Emerging Market Links + The Week Ahead (January 15, 2024)

A lengthy Freightwaves piece has noted how we got too accustomed to peaceful seas and need to say goodbye to the global ‘conveyor belt’ as the world goes from an American-controlled unipolar to a multipolar world.

Another recent piece by Allianz Global Investors noted how (in the short term) shipping firms may benefit from the disruption. However, many retailers who depend on sea freight for their stock may be vulnerable to delays while a greater use of air freight means the technology sector appears to be largely unscathed. They also think quality companies that have adapted their operations after other recent supply chain shocks are likely to be better able to withstand the latest disruptions.

Finally, Taiwan just had elections and so far, it appears nothing will change beyond the usual back and forth war of words and air or sea incursions.

$ = behind a paywall

-

Mirae Asset Securities’ Korean Stock Picks (November-December 2023) Partially $

-

Includes: SK Hynix, Creative & Innovative System Corp, DE&T Co Ltd, Krafton, Wemade, OCI Holdings, LIG Nex1 Co, HD Hyundai Electric Co Ltd, Chong Kun Dang Holdings, Nexon Games, PearlAbyss Corp, Neowiz, NCSoft Corp, Netmarble Corp, CS Bearing Co, SK Oceanplant, Ray Co Ltd, SOCAR, Fila Holdings Corp, Dio Corp, KEPCO, HMM, InBody, Pan Ocean, SK Biopharmaceuticals, People & Technology, Hanon Systems, Lotte Chemical, Vatech, Dentium, Korea Investment Holdings, Kakao, CS Wind Corp, SK Telecom, Kakao Games, KakaoBank, Classys, Korea Aerospace Industries, LX International, KT Corp, LG Uplus, i-SENS, CJ Logistics, Kiwoom Securities, Hankook Tire & Technology, Hanwha Systems, Joy City Corp, NAVER, Kumho Petrochemical, SK Innovation, Hanwha Aerospace, Korean Air, Vieworks, Samsung Securities, Doosan Fuel Cell, Hanmi Pharma, ST Pharm, Hanwha Solutions, Yuhan Corp, Dong-A ST Co Ltd, BNK Financial Group, Amorepacific Corp, Samsung SDI, SKC, Samsung Electronics and S-Oil Corp

