Emerging Market Links + The Week Ahead (January 19, 2026)

The Financial Times has reported that China battles price wars in fight against deflation 🗃️ as Trip.com braces for new era of competition with anti-monopoly probe (Bamboo Works) and potentially faces large fine or forced change to model (Smartkarma):

Chinese authorities have confirmed an investigation into Trip.com (NASDAQ: TCOM) anticompetitive practices

The company could face fines of 1% – 10% of 2025 net revenue (up to US$800 mn)

A less likely outcome could be sweeping changes to the company’s business model; AVOID

Note that Trip.com owns Ctrip which I used for bookings in China pre-covid as it had better options compared to (Priceline owned) Agoda. Their English language customer service was always excellent – even calling an accommodation to check whether foreigners were allowed to stay there (as sometimes it was not always clear e.g. when I travelled around Manchuria several years ago).

Finally, I will be traveling on the weekend (but will do most of the the Sunday/Monday posts ahead of time) and will get caught up on other posts etc by the end of the month. I will finish a post covering Singapore stocks by mid-week.

$ = behind a paywall

$ = Behind a paywall / 🗃️ = Link to an archived article (Note: Seeking Alpha earnings/conference etc. presentations are typically not paywalled) / ⛔ = Article archiving may not be working properly

🌏 Young Asians favour financial planning over spontaneity (The Asset) 🗃️

Over 71% prefer clear planning, 69% optimistic about financial future despite prevailing uncertainty

Asia’s young adults are taking a structured approach to managing their finances, with more than seven in 10 respondents ( 71% ) choosing clear planning over spontaneity, aiming to maintain consistent insurance and investment habits, according to a new report.

This pragmatism is coupled with optimism: nearly 70% believe their personal finances will improve in the next five to 10 years, finds the Financial Mindset of Young Adults in Asia research report published by insurer Prudential.

The report surveyed over 5,300 young adults aged 20 to 35 across seven Asian markets, including Hong Kong, Indonesia, Malaysia, the Philippines, Singapore, Taiwan and Thailand, aiming to take a pulse on this generation’s insurance and investment experiences, preferences and attitudes.

🇨🇳 Chinese market at an inflection point in 2026 (The Asset) 🗃️

Economic situation remains challenging but opportunities lie more in equities than in bonds

According to Julius Baer, the year ahead is less about macro acceleration and more about selective positioning across Chinese equities, Hong Kong markets, and bonds. Richard Tang, China strategist and head of research in Hong Kong, argues that while China’s growth challenges persist, the investment case is shifting from pessimism to pragmatism.

Chinese equities remain central to Julius Baer’s Asia strategy, based on its Market Outlook for 2026. The bank has maintained an overweight position since mid-2024, a stance that has begun to pay off despite ongoing economic softness. Tang acknowledges that headline growth indicators such as retail sales, property investment, and fixed asset investment remain weak. However, he stresses that markets are increasingly forward-looking.

🇨🇳 China Tightens Margin Trading Rules to Cool Stock Market Rally (Caixin) $

China’s stock exchanges tightened margin trading rules Wednesday, moving to cool a sharp rally after shares surged on heavy volumes.

The Shanghai, Shenzhen and Beijing exchanges said the minimum margin ratio for financing share purchases will be raised to 100% from 80%.

By tightening leverage rules, regulators are seeking to rein in a “fast bull” market, aiming to prevent a repeat of the highly leveraged boom and bust seen in 2015 and steer the rally toward a more fundamentals-driven path, analysts say.

🇨🇳 CIG’s strong profit forecast fails to excite, hinting at fading AI euphoria (Bamboo Works)

The maker of networking equipment used in homes and data centers said its profit grew strongly last year, but its stock fell sharply on the news

CIG ShangHai Co Ltd (SHA: 603083 / HKG: 6166) said it expects to report its profit rose more than 50% last year, boosted by improving margins from its growing wireless and photonics business

The company’s stock fell sharply after the announcement, but still trades at an inflated P/E ratio of more than 100

🇨🇳 MiniMax (100 HK): Index Inclusion Timeline/Flows & Stock Connect Entry (Smartkarma) $

MiniMax Group Inc (HKG: 0100 / FRA: E5A) listed on 9 January and should be included in one global index and one local index in June.

Lockup expiry in July and September should increase float significantly and there will be more passive buying in November and December.

MiniMax Group (100 HK) should be added to the HSCI in June and to Southbound Stock Connect in August.

🇨🇳 Yangtze Optical (6869 HK): Global Index Inclusion & The A/H Premium (Smartkarma) $

🇨🇳 China Probes Ronbay Over $17 Billion Battery Deal With CATL (Caixin) $

China’s securities watchdog has launched an investigation into Ningbo Ronbay New Energy Technology Co Ltd (SHA: 688005) over concerns it may have issued misleading statements about a major contract announcement with battery giant Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750).

The China Securities Regulatory Commission (CSRC) disclosed the probe on Sunday. In response, the Shanghai-listed materials supplier said it would fully cooperate with authorities and stressed that operations remain unaffected. Still, investors reacted swiftly, with shares tumbling 11.2% on Monday to close at 33.18 yuan ($4.7).

🇨🇳 China battles price wars in fight against deflation (FT) $ 🗃️

Regulators launch ‘anti-involution’ investigations against internet companies

The market regulator said this week it was investigating Ctrip (Trip.com (NASDAQ: TCOM)), China’s leading travel booking platform, after launching probes into food delivery businesses run by tech groups Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) and Alibaba (NYSE: BABA) last week.

🇨🇳 Trip.com braces for new era of competition with anti-monopoly probe (Bamboo Works)

The company is being investigated for anti-competitive practices and investments that have given it control of more than 60% of China’s vast online travel market

Trip.com (NASDAQ: TCOM) could be forced to end exclusivity practices and sell its investments in rivals as a result of a new anti-monopoly investigation into the company

The investigation is the latest by China’s market regulator into anti-competitive practices by some of the nation’s top internet companies

🇨🇳 Trip.com Subject of Antitrust Investigation | Potentially Faces Large Fine or Forced Change to Model (Smartkarma) $

Chinese authorities have confirmed an investigation into Trip.com (NASDAQ: TCOM) anticompetitive practices

The company could face fines of 1% – 10% of 2025 net revenue (up to US$800 mn)

A less likely outcome could be sweeping changes to the company’s business model; AVOID

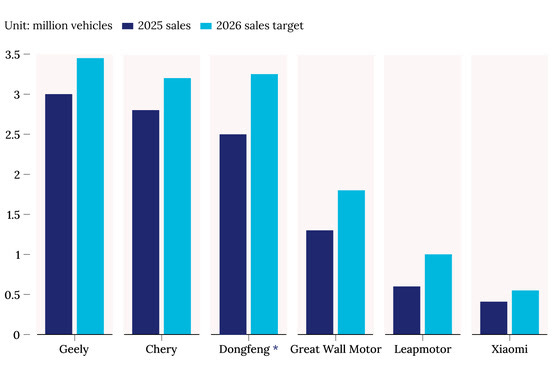

🇨🇳 Chart of the Day: Chinese Carmakers Set Ambitious 2026 Sales Targets (Caixin) $

Many Chinese carmakers are heading into 2026 with ambitious sales targets, setting the stage for fiercer competition as industry insiders anticipate a slowdown in the world’s largest auto market.

Geely Automobile Holdings (HKG: 0175), one of China’s largest privately owned carmakers, set a goal of selling 3.45 million vehicles in 2026, representing a year-on-year increase of 14%. Chery Automobile Co Ltd (HKG: 9973), the country’s top auto exporter, said that it aims to sell 3.2 million cars this year, up 14% from 2025.

🇨🇳 Automakers Brace for 2026 Cost Squeeze as Chip, Metal Prices Soar (Caixin) $

China’s automakers are heading into 2026 under mounting financial pressures as prices for key inputs — including memory chips, battery-grade lithium carbonate, copper and aluminum — continue to climb. The added burden could inflate production costs by thousands of yuan per vehicle, according to UBS Group.

Despite these rising costs, manufacturers are unlikely to pass them on to consumers due to cutthroat competition in the end market. Gong Min, head of China automotive research at UBS, said at a Wednesday media briefing that the fierce pricing environment will force automakers to absorb the increases internally.

🇨🇳 Reconditioned ZhengTong drives down new road after massive overhaul (Bamboo Works)

Caught up in price wars and a resulting sea of red ink, the former car dealership highflyer is entering a new phase after being taken over by a rival and disposing of some assets

China Zhengtong Auto Services Holding Ltd (HKG: 1728 / FRA: ZA0 / OTCMKTS: CZASF) sold industrial land in Shenzhen to an enterprise linked to its new owner, following an earlier merger with its new owner’s car dealership business

The car dealership operator has piled up cumulative losses of more than 15.1 billion yuan over the last five years as China’s car market suffers from an ongoing price war

🇨🇳 Dongfeng Motor (489 HK): Regulatory Precondition Satisfied (Smartkarma) $

Four months after the offer was announced, Dongfeng Motor Corporation has satisfied the regulatory precondition related to its Dongfeng Motor Group Co Ltd (HKG: 0489 / FRA: D4D / D4D0 / OTCMKTS: DNFGF / DNFGY) offer.

The remaining precondition is approval from the CSRC and HKEx, both of which are low-risk. The appraised value of HK$10.85 is the key point of debate.

The peers have since derated, which affects the appraised value. However, based on several methodologies, I estimate the offer is worth HK$11.51-11.55 per H Share.

