% of Americans and 23% of UK respondents said the same (decreases from the previous survey) – something CNN, AP and The Guardian might want to look into…

Meanwhile in South Africa, the CEO of a pork producer (Pork manufacturer Eskort is upbeat despite SA’s water, power crises) recently made this interesting observation increasingly applicable to developed countries:

“As you know, in this country the rules of the game have changed. If you don’t provide your own electricity, you don’t provide your own water, you’re going to have trouble. We spent R10m on this site to drill four boreholes and to put up a water purification plant. And that is money you lose on your bottom line. You get nothing for it when the government is supposed to supply you.”

Finally, the Emerging Market ETF Launches (3 for 2024) and Emerging Market ETF Closures/Liquidations (none) sections at the bottom of this post have been updated. I had also figured out why I could not save or publish new posts to my website (https://www.emergingmarketskeptic.com/ – some additional EM resources have been added to the front page) for the past few months and am almost finish publishing Substack posts there.

$ = behind a paywall

-

🇰🇷 Mirae Asset Securities’ Korean Stock Picks (January 2024) Partially $

-

Korean Air, Amorepacific Corp, LG Energy Solution, Daewoo Engineering & Construction, Samsung Engineering, SK Biopharmaceuticals, Lotte Data Communication, Kumho Petrochemical, Hotel Shilla, Hyundai Mobis, LG Innotek, Krafton, Aekyung Industrial, SK Hynix, LG Electronics, Korea Aerospace Industries, Hyundai Glovis, Samsung SDS, Hyundai Motor, Kia Corp, HanAll Biopharma, Lotte Rental, HD Hyundai Electric, Samsung Biologics, Jin Air, Lotte Data Communication, Hyundai Engineering & Construction, Hyundai AutoEver, Samsung SDS, NCSoft Corp, Wemade, SOCAR, Neowiz, Dio Corp, Joy City Corp, Hanmi Pharma, Chong Kun Dang Holdings, Cosmax Inc, Shinsegae Inc, Hyundai Department Store, KT Corp, BGF Retail, GS Retail, SK Telecom, LG Uplus, CJ Logistics, OCI Holdings, Lotte Chemical, Hanwha Solutions, DL E&C Co, Kakao, Shinsegae International, F&F Co, Samsung Electronics, Kolmar Korea & LX International

-

-

EM Fund Stock Picks & Country Commentaries (February 18, 2024) $

-

EM small cap stocks, HDFC Bank decline detracts from fund performances, the need to dig deep to find value in India, Alchip Technologies, Vivara Participacoes, Raia Drogasil, Coca-Cola Femsa, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 ZJLD Group (6979 HK): Fundamentals Intact; Share Price Wrongfully Punished (Smartkarma) $

See: ZJLD Group (HKG: 6979): IPO of the First Baijiu Maker to List Outside of China Flops

Many China consumer stocks, including ZJLD Group (HKG: 6979), have been sold off heavily in the past 6 months, primarily driven by a fear of deflation and weak consumer sentiment.

ZJLD Group is one of the exceptions, with fundamentals intact while share price heavily sold off.

Shares look attractive vs. its high growth rate and strong management team, and especially with the return of Southbound connect post holidays.

🇨🇳 Autohome shifts into higher gear with NEVs and immersive tech (Bamboo Works)

The Chinese car trading giant is expanding its network of high-tech showrooms where customers can check out various models in virtual reality

Autohome (NYSE: ATHM)’s profits rose about 4% last year to 1.88 billion yuan

The trading platform’s sales of new energy vehicles are soaring, jumping nearly 82% last year

🇨🇳 Cloopen closes the book on fraud case, looks to rebuild (Bamboo Works)

The U.S. securities regulator charged the cloud services provider with fraud for falsifying revenue, but didn’t impose any fine due to the company’s cooperation in the investigation

The SEC charged cloud services provider Cloopen Group Holding Ltd (OTCMKTS: RAASY) with falsifying revenue, but also praised it for cooperating with its investigation into the matter

The company announced a major board overhaul in December, but faces a long road in its rebuilding effort due to stiff competition and China’s slowing economy

🇨🇳 Till death do us part: A multi-bagger in the funeral industry? (Atmos Invest – Hunting for 100-baggers)

Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF): the largest funeral operator in China.