-

-

EM Fund Stock Picks & Country Commentaries (January 14, 2024) $

-

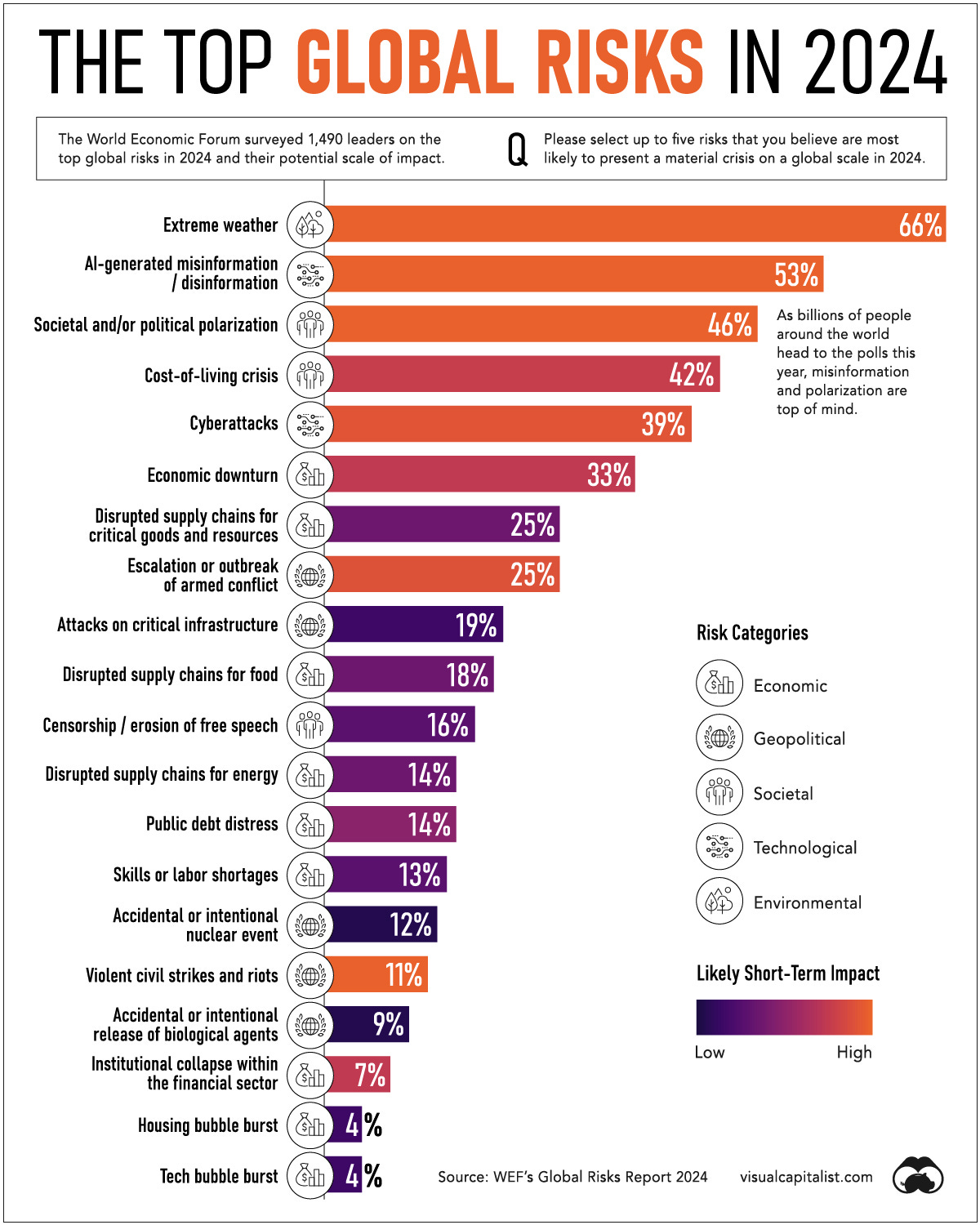

A Chairman who spent 50hrs in a truck to understand his customers, handy top 10 list of market risks, upcoming fund webinars, Vietnam outlook, several EM funds w/ detailed Dec portfolio updates, etc.

-

$ = behind a paywall / 🗃️ = Archived article

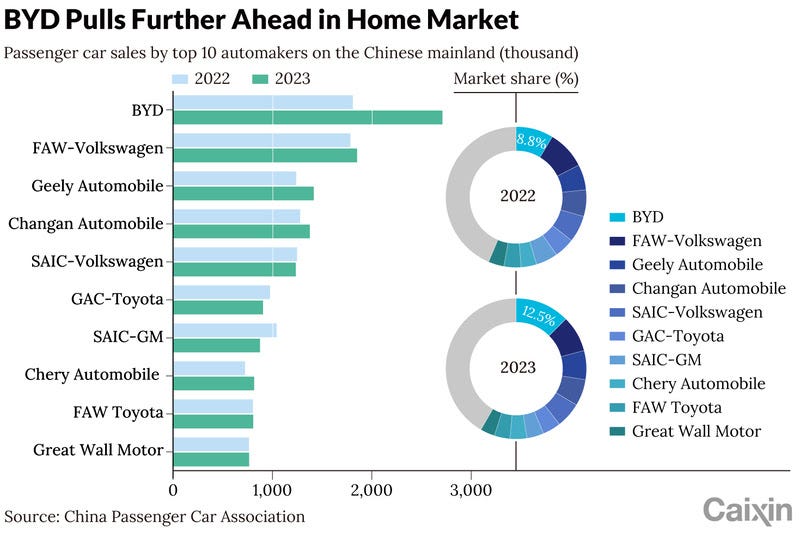

🇨🇳 Chart of the Day: BYD surges further ahead of rivals at home (Caixin) $

Chinese automaker BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) surged further ahead of its rivals on its home turf last year as sales jumped 50%, with competition looking set to heat up again in 2024 in the world’s largest auto market.

BYD led the Chinese mainland market with more than 2.7 million passenger cars sold in 2023 and a 12.5% share, up from 1.8 million vehicles and an 8.8% share in 2022, according to data from the China Passenger Car Association (CPCA).

🇨🇳 Huawei Will Be The Next To Challenge Tesla In Autonomous Driving (Zero Hedge)

To cap off the week, Caixin also wrote about how Huawei is now aiming to pull ahead of Tesla in the race for autonomous vehicles.

According to the report, by 2030, China could lead the global market for autonomous vehicles, with sales projected at $230 billion. Huawei’s entry intensifies competition, as success in the sector hinges on data, computing power, and significant resources

So while Tesla is looking out for BYD in one rear-view mirror, they’ll have to be checking the other for Huawei…

🇨🇳 Alibaba (BABA US): No Where to Go but Up (Smart Karma) $

Alibaba (NYSE: BABA) is transforming into a leaner, more efficient and more profitable technology company with sharpened focus on core business and shareholder return.

While we don’t expect growth to define the company in the near future, high single-digit P/E more than compensates for the lack of it.

This worst-performing and cheapest technology stock among global peers stands a big chance of staging a comeback in 2024 in our view.

🇨🇳 JD.com Inc.: Redefining E-commerce with Innovative Approaches! – Major Drivers (Smart Karma) $

JD.com (NASDAQ: JD) managed to surpass the revenue and earnings expectations of Wall Street.

The company broadened its free shipping reach in the third quarter by leveraging enhanced logistics capabilities.

The company strategically reduced the minimum order value for free shipping services, granting JD Plus members unlimited free shipping for 1P products.