🇨🇳 Luxshare-Wingtech Deal Unravels Amid Legal Wrangling Over Indian Sites (Caixin) $

Luxshare Precision Industry (SHE: 002475), a key supplier to Apple Inc., has initiated arbitration proceedings to unwind its acquisition of Indian manufacturing facilities from Wingtech Technology (SHA: 600745)., citing a government seizure of the properties that has made transferring ownership impossible.

The deal’s unraveling deepens the turmoil facing Wingtech, which is already grappling with U.S. trade restrictions and an escalating legal fight over control of its Dutch chip unit, Nexperia.

🇨🇳 In Depth: How Ruyi’s ‘LVMH of China’ Dream Unraveled (Caixin) $

Shandong Ruyi Woolen Garment Grop Co Ltd (SHE: 002193), once billed as the “LVMH of China,” is unraveling across multiple jurisdictions, as creditors chase assets overseas and regulators tighten scrutiny at home.

On Jan. 4, the Shenzhen-listed company disclosed that its shareholder count had fallen to 22,980 by the end of last year — about half its peak — while its market capitalization had shrunk to less than 1.4 billion yuan ($201 million).

🇨🇳 Anta takes aim at global big leagues with Puma bid (Bamboo Works)

China’s leading sportswear brand has reportedly offered to buy 29% of the German brand, which, if successful, could give a big boost to its global aspirations

ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) has reportedly offered to buy the 29% of Puma held by France’s Pinault family, the German sports brand’s top shareholder

A deal would add to Anta’s growing portfolio of global brands, but still could face hurdles over valuation and regulatory scrutiny

🇨🇳 Sportwear brand 361 Degrees maintains its sales tempo (Bamboo Works)

The retailer of sports shoes and athletic apparel posted double-digit growth in quarterly sales, despite broader market pressures and fragile consumer sentiment

Offline sales of the main 361 Degrees International Limited (HKG: 1361 / FRA: 36L / OTCMKTS: TSIOF) brand and the firm’s sports clothing for children rose about 10% while e-commerce sales posted brisk growth

The company pressed ahead with its rollout of super stores selling multiple ranges of performance footwear and specialized sports outfits

🇨🇳 China Tourism Group Duty Free acquiring DFS’ Macau and HK retail biz and DFS brand in Greater China for up to US$395mln (GGRAsia)

China Tourism Group Duty Free (SHA: 601888 / HKG: 1880) (CTG Duty Free) says it will acquire travel-focused luxury retailer DFS Group’s businesses in Macau and Hong Kong, as well as intangible assets encompassing the DFS brand, for exclusive use in the Greater China region.

CTG Duty Free is a Chinese state-owned travel retailing business listed in Shanghai and Hong Kong. The seven Macau DFS outlets involved in the deal are all within Macau casino resorts.

The acquisition price for the deal – funded by “internal resources” of CTG Duty Free and to be settled in cash – will “not exceed US$395 million”, according to a Tuesday filing in Hong Kong by the suitor. The deal is due to close in around two months’ time.

DFS Group is privately held, and majority owned by luxury conglomerate LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF), alongside DFS co-founder and shareholder Robert Miller.

🇨🇳 After Profits Cool, Haidilao Hot Pot Founder Brought Back to Turn Up the Heat (Caixin) $

Zhang Yong, founder of Haidilao International Holding (HKG: 6862 / FRA: 8HI / OTCMKTS: HDALF), has resumed his role as chief executive officer of the popular hot pot chain, returning to the operational helm to navigate a strategic overhaul as earnings flag and China’s dining sector cools.

The leadership shake-up, announced late Tuesday, signals what insiders call a “second revolution” for the Hong Kong-listed company. Zhang aims to revive profitability through an accelerated rollout of the “Red Pomegranate Plan,” an initiative launched in 2024 to develop new restaurant brands beyond hot pot. While Zhang has in recent years focused on high-level strategy, sources familiar with the matter said his return is meant to quicken decision-making during a pivotal transition.

🇨🇳 InSilico lands drug discovery deal after Hong Kong IPO (Bamboo Works)

The developer of AI-enabled drugs could get up to $888 million from the new deal but, without any viable products yet, its revenues rely on partner payments

The company’s Hong Kong IPO late last year attracted pharmaceutical giants, technology titans, sovereign wealth funds and big asset managers, attracted by the promise of accelerated drug development using AI

Insilico Medicine Cayman TopCo (HKG: 3696)’s core candidate drug for lung disease can boast one of the world’s fastest rates of progress for an AI-powered discovery

🇭🇰 Global Funds Flow Back to Hong Kong as Appetite for Chinese IPOs Grows (Caixin) $

More than half of the long-term global capital that exited Hong Kong’s stock market in recent years has now returned, according to a senior Goldman Sachs executive, in a sign that renewed IPO activity and a fresh appetite for Chinese assets are helping to outweigh lingering geopolitical concerns.

The shift could eventually see up to 70% of the capital withdrawn capital flow back, as international investors chase returns from Chinese technology firms that are ramping up fundraising efforts, the Wall Street bank said.

🇲🇴 Citigroup’s January Macau casino survey sees 72pct year-on-year rise in bet volume by ‘whales’ (GGRAsia)

Banking institution Citigroup reported a 72.3 percent year-on-year increase in the observed volume of betting by ‘whales’ – high-value players – in the Macau casino market, in its January table survey.

Citi also reported a 16.7-percent rise in the number of such big players witnessed this time, from 24 to 28.

Macau government data issued on Friday showed gross gaming revenue for VIP baccarat – a traditional play format for ‘whales’ – went up circa 20 percent sequentially in the fourth quarter, and rose 3.7 percentage points in terms of market share of GGR, to 30.7 percent.

🇲🇴 Macau VIP GGR growth to slow dramatically in 2026, with mass speeding up: Jefferies (GGRAsia)

Brokerage Jefferies Hong Kong Ltd expects year-on-year growth in Macau mass-market gross gaming revenue (GGR) to speed to 6.6 percent in 2026, compared to its calculated 4.3 percent growth in 2025. It gave the estimate in a Tuesday note.

The institution thinks VIP GGR growth will slow from 24.1 percent year-on-year in 2025 to 2.0 percent in 2026.

That would put mass GGR for 2026 at just over MOP191.26 billion (US$23.82 billion) and VIP GGR at just above MOP69.34 billion.

Banking institution Citigroup recently reported a 72.3 percent year-on-year increase in the observed volume of betting by ‘whales’ – high-value players – in the Macau casino market, in its January table survey.

🇲🇴 Macau 2026 EBITDA growth likely steady, but parent-firm projects, shareholder payouts weigh on op cashflow: S&P Global (GGRAsia)

While the Macau gaming sector should see “steady” growth in 2026 earnings before interest, taxation, depreciation and amortisation (EBITDA), “heavy capital spending and shareholder payouts” could weigh on cash flow of casino operators there, suggests S&P Global Ratings.

The institution’s rated issuers in context of the Macau industry are Melco Resorts (Macau) Ltd (Melco International (HKG: 0200 / FRA: MX7A / OTCMKTS: MDEVF) / Melco Resorts & Entertainment Ltd (NASDAQ: MLCO)); Studio City Co Ltd; Wynn Resorts Ltd (NASDAQ: WYNN); Las Vegas Sands (NYSE: LVS), and MGM Resorts International (NYSE: MGM).

Of these operators, only Las Vegas Sands – parent of Macau operator Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) – has returned to S&P Global’s pre-pandemic rating level of “BBB-”, with ‘stable’ outlook.

🇲🇴 JP Morgan cuts Macau-market 2026 adjusted EBITDA forecast, citing play mix and operating costs (GGRAsia)

Macau casino gross gaming revenue (GGR) had since June “topped even the most bullish expectations every quarter,” but operator “margins … haven’t,” says a Friday note from banking group JP Morgan.

“We still think GGR recovery has legs this year, but our confidence in the profit upcycle has dimmed,” stated analysts DS Kim, Selina Li, and Lindsey Qian.

The institution has trimmed to MOP71.9 billion (US$8.95 billion) its forecast for full-year 2026 industry adjusted earnings before interest, taxation, depreciation, and amortisation (EBITDA) for the city’s six operators.

🇲🇴 SJM group completes offering of US$540mln senior notes (GGRAsia)

Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) has completed a previously-announced offering to investors, issuing US$540-million in senior unsecured notes, according to a Thursday filing to the Hong Kong Stock Exchange (HKEX).

The notes carry a yearly interest rate of 6.500 percent, and mature in January 2031.

The issuance – via a wholly-owned subsidiary, SJM International Ltd – would “extend the maturity profile of the group’s indebtedness and enhance the group’s financial flexibility”, said SJM Holdings last week, when it announced the offering.

The casino firm has also confirmed the listing of the U.S.-dollar denominated notes on the HKEX.

🇹🇼 How Taiwan Made Cashless Payments Cute (Wired) $ 🗃️

Taiwan’s digital payment infrastructure is tactile, decentralized, and completely distinct from China’s QR code-dominated model.

At a 7-Eleven convenience store (President Chain Store Corporation (TPE: 2912)) in Taiwan, you can pick up a 4-inch plushie of Miffy, the bunny character from the Netherlands, a mini bento box charm complete with a realistic chicken drumstick, or a tiny plastic rotary phone. Produced by iCash Corporation (a 7-Eleven affiliate), these keychains are more than just trinkets: Each contains a contactless chip that connects it to Taiwan’s elaborate stored-value payment system.

iCash cards, along with those made by competitors like EasyCard and iPASS, can be used to ride the subway and buses, as well as to make purchases at convenience stores and other retailers in Taiwan. The over-the-top branded keychains, which cost anywhere from $10 to over $30, generate modest direct sales. But their real value lies in their marketing power, drawing shoppers deeper into 7-Eleven’s rewards ecosystem and keeping small payments inside its orbit.