In 1994, it was one of the first death care companies that was created in China (most of them were run by the government).

Can Fu Shou match the past performance of Service Corporation International (NYSE: SCI)? Let’s find out.

We can see that the epicenter of the business is still in Shanghai where revenue has grown four-fold in 12 years. In 2010, Shanghai represented almost 70% of revenues, now it is still 50% of overall revenues for the company.

🇨🇳 China Sportswear (Anta, Li-Ning) – Part 1 (East Asia Stock Insights)

China’s homegrown brands are the structural winners

Part 1 of this report will examine the evolution of China’s sportswear industry and the relevant industry context. Importantly, we will discuss the key structural backdrops that underpin the compelling opportunities I see today in the Chinese sportswear companies.

Part 2 will be a discussion on ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) and Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF), delving into the company-specific factors. This part will also feature up-to-date insights from store visits that I conducted earlier this month in Beijing.

🇨🇳 Another Chinese Bubble Tea Chain Brews Hong Kong IPO (Caixin) $

Chinese bubble tea chain Auntea Jenny has filed for a Hong Kong IPO, becoming the latest beverage brand to take advantage of a post-pandemic revival in consumer spending to spice up business.

Auntea Jenny (Shanghai) Industrial Co. Ltd., the owner of the brand, plans to use the majority of the proceeds to boost digitalization and supply chain capabilities, as well as expand product offerings and upgrade equipment, according to its prospectus published by the Hong Kong Stock Exchange Wednesday.

🇨🇳 Tianjin Development Holdings (0882.HK) (Small Cap Value Investing with Phil)

Tianjin Development Holdings Ltd (HKG: 0882 / FRA: TJN / OTCMKTS: TJSCF)

When your cash reserve is 3x your market capitalization, your projected P/E is below 2, and you operate within growing sectors in an expanding market

The company operates in various sectors, including:

Utilities (Tianjin TEDA Tsinlien Water Supply Co., Ltd, Tianjin TEDA Tsinlien Heat & Power Co., Ltd., Tanjin TEDA Electric Power Co., Ltd.)

Pharmaceuticals (Tianjin Yiyao Printing Co., Ltd., Tianjin Lisheng Pharmaceutical Co., Ltd., Tianjin Institute of Pharmaceutical Research Co., Ltd.)

Hospitality (Tsinlien Realty Limited which operates the Courtyard by Marriott Hong Kong)

Electrical and Mechanical (Tianjin Tianfa Heavy Machinery & Hydro Power Equipment Manufacture Co., Ltd.)

🇭🇰 HSTECH Index Rebalance: Tongcheng (780 HK) In; GDS (9698 HK) Out; Round Trip Trade US$1bn (Smartkarma) $

🇲🇴 Macau Feb GGR might top US$2.5bln, solid CNY biz: CLSA, Macau nearly 900k tourists in first 5 days of CNY break & Macau welcomes 1.4mln visitors for 8-day CNY break: govt (GGRAsia)

See our Macau ADRs list.

“Macau is poised to deliver solid performance during Chinese New Year as average visitations over 10 to 17 February track the Macao Government Tourism Office’s (MGTO) forecast of 120,000 per day,” wrote analysts Jeffrey Kiang and Leo Pan in a Tuesday note.

Macau welcomed more than 898,000 visitors in the first five days of the Chinese New Year break, according to official data. The average number of visitor arrivals stood at about 179,700 a day, showed preliminary figures from the city’s Public Security Police.

🇲🇴 MGM China record 20pct Macau share in Jan: Hornbuckle (GGRAsia)

“Macau is doing amazingly well. I know some of our competitors are wondering what we’re doing,” stated Bill Hornbuckle, chief executive and president of MGM Resorts International (NYSE: MGM) during the parent’s latest fourth-quarter earnings call.

Analyst John DeCree of CBRE Equity Research, said of MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) in a Wednesday note regarding the group results: “The company’s market share exceeded 16 percent in fourth-quarter 2023 and hit 20 percent in January 2024, likely due to some favourable hold.”