🇨🇳 Yixin steers away from young joint venture to stay focused on China auto market (Bamboo Works)

The online car loan facilitator is pulling out of a 2-year-old tie-up as its state-owned partner seeks to take the venture into new unrelated areas

Yixin Group (HKG: 2858 / FRA: 1YX) will sell its 49% stake in a 2-year-old joint venture to partner Qingdao Caitong, which wants to expand into areas beyond the venture’s original auto leasing services

Yixin’s auto financing business is growing despite an unsteady Chinese car market, fueled by booming demand for electric vehicles

🇨🇳 Chaoju Eye Care sees strong growth in acquisitions (Bamboo Works)

The Inner Mongolia-based eye care provider is building a substantial portfolio in the high-growth sector for private hospitals and clinics

Chaoju Eye Care (HKG: 2219) has announced its purchase of a Beijing Hospital as part of its strategy of growth through acquisitions

The eye care provider’s revenue and profit rose 30% and 44.3% in the first six months of last year, respectively, producing plenty of cash to fund its buying spree

🇨🇳 Xtep International (1368 HK): Strong Headline Retail Sales Growth In 4Q23 But Quality Is Still Low (Smart Karma) $

Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) announced an operational update for 4Q23, with retail sales growing more than 30% for the Xtep brand (off of a low base in 4Q22).

The overall quality of the retail sales growth is low, as the growth was mainly driven by higher discount level (around 30% compared to 25-30% in the previous quarter).

I still prefer ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) over Xtep at this stage, as Xtep is more of a beta play if the consumer sentiment turns around in China.

🇨🇳 Cover Story: Feed giant New Hope navigates downside of boom-bust cycle (Caixin) $

New Hope Liuhe Co. Ltd. (SHE: 000876), China’s top animal-feed maker and third largest hog producer, responded like many of its competitors when pork prices started rising several years ago: it poured money into expansion. Now, 12 months into a cycle of falling prices, the pig farming concern is seeing losses instead of profits and embarking on a retrenchment to regain its footing.

China, the world’s largest pork market, is once again in the downside of a business cycle. Every three to four years, the nation’s hog breeders find themselves caught in a boom-bust cycle, navigating the fluctuations of pork prices. Over-leveraged producers may be pushed to the brink of a debt crisis, while resilient breeders patiently await a market revival.

🇨🇳 Nongfu Spring makes major new investment amid profit pressures (Bamboo Works)

China’s leading bottled water producer has attracted investor attention for its high profit margins, but also caution over its highly priced shares

Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF) will invest 5 billion yuan with the city of Jiande in Zhejiang province to build a new production base for its drinking water and other beverage products

With gross and net profit margins of 60% and 28%, respectively, the company far outperforms its Mainland Chinese peers in terms of profitability

🇨🇳 Mixue brews up renewed IPO bid, tempting investors with overseas expansion (Bamboo Works)

After an aborted attempt to list on China’s domestic A-share market, the country’s leading bubble tea chain has filed a new IPO application for Hong Kong

Mixue Group (MIX HK) has filed to list in Hong Kong, in a deal that could value it at $5 billion or more as it reportedly seeks to raise up to $1 billion

An increasingly crowded China market is pushing Mixue to accelerate its global expansion, with the company currently operating about 4,000 stores overseas

🇨🇳 Guming joins China’s tea market party with IPO bid (Bamboo Works)

The tea chain that sells fruity and milky brews in China’s smaller cities has been dubbed a cheaper version of the upmarket Heytea brand

As of the end of last year, Guming had 9,001 outlets nationwide, but all but six of the stores were franchised

The company’s profits more than tripled to 990 million yuan in the first nine months of last year, mainly due to sharply reduced losses from fair-value changes

🇨🇳 TH International reaches Popeyes goal, but falls short on Tim Hortons (Bamboo Works)

The operator of the two Western fast food chains in China said it has 919 stores, trailing its previously announced goal for 1,000 stores by the end of 2023

TH International (NASDAQ: THCH) said it currently has 919 stores in its network, including 10 Popeyes and the remainder from its main Tim Hortons chain

The fast food operator opened about 156 stores in the fourth quarter, more than the total for the previous three quarters combined

🇨🇳 🇭🇰 Meituan Becomes No. 2 Hong Kong Food Service Months After Debut (Bloomberg) $

It’s surpassed Deliveroo in market share since May launch

Meituan (SEHK: 3690) is expanding overseas to offset China’s weak demand

🇭🇰 Cathay Pacific struggles to put its troubles behind it (FT) $ 🗃️

(Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF))

🇭🇰 Pacific Textiles (1382 HK): Material Benefits (Smart Karma) $

Back in June 2017, Toray Industries (TYO: 3402 / FRA: TOR1 / OTCMKTS: TRYIF) acquired a 28.03% stake in Pacific Textiles (HKG: 1382 / FRA: WHE / OTCMKTS: PTEXF) (@ HK$10/share). Rumours that Toray would take this stake to 50% never unfolded.

Pacific Textiles is currently trading at HK$1.30/share, its lowest level outside of the GFC.

