Emerging Market Links + The Week Ahead (February 5, 2024)

As Chinese and Hong Kong markets continue to tread water, India’s stock market rally has fueled a rush of IPOs with sixty-six companies filing listing documents, but some investors are wary after poor performance of many flotations. On the other hand, Brazil’s domestic stock market has experienced the longest stretch without a new flotation for at least two decades despite most emerging market funds being overweight in the country.

Meanwhile, a couple of annual research reports worth noting have become available: China Business Climate Survey Report (AmCham China), BRICS Wealth Report 2024 (Henley & Partners) and EMEA Private Business Attractiveness Index (PwC). The latter reports painted a less dire picture for South Africa and Western Cape (Cape Town…) in particular.

Finally, our cleaned-up and more focused EM Fund Stock Picks & Country Commentaries (February 4, 2024) type posts will start having some links to tear sheets for potentially interesting stocks mentioned by funds with this format:

- Overview

- Key Ratios (P/E & Dividend Yields)

- 1 Year Chart

- Long Term Chart

- Recent Research & News

- Recent Financials

- Share Ownership & Listings

- What Analysts, Funds & Rating Agencies Have to Say

- Additional Resources

- Investor Relations Contacts$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Shein’s Chinese roots likely to rub some shine from its IPO (Bamboo Works)

Despite working hard to recast itself as a Singaporean company, the fast fashion giant may find that Chinese regulatory scrutiny is its biggest obstacle to a planned U.S. IPO

Shein is trying to downplay its Chinese roots in the run-up to a planned U.S. listing, after its valuation jumped to $66 billion with its latest financing last May

The fast fashion giant beat rivals such as Temu and Amazon to top the global chart for shopping-category apps two years in a row

🇨🇳 Meituan (3690 HK): Turning Cautiously Positive (Smartkarma) $

Share price of Meituan (SEHK: 3690) has fallen by 25% since we flagged the name as high-conviction sell for 2024 last December, due in large to its weakening fundamental and earnings cut.

We believe its competitive positioning in food delivery remains rock solid and estimates Meituan will likely command over 2/3 market share in in-store business, at the expense of margin.

The company trades at 12x/8.6x 2024/25 consensus earnings. Current valuation already priced in rather bearish outlook amidst macro concerns and intensified competition in our view. We see value emerging.

🇨🇳 NetEase layoff rumors: staff churn or a bigger restructuring? (Bamboo Works)

Speculation is swirling that NetEase (NASDAQ: NTES) has started to cut its workforce, with headcounts reportedly slashed by up to half in some divisions, but the gaming giant has dismissed reports of sweeping layoffs

Rebutting the claims, NetEase said personnel adjustments were part of the normal course of business and insisted the company was still actively hiring

The company has overtaken Meituan (SEHK: 3690) to become China’s fourth most valuable internet business

🇨🇳 Lenovo caught in a ‘Thucydides Trap’ between an old power and a rising one (Bamboo Works)

A Newsweek article quoted a research group saying the company’s PCs could pose a risk to U.S. national security and advised banning them

Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF)’s shares nosedived after publication of an article citing a research organization saying the U.S. should ban the company’s computers

Concerns are growing that weak Lenovo sales may have been a factor behind chip giant Intel’s recent worse-than-expected first-quarter revenue forecast

🇨🇳 Dell, Micron Backed a Group Raising Alarms on Rivals’ China Ties (Bloomberg) $ 🗃️

China Tech Threat’s advocacy aligns with the corporate interests of Dell and Micron, which have supported the group financially, say people familiar with the group.

🇨🇳 CATL teams up with Didi, deepening push into battery swapping (Caixin) $

Battery giant Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) has set up a battery swapping joint venture (JV) with ride-hailing company Didi Global Inc. (OTCMKTS: DIDIY) to service Didi’s expanding fleet of electric vehicles (EVs).

The tie-up is CATL’s latest foray into battery swapping — dominated by EV-maker NIO Inc (NYSE: NIO) — as it aims to expand beyond production and into downstream businesses that make use of its products. It comes as the world’s No. 1 producer of EV batteries by installed capacity faces growing competition from rivals such as BYD Co. Ltd., which produces both vehicles and their batteries.

🇨🇳 Bank of Jinzhou: Bailed out, but not out of trouble (Bamboo Works)

A one-year suspension of the regional lender’s shares will continue as it’s not yet ready to publish its financial results for 2022 and the first half of last year

Bank of Jinzhou (HKG: 0416 / FRA: 2JI)’s stock will remain suspended pending publication of its results for 2022 and the first half of last year

Beijing bailed out the bank in 2019 using state-owned banking giant ICBC, which was followed by more financial support from government-affiliated entities

🇨🇳 China’s Big-Three Airlines Expect 2023 Loss While Private Carriers Turn Profit (Caixin) $

What’s new: China’s three largest state-owned airlines reported losses for the full year in 2023 while some smaller private airlines turned in a profit, thanks to the recovery of domestic tourism.

🇨🇳 China’s big airlines set for fourth straight lossmaking year (FT) $ 🗃️

🇨🇳 Everest reaches new heights on growing drug sales (Bamboo Works)

The innovative drug maker said its revenue soared more than 850% last year to between 124 million yuan and 126 million yuan

Everest Medicines (HKG: 1952 / FRA: 6HN)’ revenue soared nine-fold last year, powered by rapid gains for its two recently approved star products, as it gets set to introduce more drugs this year

Ten of the drug maker’s existing twelve drugs were acquired through licensing agreements, and it pocketed $300 million by returning some rights to a drug developed by Gilead Sciences

🇨🇳 WuXi AppTec, Wuxi Bio Tumble as U.S. Lawmakers Propose Ban (Bloomberg) $ 🗃️

WuXi AppTec Co (HKG: 2359 / SHA: 603259 / OTCMKTS: WUXAY) / Wuxi Biologics‘ (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF)

🇨🇳 JS Global Lifestyle’s profits evaporate with China homecoming (Bamboo Works)

The kitchen appliance maker warned its profit fell 37% last year, following the spinoff and separate listing of its U.S.-based SharkNinja (NYSE: SN) unit that accounted for three-quarters of its revenue

JS Global Lifestyle (HKG: 1691 / FRA: 3JS / OTCMKTS: JGLCF)’s profit fell 37% last year, as it blamed growing competition in its main China market following a spinoff of most of its global business

