Emerging Market Links + The Week Ahead (February 24, 2025)

Several interesting developments to note this week – including: As discussed last May 6th and May 20th, Starbucks is among the many (mostly) western brands facing boycotts over real or perceived ties to Israel. The Malay Mail has reported that Starbucks’ Malaysian franchise holder Berjaya Foods sees revenue slashed by almost half last year amid pro-Palestine boycott – its fifth consecutive quarterly loss. Again, Chinese brands like Luckin (OTCMKTS: LKNCY) and Mixue who have entered Malaysia don’t have these sorts of problems and neither do most local brands.

Meanwhile, Singapore’s Budget 2025 and the Monetary Authority of Singapore (MAS) are coming up with proposed measures to strengthen equities market development, improve liquidity, and attract more capital and IPOs to the Singapore market. This includes rewarding fund managers for putting their money into Singapore-listed companies.

Finally, Thailand has been mulling casinos for some time and such plans could put Thailand behind only Las Vegas and Macao. However, a proposed US$1.5mln wealth threshold for locals to play in any Thai casinos might be good for local society; it could scramble the financial numbers for Macau-based and other casino groups who are considering entering the market should it become open to casino gaming.

$ = behind a paywall

-

🇰🇷 Korean Stock Picks (January 2025) Partially $

-

🤖 AI generated insights about Korean stocks (and some wild unverifiable answers)

-

Includes DeepSeek insights: NAVER, Hyundai Mobis, S-Oil Corp, Kia Corp, DoubleDown Interactive, LG Display, Samsung Life Insurance, Kangwon Land, Hyundai Department Store, Samsung E&A, Hyundai Motor, Samsung SDS, SK Hynix, ST Pharm, LG Innotek, Korea Zinc / Young Poong Precision Corporation, Samsung Electronics, Samsung Biologics, Hyundai Engineering & Construction, HMM, CS Wind Corp & LX Hausys

-

Stocks with no DeepSeek AI generated insights because I got tired of waiting on their server: Hyundai Rotem, LIG Nex1, Hana Micron, HD Hyundai Mipo Co Ltd, HD Korea Shipbuilding & Offshore Engineering, HD Hyundai Heavy Industries, Shinhan Financial Group, T’Way Air, SK Telecom, KT Corp, LS Electric Co Ltd, Coway Co Ltd, Hyundai Livart Furniture Co Ltd, Dear U Co Ltd, JYP Entertainment Corp, SM Entertainment Co Ltd, HYBE, Ecopro BM Co Ltd, Hugel, Doosan Corp, Kolmar Korea, BNK Financial Group, KB Financial Group, GS Engineering & Construction Corp, Hyundai Motor Securities, E-Mart, DL E&C Co Ltd, Amorepacific Corp, LG Energy Solution, LG Electronics, Hanwha Solutions, LX International, LG Corp, NH Investment & Securities, Korea Investment Holdings, Samsung Electro-Mechanics, Krafton, Lotte Tour Development, Paradise Co Ltd & HD Hyundai Electric Co Ltd

-

-

🌐 EM Fund Stock Picks & Country Commentaries (February 23, 2025) Partially $

-

Tariff risks being priced differently across countries + China consumption as a counter, Amer Sports (ANTA Sports Products), India still compelling, EM investing red flags, frontier market debt, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 Suddenly, Everybody Loves Alibaba, But Struggles Persist (The Great Wall Street – Investing in China)

AI Promises and Cloud Growth Mask Deeper Issues in Alibaba (NYSE: BABA)’s Other Business Segments

Let me walk you through the different business units, focusing primarily on the core ones and briefly touching on the non-core units without going into too much detail.

🇨🇳 Alibaba (BABA): 3Q25, Main Business Growth Close to Double Digits (Smartkarma) $

Total revenue growth rate continued to rise in 3Q25 ending March 2025.

Also, the growth rate of the largest business line, customer management, was close to double digits.

The upside for the next twelve months was narrowed to 18%, as Alibaba’s stock surged after our preview note.

🇨🇳 CATL to recharge its offshore output with new shares (Bamboo Works)

The world’s leading maker of electric car batteries has filed for a secondary listing in Hong Kong, aiming to boost its production capacity outside China

The company said it should not suffer any serious damage from being labelled a military-linked business by the United States

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) forecast its revenue for 2024 would fall between 8.7% and 11.2%

🇨🇳 iMotion Automotive rides DeepSeek fever to new fundraising (Bamboo Works)

The intelligent driving solutions provider raised HK$228 million in a new share placement, its second in the last three months

iMotion Automotive Tech (HKG: 1274) raised HK$228 million through new share placement, three months after raising a smaller HK$73 million

Last month the company entered a strategic tie-up with Horizon Robotics (HKG: 9660) aimed at speeding up sales of its intelligent driving solutions into mass-produced vehicles

🇨🇳 Black Sesame emerges as dark horse in driving technology race (Bamboo Works)

The smart car technology maker’s shares are down since their trading debut last August, lagging strong gains for other recently listed peers

Black Sesame International Holding Ltd (HKG: 2533)’s revenue rose about 52% last year, though the growth rate slowed from the first half to the second half

The company’s gross margin improved notably in the first half of last year as its products were included in two mass-produced vehicles

🇨🇳 AAC Technologies scores big turnaround. But is its stock running out of steam? (Bamboo Works)

Surging smartphone sales helped to power the acoustic component supplier to turbocharged profit growth last year, but the stock failed to rally strongly on the news

Aac Technologies Holdings (HKG: 2018 / FRA: A2X / OTCMKTS: AACAY / AACAF) said it expects to report that its profit rose as much as 145% last year

The acoustic component maker said car acoustics are expected to become a future growth driver

🇨🇳 Vipshop gets left behind in China tech stock rally (Bamboo Works)

The ‘daily deal’ e-commerce company reported a third consecutive quarter of declining revenue, though the declines are moderating

Vipshop Holdings (NYSE: VIPS)’s revenue fell for a third consecutive quarter in the final three months of 2024, though it could return to growth this year

The company’s stock has been relatively overlooked during the recent China tech rally, up just 16% in the last six months compared with much larger gains for Alibaba (NYSE: BABA) and JD.com (NASDAQ: JD)

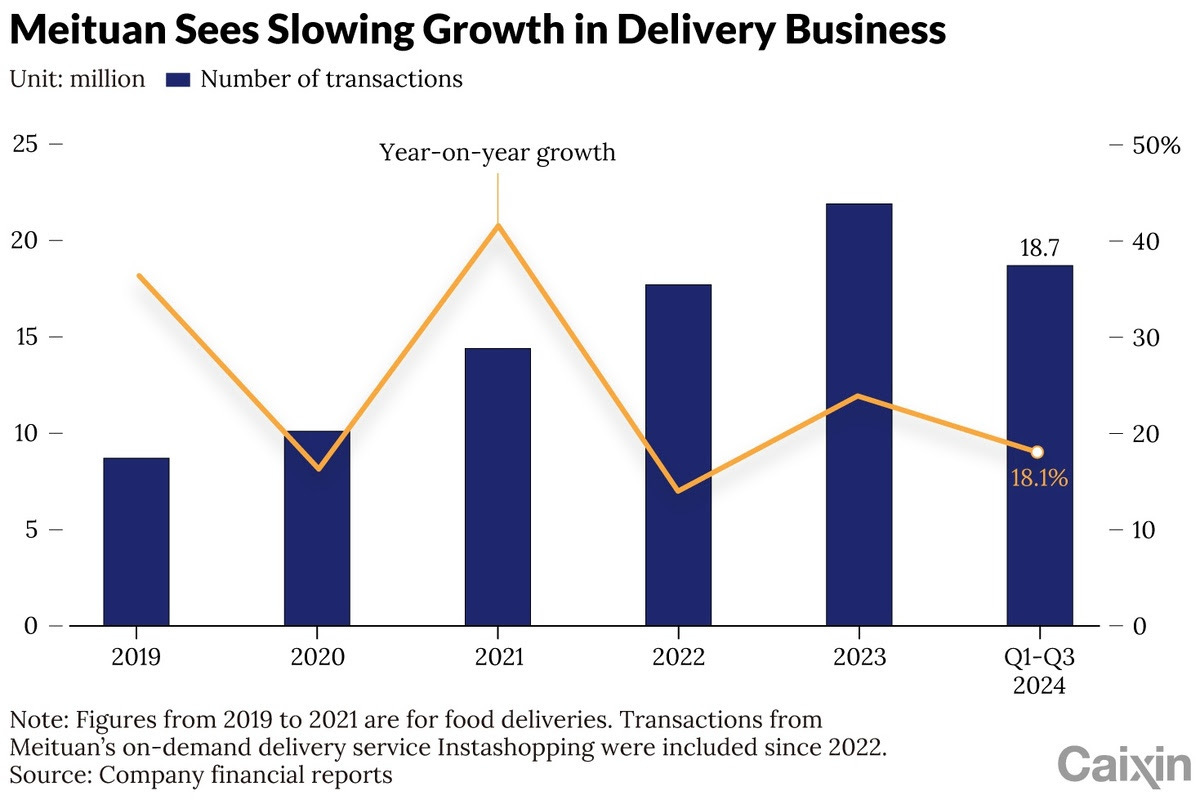

🇨🇳 In Depth: Meituan Hopes Middle East Expansion Will Deliver Growth (Caixin) $

Among the delivery drivers that crisscross streets and zip between buildings in Riyadh, there is a growing consort of riders and e-bikes donning Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY)’s characteristic black and yellow. Soon, drones clad with the same colors could take to the skies over the Saudi Arabian capital.

After pulling off a rapid takeover of the Hong Kong market, Meituan has taken its sister food delivery platform Keeta to the Middle East for its first foray outside China.