Relatively inexpensive, high digit yield and M&A angle, Pacific Textiles remains attractive. This is supported by the recent Offer for Weiqiao Textile Co (HKG: 2698 / FRA: WEZ / OTCMKTS: WQTEF) and David Webb taking a 5% stake.

🇭🇰 Tai Cheung (88 HK) (Asian Century Stocks) $

Solid Hong Kong property developer at 79% discount to NAV with no debt

Tai Cheung (HKG: 0088 – US$261 million) is a small Hong Kong property developer. It owns 35% of the Sheraton Hotel and several higher-end residential developments on Hong Kong Island.

The stock was recently mentioned by the French Substack Patrimoine en Actions, and it’s also a long-term holding of Spain’s Horos Asset Management. I met with Tai Cheung several times in a previous job and have a decent impression of the company and its management team.

🇲🇴 Macau op deleveraging to hasten with mass recovery: S&P (GGRAsia)

“Strong recovery” in Macau’s mass gambling market “will support faster deleveraging for rated issuers,” says a Tuesday note from S&P Global Ratings.

“We expect the improvement in EBITDA (earnings before interest, taxation, depreciation and amortisation) for rated issuers will accelerate over the next several quarters due to increased Macau visitation and greater availability of hotel rooms in the market,” stated the institution.

There are six gaming concessionaires in the Macau market, with all of them having started new 10-year public concessions in January 2023. S&P Global rates four of the city’s casino operators: Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF); Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF); MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY); and Melco Resorts (Macau) Ltd, the concession-holding entity of Melco Resorts & Entertainment Ltd (NASDAQ: MLCO).

🇹🇼 Taiwan High-Speed Rail (2633 TT): Better than a Government Bond (Smart Karma) $

Taiwan High Speed Rail Corp (THSR) (TPE: 2633) solid traffic growth and high utilization rate are driving strong profits and cashflows which will be mostly paid out as dividends

We view THSR as a government-backed perpetual bond masked as equity as it has a minimum profit guarantee, a firm dividend mandate, and impetus to disperse excess cash to shareholders

The current yield margin against the 10-year bond is the widest since its IPO and is forecasted to widen further with strong profit growth. Attractive for alternative fixed-income investors

🇰🇷 Korean Air: European Approval for Asiana Merger Reportedly Imminent (Smart Karma) $

Reuters reported on the Friday that the European Commission is to accept concessions of four European route divestitures and the sale of Asiana Airlines (KRX: 020560)‘s cargo business.

The EC had set a preliminary decision deadline of 14 February.

US and Japanese approvals are still required, while it remains to be seen who might acquire Asiana Cargo.

🇰🇷 Korean Air: Earnings Remain Elevated but Premium May Continue to Unwind as Cargo Yields Re-Set (Smart Karma) $

We forecast EBITDAR of KRW3.35trn for Korean Air (KRX: 003490) in 2023 (KRW3.8trn previously) with EBITDAR/ATK up 50% on 2019/32% on 2018. We remain at KRW2.9trn in 2024 (EBITDAR/ATK +28% vs 2019).

Unwinding cargo yields may fully eliminate earnings gains but cost management safeguards future prospects despite Asiana Airlines (KRX: 020560) merger uncertainty.

Cost inflation management inflected negatively in 3Q as labour costs rose – control crucial as market conditions normalize and low cost competitors expand.

🇰🇷 OCI Holdings Plans to Acquire a 27% In Hanmi Science – To Spark a Family Feud? (Smart Karma) $

After the market close on 12 January, OCI Holdings (KRX: 010060) announced that it plans to acquire a 27.03% stake in Hanmi Science (KRX: 008930) for 770 billion won.

Through this investment and integration between OCI Holdings and Hanmi Science, the OCI Group and Hanmi Pharmaceutical Group (Hanmi Pharma (KRX: 128940)) plans to establish a joint management system.

This deal between OCI Holdings and Hanmi Science is not over and it could lead to an M&A fight for the control of Hanmi Science by its family members.

🇰🇷 LG Energy Solution: A Big Earnings Miss in 4Q 2023 (Smart Karma) $

LG Energy Solution (KRX: 373220) reported disappointing preliminary earnings in 4Q 2023. The company reported operating profit of 338.2 billion won (43.5% lower than consensus).

Post a major earnings miss for LGES in 4Q 2023, the consensus is likely to reduce earnings estimates of the company in 2024 and 2025.

Major EV players such as Tesla were reducing prices in the past year causing higher pressures on EV battery makers such as LGES to reduce their prices as well.

🇸🇬 Sheng Siong is Bidding for New Shop Spaces: Can the Retailer’s Share Price Hit a New High for 2024? (The Smart Investor)

As the New Year rolls in, can the supermarket operator see its business improve?

Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) posted a commendable set of earnings for the first nine months of 2023 (9M 2023) despite the high inflation numbers.

Management is committed to increasing the number of stores it has in Singapore.

Meanwhile, investors can also look at another tailwind for Sheng Siong – the steady improvement of its gross profit margin.