🇹🇼 US and Taiwan strike trade deal tied to $250bn chip investment (FT) $ 🗃️

🇹🇼 Taiwan Dual-Listings Monitor: TSMC Beat Drives Spread Surge; UMC Sharp Headroom Decline (Smartkarma) $

🇹🇼 HonPrecision (7769 TT): TWSE Listing & Stock Run-Up Leads to Double Index Inclusion (Smartkarma) $

HonPrecision Inc (TPE: 7769) should be added to a global index in February and then to a country index in March.

Following the run-up in the stock, Hon Precision (7769 TT) now trades at a higher forward EV/EBITDA and forward PE compared to the average and median of its peer group.

While there has been an increase in positioning, we see a similar trend in peers. The rally could have legs for a while longer.

🇹🇼 Taiwan Semiconductor: The Joule Advantage Through The N2 Super-Cycle (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Why I’m Downgrading After The Company’s Best Quarter Ever (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Strong Buy: The AI Supercycle Is Outrunning Chip Supply (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor: Soaring To New All-Time Highs (Seeking Alpha) $ 🗃️

🇹🇼 AI Is Endless, And TSMC’s Upside Still Isn’t Fully Priced In (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Knocks It Out Of The Park With Q4 2025 Earnings (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Big Q4 Fuels A Global AI Chip Rally, Lifting My Price Target (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Set For New All-Time Highs (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor’s Q4 Earnings Should Ignite Rally Continuation (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor Manufacturing Company Limited 2025 Q4 – Results – Earnings Call Presentation (Seeking Alpha)

🇹🇼 Taiwan Semiconductor: Another Blowout Earnings Look Inevitable (Seeking Alpha) $ 🗃️

🇹🇼 TSMC Results: Leading-Edge Nodes Push Margins and Growth Above 2026E Market Assumptions (Smartkarma) $

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM): 4Q25 Results and Guidance Point to 2026E Margins and Revenue Ahead of Consensus

Management expects AI accelerator revenue to remain strong and compound at a mid-to-high-50% CAGR through 2029E. This growth is complemented by resilient demand for high-end smartphone chips.

Structural Long: We estimate that TSMC’s guidance implies roughly a 10% uplift required for current 2026E consensus earnings and an all-time high margins outlook.

🇹🇼 TSMC (2330 TT) Tactical Outlook AFTER January Earnings (Smartkarma) $

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) released its Fourth Quarter 2025 earnings on January 15, 2026. Strong results, no significant news.

The stock is incredibly overbought – this insight is an update to our insight published on Dec 30th. We discuss the stock’s most likely trajectory for the next few weeks.

The general outlook remains bullish but the short-term tacticals suggest the stock is overdue for a pullback and the pullback can be bought.

🇹🇼 Taiwan Semiconductor Manufacturing Company: AI (Smartkarma) $

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) delivered a mixed set of results in its fourth quarter of 2025 and provided an outlook for the first quarter of 2026.

On the positive side, TSMC reported a sequential increase in revenue and gross margin in the fourth quarter supported by strong demand for its leading-edge process technologies.

The revenue in US dollar terms grew by 1.9% to NT$33.7 billion, slightly beating their guidance.

🇰🇷 Grand Korea Leisure says ‘rumour’ it’s to build a Seoul casino resort, and ‘no specific decisions made’ (GGRAsia)

Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, said in a Tuesday filing that “no specific decisions have been made” regarding what it termed a “project” that had been reported in the country’s media.

The Korea Economic Daily had published a Monday story headlined: “GKL to build a casino resort in Seoul.”

In its Tuesday statement to the Korea Exchange, Grand Korea Leisure described the report as “rumours” that were “unconfirmed”.

The company said, without specifically referring to Seoul, the country’s capital: “Currently, the company is preparing to apply for a preliminary feasibility study with the Ministry of Economy and Finance regarding securing its own business site.

“No specific decisions have been made regarding this project.”

🇰🇷 Hanwha Corp: Creation of Two Separate Holding Companies & Cancellation of 5.9% of Outstanding Shares (Douglas Research Insights) $

On 14 January, Hanwha Corporation (KRX: 000880 / 00088K) announced that it will create two separate holding companies for the Hanwha Group – Hanwha Corp and Hanwha Machinery & Service Holdings.

Hanwha Corp will also cancel 4.45 million treasury shares (5.9% of outstanding shares) to improve shareholder value.

We have raised our NAV valuation of Hanwha Corp. Our upgraded NAV analysis of Hanwha Corp is target price of 204,800 won per share (up 63% from current price).

🇰🇷 Hyundai Motor Preferred – Time to Catch Up to Common Shares (Douglas Research Insights) $

In this insight, we argue how the gap between Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) (common) and Hyundai Motor (005385 KS) (preferred) shares has widened too much.

It is time for Hyundai Motor (005385 KS) (preferred) shares to catch up to its common shares. Price ratio of preferred/common shares has exceeded 2 standard deviations (3 months).

The biggest driver of higher share price performance of Hyundai Motor in the past three months has been the tremendous positive sentiment from the Atlas robots made by Boston Dynamics.

🇰🇷 LS Corp – Pushing to Allocate IPO Shares of Essex Solutions to Existing LS Corp Shareholders (Douglas Research Insights) $

Simultaneous to the IPO of Essex Solutions, LS Corp (KRX: 006260) is also pushing to reforms that would allocate IPO shares of Essex Solutions to the existing shareholders of LS Corp.

Although this has not been formally approved by the Korean financial authorities, we believe there is a high probability of being approved.

Overall, we believe this is likely to positively impact LS Corp in the coming weeks.

🇰🇷 F&F – To Sell Its Stake in TaylorMade to Buy Canada Goose? (Douglas Research Insights) $

The M&A of TaylorMade is coming to a conclusion in the next few weeks. Old Tom Capital (US) so far has submitted the highest bid at about 4.4 trillion won.

F&F Co (KRX: 383220) could sell its stake in TaylorMade to Old Tom Capital at higher than 4 trillion won, which could result in cash inflow of nearly 1 trillion won for F&F

From this stake sale, one of the emerging scenarios is for F&F to potentially acquire the controlling stake in Canada Goose.

🇰🇷 Dongwon Group: Getting Ready to Bid for Controlling Stake in HMM + New Arctic/Greenland Sea Routes? (Douglas Research Insights) $

There are credible signs that the Dongwon Group is getting ready to bid for a controlling stake in HMM (KRX: 011200).

If the StarKist sale is completed, Dongwon Industries (KRX: 006040) could gain an additional 2 trillion won in cash.

The increasing commercial feasibility of conducting container shipping through the new North Sea Arctic and Greenland seas could provide new long-term revenues/lower costs for HMM (011200 KS).

🇰🇷 SK Telecom’s Investment in Anthropic – A Huge Homerun (Douglas Research Insights) $

Founded in 2021, Anthropic has rapidly become one of the most important companies in the global generative AI market.

In early 2026, Anthropic’s valuation has surged to US$350 billion. In August 2023, SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) announced a US$100 million investment in Anthropic valuing the company at around US$5 billion.

At the current valuation of US$350 billion for Anthropic, a 2% stake would be worth about US$7 billion (10 trillion), representing 79% of SK Telecom’s market cap.

🇰🇷 KEPCO – Four Major Reasons for Surging Share Price (Douglas Research Insights) $

KEPCO (NYSE: KEP / KRX: 015760 / FRA: KOP)’s share price is up 215% in the past one year, outperforming KOSPI which is up 94% in the same period.

We provide four major reasons for KEPCO’s surging share price in the past year including higher electricity demand from AI data centers, corporate governance reforms, and increased nuclear power generation.

Plus, there have been increased talks about a potential merger of its five power generation subsidiaries which may have contributed to KEPCO’s 16% share price rise today.

🇰🇷 A Second Tender Offer of Rothwell International by Trillion Luck Group (Douglas Research Insights) $

On 20 January, Trillion Luck Group announced a second tender offer of Rothwell International Co Ltd (KOSDAQ: 900260) for the remaining shares with the aim of delisting the company.

Under this second tender offer, Trillion Luck Group plans to acquire approximately 15.5% stake in Rothwell International through this second tender offer.

The company had 213 billion won in net cash at the end of 3Q 2025, representing 292% of its market cap (73 billion won).

🇰🇷 K Bank IPO Valuation Analysis (Key Beneficiary of Stablecoin Expansion in Korea) (Douglas Research Insights) $

Our base case valuation of K Bank is target price of 11,986 won per share, which is 26% higher than the high end of the IPO price range.

A key reason why we have chosen a 30% premium valuation multiple (P/B of 2.0x) is mainly due to increasing positive sentiment from the stablecoin business.

BOK and other key financial authorities have been debating how to regulate stablecoins with proposals favoring bank-led stablecoin consortia which could favor licensed banks such as KakaoBank (KRX: 323410) and K Bank.

🇰🇷 K Bank IPO Preview (Third Try Is a Charm?) (Douglas Research Insights) $

K Bank is getting ready to complete its IPO on the KOSPI exchange in February 2026. This is the company’s third attempt at an IPO in the past several years.

The IPO price range is from 8,300 won to 9,500 won, resulting in an offering value of approximately 498 billion to 570 billion won.

The expected market caps range from 3.4 trillion won to 3.9 trillion won which are lower than the previous market cap range of 4.0 trillion won to 5.0 trillion won.

🇵🇭 Philippines’ pro-tourism policies should bring growth in 2026: Maybank (GGRAsia)

Pro-tourism policies by the Philippines government “should provide growth” for the sector this year, suggests a Thursday report from Maybank Securities Inc.