Though he added: “Mid-to-high teens is the target market share for MGM with margins in the high-20 percent range, which points to meaningful EBITDA growth on the horizon.”

🇲🇴 Galaxy likely only Macau op with 2024 dividend: Jefferies (GGRAsia)

See: Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF): Macau’s Best Casino Stock Positioned for Growth

Brokerage Jefferies says it expects Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) to be the only one of Macau’s six casino operators to pay a dividend during 2024. Hong Kong-based analyst Andrew Lee cited as one element for such a view conversation with Galaxy Entertainment management at an event for investors in the United Kingdom’s capital, London.

“Given their strong financial position, we expect Galaxy will remain the only (Macau) operator to pay dividend” in 2024, “and be in a position to possibly raise their payout ratio this year,” stated Mr Lee in a Wednesday memo.

🇲🇴 Galaxy Entertainment: VIP-To-Mass Transition Is A Work-In-Progress (Seeking Alpha) $

I don’t anticipate that Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF)‘s actual Q4 2023 EBITDA will beat the market’s expectations, as it is still transitioning from the VIP segment to the mass segment.

But investors are paid to wait out the VIP-to-mass transition process with expectations of growing dividend distributions for Galaxy Entertainment.

I have a Hold rating for GXYEF stock, taking into account its near-term financial prospects and medium-term shareholder capital return outlook.

🇲🇴 SJM – time to dip into Macau? (Undervalued Shares)

SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) is the oldest casino company in Macau.

It embodies gambling in Macau in quite the same way as SBM (EPA: BAIN) does in Monte Carlo.

Since its peak in 2014, the stock is down 90%.

In fact, it’s now back to the same level when it first went public in 2008. Both SJM and Macau have since advanced by leaps and bounds.

Will the stock of SJM ever return to its former glory?

🇹🇼 Asian Dividend Gems: Acter Co (Asian Dividend Stocks) $

Based in Taiwan, Acter Group Corporation Limited (TPE: 5536) is capitalizing on its extensive experience of high-end cleanroom integration, recycling and regeneration systems, electromechanical engineering to generate consistent growth in earnings and cash flow. Semiconductor and electronics are two biggest customer segments of the company.

Acter Co’s dividend yield averaged 8.2% from 2019 to 2022. Its annual dividend payout averaged 76% in the same period. Estimated dividend yield is 7% in 2023.

🇰🇷 Douzone Bizon: A Strong Turnaround Story in the Korean Software Industry (Smartkarma) $

Douzone Bizon (KRX: 012510)‘s results turned around strongly in 2023. It had sales of 353.6 billion won (up 16.2% YoY) and operating profit of 68.4 billion won (up 50.4% YoY) in 2023.

The company plans to release software platforms with artificial intelligence capable functions in 1Q 2024.

The sharp increase in the share price and market cap of Douzone Bizon raises the probability of the company being included in the KOSPI 200 rebalance in 2024.

🇰🇷 Carlyle Group Selling More than 320 Billion Won Worth of KB Financial in a Block Deal Sale (Smartkarma) $

After the market close on 14 February, KB Financial Group (NYSE: KB) announced that The Carlyle Group is trying to sell a 1.2% stake in the company through a block deal sale.

The expected block deal price range is 64,608 won to 65,954 won per share, representing a 2 to 4% discount to the closing price of 67,300 won on 14 February.

We would pass on this block deal sale. Despite excellent gains so far YTD, there is looming risk of many investors that may bail out of KB Financial post ex-dividend.

🇸🇬 Our thoughts on Qoo10’s acquisition of Wish (Momentum Works)

ContextLogic (NASDAQ: WISH), Wish’s parent, will carry on as a listed entity to ‘monetise’ its US$2.7 billion net operating losses.

Back to the deal. Qoo10 has raised significant amount of money but has been bleeding cash. Its accumulated losses by end of 2021 (the latest filing) was US$309 million. Southeast Asia will be too small a market for it to turn around, not to mention the fierce competition here;

While it is almost impossible to fight a price war against Temu, US is too big a market that a differentiated, niche offering can still make a large, profitable ecommerce platform. Look at eBay and Etsy. It it is serious for a breakthrough, Qoo10 would need to find that niche.