Management has been aggressive in bidding for more HDB shop spaces as it seeks to grow the group’s network of stores around Singapore.

🇸🇬 Dividend List, First on Substack (8% Value Investhink)

Overseas Education Ltd (SGX: RQ1) pays a 7-9% dividend over the past years, but as there was no growth (revenue did not grow and ROE was only 3-4%), the stock price simply falls by that amount annually as exemplified by the share price chart above. That’s not a dividend stock you want to own.

The first section of the list shows the blue chip names and we have Thai Beverage (SGX: Y92 / OTCMKTS: TBVPF / TBVPY) and Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) discussed in depth on this platform. It is also interesting to note that most names are trading at teens PE which alludes to the cheapness we see in the Singapore market today. As for other noteworthy names, Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF) stands out.

The interesting names that popped up are the watch distributors The Hour Glass (SGX: AGS) and Cortina Holdings (SGX: C41), with double digit ROAs and trading at single digits PE and give close to 5% dividend.

🇸🇬 🇿🇦 Grindrod Shipping: When A Young Fleet And Healthy Financials Are Not Enough (Seeking Alpha) $

Grindrod Shipping (NASDAQ: GRIN) owns 12 Handysize and 7 Ultramax/Supramax vessels, with an average age of 9.6 years. Apart from its fleet, the company has six chartered-in ships.

The company has a solid balance sheet with $71 million cash and $168 million total debt (including lease obligations), with lower debt to equity and total liabilities to assets ratios than its peers.

The last quarter’s figures were disappointing due to declining daily rates. However, GRIN realized solid FCF, partially driven by the sales of a few vessels.

GRIN trades at a discount to MCAP/NAV, five-year average figures, and peaks.

The lack of scrubber-equipped vessels, a large percentage of chartered-in ships, and expected lower dividend yields puts GRIN on the watch list for the foreseeable future.

🇸🇬 🇿🇦 Grindrod Shipping: Favorable Outlook, M&A Completion, And Very Cheap (Seeking Alpha) $

Grindrod Shipping (NASDAQ: GRIN) didn’t only continue to reduce its total amount of debt in the last quarter, management also reported the completion of the acquisition of Tamar Ship Management Limited.

Favorable outlook for the geared dry bulk segment and expected market growth in the Asia Pacific region could lead to net sales growth.

Stable balance sheet with negative working capital and recent debt reduction promises may positively impact future valuation multiples

🇮🇩 Adi Sarana Armada (ASSA IJ) – Leading Player in People and Goods Mobility (Smart Karma) $

Adi Sarana Armada (IDX: ASSA) represents one of the most interesting plays on people and goods mobility and end-to-end logistics in Indonesia, being market leaders in auto leasing and auctions.

Revenues slowed in 9M2023 due to a slowdown in Anteraja because of slower e-commerce but other areas saw strong growth, especially its auction and used car business.

Adi Sarana Armada continues to build its renamed Cargoshare end-to-end logistics business with new customers and a move into cold chain logistics. Valuations are attractive relative to growth.

🇮🇳 Wipro: On The Recovery Path (Seeking Alpha) $

Wipro Ltd (NYSE: WIT) has been hit hard by IT spending cuts in recent years.

With a recovery on the horizon, however, the company is now poised to outperform.

Wipro stock is priced quite reasonably relative to underlying growth and broader Indian indices.

🇮🇳 HDFC Bank: India’s Consumption Engine, With Mid-Teens ROE (MOI Global) $

Housing Development Finance Corp or HDFC Bank (NYSE: HDB) is the largest private sector bank in India and one of the top five most valuable banks globally, with a market capitalization of $150 billion.

HDFC Bank recently merged with HDFC Limited (its parent entity). The merger provides several synergies for the combined franchise given the 90% unpenetrated customer base of HDFC Bank for mortgages.

HDFC also has a unique business model built to weather cycles.

HDFC Bank is available at 15x P/E (FY25E) and is trading near valuation levels last seen in the great financial crisis of 2008.

🇮🇱 Tower Semiconductor Ltd. Is Making A Comeback (Seeking Alpha) $

Tower Semiconductor (NASDAQ: TSEM)‘s stock price is not keeping pace with other chip foundry companies due to factors including the impact of the ME war and disappointment in a failed buyout.

Tower Semiconductor is seen as a potential opportunity for retail value investors with patience and risk tolerance.

Tower Semiconductor specializes in analog semiconductor solutions and has the potential for growth as demand for analog chips increases.

🌍 The cocoa question (Asian Century Stocks) $

In the past year, cocoa prices have spiked to elevated levels. The culprit has been heavy rainfall in West Africa, leading to poor cocoa crops.

There’s nothing suggesting that the tightness in the cocoa market will end anytime soon. Sea temperatures and the cocoa stock-to-grindings ratio remain at extreme levels. But if history is any guide, the cocoa market will return to balance within three years.