🇨🇳 Fenbi chalks up loss as edtech scrambles into AI (Bamboo Works)

The provider of civil service exam preparation services is just one of many Chinese edtech companies rushing to incorporate DeekSeek into their products

Fenbi Ltd (HKG: 2469) fell into the red in the second half of last year, as its revenue fell 15% during the six-month period

The edtech company was profitable for all 2024 thanks to a strong first half, but its annual revenue fell 8.3% as competitors cut into its market share

🇨🇳 Imax China roars into Year of the Snake after weak performance in 2024 (Bamboo Works)

The operator of large-screen theaters said it posted a strong start to 2025 on the success of the blockbuster animated film ‘Ne Zha 2’

IMAX China Holding Inc (HKG: 1970 / FRA: IMK / OTCMKTS: IMXCF)’s revenue slumped 11% in the second half of last year, accelerating from a 3.1% decline in the first half, as China’s box office fell 23% during the year

The large-screen cinema operator said it recorded strong business during this year’s Chinese New Year holiday on the success of animated film “Ne Zha 2”

🇨🇳 H World Group: The Undisputed Value-For-Money Hospitality Leader With Global Ambitions (Seeking Alpha) $ 🗃️

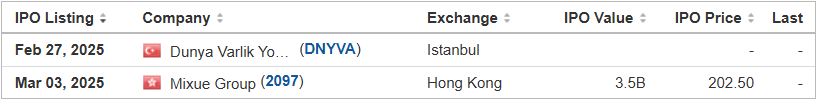

🇨🇳 Mixue Group IPO Preview (Douglas Research Insights) $

Mixue Group is getting ready to complete its IPO in Hong Kong in the coming weeks. Mixue Group plans to raise about US$500 million from its Hong Kong IPO.

The company has an excellent income statement with notable growth in sales and profits in the past four years.

Net margin improved from 15.7% in 2023 and 18.7% in 1Q-3Q 2024, driven by higher sales base and lower major operating costs as a percentage of sales.

🇨🇳 Chinese Real Estate Sector Analysis Part 2: Exploring the debacle and undervalued stocks in an absolutely despised sector (Dragon Invest)

Welcome to the second part of my Chinese Real Estate Sector Analysis. In the first part, I tried to provide much needed historical context along with a detailed analysis of both the current and prospective future state of the industry.

This post shall contain both stocks directly related to the sector and undervalued real estate proxy plays to provide a fair balanced list of companies spread across the real estate sector for you to analyze.

(COVERS IN DETAIL):

🇭🇰 HK 第35部分; One-Day Stocks #4 (Jam_invest) $

A recap of the Hong Kong stocks journey thusfar… an overview of One-Day Stocks… some new names… and a HK stock exit

This HK 第部分 mini-series started with the Mexan Ltd (HKG: 0022) $0022.hk special situation.

When I started buying Hong Kong stocks late 2023 and early 2024, I first focused on absurd-cheap stocks of quality businesses. That lead to positions in amongst others…

China Tower Corp Ltd (HKG: 0788 / FRA: 2Y1 / OTCMKTS: CHWRF)🏷️; The monopolist telecom towers company in China.

Tianjin Development Holdings Ltd (HKG: 0882 / FRA: TJN / OTCMKTS: TJSCF) 🏷️; This is still one of my favorite HK stocks. Many investors may not regard this SOE conglomerate as such… but Tianjin Development does own quality.

MicroPort NeuroScientic Corp (HKG: 2172) 🏷️; The leading domestic player in neurointervention. Neurointervention is a minimally invasive surgery to clear and repair cerebral vascular pathways.

🇭🇰 Tam Jai (2217 HK): Toridoll (3397 JP)’s Scheme Privatisation at HK$1.58 (Smartkarma) $

(Restaurants under the TamJai and SamGor brands) Tam Jai International Co Ltd (HKG: 2217 / FRA: 29S) announced a scheme privatisation offer from (restaurants/coffee shops) TORIDOLL Holdings Corp (TYO: 3397 / OTCMKTS: TORLF) at HK$1.58 per share, a 75.6% premium to the last close price.

The key condition is the scheme approved by at least 75% disinterested shareholders (<10% disinterested shareholders rejection). No disinterested shareholder holds a blocking stake.

The offer price is final. While 53% below the IPO price, the offer is attractive compared to peer multiples and historical trading ranges. This is a done deal.

🇲🇴 Wynn Macau Ltd’s free cash flow from operations sufficient for 2025 capex: CreditSights (GGRAsia)

Macau casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF)’s free operating cash flow is likely to remain positive in fiscal year 2025, and be sufficient to cover the company’s expected incremental capital expenditure within the year. That is according to analysts at CreditSights, a credit research specialist, writing in a Friday memo.

The memo was issued following the fourth-quarter 2024 results of Wynn Macau Ltd, disclosed by its U.S. parent Wynn Resorts Ltd. The group’s unit runs the Wynn Macau resort in downtown Macau, and Wynn Palace in the newer Cotai casino district.

🇲🇴 Galaxy Ent lodges requests for trademarks featuring ‘Bangkok’, and ‘Thailand’ (GGRAsia)

A licensing entity linked to Macau casino resort operator Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) has applied to the Macau government for several trademarks containing the words “Bangkok” or “Thailand”.

The trademarks’ associated services are listed respectively as accommodation, and food and drink, as well as meeting-related services. That is according to GGRAsia’s checks of the relevant application records.

Banking group JP Morgan mentioned in an October note – about the prospects of a Thai casino industry – six organisations that had expressed interest in Thailand, including Galaxy Entertainment.

🇰🇷 KB Financial Group: A Conservative Bank With Conservative Returns (Seeking Alpha) $ 🗃️

🇰🇷 Insider Selling at Rainbow Robotics (Douglas Research Insights) $

On 19 February, it was reported that Rainbow Robotics (KOSDAQ: 277810)‘ VP Kim In-Hyeok sold 30,000 of his 55,000 shares (0.28% stake) on the 14th. Disposal price was 413,796 won per share.

At end of 2024, Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) announced that it will become the largest shareholder of Rainbow Robotics which has been the key reason why Rainbow Robotics’ share price has surged.

Despite Samsung Electronics becoming the largest shareholder of Rainbow Robotics, the overly stretched valuations could result in higher downside risk ahead. It is trading at P/S of 106x in 2026.

🇰🇷 Recent Block Deal Sale on HD Hyundai Marine Solution and Headwinds on Korean Shipbuilding Sector (Douglas Research Insights) $

On 19 February, KKR sold 2 million shares (4.49%) stake in HD Hyundai Marine Solution Co Ltd (KRX: 443060) at 147,500 won (9.3% discount to the previous day’s closing price), representing 295 billion won.

Therefore, we would argue that these major shipbuilding shares in Korea (such as HD Hyundai Heavy Industries (KRX: 329180) and Hanwha Ocean (KRX: 042660)) could face more difficult headwinds in the coming months.

KKR’s timing of its block deal sale of HD Hyundai Marine Solution also reflects its attempt to partially sell its shares while the stock price is still at lofty levels.

🇰🇷 Growing Importance of ACT – Korea’s Largest Minority Shareholders Platform (Douglas Research Insights) $

In this insight, we discuss about the growing importance of ACT, the largest minority shareholders platform (https://www.act.ag/) in Korea with nearly 100,000 members and market share of more than 50%.

Recently, ACT has been demanding corporate governance improvements on the following companies: E-Mart (KRX: 139480), DB HiTek Co Ltd (KRX: 000990), Lotte Shopping Co Ltd (KRX: 023530), Youlchon Chemical Co Ltd (KRX: 008730), Hanmi Science (KRX: 008930), and Solu-M.

ACT has played an important role in the recent shareholder return polices announced by E-Mart which announced a sharply higher total shareholder return policy including higher dividends and share cancellations…

🇲🇾 Starbucks’ Malaysian franchise holder Berjaya Foods sees revenue slashed by almost half last year amid pro-Palestine boycott (Malay Mail)

Berjaya Food Bhd (KLSE: BJFOOD) reported its fifth consecutive quarterly loss, with a 46 per cent drop in revenue to RM247.3 million for the six months ending December 31, 2024, citing boycotts over the Middle East conflict as the main factor.

Despite challenges, the group remains focused on expansion and diversification, while founder Tan Sri Vincent Tan’s call to end the Starbucks boycott sparked controversy.

In October last year, Starbucks Malaysia refuted claims that over 100 of its stores in the country had closed, saying most of its locations were just temporarily closed as part of a strategic review aimed at better aligning the company’s operations and no jobs were lost.

🇲🇾 Top 3 Reasons Why David Kuo is Buying Malaysian Stocks (The Smart Investor)

When Singaporean investors look at Malaysia, many are turned off by the risks.

Others, like my co-founder David Kuo, see an opportunity.

Familiar businesses

A larger consumer market

Get Smart: Dividends, dividends, dividends

🇵🇭 Jollibee: Watch Internal And External Changes (Seeking Alpha) $ 🗃️

-

🌐 Jollibee Foods (PSE: JFC / OTCMKTS: JBFCF / JBFCY) – Foreign & local fast food/restaurant brands in the Philippines & abroad (Chowking, Greenwich, Red Ribbon, Mang Inasal, etc.). 🇼

🇸🇬 Mapletree Industrial: A Hold Considering Lease Renewal Risks And Capital Allocation Moves (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings: A Lot Of Unlocked Potential Is Still There (Seeking Alpha) $ 🗃️

🇸🇬 Grab Holdings: This Is Not A Meme Stock (Seeking Alpha) $ 🗃️

🇸🇬 SIA Engineering, ThaiBev, and UOI: Winners, Challenges, and What’s Next (The Smart Investor)

🇸🇬 The MAS Unleashes a S$5 Billion Programme to Boost the Stock Market: 4 Singapore Stocks That Will Benefit (The Smart Investor)

In August last year, the Monetary Authority of Singapore (MAS) announced the formation of a review group to recommend measures to strengthen equities market development in Singapore.

The Equities Market Review Group has come up with a battery of suggestions for improving liquidity and attracting more capital to invest in the local bourse.

A bazooka to boost market demand

Measures to attract quality IPOs

Strengthening investor confidence’

Other proposals being considered

Companies that are expected to benefit

As trading volumes increase, UOB-Kay Hian Holdings Ltd (SGX: U10 / FRA: 4LJ) will also benefit from higher revenues generated by trading commissions and fees.

🇸🇬 Can Singapore’s 2025 Budget Give a Boost to the Singapore Exchange (SGX)? (The Smart Investor)

Will Singapore’s Budget 2025 revitalize Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) and attract new listings?

Singapore’s Budget 2025 has introduced a series of measures aimed at strengthening the country’s capital markets.

Encouraging More Fund Flows into Singapore

SGX Listing Incentives: Will They Be Enough?