🇸🇬 OUE REIT Undergoes a Rebranding as it Maintains DPU for 2H 2023: 5 Highlights from its Latest Earnings (The Smart Investor)

The commercial and hospitality REIT announced a rebranding exercise late last month to change its name from “OUE Commercial REIT” to “OUE REIT (SGX: TS0U)” to better reflect its current focus on growth opportunities in the hospitality, office, and retail sectors.

Here are five highlights from the REIT’s latest 2023 earnings.

A resilient financial performance

Prudent debt management

Higher valuations with strong operating metrics

A mixed performance for the Commercial segment

A rebound for the Hospitality segment

🇸🇬 StarHub More Than Doubles its Net Profit and Hikes its Dividend by 34%: 5 Highlights from the Telco’s Latest Results (The Smart Investor)

It has been more than two months since StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) announced its Investor Day objectives.

The telco has ambitious plans to create an all-in-one app and execute an enterprise IT transformation.

Here are five highlights from the group’s latest earnings report.

A stellar set of earnings

Low churn and higher ARPU for Mobile

A mixed performance for Broadband and Entertainment divisions

Cybersecurity takes centre stage for Enterprise division

A positive outlook with a sharp jump in dividends

🇸🇬 Singapore Post’s Share Price Hits an All-Time Low: Can the Postal Group Manage a Turnaround? (The Smart Investor)

The postal group’s share price is spiralling down to a new low. Can the group’s business pick up and do better in the future?

Singapore Post Limited (SGX: S08 / FRA: SGR / OTCMKTS: SPSTY / SPSTF), or SingPost, used to be a dividend stalwart which investors relied on for steady, reliable dividends.

Of late though, the postal service and e-commerce provider has performed poorly.

Weak operating results

Scaling up its network in Australia

An ongoing strategic review

Get Smart: Logistics is a profitable business

🇸🇬 Keppel DC REIT’s Unit Price is Hitting its 52-Week Low: Is the Data Centre REIT a Bargain? (The Smart Investor)

We explore if the data centre REIT makes a compelling bargain after its unit price tumbled in the wake of a tenant problem.

Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) has not had an easy time.

Distribution impacted by finance costs and a provision

Grey skies for Bluesea

Solid industry fundamentals

Get Smart: Rough seas in the short-term

🇸🇬 4 Singapore Stocks Touching Their 52-Week Lows: Are They a Bargain? (The Smart Investor)

One way to search for bargains is to look at stocks that are hitting their 52-week lows.

Here are four Singapore stocks that recently hit their year-low and could end up on your buy watchlist.

Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY) is a leading agribusiness group with business activities that include oil palm cultivation, processing, branding, and distribution of a wide range of edible foods and industrial products.

Japan Foods (SGX: 5OI / TYO: 2599) is a leading Japanese restaurant chain in Singapore operating 78 outlets as of 31 December 2023 such as Ajisen Ramen, Osaka Ohsho, Menya Musashi, and Tokyo Shokudo.

CapitaLand China Trust (SGX: AU8U / OTCMKTS: CLDHF), or CLCT, is a China-focused REIT with a portfolio of nine shopping malls, five business park properties, and four logistics park properties.

Seatrium Limited (SGX: S51 / FRA: S8N / OTCMKTS: SMBMF) Seatrium provides engineering solutions to the global offshore, marine, and energy industries.

🇮🇳 India narrows gap with China in key MSCI index with weight hitting new high (Reuters) 🗃️

🇮🇳 Initial Thoughts on Hyundai Motor India IPO (Smartkarma) $

Hyundai Motor India has been taking initial steps for an IPO. We believe this IPO could be completed sometime in 4Q 2024.

Hyundai Motor India Limited (HMIL) IPO offering size is estimated to be at least US$3 billion, which would be one of the largest in India and the world this year.

If HMIL is valued at US$25 billion and HMC sells a 15% stake, its remaining 85% stake would be worth US$21 billion, representing 55% of HMC’s market cap.