High cocoa prices are a big headwind for processors like Barry Callebaut (SWX: BARN / FRA: BCLN / BCLM / OTCMKTS: BRRLY / BYCBF) and chocolate manufacturers like Delfi Limited (SGX: P34 / OTCMKTS: PEFDF). But they’ll eventually be able to pass on the higher costs to consumers, which typically takes about two years.

The valuation multiples for Asian chocolate manufacturers such as Delfi and Orion Corp (KRX: 271560) remain lower than the global average, even though they have less exposure to geographies where the weight-loss drug Ozempic is popular. This strikes me as an anomaly. It probably reflects global investor preference for “quality stocks” in either the US or continental Europe rather than here in Asia. But that could change.

🇿🇲 Will Zambeef Products soon wake up from its eight-year slumber? (Undervalued Shares)

Since listing in London in 2011, the stock of Zambia’s largest integrated agribusiness and food chain is down a whopping 90%.

A cursory look indicates Zambeef Products (LSE: ZAM) stock might be trading at a price/earnings ratio of less than 3.

For Zambeef shareholders, 16 September 2024 will be a crucial date. That day, the conditions for the convertible redeemable preference shares held by BII will change.

For lack of viable alternatives, BII will choose its option to convert these convertible redeemable preference shares into ordinary shares.

🇿🇲 Indian hospitality group sells 90% stake in Zambian hotel business to UAE investors (Capital Markets Africa)

The US$18m deal highlights the growing importance of Gulf money to African markets, and the challenges facing the hospitality sector post-Covid

Taj Pamodzi Hotels Plc (LuSE: PAMODZI), the only listed Zambian hospitality group, announced last month that it has a new majority shareholder. Tata International Singapore Pte Limited (TISPL) sold its 90% stake in the business to ASB Hospitality LLC, a subsidiary of Dubai-based investment company Albwardy Group, for US$18 million.

🌎 Adecoagro: Consider This Sweet Sugar Stock (Seeking Alpha) $

I rate Adecoagro Sa (NYSE: AGRO) a Hold with a price target of $14.41, representing a 30% potential upside.

The company has diversified its income sources away from sugar and ethanol, but a heavy downturn in sugar prices remains a concern.

On a comparable basis to other South American agriculture stocks, AGRO looks cheap.

🇧🇷 Prio: Top Pick Among Brazilian ‘Junior Oil’ Companies In 2024 (Seeking Alpha) $

Prio SA (BVMF: PRIO3), Brazil’s largest independent oil producer, strategically emphasizes efficient reservoir management and mature field development.

Overcoming challenges, Prio exhibits resilience and adaptability in the competitive oil sector, solidifying its position in the Brazilian energy landscape.

Prio has undergone a financial turnaround, achieving significant profits and establishing itself as a noteworthy player in the Brazilian energy landscape.

Prio achieved a production milestone in Q3 2023, showcasing its commitment to growth through initiatives like the successful new well in the Frade field.

Prio’s robust financial health, low lifting costs, declining debt, and adaptability position it favorably. The investment thesis emphasizes robust production growth, resilience to market cyclicality, and potential dividends, making Prio a bullish choice for 2024.

🇧🇷 Marfrig: Financial Discipline Expected To Yield Long-Term Benefits (Seeking Alpha) $

Marfrig Global Foods Sa (BVMF: MRFG3 / FRA: MGP1 / OTCMKTS: MRRTY)‘s Q3 2023 success drove year-end share gains, fueled by strategic financial discipline and leverage reduction efforts.

Despite U.S. cattle cycle challenges, Marfrig foresees gradual recovery and enhanced EBITDA, especially in South America.

Initiatives like selling 16 plants to Minerva Sa (BVMF: BEEF3) and capital increases led to a substantial rise in Marfrig’s shares since October 2023.

Marfrig’s attractive forward EV/EBITDA of 7.1x positions it favorably compared to competitors, remaining 37% below industry average.

Despite potential challenges, the positive long-term outlook for Marfrig persists, anticipating continued deleveraging and improved results.

🇧🇷 Lojas Renner: Why I’m Not Buying The Leading Brazilian Fashion Retailer (Seeking Alpha) $

Lojas Renner (BVMF: LREN3 / OTCMKTS: LRENY) is a Brazilian retailer focused on fashion and lifestyle, with over 600 stores in Brazil, Argentina, and Uruguay.

Positive aspects for investment include a strong net cash position, a new distribution center for efficiency, a strategic focus on digital growth, and potential benefits from new taxation on international purchases.

Challenges include financing projects with cash, macroeconomic impact on stores in lower-income areas, and concerns about credit portfolio deterioration and elevated delinquency rates.

Despite a significant share price decline since 2019, Lojas Renner’s valuation remains unattractive, trading at a P/E ratio of 17x.

The company faces challenges from high interest rates, international competition, and a prevailing market pessimism.

🇧🇷 Vale: Bet On Rising Iron Ore Demand While Being Paid To Wait (Seeking Alpha) $

Vale (NYSE: VALE) is the largest global iron ore producer, with 80% of its revenue coming from iron ore and the remaining 20% from energy transition materials.