Favourable factors would include the expansion of the country’s electronic visa (e-Visa) programme, which currently covers 12 nationalities. Chinese and Indian nationals had joined the list with effect from November 2025, and this would have the impact of “back-loading gains into early 2026,” wrote Maybank analyst Ronalyn Joyce Lalimo.

Separately, a value-added-tax refund scheme – expected to be in place by late 2026 – could add PHP8.6 billion (US$144.8 million) to PHP12.8 billion per year, “and lift retail spending,” she added.

🇸🇬 LVS ‘powers ahead’ in Singapore but all Macau ops face cost pressures: Seaport (GGRAsia)

The Singapore casino operation of Las Vegas Sands (NYSE: LVS) “powers ahead”, and while Macau gaming operators have seen growth in top-line performance, their costs in the fourth quarter have escalated, says an earnings preview from Seaport Research Partners.

Senior analyst Vitaly Umansky wrote in a Wednesday memo that Las Vegas Sands, “should benefit from both Macau growth (Sands China) and from its dominant Singapore market position in the long run”.

A recent note from Citigroup mentioned cost pressures faced by Macau operators.

In his memo, Seaport’s Mr Umansky highlighted the benefits of Las Vegas Sands’ Asia-Pacific diversification via its Singapore property Marina Bay Sands (pictured).

🇸🇬 Resorts World Sentosa CEO says it ‘takes time to rebuild’ the property’s appeal and results (GGRAsia)

The bulk of the disruptive renovation work at Singapore’s casino complex Resorts World Sentosa (Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY)) has now been completed, and management’s focus is on rebuilding business and performance. That is according to Lee Shi Ruh (pictured), chief executive of Resorts World at Sentosa Pte Ltd, the operating entity of Singapore’s Resorts World Sentosa casino resort.

The firm is in the midst of implementing a multi-year expansion of Resorts World Sentosa, an initiative also known as ‘RWS 2.0’. It represents a total investment of about SGD6.80 billion (US$5.28 billion at current rates).

In November 2024, the company broke ground for a new waterfront development at the complex. The firm expects the expansion to be completed in 2030.

🇸🇬 Wave Life Sciences Ltd. (WVE) Presents at 44th Annual J.P. Morgan Healthcare Conference – Slideshow (Seeking Alpha)

🇸🇬 2026 Singapore IPO Outlook: Top SGX Debuts and Market Trends (The Smart Investor)

Singapore’s IPO market has rebounded in 2025 — here are the key trends shaping the SGX and the standout debuts from Centurion Accommodation REIT, NTT DC REIT, Coliwoo, and Info-Tech Systems during the year.

What’s in store for 2026? We may get some clues from 2025’s IPO debuts.

Centurion Accommodation REIT (SGX: 8C8U)

Centurion Accommodation REIT (SGX: 8C8U) or CAREIT has carved out a niche as the first pure play, purpose-built worker and student accommodation REIT to be listed on the SGX.

NTT DC REIT (SGX: NTDU)

NTT DC REIT (SGX: NTDU) went public in July 2025, with strong financial backing from Japan’s NTT Group (TYO: 9432).

The IPO portfolio comprised six data centres valued at US$1.6 billion, with a presence in the United States, Austria and Singapore, and has an occupancy rate of 94.3%.5

Coliwoo Holdings (SGX: W8W)

Coliwoo (SGX: W8W) is a leading co-living space provider in Singapore, with over 2,900 rooms in high-demand residential clusters, of which over 95% are occupied.7

Info-Tech Systems (SGX: ITS)

What These 2025 IPOs Mean for the SGX

Get Smart: Cautious optimism

🇸🇬 3 Blue Chip Stocks That Could Benefit From the SGX Tie-Up With Nasdaq (The Smart Investor)

With Singapore’s upcoming landmark SGX-Nasdaq dual-listing bridge, the long-awaited moment to uplift quality Singapore stocks could be right around the corner, benefiting investors who positioned early.

Here are three Singapore dividend stocks that could benefit from this new cross-border arrangement.

Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY) – The Direct Beneficiary

SGX isn’t just a beneficiary of the SGX-Nasdaq tie-up – it is part of the tie-up.

As the sole integrated securities and derivatives exchange operator in Singapore, SGX runs a diversified, multi-asset marketplace spanning the entire trading lifecycle.

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF) or ST Engineering – The Global Compounder

STE operates globally across diversified sectors in Commercial Aerospace, Defence & Public Security, and Urban Solutions & Satcom (satellite communications).

Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF) – The Tech Value Play

Venture stands out from other traditional electronics manufacturing services (EMS) providers with its “EMS++” strategy, excelling in high-mix, complex manufacturing processes.

What This Means for Investors

Get Smart: Move Early

🇸🇬 The $20 Question: If You Didn’t Buy OCBC at $15, Should You Buy It Now? (The Smart Investor)

Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) shares have surged from $15 levels. Is it still worthwhile to buy now, or has the opportunity already passed for investors?

Introduction: The Question Every Investor Is Asking

Overseas-Chinese Banking Corporation Today: What Are You Really Buying?

Valuation Check: Cheap, Fair, or Fully Valued?

The Real Risk: Buying for the Wrong Reason

When Buying Now Could Still Make Sense

When It Might Be Better to Wait

Conclusion – Get Smart: The Right Question Is Not “What If”

🇸🇬 UOB vs OCBC: Which Singapore Bank Offers the Better Dividend Deal in 2026? (The Smart Investor)

UOB and OCBC are among Singapore’s most reliable dividend banks. With interest rates expected to fall in 2026, we compare their yield potential, earnings outlook, and payout strength to see which bank currently offers a more compelling dividend profile.

Interest rates are easing, net interest margins are no longer expanding, and the easy gains from higher rates are behind us.

That shift has prompted a more important question: can United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, and Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY), better known as OCBC, continue paying attractive dividends when conditions are no longer working in their favour?

Dividend track record: consistency versus flexibility

Dividend yield comparison for 2026

Earnings outlook as rates fall

Earnings Outlook: Can Dividends Be Sustained as Rates Fall?

Balance Sheet Strength and Capital Buffers

Get Smart: Dividends Depend on More Than Just Yield

🇸🇬 Are Singapore Bank Stocks Still Worth Buying at All-Time Highs? (The Smart Investor)

As Singapore’s big three banks continue climbing, do their dividends justify buying at all-time highs?

As of last Friday, shares of DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) and Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) were within touching distance of their all-time highs.

The Earnings Picture is Shifting

Dividends Remain Attractive

The Waiting Game has Costs Too

Get Smart: Have the Right Expectations

🇸🇬 This Dividend Stock Just Surprised With a Payout Hike — Is It Too Late to Buy? (The Smart Investor)

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) just raised its dividend — but with aviation uncertainty, the key question remains: is that bump already priced in or is the income story still intact?

Understanding SATS: Business Model and Why Dividend Policy Matters

The Payout Upgrade: What Changed and What It Signals

What the Dividend Hike Actually Means (and What It Doesn’t)

Is It Too Late to Buy? A Reality Check on Valuation and Expectations

What to Watch Before Buying: Key Risk Factors & What to Monitor

Get Smart: A 33% Dividend Hike Does Not Mean It’s an Automatic Buy

🇸🇬 SIA’s Share Price Is Flat — But Is There More Upside Ahead? (The Smart Investor)

Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF)’ latest results show resilient passenger demand, and with a higher share price, investors are now weighing earnings quality against longer-term growth potential.

In this article, we take a look under the hood of SIA’s latest earnings to examine how the airline is doing, and if you should consider adding this blue chip to your portfolio.

Revenue Growth Masks a Sharp Profit Decline

Air India Losses Take Centre Stage

Passenger Demand Remains Strong, But Yields Are Under Pressure

A Strong Balance Sheet Still Provides Cushion

Dividends Reflect a More Cautious Phase

What Could Influence the Next Leg for the Share Price

What This Means for Investors

Get Smart: Recovery Is No Longer the Only Story

🇸🇬 Are Singapore REITs Ready to Soar as Rates Fall? (The Smart Investor)

With interest rates expected to decline in 2025 and 2026, investors are asking whether Singapore REITs are set for a major rebound. We break down the opportunities, risks, and what falling rates could mean for distributions and valuations.

Why REITs Struggled During the High-Rate Cycle

Since 2022, Singapore REITs have been fighting an uphill battle, and it wasn’t because their properties suddenly became bad assets.

The problem was simple and relentless: interest rates stayed higher for longer.

You can see this clearly in names like Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF), or FLCT, a REIT that focuses on logistics and industrial properties.

Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, held up better operationally than the headline numbers suggest, but the high-rate and strong-SGD backdrop still left a mark on distributions.

How Falling Rates Improve the Outlook for REITs

What Investors Should Monitor as Rates Fall

Get Smart: Rate Cuts Could Renew REIT Momentum

🇸🇬 Beyond Blue Chips: 3 Singapore Stocks Offering Better Dividend Yields than The STI (The Smart Investor)

The STI yields about 3.7%, but these three Singapore stocks offer higher dividend yields for income investors willing to look beyond blue chips.

By venturing just a step beyond the Straits Times Index (SGX: ^STI), you can find businesses with the cash flow and resilience to supercharge your dividend portfolio.

🇸🇬 4 Blue-Chip Stocks That Have Quietly Beaten The STI (The Smart Investor)

🇸🇬 Singtel’s Turnaround: Can the Stock Finally Break Out in 2026? (The Smart Investor)

Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel’s latest results show rising profits, stronger dividends, and improving balance sheet strength. The key question now is whether these gains mark a genuine turnaround that can finally translate into sustained share price momentum in 2026.