🌍 Some Facts About Africa’s Listed Brewing Companies (Capital Markets Africa)

Note: The post contains a good table…

there are FIVE listed African brewing businesses with market caps over half a billion US dollars?

European brewing multinationals AB InBev, Heineken, Diageo, and Groupe Castel dominate the African market via a network of subsidiaries and significant shareholdings?

🇿🇦 Nampak progresses turnaround despite African currency headwinds (IOL)

Nampak Ltd (JSE: NPK / FRA: NNZ0), Africa’s largest packaging group that is being restructured due to financial difficulties, needs to sell three key assets as its operations are not yet sufficient to put the group back on a sustainable growth trajectory, CEO Phildon Roux said yesterday.

Roux was also asked what had caused “other players to eat Nampak’s lunch” considering that Nampak was the only beverage can maker in South Africa in 2018 and currently there were four manufacturers.

🇨🇿 CEZ: Earnings At Risk Amid Sharp Drop In Electricity Prices (Seeking Alpha) $

CEZ as (PSE: CEZ / WSE: CEZ / FRA: CEZ / OTCMKTS: CZAVF)

The recent decline in electricity prices in Europe is anticipated to have a negative impact on earnings, leading to the likelihood of a dividend cut.

Significant investment plans are posing an additional threat to the bottom line.

The windfall tax implemented by the Czech government has resulted in a substantial reduction in profits, significantly impacting the company’s financial performance.

🇵🇱 Refining e-commerce with a Polish touch. (Active balance)

Shoper SA (WSE: SHO / FRA: 8FF) is not only an e-commerce platform, but a whole ecosystem of services that supported online stores. The company specifically targets micro, small, and medium-sized enterprises with its offerings. Shoper is the leader in the Polish market of software for e-commerce in the SaaS model and had over 45% market share in terms of the number of customers served.

🇧🇷 Vale: Potential Value Trap Reliant On Weakening Chinese Iron Ore Demand (Seeking Alpha) $

I previously issued a bear call on Vale (NYSE: VALE) in Jul-23, I am even more bearish now.

Construction accounts for over 50% of Chinese steel demand, whereas new home sales have fallen by a third and new housing starts fallen by over 50% from their 2021 peak.

I believe there is a significant risk China’s property market downturn will materially negatively impact steel demand, iron ore prices and Vale’s stock price beyond market expectations.

Vale’s P/E of 6 and dividend yield of 6% comes with this underlying risk, which I believe to be significant. Dividend investors should be aware of and cautious about it.

🇧🇷 Vale: 9.16% Yield And A Sizeable Buyback Program But Earnings Approaching Fast (Seeking Alpha) $

Vale (NYSE: VALE) is reporting earnings with consensus estimates of $0.92 in normalized EPS and $0.98 in GAAP EPS.

Analysts expect revenue to come in at $13.07 billion.

Vale’s Q4 iron ore production exceeded estimates, leading to an increase in analyst estimates.

🇧🇷 Atacadão: A Great Brazilian Cash And Carry Worth Monitoring (Seeking Alpha) $

Atacadao (BVMF: CRFB3), a Brazilian cash and carry retailer owned by Carrefour S.A., operates throughout Brazil, offering a mix of food and non-food products, convenience stores, pharmacies, and gas stations.

ATAAY faces challenges such as declining food inflation, high indebtedness, and intensified competition.

Despite the conversion of BIG Group stores and synergy gains, high costs and delays in store maturation have pressured Atacadão’s margins, impacting its profitability.

Looking ahead to 2024, Atacadão anticipates increased profitability driven by factors like Brazil’s food inflation recovery, lower interest rates, store maturation, and CapEx reduction.

The Company’s valuation, while stretched compared to historical averages, is aligned with domestic peers and poised for profit growth, suggesting a potential convergence in profitability by 2024.

🇧🇷 Suzano: Net Prices Should Be Stable For Next Quarter, Cerrado Soon Finished (Seeking Alpha) $

Suzano S.A. (NYSE: SUZ) is maintaining price levels despite the downturn in pulp prices, thanks (we think) to the nearing completion of the Cerrado project.