It is well-positioned to meet the growing demand for iron ore, especially in China, and has expanded into copper and nickel mining.

The company has strong financials, with low production costs and a solid balance sheet, and offers attractive dividends and share buybacks to shareholders.

Vale is the cheapest by a wide margin compared to its direct competitors, BHP Group (NYSE: BHP) and Rio Tinto plc (NYSE: RIO). Vale’s present EV/Sales and EV/EBITDA trade at low multiples compared to its ten-year figures.

Vale has been part of my portfolio over the last two years, and I plan to hold it for longer. I give Vale a buy rating.

🇲🇽 Banorte: Riding The Mexican Momentum (Seeking Alpha) $

Grupo Financiero Banorte SAB de CV (BMV: GFNORTEO / FRA: 4FN / OTCMKTS: GBOOY / GBOOF) has defied earnings expectations in recent quarters.

Management is also making all the right moves to limit any rate-driven normalization impact ahead.

The stock may have re-rated into year-end but is still priced quite reasonably relative to its underlying fundamentals.

🇲🇽 Global Airlines: Mexico’s Volaris Shows GTF Groundings Can Drive Higher Pricing (Smart Karma) $

Mexico’s Volaris (NYSE: VLRS) has announced its 1Q24 and FY24 capacity is likely to be down 16-18% yoy due to GTF engine inspections grounding aircraft.

However, on this reduced capacity, management anticipates a 31-33% EBITDAR margin, up from 26% in 2023, helped by fuel costs down c.9%. We model $1bn EBITDAR in 2024 (2023 $840m).

This dynamic has read across for many short/medium haul markets around the world has capacity constraints are likely to drive up pricing/earnings for affected carriers and also competitors.

$ = behind a paywall / 🗃️ = Archived article

🌍 We got too accustomed to peaceful seas (Freightwaves)

Say goodbye to the global ‘conveyor belt’

“It was almost like you had a conveyor belt from the shoe factory in Bangladesh to the shop in Chicago,” said Simon Sundboell, founder and CEO of Copenhagen-based maritime intelligence company eeSea. “That’s just not happening anymore. You’re in a world that’s going increasingly from American-controlled unipolar to multipolar globally. You’re going to have a much more fraught supply chain, and every BCO (beneficial cargo owner), importer, exporter, and logistics provider is going to have to deal with that going forward. The Houthis are just one step in that.”

Rates from Asia to North America have popped by 75% over the last month, according to Flexport. The firm expects rates to increase by an additional 50% to 100% in the second half of January. Meanwhile, Asia to Europe rates have soared by 200% from mid-December to early January. Ocean carriers now must transit around the southernmost tip of Africa to avoid the Red Sea, increasing transit times by 10 to 14 days.

🌍 Red Sea disruption: impact by sector (Allianz Global Investors)

In the short-term, shipping firms may benefit from the disruption as increased demand for vessels due to longer transport times helps push up container rates.

Many retailers depend on sea freight for their stock and may be vulnerable to delays, while a greater use of air freight means the technology sector appears largely unscathed.

We think quality companies that have adapted their operations after other recent supply chain shocks (such as from Covid-19) are likely to be better able to withstand the latest disruption.

🌍 The Red Sea Crisis – Observable Changes (Calvin’s thoughts) $

🌎 The dwindling of the Panama Canal boosts rival trade routes (The Economist) $ 🗃️

Other Latin American governments spy opportunity…

Mexico’s Interoceanic Corridor (ciit) is the closest to completion…

Other competition against Panama is more of a dream…

The other big projects are roads. The Capricorn Bioceanic Corridor is a dual-carriage highway through Bolivia, Brazil, Argentina, Paraguay and Chile, roughly on the Tropic of Capricorn…

Several maritime alternatives to the Panama Canal have also been mooted…

🇨🇳 Ship shortage holds up Chinese EV sales in Europe (FT) $ 🗃️

🇨🇳 State companies’ rush to clean energy sparks bubble fears (Caixin) $

China’s largest state-owned companies have poured hundreds of billions of yuan into wind and solar power projects, putting the country on course to hit its clean energy target six years ahead of schedule. But the investment frenzy has also raised concerns over profitability and waste.

China has seen explosive growth in photovoltaic and wind power over the past three years as Beijing pushes to achieve a carbon peak by 2030 and carbon neutrality by 2060. To meet these goals, China in 2020 set a target to install 1.2 billion kilowatts of wind and solar power capacity by 2030.

🇨🇳 China reaffirms support for offshore IPOs, but new listings likely to remain small (Bamboo Works)

More than 80 companies have successfully registered with China’s securities regulator to list shares in the U.S. and Hong Kong, and another 23 have registered to issue GDRs in Europe

A top Chinese securities regulator said 86 companies have successfully registered to make IPOs in Hong Kong and the U.S. since the launch of a new registration system last March

New listings in Hong Kong and the U.S. are likely to come mostly from smaller companies raising less than $100 million due to data sensitivity issues

🇨🇳 China travel unlikely this year to match 2019: Nomura (GGRAsia)

“Sizeable headwinds remain” for recovery of outbound overseas tourism from China “in 2024 and possibly 2025,” says a report from banking group Nomura.