In this article, let’s take a deeper look at the group’s latest results — and see if Singtel’s improving fundamentals could finally herald a shift in market perception.

Profit Growth Despite Currency Headwinds

NCS Emerges as a Key Growth Engine

Optus and Core Telco Operations Stabilise

Associates Provide a Powerful Earnings Boost

Dividend Growth Signals Confidence

Balance Sheet Strength Continues to Improve

What Could Unlock a Share Price Breakout

What This Means for Investors

Get Smart: Turnarounds Take Time to Be Recognised

🇸🇬 3 Dividend Stocks Beating Inflation With Yields Above 5% (The Smart Investor)

A dividend yield above 5% can beat inflation, but only when payouts are backed by strong cash flow, resilient businesses, and sustainable fundamentals.

QAF Ltd (SGX: Q01)

QAF Limited (QAF) is a leading food company with core businesses spanning bakeries, distribution, and warehousing.

The company’s operations and distribution network are spread across the Asia-Pacific, including Singapore, Malaysia, Indonesia and Australia.

ComfortDelGro Corporation (SGX: C52 / FRA: VZ1 / VZ10 / OTCMKTS: CDGLF / CDGLY)

ComfortDelGro is a leading transport operator that provides both public and private transportation services.

It has business operations across 13 countries, including Singapore, the United Kingdom, Australia, China, and more.

Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF)

Founded in 1989, Venture is a provider of technology services, products and solutions.

Headquartered in Singapore, Venture’s footprint spreads across over 30 countries.

Get Smart: Quality dividend stocks are here for investors to pick up

🇸🇬 This Unassuming Singapore Stock Could Fund Your Retirement Income (The Smart Investor)

A 72.9% market share, a 70% payout ratio, and S$21.7 million in net cash – this unassuming Singapore stock has the makings of a retirement income compounder.

Let’s examine whether Vicom Ltd (SGX: WJP) can deliver the steady income that retirement portfolios demand.

🇮🇳 Can India be luxury’s next big thing? (FT) $ 🗃️

Slowing demand in China has pushed brands to seek pockets of growth in new markets

But India remains difficult to develop due to logistical challenges, a lack of luxury shopping malls and the tendency of wealthy Indians to travel to Dubai, Singapore or countries in Europe to shop, according to industry experts. High customs duties and bureaucracy have also slowed growth.

Luxury sales across all emerging markets — spanning Latin America, the Middle East, south-east Asia including India, and Africa — are equivalent to the €40bn to €45bn in sales China is expected to have generated in 2025, according to consultancy Bain & Co.

🇮🇳 ICICI Bank Limited 2026 Q3 – Results – Earnings Call Presentation (Seeking Alpha)

🇮🇳 Infosys: Rating Upgrade As Potential For Growth To Accelerate Has Gone Up (Seeking Alpha) $ 🗃️

🇮🇳 Infosys: Still A Quality Name, Still Fully Valued (Seeking Alpha) $ 🗃️

🇮🇳 HDFC Bank: A Mixed View Of Business Update And Earnings Preview (Seeking Alpha) $ 🗃️

🇮🇳 Lemon Tree Hotels Demerger: Separating Growth Engines for Better Valuation Visibility (Smartkarma) $

Lemon Tree Hotels (NSE: LEMONTREE / BOM: 541233) has announced a demerger to separate its asset-light hotel management business from its asset-heavy hotel ownership platform, alongside a strategic investment by Warburg Pincus.

The demerger creates two focused platforms with distinct capital structures, growth paths, and valuation frameworks.

By transitioning to a dual-platform structure, It positions itself for clearer earnings visibility, potential valuation re-rating, and more efficient growth execution across both management-led and asset-backed hospitality businesses.

🇮🇳 IDFC First Bank: Transformation & Way Forward (Smartkarma) $

(IDFC First Bank (NSE: IDFCFIRSTB / BOM: 539437))

The narrative is no longer about survival or structure; it is about the monetization of a 35-million-strong customer base, positioning bank to deliver a high-quality 1.1%–1.2% RoA trajectory by FY27.

High-Cost legacy debt (8-9%) is being replaced by granular retail deposits. With a 60-65% fixed-rate loan book, the bank is uniquely positioned to benefit from a late-2026 rate-cut cycle.

As credit costs normalize to 1.8% and the “investment phase” opex cools, IDFC First is transitioning from a “growth-at-all-costs” startup to an efficiency-led institutional giant.

🇮🇳 Eternal (ETERNAL IN): Foreign Selling Will Lead to Large Passive Buying (Smartkarma) $

Foreign investors sold shares in Eternal Ltd (NSE: ETERNAL / BOM: 543320) (Formerly Zomato Limited (NSE: ZOMATO / BSE: ZOMATO)) in the last quarter of 2025. The increase in foreign room should result in buying from global index trackers in February.

Estimated passive buying is 214m shares (US$700m; 7.8x ADV; 13.5x delivery volume) and there appears to be minimal positioning in the stock.

Eternal (ETERNAL IN) has outperformed Swiggy Ltd (NSE: SWIGGY / BOM: 544285) in the last week and that could continue over the near-term.

🇮🇳 Emmvee: Accelerating the Next Growth Phase Through TOPCon Technology and Capacity Expansion (Smartkarma) $

Emmvee Photovoltaic Power Ltd (NSE: EMMVEE / BOM: 544608) is entering a high-growth phase, anchored by aggressive TOPCon capacity expansion, deeper integration, and rising domestic-content demand across utility-scale, C&I, and government-backed solar projects.

As India’s solar manufacturing cycle matures, scale, technology leadership, and execution discipline will determine winners, positioning Emmvee to outperform as weaker, under-integrated players face margin pressure.

With cell capacity targeted at ~8.9 GW and module capacity at ~16.3 GW by FY28, Emmvee is well placed to compound earnings beyond the current policy-driven solar upcycle.

🇮🇳 Amagi Media Labs Limited IPO Analysis (Smartkarma) $

Amagi Media Labs (1232899D IN) Amagi is a global SaaS leader providing cloud-native “glass-to-glass” solutions for content creation, distribution, and monetization across diverse media and streaming platforms.

The company serves over 400 content providers and 300 distributors globally, maintaining strong relationships with top-tier media and entertainment entities.

By leveraging AI-driven capabilities and achieving a turn to profitability in H1FY26, Amagi is strategically positioned to capitalize on structural shifts in streaming

🇮🇳 Smartworks: Can India’s Largest Managed Office Platform Turn Pat Positive in Q3FY26? (Smartkarma) $

Smartworks Coworking Spaces Ltd (NSE: SMARTWORKS / BOM: 544447) is India’s largest managed office platform with a 40% CAGR, yet high finance costs and IND-AS depreciation have historically hindered its net profitability.

In Q2FY26, the company achieved INR 425 crore revenue with a 16.4% EBITDA margin and maintained 88% occupancy across its mature operational office centers.

Profitability is expected from Q3FY26 due to reduced debt interest from IPO proceeds, operational leverage, and the maturation of 1.4 million square feet.

🇮🇳 Shadowfax IPO: Powering the Next Phase of India’s Delivery Growth (Smartkarma) $

Shadowfax is entering public markets with a INR 1,907.27 crore IPO, offering investors exposure to a scaled, technology-led, asset-light logistics platform aligned with India’s fast-growing digital commerce ecosystem.

The company operates at the intersection of e-commerce, quick commerce, and on-demand delivery, where speed, flexibility, and cost-efficient last-mile execution are increasingly critical for enterprise clients.

Shadowfax offers a scalable logistics platform with strong volume momentum; however, long-term investment appeal will depend on margin sustainability, competitive positioning, and disciplined execution post listing.

🇮🇱 Teva Is No Longer A Turnaround Story; It’s A Growth One (Seeking Alpha) $ 🗃️

🇮🇱 Teva Pharmaceutical Industries Limited (TEVA) Presents at 44th Annual J.P. Morgan Healthcare Conference – Slideshow (Seeking Alpha)

🇮🇱 Mobileye: A High-Growth Tech Leader Trading At A Bargain Price (Seeking Alpha) $ 🗃️

🇿🇼 Caledonia Mining: Fundamental Position Weakening As Gold Continues Ascent (Seeking Alpha) $ 🗃️

🌎 The LatAm Election Season Starts Soon; Thoughts on Gran Colombia, Populist Measures, and EM debt (TheOldEconomy Substack)

The first two weeks of 2026 didn’t fail to disappoint Latin American analysts and investors. Venezuela-US relations entered a new phase after Maduro’s extraction; Argentina paid its swap line debt; Gustavo Petro announced his aspirations for Gran Colombia. And those are just a few examples of the present dynamics.

As you can see, 2026 starts strong for EM debt.

This matters not only for Colombia but for the EM theme as a whole. Recovering trust means investors start to see not only the downside risk associated with EMs but also their upside potential. This is good news for LatAm degens like me because strong credit markets lead to robust equity markets.