The kitchen appliance maker’s spinoff of its U.S.-based SharkNinja unit reflects a growing trend among Chinese companies that are separating their global and China businesses

🇨🇳 Global yarn giant Texhong spins into the red (Bamboo Works)

The company issued its second profit warning in the last seven months, as it fell into the red last year and began selling assets to raise cash

Texhong International Group (HKG: 2678 / FRA: T1TA) reported it fell into the red with a loss of about 300 million yuan for 2023, reversing a 200 million yuan profit the previous year

The yarn maker has begun selling assets to raise cash, as it and its peers suffer from plunging margins due to weak global demand for textiles

🇨🇳 Caught in a payment jam, Hongjiu Fruit issues more shares (Bamboo Works)

Chongqing Hongjiu Fruit Co Ltd (HKG: 6689)

The leading Chinese distributor of high-end fruit has been forced to raise more capital to help bridge a gap between incoming payments and outgoings

In the first half of 2023, its receivables were equivalent to 92.4% of total liquid assets

The company’s cash flow turned positive in the first three quarters of 2023 with a net inflow of 26.9 million yuan

🇨🇳 Jiumaojiu takes a taste of franchising (Bamboo Works)

The restaurant operator said it will test out franchising for its popular Tai Er ‘sauerkraut fish’ chain in transport hubs and Western China’s Xinjiang and Tibetan regions

Jiumaojiu International Holdings (HKG: 9922 / FRA: 3YU) will trial franchising for a limited number of restaurants from its Tai Er chain, as well as for a new hotpot chain

The restaurant operator is part of a growing number of food and beverage chains in China to try out franchising to boost their expansion

🇨🇳 HK 第4部分; Yum China is not Yum! Brands (Jam_invest’s Newsletter)

A growing number of people has been salivating over the valuation of Yum China Holdings, lately. I want to set the record straight on two often-made fallacies.

Conclusions

YUM China (NYSE: YUMC) is not Yum! Brands (NYSE: YUM); YUM clearly has the superior economic model

YUMC may be looking attractively valued, but that’s a common feature among Chinese/Hong Kong stocks at the moment.

🇭🇰 HK 第3部分; Dollars trading for Pennies (Jam_invest’s Newsletter)

Note: Mentions a number of HK Stocks.

HK 第3部分; Dollars trading for Pennies The Hong Kong stock exchange fosters a large number of absurdly cheap stocks, of profitable, dividend-paying companies. On January 12th, 2024, I started writing about some of them. Today part 3.

🇭🇰 Interview with Alex Chan, Founder and Chairman of Plover Bay Technologies (1523.HK) (Pyramids and Pagodas)

A Hong Kong home-grown success story sits down to tell us how he scaled from humble beginnings to a global business serving the needs of our increasingly connected world

Plover Bay Technologies (HKG: 1523 / OTCMKTS: PBTDF) (“Plover Bay”), listed on the HK Stock Exchange in 2016, is an under-followed niche company that sells routers and software licenses. Have you ever wondered how Wi-Fi connectivity works on planes, trains, and automobiles? Plover Bay’s routers remove the need for wired connections by drawing on 4/5G networks and low-earth orbit satellites (like Starlink) to provide connectivity in hard-to-reach areas and to users for whom connectivity could be a matter of life and death.

🇲🇴 Fitch now thinks Sands China dividend resumption in 2026 (GGRAsia)

Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF)

The parent company restarted payment of dividends in August last year.

Fitch said that while it made “no assumptions” regarding the possible financial impact of the Las Vegas Sands (NYSE: LVS) group successfully bidding for a New York City project, “if the company receives a licence, it would be required to pay a US$500-million licensing fee up front”.

Fitch added that “given the assumption of strong free cash flow and high cash balances” in the group’s existing Macau and Singapore operations, it believed “these capital outlays are adequately financeable”.

🇹🇼 Gogoro: Forget Latam, It’s Only Big In Taiwan (Seeking Alpha) $

Gogoro (NASDAQ: GGR) has announced plans to set foot in Latin America through a partnership with Copec.

The details about the deal are few and I don’t have high hopes considering Gogoro has failed in its expansion plans for Europe and Asia.

In addition, I expect 2024 to be underwhelming for the company due to a price war in the scooter market in Taiwan.

🇹🇼 ASE Technology Holding: May Be Due For A Bigger Correction (Seeking Alpha) $

ASE Technology Holding (TPE: 3711 / NYSE: ASX) released its latest report on February 1, which had some positive things to say, but also some less than positive things worth mentioning.

FY2023 was a down year for ASX with both the top and the bottom line shrinking, but the FY204 outlook sees change coming this year.

The charts have a number of interesting things worth noting, which could provide clues as to how to position oneself in the near term.

Long ASX makes sense if viewed from a long-term perspective, but in the short term, it is a more dicey proposition.

🇰🇷 Activist shareholders target Samsung to unlock value (FT) $ 🗃️

Investors in South Korea emboldened by Japan’s corporate governance drive

A group of investors has called on Samsung’s de facto holding company to increase dividends and institute share buybacks, as pressure mounts on South Korean companies to address their low valuations.

🇰🇷 Korean Air – 4Q Loss Driven by Exceptional Financial Costs; Underlying Picture Healthier (Caixin) $

Korean Air (KRX: 003490) has reported a 4Q23 net loss of KRW235bn, which is down from a profit of KRW354bn in 4Q22. We had expected KRW264bn profit but higher opex/financing costs weighed

We highlight 4Q23 saw KRW409bn in other financial expenses, which compared to an income of KRW322bn in 9M23. Without this, KAL would have generated profit of around KRW200bn in 4Q23

Pre-Pandemic, 4Q saw a near-breakeven performance (KRW17-38bn losses in 4Q18-4Q19) so a KRW184bn profit in 4Q23 still remains strong relative to pre-pandemic levels

🇰🇷 Emart: Double Catalysts Of “Open on Sundays” + Focus on Low P/B Stocks (Smartkarma) $

E-Mart Inc (KRX: 139480) has been a strong outperformer this year (up 5.6% YTD) versus KOSPI which is down 5.8% in the same period.