Market Reaction: Cautiously Optimistic

Get Smart: The Big Picture

🇸🇬 Boustead Singapore meeting (BOCS SP) (Asian Century Stocks) $

I had the great pleasure of meeting with Boustead Singapore (SGX: F9D / OTCMKTS: BSTGF)’s Chief Investment Officer, Keith Chu, and Head of Investor Relations, Dominic Seow, at their headquarters at the Edward Boustead Centre in Singapore. The meeting was set up by our friends at Smartkarma, whose analysts have covered Boustead Singapore in the past.

While the stock price has risen +15% over the past year, it still trades at just 6.8x trailing P/E and 9.4x forward P/E.

In this post, I’ll discuss what we learnt from the meeting with Keith and Dominic and what the future might hold for Boustead Singapore.

🇸🇬 GEN Singapore 2024 profit down 5pct as revenue grows to US$433mln, firm to pay dividend (GGRAsia)

Casino operator Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) posted annual net profit of nearly SGD578.9 million (US$432.7 million) for full-year 2024, down 5.4 percent from the prior year. That was on revenue that actually rose 4.7 percent year-on-year, to just below SGD2.53 billion, according to unaudited results published on Thursday by the firm.

On November 18, the city-state’s Gambling Regulatory Authority announced that the casino licence of Resorts World at Sentosa Pte Ltd, the operating entity of Resorts World Sentosa, had been renewed for two years – a period shorter than permitted under regulations – due to an assessment the property had an “unsatisfactory” tourism performance between 2021 and 2023.

🇸🇬 Haw Par Corp (HPAR SP): $1 Special Dividend–Xie Xie, Let’s Make It Regular! (Smartkarma) $

Haw Par Corporation (SGX: H02 / OTCMKTS: HAWPF) announced a special dividend of S$1.00 per share for 2024, alongside its regular S$0.40 dividend.

Investors have long pushed for higher payouts and special dividends, given the company’s strong cash reserves and free cash flow.

Based on our analysis of its financials, Haw Par could sustainably raise its regular dividend to S$1.00 per share without tapping into reserves.

🇮🇳 Kilburn Engineering Limited Q3 FY25 Update: Strategic Acquisitions and Strong Growth (Smartkarma) $

Kilburn Engineering Ltd (BOM: 522101)’s Q3 FY25 revenue rose 25.1% YoY to ₹911 million with EBITDA up 30.1%, driven by strategic acquisitions and a robust order backlog exceeding ₹3,600 million.

Robust financials, an expanding order book, and targeted acquisitions enhance growth prospects and operational efficiency, solidifying Kilburn Engineering’s market position.

Investors gain confidence as Kilburn Engineering’s disciplined execution and diversified strategy signal sustainable long-term revenue and margin expansion.

🇮🇳 Archean Chemical Industries Limited Q3 FY25 Analysis (Smartkarma) $

Archean Chemical Industries Ltd (NSE: ACI / BOM: 543657)’s Q3 FY25 standalone total income reached INR 2,547 million, with EBITDA at INR 963 million (38% margin) and export markets contributing approximately 76% of revenue.

Strong export performance and stable margins underscore resilience amid global market challenges, while strategic investments in new battery technologies promise future growth and diversification.

The company aims to produce 20,000-25,000 tons of Bromine in FY’26 and expecting double digit growth in FY26.

🇮🇳 Hyundai Motor India: MSCI Index Inclusion. Is It Enough to Fast-Track HMIL? (Smartkarma) $

Hyundai Motor India (NSE: HYUNDAI / BOM: 544274) was added to MSCI Global Standard Index. The changes will take effect at the close of February 28, with an effective date of March 3, 2025

Despite being India’s second-largest passenger vehicle brand with over 13% market share, Hyundai Motor India Ltd (HMIL) faces stiff competition and sluggish industry growth.

In 2025, HMIL has potential to drive sales and market share gains by capitalising on the high-growth EV and CNG segments with model launches; exports recovery too will be critical.

🇮🇳 Arvind SmartSpaces Limited Q3 Update: Leveraging Market Trends for Future Revenue Potential (Smartkarma) $

Arvind Smartspaces Ltd (NSE: ARVSMART / BOM: 539301) posted 149% YoY revenue growth in Q3 FY25 and secured new projects worth RS. 3,850 crore, despite a 20% YoY decline in bookings due to approval delays.

Improved profitability and strategic project wins underscore its resilience in a dynamic real estate market, driving long-term value despite operational hurdles.

Company is planning to deploy Rs.500 to Rs. 600 crore in both vertical and horizontal projects over the next six months.

🇮🇳 EFC India Limited Q3 Update: Driving Growth Through Design and Build Verticals (Smartkarma) $

EFCI Ltd (NSE: EFC / BOM: 512008) witnessed a robust Q3 & 9M FY25 growth with sequential revenue, EBITDA, and PAT increases; new SM REIT registration and strategic seat expansion initiatives bolster operations.

Strong financial performance amid market challenges underscores resilience in flexible workspace and real estate sectors, positioning EFC India to capitalize on rising demand and government support.

Company is planning to add 25000 seats annually, where expecting furniture vertical worth INR 150Crs and Design & Build worth INR 225-250Crs next year.

🇮🇳 Synergy Green Industries Ltd Q3 Update: Set to Triple Capacity and Maximize Growth (Smartkarma) $

(Wind turbine casting and other large precision castings) Synergy Green Industries Ltd (NSE: SGIL / BOM: 541929) Q3 FY2025 results show 10.5% YoY revenue growth, 61% PBT and 128% PAT improvements, alongside capacity upgrades and increased export revenue.

Robust financial performance and strategic CAPEX investments in capacity expansion and green initiatives strengthen Synergy’s market position amid rising renewable energy demand.

The company has an installed capacity of 30,000 MT per annum, with an ongoing upgrade to 45,000 MT which is anticipated to start the production in Q2 FY2026.

🇮🇳 Kuantum Papers Limited Q3 Update: Navigating Market Pressures with Strategic Initiatives (Smartkarma) $

Kuantum Papers Ltd (NSE: KUANTUM / BOM: 532937)‘s Q3 & 9M FY25 results show revenue and EBITDA declines, yet steady sales volumes, cost optimization initiatives, and ongoing mill expansion efforts.

Strategic cost management and mill expansion position the company to mitigate revenue challenges, ensuring long-term competitiveness in a dynamic paper industry.

Industry is also asking for anti-dumping duty on some set of paper, especially copier, to make a level playing field with imported products.

🇮🇳 Deep Industries Limited: Q3 & 9M FY25 – Stellar Performance Driven by Strategic Growth Initiatives (Smartkarma) $

(Oil and gas field services) Deep Industries Ltd (NSE: DEEPINDS / BOM: 543288) Q3 & 9M FY25 revenue surged 47% and EBITDA grew 53%, driven by robust order book (Rs. 2,701 crore) and major contracts like the ONGC PEC order.

Robust growth underscores Deep Industries strategic positioning in the energy sector, with record profitability and order book expansion paving the way for long-term value creation amid favorable government initiatives.

Company is anticipating a growth of more than 30% year-on-year for the next 3 years with target revenue of 800Cr in FY26 and margin of 45-47%.

🇮🇳 Innova Captab Limited: Q3 FY25 Update (Smartkarma) $

(Pharma contract development and manufacturing organization services) Innova Captab Ltd (NSE: INNOVACAP / BOM: 544067)’s Q3 FY25 results show modest revenue growth, enhanced EBITDA margins, and a significant manufacturing expansion via the new Jammu facility with innovative dosage forms.

Improved margins and strategic expansion into new dosage forms enhance competitiveness, setting the stage for 25%+ growth and long-term profitability in the evolving CDMO and generics market.

The company anticipates Rs. 400 to Rs. 500 crores of incremental revenue from the Jammu facility in the next fiscal year.

🇮🇳 Adani Energy Solutions Limited Q3 FY25 Update (Smartkarma) $

Adani Energy Solutions Ltd (NSE: ADANIENSOL / BOM: 539254) Q3 FY25 shows 15% revenue growth to Rs. 6,000 crores, an 80% PAT increase, and aggressive capex investments, driven by robust transmission and smart metering initiatives.

Strong financial performance, combined with increased capex and operational efficiency in transmission and smart metering, signals enhanced market positioning and long-term growth potential in a supportive energy sector.

AESL significantly increases its capex ramp-up by around 3 times driven by unparallel project and operating excellence coupled with robust capital management program.

🇮🇳 Allied Blenders & Distillers Ltd Q3FY25 Update: Volume Growth, Premiumization (Smartkarma) $

Allied Blenders & Distillers (NSE: ABDL / BOM: 544203)‘s Q3 FY25 results showed robust growth in revenue at Rs. 2,346 crores (up 15.5% sequentially, 12.9% YoY) and strong premiumisation with expanded export reach.

Enhanced margins driven by effective cost optimization and profitable state brand mix highlight ABDL’s resilience and ability to capture premium market trends, strengthening its competitive position in India’s spirits industry.

The company aims to grow the aggregate market share of its four millionaire brands and consolidate its position in the P&A whisky segment through its three millionaire brands

🇮🇳 Apcotex Industries Ltd Q3FY25 Update: Capacity Utilisation and Industry Dynamics Driving Growth (Smartkarma) $

(Emulsion Polymers) Apcotex Industries (NSE: APCOTEXIND / BOM: 523694) operational revenue rose 38.2% YoY to INR 3,553 million in Q3 FY25, driven by strong volume gains and a 30% YoY increase in export volumes.

Robust volume and export growth, alongside management’s capacity and anti-dumping initiatives, position Apcotex for margin recovery and long-term revenue expansion.

The company expects margins to improve in Q4, driven by better capacity utilisation and an improving situation in the XNB (Nitrile Latex) business due to duties imposed by the US.

🇮🇳 Godawari Power & Ispat Limited Q3 FY25 Update: De-Growth Due to Lower Iron Ore and Pellet Production (Smartkarma) $

Godawari Power and Ispat Limited (NSE: GPIL / BOM: 532734) Q3 FY25 results show revenue and EBITDA declines due to lower iron ore and pellet production, despite improved volumes in HB wires and fabricated products.

These declines highlight operational challenges affecting profitability, emphasizing the need for capacity expansion and enhanced cost controls in a competitive global steel market.

The company dropped the plan to set up a greenfield integrated steel plant of 2 million tons. Instead, GPIL is evaluating alternative projects with lower capacity and capex.