🇦🇷 Lithium Argentina: Solidifying Foundations, But The Market Has Already Priced It In (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇦🇷 YPF Sociedad Anonima: An Asymmetric Energy Play Tied To Argentina’s Normalization (Seeking Alpha) $ 🗃️

-

🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇦🇷 Pampa Energía: How Cheaper Oil And Venezuelan Supply Could Affect Its Operations (Seeking Alpha) $ 🗃️

🇧🇷 Ambev: Valuation And Dividend Yield Remain Compelling Despite Near-Term Pressure (Seeking Alpha) $ 🗃️

🇧🇷 Sigma Lithium: Danger, Will Robinson (Downgrade To Sell) (Seeking Alpha) $ 🗃️

🇧🇷 Companhia Siderúrgica Nacional (SID) Shareholder/Analyst Call – Slideshow (Seeking Alpha)

🇨🇴 The Slow Destruction Of Colombia’s Ecopetrol (Seeking Alpha) $ 🗃️

-

🇨🇴🏛️ Ecopetrol SA (NYSE: EC) – Organized under the form of a public limited company, of the national order, linked to the Ministry of Mines & Energy. Mixed economy company of an integrated commercial nature in the oil & gas sector. 🇼 🏷️

🇲🇽 Coca-Cola FEMSA: Reasonable Price, Solid Yield, And Venezuela Upside (Seeking Alpha) $ 🗃️

🇵🇦 First Quantum backs Panama’s plan to allow stockpile processing at shut copper mine (Reuters)

Canadian miner First Quantum Minerals Ltd (TSE: FM / FRA: IZ1 / OTCMKTS: FQVLF) on Thursday welcomed Panama President Jose Raul Mulino’s plan, announced early this month, to allow the removal and processing of stockpiled ore at its shuttered Cobre Panama copper mine.

The company said processing of the ore stockpiles will allow it to mitigate the environmental and operational risks associated with acid rock drainage and ensure a supply of feed material to the leftover, or tailings, management facility.

The Cobre Panama mine, one of the world’s largest open-pit copper deposits, was closed in 2023 following protests from local residents over tax contributions and environmental impacts.

The processing of stockpiles does not constitute reopening the mine, and will not require any new extraction, drilling or blasting, the company said in a statement.

🇻🇪 Hedge Funds Get Ready for the ‘Donroe Doctrine’ Trade (WSJ) 🗃️

🌐 Nebius: How Microsoft And Meta Deals Are Powering AI Expansion (Seeking Alpha) $ 🗃️

🌐 Nebius: Why I’m Flipping To Sell As Hidden Risks Catch Up (Seeking Alpha) $ 🗃️

🌐 Nebius Is Entering The Hardest Phase (Seeking Alpha) $ 🗃️

🌐 Nebius: Don’t Miss It While It’s Cheap (Seeking Alpha) $ 🗃️

🌐 Nebius: The Bottom May Be In – But When Do We Sell? (Technical Analysis) (Seeking Alpha) $ 🗃️

🌐 Nebius: Why This Stock Is My Largest Holding (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

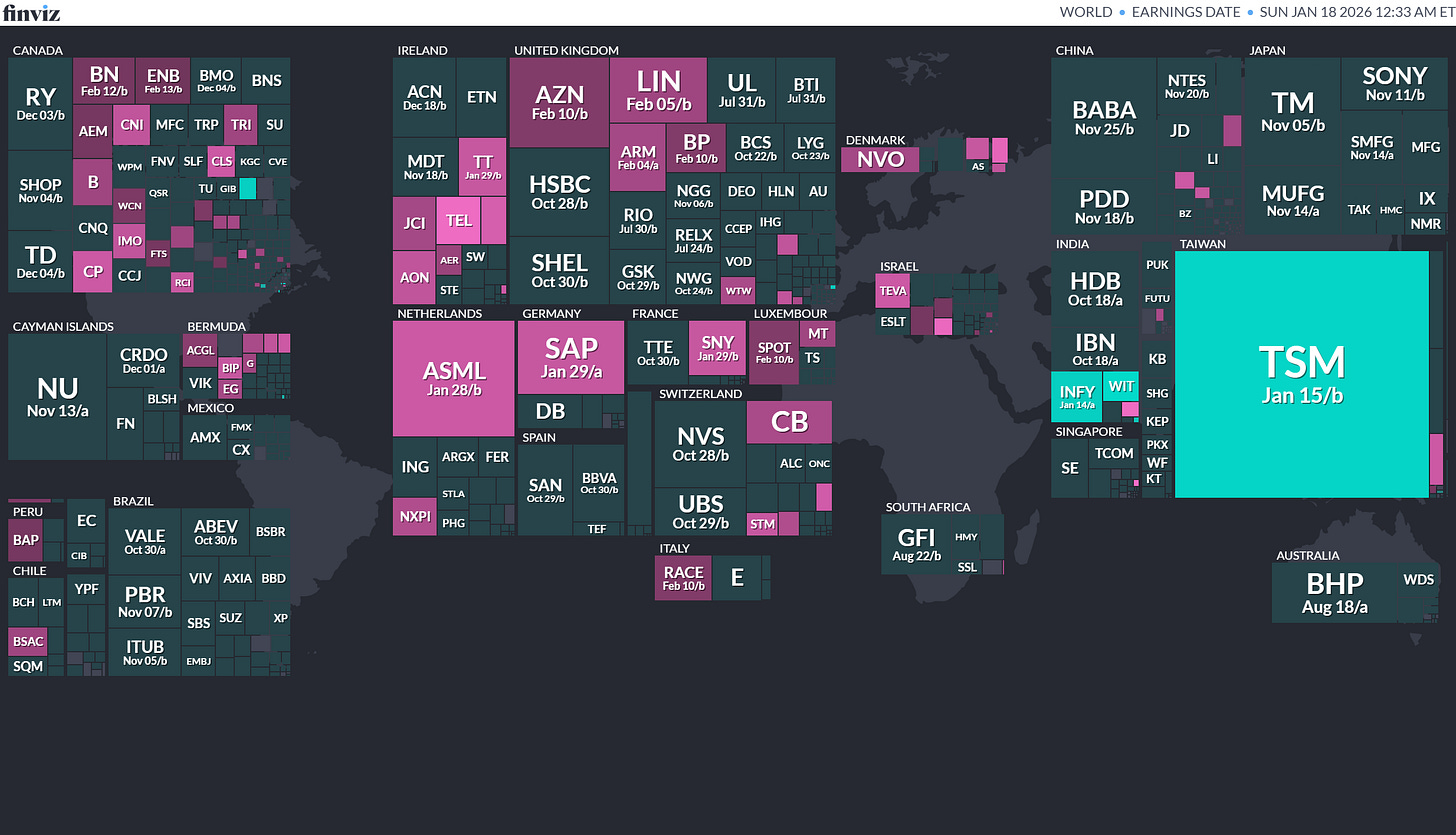

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

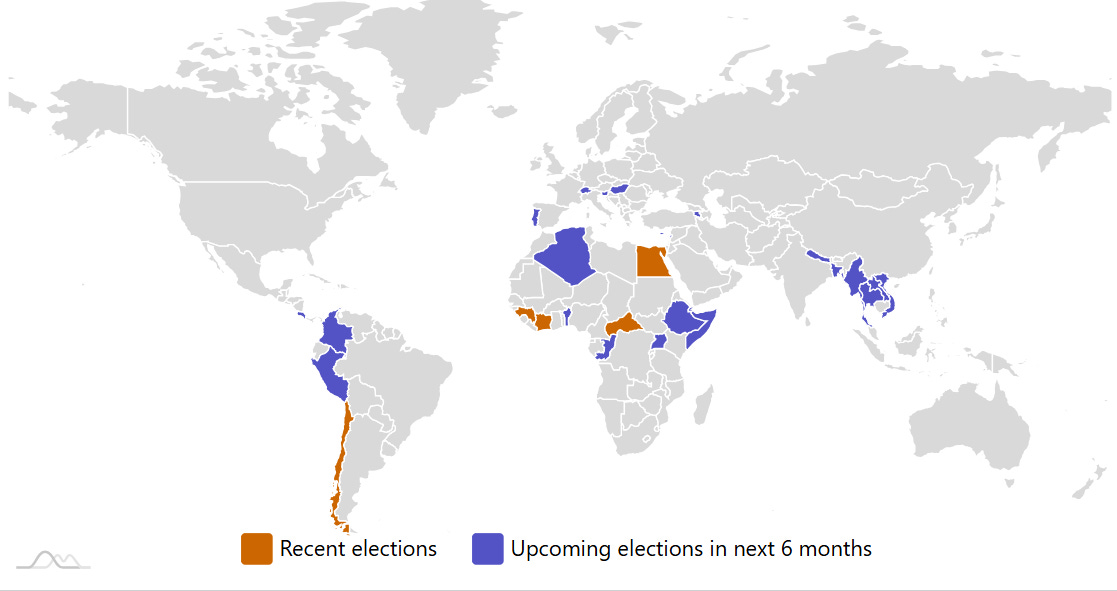

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

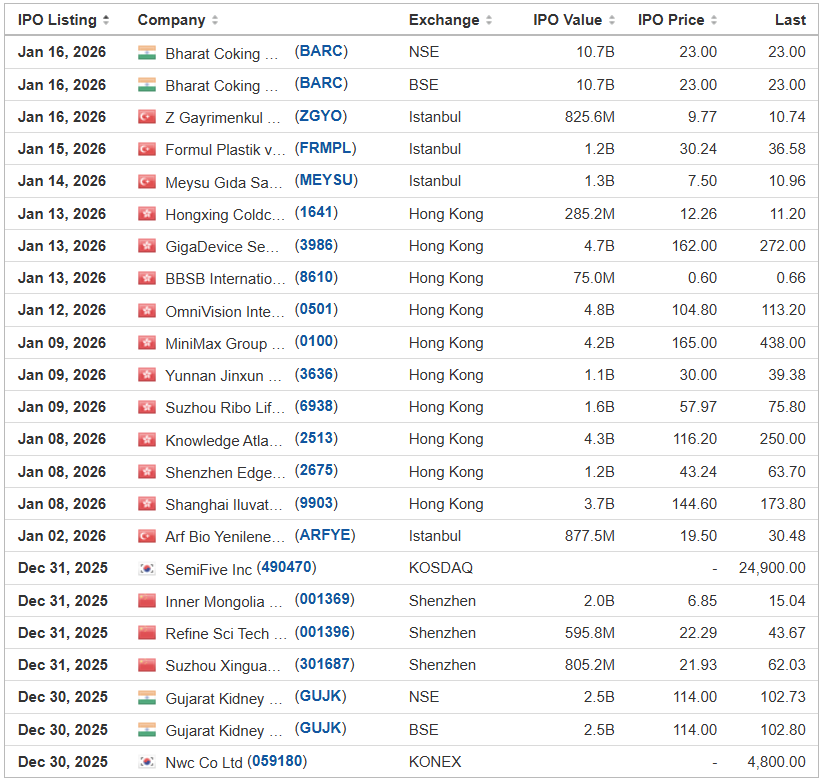

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

AIGO Holding Ltd. AIGO Eddid Securities USA, 2.0M Shares, $4.00-6.00, $10.0 mil, 1/26/2026 Week of

(Incorporated in the Cayman Islands)

We are a consumer products provider well established in Southern Europe with global operations that extend into geographic regions including Europe, Asia, North America, Latin America, and Africa. In 2024, we generated revenue from approximately 40 countries and regions in four continents.