We expect E Mart to outperform the market in the rest of 2024 driven by two major factors including “open on Sundays” policy and focus on low P/B stocks.

E Mart is trading at P/B of 0.2x versus Coupang (NYSE: CPNG) which is trading at P/B of 8.3x. E Mart is more attractive than Coupang, especially considering the recent catalysts.

🇰🇷 Paradise Co Jan casino rev at US$56mln, up 55pct y-o-y (GGRAsia)

Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only gaming venues, reported casino revenue of just above KRW74.53 billion (US$56.2 million) for January, up 54.9 percent year-on-year, according to a Friday filing to the Korea Exchange.

The January casino revenue also represented a 17.7-percent sequential increase on Paradise Co’s December tally of nearly KRW63.33 billion.

🇰🇷 S.Korea op GKL casino sales dip 44pct m-o-m in January (GGRAsia)

Casino sales in January at Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, fell by 43.9 percent month-on-month, to KRW19.59 billion (US$14.8 million), the company said in a Friday filing to the Korea Exchange. The latest monthly tally was down 38.9 percent from the prior-year period.

The company is a subsidiary of the Korea Tourism Organization, which in turn is affiliated to the country’s Ministry of Culture, Sports and Tourism.

🇰🇷 SK Telecom: Eyes On Q4 Earnings Beat And Korea Discount (Seeking Alpha) $

SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) registered better-than-expected earnings for Q4 2023, but it still trades at a discount to US-listed peers.

The South Korean government and financial regulators want to address the issue of Korean companies being assigned low valuations.

I have a positive view of the Company’s moves to grow sales contributions from AI businesses and return excess capital through share repurchases.

SKM could potentially trade at a higher EV/EBITDA multiple closer to its US peers, assuming the Korea discount is narrowed in the future.

🇰🇷 Samhyun IPO Preview (Smartkarma) $

Samhyun is getting ready to complete its IPO on the KOSDAQ exchange in March. The IPO total offering amount is 40 billion won to 50 billion won.

The company generated sales of 99.8 billion won (up 45.5% YoY) and operating profit of 9.8 billion won (up 250% YoY) in 2023.

Samhyun developed one of the world’s first CVVD (Continuously Variable Valve Duration) technology for automobile engines, which improves fuel efficiency by controlling the engine’s valve opening time.

🌏 In focus: food delivery platforms in Southeast Asia + Food delivery platforms in Southeast Asia 2024 (Momentum Works)

Momentum Works has released our 4th annual Food Delivery Platforms in Southeast Asia Report. What has changed?

During our online briefing on 31 Jan 2024, where we had a candid discussion (as usual) focusing on key questions including the following:

How has the market share of key players changed – what is causing these changes?

What does the recovery of the F&B sector and increasing presence of Chinese F&B players in the region mean for platform players & the whole ecosystem?

Amid almost no GMV growth in the sector, how are platforms’ diverging strategies come to serve the same objective?

How do Grab Holdings Limited (NASDAQ: GRAB) & other leading platforms tap into the 95% of the region’s population they do not currently serve?

Have we reached the end game in terms of competition?

Should Grab, PT GoTo Gojek Tokopedia Tbk (IDX: GOTO.JK) and LINE MAN invest in live streaming?

🇸🇬 Singapore Airlines: Back To Hold (Rating Downgrade) (Seeking Alpha) $

Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF) stock was initially rated as a hold but was later upgraded to a buy due to improved investment opportunities. We now alter our rating once again.

Since the upgrade, the stock has appreciated by 17.5%, but stronger performance is desired.

The company’s H1 2024 results showed a strong rebound in passenger traffic but declining unit revenues and potential challenges in the cargo business.

🇸🇬 Keppel DC REIT’s 2023 DPU Tumbles 8.1%: 5 Highlights from the Data Centre REIT’s Full Year Earnings (The Smart Investor)

Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF)

🇰🇭 NagaWorld 2024 GGR to rise 26pct, China play helping: CICC (GGRAsia)

The NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) casino complex in Cambodia is likely to record a 26-percent year-on-year increase in gross gaming revenue (GGR) for full-year 2024. The estimate is by China International Capital Corporation (CICC) Hong Kong Securities Ltd.

🇮🇩 Telekomunikasi Indonesia: A Buy For The Short Term And The Long Run (Seeking Alpha) $

Telkom Indonesia (Persero) Tbk PT (NYSE: TLK)‘s mobile and broadband businesses could perform above expectations in the short term, considering the favorable market environment for the Indonesian mobile industry and its attractive Telkomsel Orbit offering.

For the long term, TLK’s data center still has a long growth runway ahead, taking into account its overseas market expansion plans.

Telekomunikasi Indonesia deserves a Buy rating based on a comparison of its valuations with its growth outlook.

🇮🇳 Shrimp Industry Shakeup: Ecuador Crisis Sparks Opportunities for Indian Seafood Companies (Smartkarma) $

Ecuador’s crisis, driven by violence and narco-gang threats, impacts the global seafood supply chain, especially the lucrative shrimp exports sector.

Resilient amid challenges, India holds its position as the second-largest global shrimp producer, balancing opportunities and persistent challenges in logistics and competition.

Investors urged caution in the Indian seafood boom, yet potential opportunities arise from Ecuador’s supply disruptions, with reduced import duty enhancing India’s competitiveness.