The completion of the Cerrado project should have a substantial impact on overall volumes and increase profitability, given current pulp prices hold.

Suzano’s Q4 should be relatively flat sequentially. All eyes should be on Cerrado, as the end of that CAPEX will restore FCFs and also resume deleveraging.

🇧🇷 Banco do Brasil: Q4 Earnings, A Few Issues, But Still Leading The Pack In Brazilian Banking (Seeking Alpha) $

Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY)‘s Q4 2023 results were robust, with adjusted net profit reaching R$9.4 billion, showing significant growth compared to the previous year.

Despite challenges in credit quality and an increase in provisions for doubtful debts, the bank remains optimistic, maintaining its attractive dividend outlook for 2024.

Banco do Brasil plans to increase its dividend payout from 40% to 45% and has provided bold profit growth guidance for 2024.

The bank’s focus on maintaining and expanding its return on equity (ROE) above that of other private banks contributes to its positive investment thesis.

Despite some negative points in the quarter, including a decline in coverage ratio and an increase in delinquency, Banco do Brasil continues to offer upside potential and an attractive dividend outlook through 2024.

🇧🇷 Inter & Co’s Q4 Earnings: Defaults Taking A Dip, Bold Plan Gaining Ground (Seeking Alpha) $

Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) reported record growth in 2023, aligning with its ambitious growth plan to rival traditional banks in Brazil by 2027.

The digital bank showcased robust growth in net profit, credit portfolio, and client expansion in Q4 2023.

The decline in delinquencies suggests potential growth in new loan originations, driving operational growth in the future.

Despite dilution concerns, the market has reacted positively to The Company’s capital increase.

INTR’s trading below a 1.5x price-to-book ratio is appealing, considering its robust growth as a digital bank.

🇧🇷 Afya – LATAM Stocks Investment Analysis #23 (Latam Stocks)

Afya (NASDAQ: AFYA) is the largest private medical education company in Brazil.

On a personal note, my sister-in-law is in the process of applying to medical schools, so I thought I might learn something useful for my family by doing this analysis.

Overall, I think Afya is a solid company, and their business should continue to do well. There are over 5 applicants for every available medical school seat in Brazil, so I expect continued demand for Afya’s products.

However, the current valuation is quite expensive. Investors have been willing to pay a premium for the category leader. So I am not as confident that the company’s stock will perform as well as its business.

🇨🇱 Sociedad Química y Minera de Chile: Why Investors Should Get Back In The Ring (Seeking Alpha) $

The risk-reward equation swings to Sociedad Química y Minera de Chile (NYSE: SQM)‘s favor after derisking with the LCE prices back to YE21 levels and the new concession term.

The consensus has largely factored in a prolonged weak scenario and yet still finds upside.

On US$11kg LCE price (forever) plus lower margins I arrive at a target price of US$48.

Any rise in EV demand or restocking that moves LCE prices higher may trigger a sector and SQM resurgence.

🇨🇴 Protests in Colombia & I bought the dip in Parex Resources (Calvin’s thoughts)

Also see: Global X MSCI Colombia ETF Holdings (September 2023)