🇮🇳 2025 High Conviction Update: Aster DM Healthcare (ASTERDM IN) Q3 Result- Margin Expansion Continues (Smartkarma) $

(Healthcare and allied services) Aster DM Healthcare Ltd (NSE: ASTERDM / BOM: 540975) reported stellar performance in Q3FY25. Revenue achieved 11% YoY growth to INR10.5B, driven by increased patient volumes and growth in ARPOB.

Consistent growth across core businesses, combined with strategic cost optimization, operational efficiencies, and optimized service mix, have significantly strengthened margins, with Q3FY25 operating EBITDA margins standing at 19.3% (Q3FY24: 17.7%).

Our original investment thesis is intact. Margin levers are working well. Expansion plan is on track. Macro trend is favorable. Merger with Quality Care can be a game changer.

🇮🇱 Ituran Location And Control: Finally Fairly Valued, Q4 Numbers May Change It (Seeking Alpha) $ 🗃️

🇮🇱 Ituran Q4 Earnings Preview: More Room To Grow (Seeking Alpha) $ 🗃️

-

🌐 🇧🇷 Ituran Location And Control Ltd (NASDAQ: ITRN) – Leader in the emerging mobility technology field, providing value-added location-based services, including a full suite of services for the connected-car. 🇼 🏷️

🇮🇱 Tel-Aviv Stock Exchange: An Enticing Moat-Rich Stock Market Operator To Own For Life (Seeking Alpha) $ 🗃️(?)

🇹🇷 Hepsiburada: A Growth Stock With A Long Runway (Seeking Alpha) $ 🗃️

🇹🇷 TAV Airports: Rising Profits Supports Bullish Price Target (Seeking Alpha) $ 🗃️ (?)

🇿🇦 Anglo American on track to complete Amplats demerger by June 2025 (IOL)

Anglo American Plc (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) is expecting to wrap up the demerger of its platinum producing unit, Anglo Anglo American Platinum (JSE: AMS / FRA: RPHA / RPH1 / OTCMKTS: AGPPF / ANGPY) (Amplats), by June this year and will benefit from a dividend windfall despite Amplats reporting on Monday a 40% plunge in earnings for the full year ended December 2024.

Amplats is being de-merged from Anglo American as the London and Johannesburg listed resource group restructures its portfolio to focus more on copper, premium iron ore and crop nutrients.

🌎 MercadoLibre Q4 Earnings: Where Margins Take Center Stage (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Strong Q4 Validates The Bullish Thesis (Seeking Alpha) $ 🗃️

🇦🇷 Cresud’s Standalone Operations Are Unprofitable, Not An Opportunity (Seeking Alpha) $ 🗃️

🇦🇷 Corporación América Airports: Accelerating Traffic Growth To Power Next Leg Higher (Seeking Alpha) $ 🗃️

🇦🇷 🇧🇷 Brazil Inc places cautious bet on Argentina turnaround under Milei (Reuters)

Brazil companies make new investments or consider ramping up

Economic change is spurring confidence in neighbor

Sectors from consumer goods to oil cite interest

Brazil’s state-run oil firm Petrobras (NYSE: PBR / PBR-A / BCBA: PBR / PETR4) is considering a new bet on Argentina after signing a memorandum of understanding with Argentine peer Ypf Sa (NYSE: YPF) last September to explore joint investments in exploration and production.

Brazil-based CVC Brasil Operadora e Agencia de Viagens SA (BVMF: CVCB3), one of the largest travel groups in Latin America, is already expanding in Argentina, where it first arrived in 2018. The firm opened 42 storefronts in Argentina last year and aims for similar this year.

Cambuci SA (BVMF: CAMB3), Brazil’s largest producer of soccer balls, footwear and apparel, recently secured a five-year distribution agreement in Argentina, after closing its local subsidiary in 2023 amid raw material shortages and currency restrictions.

🇧🇷 Ambev: Only The Third FCF-Yield Strong Buy Signal In 25 Years (Seeking Alpha) $ 🗃️

🇧🇷 Companhia Siderúrgica Nacional: This Is How Tariffs Affect The Company (Seeking Alpha) $ 🗃️(?)

🇧🇷 Banco Bradesco’s 16% Earnings Yield Is Not So Attractive Amid Its Challenges (Seeking Alpha) $ 🗃️

🇧🇷 Banco do Brasil Remains A Buy Despite Rural Credit Risk (Seeking Alpha) $ 🗃️

🇧🇷 Banco do Brasil’s Q4: Decent Results, Soft Guidance, I Remain Cautious (Seeking Alpha) $ 🗃️

🇧🇷 XP: Like A Bank But Conserves Optionality To Equities, It Is An Opportunity (Seeking Alpha) $ 🗃️

-

🌎 XP Inc (NASDAQ: XP) – Wealth management & other financial services (fixed income, equities, investment funds & private pension products). 🇼

🇧🇷 Nu Holdings: Reasons For The Q4 Miss Are Critical & Mercado Pago Competition Worries (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: I Am Buying The Dip After Q4 Results (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Deposit Surge, Net Interest Margins Squeeze. A Risky Balance (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: A Very Solid Quarter Despite What You May Think (Seeking Alpha) $ 🗃️

🇧🇷 TIM S.A. Q4: Solid Guidance Opens Doors For Further Upside (Seeking Alpha) $ 🗃️

🇧🇷 High Rates, High Returns: How Petrobras Thrives Amid Treasury Turmoil (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras Q4: All Eyes On Extraordinary Dividends (Seeking Alpha) $ 🗃️

🇧🇷 Vale: How Solid Is The Dividend Thesis (Seeking Alpha) $ 🗃️

-

🌐 Vale (NYSE: VALE) – Iron Solutions & Energy Transition Materials segments. Produces & sells iron ore, iron ore pellets, nickel, copper etc + related logistic service. 🇼 🏷️

🇨🇴 Bancolombia: Electoral Trade, Too Early To Play (Seeking Alpha) $ 🗃️ (?)

-

🌎🅿️ Bancolombia (NYSE: CIB / BVC: PFBCOLOM) – First Colombian financial institution listed on the NYSE. It provides banking products & services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda & Guatemala. 🇼 🏷️

🇨🇴 Leftist’s Flop in Colombia Sparks Wild Election-Bet Stock Rally (Bloomberg) $ 🗃️

Colcap at highest since 2022 on chance of political shift

Ecopetrol SA (NYSE: EC), Bancolombia (NYSE: CIB / BVC: PFBCOLOM) seen as a way into election play

For one, the market is way up — some 21% in dollar terms, more than almost any other market in the world. And then there’s the odd rationale fueling it: the leftist president, Gustavo Petro, is mismanaging the country and its international relations so badly that, when elections next come around, a more conservative, pro-business candidate is bound to win.

In other words, things are so bad that they’re good for a market that had become the cheapest in Latin America. It’s a decidedly glass half-full take. The election, after all, is still 15 months away.

🇵🇪 Cementos Pacasmayo May Offer An Adjusted 13% Earnings Yield, But Is Fairly Valued (Seeking Alpha) $ 🗃️(?)

🌐 Nebius Group: Another Outstanding Quarter – Strong Buy Confirmed (Seeking Alpha) $ 🗃️

🌐 Quad 7 Capital avatar Trading Nebius Group’s Hypergrowth And Hyper-Volatility (Seeking Alpha) $ 🗃️

🌐 Nebius Group After Dumping My Microsoft Shares (Seeking Alpha) $ 🗃️

🌐 Nebius Q4: $1 Billion ARR Is Only Half The Story (Seeking Alpha) $ 🗃️

🌐 Nebius Group Is Building An Inspiring Growth Story, But Risks Remain (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

$ = behind a paywall / 🗃️ = Link to an archived article

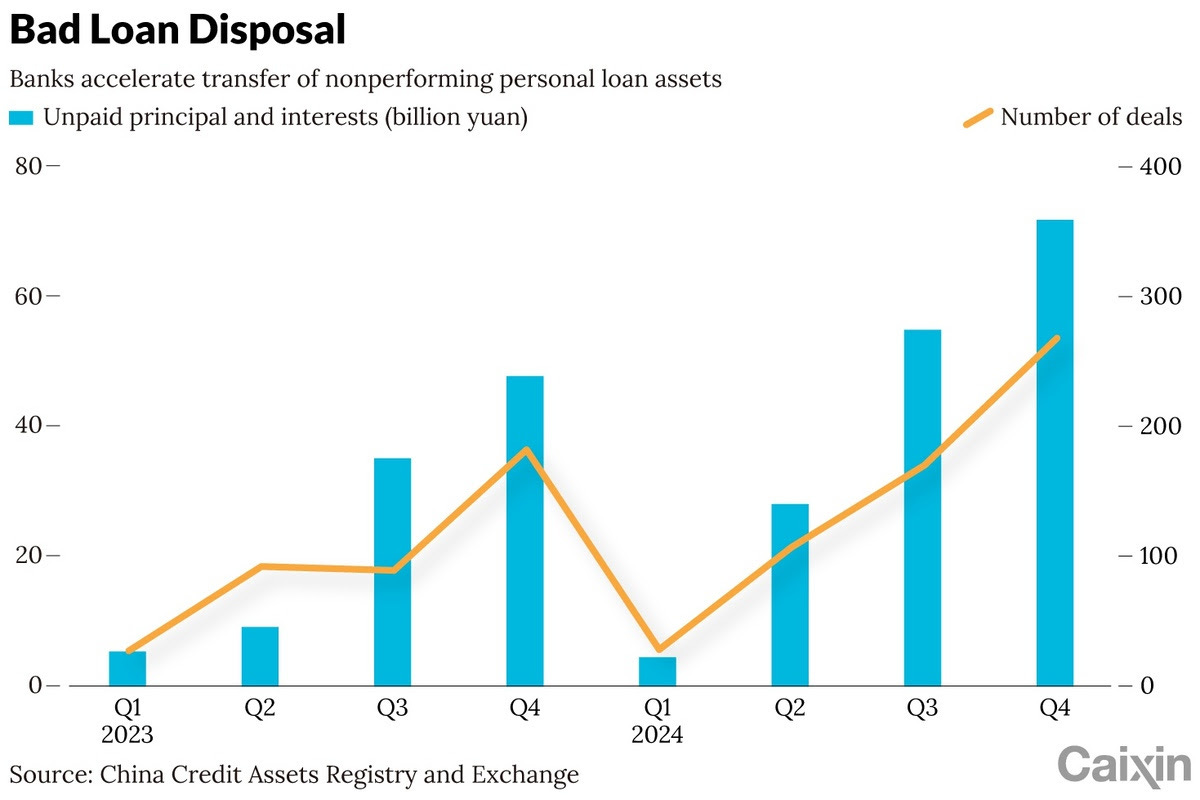

🇨🇳 Cover Story: How to Provide Relief as Personal Debt Piles up in China / Interview: time is right for China to fix personal bankruptcy legal omission, expert says (Caixin) $

China’s economic slowdown has led to a growing accumulation of personal debt, placing increasing pressure on both individual borrowers and financial institutions. Meanwhile, the lack of a well-established bankruptcy system leaves many without a clear path to resolve their financial problems.