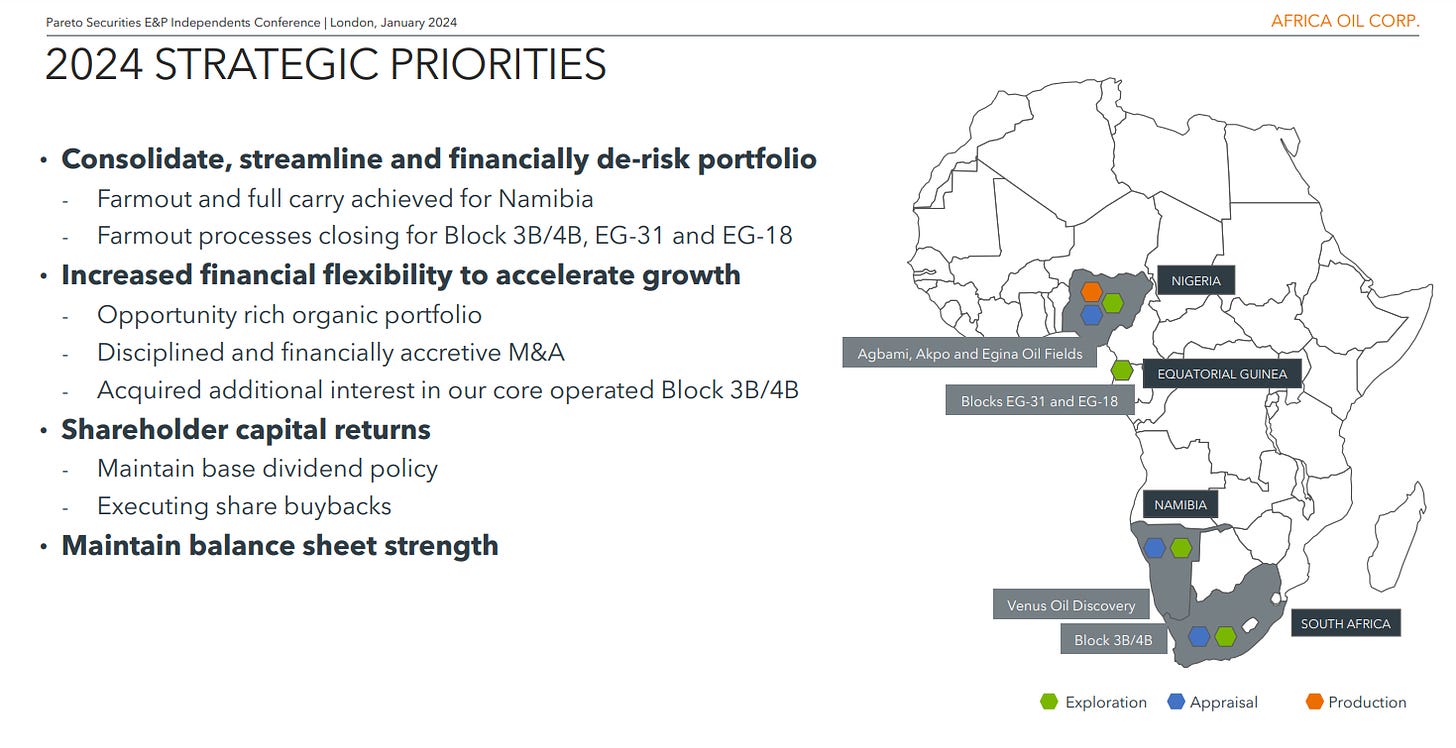

🌍 Africa Oil: The cheapest oil stock I know (AlmostMongolian)

Africa Oil (TSE: AOI / STO: AOI / FRA: AFZ / OTCMKTS: AOIFF)has been cheap for a while, but it has also been confusing, and directionless, but in recent months there has been a shift within the company, because of management changes. A new direction that I like. Maybe some of you have looked into this company in the past and you have seen this monstrosity.

This is the cheapest oil stock I know at the moment. Before when someone said why they didn’t like this stock it was usually something about the management, but after the new direction the new CEO has taken I think a lot of their concerns have been addressed. I don’t think I have seen anyone ever make an argument that it wasn’t cheap. When you compare the valuation to their assets it’s hard to say it’s not.

🇿🇦 Vivendi’s Canal+ offers to buy biggest pay-TV group in Africa (FT) $ 🗃️

Proposal that values MultiChoice Group Ltd (JSE: MCG / FRA: 30R / 30R0 / OTCMKTS: MCHOY / MCOIF) at $2.5bn aims to build rival to Netflix (NASDAQ: NFLX) in world’s fastest-growing streaming market.

But the French company, controlled by billionaire corporate raider Vincent Bolloré, will have to find a way around South African legislation that forbids foreign owners from controlling more than 20 per cent of the voting rights in the country’s broadcasters.

🇬🇷 TESIS KRI KRI MILK (Turtle Capital by Adrià Rivero)

(Note: Witten in Spanish. A browser translator will translate)

Today I bring you a new investment thesis from a company (Kri Kri Milk Industry SA (FRA: AO2)) I’ve been studying recently. It is a €320 million Greek small cap that meets the characteristics to be a very good investment.

Easy-to-understand company

Double-digit growth in a stable sector

The family in charge has 70%

No Debt

In the midst of European expansion

At an attractive valuation

In the last 10 years, the stock market has grown at 19% per year

🇵🇱 HiProMine (value at risk newsletter)

(Note: Witten in Polish. A browser translator will translate)

HiProMine (WSE: HPMP) has been gaining popularity lately. The imagination of investors is influenced not only by innovative activities, but also, above all, by the upcoming launch of a new plant that will allow for the start of production on an industrial scale.

HiProMine S.A. is a supplier of protein from alternative sources, produced using innovative and proprietary technology of industrial insect breeding. The company’s offer is mainly aimed at the market of pet food, farm food and fish farming, as well as horticulture. In the Company’s opinion, the use of insect protein in the production of feed and feed materials is a solution to the problems of the modern world, such as: relatively fast population growth, which results in a growing demand for protein, accompanied by the phenomenon of widespread food waste, in particular in developed countries2.

🌎 🇦🇷 🇱🇺 Corporación América Airports: Excellent Growth On Incremental Capital, Justifies 21x Earnings (Seeking Alpha) $

The industrials sector is a strong starting point for top-down asset allocation in 2024.

Corporación América Airports (NYSE: CAAP) presents with short-term, mid-term, and long-term investment prospects.

CAAP has shown strong growth in passenger traffic and has attractive return on incremental capital investments.

🇦🇷 Despegar’s Stock Price Is Overly Optimistic (Seeking Alpha) $

Despegar.com Corp (NYSE: DESP) achieved operational profitability with increased revenues and flat costs, resulting in a 40% stock appreciation.

The stock requires significant optimism to generate an adequate yield.

Despegar’s growth rate of 13% for five years may not be sustainable, and the company is still exposed to economic cycles.

🇦🇷 🇱🇺 Adecoagro Trades At Exaggerated Average Multiples (Seeking Alpha) $

Adecoagro Sa (NYSE: AGRO) is a Latin American company involved in agricultural and food businesses, particularly sugarcane cultivation and processing in Brazil.