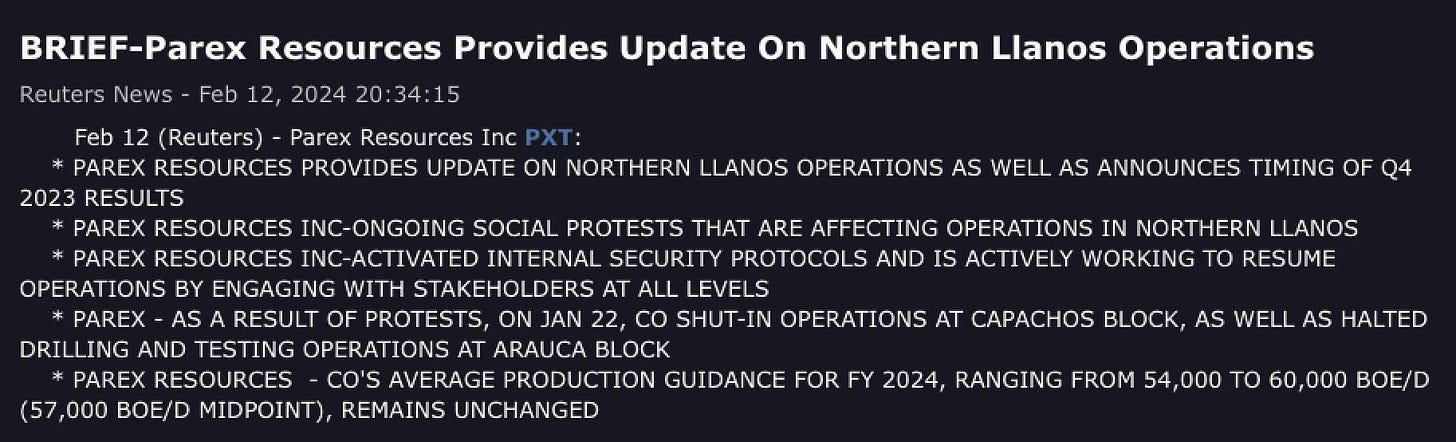

Over the past month, there have been protests in Colombia. This morning, Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) dropped this headline, which has spooked its Canadian shareholder base yet again. The company said their current production is at 50k bpd, which is 4-10k bpd lower than annual guidance, but also said their previous guidance levels included expectation for situations like this, and left the annual production target unchanged.

🇨🇴 ¡Viva Colombia! A story of political unrest and shareholder returns (The Modern Investing Newsletter)

GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O) and Parex Resources (TSE: PXT / FRA: QPX / OTCMKTS: PARXF) are tremendously undervalued …

All in all, the situation in Colombia appears to be not as dramatic as portrayed by the media. Several times in Colombia’s history, there have been protests and riots as a result of politics, and the country still exists. With one of the cheapest stock markets in the world, there are several interesting stocks. These are namely Geopark GPRK 0.00%↑, Parex Resources $PXT.TO, Ecopetrol SA (NYSE: EC) and Bancolombia (NYSE: CIB). My personal favorite is Geopark, as the independent oil & gas producer is deeply undervalued and has great capital allocation.

🇲🇽 Grupo Televisa SAB (NYSE: TV)

🇲🇽 Grupo México: For Long-Term Holders, A Correction May Be Coming (Seeking Alpha) $

Grupo Mexico (BMV: GMEXICOB / FRA: 4GE / OTCMKTS: GMBXF) receives a “Hold” rating for its shares.

There is potential for a bottom formation in the stock price cycle, offering a good return when shares are in an uptrend.

Long-term prospects for robust copper demand support the investment in Grupo México.

🇲🇽 CEMEX: Volume Recovery And Strong Pricing To Drive Growth In 2024 (Seeking Alpha) $

CEMEX (NYSE: CX) is experiencing strong volume recovery in its Mexican business across most of its products.

The company’s margin profile has improved significantly, supported by the strong performance of its Urbanization Solutions business and pricing strategies.

Cemex’s stock is trading at an attractive price point, offering a significant discount compared to its historical average and the sector median.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Investors hope for catch-up rally as Chinese stocks reopen (FT) $ 🗃️

🇨🇳 US companies may find China exposure a growing headache (FT) $ 🗃️

🇨🇳 US investors in emerging markets switch to ETFs that exclude China (FT) $ 🗃️

🇨🇳 Chinese local governments reduce reliance on real estate in shift from old to new industries (Caixin) $

Chinese local governments are pivoting from a reliance on property investment to developing hubs for cutting-edge industries after more than half of the Chinese mainland’s provincial-level regions missed their GDP targets for 2023.

The world’s second-largest economy grew 5.2% last year, in line with Beijing’s target of “around 5%.” Performance at the local level, however, was a patchwork. Out of the 31 provincial-level governments on the mainland, 17 fell short of their objectives.