The lack of an effective legal avenue for personal debt relief in China has driven many debtors to turn to debt intermediaries, some of whom engage in illegal practices, further trapping borrowers in financial distress.

🇨🇳 In Depth: China’s Policymakers Target Consumption to Kick Economy Into Gear (Caixin) $

China’s most economically important regions are under pressure to drive the country’s GDP growth this year, with a focus on increasing consumption and overall domestic demand amid an increasingly hostile and uncertain international environment.

The most economically developed provincial-level governments have been called on to “take the lead” in boosting growth, which slowed to 5% in 2024 from 5.2% the previous year. In an article published on Jan. 1 in Qiushi, the Communist Party’s main theoretical journal, to discuss China’s economic roadmap for 2025, Han Wenxiu, a deputy director of the general office of the Central Commission for Financial and Economic Affairs, said they play a vital role in national economic development.

🇨🇳 Green light for Chinese mainland branches of Hong Kong, Macau banks to issue bank cards (Caixin) $

Chinese mainland citizens will soon be able to open foreign currency bank accounts at mainland branches of Hong Kong and Macau banks, though restrictions on opening offshore bank accounts remain unchanged.

The National Financial Regulatory Administration (NFRA) announced Wednesday that these branches will be allowed to issue bank cards to existing customers from March 1. Under the new policy, foreign citizens can open both foreign currency and renminbi accounts, while corporate clients — including enterprises, public institutions and government agencies — will be eligible for both types of accounts.

🇰🇷 Resumption of Short Selling in Korea on 31 March and Potential Short Selling Candidates (Douglas Research Insights) $

The resumption of short selling in Korea will start again on 31 March. There has been a ban on short selling in Korea since November 2023.

We provide some short selling candidates in Korea. Their sharply increasing share prices in the past five years have resulted in much more burdensome valuations.

Despite their burdensome valuations and sharply higher share prices, the remains high risk of some of these stocks that could overshoot to the upside.

🇰🇷 China Could Lift Ban on Korean Popular Culture (Hallyu) As Early As May 2025 (Douglas Research Insights) $

One of the big thematic events on the Korean stock market has been the expectation that China could lift ban on Korean popular culture (Hallyu) as early as May 2025.

China’s President Xi recently stated “Cultural exchanges are a valuable part of our bilateral relations (between China and Korea). We should avoid any problems occurring in handling such matters.”

We provide a list of 40 stocks in Korea that could most benefit from the end of lifting ban of Korean popular culture.

🇹🇭 Thais to face US$1.5mln bank deposit threshold to gamble in any local casinos according to latest draft law (GGRAsia)

Under the fresh draft, Thais wishing to enter casinos would be required to present a fixed-deposit bank account statement showing a balance of at least THB50 million (US$1.5 million) dating back six consecutive months. The news was first reported by Bloomberg.

According to the latest draft of the Entertainment Complex Bill, punters must be at least 20 years old to enter a casino. In Macau, where there are no restrictions or earnings qualifications on locals gambling, the minimum age for gambling is 21.

The revised draft also proposes that casinos can make up no more than 10 percent of the premises at the entertainment complexes.

🇹🇭 Proposed US$1.5mln wealth threshold for locals to play in any Thai casinos shifts casino-policy focus: observers (GGRAsia)

A proposal from Thailand’s Council of State that locals should have the equivalent of US$1.5 million in the bank before they could gamble in any casinos established there, has the potential to shift the economic focus of the country’s casino-legalisation push, say a number of observers in comments to GGRAsia. In the view of several, it could dampen investment interest among international casino brands.

Ben Lee, managing partner at industry consultancy, IGamiX Management & Consulting Ltd, told GGRAsia: “The fixed deposit (proposal) of THB50 million or US$1.5 million… is pernicious and will absolutely drastically remove any local play, as even the people with that amount of spare cash will likely keep travelling elsewhere for their entertainment.”

He added: “Removing the potential local business does change the equation substantially as can be seen in the moribund South Korean gaming industry.”

🇹🇭 Thai cabinet unlikely to back wealth threshold for locals to enter casinos: minister (GGRAsia)

Thailand’s Interior Minister Anutin Charnvirakul has said a proposal to create a high-income qualification for any Thais that wanted to wager in casino resorts mooted for that nation is not likely to gain approval by the country’s cabinet.

Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY)’s management however said – in a follow-up call with investment analysts – that it would be hard to commit to a sizeable investment for a casino resort if the Thai market is mostly aimed at foreigners.

🇹🇭 Thailand policy focus on casino-resorts plan is getting revenue from foreigners: law firm (GGRAsia)

Tilleke & Gibbins – which also has a practice in Vietnam – drew attention to a recent pilot programme – currently lapsed – for locals gambling in that nation. The law firm observed that Thailand’s proposed monetary conditions for locals play would be “significantly higher” than under Vietnam’s pilot.

Long Gia Nguyen, partner in Tilleke & Gibbins’ Ho Chi Minh City office, stated in comments to GGRAsia: “Vietnamese regulations require local players to be at least 21 years old and have a regular income of at least VND10 million per month – about US$400 – or be a person subject to personal income tax at level 3 or higher.”

Mr Long added: “Vietnamese players must also purchase a VND1 million – about US$40 – single-day casino entry ticket or a monthly pass for VND25 million.”

🇹🇭 In Depth: Casino Plan Could Put Thailand Behind Only Las Vegas and Macao (GGRAsia)

Thailand’s Phuket has a lot to offer tourists from around the world. It boasts white sandy beaches, turquoise waters, a lively party scene and much more besides.

Soon, it might add another offering — casinos.

On Jan. 13, the Thai cabinet approved the Entertainment Complex Bill, paving the way for gambling to be legalized as soon as the middle of the year. While specific locations have yet to be finalized, likely to be targets for investment are Bangkok, Chiang Mai, Phuket and Pattaya, according to a report last month from the Bangkok Post.

🇿🇦 South Africa’s budget postponed amid disagreement over planned VAT rise (FT) $ 🗃️

🇦🇷 Argentina’s peso is a meme coin pretending to be a real currency (Latin America Risk Report)

It’s possible that the Milei crypto scandal accelerates dollarization

Last Friday, President Milei promoted the $Libra cryptocurrency on his personal Twitter account. Thousands of people bought in, but the early owners sold, and the currency crashed. This sort of “rug pull” scam happens regularly online but usually does not occur using the social media account of a world leader.

🇦🇷 Argentina’s Javier Milei is betting big on an oil gusher (The Economist) $ 🗃️

🇧🇷 Decaffeinated Brazilians blame Lula for surging cost of morning brew (FT) $ 🗃️

🇲🇽🚦 The Peso crisis (1994) (Macro Mornings 💡)

How currency and debt mismatches crashed mexico’s economy

In today’s edition of “Macro Mistakes,” we explore the Peso Crisis of 1994, also known as the Tequila Crisis, which plunged Mexico into a deep financial crisis and sent shockwaves through emerging markets worldwide.

This event highlights the dangers of currency mismatches, over-reliance on short-term foreign capital, and the critical importance of managing sovereign debt.