We primarily offer consumers lifestyle products through our various sales channels, with a particular focus on four main product categories: (i) lighting products; (ii) electrical products; (iii) household appliances; and (iv) pet products. Since 2019, we have also been developing and offering IoT-related consumer products.

We have three proprietary brands, namely, AIGOSTAR®, nobleza® and Taylor Swoden®, each of which has its distinct product lines, marketing strategies and intended consumers. As of December 31, 2024, we had a 115-member R&D team that is dedicated to research and development of new products tailored to customer needs as well as the development of our IT system. We generate recurring revenue from certain core products as well as revenue from new products we offer to the market.

We sell our products through both offline and online channels. Our offline customers are mainly business entities, including local community stores and/or high-end boutiques, shopping malls, supermarkets and distributors, who purchase products from us, either by directly placing orders with us or through our proprietary apps designed specifically for our offline customers to place orders efficiently, and on-sell them to end consumers. Our online customers are generally users who purchase products directly from us through third-party E-commerce platforms and our proprietary AigoSmart App.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: AIGO Holding Ltd. is offering 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its F-1 filing dated Aug. 21, 2025.)

Amatuhi Holdings AMTU Spartan Capital, 1.0M Shares, $5.00-5.00, $5.0 mil, 1/26/2026 Week of

(Incorporated in Delaware)

AMATUHI HOLDINGS, Inc., was incorporated on June 24, 2025, in Delaware to act as the holding company of AMATUHI Inc. AMATUHI Inc. (“AMATUHI”) was incorporated on February 22, 2021, and is an operating company in Japan with the headquarter in Yokohama, Kanagawa, and a branch in Osaka. AMATUHI operates under the “AMANEKU” brand in Japan.

Our company operates group homes in Japan for people with disabilities under the brand name of “AMANEKU.” “AMANEKU” is a “communal living assistance” service based on the “Comprehensive Support for Persons with Disabilities Act” which is implemented based on the self-support benefits provided by the Japanese government under the act. The act supports people who wish to live independently so that they can advance toward their respective goals through communal living in small groups and interaction with the local community.

In the fiscal year that ended March 31, 2025, Amatuhi added 18 group homes and cumulatively operated 29 group homes, according to the prospectus.

AMANEKU provides group homes with Daytime Service Support, which was established as a result of amendments to the Comprehensive Support for Persons with Disabilities Act, that allows for the provision of extensive 24-hour services in response to the increasing aging population and people with disabilities.

Our primary services to the disabled include but are not limited to: Three nutritionally balanced meals daily, counselling and support, assistance with personal care (bathing, dressing, mobility, oral care), medication management, money management, room cleaning, working with medical professionals to provide required medical care and helping our clientele with public assistance, pensions and family matters.

AMANEKU daytime support group homes are mainly two-story buildings with a capacity of 10 residents on each floor. Based on the aging population in Japan, there is a shortage of group homes for people with severe disabilities. Our Company is working to fulfil the needs of the growing disabled population, by providing a number of services to address their needs.

We are reimbursed for the services we provide to disabled people through Japanese government funding issued under the Comprehensive Support for Persons with Disabilities Act.

We are engaged in businesses that support the lives of people with disabilities, including the construction of group homes for people with disabilities and social participation for people with disabilities.

We are specialized in designing, constructing and operating group homes for individuals with disabilities. We also focus on providing supportive living environments, particularly for individuals with significant needs through our Daytime Service Support Type group homes. We are expanding within a market characterized by high demand and insufficient supply, positioning ourselves as a key provider addressing critical social needs related to disability care and housing.

AMATUHI specializes in providing communal living assistance (group homes) as defined under Japan’s “Comprehensive Support Law for Persons with Disabilities.” This is a government-regulated sector where services are funded primarily through social security benefits.

Japan Lifestyle No.1 Investment Limited Partnership directly and indirectly controls approximately 95.0% of the voting power of our outstanding capital stock. As a result, it will have the ability to determine all matters requiring approval by stockholders. In other words, the fund will be able to control any action requiring general stockholder approval, including the election of our Board of Directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger or sale of substantially all of our assets.

If we obtain a listing on the Nasdaq Capital Market, we will be a “controlled company” as defined in Nasdaq Listing Rule 5615(c)(1) because more than 50% of our voting power will be held by a single entity — Japan Lifestyle No.1 Investment Limited Partnership — after the offering.

As a “controlled company,” we will be exempt under Nasdaq listing standards from certain corporate governance requirements that would otherwise apply to companies that are not controlled, including the requirements that:

(i) a majority of the Board of Directors consist of “independent” directors as defined under Nasdaq listing standards,

(ii) we have a nominating and corporate governance committee composed entirely of independent directors with a written committee charter, and

(iii) we have a compensation committee composed entirely of independent directors with a written committee charter.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended March 31, 2025.

(Note: Amatuhi Holdings filed its S-1 for its small IPO on Sept. 12, 2025, and disclosed the terms – 1 million shares at an assumed IPO price of $5.00 – the mid-point of its $4.00-to-$6.00 price range – to raise $5 million. The holding company is incorporated in Delaware. But the company’s business is based in Japan.)

Hartford Creative Group, Inc. (Uplisting) HFUS WestPark Capital, 1.5M Shares, $4.00-4.00, $6.0 mil, 1/26/2026 Week of

Note: This is NOT an IPO. This is a NASDAQ uplisting from the OTC Markets Group – a public offering of 1.5 million shares at an assumed public offering price of $4.00 – to raise $6 million. The last reported sale price of Hartford Creative Group’s stock on the OTC Market was $4.50 on Dec. 12, 2025, according to the prospectus.

(Incorporated in Nevada)

Disclosure: “We currently have three subsidiaries located in the People’s Republic of China (the “PRC” or “China”), and some of our executive officers and directors are located in or have significant ties to China. These ties to China present legal and operational risks to us and our investors, including significant risks related to actions that may be taken by China in the areas of regulatory, liquidity and enforcement, which exist and could affect our current operations and the offering of our securities. For example, if these ties were to cause China to view us as subject to their regulatory authority, China could take actions that could materially hinder or prevent our offering of securities to investors and cause the value of such securities to significantly decline or be worthless.”

Hartford Creative Group, Inc. (“HFUS,” “we,” “us,” or “Company”) specializes in delivering marketing solutions tailored to businesses of small and medium-sized enterprises (SMEs). Our suite of precision marketing services offers cross-media strategies that enable advertisers to effectively target and engage audiences across premier media platforms. We leverage our interconnecting network and keen insights into market demands to develop and implement bespoke marketing initiatives. These initiatives encompass the design, placement, monitoring, and optimization of advertising campaigns.

Navigating the intricate landscape of the modern marketing and sales value chain presents numerous challenges, particularly for enterprises lacking the necessary expertise. Many struggle with creating ample marketing content, devising effective strategies, converting leads, and managing customer relations—tasks made more daunting by the sheer volume of use cases across diverse marketing channels. According to the publication Digital Transformation Market Size, Share, Growth & Trends Analysis Report By Solution, By Deployment, By Service, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 – 2030, the global digital transformation market size was estimated at USD 880.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 27.6% from 2024 to 2030. With 1.02 billion internet users and the world’s largest social media population, China’s growing economy, booming technology sector, and thriving e-commerce scene make it one of the most intriguing markets in the world today. Social media has long been one of the most important communication channels in China, with the country having the world’s largest number of social media users at over 983.3 million as of November 2024.

The pent-up demand from social media influencers’ marketing needs on social media apps led the Company to seize the opportunity in providing precise marketing services. As an advertising collaborator of China’s major social media markets, we aim to provide customers with vertical integration services, from early-stage such as advertising video creation, photography and editing, to advertising operation and management on social media apps. Furthermore, we plan to initiate TikTok advertising campaigns overseas and equip our Chinese clientele with the tools to penetrate international markets, including the United States.

We have been committed to building an efficient sales network and mechanism to achieve effective customer coverage and sustainable growth. We seek to maintain mutually beneficial relationships with customers and have gained the trust of many customers across a spectrum of industries, presenting us with further cross-selling and up-selling opportunities. We have built a diversified customer base with a strong willingness to pay. During fiscal year 2025, we have secured advertising service agreements with about 43 customers and received approximately RMB 279.9 million (USD 38.8 million) from these customers. We also entered about 53 supplier contracts for advertising placement and paid RMB 262.6 million (USD 36.4 million) during fiscal year 2025.