The company’s profitability is heavily dependent on its sugarcane and ethanol segment, which has consistently posted positive earnings despite commodity market fluctuations.

When evaluated under the optic of cycle-average earnings, the company currently trades at a high price that does not represent an opportunity.

🇧🇷 Azul Should Benefit From GOL’s Chapter 11 (Seeking Alpha) $

🇧🇷 Azul Benefiting From Gol Bankruptcy Is Not Certain (Seeking Alpha) $

Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4)‘ bankruptcy may not necessarily benefit Azul Sa (NYSE: AZUL / BVMF: AZUL4) as Gol could emerge stronger.

There’s no fleet compatibility between Azul and Gol, making it unlikely for Azul to take any aircraft from Gol.

Gol’s Chapter 11 bankruptcy allows the company to protect its assets and remain operational, potentially leading to a more nimble and efficient structure.

🇧🇷 Nubank: Bet Big On Latin America With This Fintech Monster (Seeking Alpha) $

Latin America’s population growth remains strong, with fertility rates in the 1.8-2 range, making it a promising market for growth.

Nu Holdings Ltd (NYSE: NU), a popular mobile banking provider in Brazil, Mexico, and Colombia, is well-positioned to capture this market opportunity, especially due to ongoing digitization trends.

Nubank’s strong brand, low customer acquisition cost, and low cost-base contribute to its promising growth prospects and make it a worthwhile investment.

We rate shares a “Strong Buy”.

🇧🇷 Santander Brasil Q4: A Buy Despite Recent Setbacks (Seeking Alpha) $

Banco Santander Brasil (NYSE: BSBR)‘s Q4 earnings fell short of market expectations, with a miss of R$ 650 million.

However, this miss is largely driven by a one-timer and it masks the positive performance in Net Interest Margin.

Santander Select has hit its milestone of 1 million customers and delinquencies in the 15 to 90 days period are already trending down.

Sustained Net Interest Income growth YoY and QoQ coupled with lower interest rates make Santander Brasil a Buy.

🇧🇷 Banco Santander (Brasil): Q4 Earnings, Still Struggling To Turn Bullish (Seeking Alpha) $

Banco Santander Brasil (NYSE: BSBR)’s Q4 results were not favorable, witnessing a 19% decline in net income compared to the previous quarter.

The bank’s return on equity (ROE) remained low at 10.3%, below its historical performance and competitors.

Despite some positive aspects such as improvement in interest income and stability in non-performing loans, the bank’s profitability worsened in Q4.

Despite holding a premium valuation, I maintain a neutral stance on Santander Brasil, awaiting clearer signals of stabilization in provisions and improvement in ROE.

🇧🇷 BRF: Poor Capital Allocation, Dangerous Leverage Makes It A Hold (Seeking Alpha) $

BRF Brasil Foods SA (NYSE: BRFS / BVMF: BRFS3)‘s stock is not recommended due to poor past capital allocation decisions, high leverage levels, and lack of business diversification.

JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) and Minerva Sa (BVMF: BEEF3) are preferred investment opportunities over BRF.

BRF’s operational performance has been weaker compared to its peers, with slower growth and declining margins.

The company’s current situation is dangerous, given its operational losses and high leverage.

🇧🇷 Lavoro: Difficult Market And Weather Conditions May Impact Financials (Rating Downgrade) (Seeking Alpha) $

(Agricultural inputs retailer) Lavoro (NASDAQ: LVRO)’s stock price has increased by 33% since August 2021, but unfavorable market conditions and adverse weather may result in a correction.

Their impact is visible on the company’s recently released results, which showed softening in revenue growth and a downgrade in the adjusted EBITDA outlook.

The stock’s market multiples also look elevated right now. Even though there’s potential for improvement in FY25, right now, the stock is more likely due for a correction than not.

🇧🇷 The world’s biggest meat processor — a major polluter — is coming to Wall Street (Politico)

JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) wants to join the New York Stock Exchange. The move could lead to rapid deforestation, critics say.

🇧🇷 Gerdau S.A.: Assessing If Storm Clouds Are Beginning To Form (Technical Analysis) (Seeking Alpha) $

Metalurgica Gerdau SA Preference Shares (BVMF: GOAU4 / GOAU3)‘s dividend yield has decreased to 7.43% and the buyback program has ended, leading to diminished shareholder returns.

Adverse macro trends and increased competition in the Brazilian market pose significant challenges for Gerdau’s profitability.

Gerdau’s technical charts indicate potential weakness in the stock in the near future, despite remaining in a long-term bull market.

🇨🇱 Enel Chile Stock: I Remain Bullish (Seeking Alpha) $

Enel Chile (NYSE: ENIC) is a $4.2 billion electricity utility company based in Chile, involved in power generation from diverse sources and the distribution of electricity in the Santiago metropolitan region.

Last quarter, the company successfully added new renewable energy capacity and saw a boost in hydro production.

ENIC stock has an attractive valuation, with a high dividend yield and a low EV/EBITDA multiple, making it appealing to income-seeking investors.

I remain bullish on ENIC in the long term and also expect the upcoming Q4 report to be stronger than the market expects.

🇲🇽 Volaris Stock Surges: What’s Next? (Seeking Alpha) $

(Low-cost airline) Volaris (NYSE: VLRS) stock price has appreciated significantly since the buy rating was maintained, offering a profitable opportunity for investors.

Volaris has provided guidance for the first quarter and full year 2024, with a steeper capacity reduction but expected higher unit revenues.

Despite the challenges of the GTF grounding issues, Volaris is navigating well and has strong EBITDAR margins for 2024, with potential for further upside in stock price.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 ‘Uninvestable’: China’s $2tn stock rout leaves investors scarred (FT) $ 🗃️

🇨🇳 China’s vice premier urges more support for listed firms amid market rout (Reuters)

“Promoting high-quality development of listed companies helps to achieve high-level technological self-reliance, accelerate the construction of a modern industrial system and enhance market confidence.”