The institution added in its Monday memo that “supply-side constraints” had “eased,” in terms of things such as volume of available flights and their cost, and the availability of exit visas for Chinese.

But the weakness of China’s currency the yuan relative to some other major currencies; the condition of the domestic economy; “stagnated” income growth; and high youth unemployment, meant that the “demand side” drag on Chinese consumers’ appetite for outbound travel, was “now starting to kick in”.

🇹🇼 Taiwan elections: 5 things to know about the stakes, stances and system (Nikkei Asia)

What is at stake?

How do the presidential and legislative elections work?

How do the candidates differ on policy?

How serious is China’s intervention this time?

How important is the legislative election?

🌍 Visualizing the Top Global Risks in 2024 (Visual Capitalist)

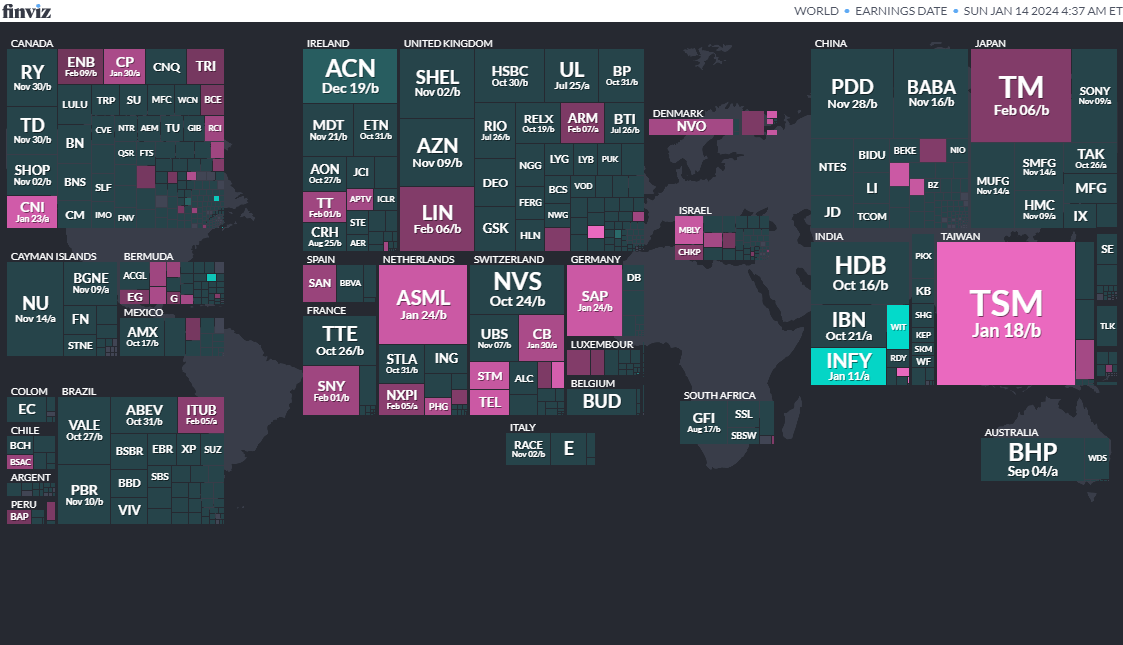

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

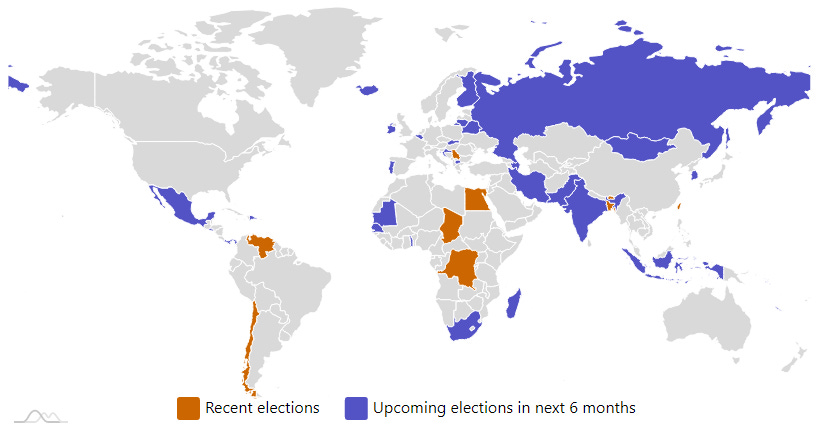

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

TaiwanTaiwanese Legislative YuanJan 13, 2024 (d) Confirmed Jan 11, 2020 -

TaiwanTaiwanese PresidencyJan 13, 2024 (d) Confirmed Jan 11, 2020 -

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

-

Indonesia Indonesian Regional Representative Council Feb 14, 2024