🇭🇰 It pains me to say Hong Kong is over (FT) $ 🗃️

🇮🇩 Consider This: Indonesian elections 2024—what’s in it for investors? (Franklin Templeton)

As Southeast Asia’s largest economy and third-largest democracy in the world, Indonesia’s elections are likely to have implications for global investors. Franklin Templeton Investment Institute Investment Strategist Kim Catechis weighs in.

🇮🇩 A popular anti-populist’s exit poses a challenge for Indonesia (FT) $ 🗃️

After a decade of stability in a country not known for it, Joko Widodo will be a hard act to follow

In a 2023 Edelman survey of leading developed and developing nations, 73 per cent of Indonesians said they expected to be better off in five years — among the highest readings for any country.

🇮🇳 India opposition alliance fractures as support for Narendra Modi soars (FT) $ 🗃️

🇿🇦 Pork manufacturer Eskort is upbeat despite SA’s water, power crises (IOL)

This was an interesting observation:

“As you know, in this country the rules of the game have changed. If you don’t provide your own electricity, you don’t provide your own water, you’re going to have trouble. We spent R10m on this site to drill four boreholes and to put up a water purification plant. And that is money you lose on your bottom line. You get nothing for it when the government is supposed to supply you.”

🌐 The big opportunity in emerging market debt (FT) $ 🗃️

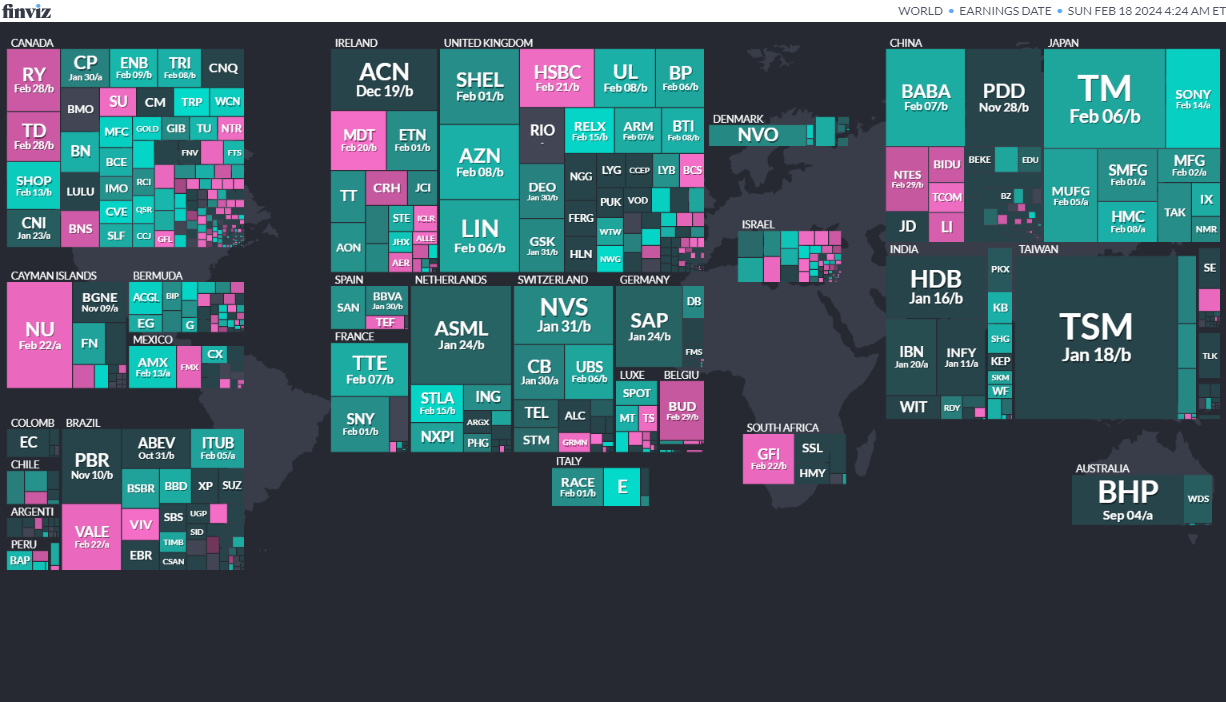

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

IndonesiaIndonesian Regional Representative CouncilFeb 14, 2024