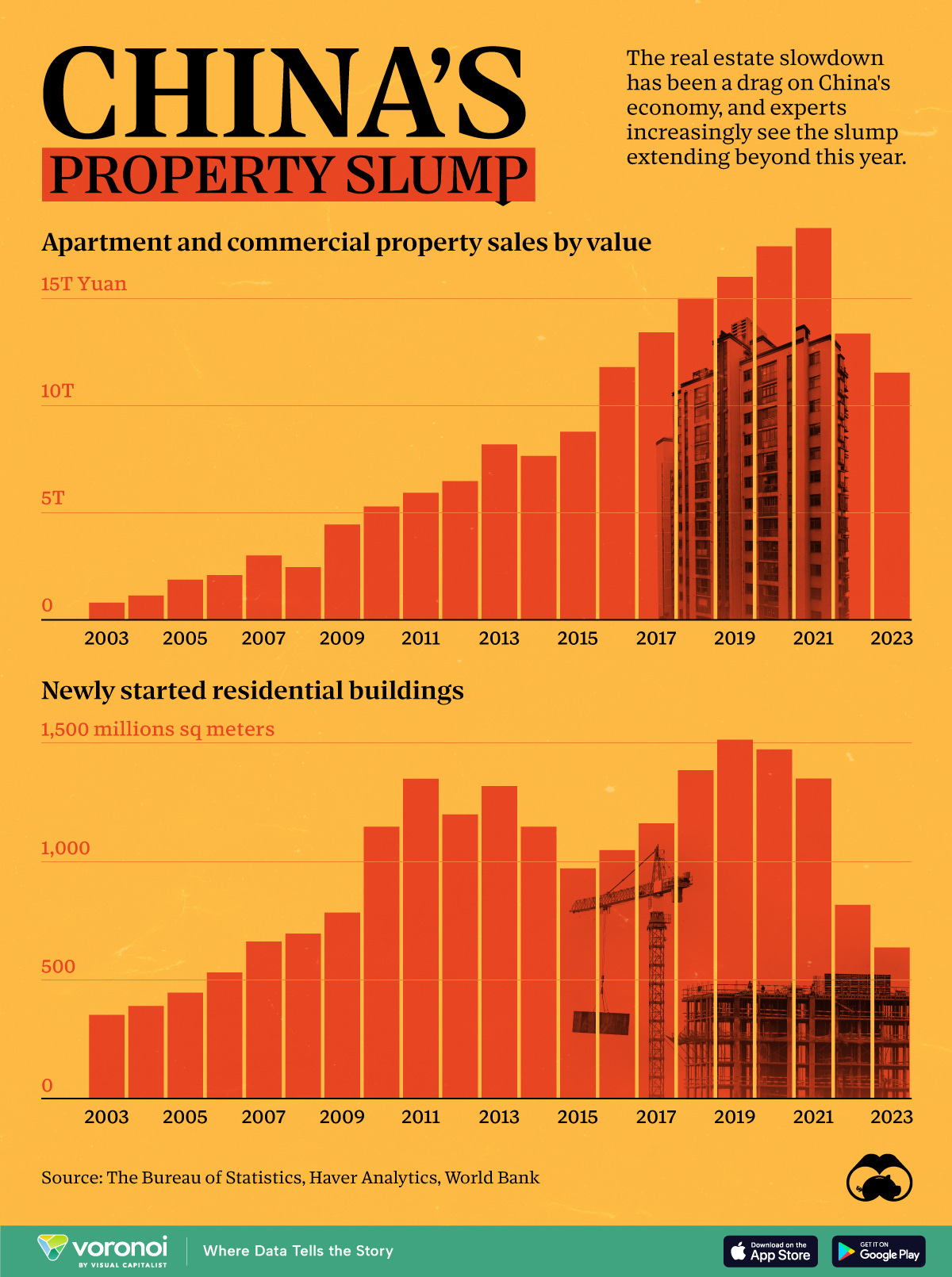

🇨🇳 China’s Real Estate Crisis, Shown in Two Charts (Visual Capitalist)