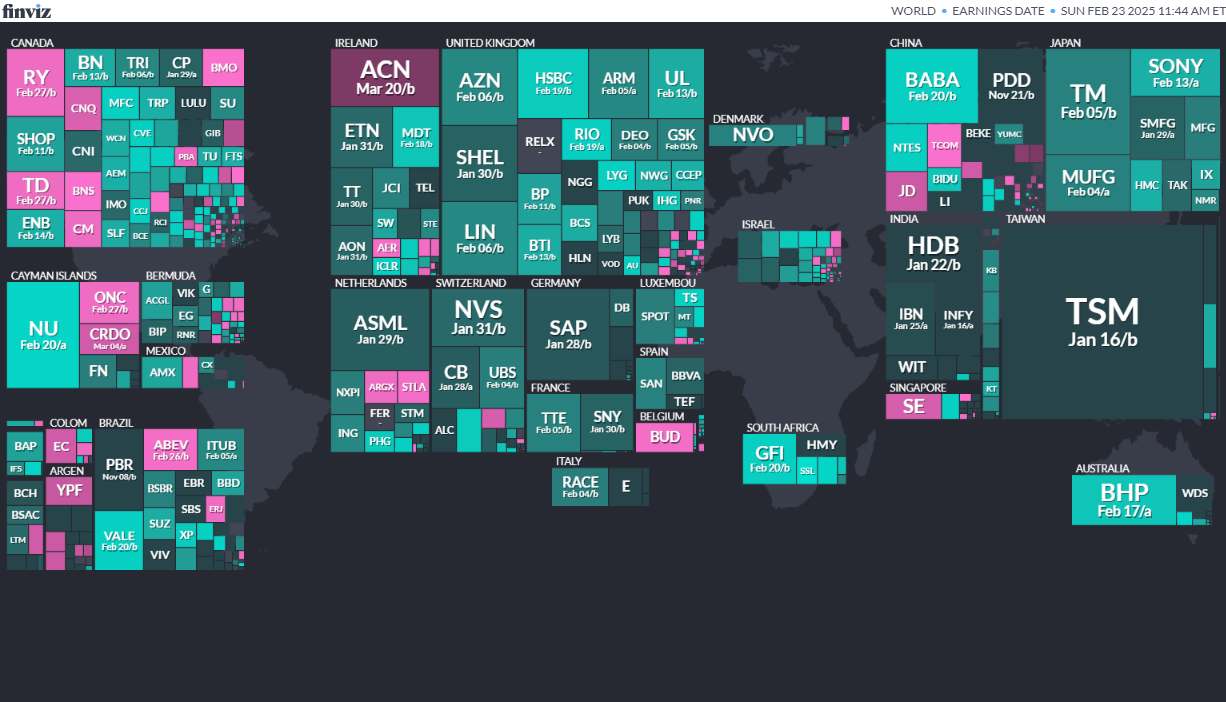

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

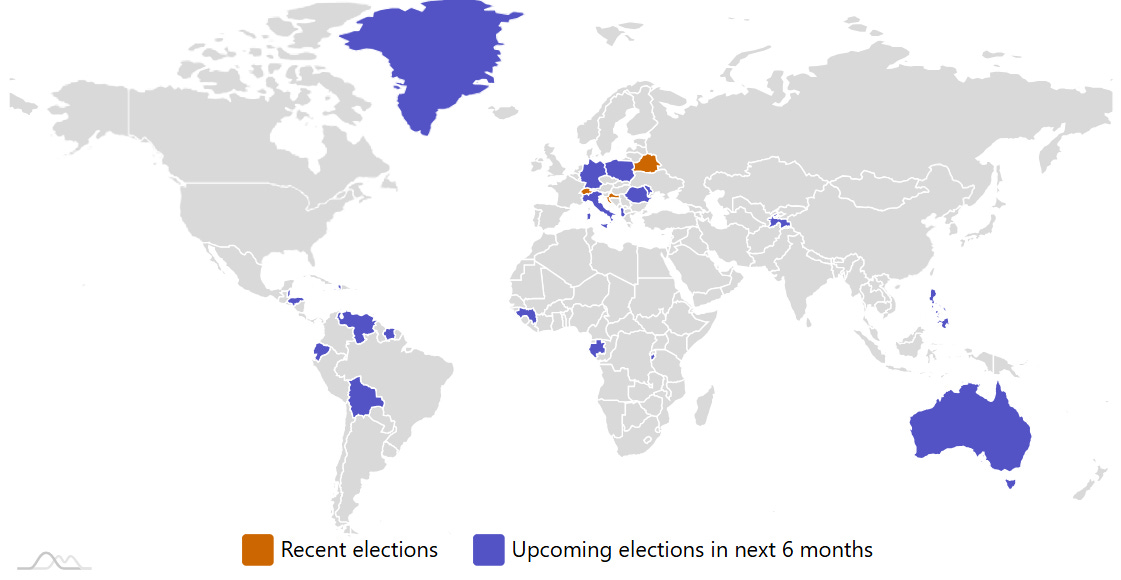

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

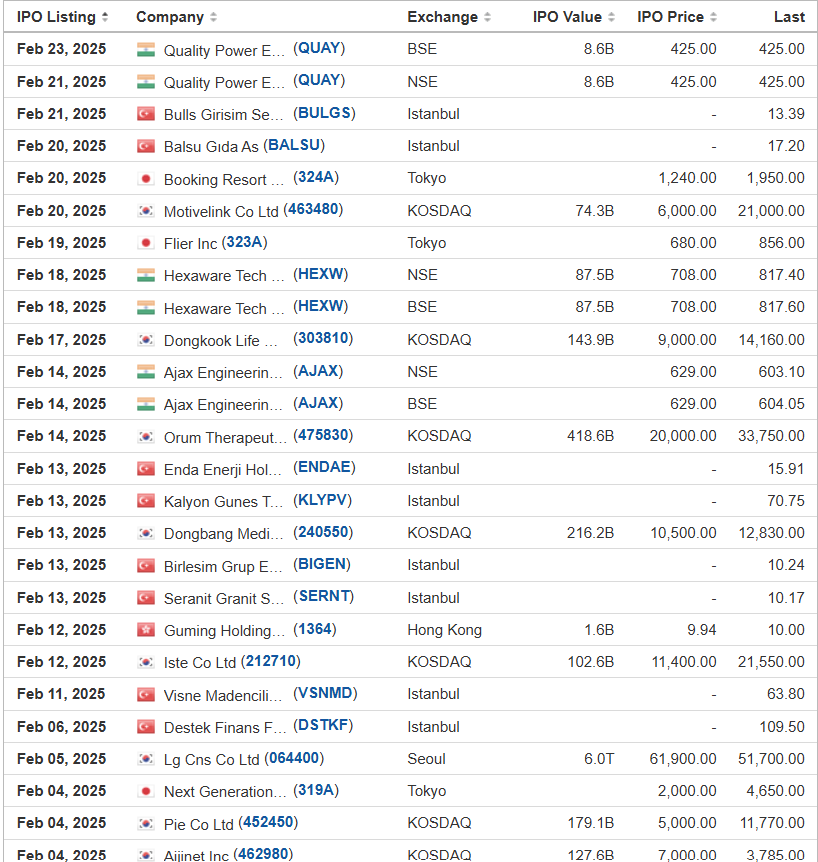

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Basel Medical BMGL Cathay Securities, 2.2M Shares, $4.00-5.00, $9.9 mil, 2/25/2025 Tuesday

(Incorporated in the British Virgin Islands)

With over 20 years of medical services experience, Basel Medical’s journey began with a simple commitment – to restore healthy and active lifestyles, one at a time. Today, that commitment has transformed into a vision for innovation, growth and far-reaching impact.

We rely on an experienced group of medical practitioners to provide a wide spectrum of general and subspecialized orthopedic, trauma, sports medicine and neurosurgical services such as knee/hip replacements, sports medicine/surgery, spine surgery, foot/ankle surgery, minimally invasive orthopedic procedures and other complex neurosurgical procedures. We operate our two clinics at Gleneagles Medical Centre in Singapore and currently have five medical practitioners practicing with Basel Medical (together with its subsidiaries, the “Group”), comprising four orthopedic specialists and one neurosurgery specialist. The services provided by our clinics include, but are not limited to, consultation, medical diagnosis and medical or surgical treatments for orthopedic, trauma, sports medicine and neurological conditions and our clinics are equipped with the facilities needed to perform a variety of procedures on site and minor surgical services, while more complex surgical procedures are performed at operating theaters of other hospitals with such facilities.

Our Group has a patient-oriented philosophy of providing personalized, quality and integrated medical care. We aim to be a one-stop integrated healthcare provider for all musculoskeletal-related medical care, including post-surgery rehabilitation services such as physiotherapy as well as other ancillary services such as pain management.

Within the next 12 to 18 months, we intend to actively seek acquisition and collaboration partners in Singapore and Malaysia. Our acquisition and collaboration targets include general practitioner (GP) clinics and specialist clinics that complement our orthopedic services, particularly those focused on the musculoskeletal system, aging treatments, physiotherapy and occupational therapists. Our goal is to become an internationally known medical services provider in the Southeast Asian market, with a presence in at least four Southeast Asia countries (potentially covering Singapore, Malaysia, Indonesia and Thailand) within the next three years. As of the date of this prospectus, we have not identified such targets.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Basel Medical Group is offering 2.21 million shares (2,205,000 shares) at a price range of $4.00 to $5.00 to raise $9.92 million, according to its F-1/A filing dated Feb. 13, 2025.)

LZ Technology Holdings LZMH Benjamin Securities/ D. Boral Capital (ex-EF Hutton), 1.8M Shares, $4.00-6.00, $9.0 mil, 2/27/2025 Week of

Business:

We are a holding company whose operating subsidiaries provide advertising services in China. (Incorporated in the Cayman Islands)

The Company is an information technology and advertising company. Its operations are organized primarily into three business verticals: (i) Smart Community, (ii) Out-of-Home Advertising, and (iii) Local Life.

Smart Community. The Company provides intelligent community building access and safety management systems through access control monitors and vendor-provided SaaS platforms. The Company’s intelligent community access control system makes resident access to properties simpler. As of June 30, 2024, approximately 72,773 of the Company’s access control screens had been installed in over 4,000 residential communities, serving over 2.7 million households.

Out-of-Home Advertising. The Company offers clients one-stop multi-channel advertising solutions. Capitalizing on the Company’s network of monitors that span approximately 120 cities in China such as Shanghai, Beijing, Guangzhou, Shenzhen, Nanjing, Xiamen, Hefei, Dalian, Ningbo, Chengdu, Hangzhou, Wuhan, Chongqing, Changsha, the Company’s Out-of-Home Advertising services help merchants display advertisements in a variety of formats across its intelligent access control and safety management system. Advertisements are placed on the monitors and within the SaaS software. Residents are exposed to these advertisements each time they enter and exit community buildings or open the SaaS software. This level of visibility serves as a highly effective means of advertising, assisting merchants in effectively promoting their brands and accelerating their product sales. Moreover, the Company partners with other outdoor advertising providers to maximize coverage by placing the advertisements on the partners’ numerous displays in public transportation, hotels and other settings as well as deploying posters at events. This broad approach provides clients with a truly comprehensive out-of-home advertising solution.

Local Life. The Company connects local businesses with consumers via online promotions and transactions. With its strong technological capabilities, the Company helps local restaurants, hotels, tourist companies, retail stores, cinemas and other merchants offer deals and coupons to consumers on social media platforms such as WeChat, Douyin (the Chinese version of TikTok) and Xiaohongshu. The Local Life vertical bridges the businesses’ need for product sales and promotions and the consumers’ need for dining, shopping, entertainment, tourist attractions and other local services. In addition, deals from local businesses can also be displayed on the access control screens. In this way, clients of the Company’s Local Life services can also reach the Smart Community residents, leveraging the Company’s access control screens’ extensive coverage and high exposure potential. Since early 2023, we have embarked on executing the strategy of deepening engagement with merchants and manufacturers within our Local Life space through facilitating retail sales of diversified goods and services, including beverages, groceries and travel packages.

The Company reports financial results in one segment. Currently, a substantial portion of the Company’s revenues are generated from advertising and promotional activities, namely by the Out-of-Home Advertising and Local Life verticals. Revenues from Smart Community, which mainly consist of product sales of access control devices and service fees, contribute only a small portion to the Company’s total revenues. Thus, the Smart Community revenues are grouped with other miscellaneous revenue sources, such as advertising design and production and social media account operations, under the catch-all category titled “Other Revenues” in the description of the Company’s revenues.