During the year ended July 31, 2025, we reported net revenues of $2.0 million, compared to $1.4 million for the same period of 2024, reflecting the launch of our advertising business in January 2024. Net income was $1.1 million, or $0.04 per share, for both the years ended July 31, 2025 and 2024. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion.

Based on market research and discussions between the board and third-party suppliers and experts, the Company has further developed a plan of mini-drama business. The Company is strategically positioned to capture considerable market interest and enhance revenue streams from our innovative mini-drama business. While initial steps toward this ambitious goal have been initiated, it is important to note that the commencement and future success of the mini-drama venture are not yet guaranteed.

Our mission is to excel as the premier partner for enterprises worldwide, driving digital and intelligent transformation with unparalleled expertise and commitment.

Note: Net income and revenue are in U.S. dollars for the fiscal year that ended July 31, 2025.

(Note: Hartford Creative Group, Inc. has applied to uplist its stock to the NASDAQ from the OTC Markets Group – and in conjunction with that goal – the company is offering 1.5 million shares at an assumed public offering price of $4.00 per share – to raise $6.0 million, according to an SEC filing – a post-effective amendment – dated Dec. 16, 2025. Background: Hartford Creative Group started its NASDAQ uplisting/public offering process with a plan to offer up to $10 million of stock at an assumed public offering price of $4.00 per share – in an S-1 filing dated Feb. 24, 2025.)

Hillhouse Frontier Holdings HIFI Cathay Securities, 3.8M Shares, $4.00-6.00, $18.8 mil, 1/26/2026 Week of

(Incorporated in Nevada)

We are a luxury vehicle exporter. Through our subsidiary, Hillhouse Capital Group, we run a vehicle export business that specializes in finding premium vehicles in the U.S. and facilitating their shipment to Hong Kong to our client, who distributes the vehicles to its clients in the People’s Republic of China (PRC).

In 2024, Hillhouse Capital Group did 67 vehicle transactions, including 34 with authorized dealerships and 33 with independent dealers. We worked with 15 purchasing agents.

We specialize in exporting U.S. luxury vehicles having MSRPs of at least $80,000, targeting affluent consumers and dealers seeking premium luxury brands, such as Mercedes-Benz, BMW, Audi and Cadillac. Unlike smaller industry participants—typically family-run businesses that rely on informal sourcing networks—we operate through a structured purchasing model with authorized dealerships (i.e., purchasing from them through their designated purchasing agents) and independent dealers, ensuring a stable and scalable supply chain.

Fenglong Ma has served as our CEO and our chairman of the board since October 2022. He is a seasoned entrepreneur in international trade and automotive sales. He founded our company in October 2022, leading its strategy, operations, and entry into automotive exports. Previously, he co-founded Qingdao High-End Vehicle Trading Co., and served as general sales manager from January 2020 to September 2022. He was responsible for sales, market expansion, and supply chain management of high-end imported vehicles, establishing strong global partnerships and optimizing procurement processes. He received an associate degree in business management from Mudanjiang Forestry Vocational and Technical College. Mr. Ma is a citizen of the PRC and currently resides in the PRC.

Zheng Wen Tong has served as our chief operating officer since November 2024, overseeing vehicle procurement, logistics, and financial transactions. She has extensive experience in automotive trade and supply chain management. Before this, she was an office manager at TW&EW Service from April 2024 to October 2024 and was employed by Wave Capital Management from January 2022 to March 2024, where she oversaw administrative and supply chain operations. From January 2020 to March 2020, she served as an office manager at Luxury Unlimited Group. She received a diploma in accounting from Shanghai Business Trade College in July 1994. Ms. Tong is a citizen of the United States and currently resides in the United States.

Chihyuan Lin has served as our CFO since February 2025, overseeing financial strategy and operations. He is an experienced financial executive with expertise in strategic financial management, accounting, and SEC reporting. Before joining us, he founded Linck Consulting Inc. in September 2024 and has been serving as its CEO, providing accounting and tax consulting services. From September 2023 to September 2024, he worked as a consultant at 8020 Consulting LLC, focusing on SEC reporting and financial advisory services. Prior to that, from October 2022 to September 2023, he was the senior manager of financial reporting and technical accounting at Tattooed Chef, where he managed SEC filings, financial reporting, and statement consolidation. From October 2021 to October 2022, he held the role of senior manager of financial reporting and analysis at HF Foods Group Inc., overseeing financial reporting and compliance matters. Earlier, from February 2018 to October 2021, he served as the assistant director of finance and assistant controller at Ta Chen International Inc., specializing in operational accounting and financial statement consolidation. Mr. Lin earned a Master of Science degree in accounting from the University of Texas at Dallas on August 12, 2011, and a Master of Science degree in Finance from the University of Illinois Urbana-Champaign on May 16, 2010. Mr. Lin is a citizen of the United States and currently resides in the United States.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended Sept. 30, 2025.

(Note: Hillhouse Frontier Holdings increased its IPO’s size to 3.75 million shares – triple its size in its initial filing – and kept the price range at $4.00 to $6.00 – to raise $18.75 million, according to an S-1/A filing dated Jan. 15, 2026. Background: Hillhouse Frontier Holdings filed its S-1 for its IPO on July 21, 2025, and disclosed the terms: 1.25 million shares at a price range of $4.00 to $6.00 to raise $6.25 million, if priced at the $5.00 mid-point of its range.)

Riku Dining Group RIKU Eddid Securities USA, 2.3M Shares, $4.00-6.00, $11.3 mil, 1/26/2026 Week of

(Incorporated in the Cayman Islands)

We operate and franchise Japanese-style restaurants in Canada and Hong Kong:

In Canada – Ajisen Ramen is our franchise. We run four restaurants and we franchise nine more restaurants across Ontario.

In Hong Kong – We have seven restaurants under three franchised brands – Yakiniku Kakura, Yakiniku 802 and Ufufu Cafe.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended March 31, 2025.

(Note: Riku Dining Group disclosed the terms for its IPO in an Oct. 8, 2025, filing with the SEC: The company is offering 2.25 million shares at a price range of $4.00 to $6.00 to raise $11.25 million. Background: Riku Dining Group filed its F-1 for its IPO in September 2025 without disclosing the terms. Estimated IPO proceeds are $16 million.)

Seahawk Recycling Holdings, Inc. SEAH Cathay Securities, 3.8M Shares, $4.00-6.00, $18.8 mil, 1/26/2026 Week of

(Incorporated in the British Virgin Islands)

Headquartered in Tokyo, Japan, we are an international recycling company dedicated to advancing sustainable material solutions across East Asia and Southeast Asia. As a committed advocate for environmental sustainability, we have devoted ourselves to promoting the development of a low-carbon and zero-waste global green circular economy by engaging in the trading of recyclable resources such as waste paper and scrap metal.

Our operations are structured around two core business segments: waste paper recycling and scrap metal recycling.

Under our waste paper recycling business, we operate across both the domestic Japanese and international markets by trading two main product categories: waste paper and paper pulp. We source waste papers from collection companies in Japan and supply them to recycled pulp mills or trading companies. In parallel, we purchase paper pulps from recycled pulp mills and supply them to paper manufacturers or trading companies. While our waste paper transactions are primarily domestic, our paper pulp exports serve a broad customer base across East Asia and Southeast Asia.

We also conduct cross-border transactions under our waste paper recycling business by procuring waste paper from suppliers in the U.S. and arranging for direct shipments to pulp mills or paper manufacturers in Malaysia.

Our scrap metal recycling business focuses on the trade of dismantled metal wires and old metal appliances such as motors, engines, air conditioners and refrigerators. For old metal appliances, we acquire these materials from collection companies and supply them to smelters or trading companies, while for dismantled metal wires, we purchase processed and dismantled metal wires such as copper wires, aluminum wires, brass wires and iron wires, from dismantling factories, and then sell them to smelters, or trading firms. While the operations under our scrap metal recycling business are primarily concentrated within Japan due to the heavier nature of these materials, we also export a portion of our dismantled metal wires to our customers in East Asia and Southeast Asia.

For export transactions, we manage the full logistics chain from supplier pickup and port delivery to international shipping, allowing us to ensure timely and cost-effective deliveries.

Note: Net income and revenue are for the fiscal year that ended March 31, 2025.

(Note: Seahawk Recycling Holdings, Inc. nearly doubled the size of its small IPO to raise $19 million – up from $10 million originally – according to its F-1/A filing on Jan. 7, 2026. Seahawk Recycling Holdings now plans to offer 3.75 million shares – up from 2.0 million shares originally – at the price range of $4.00 to $6.00 (same price range as in its initial filing) – to raise $18.75 million, according to its F-1/A filing dated Jan. 7, 2026. Background: Seahaawk Recycling Holdings, Inc. filed its F-1 for its small-cap IPO and disclosed the terms: 2 million shares at a price range of $4.00 to $6.00 to raise $10 million, according to its SEC filing on Sept. 25, 2025.)

HW Electro Co., Ltd. (NASDAQ-New Filing) HWEP American Trust Investment Services/WestPark Capital, 4.2M Shares, $4.00-4.00, $16.6 mil, 2/2/2026 Week of

We are the first company in Japan to obtain a license plate number for imported electric light commercial vehicles. We are the second company and also one of the three companies that sell electric light commercial vehicles in Japan as of the date of this prospectus. (Incorporated in Japan)

The electric light commercial vehicles we sell belong to the category of “light commercial vehicles,” which are commercial carrier vehicles with a gross vehicle weight of no more than 3,500 kilograms.