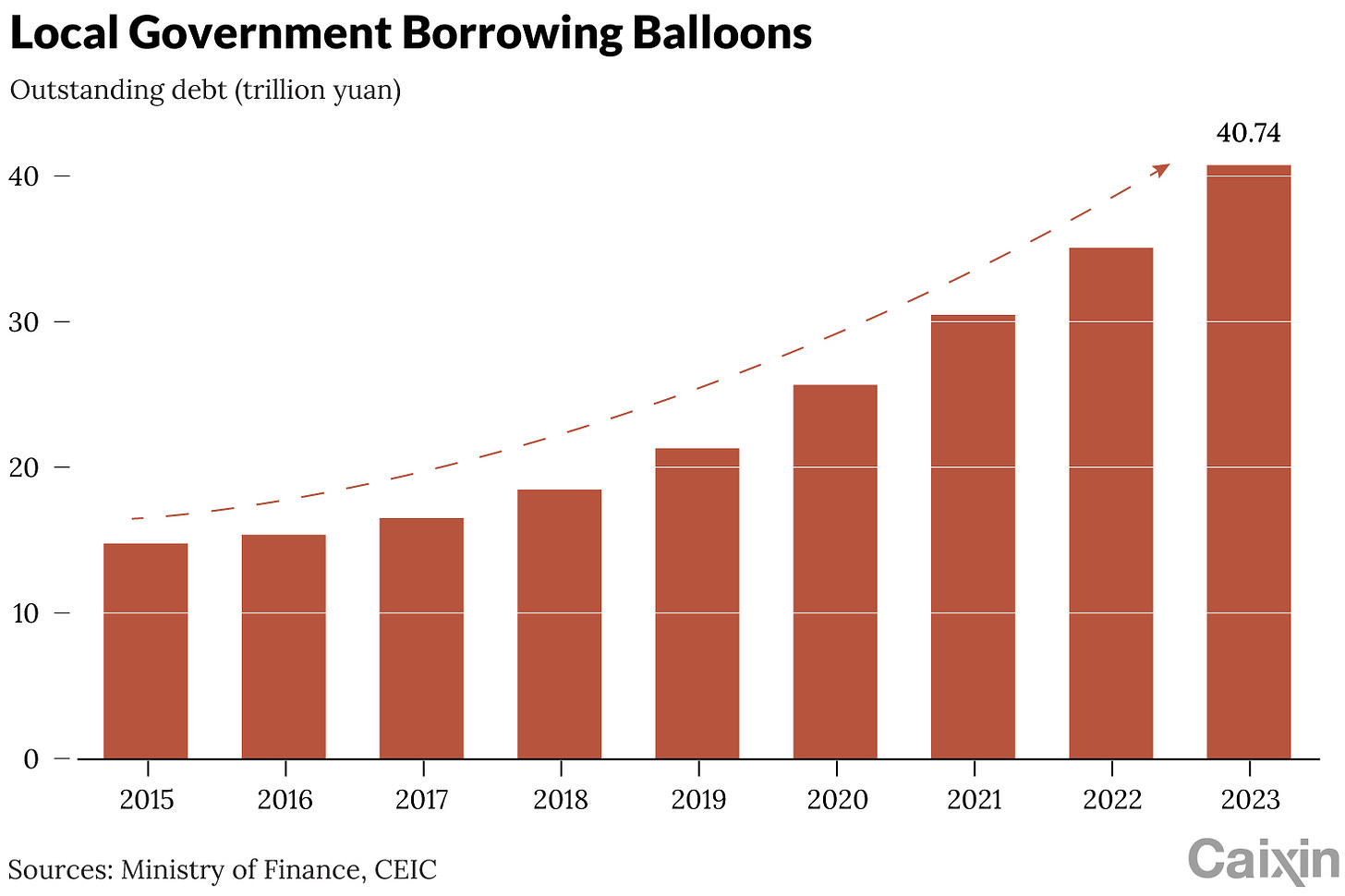

🇨🇳 China’s Local Governments Paid Record $174 Billion in Bond Interest Last Year & China’s Debt-to-GDP Ratio Climbs to Record 287.8% in 2023 (Caixin)

🇨🇳 China Business Climate Survey Report (AmCham China)

The 2024 BCS report includes answers and data charts to 67 survey questions covering the snapshots of business performance, operations and goals, business environment, and bilateral relations. Around half of AmCham China’s member companies provided data in October 2023.

🇨🇳 The dilemma of the China-shedding strategy (Bamboo Works)

🇲🇾 Big opportunity for ECRL land-bridge to be a competitive transport route (Murray Hunter)

In addition, Thailand has so far failed to obtain investors for the project. In particular, China has lost interest in the project and has sort out a deep-sea port in Kyaukphyu, in Rakhine State Myanmar, as an effective route that avoids the Melaka Straits. This port will also be serviced with a pipeline from China. Its unlikely the United States, Korea, and Japan would commit to investing in the land-bridge, due to the huge costs of the Thai project, as ports need to be built from scratch.

Since the ECRL is an ongoing project, the land bridge will provide massive positive externalities that will benefit both the East and West coasts. The land bridge will boost shipping, transport, and provide Malaysia another lever to be competitive over the Port of Singapore.

Malaysia’s land bridge could become one of the region’s most strategic assets, and project Malaysia’s economy forward.

🇮🇳 India’s stock market rally fuels rush of IPOs (FT) $ 🗃️

🇿🇦 SA’s attractiveness for business improves despite setbacks – PwC (IOL)

South Africa’s attractiveness for private business has improved in the past year, although corruption is worsening while access to capital has remained a drawback, in addition to logistics and energy bottlenecks, notes PwC in a new report.

According to the EMEA Private Business Attractiveness Index released by PwC yesterday, South Africa ranks 23rd out of 33 countries surveyed, an improvement from 2021 and 2022 when the country was ranked 31st and 25th, respectively, under the same index.

🇿🇦 Cape Town to drive SA’s wealth by 60% over next 10 years (IOL)

Cape Town is attracting large numbers of high-net-wealth individuals from other South African cities while it has also become a popular destination for wealthy individuals from elsewhere across Africa, Europe, Russia and the UK, the BRICS Wealth Report showed yesterday.

Henley & Partners, which published the BRICS Wealth Report 2024, said it had seen “a significant increase in interest in residence and citizenship by investment”.

🇧🇷 Hopes rise of a break in Brazil’s IPO drought (FT) $ 🗃️

Domestic stock market has experienced the longest stretch without a new flotation for at least two decades

Most EM funds are overweight Brazil and positions have increased over the past year, says Pablo Riveroll, head of LatAm equities at Schroders. “Money from local investors is likely to move back into equities as rates fall, probably accelerating once in single digits,” he adds. “The market expects that to happen towards the middle of the year so it is probably then that IPO activity accelerates.”

🇨🇱 Santiago, Chile – Thoughts with a Financial Bent (Calvin’s thoughts)

I’ve spent much of the past month in Chile’s capital. Are there any opportunities? How does the system work? I’ll dig into that a bit in this post

While I did meet Uber drivers who have been robbed at gunpoint in bad areas, and virtually every Chilean I met said something along the lines of, “You should have seen how nice it was ten years ago, before the immigration”, I have been thoroughly impressed with the country, its infrastructure, and its people.

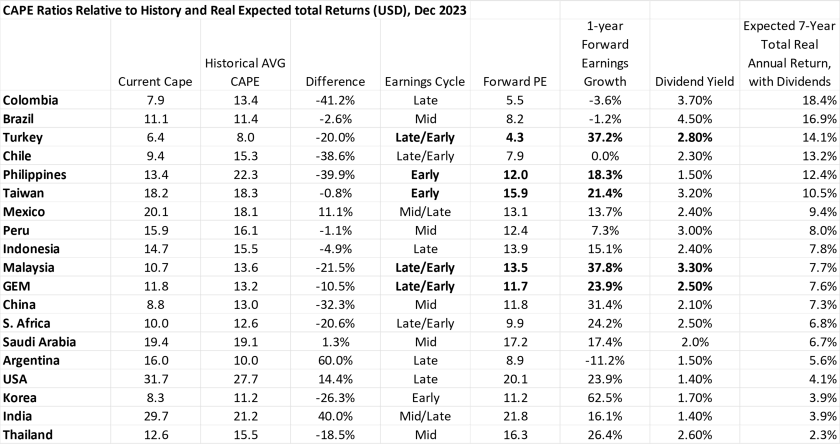

🌐 4Q 2023, Expected Returns in Emerging Markets (The Emerging Markets Investor)