For the years ended December 31, 2022 and 2023, the Company had a total of 247 and 255 customers, respectively, who entered into contracts with the Company to purchase the Company’s products and services. For the six months ended June 30, 2024 and 2023, the Company had a total of 168 and 102 customers, respectively, who entered into contracts with the Company to purchase the Company’s products and services. The Company, however, has derived a large portion of its revenues from a few customers. For the years ended December 31, 2022 and 2023, the Company’s top three customers collectively accounted for approximately 84.4% and 24.2% of its total revenue, respectively. For the six months ended June 30, 2024, the Company’s top three customers collectively accounted for approximately 33.2% of its total revenue.

Note: Net loss and revenue are in U.S. dollars (converted from China’s currency) for the 12 months that ended June 30, 2024.

(Note: LZ Technology Holdings increased its IPO’s size to 1.8 million shares – up from 1.5 million shares – and kept the price range at $4.00 to $6.00- to raise $9.0 million, according to an F-1/A filing dated Feb. 7, 2025. Background: LZ Technology Holdings cut the size of its IPO to 1.5 million shares – down from 10.0 million shares previously – and kept the price range at $4.00 to $6.00 – to raise $7.5 million, according to an F-1/A filing dated Oct. 30, 2024.)

Micropolis Holding Co. MCRP Network 1 Financial, 5.0M Shares, $4.00-5.00, $22.5 mil, 2/27/2025 Week of

We are a holding company. Micropolis Digital Development FZ-LLC (“Micropolis Dubai”), our wholly owned subsidiary, is a robotics manufacturer founded in 2014 and based in the United Arab Emirates (“UAE”) with its headquarters located in Dubai Production City, Dubai, UAE. (Incorporated in the Cayman Islands)

We specialize in developing autonomous mobile robots (“AMRs”) that utilize wheeled electric vehicle (“EV”) platforms and are equipped with autonomous driving capabilities.

We have historically conducted our business through Micropolis Dubai.

We operate in the GCC region, with a focus on the UAE and Saudi Arabia. The robotics industry in the UAE and Saudi Arabia is rapidly growing, with governments committing significant resources to technological advancement. Furthermore, Dubai, a hub for technological innovation in the region, presents a unique opportunity for the Company. With a robust portfolio of AMRs and a strong track record of successful partnerships with local governments, the Company is poised to take advantage of the growing demand for innovative robotics solutions in the Middle East.

Our flagship products are customized AMRs that can operate without the need for human intervention. These robots can be used in a wide range of industries, including security, hospitality, real estate, retailing, city cleaning, and logistics. The robots can be equipped with advanced sensors, machine learning algorithms, and computer vision technology that enable them to navigate complex environments, avoid obstacles, and interact with humans.

We specialize in the development and integration of AMRs, operating software, electronic control units and power storage units. Our extensive product offerings are organized into three main categories:

A. AMRs: Our AMRs (autonomous mobile robots) are engineered with precision and tailored to meet diverse requirements. They are composed of two main parts, namely the mobility specific platform and application-specific pods.

B. Operating Software: Our software suite is further segmented into three distinct categories: (1) autonomous driving software, allowing users to manage fleets of AMRs from an operational room with real-time streaming service; (2) fleet mission planner, aiding operators in mission planning, path management, and performance monitoring; and (3) user bespoke software development service, offering customized software solutions for customers, integrating additional robot functionalities with existing systems to ensure cost-effectiveness and seamless deployment

C. Electronic Control Units and Power Storage Units: Our in-house-developed control units and power storage solutions serve as the driving force behind our AMRs, providing energy-efficient and reliable performance. The Micropolis Robotics Controller Unit (“MRCU”) is an innovative and advanced electronics board designed to serve as a centralized control unit for a wide range of robots, including AMRs and EVs; while The Smart Power Distribution Unit (“SPDU”) is designed to address the challenges present in battery-based systems, i.e. efficient energy utilization.

Our business is collaboration-based. In collaboration with our customers and partners, we are actively engaged in the development of cutting-edge technologies that aim to bring enhancements in security, logistics, and surveillance operation management. We have established a strong track record of successful partnerships with local governments and real estate developers. Our work with the Dubai Police is a prime example of this ongoing effort; they are playing an essential role in the creation of “Microspot,” which is an AI-powered security software we are currently developing as of the date of this prospectus. In particular, the Dubai Police have assembled a team to assist us in shaping the Microspot software, providing crucial insights into police operations and supplying dummy data for data science and machine learning. This partnership has not only facilitated us in navigating regulatory complexities but also provided invaluable support in testing and validating our products. Further, we have partnered with Dubai Police to develop self-driving security patrolling vehicles that enhance security surveillance operations, to help reduce crime through security deterrence.

We are also working closely with the Road and Transportation Authority in Dubai, UAE (“RTA”) through Dubai Police Innovation Lab. RTA is aiding us by designating the Jumeirah 1 area in Dubai as a safe testing environment for our autonomous driving system, which is still in development as of the date of this prospectus. RTA is also supplying high-definition maps of the area and data that will be essential in shaping the autonomous driving system.

Furthermore, our ongoing partnership with The Sustainable City in Dubai is proving invaluable, as they provide us with both high-definition city mapping and a living lab within their residential community for testing and validation. This collaboration allows us to work within a real-life environment to iteratively refine our autonomous driving features. Further, we have also worked with The Sustainable City in Dubai to develop autonomous community delivery robots that are able to autonomously deliver goods within their assigned territory, making urban and sub-urban logistics more cost effective and energy preserving.

Note: MIcropolis Holding Co. reported a net loss on minimal revenue for the 12 months that ended June 30, 2024. (These net loss and revenue figures are in U.S. dollars converted from the UAE’s currency.)

(Note: Micropolis Holding Co. cut its IPO’s size to 5.0 million shares – down from 8.2 million shares originally – and kept the price range of $4.00 to $5.00 – to raise $22.5 million, according to its F-1/A filing on Sept. 24, 2024. Background: Micropolis Holding Co. initially planned to offer 8.2 million shares at $4.00 to $5.00, according to its F-1 filing on Dec. 22, 2023.)

Waton Financial Ltd. WTF Cathay Securities, 5.0M Shares, $4.00-6.00, $25.0 mil, 2/27/2025 Week of

We are a holding company. (Incorporated in the British Virgin Islands)

We are a provider of securities brokerage and financial technology services primarily through our Hong Kong subsidiaries, Waton Securities International Limited, or WSI, and Waton Technology International Limited, or WTI.

WSI is principally engaged in the provision of (i) securities brokerage services for securities listed on the Hong Kong Stock Exchange, including shares under the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, the New York Stock Exchange (NYSE) and the Nasdaq Stock Market, margin financing services and other ancillary services through WSI’s electronic trading platform to its corporate and individual brokerage customers and bond distribution services; and (ii) software licensing and related support services including the licensing of trading platform APP, upgrades and enhancements, maintenance and other related services to financial institutions. Since September 2023, WTI has provided software licensing and related support services in order to focus on the expertise of operations and service areas. WSI has developed and provided Broker Cloud solutions to securities brokers with the combination of software licensing and related support services, securities brokerage services, margin financing services and other related services, where securities broker customers are provided with a perpetual on-premise licensed trading platform APP and optional related support services, with the front-, middle- and back-office operation functions and securities trading function where securities trading orders can be cleared and settled through WSI.

Founded in 1989, WSI is an established integrated securities broker in the Hong Kong financial services industry. WSI is licensed to conduct Type 1 (dealing in securities), Type 4 (advising on securities), Type 5 (advising on futures contracts) and Type 9 (asset management) regulated activities under HKSFO in Hong Kong. WSI is a Hong Kong Stock Exchange participant and holds one Hong Kong Stock Exchange trading right. WSI provides securities brokerage services through WSI’s integrated electronic trading platform, which is easy to access, use, and deposit to WSI’s customers. The trading platform can be accessed through WSI’s APP, which provides WSI’s customers with a seamless and secured trading experience. WSI offers its customers comprehensive brokerage and value-added services, including trade order placement and execution, account management, and customer support. WSI further provides its customers with market data, news and research, so as to help them make well-informed investment decisions. WSI has accumulated a corporate and individual customer base across the globe, including a securities brokerage company in New Zealand known as Wealth Guardian Investment Limited (“WGI”), which is a related party of the Company. We derived a substantial portion of revenues from WGI, which accounted for approximately 39.5% and 81.5% of our total revenues in the fiscal years ended March 31, 2024 and 2023, respectively, and approximately 68.0% and 98.2% of our total revenues for the six months ended September 30, 2024 and 2023, respectively. See “Related Party Transactions” and “Risk Factors — Risks Related to Our Subsidiaries’ Business and Industry — We derived a substantial portion of revenue from WGI, a single related party customer”. By capitalizing on its customer base, WSI commenced to provide bond distribution services by acting as a manager, a placement agent or a non-syndicate capital market intermediary, to procure subscribers to subscribe and pay for bonds in principal amounts during the fiscal year ended March 31, 2024 and for the six months ended September 30, 2024. As of September 30, 2024, WSI had more than 5,800 securities brokerage customers who opened trading accounts with WSI, 59 of which are corporate customers who opened corporate accounts and three of which are introducing broker customers who opened omnibus accounts. The remaining portion of the securities brokerage customers are individual customers whoopened individual accounts and typically trade through WSI’s trading platform APP. As of the same date, WSI had over 600 active customers, who were registered customers with assets in their trading accounts. We generate brokerage and commission income from WSI’s securities brokerage, bond distribution and other ancillary services and interest income from WSI’s margin financing services, and our brokerage and commission income and interest income which amounted to approximately US$9.4 million and US$2.3 million, and accounted for approximately 93.4% and 39.9% of our total revenues, for the fiscal years ended March 31, 2024 and 2023, respectively, and amounted to approximately US$1.8 million and US$1.9 million, and accounted for approximately 61.3% and 83.7% of our total revenues, for the six months ended September 30, 2024 and 2023, respectively.