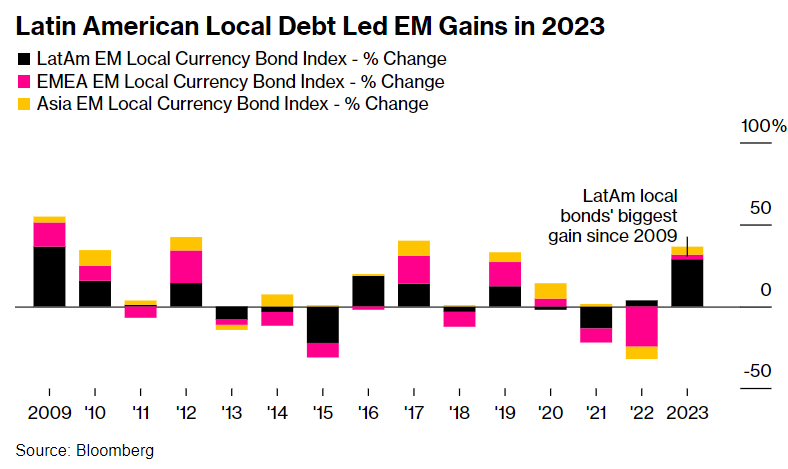

🌐 Traders Line Up for ‘Once-in-a-Generation’ Emerging Markets Bet (Bloomberg) $ 🗃️

Latin American debt is bright spot amid high rates, cheap FX

Short bets on EM local-currency debt ETF drop to four-year low

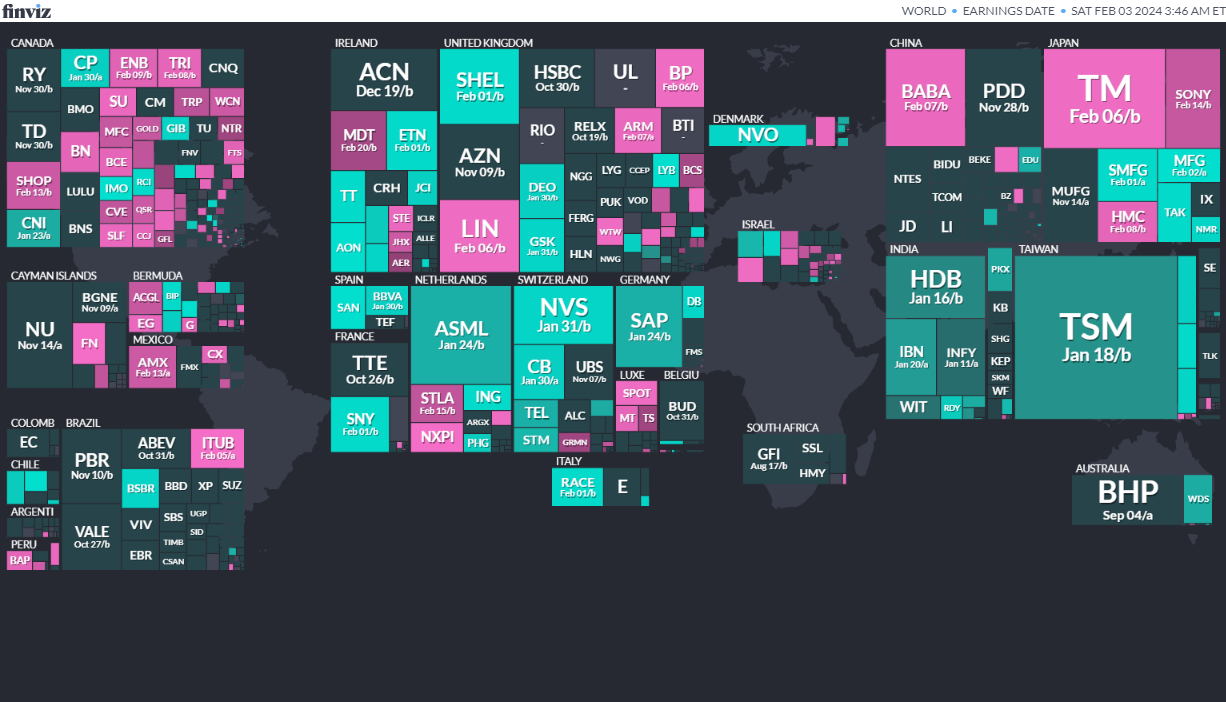

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

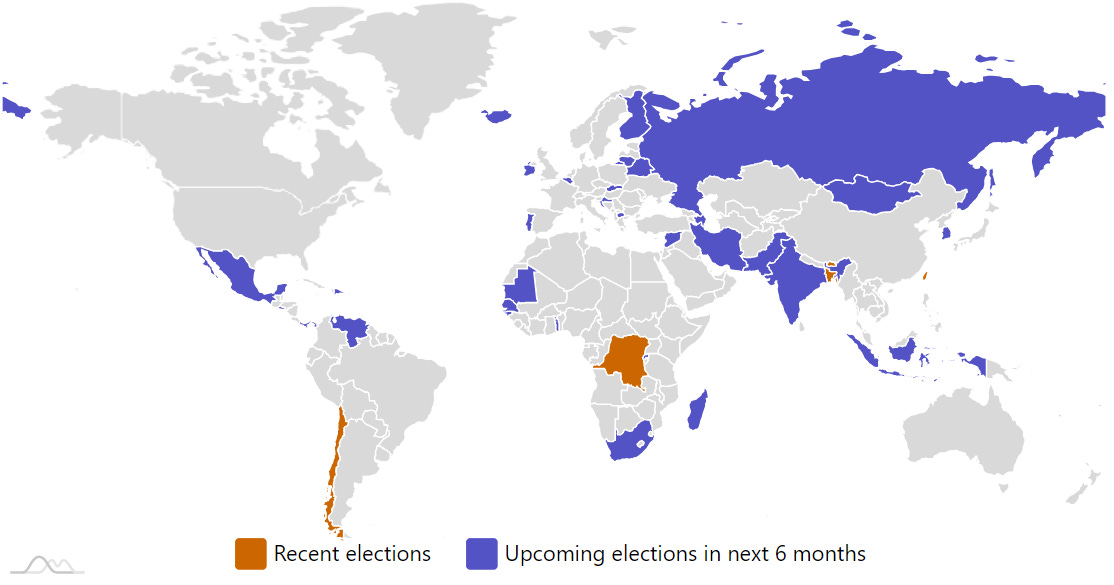

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

-

Indonesia Indonesian Regional Representative Council Feb 14, 2024