Leveraging on WSI’s accumulated industry knowledge on the needs of small and medium-sized securities brokers and operational experience in online brokerage over the years, WSI started to develop the provision of fintech solutions in trading platform APP software licensing and related support services targeting the securities brokers and securities-related financial institutions in April 2021. We are a pioneer of business-to-business fintech services in the Asia-Pacific region to offer one-stop brokerage software solutions to small and medium-sized brokers, according to Frost & Sullivan Limited, or Frost & Sullivan. WSI provides one-stop, integrated and customized software solutions to develop trading platform APP that covers the front-, middle- and back-office operations of securities brokerage business such as electronic trade order placing, customer relationship management and operational data management, in addition to the business-to-business securities order clearing and settlement services provided by WSI in the Broker Cloud solutions, which enables the securities broker customers to digitalize and streamline their business operations, and interact with the financial market more efficiently. As of September 30, 2024, March 31, 2024 and 2023, WSI and WTI provided software licensing and related support services to a total of five, three and five securities brokers and securities-related financial institutions, respectively, including WGI, which is a related party of the Company. See “Related Party Transactions” and “Risk Factors — Risks Related to Our Subsidiaries’ Business and Industry — We derived a substantial portion of revenue from WGI, a single related party customer”. We generate software licensing and related support service income from WSI’s and WTI’s software licensing and related support services, which amounted to approximately US$1.4 million and US$3.5 million, and accounted for approximately 13.7% and 60.1% of our total revenues for the fiscal years ended March 31, 2024 and 2023, respectively, and amounted to approximately US$1.1 million and US$0.7 million, and accounted for approximately 38.7% and 29.0% of our total revenues, for the six months ended September 30, 2024 and 2023, respectively. WSI and WTI have outsourced the software licensing and related support services to Shenzhen Jinhui Technology Co., Ltd., a related party of the Company. See “Related Party Transactions” and “Risk Factors — Risks Related to Our Subsidiaries’ Business and Industry — WSI and WTI are dependent on a single related party supplier, Shenzhen Jinhui Technology Co., Ltd., an information technology company and a related party controlled by Mr. Zhou Kai, our Chairman of the Board, Director, Chief Technology Officer and shareholder, for providing software development and related support services”.

Note: Net income and revenue are for the 12 months that ended Sept. 30, 2024.

(Note: Waton Financial Ltd. is offering 5.0 million shares at a price range of $4.00 to $6.00 to raise $25.0 million.)

Epsium Enterprise Ltd. EPSM Benjamin Securities/ D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-5.00, $5.6 mil, 3/3/2025 Week of

(Incorporated in the British Virgin Islands)

We are a holding company incorporated under the laws of British Virgin Islands. As a holding company with no material operation of its own, we conduct substantially all our operations through an indirect Macau subsidiary, Companhia de Comercio Luz Limitada in Macau, or Luz. Luz is an 80%-owned subsidiary of Epsium Enterprise Limited in Hong Kong, or Epsium HK. Mr. Son I Tam, our CEO, CFO, Chairman, principal shareholder, and the founder of Epsium and Luz directly holds (i) 89.996% ownership interest in Epsium, (ii) 19% interest in Epsium HK, and (iii) 20% ownership interest in Luz.

Luz is an import trading and wholesaler of primarily alcoholic beverages in Macau. Through Luz, we import and sell a broad range of premium beverages, primarily alcoholic beverages and, in 2022, a small quantity of tea and fruit juice. The alcoholic beverages we sell include Chinese liquor, French cognac, Scottish whiskey, fine wine, Champagne, and other miscellaneous beverage alcohol. Sales of Chinese liquor is by far our most significant operations, and we are a top wholesaler of high-end Chinese liquor in Macau. We operate only in Macau.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Epsium Enterprise Ltd. increased its IPO’s size to 1.25 million shares – up from 1.0 million shares – and cut the price range to $4.00 to $5.00 – down from $5.00 to $7.00 – to raise $5.63 million, according to an F-1/A filing dated Feb. 3, 2025.)

(Note: Epsium Enterprise Ltd. made a change in its joint book-running team, according to an F-1/A filing dated Jan. 8, 2025: D. Boral Capital (formerly known as EF Hutton) was named as a joint book-runner, replacing Prime Number Capital, to work with Benjamin Securities. Background: This is a micro-cap IPO – just 1.0 million shares at a price range of $5.00 to $7.00 to raise $6.0 million.)

Ruanyun Edai Technology Inc. RYET AC Sunshine Securities, 3.8M Shares, $4.00-5.00, $16.9 mil, 3/3/2025 Week of

We are not a Chinese operating company but a Cayman Islands holding company with no operations. (Incorporated in the Cayman Islands)

**Note: The ordinary shares offered in this (initial public) offering are shares of our offshore holding company, Ruanyun Edai Technology Inc., instead of shares of the VIE or its subsidiaries in China. (From the prospectus – See link to the prospectus in the chart below.)

We are a data driven artificial intelligence, or A.I., technology company focused on kindergarten through year twelve, or K-12 education in China. We bring technology to schools, and we are committed to reforming the traditional Chinese education and learning model by facilitating schools, teachers and students with new teaching, learning, and assessment methods in the A.I. era.

We believe the road to college should come with directions. Our mission is to help each K-12 student understand their specialty and find their way to higher education and future success. We believe we have one of the most comprehensive online learning ecosystems covering all K-12 subject fields and grade levels, one of the largest academic exercise question banks that is designed and built for interactive learning, and one of the most advanced A.I. algorithms that power such questions, all of which are accessible online and on demand.

As of Nov. 30, 2022, our online academic exercise question bank has accumulated more than 10 billion test data generated by approximately 14.26 million students from more than 27,000 schools and we have issued over 298 million evaluation reports. With the continuous collection and analyzing of students’ online learning data, our A.I. algorithms are constantly expanding and upgrading, reaching an evaluation accuracy rate of 97% (based on our own calculations), allowing us to provide students with tailored and effective learning strategies. We believe that, in time, our online learning platform will be proven revolutionary in affecting the advancement of China’s K-12 education system.

As of Nov. 30, 2022, approximately 14.26 million students use Jiangxi Ruanyun to collect their daily homework exercise data, prepare for a test or attend the Academic Proficiency Assessment, which is an official assessment across all subjects taught in schools, conducted by the Education Testing Authority in China. This allows us to understand each student better and enables us to help them reach the next level of educational success with an effective strategy, every step of the way.

We value our proprietary technologies and strong research and development capabilities, which we believe differentiate us from other companies in our industry. As of the date of this prospectus, we have an intellectual property portfolio consisting of 11 patents (9 of which have been registered and 2 are pending) and 23 trademarks filed with the PRC State Intellectual Property Administration, 50 copyrights registered with the PRC State Copyright Bureau, and 8 domain names.

Over the last decade, our A.I. learning platform has expanded from learning to assessment in school to A.I application, services and hardware. We believe we are a trend-setter in reforming the traditional education model in China using the technological progress brought about by the advent of A.I. technology. We believe we are the only educational A.I. company in China that serves both everyday learning and Academic Proficiency Test in school. We provide computerized testing for China’s Academic Proficiency Test, or ATP, which is equivalent to the SAT in China. Our everyday learning to official assessment model allows us to expand into a range of personalized “online” services and “offline” products for students in high demand.

We currently sell our products and services through two primary product lines, namely our SmartExam® solution and SmartHomework® solution. Our SmartHomework® solution delivers personalized learning solutions for students to study more effectively. Teachers can adjust instructions for students based on their specific needs. In addition, our SmartExam® solution helps deliver China’s Academic Proficiency Test, which is required in China for obtaining a high-school diploma, in computer-based format. We also provide self-learning solutions and smart-devices, such as smart printer / smart headset for everyday study and test preparation.

*Note – Re corporate structure: We conduct substantially all of our operations in the People’s Republic of China, or the PRC or China, through Jiangxi Ruanyun, the variable interest entity (VIE) and its subsidiaries. We do not have any equity ownership of the VIE. Instead, we have the power to direct the activities and receive the economic benefits and absorb losses of the VIE’s business operations through certain Contractual Arrangements (as defined in the prospectus) and the VIE is consolidated for accounting purposes. This structure involves unique risks to investors. This VIE structure is used to provide contractual exposure through the Contractual Arrangement to foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies.

*Note: Under the Contractual Arrangements, cash is transferred among the Company, Rollingthunder Technology (Jiangxi) Co., Ltd, or our WFOE, Soft Cloud and the VIE. (See the prospectus – link in the chart below – for details on cash transfers, financial statements and other disclosures pertinent to the IPO).

**Note: Net loss and revenue figures are in U.S. dollars for the fiscal year that ended March 31, 2024.

(Note: Ruanyun Edai Technology Inc. filed a new F-1 on Aug. 30, 2024, and disclosed terms for its IPO: The company is offering 3.75 million shares at a price range of $4.00 to $5.00 to raise $16.88 million. The new filing declared that AC Sunshine Securities is the new sole book-runner; under the previous plans, Univest Securities and AC Sunshine Securities were slated to be joint book-runners.)

(Note: The SEC declared that Ruanyun Edai Technology’s IPO filing was abandoned in February 2024 because the company had not updated the filing in a long time. Background: Ruanyun Edai Technology Inc. filed its F-1 on Dec. 29, 2022. The Cayman Islands-incorporated holding company submitted confidential IPO paperwork to the SEC on Aug. 31, 2021.)

Top Win International Ltd. TOPW Dominari Securities/ Revere Securities, $2.7M Shares, $4.00-6.00, $13.3 mil, 3/3/2025 Week of

Through our Operating Subsidiary in Hong Kong, Top Win International Trading Limited, we are a wholesaler engaged in trading, distribution, and retail of luxury watches of international brands.

As the purveyor of fine watches, we source luxury products directly or indirectly from authorized dealers, distributors, and brand owners, located in Europe, Japan, Singapore, and other locations, and sell them to our customers, comprising independent watch dealers, watch distributors, and retail buyers within the watch industry. Our strategic location in Hong Kong positions us advantageously within the Asia-Pacific luxury market. This region has seen significant growth in demand for luxury goods, driven by rising disposable incomes and a growing appreciation for high-quality, branded products. We currently offer a selection of over 30 internationally renowned watch brands, including Blancpain, Breguet, Cartier, Chopard, Hermes, IWC, Jaeger, Rolex, Omega, and Longines. We primarily trade watches within the price range of $1,900 to $7,500 with our target customers being middle to high-income earners.

(Note: Top Win International Ltd. is offering 2.66 million shares at a price range of $4.00 to $6.00 to raise $13.3 million, according to its SEC filings.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-